Coursera (COUR)

We’re skeptical of Coursera. Its sales and EPS are expected to be weak over the next year, which doesn’t bode well for its share price.― StockStory Analyst Team

1. News

2. Summary

Why Coursera Is Not Exciting

Founded by two Stanford University computer science professors, Coursera (NYSE:COUR) is an online learning platform that offers courses, specializations, and degrees from top universities and organizations around the world.

- Customer spending has dipped by 8.1% on average as it focused on growing its customers

- Excessive marketing spend signals little organic demand and traction for its platform

- A positive is that its paying Users are rising, meaning the company can increase revenue without incurring additional customer acquisition costs if it can cross-sell additional products and features

Coursera’s quality is lacking. We see more attractive opportunities in the market.

Why There Are Better Opportunities Than Coursera

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Coursera

Coursera’s stock price of $6.33 implies a valuation ratio of 4.2x forward EV/EBITDA. This is a cheap valuation multiple, but for good reason. You get what you pay for.

It’s better to pay up for high-quality businesses with higher long-term earnings potential rather than to buy lower-quality stocks because they appear cheap. These challenged businesses often don’t re-rate, a phenomenon known as a “value trap”.

3. Coursera (COUR) Research Report: Q4 CY2025 Update

Online learning platform Coursera (NYSE:COUR) reported revenue ahead of Wall Street’s expectations in Q4 CY2025, with sales up 9.9% year on year to $196.9 million. Guidance for next quarter’s revenue was optimistic at $195 million at the midpoint, 2.5% above analysts’ estimates. Its non-GAAP profit of $0.06 per share was in line with analysts’ consensus estimates.

Coursera (COUR) Q4 CY2025 Highlights:

- On December 17, 2025, Coursera and Udemy, Inc. (NASDAQ: UDMY) entered into a definitive merger agreement pursuant to which Coursera will combine with Udemy in an all-stock transaction. The transaction has been unanimously approved by the Boards of Directors of both Coursera and Udemy. The transaction is subject to the receipt of required regulatory approvals, approval by Coursera and Udemy shareholders, and the satisfaction of other customary closing conditions.

- Revenue: $196.9 million vs analyst estimates of $191.7 million (9.9% year-on-year growth, 2.7% beat)

- Adjusted EPS: $0.06 vs analyst estimates of $0.06 (in line)

- Adjusted EBITDA: $11.2 million vs analyst estimates of $9.05 million (5.7% margin, 23.7% beat)

- Revenue Guidance for Q1 CY2026 is $195 million at the midpoint, above analyst estimates of $190.2 million

- EBITDA guidance for Q1 CY2026 is $13 million at the midpoint, below analyst estimates of $19.01 million

- Operating Margin: -16.4%, in line with the same quarter last year

- Free Cash Flow was -$2 million, down from $26.6 million in the previous quarter

- Market Capitalization: $1.02 billion

Company Overview

Founded by two Stanford University computer science professors, Coursera (NYSE:COUR) is an online learning platform that offers courses, specializations, and degrees from top universities and organizations around the world.

The company’s founders wanted to make education accessible to everyone, regardless of location or finances. Coursera addresses two consumer pain points of learning: access and convenience. First, taking courses and especially earning degrees can be financially out of reach for many. Second, learning traditionally involved a teacher and his/her students meeting in the same physical space at the same time.

Coursera digitizes learning and enables affordable, flexible, and self-paced learning. There is a free tier that gives access to select courses, but there are no assignments and certificates upon completion. There are multiple paid tiers that unlock additional courses, assignments, and access to degrees and certifications upon successful completion.

The largest source of revenue for the company is subscriptions for courses. However, Coursera’s revenue isn’t just from the busy working mom completing a statistics degree. Coursera may provide Nike with a social media advertising course to its incoming marketing employees. Nike pays for the courses, and the employees earn credentials. Another example is the Master's in Computer Science program offered by the University of Illinois on Coursera. It allows students to earn a Master's in computer science entirely online at a fraction of the cost of a traditional program.

4. Consumer Subscription

Consumers today expect goods and services to be hyper-personalized and on demand. Whether it be what music they listen to, what movie they watch, or even finding a date, online consumer businesses are expected to delight their customers with simple user interfaces that magically fulfill demand. Subscription models have further increased usage and stickiness of many online consumer services.

Competitors offering online legal or document services include Udemy (NASDAQ:UDMY), Microsoft’s LinkedIn Learning (NYSE:MSFT), and Skillsoft (NYSE:SKIL).

5. Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last three years, Coursera grew its sales at a decent 13.1% compounded annual growth rate. Its growth was slightly above the average consumer internet company and shows its offerings resonate with customers.

This quarter, Coursera reported year-on-year revenue growth of 9.9%, and its $196.9 million of revenue exceeded Wall Street’s estimates by 2.7%. Company management is currently guiding for a 8.8% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 5% over the next 12 months, a deceleration versus the last three years. This projection doesn't excite us and implies its products and services will see some demand headwinds.

6. Gross Margin & Pricing Power

For internet subscription businesses like Coursera, gross profit tells us how much money the company gets to keep after covering the base cost of its products and services, which typically include customer service, data center and infrastructure expenses, royalties, and other content-related costs if the company’s offerings include features such as video or music.

Coursera’s gross margin is slightly below the average consumer internet company, giving it less room to invest in areas such as product and marketing to grow its presence. As you can see below, it averaged a 54.1% gross margin over the last two years. Said differently, Coursera had to pay a chunky $45.86 to its service providers for every $100 in revenue.

Coursera produced a 54.2% gross profit margin in Q4, in line with the same quarter last year. On a wider time horizon, Coursera’s full-year margin has been trending up over the past 12 months, increasing by 1.1 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold (such as servers).

7. User Acquisition Efficiency

Unlike enterprise software that’s typically sold by dedicated sales teams, consumer internet businesses like Coursera grow from a combination of product virality, paid advertisement, and incentives.

It’s very expensive for Coursera to acquire new users as the company has spent 61.7% of its gross profit on sales and marketing expenses over the last year. This inefficiency indicates a highly competitive environment with little differentiation between Coursera and its peers.

8. EBITDA

Operating income is often evaluated to assess a company’s underlying profitability. In a similar vein, EBITDA is used to analyze consumer internet companies because it excludes various one-time or non-cash expenses (depreciation), providing a clearer view of the business’s profit potential.

Coursera has managed its cost base well over the last two years. It demonstrated solid profitability for a consumer internet business, producing an average EBITDA margin of 7.2%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Looking at the trend in its profitability, Coursera’s EBITDA margin rose by 15.4 percentage points over the last few years, as its sales growth gave it immense operating leverage.

This quarter, Coursera generated an EBITDA margin profit margin of 5.7%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

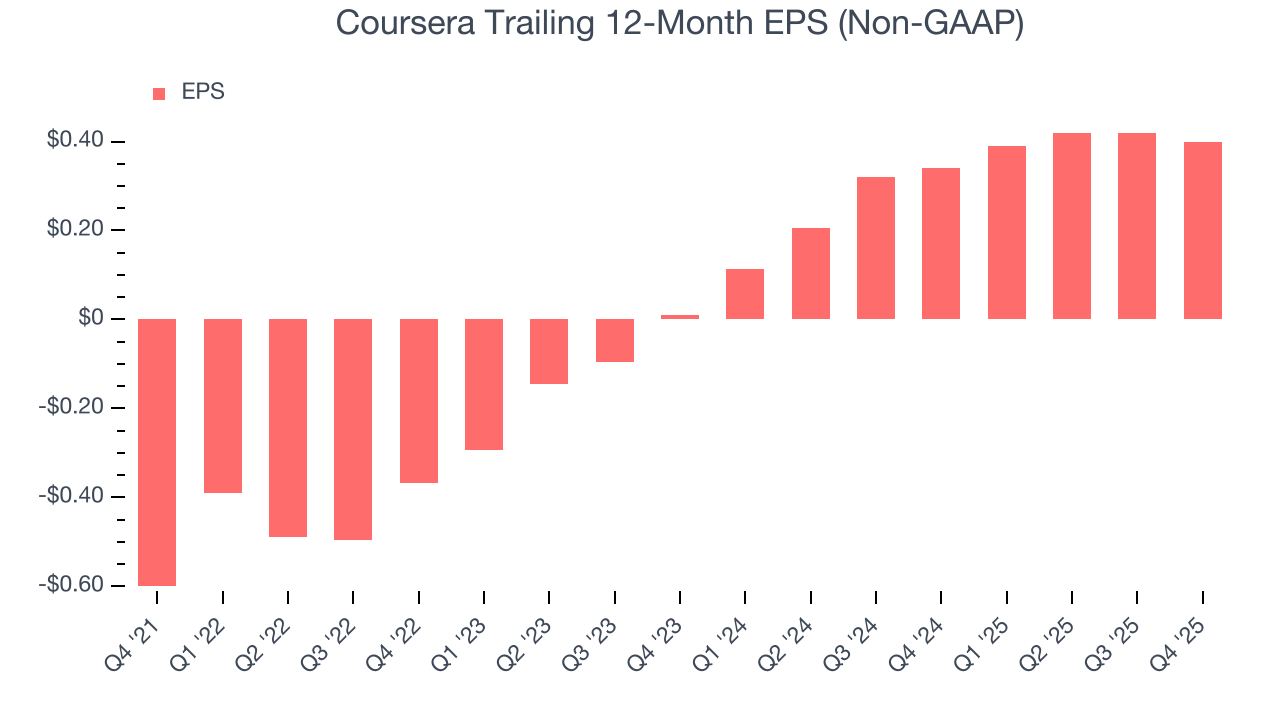

9. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Coursera’s full-year EPS flipped from negative to positive over the last three years. This is encouraging and shows it’s at a critical moment in its life.

In Q4, Coursera reported adjusted EPS of $0.06, down from $0.08 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects Coursera’s full-year EPS of $0.40 to grow 10.1%.

10. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Coursera has shown impressive cash profitability, giving it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 9.5% over the last two years, better than the broader consumer internet sector.

Taking a step back, we can see that Coursera’s margin expanded by 20.5 percentage points over the last few years. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability.

Coursera burned through $2 million of cash in Q4, equivalent to a negative 1% margin. The company’s cash flow turned negative after being positive in the same quarter last year, prompting us to pay closer attention. Short-term fluctuations typically aren’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

11. Balance Sheet Assessment

Companies with more cash than debt have lower bankruptcy risk.

Coursera is a well-capitalized company with $792.6 million of cash and no debt. This position is 77.8% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from Coursera’s Q4 Results

We were impressed by how significantly Coursera blew past analysts’ EBITDA expectations this quarter. We were also glad its revenue guidance for next quarter exceeded Wall Street’s estimates. On the other hand, its EBITDA guidance for next quarter missed. Overall, this print had some key positives. The stock traded up 3.2% to $6.17 immediately following the results.

On December 17, 2025, Coursera and Udemy, Inc. (NASDAQ: UDMY) entered into a definitive merger agreement pursuant to which Coursera will combine with Udemy in an all-stock transaction. The transaction has been unanimously approved by the Boards of Directors of both Coursera and Udemy. The transaction is subject to the receipt of required regulatory approvals, approval by Coursera and Udemy shareholders, and the satisfaction of other customary closing conditions.

13. Is Now The Time To Buy Coursera?

Updated: March 5, 2026 at 9:37 PM EST

Are you wondering whether to buy Coursera or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

Coursera isn’t a terrible business, but it isn’t one of our picks. Although its revenue growth was good over the last three years, it’s expected to deteriorate over the next 12 months and its ARPU has declined over the last two years. And while the company’s rising cash profitability gives it more optionality, the downside is its sales and marketing spend is very high compared to other consumer internet businesses.

Coursera’s EV/EBITDA ratio based on the next 12 months is 4.2x. While this valuation is fair, the upside isn’t great compared to the potential downside. We're pretty confident there are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $10.27 on the company (compared to the current share price of $6.33).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.