Cushman & Wakefield (CWK)

Cushman & Wakefield is up against the odds. Its weak sales growth and low returns on capital show it struggled to generate demand and profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think Cushman & Wakefield Will Underperform

With expertise in the commercial real estate sector, Cushman & Wakefield (NYSE:CWK) is a global Chicago-based real estate firm offering a comprehensive range of services to clients.

- Scale is a double-edged sword because it limits the company’s growth potential compared to its smaller competitors, as reflected in its below-average annual revenue increases of 4.1% for the last five years

- Incremental sales over the last five years were less profitable as its earnings per share were flat while its revenue grew

- Responsiveness to unforeseen market trends is restricted due to its substandard operating margin profitability

Cushman & Wakefield’s quality doesn’t meet our hurdle. There are more appealing investments to be made.

Why There Are Better Opportunities Than Cushman & Wakefield

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Cushman & Wakefield

At $16.22 per share, Cushman & Wakefield trades at 12.2x forward P/E. Cushman & Wakefield’s multiple may seem like a great deal among consumer discretionary peers, but we think there are valid reasons why it’s this cheap.

We’d rather pay up for companies with elite fundamentals than get a bargain on weak ones. Cheap stocks can be value traps, and as their performance deteriorates, they will stay cheap or get even cheaper.

3. Cushman & Wakefield (CWK) Research Report: Q3 CY2025 Update

Real estate services firm Cushman & Wakefield (NYSE:CWK) beat Wall Street’s revenue expectations in Q3 CY2025, with sales up 11.2% year on year to $2.61 billion. Its non-GAAP profit of $0.29 per share was 4.3% above analysts’ consensus estimates.

Cushman & Wakefield (CWK) Q3 CY2025 Highlights:

- Revenue: $2.61 billion vs analyst estimates of $2.42 billion (11.2% year-on-year growth, 7.9% beat)

- Adjusted EPS: $0.29 vs analyst estimates of $0.28 (4.3% beat)

- Adjusted EBITDA: $159.6 million vs analyst estimates of $156.1 million (6.1% margin, 2.2% beat)

- Operating Margin: 4.1%, in line with the same quarter last year

- Free Cash Flow Margin: 8.6%, similar to the same quarter last year

- Market Capitalization: $3.83 billion

Company Overview

With expertise in the commercial real estate sector, Cushman & Wakefield (NYSE:CWK) is a global Chicago-based real estate firm offering a comprehensive range of services to clients.

Cushman & Wakefield's services span various domains of commercial real estate, including leasing, property management, capital markets, valuation, and advisory. The company caters to a diverse clientele, including tenants, investors, and developers, and its range of services allows it to engage with clients at every stage of the property life cycle, from acquisition and leasing to management and disposition.

Cushman & Wakefield possesses an extensive global network, giving it an understanding of numerous local markets while utilizing a big-picture view. This combination enables the company to offer strategic insights to clients regardless of location.

Cushman & Wakefield strives to build long-term relationships with its customers to generate repeat business. In the leasing segment, Cushman & Wakefield represents both tenants and landlords, providing strategic advice and execution for property leasing and sales. The firm's capital markets team offers expertise in real estate investment sales, debt and equity financing, and loan sales. In valuation and advisory, the company provides appraisal services, strategic planning, and research, offering clients comprehensive insights into the value and potential of their real estate assets.

4. Real Estate Services

Technology has been a double-edged sword in real estate services. On the one hand, internet listings are effective at disseminating information far and wide, casting a wide net for buyers and sellers to increase the chances of transactions. On the other hand, digitization in the real estate market could potentially disintermediate key players like agents who use information asymmetries to their advantage.

Cushman & Wakefield's (NYSE:CWK) primary competitors include CBRE (NYSE:CBRE), Jones Lang LaSalle (NYSE:JLL), Colliers International (NASDAQ:CIGI), and Savills (LSE:SVS).

5. Revenue Growth

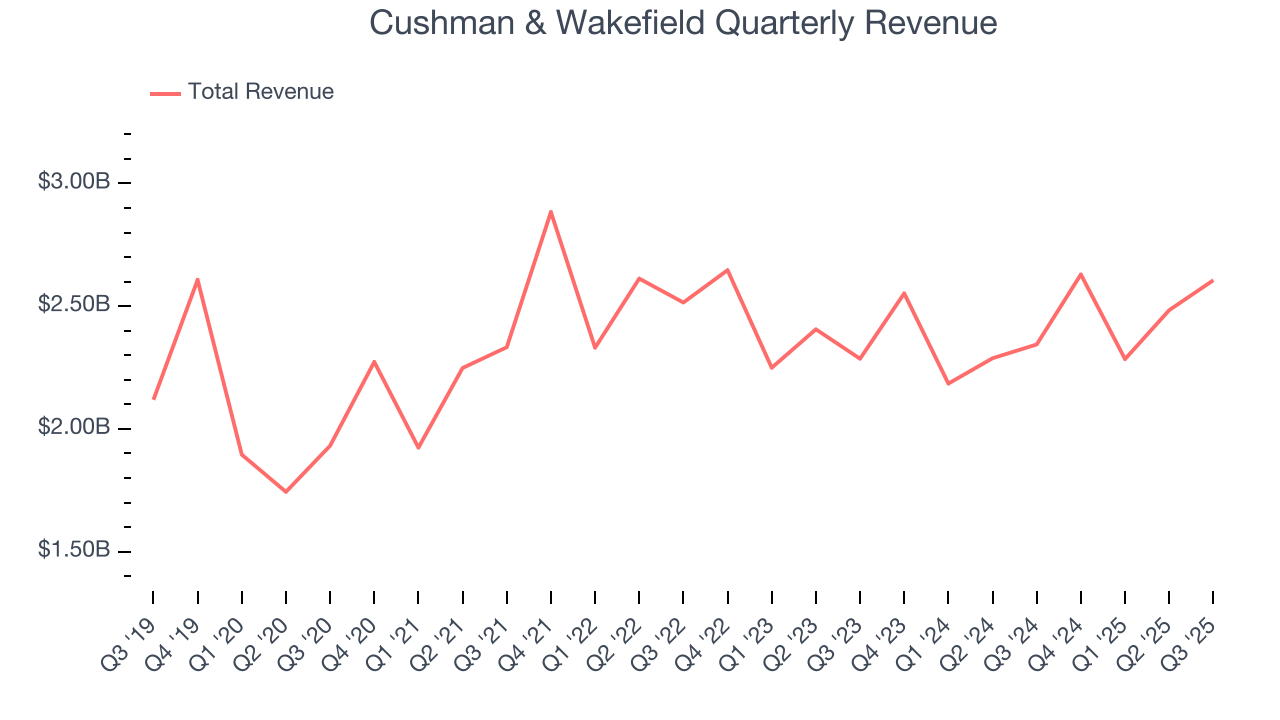

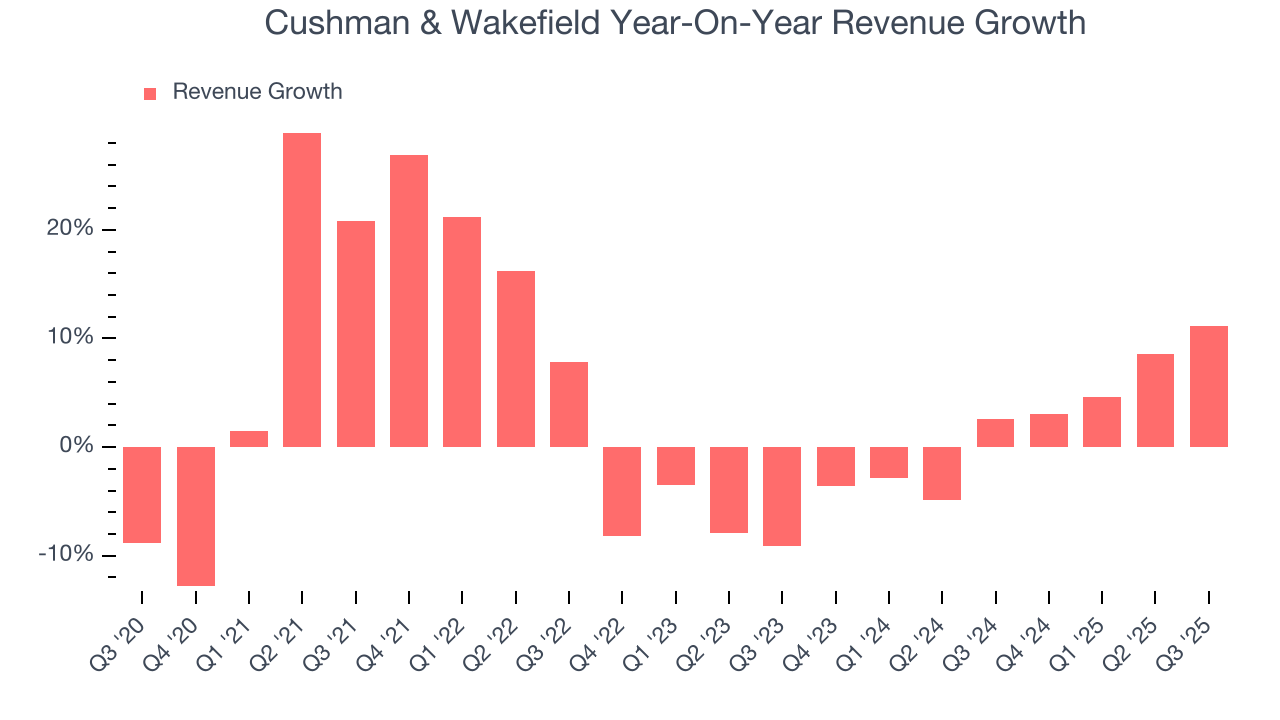

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, Cushman & Wakefield’s 4.1% annualized revenue growth over the last five years was sluggish. This fell short of our benchmark for the consumer discretionary sector and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Cushman & Wakefield’s recent performance shows its demand has slowed as its annualized revenue growth of 2.1% over the last two years was below its five-year trend.

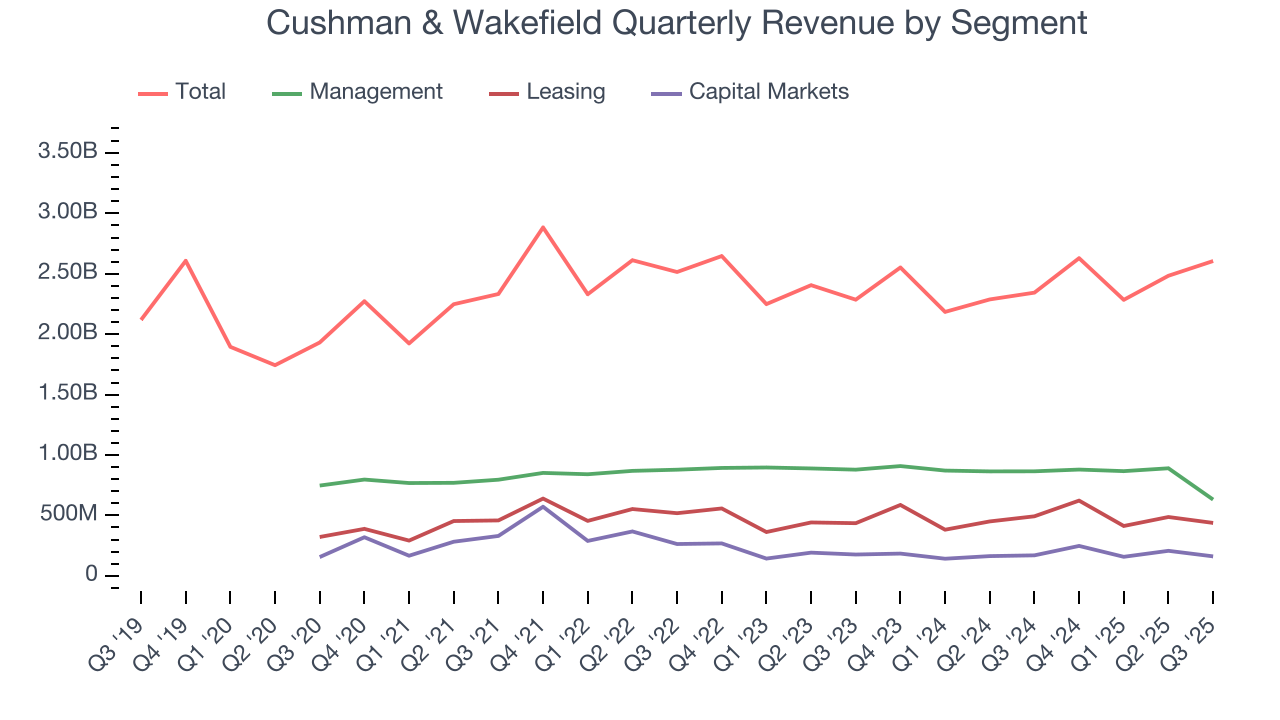

We can dig further into the company’s revenue dynamics by analyzing its three most important segments: Management, Leasing, and Capital Markets, which are 24.2%, 16.8%, and 6.2% of revenue. Over the last two years, Cushman & Wakefield’s Management revenue (property management) averaged 4.1% year-on-year declines, but its Leasing (sourcing tenants) and Capital Markets (financial advisory) revenues averaged 4.6% and 2.1% growth.

This quarter, Cushman & Wakefield reported year-on-year revenue growth of 11.2%, and its $2.61 billion of revenue exceeded Wall Street’s estimates by 7.9%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months, a slight deceleration versus the last two years. This projection is underwhelming and implies its products and services will face some demand challenges.

6. Operating Margin

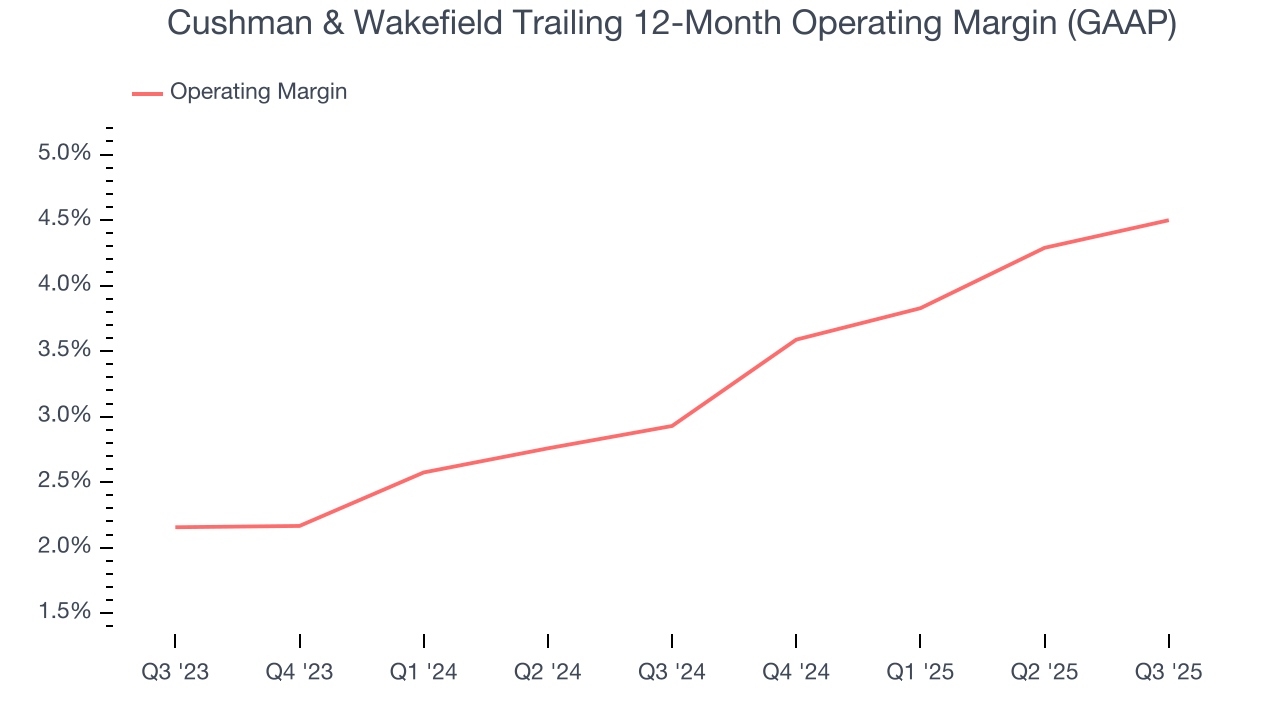

Cushman & Wakefield’s operating margin has been trending up over the last 12 months and averaged 3.7% over the last two years. The company’s higher efficiency is a breath of fresh air, but its suboptimal cost structure means it still sports lousy profitability for a consumer discretionary business.

In Q3, Cushman & Wakefield generated an operating margin profit margin of 4.1%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

7. Earnings Per Share

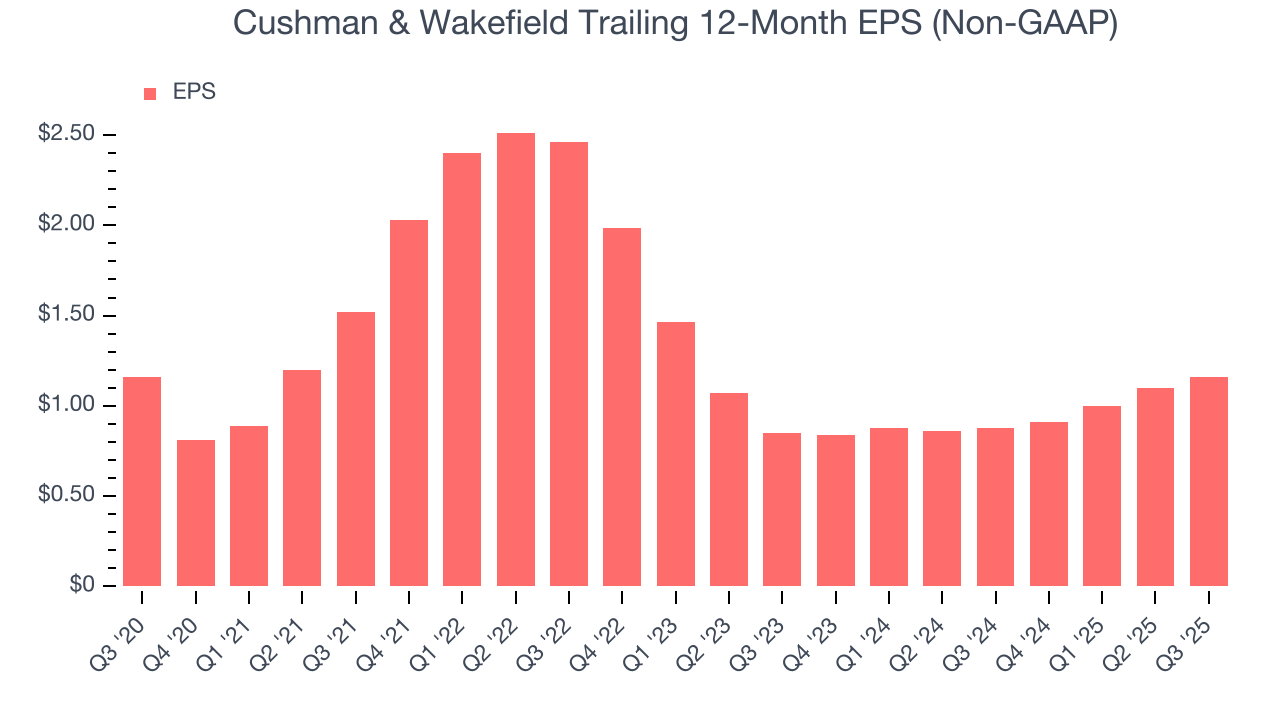

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Cushman & Wakefield’s flat EPS over the last five years was below its 4.1% annualized revenue growth. However, its operating margin actually improved during this time, telling us that non-fundamental factors such as interest expenses and taxes affected its ultimate earnings.

In Q3, Cushman & Wakefield reported adjusted EPS of $0.29, up from $0.23 in the same quarter last year. This print beat analysts’ estimates by 4.3%. Over the next 12 months, Wall Street expects Cushman & Wakefield’s full-year EPS of $1.16 to grow 15.9%.

8. Cash Is King

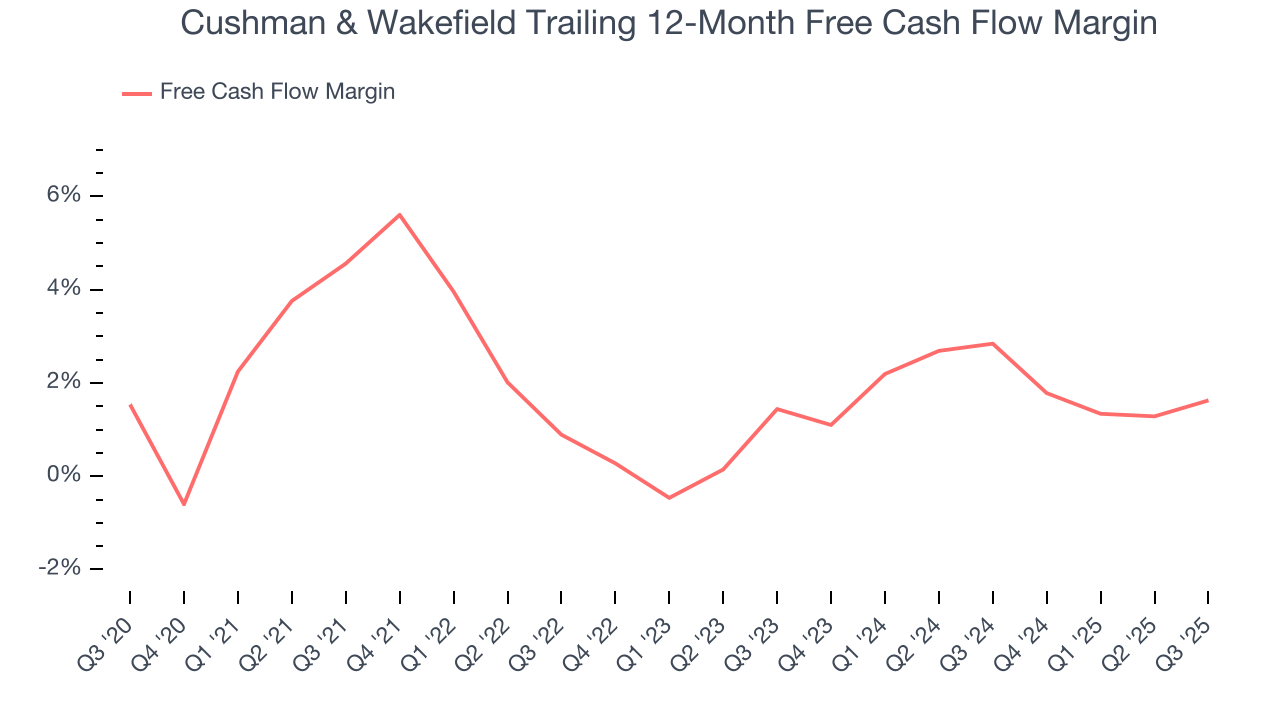

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Cushman & Wakefield has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 2.2%, lousy for a consumer discretionary business.

Cushman & Wakefield’s free cash flow clocked in at $225 million in Q3, equivalent to a 8.6% margin. This cash profitability was in line with the comparable period last year and above its two-year average.

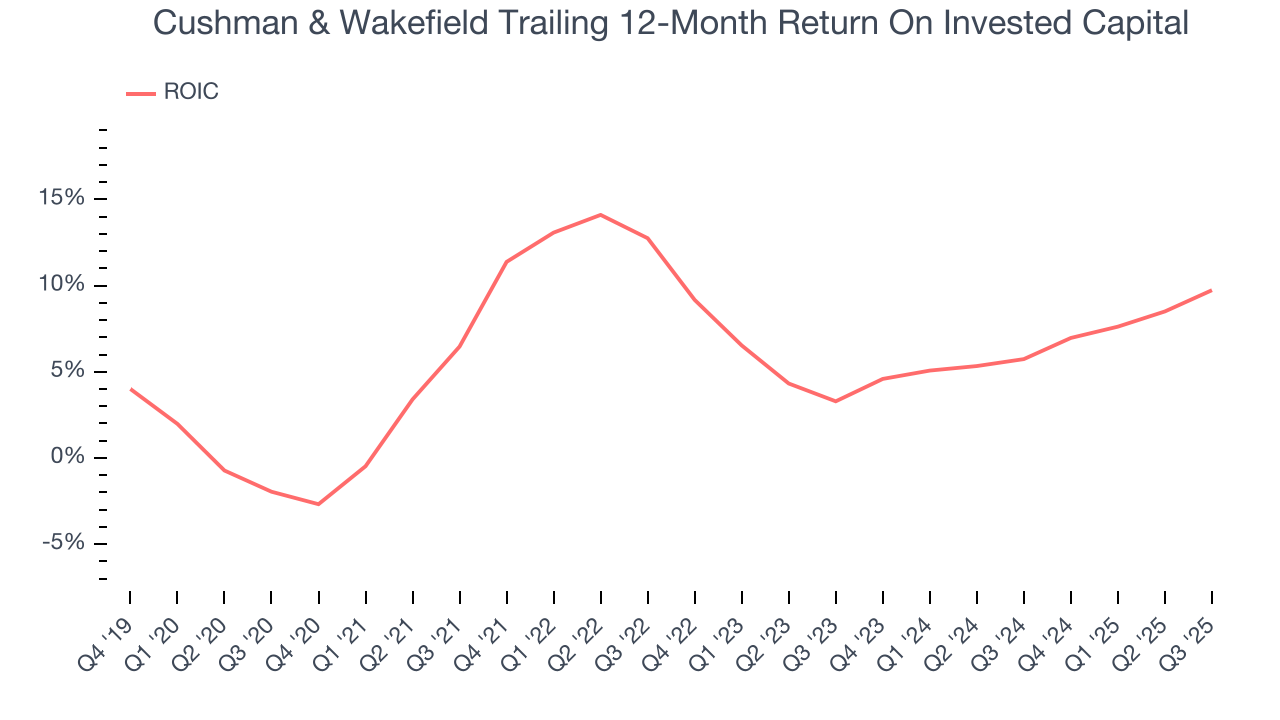

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Cushman & Wakefield historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 7.6%, somewhat low compared to the best consumer discretionary companies that consistently pump out 25%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Cushman & Wakefield’s ROIC averaged 1.9 percentage point decreases each year. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

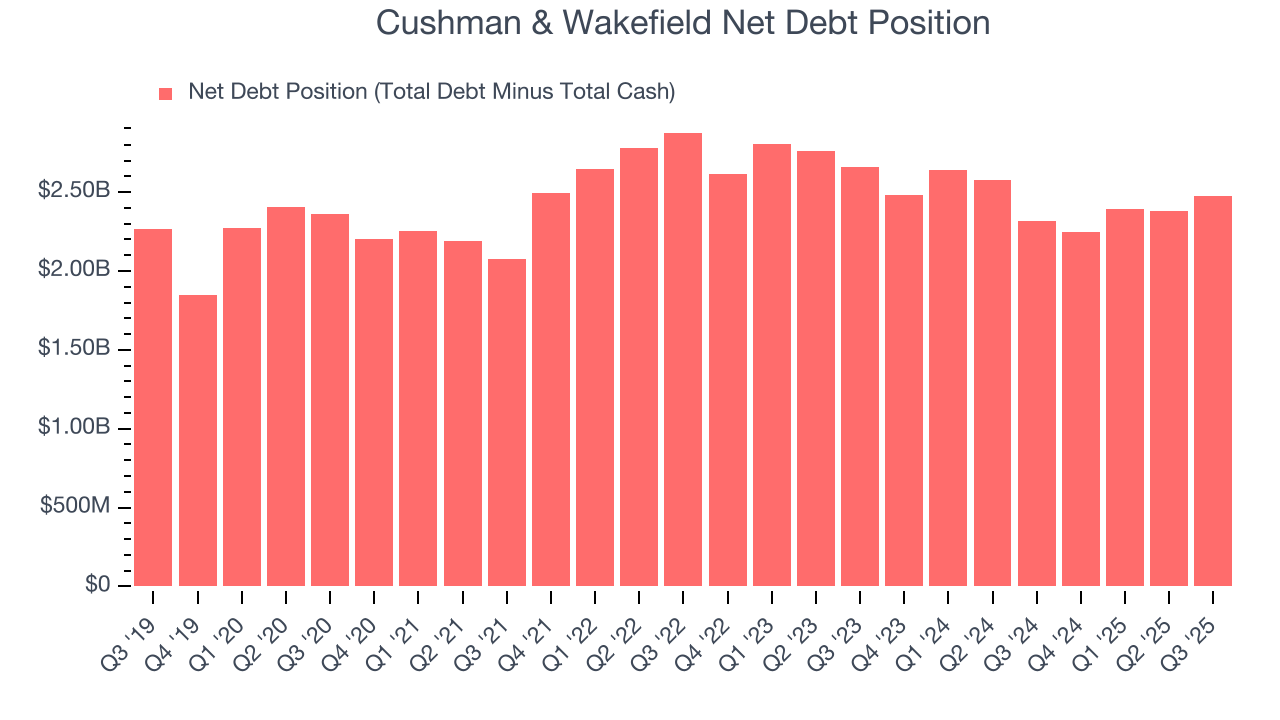

10. Balance Sheet Assessment

Cushman & Wakefield reported $634.4 million of cash and $3.11 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $639.8 million of EBITDA over the last 12 months, we view Cushman & Wakefield’s 3.9× net-debt-to-EBITDA ratio as safe. We also see its $212.6 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Cushman & Wakefield’s Q3 Results

We enjoyed seeing Cushman & Wakefield beat analysts’ revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 1.5% to $16.80 immediately following the results.

12. Is Now The Time To Buy Cushman & Wakefield?

Updated: January 24, 2026 at 9:56 PM EST

When considering an investment in Cushman & Wakefield, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

Cushman & Wakefield falls short of our quality standards. First off, its revenue growth was weak over the last five years, and analysts expect its demand to deteriorate over the next 12 months. On top of that, Cushman & Wakefield’s weak EPS growth over the last five years shows it’s failed to produce meaningful profits for shareholders, and its relatively low ROIC suggests management has struggled to find compelling investment opportunities.

Cushman & Wakefield’s P/E ratio based on the next 12 months is 12.2x. While this valuation is fair, the upside isn’t great compared to the potential downside. There are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $18.40 on the company (compared to the current share price of $16.22).