Ulta (ULTA)

Ulta is interesting. It repeatedly invests in lucrative growth initiatives, generating robust cash flows and returns on capital.― StockStory Analyst Team

1. News

2. Summary

Why Ulta Is Interesting

Offering high-end prestige brands as well as lower-priced, mass-market ones, Ulta Beauty (NASDAQ:ULTA) is an American retailer that sells makeup, skincare, haircare, and fragrance products.

- Market-beating returns on capital illustrate that management has a knack for investing in profitable ventures

- Store expansion strategy is justified by its healthy same-store sales

- A downside is its annual sales growth of 7.3% over the last three years lagged behind its consumer retail peers as its large revenue base made it difficult to generate incremental demand

Ulta shows some promise. If you believe in the company, the price seems reasonable.

Why Is Now The Time To Buy Ulta?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Ulta?

Ulta is trading at $676.29 per share, or 24.9x forward P/E. Looking at the consumer retail landscape, we think the price is reasonable for the quality you get.

If you think the market is undervaluing the company, now could be a good time to build a position.

3. Ulta (ULTA) Research Report: Q3 CY2025 Update

Beauty, cosmetics, and personal care retailer Ulta Beauty (NASDAQ:ULTA) reported Q3 CY2025 results exceeding the market’s revenue expectations, with sales up 12.9% year on year to $2.86 billion. The company’s full-year revenue guidance of $12.3 billion at the midpoint came in 2% above analysts’ estimates. Its GAAP profit of $5.14 per share was 11.7% above analysts’ consensus estimates.

Ulta (ULTA) Q3 CY2025 Highlights:

- Revenue: $2.86 billion vs analyst estimates of $2.72 billion (12.9% year-on-year growth, 5.2% beat)

- EPS (GAAP): $5.14 vs analyst estimates of $4.60 (11.7% beat)

- Adjusted EBITDA: $364.9 million vs analyst estimates of $349.4 million (12.8% margin, 4.4% beat)

- The company lifted its revenue guidance for the full year to $12.3 billion at the midpoint from $12.05 billion, a 2.1% increase

- EPS (GAAP) guidance for the full year is $25.35 at the midpoint, beating analyst estimates by 3.3%

- Operating Margin: 10.8%, down from 12.6% in the same quarter last year

- Free Cash Flow was -$81.63 million compared to -$171.1 million in the same quarter last year

- Locations: 1,500 at quarter end, up from 1,437 in the same quarter last year

- Same-Store Sales rose 6.3% year on year (0.6% in the same quarter last year)

- Market Capitalization: $24.42 billion

Company Overview

Offering high-end prestige brands as well as lower-priced, mass-market ones, Ulta Beauty (NASDAQ:ULTA) is an American retailer that sells makeup, skincare, haircare, and fragrance products.

Given its variety in both price point as well as product, Ulta serves as a one-stop-shop for beauty. The core customer is a middle to higher-income woman across a variety of ages. This customer has specific needs or tastes in beauty that may not be served by the narrower selection of a department store or mass merchandise retailer.

A typical store is around 10,000 square feet. Key sections include fragrance, makeup, skincare, and haircare. The makeup section tends to be the largest, and most sections allow customers to try out a variety of products before purchasing. In addition to these sections, stores may also offer salon and spa services, where customers can receive professional haircuts, color treatments, and waxing. Ulta also has an e-commerce presence, featuring not just products but reviews and tutorials, that the company has been investing in since 2008.

The brand selection in Ulta stores is diverse and constantly evolving based on customer tastes and broader trends in beauty. MAC, Clinique, and Urban Decay are globally-recognized brands that can be found in stores, for example. Additionally, there are brands exclusive to Ulta as well as emerging ones like Fourth Ray Beauty.

4. Beauty and Cosmetics Retailer

Beauty and cosmetics retailers understand that beauty is in the eye of the beholder, but a little lipstick, nail polish, and glowing skin also help the cause. These stores—which mostly cater to consumers but can also garner the attention of salon pros—aim to be a one-stop personal care and beauty products shop with many brands across many categories. E-commerce is changing how consumers buy cosmetics, so these retailers are constantly evolving to meet the customer where and how they want to shop.

Retailers specializing in beauty products include Sally Beauty (NYSE:SBH) and Bath & Body Works while department stores such as Kohl’s (NYSE:KSS) and Macy’s (NYSE:M) typically feature large cosmetics and fragrance sections.

5. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $11.98 billion in revenue over the past 12 months, Ulta is a mid-sized retailer, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale.

As you can see below, Ulta grew its sales at a tepid 7.3% compounded annual growth rate over the last three years (we compare to 2019 to normalize for COVID-19 impacts), but to its credit, it opened new stores and increased sales at existing, established locations.

This quarter, Ulta reported year-on-year revenue growth of 12.9%, and its $2.86 billion of revenue exceeded Wall Street’s estimates by 5.2%.

Looking ahead, sell-side analysts expect revenue to grow 4.7% over the next 12 months, a slight deceleration versus the last three years. We still think its growth trajectory is attractive given its scale and suggests the market sees success for its products.

6. Store Performance

Number of Stores

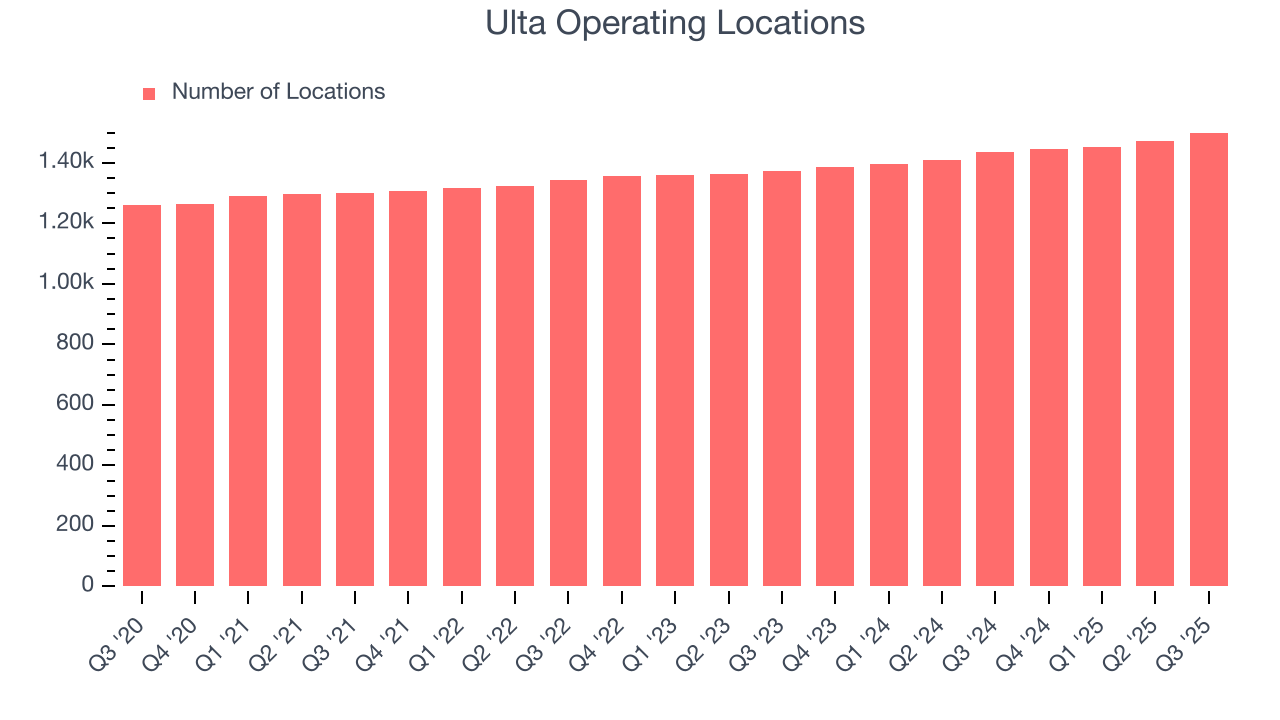

Ulta sported 1,500 locations in the latest quarter. Over the last two years, it has opened new stores quickly, averaging 3.8% annual growth. This was faster than the broader consumer retail sector.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

Same-Store Sales

The change in a company's store base only tells one side of the story. The other is the performance of its existing locations and e-commerce sales, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales gives us insight into this topic because it measures organic growth for a retailer's e-commerce platform and brick-and-mortar shops that have existed for at least a year.

Ulta’s demand has been healthy for a retailer over the last two years. On average, the company has grown its same-store sales by a robust 2.6% per year. This performance suggests its rollout of new stores could be beneficial for shareholders. When a retailer has demand, more locations should help it reach more customers and boost revenue growth.

In the latest quarter, Ulta’s same-store sales rose 6.3% year on year. This growth was an acceleration from its historical levels, which is always an encouraging sign.

7. Gross Margin & Pricing Power

At StockStory, we prefer high gross margin businesses because they indicate pricing power or differentiated products, giving the company a chance to generate higher operating profits.

Ulta’s unit economics are higher than the typical retailer, giving it the flexibility to invest in areas such as marketing and talent to reach more consumers. As you can see below, it averaged a decent 42.7% gross margin over the last two years. That means for every $100 in revenue, $57.30 went towards paying for inventory, transportation, and distribution.

This quarter, Ulta’s gross profit margin was 40.4%, in line with the same quarter last year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting it strives to keep prices low for customers and has stable input costs (such as labor and freight expenses to transport goods).

8. Operating Margin

Ulta’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 13.4% over the last two years. This profitability was top-notch for a consumer retail business, showing it’s an well-run company with an efficient cost structure.

Analyzing the trend in its profitability, Ulta’s operating margin might fluctuated slightly but has generally stayed the same over the last year. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Ulta generated an operating margin profit margin of 10.8%, down 1.8 percentage points year on year. Since Ulta’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, and administrative overhead increased.

9. Earnings Per Share

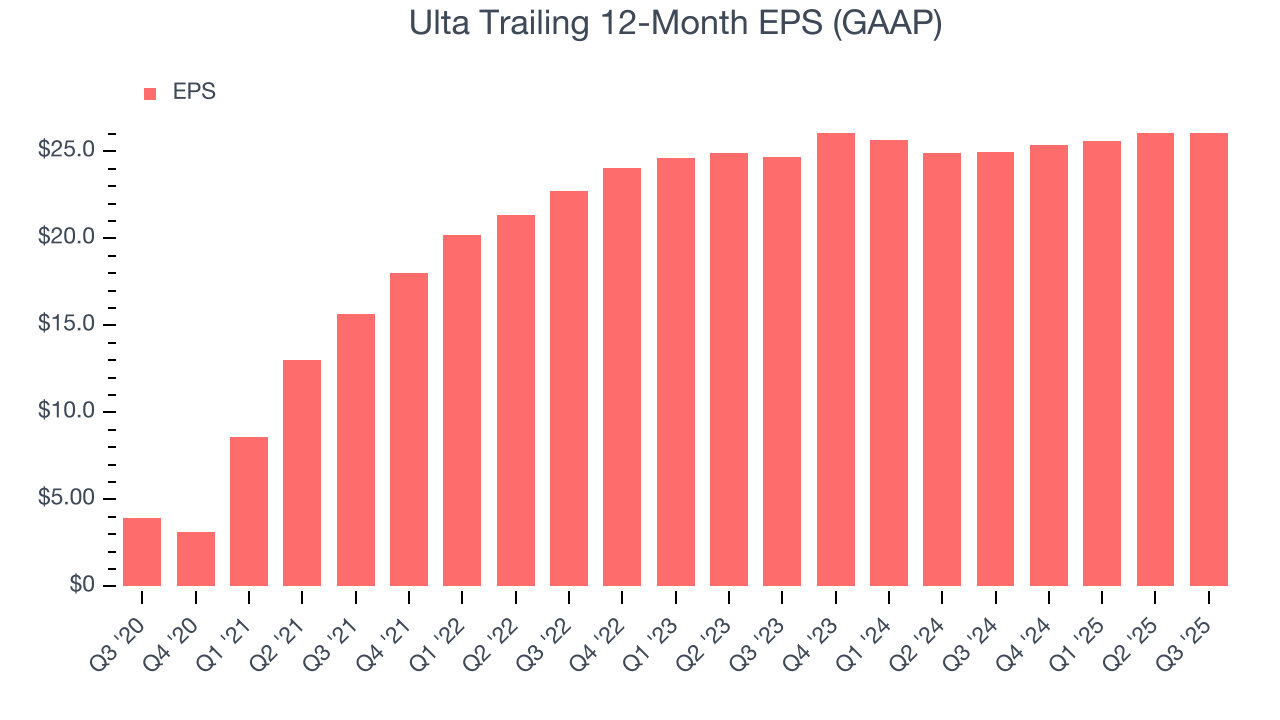

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Ulta’s EPS grew at an unimpressive 4.7% compounded annual growth rate over the last three years, lower than its 7.3% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded due to non-fundamental factors such as interest expenses and taxes.

In Q3, Ulta reported EPS of $5.14, in line with the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Ulta’s full-year EPS of $26.08 to grow 4.8%.

10. Cash Is King

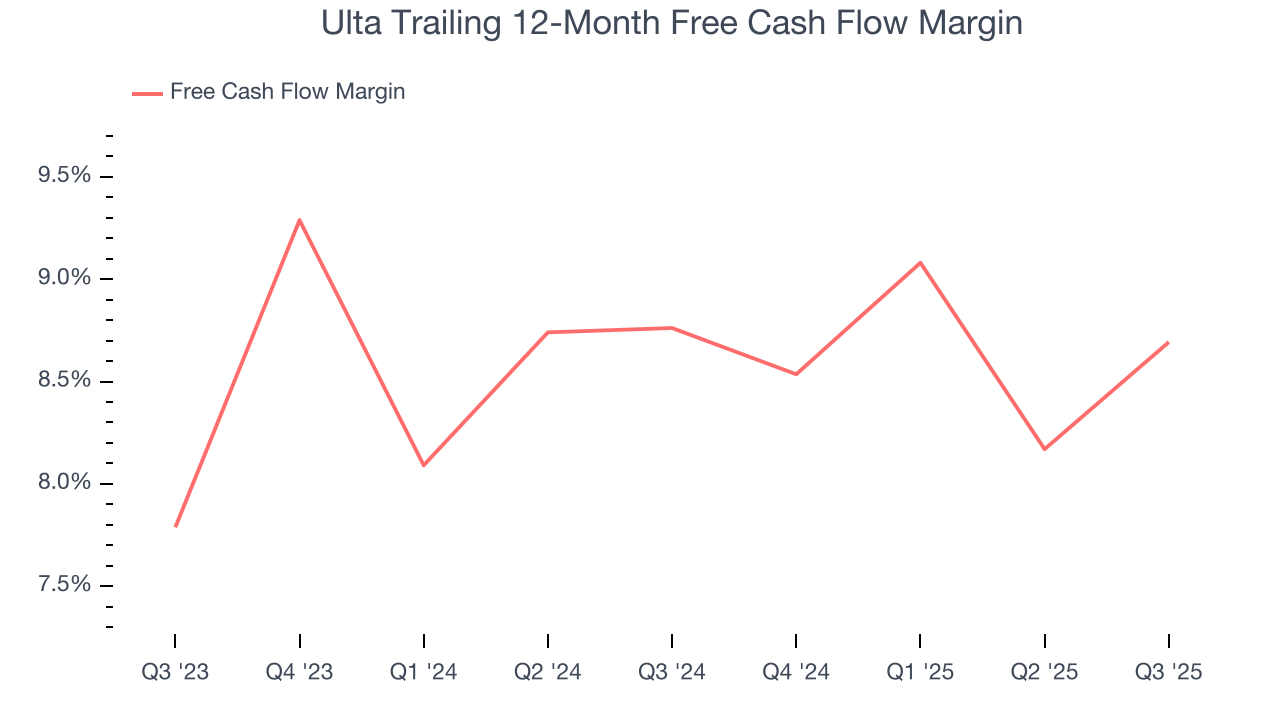

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Ulta has shown robust cash profitability, giving it an edge over its competitors and the ability to reinvest or return capital to investors. The company’s free cash flow margin averaged 8.7% over the last two years, quite impressive for a consumer retail business.

Ulta burned through $81.63 million of cash in Q3, equivalent to a negative 2.9% margin. The company’s cash burn slowed from $171.1 million of lost cash in the same quarter last year. These numbers deviate from its longer-term margin, but we wouldn’t read too much into the short term because investment needs can be seasonal, causing temporary swings.

11. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Ulta’s five-year average ROIC was 32.3%, placing it among the best consumer retail companies. This illustrates its management team’s ability to invest in highly profitable ventures and produce tangible results for shareholders.

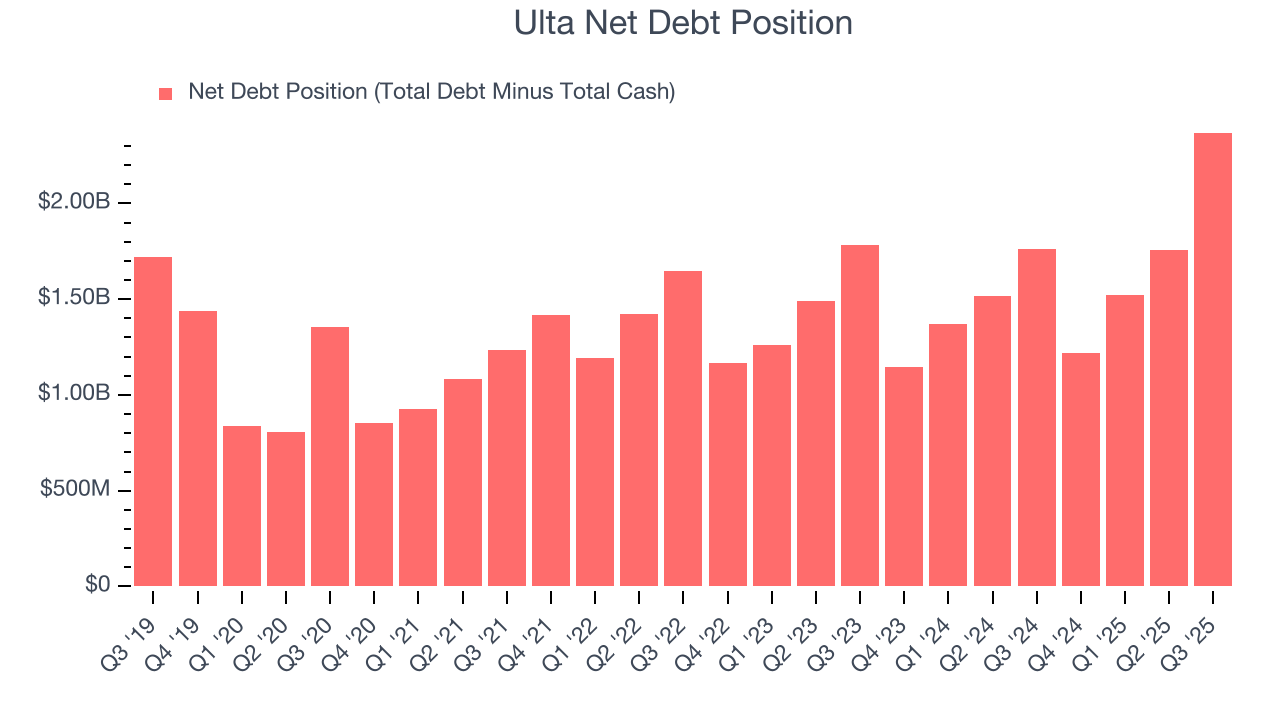

12. Balance Sheet Assessment

Ulta reported $204.9 million of cash and $2.57 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $1.84 billion of EBITDA over the last 12 months, we view Ulta’s 1.3× net-debt-to-EBITDA ratio as safe. We also see its $11.08 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

13. Key Takeaways from Ulta’s Q3 Results

We were impressed by how significantly Ulta blew past analysts’ revenue expectations this quarter. We were also glad its full-year EPS guidance exceeded Wall Street’s estimates. Zooming out, we think this quarter featured some important positives. The stock traded up 2.9% to $549.51 immediately following the results.

14. Is Now The Time To Buy Ulta?

Updated: March 2, 2026 at 10:04 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Ulta.

Ulta is a fine business. Although its revenue growth was a little slower over the last three years, its stellar ROIC suggests it has been a well-run company historically. And while its mediocre EPS growth over the last three years shows it’s failed to produce meaningful profits for shareholders, its expanding store base shows it’s playing offense to grow its brand.

Ulta’s P/E ratio based on the next 12 months is 24.9x. When scanning the consumer retail space, Ulta trades at a fair valuation. For those confident in the business and its management team, this is a good time to invest.

Wall Street analysts have a consensus one-year price target of $684.38 on the company (compared to the current share price of $676.29).