Donaldson (DCI)

We’re not sold on Donaldson. Its weak sales growth and declining returns on capital show its demand and profits are shrinking.― StockStory Analyst Team

1. News

2. Summary

Why Donaldson Is Not Exciting

Playing a vital role in the historic Apollo 11 mission, Donaldson (NYSE:DCI) manufacturers and sells filtration equipment for various industries.

- Estimated sales growth of 4.3% for the next 12 months is soft and implies weaker demand

- On the plus side, its market-beating returns on capital illustrate that management has a knack for investing in profitable ventures

Donaldson’s quality is insufficient. We’re looking for better stocks elsewhere.

Why There Are Better Opportunities Than Donaldson

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Donaldson

At $88.72 per share, Donaldson trades at 2.8x forward price-to-sales. The market typically values companies like Donaldson based on their anticipated profits for the next 12 months, but there aren’t enough published estimates to arrive at a reliable number. You should avoid this stock for now - better opportunities lie elsewhere.

It’s better to pay up for high-quality businesses with strong long-term earnings potential rather than buy lower-quality stocks because they appear cheap. These challenged businesses often don’t re-rate, a phenomenon known as a “value trap”.

3. Donaldson (DCI) Research Report: Q4 CY2025 Update

Filtration equipment manufacturer Donaldson (NYSE:DCI) met Wall Street’s revenue expectations in Q4 CY2025, with sales up 3% year on year to $896.3 million. Its non-GAAP profit of $0.83 per share was 6.6% below analysts’ consensus estimates.

Donaldson (DCI) Q4 CY2025 Highlights:

- Revenue: $896.3 million vs analyst estimates of $897.9 million (3% year-on-year growth, in line)

- Adjusted EPS: $0.83 vs analyst expectations of $0.89 (6.6% miss)

- Adjusted EBITDA: $155.5 million vs analyst estimates of $167.6 million (17.3% margin, 7.2% miss)

- Management lowered its full-year Adjusted EPS guidance to $3.97 at the midpoint, a 1.5% decrease

- Operating Margin: 13.2%, down from 14.4% in the same quarter last year

- Free Cash Flow Margin: 2%, down from 8.2% in the same quarter last year

- Constant Currency Revenue was flat year on year, in line with the same quarter last year

- Organic Revenue rose 3% year on year

- Market Capitalization: $12.04 billion

Company Overview

Playing a vital role in the historic Apollo 11 mission, Donaldson (NYSE:DCI) manufacturers and sells filtration equipment for various industries.

Donaldson traces its beginnings back to 1915, developing an air cleaner to address a farmer's tractor engine issues. Through a combination of organic growth and acquisitions, Donaldson has expanded its product portfolio to cater to the agriculture, construction, aerospace & defense, and industrial manufacturing industries. Some key acquisitions include Ultrafilter which expanded its presence in the European and Asian filtration market as well as Northern Technical which strengthened its offerings in gas turbine filtration.

Donaldson’s filtration equipment maintains equipment performance and environmental compliance. Their clientele includes small agricultural businesses, large corporations, original equipment manufacturers (OEMs), and government agencies. In agriculture for instance, its filters protect farm equipment from dust and debris. Similarly in aerospace & defense, its specialized filters are designed to remove contaminants and moisture from the air and fluids circulating through aircraft engines, hydraulic systems, and cabin air systems.

The company typically engages in long-term contracts with clients, offering customized filtration and maintenance packages. Donaldson engages in various contract types but offers a discounted price per unit on its products for long-term partnerships as an incentive to secure extended contracts. Additionally, the company utilizes a network of distributors, online sales platforms, and a direct sales team.

4. Gas and Liquid Handling

Gas and liquid handling companies possess the technical know-how and specialized equipment to handle valuable (and sometimes dangerous) substances. Lately, water conservation and carbon capture–which requires hydrogen and other gasses as well as specialized infrastructure–have been trending up, creating new demand for products such as filters, pumps, and valves. On the other hand, gas and liquid handling companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

Competitors offering similar products include Parker-Hannifin (NYSE:PH), Pall (NYSE:PLL), and Cummins (NYSE:CMI).

5. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Luckily, Donaldson’s sales grew at a decent 7.9% compounded annual growth rate over the last five years. Its growth was slightly above the average industrials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Donaldson’s recent performance shows its demand has slowed as its annualized revenue growth of 3.9% over the last two years was below its five-year trend. We’re wary when companies in the sector see decelerations in revenue growth, as it could signal changing consumer tastes aided by low switching costs.

We can better understand the company’s sales dynamics by analyzing its constant currency revenue, which excludes currency movements that are outside their control and not indicative of demand. Over the last two years, its constant currency sales averaged 3.5% year-on-year growth. Because this number aligns with its normal revenue growth, we can see that Donaldson has properly hedged its foreign currency exposure.

This quarter, Donaldson grew its revenue by 3% year on year, and its $896.3 million of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 4.3% over the next 12 months, similar to its two-year rate. This projection doesn't excite us and suggests its newer products and services will not lead to better top-line performance yet.

6. Gross Margin & Pricing Power

All else equal, we prefer higher gross margins because they make it easier to generate more operating profits and indicate that a company commands pricing power by offering more differentiated products.

Donaldson’s gross margin is good compared to other industrials businesses and signals it sells differentiated products, not commodities. As you can see below, it averaged an impressive 34.3% gross margin over the last five years. That means for every $100 in revenue, roughly $34.27 was left to spend on selling, marketing, R&D, and general administrative overhead.

Donaldson produced a 33.4% gross profit margin in Q4, down 1.8 percentage points year on year. Donaldson’s full-year margin has also been trending down over the past 12 months, decreasing by 1.1 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs (such as raw materials and manufacturing expenses).

7. Operating Margin

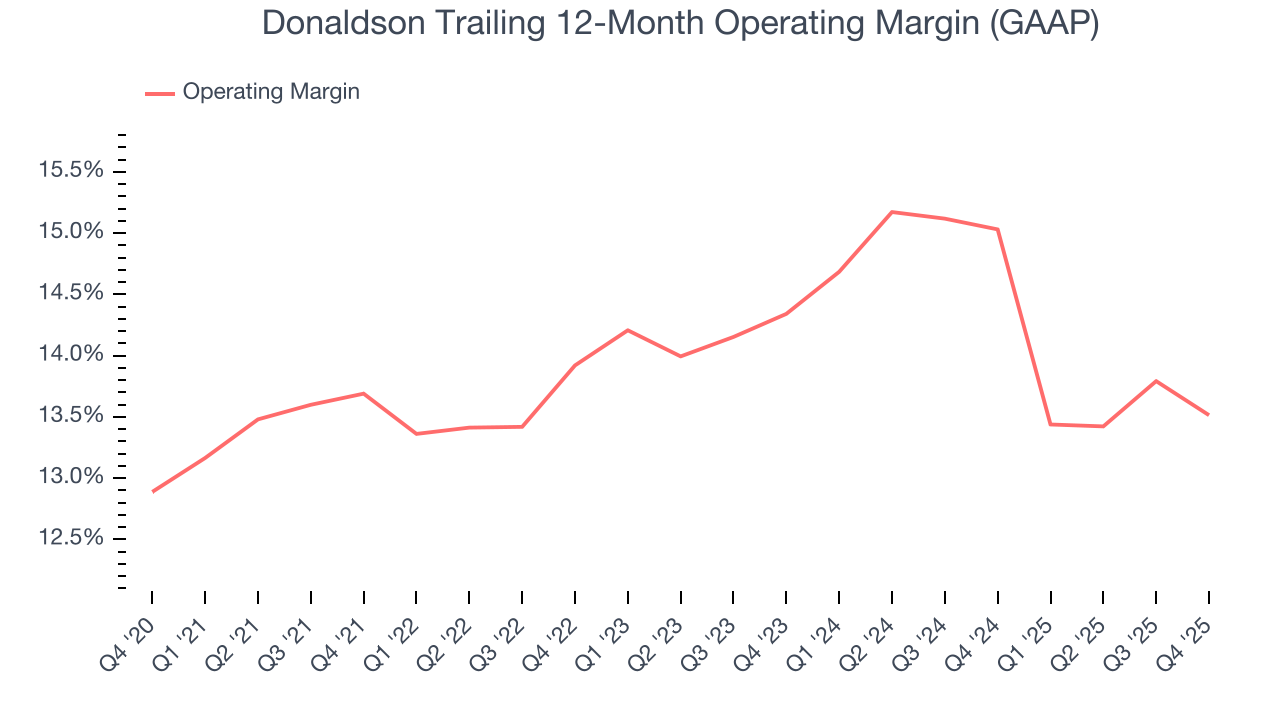

Donaldson’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 14.1% over the last five years. This profitability was top-notch for an industrials business, showing it’s an well-run company with an efficient cost structure. This result isn’t too surprising as its gross margin gives it a favorable starting point.

Looking at the trend in its profitability, Donaldson’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Donaldson generated an operating margin profit margin of 13.2%, down 1.2 percentage points year on year. Since Donaldson’s gross margin decreased more than its operating margin, we can assume its recent inefficiencies were driven more by weaker leverage on its cost of sales rather than increased marketing, R&D, and administrative overhead expenses.

8. Earnings Per Share

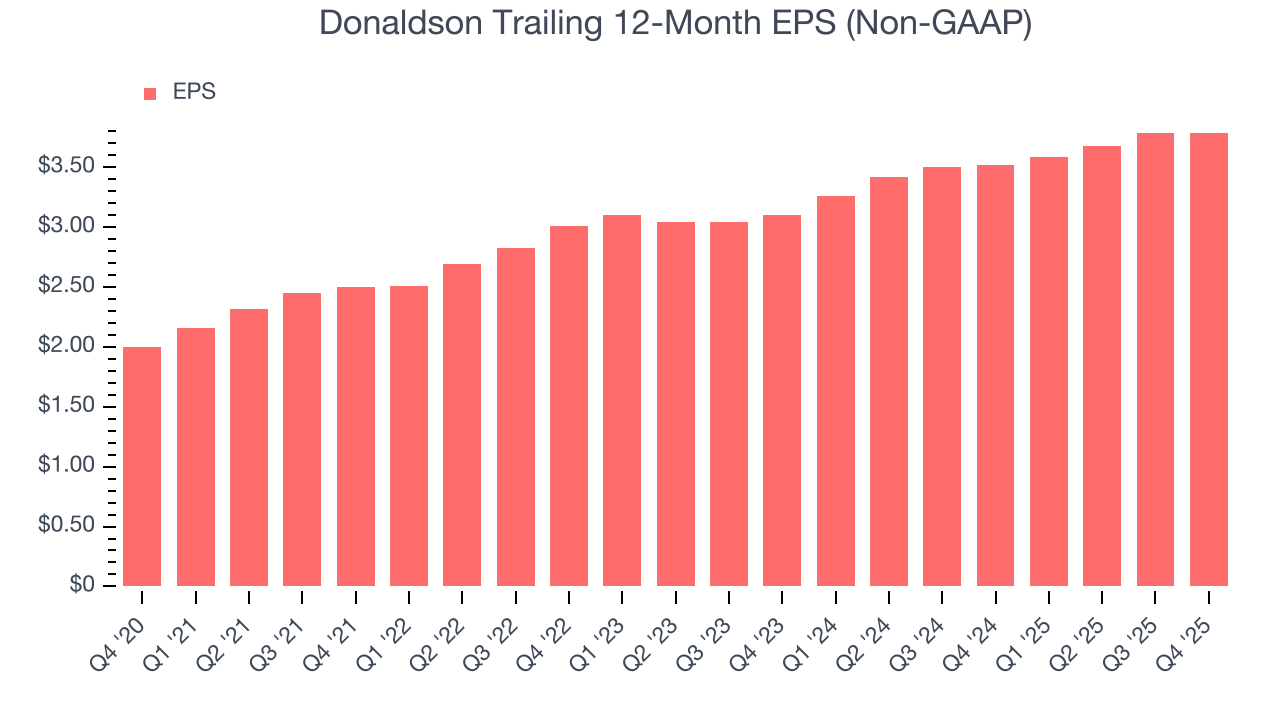

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Donaldson’s EPS grew at a remarkable 13.6% compounded annual growth rate over the last five years, higher than its 7.9% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into Donaldson’s earnings quality to better understand the drivers of its performance. A five-year view shows that Donaldson has repurchased its stock, shrinking its share count by 8%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Donaldson, its two-year annual EPS growth of 10.6% was lower than its five-year trend. We still think its growth was good and hope it can accelerate in the future.

In Q4, Donaldson reported adjusted EPS of $0.83, in line with the same quarter last year. This print missed analysts’ estimates, but we care more about long-term adjusted EPS growth than short-term movements. We also like to analyze expected EPS growth based on Wall Street analysts’ consensus projections, but there is insufficient data.

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Donaldson has shown impressive cash profitability, enabling it to ride out cyclical downturns more easily while maintaining its investments in new and existing offerings. The company’s free cash flow margin averaged 9.5% over the last five years, better than the broader industrials sector.

Taking a step back, we can see that Donaldson’s margin expanded by 2.3 percentage points during that time. This shows the company is heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability was flat.

Donaldson’s free cash flow clocked in at $18 million in Q4, equivalent to a 2% margin. The company’s cash profitability regressed as it was 6.2 percentage points lower than in the same quarter last year, prompting us to pay closer attention. Short-term fluctuations typically aren’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Although Donaldson hasn’t been the highest-quality company lately, it found a few growth initiatives in the past that worked out wonderfully. Its five-year average ROIC was 21.8%, splendid for an industrials business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Donaldson’s ROIC averaged 1.1 percentage point decreases each year. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

11. Balance Sheet Assessment

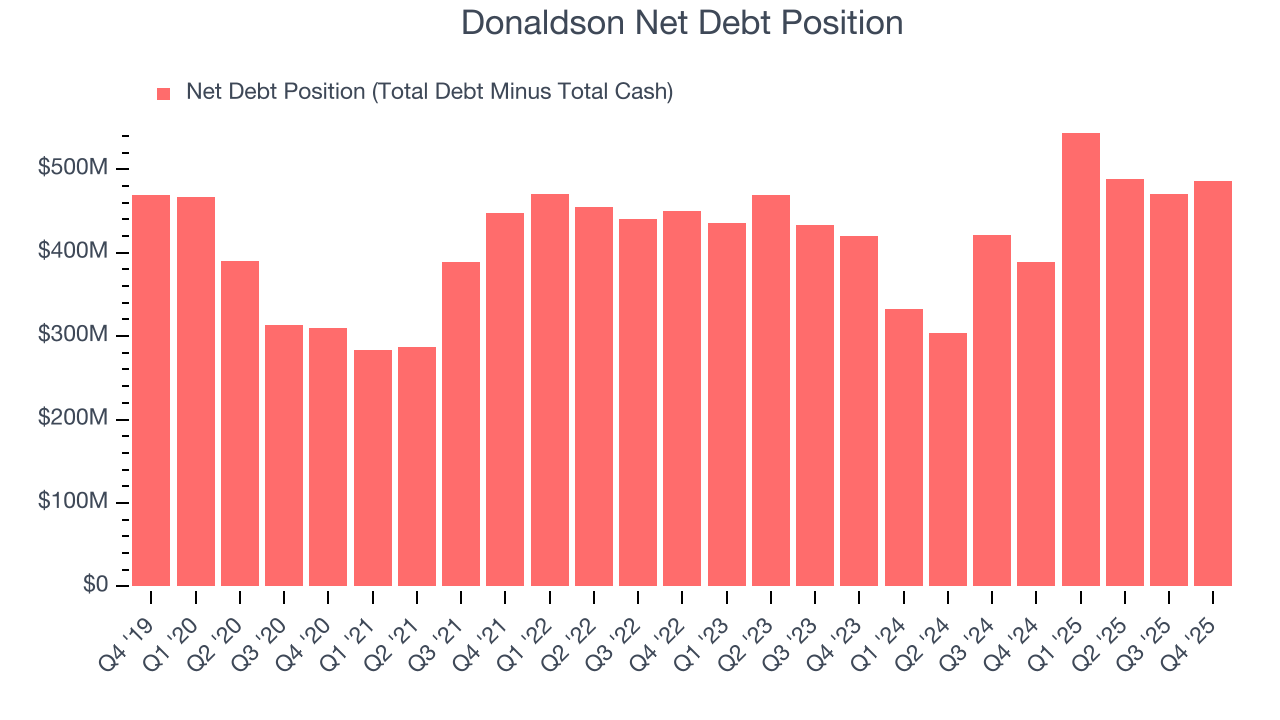

Donaldson reported $194.4 million of cash and $680.8 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $703.8 million of EBITDA over the last 12 months, we view Donaldson’s 0.7× net-debt-to-EBITDA ratio as safe. We also see its $12.2 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Donaldson’s Q4 Results

We struggled to find many positives in these results. Its EBITDA missed and its EPS fell short of Wall Street’s estimates. To add insult to injury, the company lowered full-year EPS guidance. Overall, this was a softer quarter. The stock traded down 9% to $95.00 immediately after reporting.

13. Is Now The Time To Buy Donaldson?

Updated: March 6, 2026 at 10:30 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Donaldson.

Donaldson has some positive attributes, but it isn’t one of our picks. First off, its revenue growth was decent over the last five years. And while Donaldson’s organic revenue growth has disappointed, its stellar ROIC suggests it has been a well-run company historically.

Donaldson’s forward price-to-sales ratio is 2.8x. The market typically values companies like Donaldson based on their anticipated profits for the next 12 months, but there aren’t enough published estimates to arrive at a reliable number. You should avoid this stock for now - better opportunities lie elsewhere.

Wall Street analysts have a consensus one-year price target of $98.60 on the company (compared to the current share price of $88.72).