Darden (DRI)

We aren’t fans of Darden. Its weak revenue growth and gross margin show it not only lacks demand but also decent unit economics.― StockStory Analyst Team

1. News

2. Summary

Why Darden Is Not Exciting

Founded in 1968 as Red Lobster, Darden (NYSE:DRI) is a leading American restaurant company that owns and operates a portfolio of popular restaurant brands.

- Gross margin of 21.6% is below its competitors, leaving less money for marketing and promotions

- Large revenue base makes it harder to increase sales quickly, and its annual revenue growth of 6.4% over the last six years was below our standards for the restaurant sector

- The good news is that its enormous revenue base of $12.58 billion compensates for its low gross margin and provides significant leverage in supplier negotiations

Darden’s quality is not up to our standards. More profitable opportunities exist elsewhere.

Why There Are Better Opportunities Than Darden

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Darden

At $198.93 per share, Darden trades at 18x forward P/E. Yes, this valuation multiple is lower than that of other restaurant peers, but we’ll remind you that you often get what you pay for.

Cheap stocks can look like a great deal at first glance, but they can be value traps. They often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Darden (DRI) Research Report: Q4 CY2025 Update

Restaurant company Darden (NYSE:DRI) reported Q4 CY2025 results topping the market’s revenue expectations, with sales up 7.3% year on year to $3.10 billion. Its non-GAAP profit of $2.08 per share was 0.8% below analysts’ consensus estimates.

Darden (DRI) Q4 CY2025 Highlights:

- Revenue: $3.10 billion vs analyst estimates of $3.07 billion (7.3% year-on-year growth, 1% beat)

- Adjusted EPS: $2.08 vs analyst expectations of $2.10 (0.8% miss)

- Adjusted EBITDA: $482.2 million vs analyst estimates of $465.7 million (15.5% margin, 3.5% beat)

- Management reiterated its full-year Adjusted EPS guidance of $10.60 at the midpoint

- Operating Margin: 10.3%, in line with the same quarter last year

- Free Cash Flow Margin: 3.4%, down from 7.6% in the same quarter last year

- Locations: 2,182 at quarter end, up from 2,152 in the same quarter last year

- Same-Store Sales rose 4.3% year on year (2.4% in the same quarter last year)

- Market Capitalization: $22.04 billion

Company Overview

Founded in 1968 as Red Lobster, Darden (NYSE:DRI) is a leading American restaurant company that owns and operates a portfolio of popular restaurant brands.

Although it no longer owns Red Lobster (sold to private equity firm Golden Gate Capital in 2014), Darden has expanded its banners through acquisitions, including iconic full-service restaurant chains such as Olive Garden, LongHorn Steakhouse, Cheddar's Scratch Kitchen, Yard House, The Capital Grille, Seasons 52, and Bahama Breeze.

Each brand offers a unique culinary experience, showcasing a range of flavors, cuisines, and atmospheres to suit various tastes and dining preferences. For example, casual diners can indulge in unlimited breadsticks and beloved Italian classics at Olive Garden while fine diners can enjoy a perfectly grilled steak at any of The Capital Grille’s upscale locations.

Despite these differences, the unifying theme between Darden’s restaurants is a commitment to exceptional customer service. The company places great emphasis on providing warm and welcoming environments, ensuring that guests feel at home as soon as they step through its restaurants’ doors.

Darden has also embraced technology to meet the evolving demands of the modern dining landscape. Many of its banners offer online reservation systems and convenient mobile apps for easy booking and ordering. These digital innovations streamline the dining process, providing customers with greater convenience and flexibility.

4. Sit-Down Dining

Sit-down restaurants offer a complete dining experience with table service. These establishments span various cuisines and are renowned for their warm hospitality and welcoming ambiance, making them perfect for family gatherings, special occasions, or simply unwinding. Their extensive menus range from appetizers to indulgent desserts and wines and cocktails. This space is extremely fragmented and competition includes everything from publicly-traded companies owning multiple chains to single-location mom-and-pop restaurants.

Multi-brand full-service restaurant competitors include Bloomin’ Brands (NASDAQ:BLMN), Brinker International (NYSE:EAT), Dine Brands (NYSE:DIN), Texas Roadhouse (NASDAQ:TXRH), and The Cheesecake Factory (NASDAQ:CAKE).

5. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $12.58 billion in revenue over the past 12 months, Darden is one of the most widely recognized restaurant chains and benefits from customer loyalty, a luxury many don’t have. Its scale also gives it negotiating leverage with suppliers, enabling it to source its ingredients at a lower cost. However, its scale is a double-edged sword because there are only a finite of number places to build restaurants, making it harder to find incremental growth. To expand meaningfully, Darden likely needs to tweak its prices, start new chains, or enter new markets.

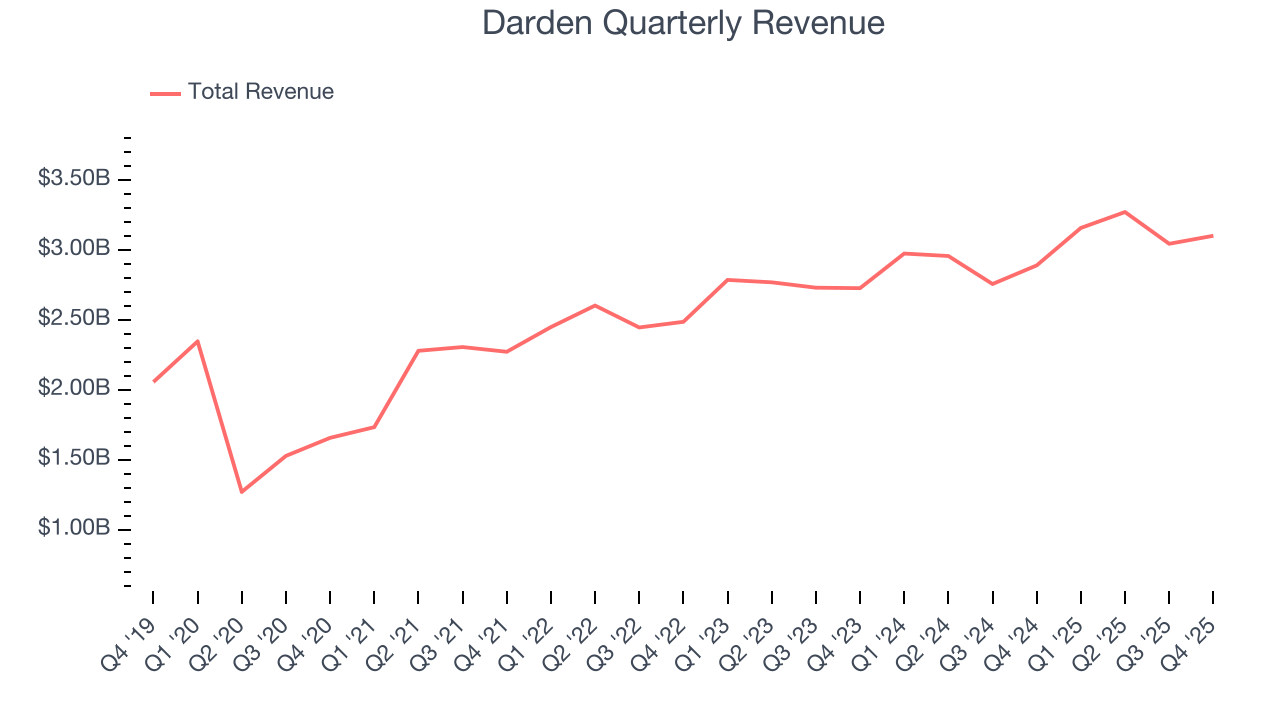

As you can see below, Darden’s sales grew at a mediocre 6.4% compounded annual growth rate over the last six years (we compare to 2019 to normalize for COVID-19 impacts) as it barely increased sales at existing, established dining locations.

This quarter, Darden reported year-on-year revenue growth of 7.3%, and its $3.10 billion of revenue exceeded Wall Street’s estimates by 1%.

Looking ahead, sell-side analysts expect revenue to grow 6.7% over the next 12 months, similar to its six-year rate. This projection is underwhelming and implies its newer menu offerings will not accelerate its top-line performance yet.

6. Restaurant Performance

Number of Restaurants

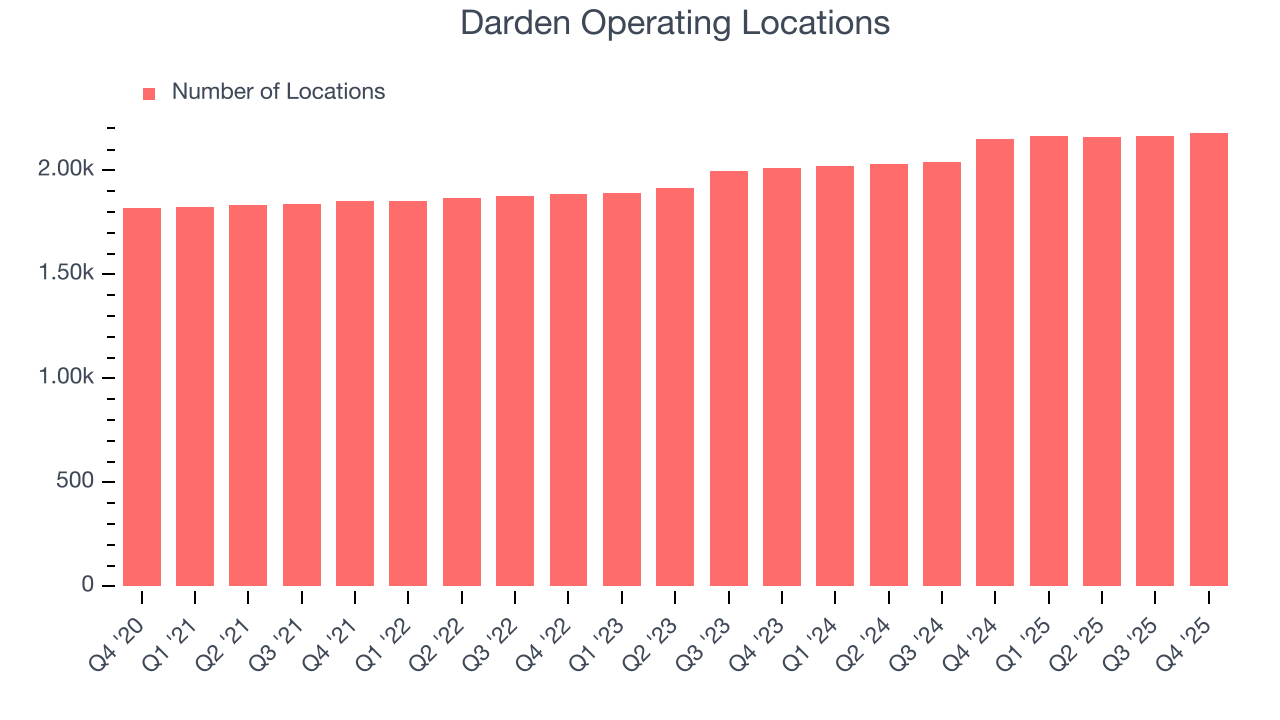

Darden sported 2,182 locations in the latest quarter. Over the last two years, it has opened new restaurants at a rapid clip by averaging 5.4% annual growth, among the fastest in the restaurant sector.

When a chain opens new restaurants, it usually means it’s investing for growth because there’s healthy demand for its meals and there are markets where its concepts have few or no locations.

Same-Store Sales

A company's restaurant base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales gives us insight into this topic because it measures organic growth at restaurants open for at least a year.

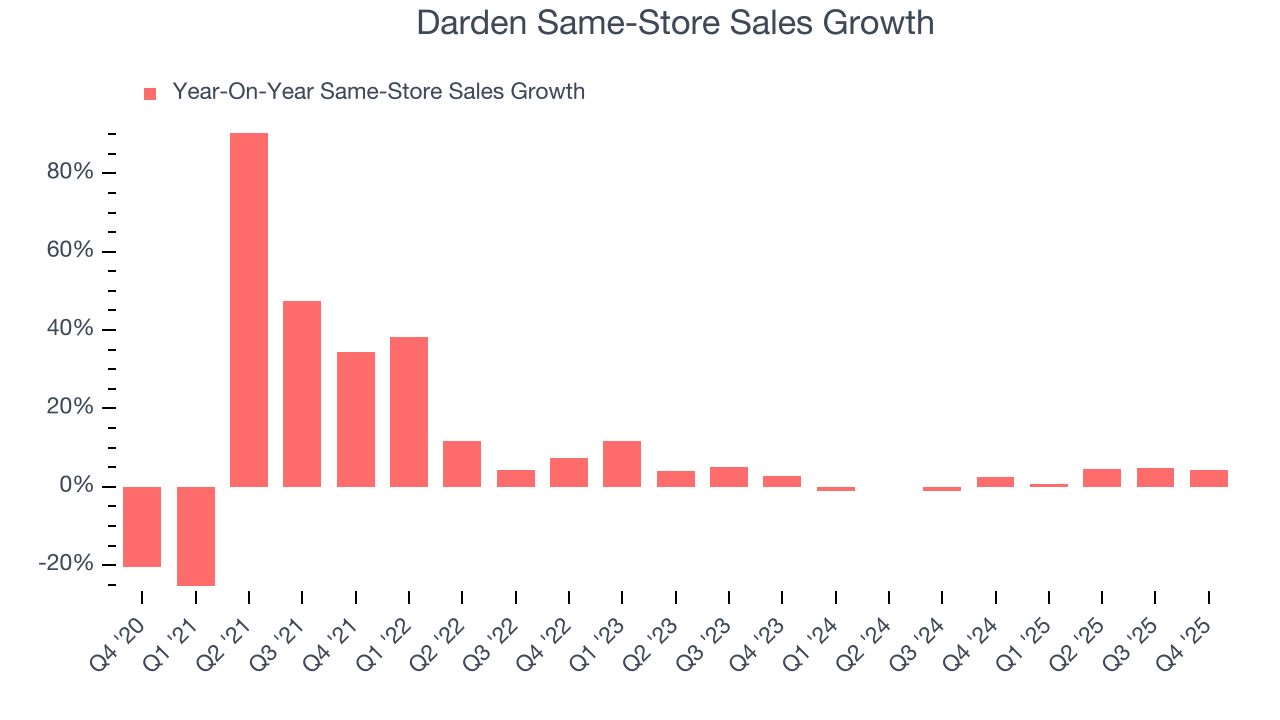

Darden’s demand within its existing dining locations has been relatively stable over the last two years but was below most restaurant chains. On average, the company’s same-store sales have grown by 1.8% per year. This performance suggests it should consider improving its foot traffic and efficiency before expanding its restaurant base.

In the latest quarter, Darden’s same-store sales rose 4.3% year on year. This growth was an acceleration from its historical levels, which is always an encouraging sign.

7. Gross Margin & Pricing Power

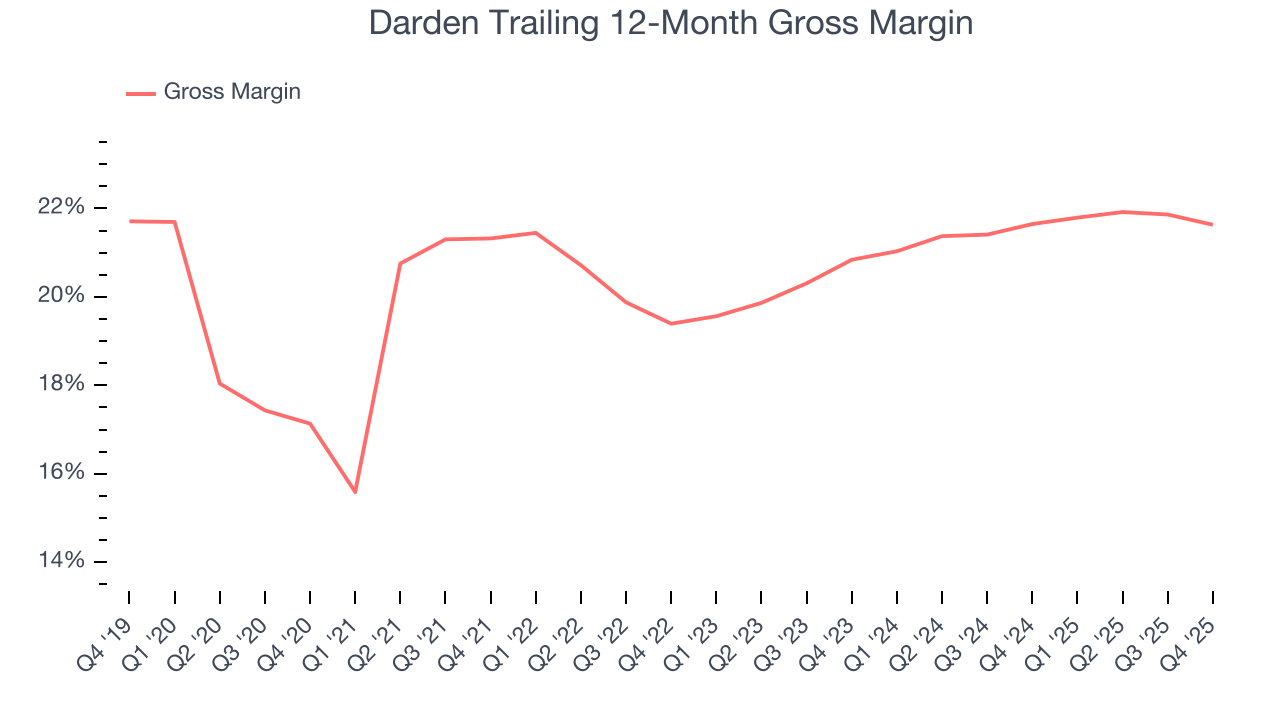

Darden has bad unit economics for a restaurant company, giving it less room to reinvest and grow its presence. As you can see below, it averaged a 21.6% gross margin over the last two years. That means Darden paid its suppliers a lot of money ($78.36 for every $100 in revenue) to run its business.

This quarter, Darden’s gross profit margin was 20.3%, in line with the same quarter last year. On a wider time horizon, the company’s full-year margin has remained steady over the past four quarters, suggesting its input costs (such as ingredients and transportation expenses) have been stable and it isn’t under pressure to lower prices.

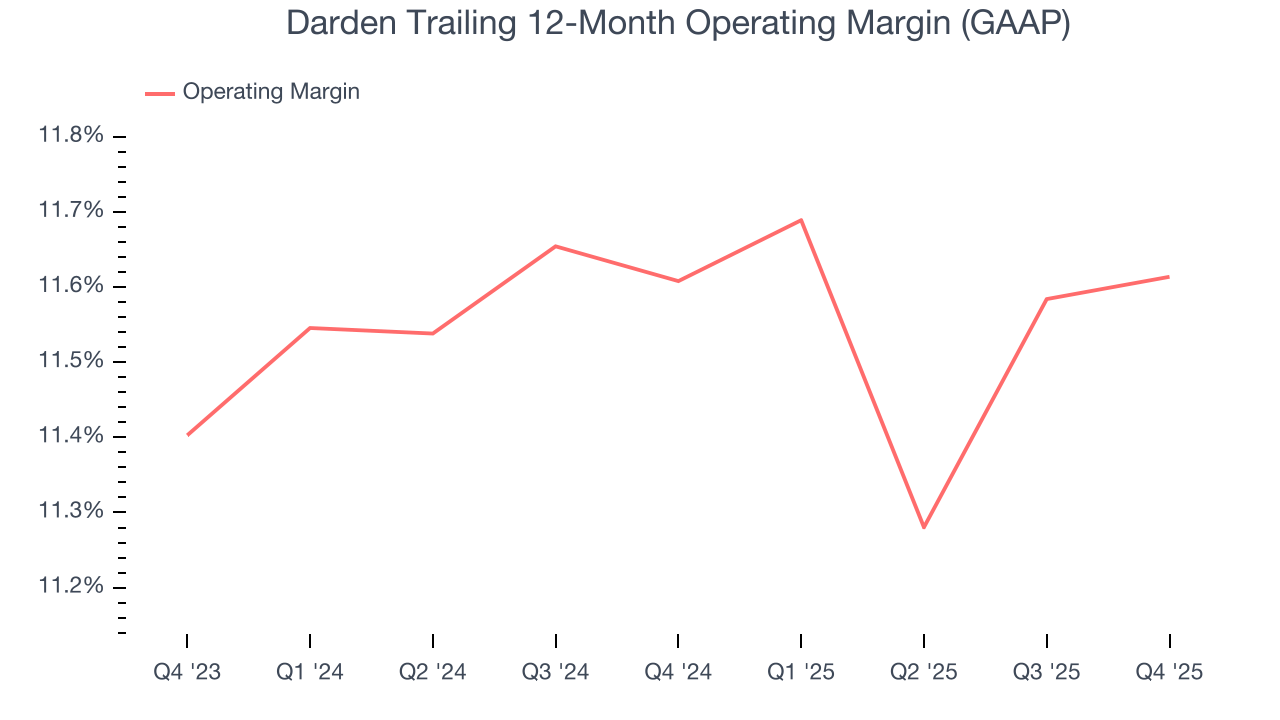

8. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Darden’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 11.6% over the last two years. This profitability was solid for a restaurant business and shows it’s an efficient company that manages its expenses well. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Looking at the trend in its profitability, Darden’s operating margin might fluctuated slightly but has generally stayed the same over the last year. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q4, Darden generated an operating margin profit margin of 10.3%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

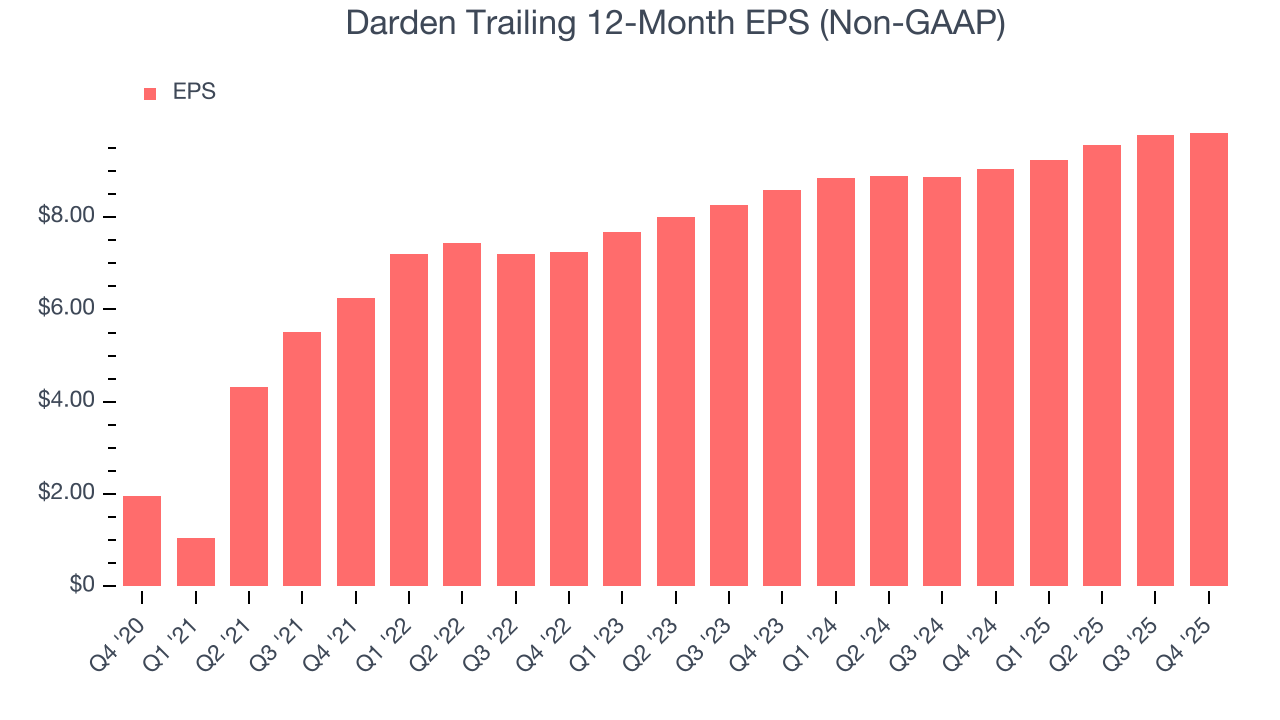

9. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Darden’s unimpressive 8.4% annual EPS growth over the last six years aligns with its revenue performance. On the bright side, this tells us its incremental sales were profitable.

In Q4, Darden reported adjusted EPS of $2.08, up from $2.03 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects Darden’s full-year EPS of $9.83 to grow 12.4%.

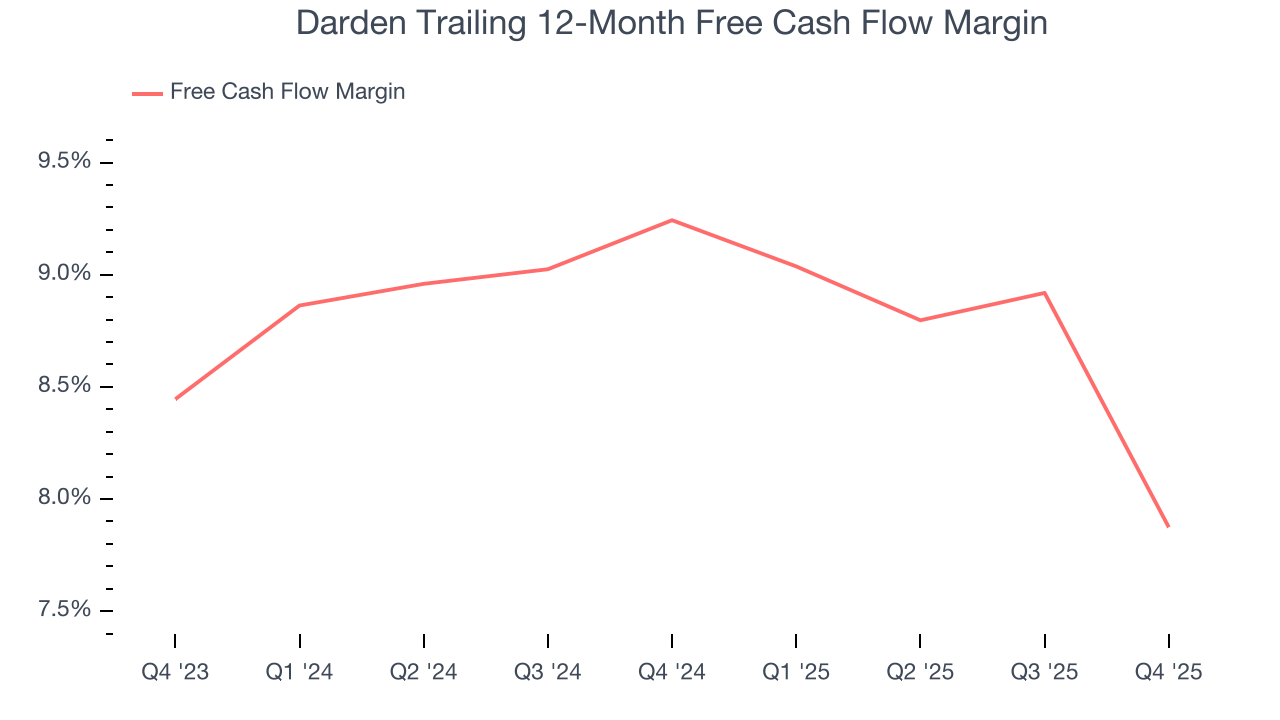

10. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Darden has shown robust cash profitability, giving it an edge over its competitors and the ability to reinvest or return capital to investors. The company’s free cash flow margin averaged 8.5% over the last two years, quite impressive for a restaurant business.

Taking a step back, we can see that Darden’s margin dropped by 1.4 percentage points over the last year. This decrease came from the higher costs associated with opening more restaurants.

Darden’s free cash flow clocked in at $106.8 million in Q4, equivalent to a 3.4% margin. The company’s cash profitability regressed as it was 4.1 percentage points lower than in the same quarter last year, suggesting its historical struggles have dragged on.

11. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Although Darden hasn’t been the highest-quality company lately, it historically found a few growth initiatives that worked out well. Its five-year average ROIC was 15%, impressive for a restaurant business.

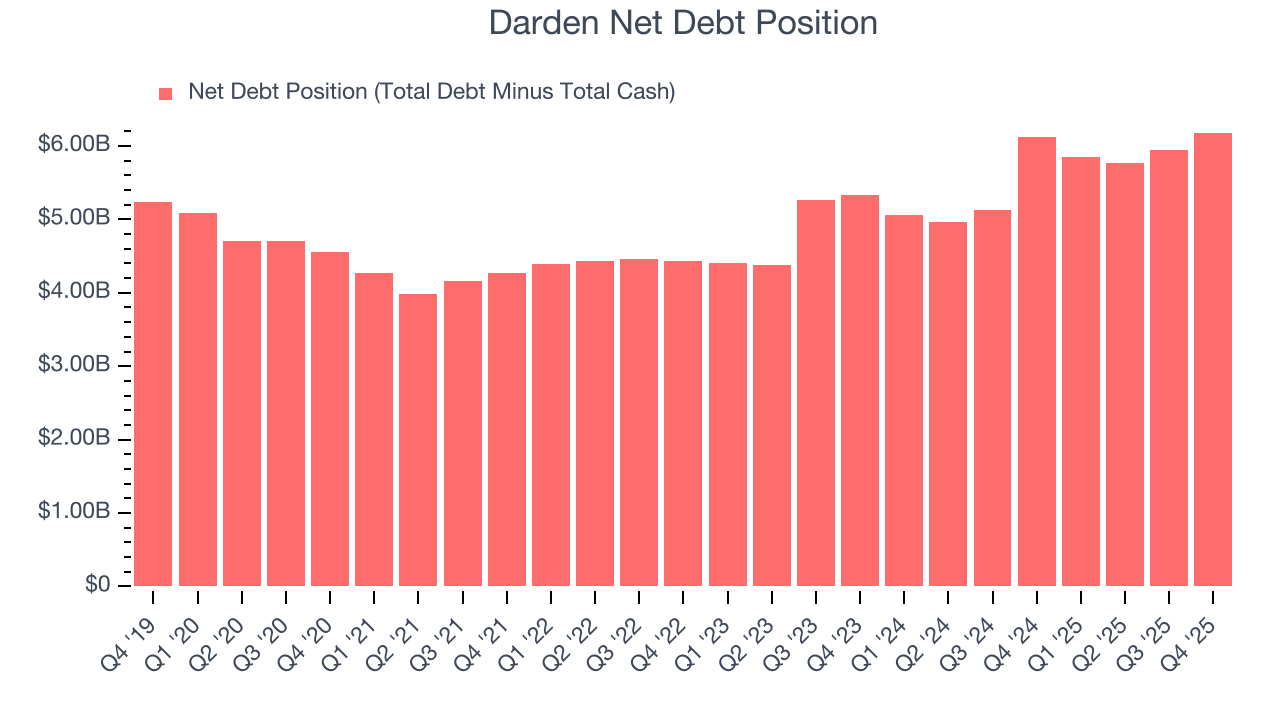

12. Balance Sheet Assessment

Darden reported $224.1 million of cash and $6.41 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $2.06 billion of EBITDA over the last 12 months, we view Darden’s 3.0× net-debt-to-EBITDA ratio as safe. We also see its $89.2 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

13. Key Takeaways from Darden’s Q4 Results

We enjoyed seeing Darden beat analysts’ same-store sales expectations this quarter. We were also happy its EBITDA outperformed Wall Street’s estimates. Overall, we think this was still a solid quarter with some key areas of upside. The stock traded up 3.8% to $196.80 immediately after reporting.

14. Is Now The Time To Buy Darden?

Updated: February 1, 2026 at 9:43 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Darden.

Darden isn’t a bad business, but we have other favorites. Although its revenue growth was mediocre over the last six years, its growth over the next 12 months is expected to be higher. And while Darden’s projected EPS for the next year is lacking, its new restaurant openings have increased its brand equity.

Darden’s P/E ratio based on the next 12 months is 18x. While this valuation is reasonable, we don’t really see a big opportunity at the moment. We're pretty confident there are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $222.38 on the company (compared to the current share price of $198.93).