GameStop (GME)

GameStop is in for a bumpy ride. Its share price is driven more by meme-fueled sentiment than fundamentals, offering little protection when the hype fades.― StockStory Analyst Team

1. News

2. Summary

Why We Think GameStop Will Underperform

Drawing gaming fans with demo units set up with the latest releases, GameStop (NYSE:GME) sells new and used video games, consoles, and accessories, as well as pop culture merchandise.

- GameStop’s brick-and-mortar engine keeps stalling as gamers migrate to digital downloads, and management is closing more outlets after shuttering hundreds of stores last year

- The share price remains an unpredictable meme-stock roller-coaster, and the purchase of thousands of Bitcoins have fueled huge swings

- On the bright side, the company has a large cash pile that gives CEO Ryan Cohen room to buy more Bitcoin or fund its collectibles and trading-card push

GameStop lacks the business quality we seek. We see more attractive opportunities in the market.

Why There Are Better Opportunities Than GameStop

High Quality

Investable

Underperform

Why There Are Better Opportunities Than GameStop

GameStop is trading at $23.65 per share, or 27.6x forward P/E. This multiple expensive for its subpar fundamentals.

Paying a premium for high-quality companies with strong long-term earnings potential is preferable to owning challenged businesses with questionable prospects. That helps the prudent investor sleep well at night.

3. GameStop (GME) Research Report: Q3 CY2025 Update

Video game retailer GameStop (NYSE:GME) fell short of the markets revenue expectations in Q3 CY2025, with sales falling 4.6% year on year to $821 million. Its non-GAAP profit of $0.24 per share was 20% above analysts’ consensus estimates.

GameStop (GME) Q3 CY2025 Highlights:

- Revenue: $821 million vs analyst estimates of $987.3 million (4.6% year-on-year decline, 16.8% miss)

- Adjusted EPS: $0.24 vs analyst estimates of $0.20 (20% beat)

- Adjusted EBITDA: $64.4 million (7.8% margin, 675% year-on-year growth)

- Operating Margin: 5%, up from -2.9% in the same quarter last year

- Free Cash Flow Margin: 13%, up from 2.3% in the same quarter last year

- Market Capitalization: $10.46 billion

Company Overview

Drawing gaming fans with demo units set up with the latest releases, GameStop (NYSE:GME) sells new and used video games, consoles, and accessories, as well as pop culture merchandise.

Note that our analysis is rooted in fundamentals, not meme-stock technicals.

Over time, physical consoles and cartridges have lost some relevance, as more games are delivered digitally. In response, GameStop established a digital storefront on its website where customers can purchase digital game downloads and in-game content. When a customer makes a purchase, they receive a digital code that can be redeemed on the platform of their choice, such as Xbox Live. GameStop also offers the option to purchase digital content in-store, where employees can help customers navigate the process and answer any questions they may have.

The core customer of GameStop is typically a young, male gamer looking for the latest video games and accessories. Stores also offer trade-in opportunities for customers who want to sell or exchange used games and consoles for store credit. The size of an average GameStop store is small, around 1,500 square feet. They are located in malls or shopping centers alongside other mass market retailers. The stores are laid out with displays of the latest video games and consoles at the front of the store, while used games and accessories are often located toward the back.

GameStop's competitors include other video game retailers like Best Buy and Walmart, as well as online retailers like Amazon and digital gaming platforms like Steam. Some of these competitors, like Best Buy and Walmart, are public companies, while others, like Steam, are private.

One interesting fact about GameStop is that the company was at the center of a trading frenzy in early 2021 when a group of amateur investors on Reddit drove up the price of GameStop's stock

4. Electronics & Gaming Retailer

After a long day, some of us want to just watch TV, play video games, listen to music, or scroll through our phones; electronics and gaming retailers sell the technology that makes this possible, plus more. Shoppers can find everything from surround-sound speakers to gaming controllers to home appliances in their stores. Competitive prices and helpful store associates that can talk through topics like the latest technology in gaming and installation keep customers coming back. This is a category that has moved rapidly online over the last few decades, so these electronics and gaming retailers have needed to be nimble and aggressive with their e-commerce and omnichannel investments.

Competitors offering video games and video game accessories include Best Buy (NYSE:BBY), Walmart (NYSE:WMT), and Amazon.com (NASDAQ:AMZN).

5. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $3.81 billion in revenue over the past 12 months, GameStop is a small retailer, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with suppliers.

As you can see below, GameStop struggled to generate demand over the last three years (we compare to 2019 to normalize for COVID-19 impacts). Its sales dropped by 13.8% annually, a rough starting point for our analysis.

This quarter, GameStop missed Wall Street’s estimates and reported a rather uninspiring 4.6% year-on-year revenue decline, generating $821 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 14% over the next 12 months, an acceleration versus the last three years. This projection is eye-popping and indicates its newer products will fuel better top-line performance.

6. Gross Margin & Pricing Power

GameStop has bad unit economics for a retailer, signaling it operates in a competitive market and lacks pricing power because its inventory is sold in many places. As you can see below, it averaged a 28.8% gross margin over the last two years. Said differently, GameStop had to pay a chunky $71.23 to its suppliers for every $100 in revenue.

GameStop produced a 33.3% gross profit margin in Q3, marking a 3.4 percentage point increase from 29.9% in the same quarter last year. GameStop’s full-year margin has also been trending up over the past 12 months, increasing by 3.8 percentage points. If this move continues, it could suggest the company has less pressure to discount products and is realizing better unit economics due to stable or shrinking input costs (such as labor and freight expenses to transport goods).

7. Operating Margin

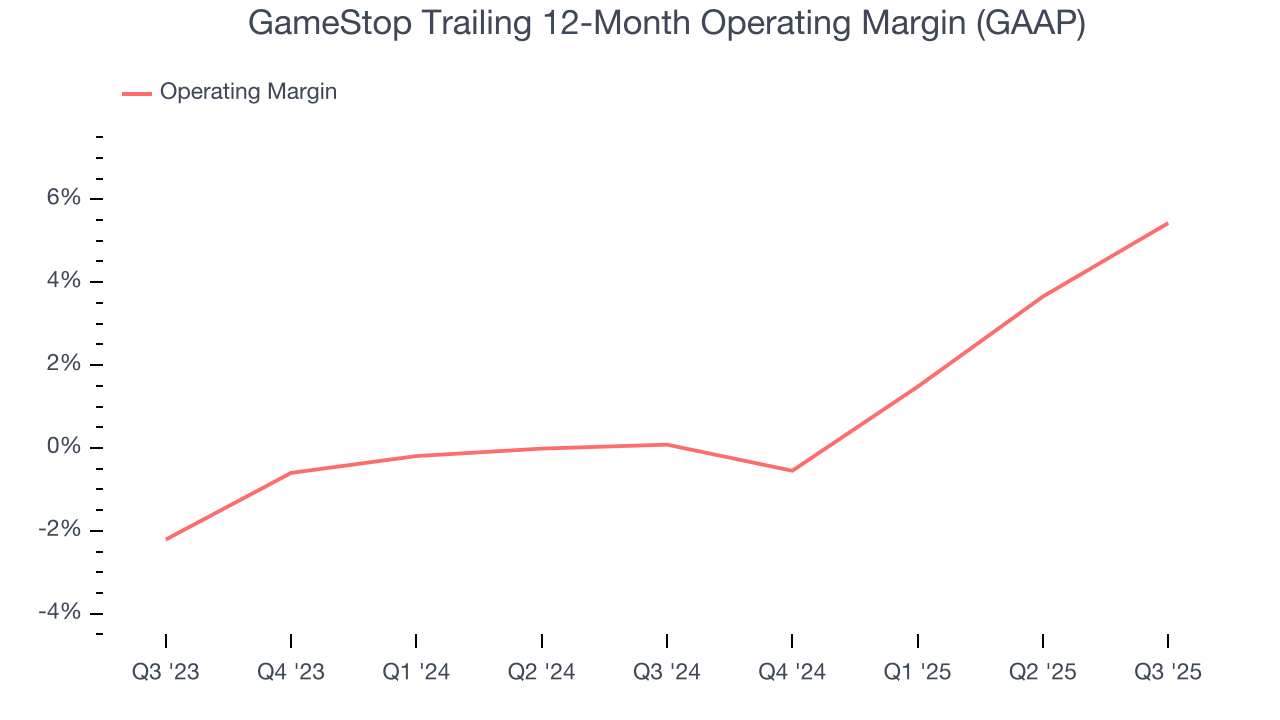

GameStop was profitable over the last two years but held back by its large cost base. Its average operating margin of 2.6% was weak for a consumer retail business. This result isn’t too surprising given its low gross margin as a starting point.

On the plus side, GameStop’s operating margin rose by 5.3 percentage points over the last year.

This quarter, GameStop generated an operating margin profit margin of 5%, up 7.9 percentage points year on year. The increase was solid, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, and administrative overhead.

8. Earnings Per Share

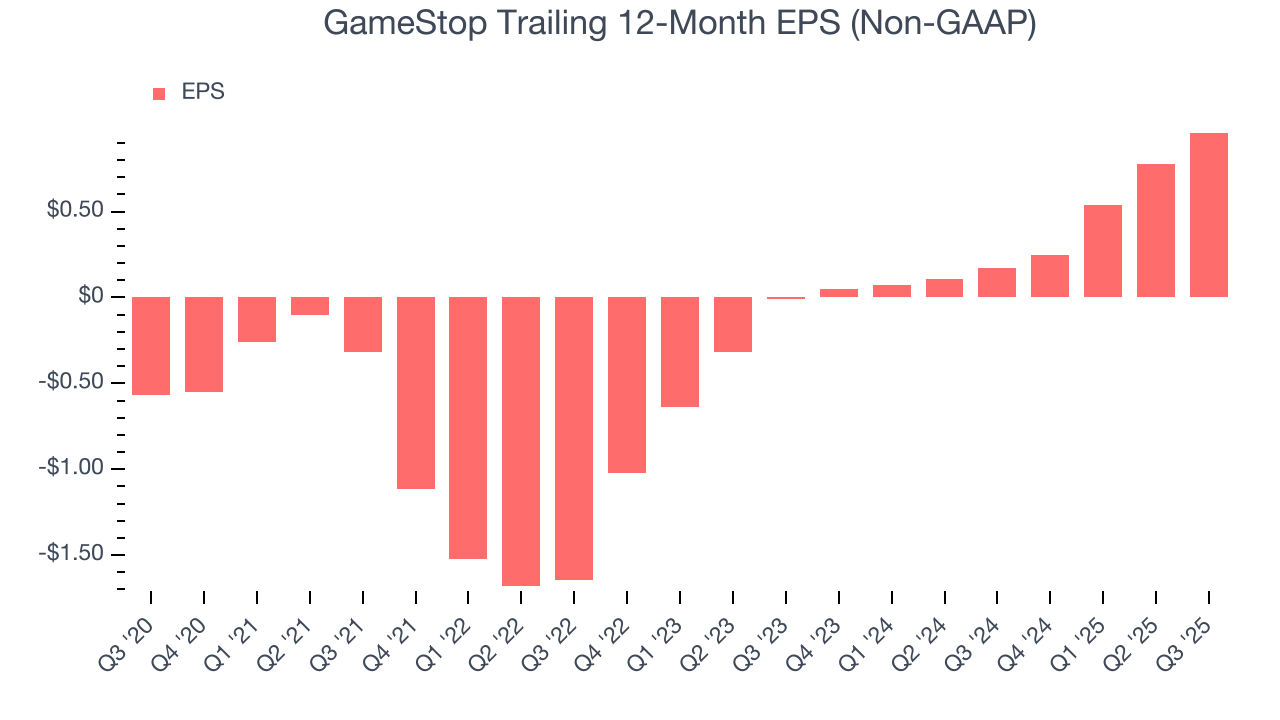

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

GameStop’s full-year EPS flipped from negative to positive over the last three years. This is encouraging and shows it’s at a critical moment in its life.

In Q3, GameStop reported adjusted EPS of $0.24, up from $0.06 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects GameStop’s full-year EPS of $0.96 to shrink by 11.5%.

9. Cash Is King

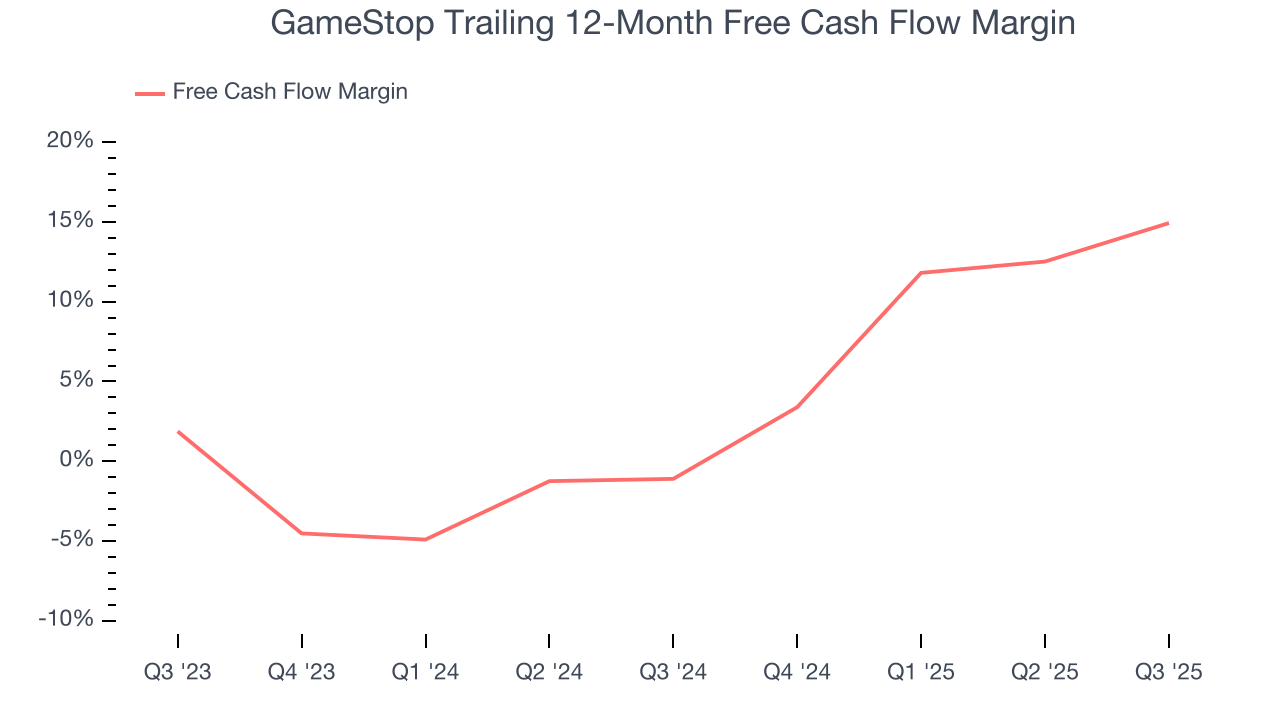

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

GameStop has shown robust cash profitability, giving it an edge over its competitors and the ability to reinvest or return capital to investors. The company’s free cash flow margin averaged 6.4% over the last two years, quite impressive for a consumer retail business. The divergence from its underwhelming operating margin stems from the add-back of non-cash charges like depreciation and stock-based compensation. GAAP operating profit expenses these line items, but free cash flow does not.

Taking a step back, we can see that GameStop’s margin expanded by 16 percentage points over the last year. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability.

GameStop’s free cash flow clocked in at $107 million in Q3, equivalent to a 13% margin. This result was good as its margin was 10.7 percentage points higher than in the same quarter last year, building on its favorable historical trend.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

GameStop’s five-year average ROIC was negative 10.9%, meaning management lost money while trying to expand the business. Its returns were among the worst in the consumer retail sector.

11. Balance Sheet Assessment

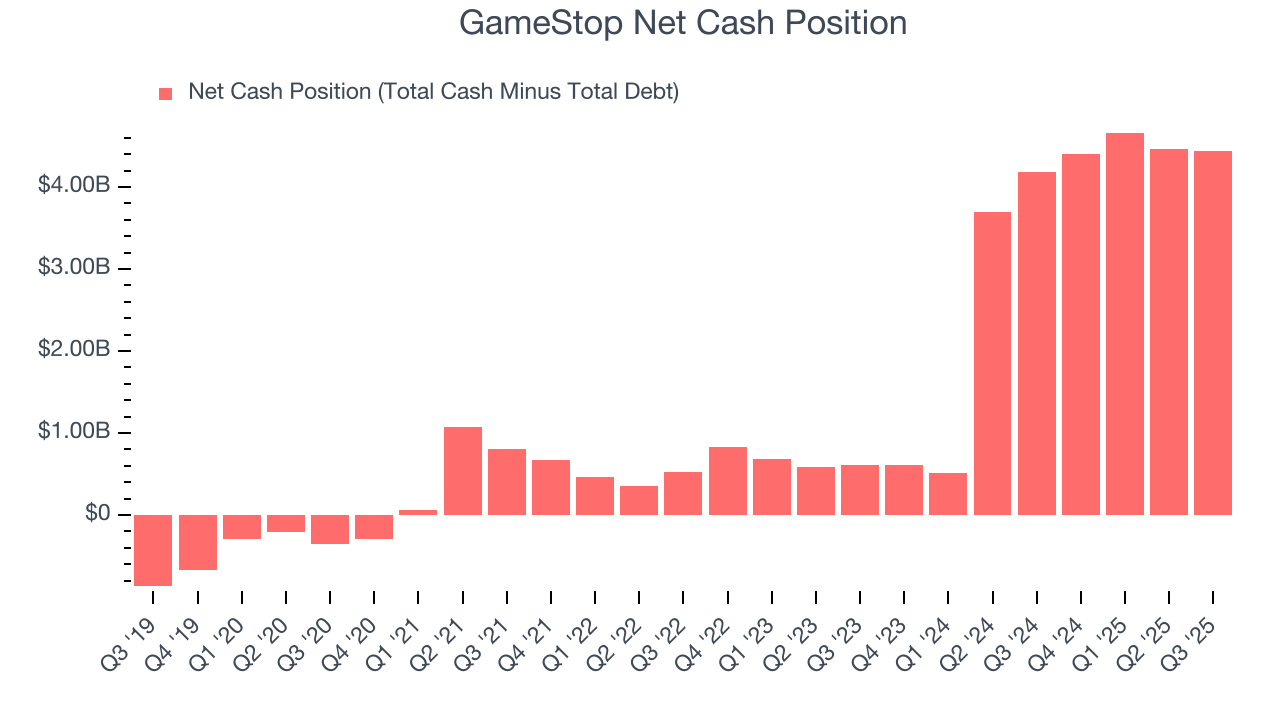

Companies with more cash than debt have lower bankruptcy risk.

GameStop is a profitable, well-capitalized company with $8.83 billion of cash and $4.39 billion of debt on its balance sheet. This $4.44 billion net cash position is 42.4% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from GameStop’s Q3 Results

We liked that gross margin and EPS outperformed Wall Street’s estimates. On the other hand, its revenue missed by a large amount. Overall, this was a mixed quarter. The stock traded down 5.4% to $21.94 immediately after reporting.

13. Is Now The Time To Buy GameStop?

Updated: February 23, 2026 at 9:46 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in GameStop.

We see the value of companies helping consumers, but in the case of GameStop, we’re out. To begin with, its revenue has declined over the last three years. While its EPS growth over the last three years has significantly beat its peer group average, the downside is its relatively low ROIC suggests management has struggled to find compelling investment opportunities. On top of that, its gross margins make it more challenging to reach positive operating profits compared to other consumer retail businesses.

GameStop’s P/E ratio based on the next 12 months is 27.6x. At this valuation, there’s a lot of good news priced in - we think there are better opportunities elsewhere.