Encompass Health (EHC)

We’re not sold on Encompass Health. Its sluggish sales growth shows demand is soft, a worrisome sign for investors in high-quality stocks.― StockStory Analyst Team

1. News

2. Summary

Why Encompass Health Is Not Exciting

With a network of 161 specialized facilities across 37 states and Puerto Rico, Encompass Health (NYSE:EHC) operates inpatient rehabilitation hospitals that help patients recover from strokes, hip fractures, and other debilitating conditions.

- Sales trends were unexciting over the last five years as its 5% annual growth was below the typical healthcare company

- Poor comparable store sales performance over the past two years indicates it’s having trouble bringing new patients into its facilities

- On the plus side, its additional sales over the last five years increased its profitability as the 13.6% annual growth in its earnings per share outpaced its revenue

Encompass Health falls short of our quality standards. We’re hunting for superior stocks elsewhere.

Why There Are Better Opportunities Than Encompass Health

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Encompass Health

Encompass Health is trading at $113 per share, or 16.5x forward P/E. Encompass Health’s multiple may seem like a great deal among healthcare peers, but we think there are valid reasons why it’s this cheap.

Cheap stocks can look like great bargains at first glance, but you often get what you pay for. These mediocre businesses often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Encompass Health (EHC) Research Report: Q4 CY2025 Update

Health care services provider Encompass Health (NYSE:EHC) met Wall Streets revenue expectations in Q4 CY2025, with sales up 9.9% year on year to $1.54 billion. The company’s outlook for the full year was close to analysts’ estimates with revenue guided to $6.42 billion at the midpoint. Its non-GAAP profit of $1.46 per share was 12.1% above analysts’ consensus estimates.

Encompass Health (EHC) Q4 CY2025 Highlights:

- Revenue: $1.54 billion vs analyst estimates of $1.54 billion (9.9% year-on-year growth, in line)

- Adjusted EPS: $1.46 vs analyst estimates of $1.30 (12.1% beat)

- Adjusted EBITDA: $335.6 million vs analyst estimates of $313.7 million (21.7% margin, 7% beat)

- Adjusted EPS guidance for the upcoming financial year 2026 is $5.96 at the midpoint, beating analyst estimates by 2.3%

- EBITDA guidance for the upcoming financial year 2026 is $1.36 billion at the midpoint, in line with analyst expectations

- Operating Margin: 18.3%, up from 17% in the same quarter last year

- Free Cash Flow Margin: 15.2%, up from 13.6% in the same quarter last year

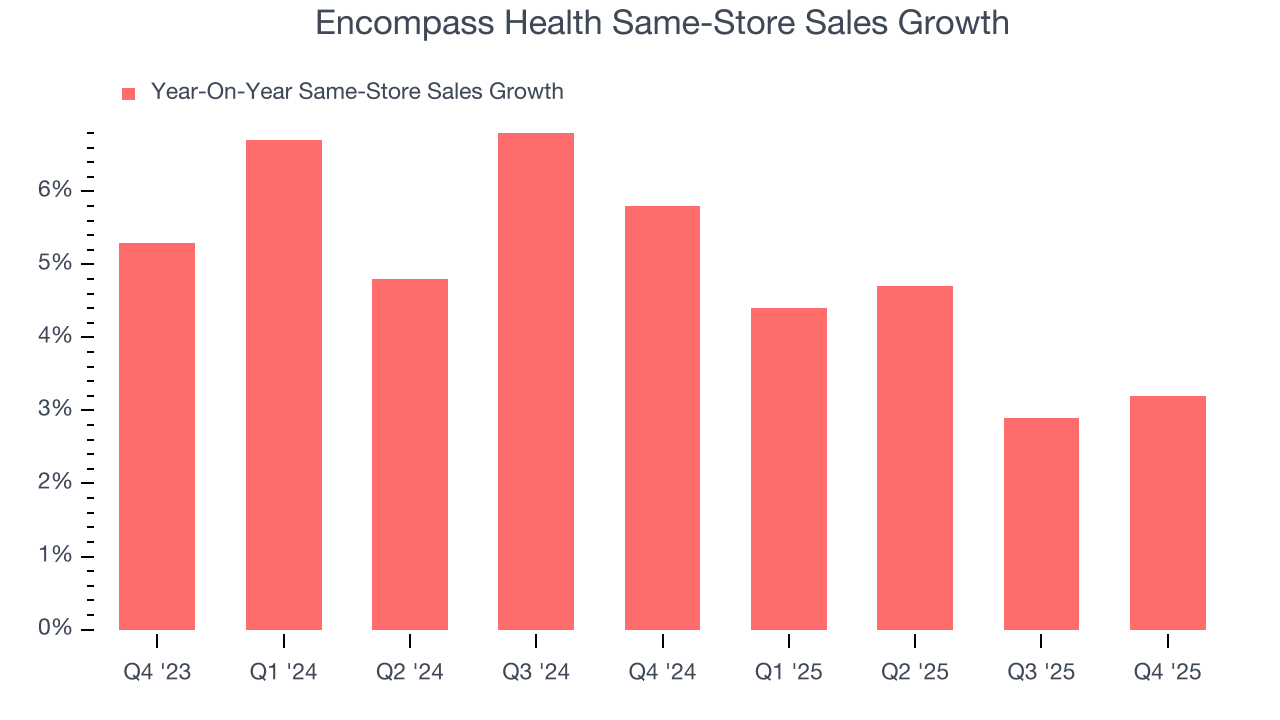

- Same-Store Sales rose 3.2% year on year (5.8% in the same quarter last year)

- Market Capitalization: $9.62 billion

Company Overview

With a network of 161 specialized facilities across 37 states and Puerto Rico, Encompass Health (NYSE:EHC) operates inpatient rehabilitation hospitals that help patients recover from strokes, hip fractures, and other debilitating conditions.

Encompass Health specializes in post-acute care, providing intensive rehabilitation services to patients who have experienced significant physical or cognitive disabilities. The company's interdisciplinary approach brings together physicians, nurses, therapists, and other specialists who create personalized treatment plans for each patient. For example, a stroke survivor might receive physical therapy to regain mobility, speech therapy to address communication challenges, and occupational therapy to relearn daily living skills—all coordinated under one roof.

Most patients (about 91%) come to Encompass Health directly from acute-care hospitals following physician referrals. These individuals typically require specialized rehabilitation that cannot be effectively delivered in a home or outpatient setting. The company's facilities are equipped with advanced therapeutic technologies and specialized equipment designed to maximize recovery potential.

Encompass Health generates revenue primarily through reimbursements from Medicare, Medicaid, and private insurance companies. The company's business model focuses on delivering measurable patient outcomes, including higher rates of patients returning to community living and shorter lengths of stay compared to alternative care settings.

The company maintains strong relationships with healthcare systems and physician networks, positioning itself as a critical link in the continuum of care. Encompass Health's facilities are strategically concentrated in regions with higher populations of elderly residents, particularly in Florida and Texas, where demand for rehabilitation services tends to be greater.

Founded in 1984 as HealthSouth Corporation, the organization rebranded to Encompass Health in 2018, reflecting its evolution and focus on comprehensive rehabilitation services. The company continues to expand its footprint by adding new hospitals and increasing capacity at existing facilities to meet growing demand for specialized rehabilitation care.

4. Outpatient & Specialty Care

The outpatient and specialty care industry delivers targeted medical services in non-hospital settings that are often cost-effective compared to inpatient alternatives. This means that they are more desired as rising healthcare costs and ways to combat them become more and more top-of-mind. Outpatient and specialty care providers boast revenue streams that are stable due to the recurring nature of treatment for chronic conditions and long-term patient relationships. However, their reliance on government reimbursement programs like Medicare means stroke-of-the-pen risk. Additionally, scaling a network of facilities can be capital-intensive with uneven return profiles amid competition from integrated healthcare systems. Looking ahead, the industry is positioned to grow as demand for outpatient services expands, driven by aging populations, a rising prevalence of chronic diseases, and a shift toward value-based care models. Tailwinds include advancements in medical technology that support more complex procedures in outpatient settings and the increasing focus on preventive care, which can be aided by data and AI. However, headwinds such as reimbursement rate cuts, labor shortages, and the financial strain of digitization may temper growth.

Encompass Health's main competitors include Select Medical Holdings (NYSE:SEM), Kindred Healthcare (private), Vibra Healthcare (private), and rehabilitation units operated within major hospital systems like HCA Healthcare (NYSE:HCA) and Universal Health Services (NYSE:UHS).

5. Economies of Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With $5.94 billion in revenue over the past 12 months, Encompass Health has decent scale. This is important as it gives the company more leverage in a heavily regulated, competitive environment that is complex and resource-intensive.

6. Revenue Growth

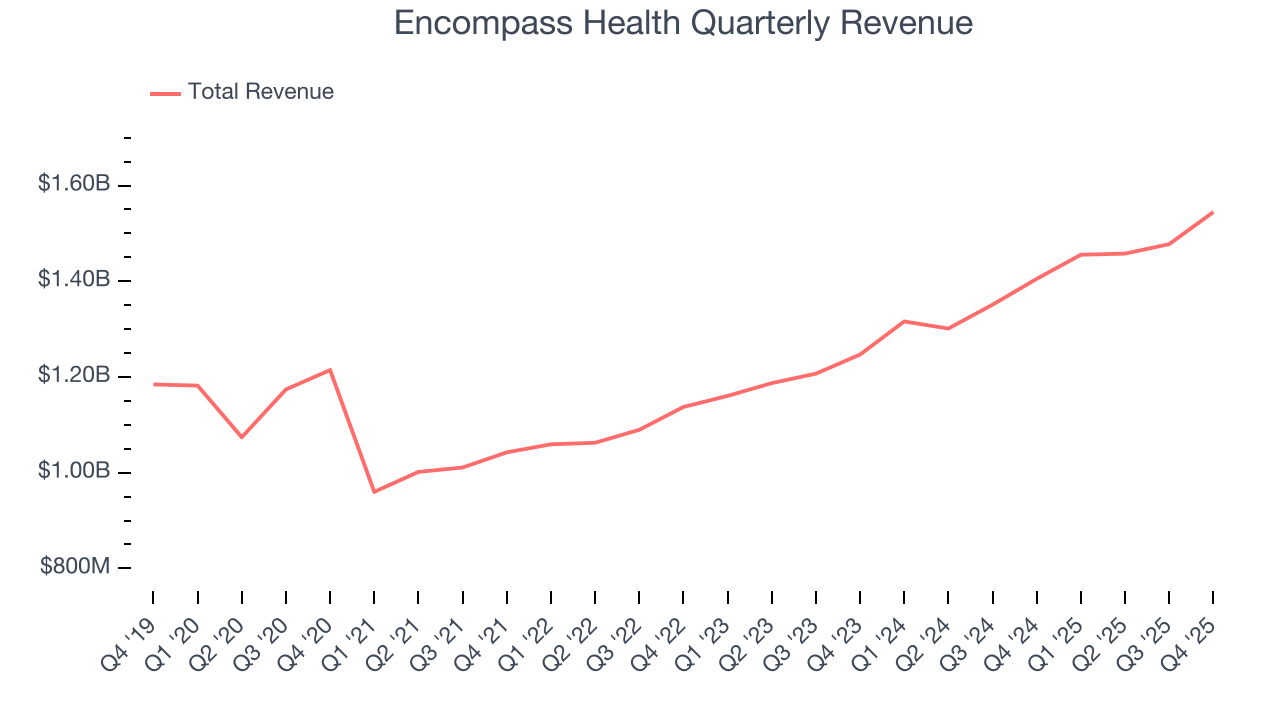

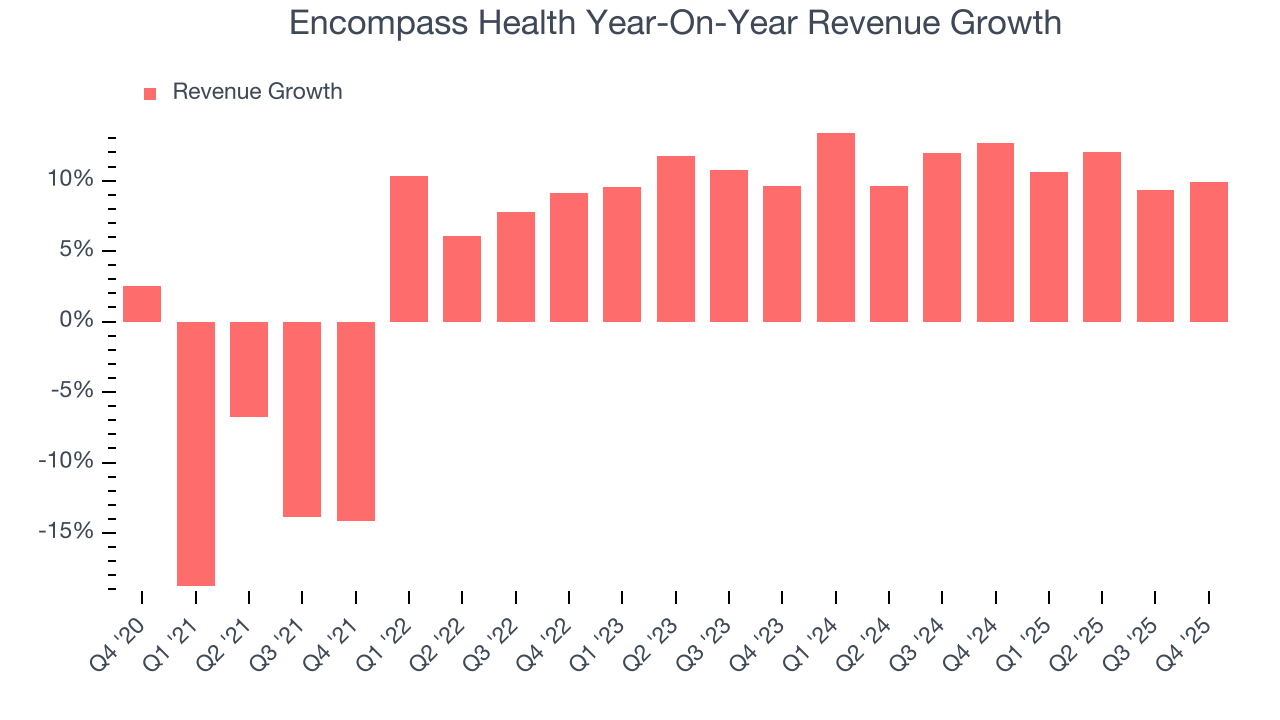

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Regrettably, Encompass Health’s sales grew at a mediocre 5% compounded annual growth rate over the last five years. This was below our standard for the healthcare sector and is a rough starting point for our analysis.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Encompass Health’s annualized revenue growth of 11.2% over the last two years is above its five-year trend, suggesting some bright spots.

We can dig further into the company’s revenue dynamics by analyzing its same-store sales, which show how much revenue its established locations generate. Over the last two years, Encompass Health’s same-store sales averaged 4.9% year-on-year growth. Because this number is lower than its revenue growth, we can see the opening of new locations is boosting the company’s top-line performance.

This quarter, Encompass Health grew its revenue by 9.9% year on year, and its $1.54 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 8.6% over the next 12 months, a slight deceleration versus the last two years. Still, this projection is noteworthy and indicates the market is baking in success for its products and services.

7. Adjusted Operating Margin

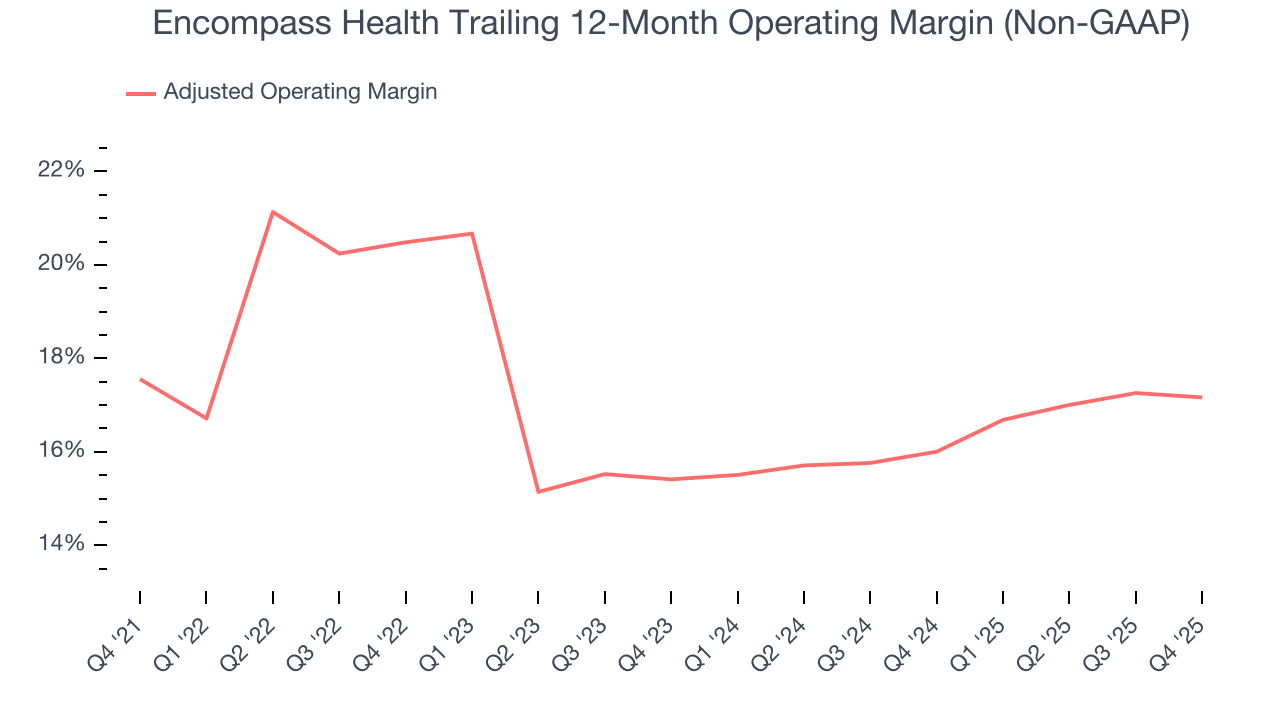

Encompass Health’s adjusted operating margin has been trending up over the last 12 months and averaged 17.2% over the last five years. Its solid profitability for a healthcare business shows it’s an efficient company that manages its expenses effectively.

Analyzing the trend in its profitability, Encompass Health’s adjusted operating margin of 17.2% for the trailing 12 months may be around the same as five years ago, but it has increased by 1.8 percentage points over the last two years.

This quarter, Encompass Health generated an adjusted operating margin profit margin of 16.1%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

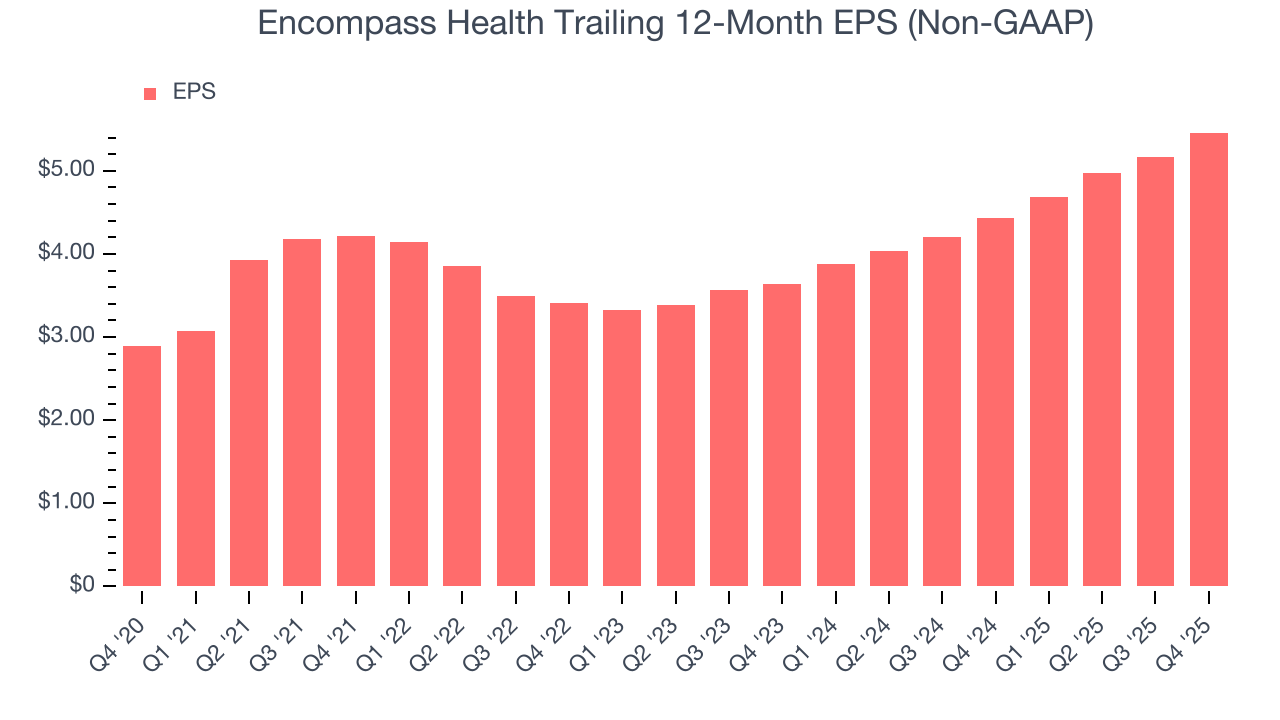

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Encompass Health’s EPS grew at a spectacular 13.6% compounded annual growth rate over the last five years, higher than its 5% annualized revenue growth. However, we take this with a grain of salt because its adjusted operating margin didn’t improve and it didn’t repurchase its shares, meaning the delta came from reduced interest expenses or taxes.

In Q4, Encompass Health reported adjusted EPS of $1.46, up from $1.17 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Encompass Health’s full-year EPS of $5.46 to grow 6.1%.

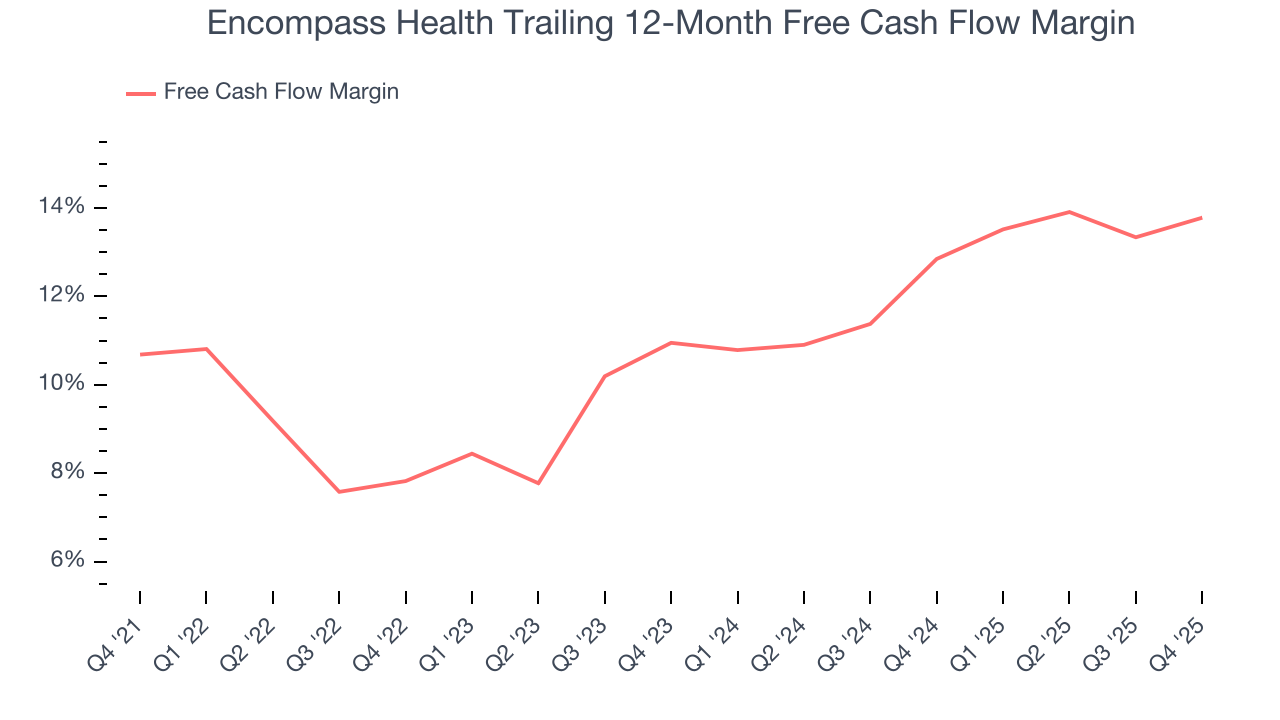

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Encompass Health has shown impressive cash profitability, giving it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 11.5% over the last five years, better than the broader healthcare sector.

Taking a step back, we can see that Encompass Health’s margin expanded by 3.1 percentage points during that time. This shows the company is heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability was flat.

Encompass Health’s free cash flow clocked in at $235.4 million in Q4, equivalent to a 15.2% margin. This result was good as its margin was 1.7 percentage points higher than in the same quarter last year, building on its favorable historical trend.

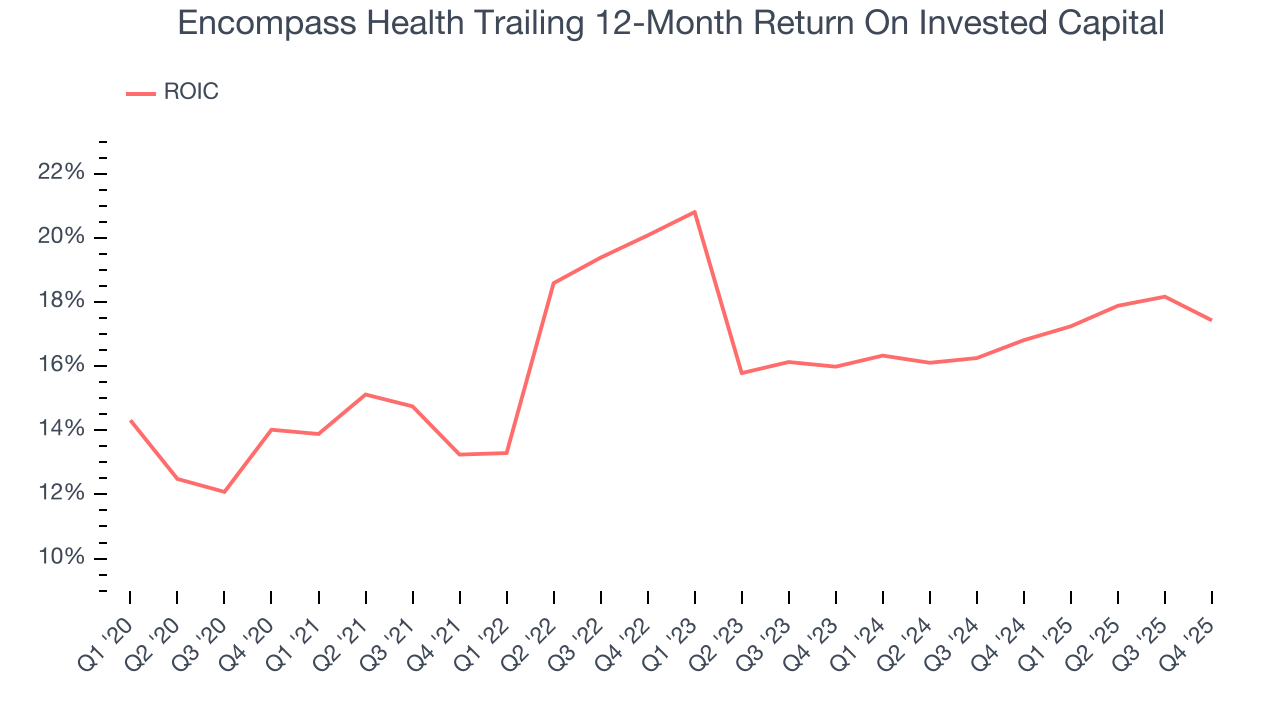

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Although Encompass Health hasn’t been the highest-quality company lately, it historically found a few growth initiatives that worked out well. Its five-year average ROIC was 16.7%, impressive for a healthcare business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Uneventfully, Encompass Health’s ROIC has stayed the same over the last few years. Given the company’s underwhelming financial performance in other areas, we’d like to see its returns improve before recommending the stock.

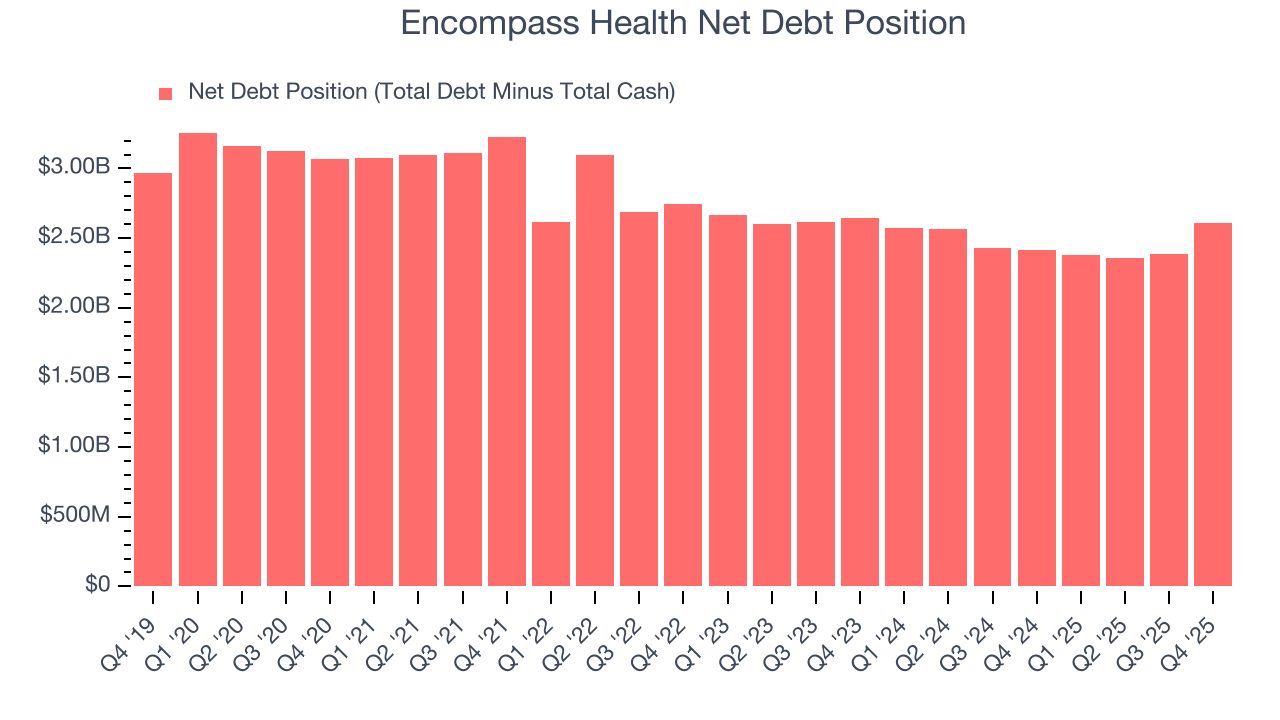

11. Balance Sheet Assessment

Encompass Health reported $102.9 million of cash and $2.71 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $1.27 billion of EBITDA over the last 12 months, we view Encompass Health’s 2.1× net-debt-to-EBITDA ratio as safe. We also see its $62.8 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Encompass Health’s Q4 Results

It was good to see Encompass Health beat analysts’ EPS expectations this quarter despite in line revenue. We were also happy its full-year EPS guidance outperformed Wall Street’s estimates, and this outlook is driving the stock up. Overall, this print had some key positives. The stock traded up 17.5% to $116.96 immediately following the results.

13. Is Now The Time To Buy Encompass Health?

Updated: February 5, 2026 at 10:55 PM EST

Before investing in or passing on Encompass Health, we urge you to understand the company’s business quality (or lack thereof), valuation, and the latest quarterly results - in that order.

Encompass Health isn’t a bad business, but we have other favorites. Although its revenue growth was mediocre over the last five years, its growth over the next 12 months is expected to be higher. Plus, Encompass Health’s spectacular EPS growth over the last five years shows its profits are trickling down to shareholders.

Encompass Health’s P/E ratio based on the next 12 months is 16.5x. This valuation multiple is fair, but we don’t have much faith in the company. We're pretty confident there are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $141.73 on the company (compared to the current share price of $113).