EPAM (EPAM)

EPAM is a sound business. Its combination of high growth and robust profitability makes it a unique asset.― StockStory Analyst Team

1. News

2. Summary

Why EPAM Is Interesting

Founded in 1993 during the early days of offshore software development, EPAM Systems (NYSE:EPAM) provides digital engineering, cloud, and AI transformation services to help global enterprises and startups modernize their technology systems and create digital products.

- Annual revenue growth of 15.6% over the past five years was outstanding, reflecting market share gains this cycle

- Stellar returns on capital showcase management’s ability to surface highly profitable business ventures

- The stock is trading at a reasonable price if you like its story and growth prospects

EPAM is solid, but not perfect. If you’ve been itching to buy the stock, the valuation looks fair.

Why Is Now The Time To Buy EPAM?

High Quality

Investable

Underperform

Why Is Now The Time To Buy EPAM?

EPAM is trading at $166.70 per share, or 13.1x forward P/E. Many business services companies may feature a higher valuation multiple, but that doesn’t make EPAM a great deal. We think the current multiple fairly reflects the revenue characteristics.

If you think the market is not giving the company enough credit for its fundamentals, now could be a good time to invest.

3. EPAM (EPAM) Research Report: Q4 CY2025 Update

Digital engineering services company EPAM Systems (NYSE:EPAM) reported Q4 CY2025 results beating Wall Street’s revenue expectations, with sales up 12.8% year on year to $1.41 billion. The company expects next quarter’s revenue to be around $1.39 billion, close to analysts’ estimates. Its non-GAAP profit of $3.26 per share was 3.2% above analysts’ consensus estimates.

EPAM (EPAM) Q4 CY2025 Highlights:

- Revenue: $1.41 billion vs analyst estimates of $1.39 billion (12.8% year-on-year growth, 1.1% beat)

- Adjusted EPS: $3.26 vs analyst estimates of $3.16 (3.2% beat)

- Adjusted EBITDA: $180 million vs analyst estimates of $237.6 million (12.8% margin, 24.2% miss)

- Revenue Guidance for Q1 CY2026 is $1.39 billion at the midpoint, roughly in line with what analysts were expecting

- Adjusted EPS guidance for the upcoming financial year 2026 is $12.75 at the midpoint, beating analyst estimates by 1.6%

- Operating Margin: 10.6%, in line with the same quarter last year

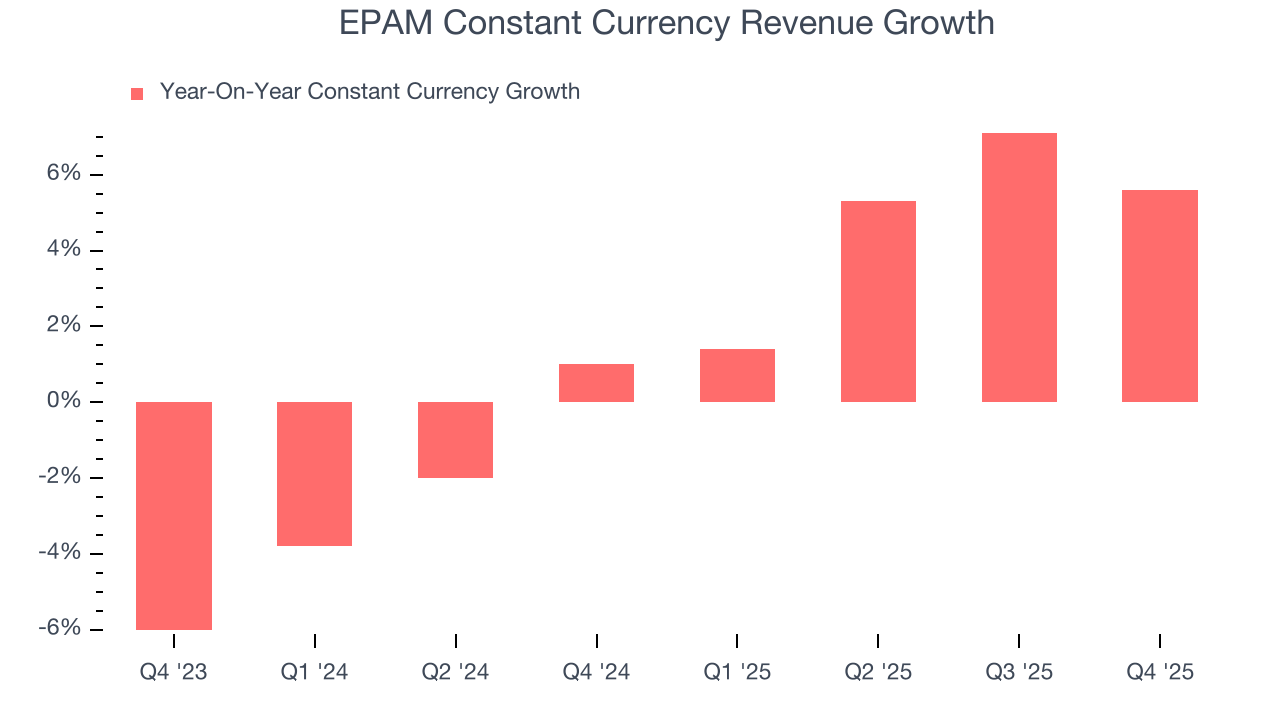

- Constant Currency Revenue rose 5.6% year on year (1% in the same quarter last year)

- Market Capitalization: $9.26 billion

Company Overview

Founded in 1993 during the early days of offshore software development, EPAM Systems (NYSE:EPAM) provides digital engineering, cloud, and AI transformation services to help global enterprises and startups modernize their technology systems and create digital products.

EPAM operates at the intersection of technology consulting and software engineering, helping organizations reimagine their businesses through a digital lens. The company's teams design, build, and implement complex software solutions that power everything from customer-facing applications to back-end systems that run critical business operations.

The company's service portfolio spans several key areas. Its engineering teams develop custom software, modernize legacy systems, and integrate various technology platforms. In cloud services, EPAM helps organizations migrate to cloud environments and build cloud-native applications. Its data and AI capabilities enable clients to extract insights from their information and implement artificial intelligence solutions. EPAM also designs customer experiences across digital channels and provides cybersecurity services to protect against evolving threats.

For example, EPAM might help a bank develop a new mobile application that integrates with legacy systems while implementing advanced security features, or assist a retailer in building a personalized e-commerce platform powered by AI recommendations.

EPAM serves clients across multiple industries, with particular strength in financial services, travel and consumer, software and technology, business information and media, and life sciences and healthcare. A global bank might engage EPAM to modernize its trading platform, while a pharmaceutical company might work with EPAM to develop scientific informatics solutions that accelerate research.

The company operates through a global delivery model with professionals located in more than 50 countries. This distributed workforce allows EPAM to combine on-site collaboration with clients and offshore development capabilities, providing both local expertise and cost efficiencies. EPAM generates revenue primarily through time-and-materials contracts, where clients pay based on the hours worked by EPAM professionals at agreed-upon rates.

4. IT Services & Consulting

IT Services & Consulting companies stand to benefit from increasing enterprise demand for digital transformation, AI-driven automation, and cybersecurity resilience. Many enterprises can't attack these topics alone and need IT services and consulting on everything from technical advice to implementation. Challenges in meeting these needs will include finding talent in specialized and evolving IT fields. While AI and automation can enhance productivity, they also threaten to commoditize certain consulting functions. Another ongoing challenge will be pricing pressures from offshore IT service providers, which have lower labor costs and increasingly equal access to advanced technology like AI.

EPAM's competitors include global IT services providers such as Accenture, Cognizant, and Infosys, as well as digital-focused firms like Globant, Endava, and Grid Dynamics. The company also competes with the consulting arms of large technology firms and regional service providers in specific markets.

5. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $5.46 billion in revenue over the past 12 months, EPAM is one of the larger companies in the business services industry and benefits from a well-known brand that influences purchasing decisions.

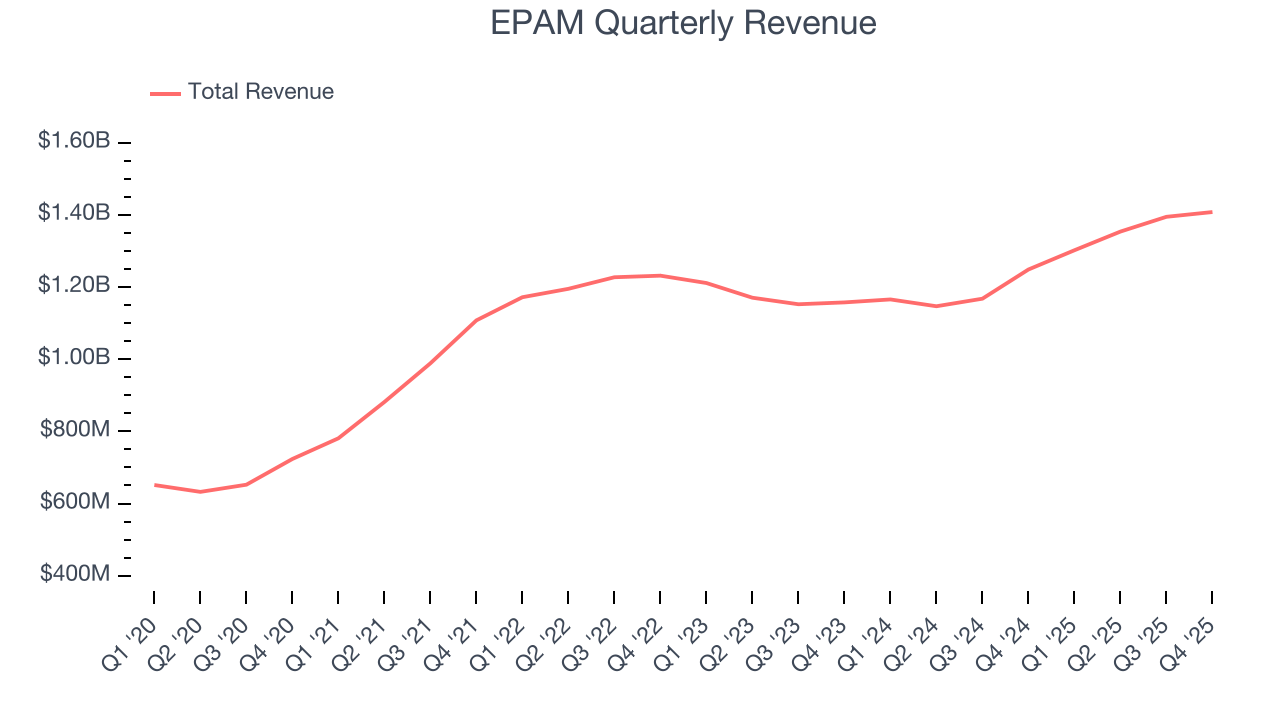

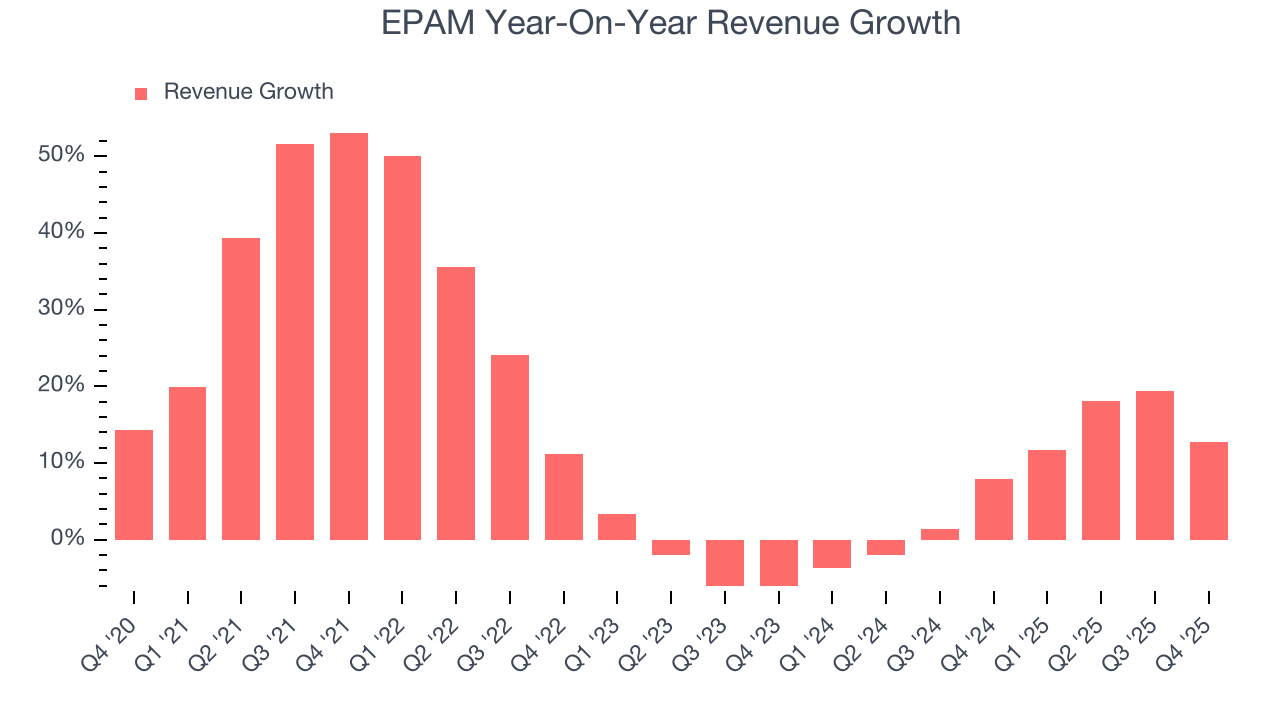

As you can see below, EPAM’s sales grew at an incredible 15.5% compounded annual growth rate over the last five years. This is an encouraging starting point for our analysis because it shows EPAM’s demand was higher than many business services companies.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. EPAM’s annualized revenue growth of 7.9% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

EPAM also reports sales performance excluding currency movements, which are outside the company’s control and not indicative of demand. Over the last two years, its constant currency sales averaged 2.1% year-on-year growth. Because this number is lower than its normal revenue growth, we can see that foreign exchange rates have boosted EPAM’s performance.

This quarter, EPAM reported year-on-year revenue growth of 12.8%, and its $1.41 billion of revenue exceeded Wall Street’s estimates by 1.1%. Company management is currently guiding for a 7% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 6.6% over the next 12 months, similar to its two-year rate. Still, this projection is above the sector average and indicates the market is forecasting some success for its newer products and services.

6. Operating Margin

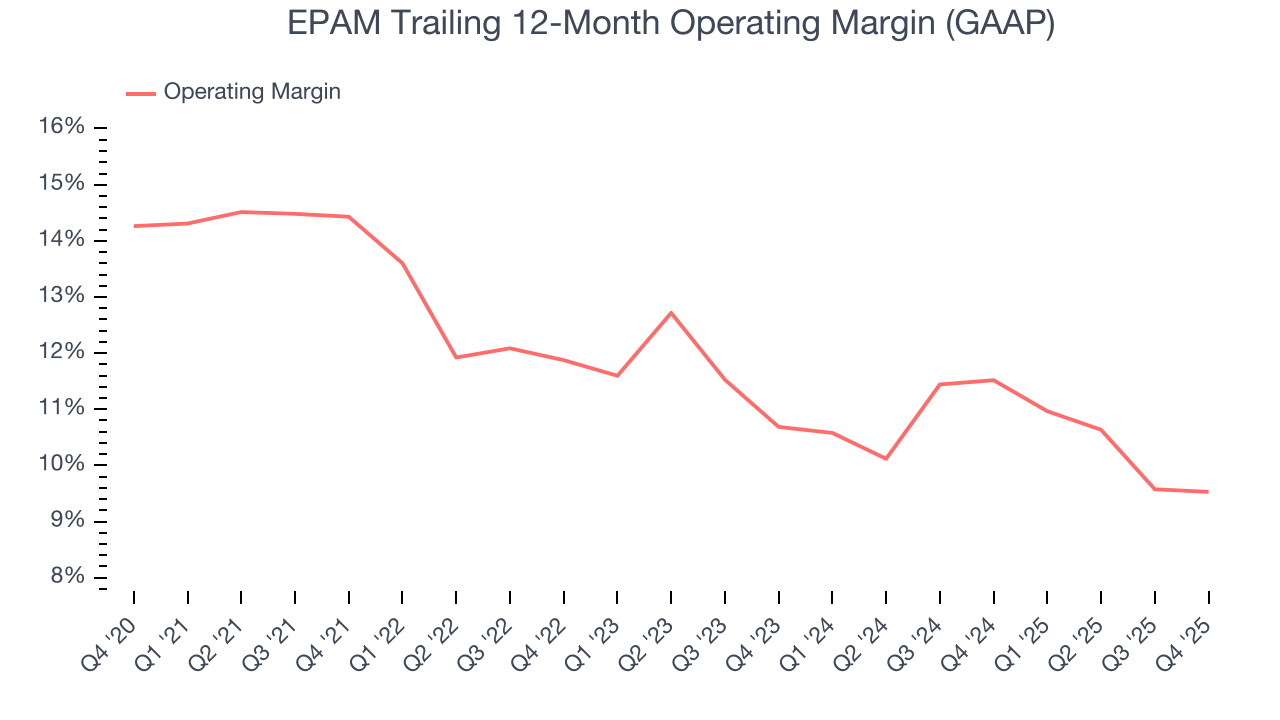

EPAM has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 11.4%, higher than the broader business services sector.

Analyzing the trend in its profitability, EPAM’s operating margin decreased by 4.9 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, EPAM generated an operating margin profit margin of 10.6%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

7. Earnings Per Share

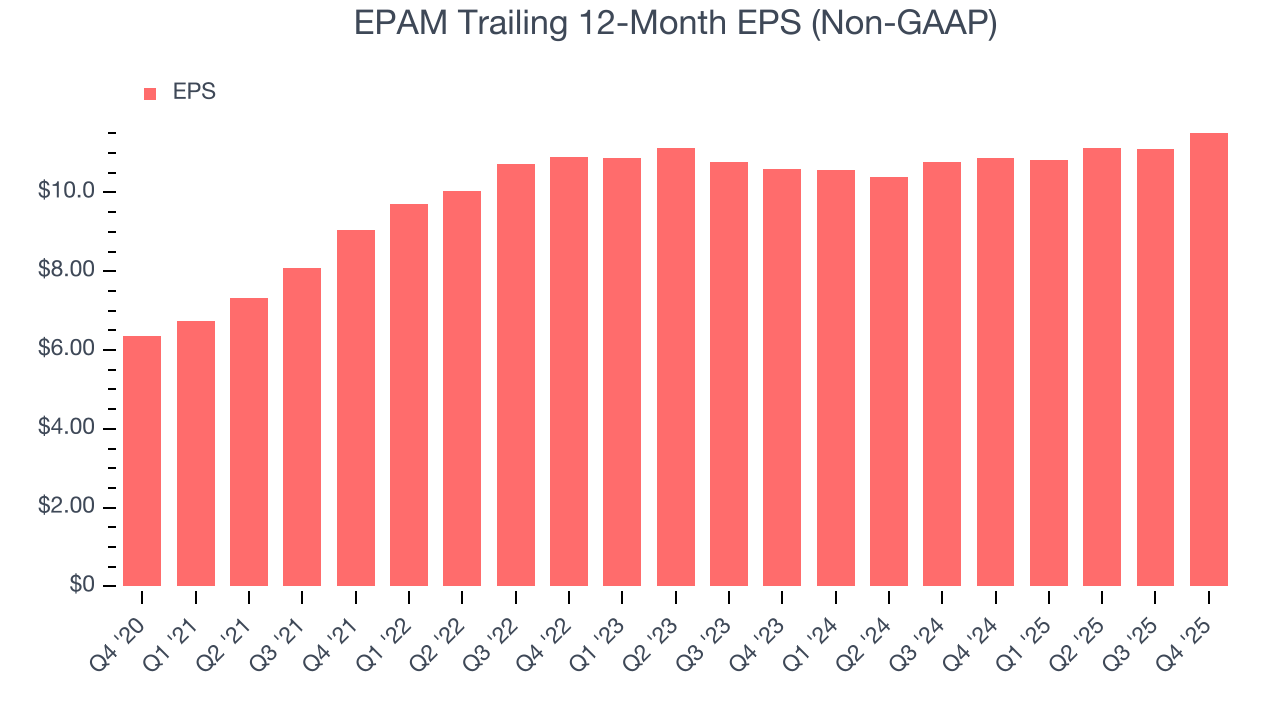

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

EPAM’s EPS grew at a remarkable 12.7% compounded annual growth rate over the last five years. However, this performance was lower than its 15.5% annualized revenue growth, telling us the company became less profitable on a per-share basis as it expanded due to non-fundamental factors such as interest expenses and taxes.

We can take a deeper look into EPAM’s earnings to better understand the drivers of its performance. As we mentioned earlier, EPAM’s operating margin was flat this quarter but declined by 4.9 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For EPAM, its two-year annual EPS growth of 4.3% was lower than its five-year trend. This wasn’t great, but at least the company was successful in other measures of financial health.

In Q4, EPAM reported adjusted EPS of $3.26, up from $2.84 in the same quarter last year. This print beat analysts’ estimates by 3.2%. Over the next 12 months, Wall Street expects EPAM’s full-year EPS of $11.52 to grow 9.2%.

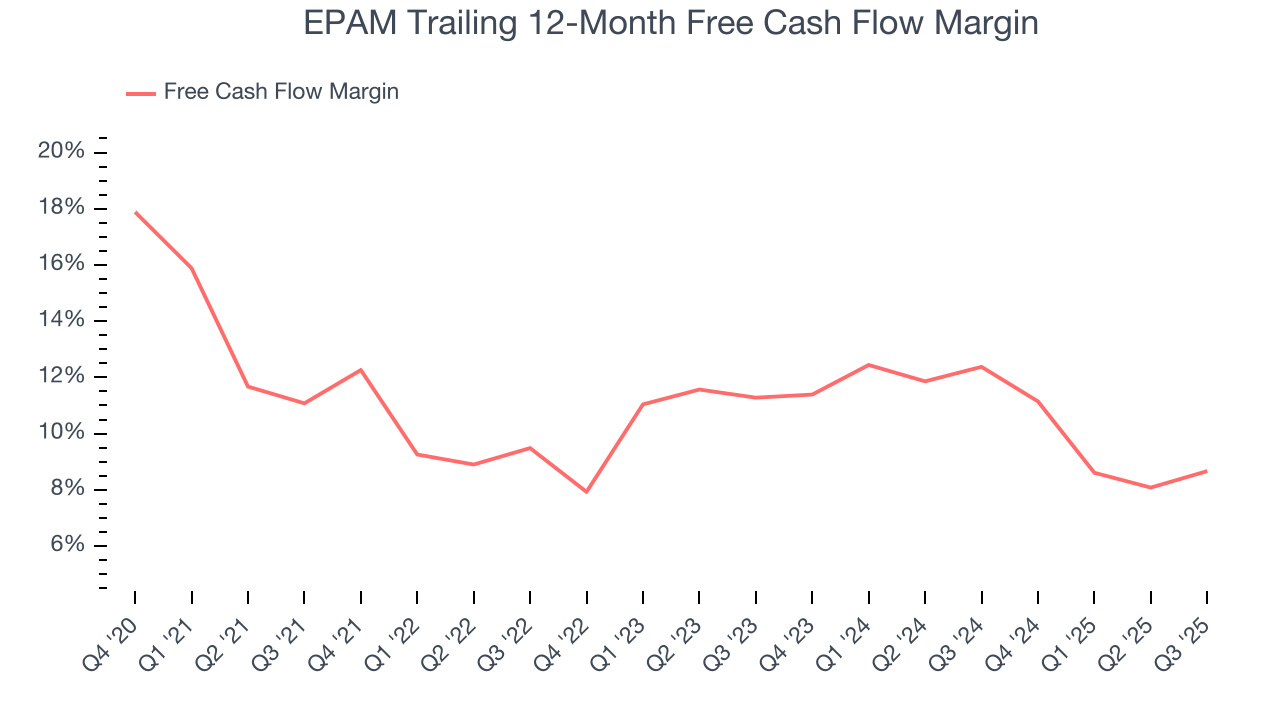

8. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

EPAM has shown robust cash profitability, giving it an edge over its competitors and the ability to reinvest or return capital to investors. The company’s free cash flow margin averaged 10.2% over the last five years, quite impressive for a business services business.

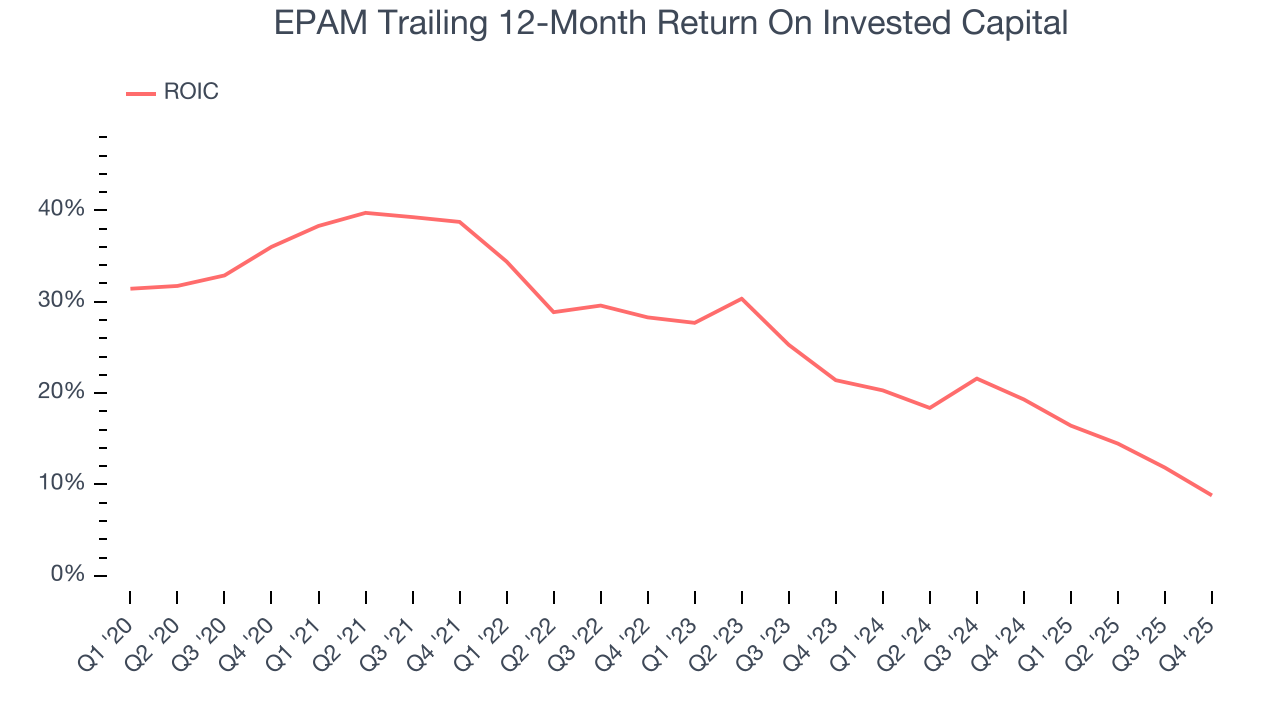

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

EPAM’s five-year average ROIC was 23.3%, placing it among the best business services companies. This illustrates its management team’s ability to invest in highly profitable ventures and produce tangible results for shareholders.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, EPAM’s ROIC has decreased significantly over the last few years. Only time will tell if its new bets can bear fruit and potentially reverse the trend.

10. Key Takeaways from EPAM’s Q4 Results

It was encouraging to see EPAM beat analysts’ full-year EPS guidance expectations this quarter. We were also happy its revenue narrowly outperformed Wall Street’s estimates. Overall, this print had some key positives. The market seemed to be hoping for more, and the stock traded down 3.3% to $162.13 immediately after reporting.

11. Is Now The Time To Buy EPAM?

Updated: February 19, 2026 at 6:17 AM EST

Before making an investment decision, investors should account for EPAM’s business fundamentals and valuation in addition to what happened in the latest quarter.

We think EPAM is a good business. To kick things off, its revenue growth was exceptional over the last five years. And while its diminishing returns show management's recent bets still have yet to bear fruit, its stellar ROIC suggests it has been a well-run company historically. On top of that, its remarkable EPS growth over the last five years shows its profits are trickling down to shareholders.

EPAM’s P/E ratio based on the next 12 months is 13.3x. When scanning the business services space, EPAM trades at a fair valuation. If you’re a fan of the business and management team, now is a good time to scoop up some shares.

Wall Street analysts have a consensus one-year price target of $227.76 on the company (compared to the current share price of $162.13), implying they see 40.5% upside in buying EPAM in the short term.