DigitalOcean (DOCN)

We’re not sold on DigitalOcean. Its decelerating growth shows demand is falling and its weak gross margin indicates it has bad unit economics.― StockStory Analyst Team

1. News

2. Summary

Why DigitalOcean Is Not Exciting

Built for simplicity in a world of complex cloud solutions, DigitalOcean (NYSE:DOCN) provides a simplified cloud computing platform that enables developers and small businesses to quickly deploy and scale applications.

- Sky-high servicing costs result in an inferior gross margin of 59.9% that must be offset through increased usage

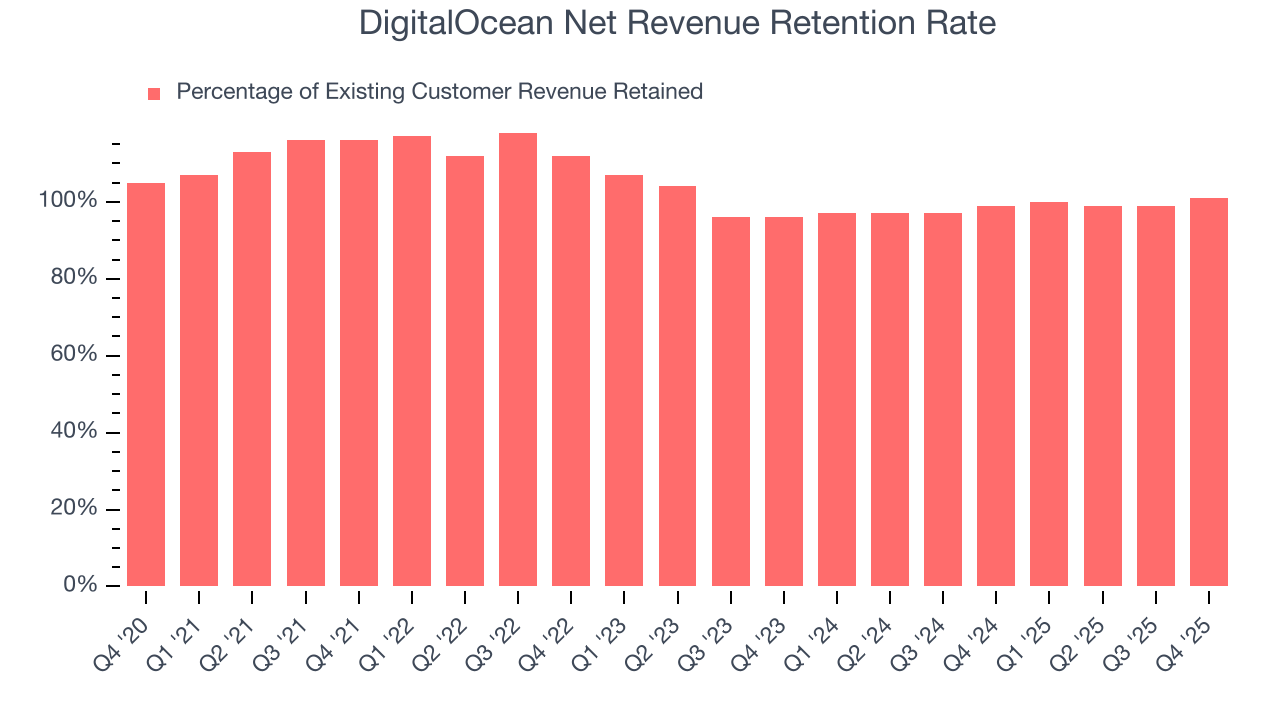

- Customers have churned over the last year due to the commoditized nature of its software, as reflected in its 99.8% net revenue retention rate

- The good news is that its software platform has product-market fit given the rapid recovery of its customer acquisition costs

DigitalOcean’s quality is not up to our standards. We’d rather invest in businesses with stronger moats.

Why There Are Better Opportunities Than DigitalOcean

High Quality

Investable

Underperform

Why There Are Better Opportunities Than DigitalOcean

DigitalOcean’s stock price of $54.28 implies a valuation ratio of 5.5x forward price-to-sales. This multiple is cheaper than most software peers, but we think this is justified.

Cheap stocks can look like a great deal at first glance, but they can be value traps. They often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. DigitalOcean (DOCN) Research Report: Q4 CY2025 Update

Cloud computing platform DigitalOcean (NYSE:DOCN) reported Q4 CY2025 results beating Wall Street’s revenue expectations, with sales up 18.3% year on year to $242.4 million. Guidance for next quarter’s revenue was better than expected at $249.5 million at the midpoint, 0.5% above analysts’ estimates. Its non-GAAP profit of $0.44 per share was 15.5% above analysts’ consensus estimates.

DigitalOcean (DOCN) Q4 CY2025 Highlights:

- Revenue: $242.4 million vs analyst estimates of $237.7 million (18.3% year-on-year growth, 2% beat)

- Adjusted EPS: $0.44 vs analyst estimates of $0.38 (15.5% beat)

- Adjusted EBITDA: $99.26 million vs analyst estimates of $92.06 million (41% margin, 7.8% beat)

- Revenue Guidance for Q1 CY2026 is $249.5 million at the midpoint, roughly in line with what analysts were expecting

- Adjusted EPS guidance for the upcoming financial year 2026 is $0.88 at the midpoint, missing analyst estimates by 55.3%

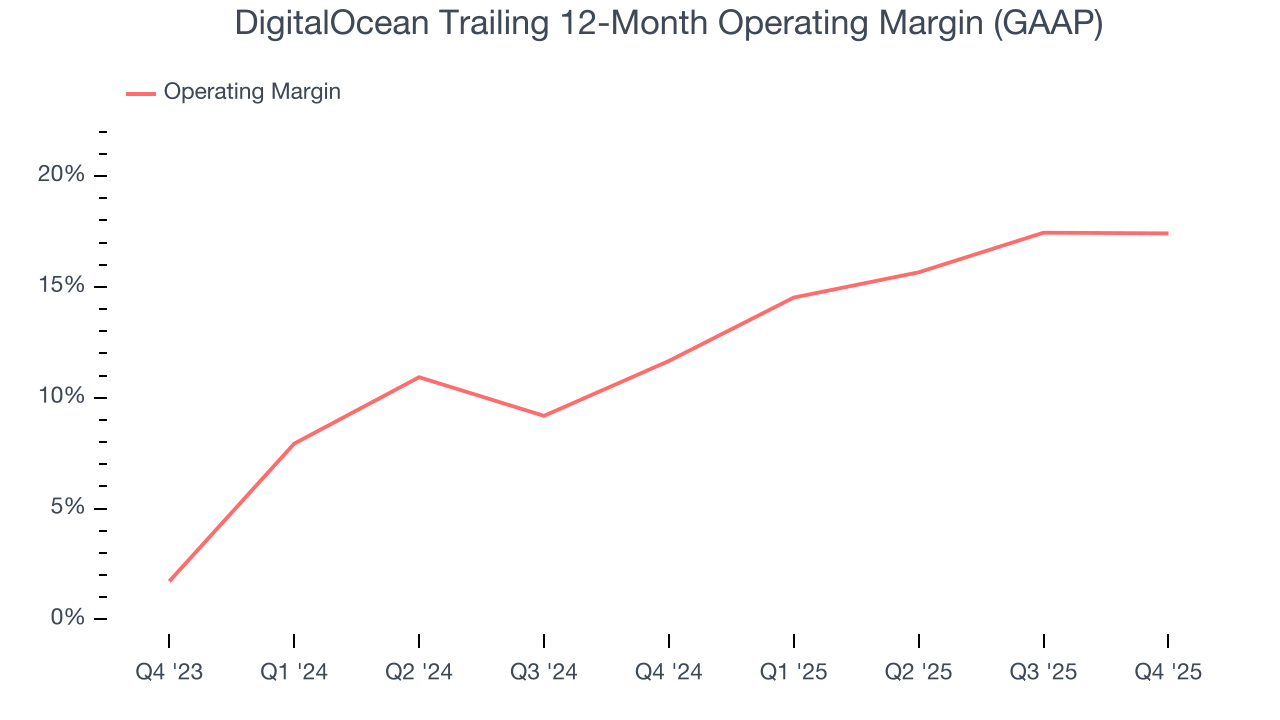

- Operating Margin: 16%, in line with the same quarter last year

- Free Cash Flow Margin: 11.1%, down from 37% in the previous quarter

- Net Revenue Retention Rate: 101%, up from 99% in the previous quarter

- Annual Recurring Revenue: $970 million (18.3% year-on-year growth, beat)

- Billings: $239.7 million at quarter end, up 17.1% year on year

- Market Capitalization: $5.42 billion

Company Overview

Built for simplicity in a world of complex cloud solutions, DigitalOcean (NYSE:DOCN) provides a simplified cloud computing platform that enables developers and small businesses to quickly deploy and scale applications.

DigitalOcean focuses on making cloud infrastructure accessible to startups and growing digital businesses, deliberately choosing simplicity over the complexity that characterizes many larger cloud providers. Its platform offers a carefully curated set of Infrastructure-as-a-Service (IaaS) options including virtual machines called Droplets, storage solutions, and networking tools; Platform-as-a-Service (PaaS) products such as Managed Databases and Kubernetes; and Software-as-a-Service (SaaS) offerings including Managed Hosting and Marketplace solutions.

The company has also expanded into AI/ML infrastructure through its Paperspace acquisition, providing GPU-accelerated computing resources for developing and deploying artificial intelligence applications. This move positions DigitalOcean to serve the growing needs of smaller businesses looking to incorporate AI capabilities.

What sets DigitalOcean apart is its transparent pricing model, with predominantly consumption-based billing that renews monthly, allowing customers to predict costs and optimize deployments. A developer working on a new e-commerce website might start with a basic Droplet, add a Managed Database as traffic grows, and later implement load balancing when scaling further—all with predictable costs and without needing to navigate complex configuration options.

DigitalOcean maintains data centers across nine geographic regions, enabling customers to deploy applications close to their users for better performance. The company has built a large developer community through educational content, technical tutorials, and events like Hacktoberfest, which helps attract new customers through a highly efficient self-service model.

4. Data Storage

Data is the lifeblood of the internet and software in general, and the amount of data created is accelerating. As a result, the importance of storing the data in scalable and efficient formats continues to rise, especially as its diversity and associated use cases expand from analyzing simple, structured datasets to high-scale processing of unstructured data such as images, audio, and video.

DigitalOcean competes primarily with large cloud providers like Amazon Web Services (NASDAQ:AMZN), Microsoft Azure (NASDAQ:MSFT), and Google Cloud Platform (NASDAQ:GOOGL), as well as smaller cloud service providers including OVHcloud, Vultr, Linode (owned by Akamai, NASDAQ:AKAM), and Hetzner. In the AI/ML space, it competes with specialized infrastructure providers like CoreWeave and Lambda Labs.

5. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Luckily, DigitalOcean’s sales grew at a solid 23.1% compounded annual growth rate over the last five years. Its growth beat the average software company and shows its offerings resonate with customers.

Long-term growth is the most important, but within software, a half-decade historical view may miss new innovations or demand cycles. DigitalOcean’s recent performance shows its demand has slowed as its annualized revenue growth of 14.1% over the last two years was below its five-year trend. We’re wary when companies in the sector see decelerations in revenue growth, as it could signal changing consumer tastes aided by low switching costs.

This quarter, DigitalOcean reported year-on-year revenue growth of 18.3%, and its $242.4 million of revenue exceeded Wall Street’s estimates by 2%. Company management is currently guiding for a 18.4% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 18.4% over the next 12 months, an improvement versus the last two years. This projection is noteworthy and implies its newer products and services will catalyze better top-line performance.

6. Annual Recurring Revenue

While reported revenue for a software company can include low-margin items like implementation fees, annual recurring revenue (ARR) is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

DigitalOcean’s ARR punched in at $970 million in Q4, and over the last four quarters, its growth slightly outpaced the sector as it averaged 15.4% year-on-year increases. This performance aligned with its total sales growth and shows the company is securing longer-term commitments. Its growth also contributes positively to DigitalOcean’s revenue predictability, a trait long-term investors typically prefer.

7. Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

DigitalOcean is extremely efficient at acquiring new customers, and its CAC payback period checked in at 10.3 months this quarter. The company’s rapid sales cycles stem from its strong brand reputation and self-serve model, where it can onboard many small customers with little to no oversight. These dynamics give DigitalOcean more resources to pursue new product initiatives.

8. Customer Retention

One of the best parts about the software-as-a-service business model (and a reason why they trade at high valuation multiples) is that customers typically spend more on a company’s products and services over time.

DigitalOcean’s net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 99.8% in Q4. This means DigitalOcean would’ve grown its revenue by -0.2% even if it didn’t win any new customers over the last 12 months.

DigitalOcean has an adequate net retention rate, showing us that it generally keeps customers but lags behind the best SaaS businesses, which routinely post net retention rates of 120%+.

9. Gross Margin & Pricing Power

For software companies like DigitalOcean, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

DigitalOcean’s gross margin is substantially worse than most software businesses, signaling it has relatively high infrastructure costs compared to asset-lite businesses like ServiceNow. As you can see below, it averaged a 59.9% gross margin over the last year. That means DigitalOcean paid its providers a lot of money ($40.14 for every $100 in revenue) to run its business.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. DigitalOcean has seen gross margins improve by 2.5 percentage points over the last 2 year, which is very good in the software space.

DigitalOcean’s gross profit margin came in at 58.7% this quarter , marking a 1.6 percentage point increase from 57.1% in the same quarter last year. DigitalOcean’s full-year margin has also been trending up over the past 12 months, increasing by 1.3 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold (such as servers).

10. Operating Margin

DigitalOcean has been a well-oiled machine over the last year. It demonstrated elite profitability for a software business, boasting an average operating margin of 17.4%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Looking at the trend in its profitability, DigitalOcean’s operating margin rose by 5.8 percentage points over the last two years, as its sales growth gave it operating leverage.

In Q4, DigitalOcean generated an operating margin profit margin of 16%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

11. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

DigitalOcean has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 18.6% over the last year, slightly better than the broader software sector.

DigitalOcean’s free cash flow clocked in at $26.9 million in Q4, equivalent to a 11.1% margin. The company’s cash profitability regressed as it was 6.8 percentage points lower than in the same quarter last year, prompting us to pay closer attention. Short-term fluctuations typically aren’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

Over the next year, analysts predict DigitalOcean’s cash conversion will improve. Their consensus estimates imply its free cash flow margin of 18.6% for the last 12 months will increase to 19.4%, it options for capital deployment (investments, share buybacks, etc.).

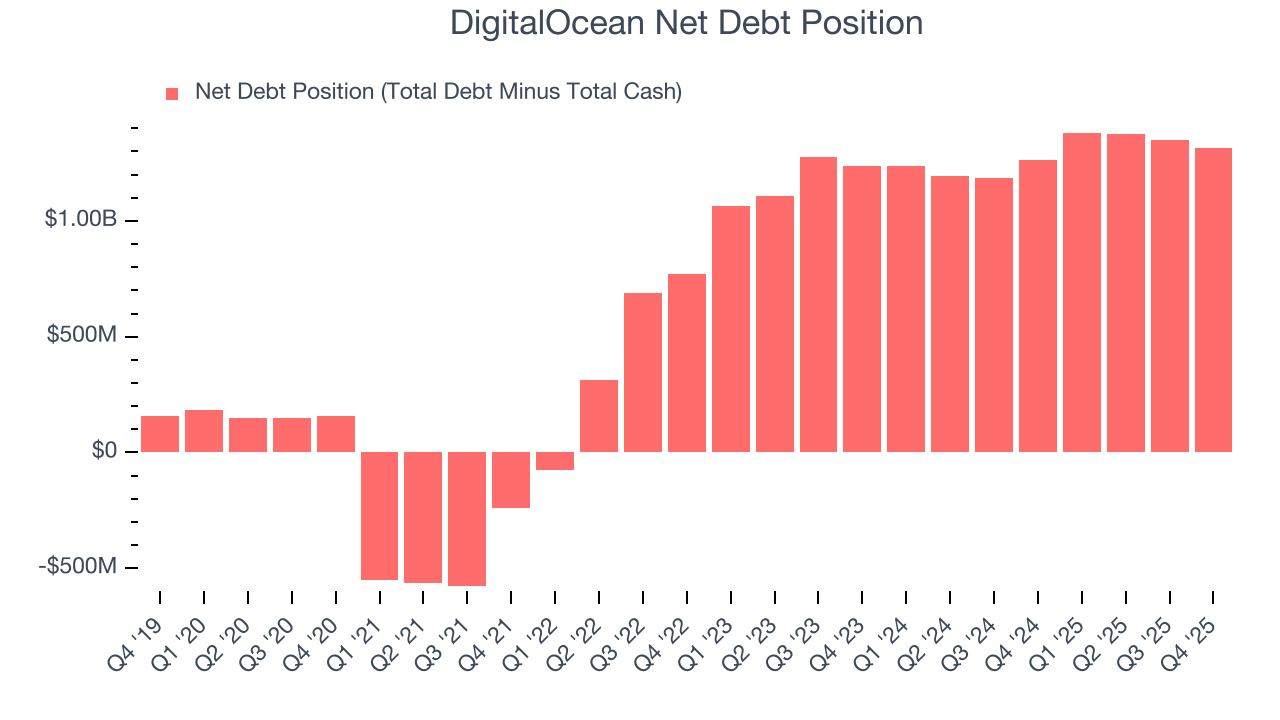

12. Balance Sheet Assessment

DigitalOcean reported $254.6 million of cash and $1.57 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $374.8 million of EBITDA over the last 12 months, we view DigitalOcean’s 3.5× net-debt-to-EBITDA ratio as safe. We also see its $12.25 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

13. Key Takeaways from DigitalOcean’s Q4 Results

We were impressed by how significantly DigitalOcean blew past analysts’ EBITDA expectations this quarter. We were also glad next year’s revenue guidance was robust. On the other hand, its full-year EPS guidance missed and its EPS guidance for next quarter fell short of Wall Street’s estimates. Zooming out, we think this was a mixed quarter. The stock traded up 1.7% to $60.25 immediately after reporting.

14. Is Now The Time To Buy DigitalOcean?

Updated: March 7, 2026 at 9:27 PM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

There are some bright spots in DigitalOcean’s fundamentals, but its business quality ultimately falls short. To kick things off, its revenue growth was solid over the last five years. And while DigitalOcean’s software has low switching costs and high turnover, its efficient sales strategy allows it to target and onboard new users at scale.

DigitalOcean’s price-to-sales ratio based on the next 12 months is 5.5x. While this valuation is reasonable, we don’t really see a big opportunity at the moment. We're pretty confident there are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $75 on the company (compared to the current share price of $54.28).