Enova (ENVA)

Enova is in a league of its own. Its superior revenue growth and returns on capital show it can achieve fast and profitable expansion.― StockStory Analyst Team

1. News

2. Summary

Why We Like Enova

Pioneering online lending since 2004 with a massive database of over 65 terabytes of customer behavior data, Enova International (NYSE:ENVA) provides online financial services including installment loans and lines of credit to non-prime consumers and small businesses in the United States and Brazil.

- Performance over the past two years shows its incremental sales were extremely profitable, as its annual earnings per share growth of 34.1% outpaced its revenue gains

- Annual book value per share growth of 22% over the last five years was superb and indicates its capital strength increased during this cycle

- Market-beating return on equity illustrates that management has a knack for investing in profitable ventures

We have an affinity for Enova. The valuation looks reasonable when considering its quality, and we think now is an opportune time to buy the stock.

Why Is Now The Time To Buy Enova?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Enova?

Enova’s stock price of $157.53 implies a valuation ratio of 11.2x forward P/E. Valuation is lower than most companies in the financials space, and we believe Enova is attractively-priced for its quality.

Entry price matters far less than business fundamentals if you’re investing for a multi-year period. But if you can get a bargain price it’s certainly icing on the cake.

3. Enova (ENVA) Research Report: Q4 CY2025 Update

Financial technology company Enova International (NYSE:ENVA) fell short of the markets revenue expectations in Q4 CY2025, with sales falling 31.2% year on year to $501.9 million. Its non-GAAP profit of $3.46 per share was 9.1% above analysts’ consensus estimates.

Enova (ENVA) Q4 CY2025 Highlights:

- Revenue: $501.9 million vs analyst estimates of $838.1 million (31.2% year-on-year decline, 40.1% miss)

- Pre-tax Profit: $98.78 million (19.7% margin)

- Adjusted EPS: $3.46 vs analyst estimates of $3.17 (9.1% beat)

- Market Capitalization: $3.93 billion

Company Overview

Pioneering online lending since 2004 with a massive database of over 65 terabytes of customer behavior data, Enova International (NYSE:ENVA) provides online financial services including installment loans and lines of credit to non-prime consumers and small businesses in the United States and Brazil.

Enova uses proprietary technology platforms and advanced analytics to quickly evaluate loan applications and make credit decisions. The company's machine learning-enabled models analyze data from over 65 terabytes of customer behavior information collected throughout its history, allowing it to assess risk more effectively than traditional credit scoring alone. This technology enables Enova to approve loans and provide funds to customers rapidly, often within the same day of application.

The company serves two distinct customer segments. Its consumer lending business targets individuals with an average annual household income of $38,000, typically with FICO scores between 500 and 680. For small businesses, Enova serves companies with median annual sales of approximately $594,000, with business owners generally having FICO scores between 650 and 780. Both customer groups often have bank accounts but limited access to traditional credit sources.

Enova offers several financial products across its markets. For consumers, these include installment loans ranging from $300 to $10,000 with terms between 3 and 60 months, and line of credit accounts with limits between $100 and $7,000. Small business products include installment loans between $5,000 and $250,000 with terms of 3 to 24 months, and lines of credit between $5,000 and $100,000. A customer seeking working capital might apply for a $15,000 small business loan through Enova's OnDeck platform, receive approval within hours, and use the funds to purchase inventory or equipment.

The company generates revenue primarily through interest and fees on its financial products. Enova operates in 37 states for consumer lending and 49 states for small business financing in the U.S., as well as in Brazil for consumer loans. It markets its products under several brands including CashNetUSA, NetCredit, OnDeck, Headway Capital, and Pangea, which provides international money transfer services.

4. Personal Loan

Personal loan providers offer unsecured credit for various consumer needs. The sector benefits from digital application processes, increasing consumer comfort with online financial services, and opportunities in underserved credit segments. Headwinds include credit risk management in unsecured lending, regulatory oversight of lending practices, and intense competition affecting margins from both traditional and fintech lenders.

Enova's competitors include traditional storefront lenders like Ace Cash Express, Check Into Cash, and One Main Financial in the consumer lending space. In the small business financing market, Enova competes with traditional banks, financial technology companies like Square Capital (Block, Inc.), PayPal Working Capital (PayPal Holdings, Inc.), and Kabbage (American Express).

5. Revenue Growth

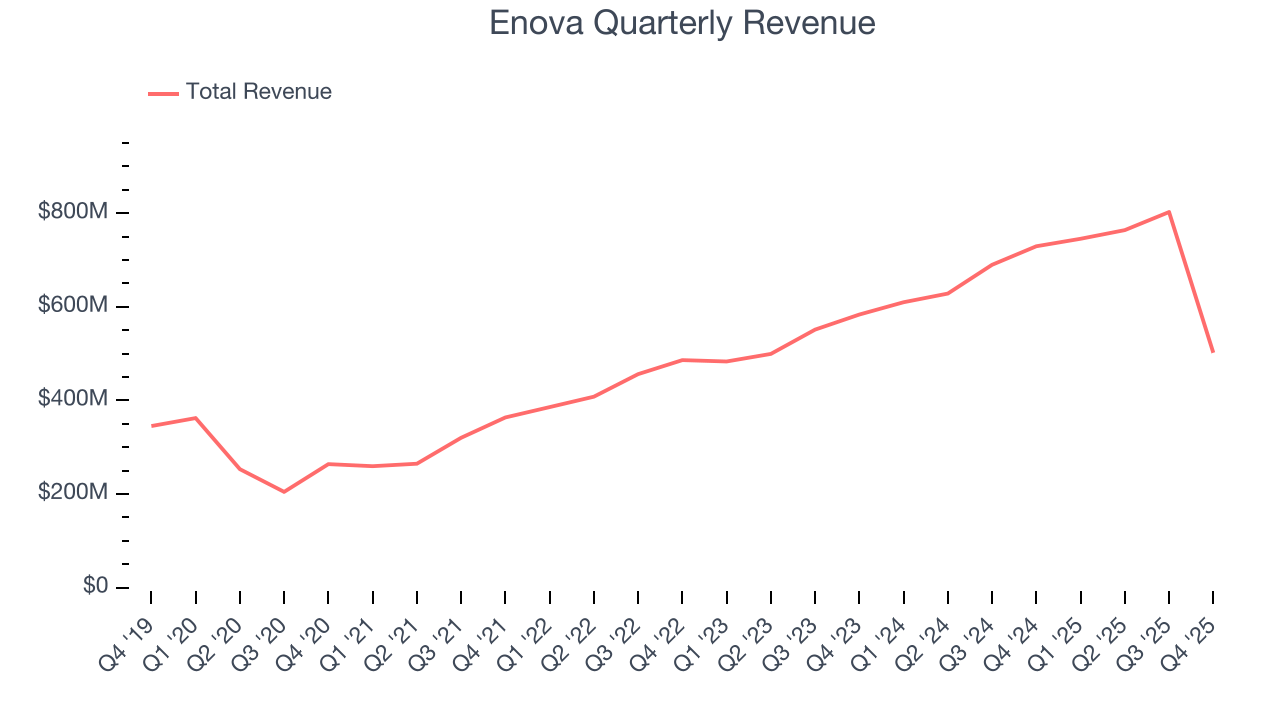

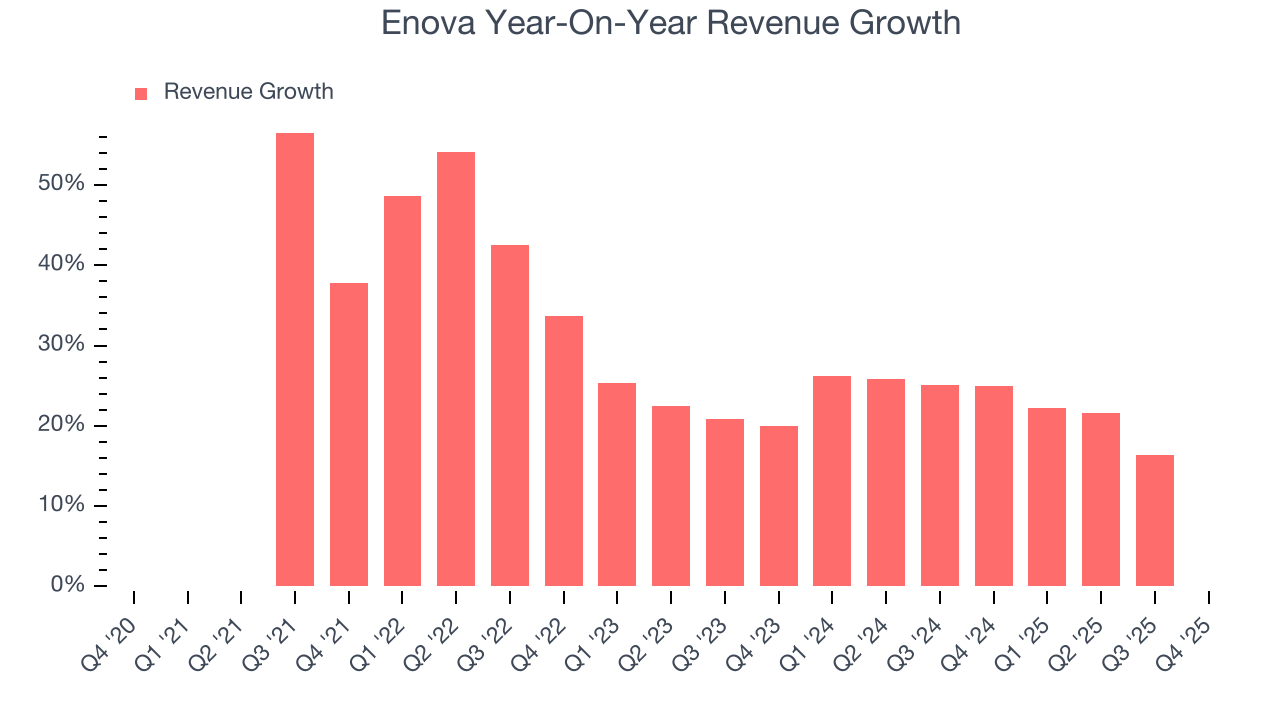

A company’s long-term sales performance can indicate its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last five years, Enova grew its revenue at an excellent 21% compounded annual growth rate. Its growth surpassed the average financials company and shows its offerings resonate with customers, a great starting point for our analysis.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. Enova’s annualized revenue growth of 15.3% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Enova missed Wall Street’s estimates and reported a rather uninspiring 31.2% year-on-year revenue decline, generating $501.9 million of revenue.

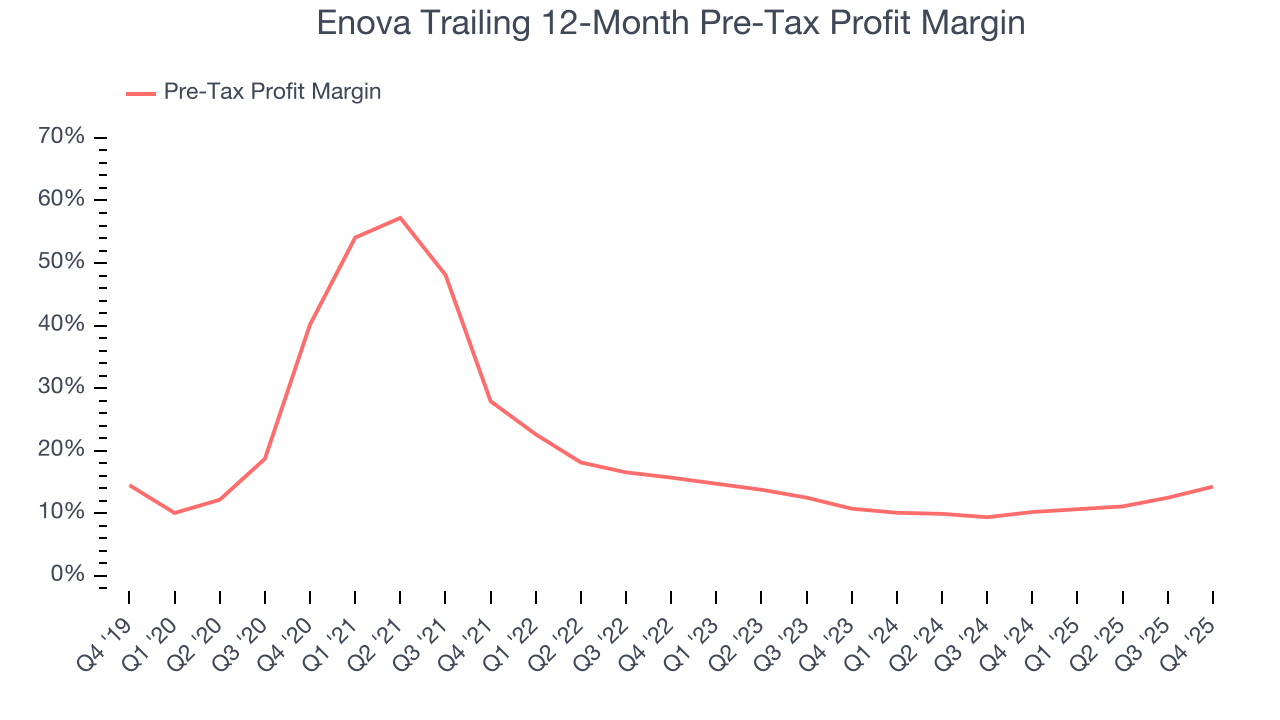

6. Pre-Tax Profit Margin

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For Personal Loan companies, we look at pre-tax profit rather than the operating margin that defines sectors such as consumer, tech, and industrials.

The pre-tax profit margin includes interest because it's central to how financial institutions generate revenue and manage costs. Tax considerations are excluded since they represent government policy rather than operational performance, giving investors a clearer view of business fundamentals.

Over the last five years, Enova’s pre-tax profit margin has risen by 25.9 percentage points, going from 27.9% to 14.3%. Luckily, it seems the company has recently taken steps to address its expense base as its pre-tax profit margin expanded by 3.5 percentage points on a two-year basis.

In Q4, Enova’s pre-tax profit margin was 19.7%. This result was 9.1 percentage points better than the same quarter last year.

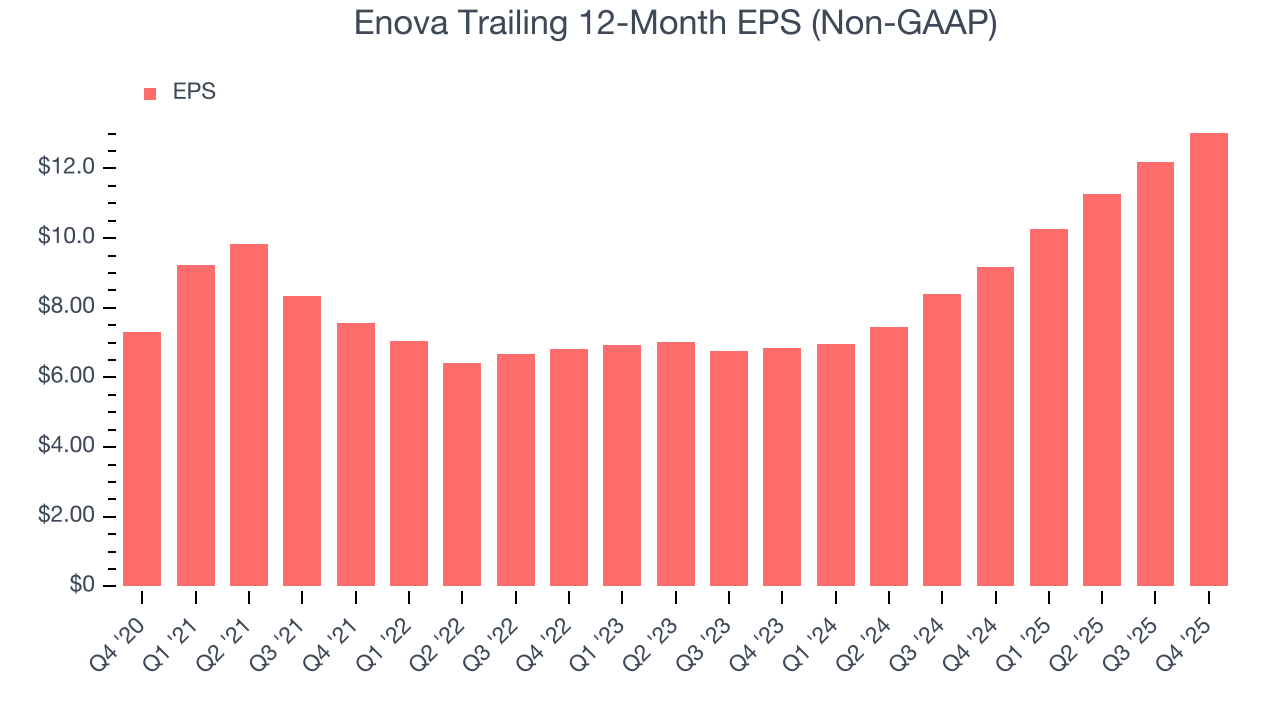

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Enova’s EPS grew at a decent 12.3% compounded annual growth rate over the last five years. However, this performance was lower than its 21% annualized revenue growth, telling us the company became less profitable on a per-share basis as it expanded due to factors such as interest expenses and taxes.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Enova, its two-year annual EPS growth of 38% was higher than its five-year trend. This acceleration made it one of the faster-growing financials companies in recent history.

In Q4, Enova reported adjusted EPS of $3.46, up from $2.61 in the same quarter last year. This print beat analysts’ estimates by 9.1%. Over the next 12 months, Wall Street expects Enova’s full-year EPS of $13.03 to grow 11.8%.

8. Return on Equity

Return on equity, or ROE, tells us how much profit a company generates for each dollar of shareholder equity, a key funding source for banks. Over a long period, banks with high ROE tend to compound shareholder wealth faster through retained earnings, buybacks, and dividends.

Over the last five years, Enova has averaged an ROE of 19.8%, excellent for a company operating in a sector where the average shakes out around 10% and those putting up 25%+ are greatly admired. This shows Enova has a strong competitive moat.

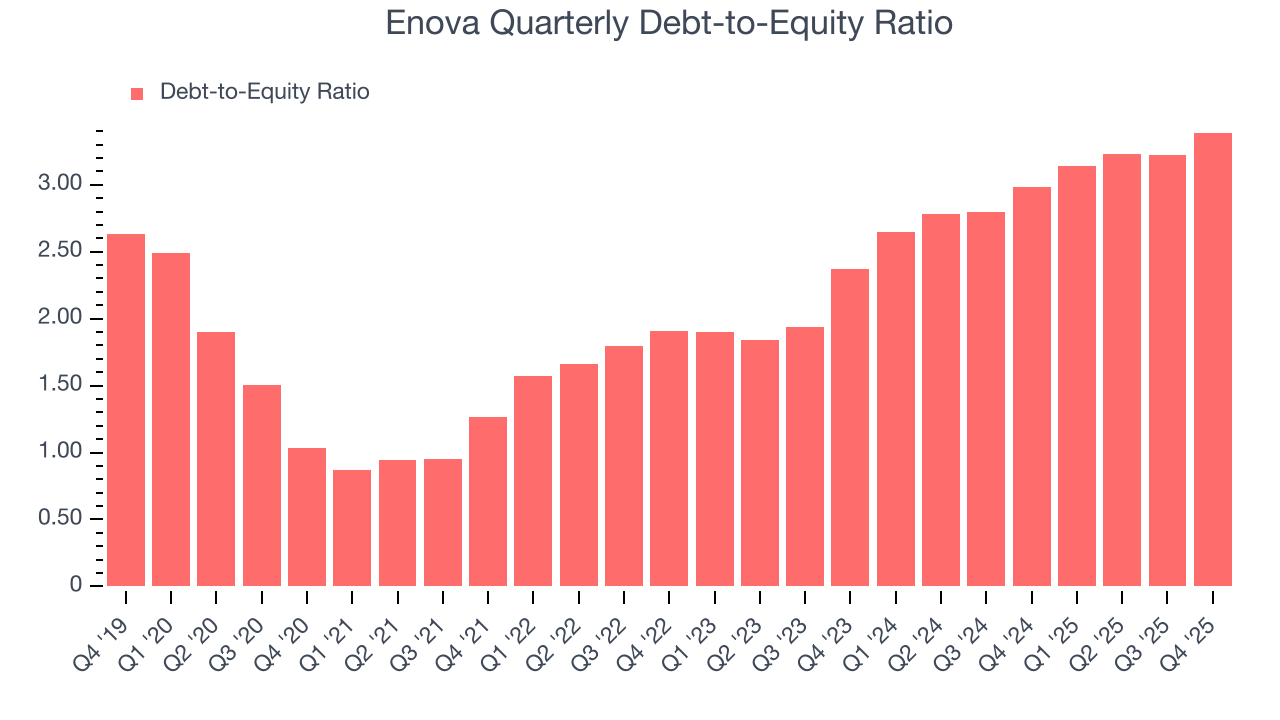

9. Balance Sheet Assessment

The debt-to-equity ratio is a widely used measure to assess a company's balance sheet health. A higher ratio means that a business aggressively financed its growth with debt. This can result in higher earnings (if the borrowed funds are invested profitably) but also increases risk.

If debt levels are too high, there could be difficulties in meeting obligations, especially during economic downturns or periods of rising interest rates if the debt has variable-rate payments.

Enova currently has $4.53 billion of debt and $1.34 billion of shareholder's equity on its balance sheet, and over the past four quarters, has averaged a debt-to-equity ratio of 3.2×. We think this is safe and raises no red flags. In general, we’re comfortable with any ratio below 3.5× for a financials business.

10. Key Takeaways from Enova’s Q4 Results

It was good to see Enova beat analysts’ EPS expectations this quarter. On the other hand, its revenue missed. Overall, this was a softer quarter. The stock traded down 2.6% to $153.51 immediately after reporting.

11. Is Now The Time To Buy Enova?

Updated: January 27, 2026 at 4:53 PM EST

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own Enova, you should also grasp the company’s longer-term business quality and valuation.

There are multiple reasons why we think Enova is an elite financials company. For starters, its revenue growth was impressive over the last five years and is expected to accelerate over the next 12 months. And while its declining pre-tax profit margin shows the business has become less efficient, its market-beating ROE suggests it has been a well-managed company historically. Additionally, Enova’s decent EPS growth over the last five years shows its profits are trickling down to shareholders.

Enova’s P/E ratio based on the next 12 months is 10.8x. Analyzing the financials landscape today, Enova’s positive attributes shine bright. We think it’s one of the best businesses in our coverage and like the stock at this price.

Wall Street analysts have a consensus one-year price target of $184.50 on the company (compared to the current share price of $153.51), implying they see 20.2% upside in buying Enova in the short term.