DXC (DXC)

DXC is in for a bumpy ride. Its low returns on capital and plummeting sales suggest it struggles to generate demand and profits, a red flag.― StockStory Analyst Team

1. News

2. Summary

Why We Think DXC Will Underperform

Born from the 2017 merger of Computer Sciences Corporation and HP Enterprise's services business, DXC Technology (NYSE:DXC) is a global IT services company that helps businesses transform their technology infrastructure, applications, and operations.

- Products and services are facing significant end-market challenges during this cycle as sales have declined by 6.9% annually over the last five years

- Sales are projected to tank by 1.9% over the next 12 months as its demand continues evaporating

- Low returns on capital reflect management’s struggle to allocate funds effectively, and its falling returns suggest its earlier profit pools are drying up

DXC’s quality is not up to our standards. We’re on the lookout for more interesting opportunities.

Why There Are Better Opportunities Than DXC

High Quality

Investable

Underperform

Why There Are Better Opportunities Than DXC

DXC’s stock price of $12.89 implies a valuation ratio of 4.2x forward P/E. This certainly seems like a cheap stock, but we think there are valid reasons why it trades this way.

Cheap stocks can look like great bargains at first glance, but you often get what you pay for. These mediocre businesses often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. DXC (DXC) Research Report: Q4 CY2025 Update

IT services provider DXC Technology (NYSE:DXC) met Wall Streets revenue expectations in Q4 CY2025, but sales were flat year on year at $3.19 billion. On the other hand, next quarter’s revenue guidance of $3.18 billion was less impressive, coming in 1% below analysts’ estimates. Its non-GAAP profit of $0.96 per share was 16.2% above analysts’ consensus estimates.

DXC (DXC) Q4 CY2025 Highlights:

- Revenue: $3.19 billion vs analyst estimates of $3.20 billion (flat year on year, in line)

- Adjusted EPS: $0.96 vs analyst estimates of $0.83 (16.2% beat)

- Adjusted EBITDA: $477 million vs analyst estimates of $459.6 million (14.9% margin, 3.8% beat)

- Revenue Guidance for Q1 CY2026 is $3.18 billion at the midpoint, below analyst estimates of $3.21 billion

- Management raised its full-year Adjusted EPS guidance to $3.15 at the midpoint, a 1.6% increase

- Operating Margin: 5.4%, in line with the same quarter last year

- Free Cash Flow Margin: 11.2%, down from 15% in the same quarter last year

- Organic Revenue fell 4.3% year on year (beat)

- Market Capitalization: $2.51 billion

Company Overview

Born from the 2017 merger of Computer Sciences Corporation and HP Enterprise's services business, DXC Technology (NYSE:DXC) is a global IT services company that helps businesses transform their technology infrastructure, applications, and operations.

DXC operates through two main segments: Global Business Services (GBS) and Global Infrastructure Services (GIS). The GBS segment focuses on analytics, engineering, applications modernization, and industry-specific solutions. For example, a multinational corporation might engage DXC to migrate its legacy applications to cloud-based platforms while ensuring business continuity. The GIS segment provides infrastructure management, cybersecurity, cloud services, and workplace modernization.

The company serves clients across various industries including healthcare, insurance, banking, manufacturing, and public sector. These organizations typically engage DXC when they need to modernize aging IT systems, improve operational efficiency, or implement new digital capabilities. A healthcare provider might work with DXC to implement secure electronic health record systems while an insurance company might use DXC's specialized software to streamline claims processing.

DXC generates revenue primarily through multi-year service contracts. Its business model combines consulting, implementation, and ongoing management of IT environments. The company maintains strategic partnerships with major technology providers like Microsoft, AWS, and ServiceNow, allowing it to integrate various technologies into comprehensive solutions for clients.

With operations spanning the Americas, Europe, Asia, and Australia, DXC employs thousands of IT professionals who design, build, and manage complex technology environments. The company's approach emphasizes industry expertise, allowing it to tailor solutions to specific business challenges rather than offering one-size-fits-all services.

4. IT Services & Consulting

IT Services & Consulting companies stand to benefit from increasing enterprise demand for digital transformation, AI-driven automation, and cybersecurity resilience. Many enterprises can't attack these topics alone and need IT services and consulting on everything from technical advice to implementation. Challenges in meeting these needs will include finding talent in specialized and evolving IT fields. While AI and automation can enhance productivity, they also threaten to commoditize certain consulting functions. Another ongoing challenge will be pricing pressures from offshore IT service providers, which have lower labor costs and increasingly equal access to advanced technology like AI.

DXC Technology competes with global IT services providers such as Accenture (NYSE:ACN), IBM (NYSE:IBM), Cognizant (NASDAQ:CTSH), and Infosys (NYSE:INFY), as well as with cloud service providers like Microsoft (NASDAQ:MSFT) and Amazon Web Services (NASDAQ:AMZN).

5. Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

With $12.68 billion in revenue over the past 12 months, DXC is a behemoth in the business services sector and benefits from economies of scale, giving it an edge in distribution. This also enables it to gain more leverage on its fixed costs than smaller competitors and the flexibility to offer lower prices. However, its scale is a double-edged sword because finding new avenues for growth becomes difficult when you already have a substantial market presence. To expand meaningfully, DXC likely needs to tweak its prices, innovate with new offerings, or enter new markets.

As you can see below, DXC’s revenue declined by 6.9% per year over the last five years, a poor baseline for our analysis.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. DXC’s annualized revenue declines of 4.4% over the last two years suggest its demand continued shrinking.

We can dig further into the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, DXC’s organic revenue averaged 4.5% year-on-year declines. Because this number aligns with its two-year revenue growth, we can see the company’s core operations (not acquisitions and divestitures) drove most of its results.

This quarter, DXC’s $3.19 billion of revenue was flat year on year and in line with Wall Street’s estimates. Company management is currently guiding for flat sales next quarter.

Looking further ahead, sell-side analysts expect revenue to decline by 1.5% over the next 12 months. Although this projection is better than its two-year trend, it’s hard to get excited about a company that is struggling with demand.

6. Operating Margin

DXC was profitable over the last five years but held back by its large cost base. Its average operating margin of 2.7% was weak for a business services business.

On the plus side, DXC’s operating margin rose by 4.6 percentage points over the last five years.

In Q4, DXC generated an operating margin profit margin of 5.4%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

DXC’s EPS grew at a weak 2.8% compounded annual growth rate over the last five years. On the bright side, this performance was better than its 6.9% annualized revenue declines and tells us management adapted its cost structure in response to a challenging demand environment.

We can take a deeper look into DXC’s earnings to better understand the drivers of its performance. As we mentioned earlier, DXC’s operating margin was flat this quarter but expanded by 4.6 percentage points over the last five years. On top of that, its share count shrank by 31.3%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For DXC, its two-year annual EPS growth of 1.5% was lower than its five-year trend. We hope its growth can accelerate in the future.

In Q4, DXC reported adjusted EPS of $0.96, up from $0.92 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects DXC’s full-year EPS of $3.32 to shrink by 6.5%.

8. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

DXC has shown mediocre cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 4.5%, subpar for a business services business.

Taking a step back, an encouraging sign is that DXC’s margin expanded by 5.1 percentage points during that time. We have no doubt shareholders would like to continue seeing its cash conversion rise as it gives the company more optionality.

DXC’s free cash flow clocked in at $359 million in Q4, equivalent to a 11.2% margin. The company’s cash profitability regressed as it was 3.7 percentage points lower than in the same quarter last year, but it’s still above its five-year average. We wouldn’t put too much weight on this quarter’s decline because investment needs can be seasonal, causing short-term swings. Long-term trends trump temporary fluctuations.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

DXC historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 0.8%, lower than the typical cost of capital (how much it costs to raise money) for business services companies.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, DXC’s ROIC averaged 3.6 percentage point decreases over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

10. Balance Sheet Assessment

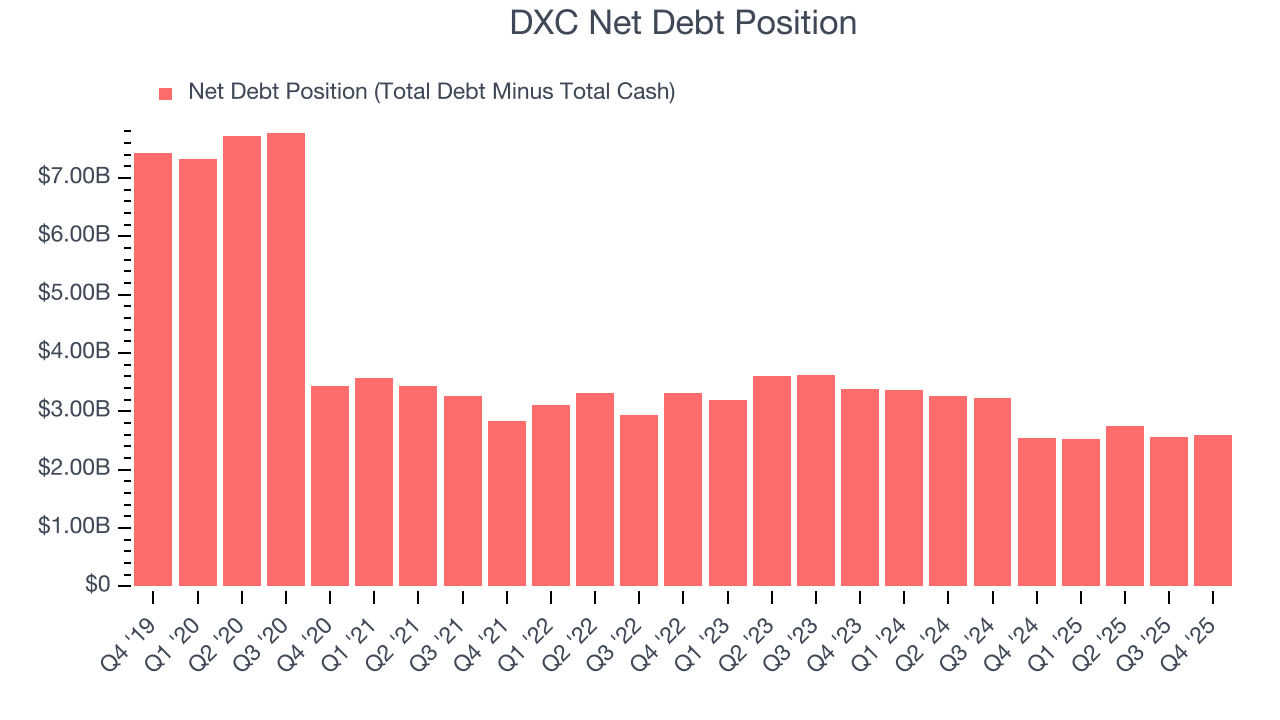

DXC reported $1.73 billion of cash and $4.32 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $1.83 billion of EBITDA over the last 12 months, we view DXC’s 1.4× net-debt-to-EBITDA ratio as safe. We also see its $19 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from DXC’s Q4 Results

It was good to see DXC beat analysts’ EPS expectations this quarter. We were also happy its full-year EPS guidance narrowly outperformed Wall Street’s estimates. On the other hand, its EPS guidance for next quarter missed and its revenue guidance for next quarter fell slightly short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 3% to $13.99 immediately after reporting.

12. Is Now The Time To Buy DXC?

Updated: March 9, 2026 at 12:51 AM EDT

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own DXC, you should also grasp the company’s longer-term business quality and valuation.

We see the value of companies helping their customers, but in the case of DXC, we’re out. To kick things off, its revenue has declined over the last five years. While its scale makes it a trusted partner with negotiating leverage, the downside is its relatively low ROIC suggests management has struggled to find compelling investment opportunities. On top of that, its projected EPS for the next year is lacking.

DXC’s P/E ratio based on the next 12 months is 4.2x. While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $14.75 on the company (compared to the current share price of $12.89).