Dick's (DKS)

Dick's is a sound business. Its marvelous same-store sales and new store openings show there’s healthy demand for its products.― StockStory Analyst Team

1. News

2. Summary

Why Dick's Is Interesting

Started as a hunting supply store, Dick’s Sporting Goods (NYSE:DKS) is a retailer that sells merchandise for traditional sports as well as for fitness and outdoor activities.

- Demand for the next 12 months is expected to accelerate above its three-year trend as Wall Street forecasts robust revenue growth of 46.8%

- Offensive push to build new stores and attack its untapped market opportunities is backed by its same-store sales growth

- On the other hand, its gross margin of 35.5% is an output of its commoditized inventory

Dick's has some respectable qualities. If you like the stock, the price looks fair.

Why Is Now The Time To Buy Dick's?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Dick's?

Dick's is trading at $207.70 per share, or 16x forward P/E. Scanning the consumer retail peers, we conclude that Dick’s valuation is warranted for the business quality.

Now could be a good time to invest if you believe in the story.

3. Dick's (DKS) Research Report: Q3 CY2025 Update

Sporting goods retailer Dick’s Sporting Goods (NYSE:DKS) fell short of the markets revenue expectations in Q3 CY2025, but sales rose 36.3% year on year to $4.17 billion. The company’s full-year revenue guidance of $13.98 billion at the midpoint came in 21.9% below analysts’ estimates. Its GAAP profit of $0.86 per share was 66.8% below analysts’ consensus estimates.

Dick's (DKS) Q3 CY2025 Highlights:

- On May 15, 2025, the Company announced that it entered into a definitive merger agreement to acquire Foot Locker, Inc., a leading footwear and apparel retailer.

- Revenue: $4.17 billion vs analyst estimates of $4.64 billion (36.3% year-on-year growth, 10.2% miss)

- EPS (GAAP): $0.86 vs analyst expectations of $2.59 (66.8% miss)

- The company slightly lifted its revenue guidance for the full year to $13.98 billion at the midpoint from $13.85 billion

- EPS (GAAP) guidance for the full year is $14.40 at the midpoint, roughly in line with what analysts were expecting

- Operating Margin: 2.2%, down from 9.4% in the same quarter last year

- Free Cash Flow was -$515.6 million compared to -$139.3 million in the same quarter last year

- Same-Store Sales rose 1.7% year on year (4.2% in the same quarter last year)

- Market Capitalization: $16.52 billion

Company Overview

Started as a hunting supply store, Dick’s Sporting Goods (NYSE:DKS) is a retailer that sells merchandise for traditional sports as well as for fitness and outdoor activities.

The core customer is anyone in need of balls, bats, rackets, or other equipment for traditional sports such as basketball, baseball, or tennis. Dick’s also addresses the needs of fitness and outdoor enthusiasts due to their selection of exercise equipment such as weights and hunting, fishing, and camping equipment such as binoculars. The breadth of sports and activities covered and the depth of product in each category is what differentiates Dick’s. Sporting goods can be large and cumbersome, so general merchandise retailers who devote limited space will have limited selection.

A Dick's store ranges from around 30,000 to 70,000 square feet, with some larger flagship locations exceeding 100,000 square feet. At the entrance is usually a large, open space that features seasonal displays and promotions. The store is then typically divided into sections such as athletic/casual apparel, sneakers/footwear, then sections based on specific sports. The company also has a developed e-commerce presence, which Dick’s launched in 1997 as an early adopter of online shopping. Many customers choose to order online and pick up at their nearest store.

4. Sports & Outdoor Equipment Retailer

Some of us spend our leisure time vegging out, but many others take to the courts, fields, beaches, and campsites; sports equipment retailers cater to the avid sportsman as well as the weekend warrior. Shoppers can find everything from tents to lawn games to baseball bats to satisfy their athletic and leisure needs along with competitive prices and helpful store associates that can talk through brands, sizing, and product quality. This is a category that has moved rapidly online over the last few decades, so these sports and outdoor equipment retailers have needed to be nimble and aggressive with their e-commerce and omnichannel presences.

Retailers offering sporting and outdoor goods include Academy Sports and Outdoor (NASDAQ:ASO), Sportsman’s Warehouse (NASDAQ:SPWH), and Hibbett (NASDAQ:HIBB).

5. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $14.88 billion in revenue over the past 12 months, Dick's is one of the larger companies in the consumer retail industry and benefits from a well-known brand that influences purchasing decisions. However, its scale is a double-edged sword because there is only so much real estate to build new stores, placing a ceiling on its growth. To expand meaningfully, Dick's likely needs to tweak its prices or enter new markets.

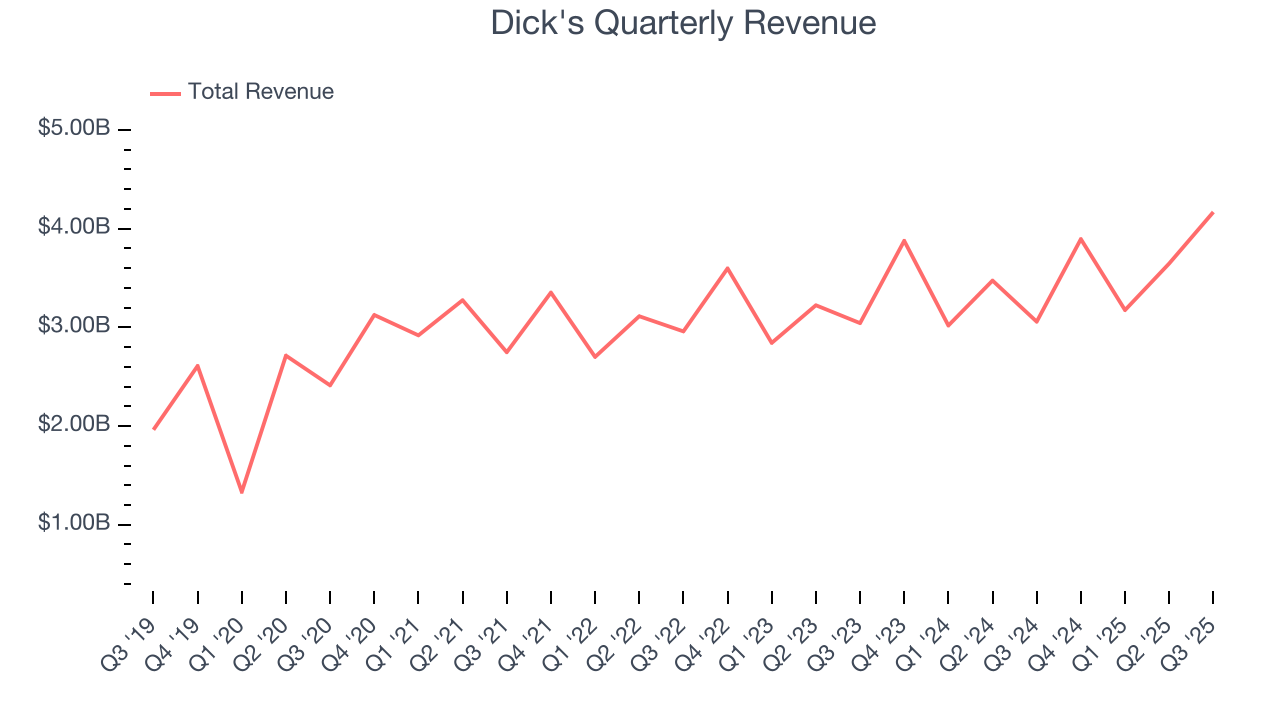

As you can see below, Dick’s 7.1% annualized revenue growth over the last three years (we compare to 2019 to normalize for COVID-19 impacts) was tepid, but to its credit, it opened new stores and increased sales at existing, established locations.

This quarter, Dick's pulled off a wonderful 36.3% year-on-year revenue growth rate, but its $4.17 billion of revenue fell short of Wall Street’s rosy estimates.

Looking ahead, sell-side analysts expect revenue to grow 49.3% over the next 12 months, an acceleration versus the last three years. This projection is eye-popping for a company of its scale and suggests its newer products will fuel better top-line performance.

6. Store Performance

Number of Stores

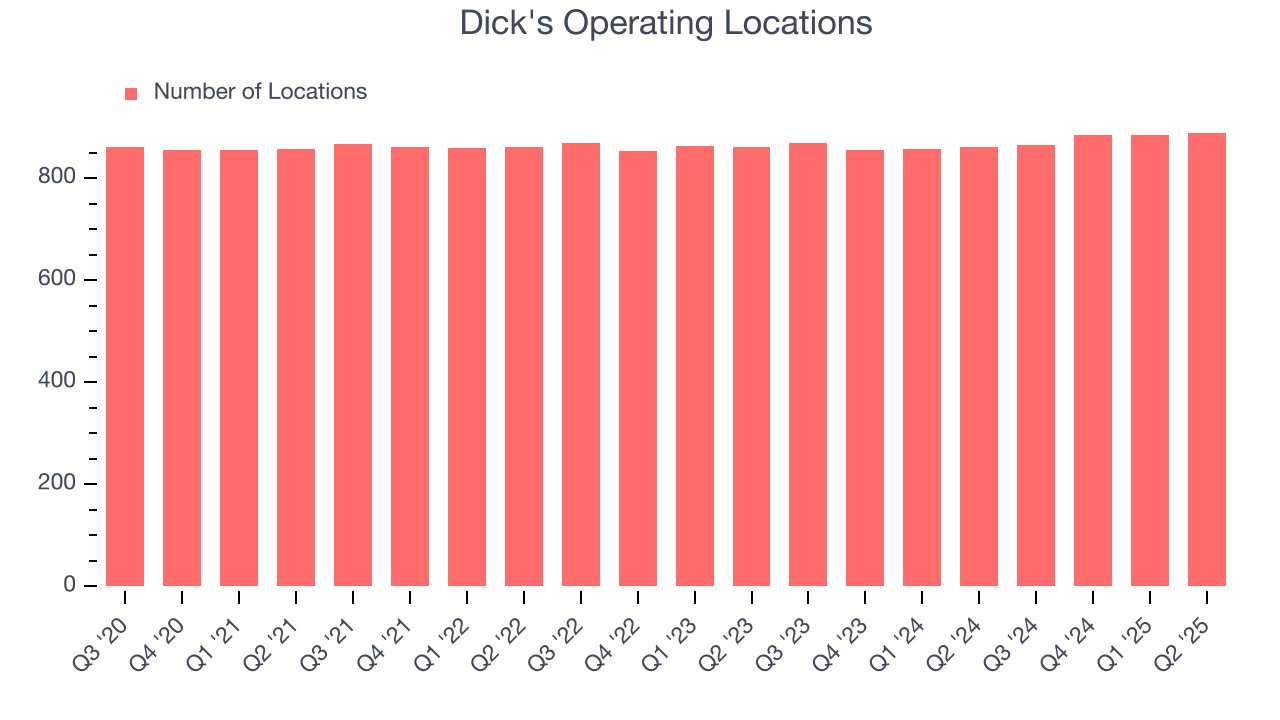

Over the last two years, Dick's has generally opened new stores, averaging 1.3% annual growth. This was faster than the broader consumer retail sector.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

Note that Dick's reports its store count intermittently, so some data points are missing in the chart below.

Same-Store Sales

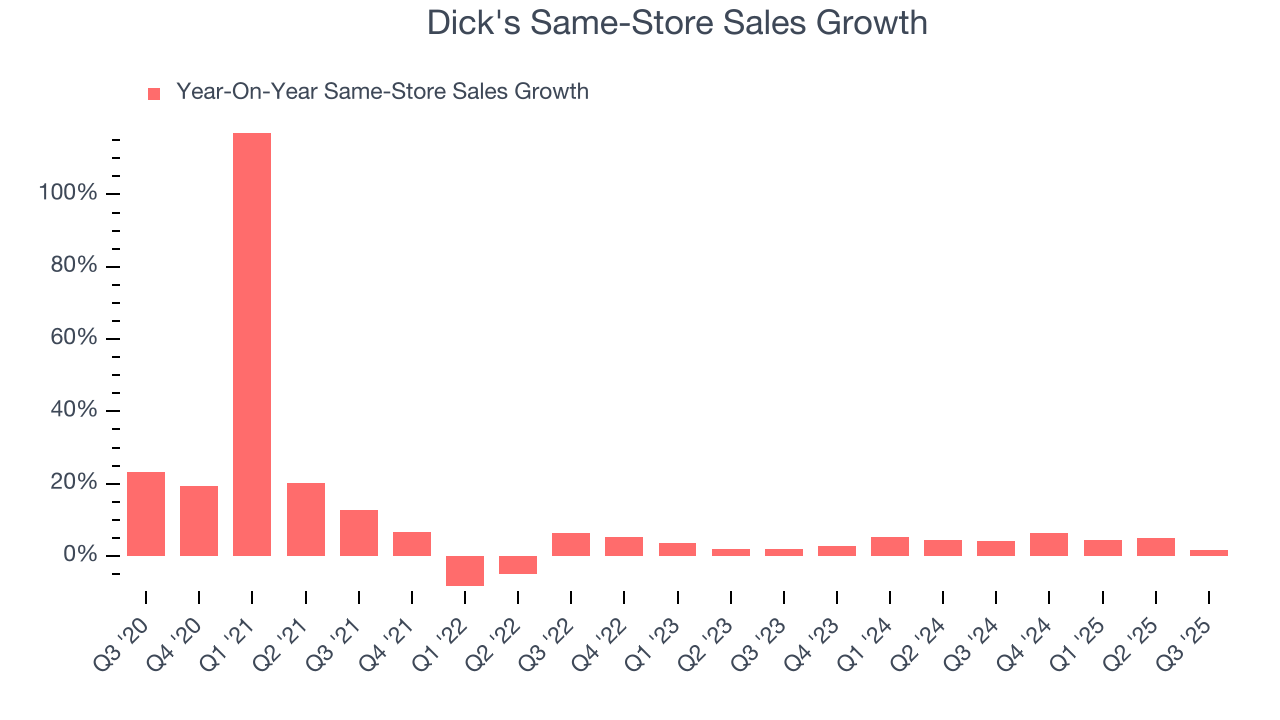

The change in a company's store base only tells one side of the story. The other is the performance of its existing locations and e-commerce sales, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales is an industry measure of whether revenue is growing at those existing stores and is driven by customer visits (often called traffic) and the average spending per customer (ticket).

Dick’s demand has been spectacular for a retailer over the last two years. On average, the company has increased its same-store sales by an impressive 4.3% per year. This performance suggests its measured rollout of new stores is beneficial for shareholders. We like this backdrop because it gives Dick's multiple ways to win: revenue growth can come from new stores, e-commerce, or increased foot traffic and higher sales per customer at existing locations.

In the latest quarter, Dick’s same-store sales rose 1.7% year on year. This was a meaningful deceleration from its historical levels. We’ll be watching closely to see if Dick's can reaccelerate growth.

7. Gross Margin & Pricing Power

At StockStory, we prefer high gross margin businesses because they indicate pricing power or differentiated products, giving the company a chance to generate higher operating profits.

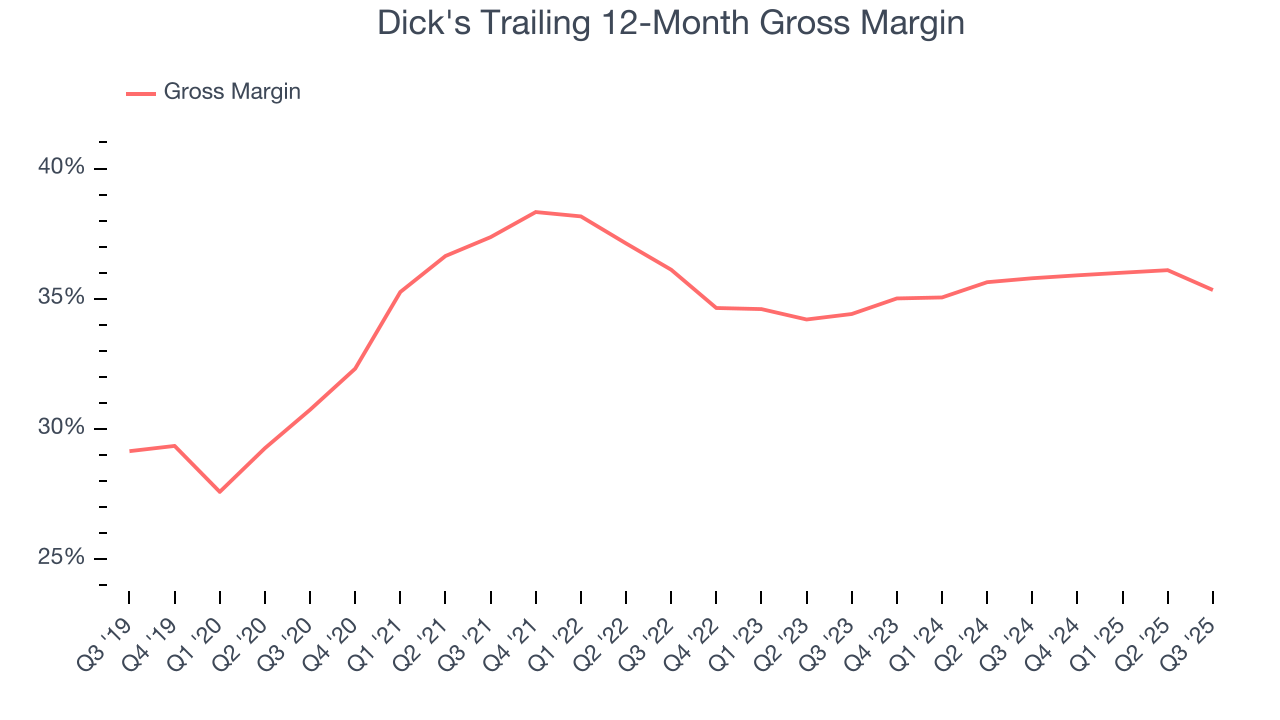

Dick's has bad unit economics for a retailer, giving it less room to reinvest and grow its presence. As you can see below, it averaged a 35.5% gross margin over the last two years. That means Dick's paid its suppliers a lot of money ($64.45 for every $100 in revenue) to run its business.

Dick's produced a 33.1% gross profit margin in Q3, marking a 2.6 percentage point decrease from 35.8% in the same quarter last year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting it strives to keep prices low for customers and has stable input costs (such as labor and freight expenses to transport goods).

8. Operating Margin

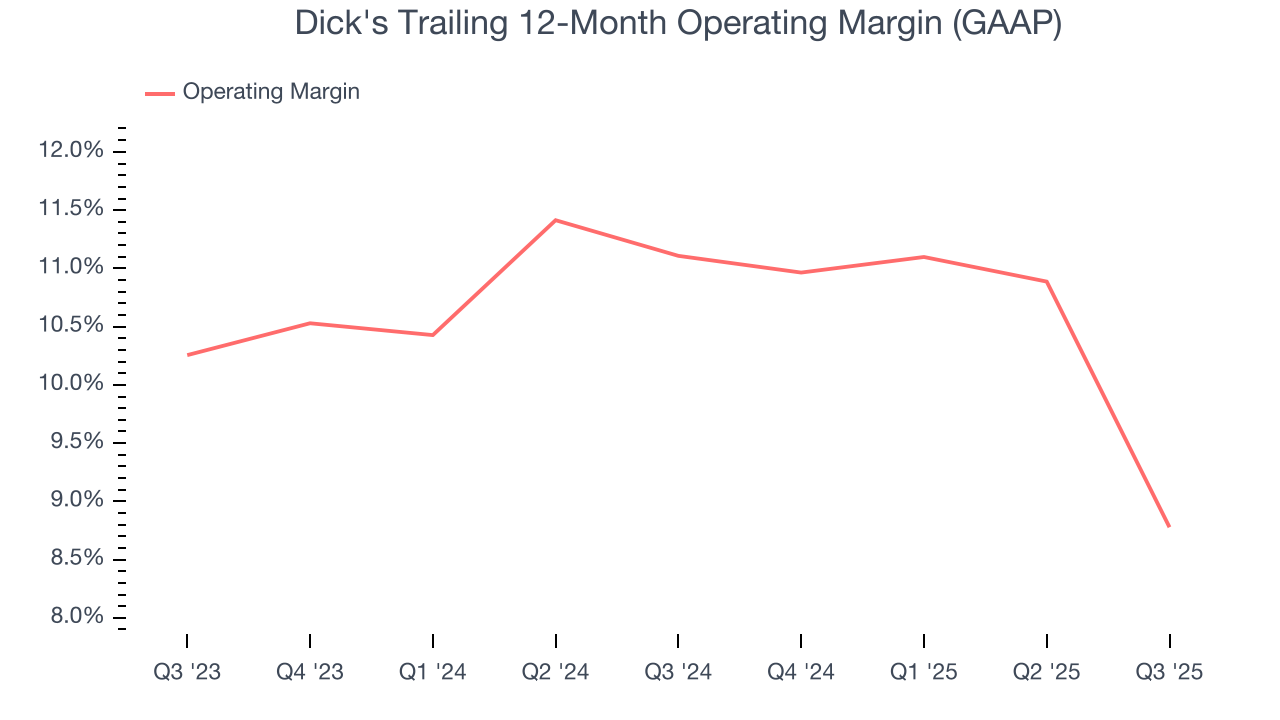

Dick's has done a decent job managing its cost base over the last two years. The company has produced an average operating margin of 9.9%, higher than the broader consumer retail sector.

Analyzing the trend in its profitability, Dick’s operating margin decreased by 2.3 percentage points over the last year. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Dick's generated an operating margin profit margin of 2.2%, down 7.1 percentage points year on year. Since Dick’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, and administrative overhead increased.

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

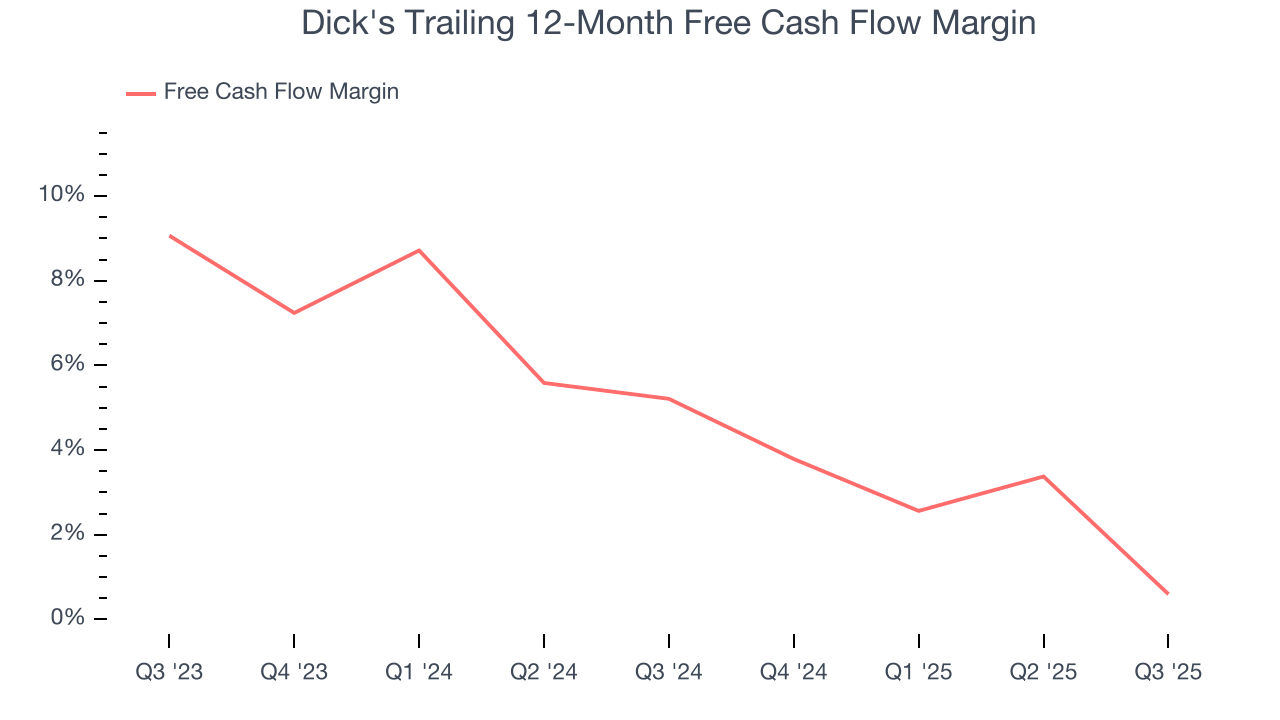

Dick's has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 2.8% over the last two years, slightly better than the broader consumer retail sector.

Taking a step back, we can see that Dick’s margin dropped by 4.6 percentage points over the last year. This decrease came from the higher costs associated with opening more stores.

Dick's burned through $515.6 million of cash in Q3, equivalent to a negative 12.4% margin. The company’s cash burn increased from $139.3 million of lost cash in the same quarter last year. These numbers deviate from its longer-term margin, indicating it is a seasonal business that must build up inventory during certain quarters.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Although Dick's hasn’t been the highest-quality company lately, it historically found a few growth initiatives that worked out well. Its five-year average ROIC was 22.9%, impressive for a consumer retail business.

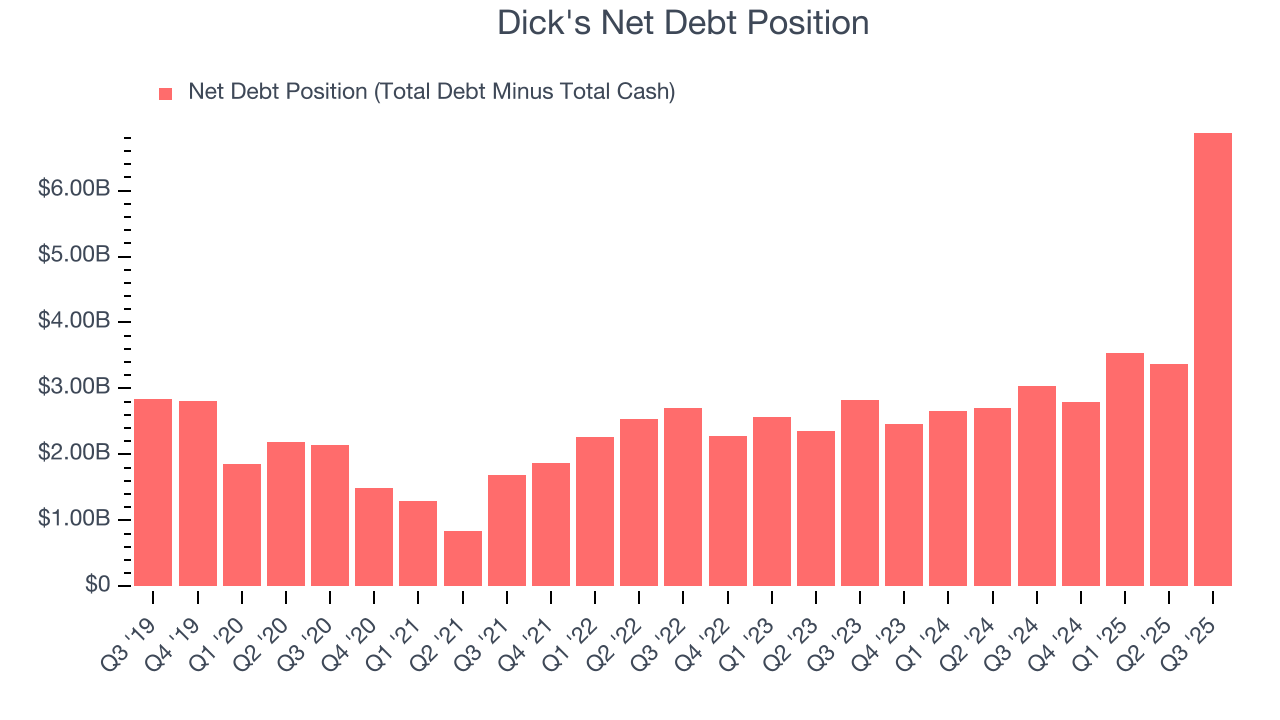

11. Balance Sheet Risk

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

Dick's posted negative $36.18 billion of EBITDA over the last 12 months, and its $7.70 billion of debt exceeds the $821.3 million of cash on its balance sheet. This is a deal breaker for us because indebted loss-making companies spell trouble.

We implore our readers to tread carefully because credit agencies could downgrade Dick's if its unprofitable ways continue, making incremental borrowing more expensive and restricting growth prospects. The company could also be backed into a corner if the market turns unexpectedly. We hope Dick's can improve its profitability and remain cautious until then.

12. Key Takeaways from Dick’s Q3 Results

We struggled to find many positives in these results. Its full-year revenue guidance missed and its revenue fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 7.9% to $190.04 immediately following the results.

13. Is Now The Time To Buy Dick's?

Updated: January 23, 2026 at 9:32 PM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

In our opinion, Dick's is a good company. Although its revenue growth was a little slower over the last three years, its growth over the next 12 months is expected to be higher. And while Dick’s gross margins make it more difficult to reach positive operating profits compared to other consumer retail businesses, its new store openings have increased its brand equity. On top of that, its marvelous same-store sales growth is on another level.

Dick’s P/E ratio based on the next 12 months is 15.7x. Looking at the consumer retail space right now, Dick's trades at a compelling valuation. If you believe in the company and its growth potential, now is an opportune time to buy shares.

Wall Street analysts have a consensus one-year price target of $237.68 on the company (compared to the current share price of $206.20), implying they see 15.3% upside in buying Dick's in the short term.