Equitable Holdings (EQH)

We wouldn’t recommend Equitable Holdings. Its weak sales growth and low returns on capital show it struggled to generate demand and profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think Equitable Holdings Will Underperform

Tracing its roots back to 1859 as one of America's oldest financial institutions, Equitable Holdings (NYSE:EQH) provides retirement planning, asset management, and life insurance products through its two main franchises, Equitable and AllianceBernstein.

- Expenses have increased as a percentage of revenue over the last two years as its pre-tax profit margin fell by 13.3 percentage points

- Annual book value per share declines of 166% for the past five years show its capital management struggled during this cycle

- Earnings per share lagged its peers over the last five years as they only grew by 2.5% annually

Equitable Holdings is skating on thin ice. We’re hunting for superior stocks elsewhere.

Why There Are Better Opportunities Than Equitable Holdings

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Equitable Holdings

Equitable Holdings’s stock price of $45.53 implies a valuation ratio of 5.7x forward P/E. Equitable Holdings’s valuation may seem like a great deal, but we think there are valid reasons why it’s so cheap.

We’d rather pay up for companies with elite fundamentals than get a bargain on weak ones. Cheap stocks can be value traps, and as their performance deteriorates, they will stay cheap or get even cheaper.

3. Equitable Holdings (EQH) Research Report: Q4 CY2025 Update

Financial services company Equitable Holdings (NYSE:EQH) fell short of the markets revenue expectations in Q4 CY2025, with sales falling 17% year on year to $3.28 billion. Its non-GAAP profit of $1.73 per share was 0.9% below analysts’ consensus estimates.

Equitable Holdings (EQH) Q4 CY2025 Highlights:

- Net Premiums Earned: $224 million

- Revenue: $3.28 billion vs analyst estimates of $3.91 billion (17% year-on-year decline, 16.2% miss)

- Pre-tax Profit: $344 million (10.5% margin)

- Adjusted EPS: $1.73 vs analyst expectations of $1.75 (0.9% miss)

- Book Value per Share: -$4.03 (2,221% year-on-year decline)

- Market Capitalization: $12.8 billion

Company Overview

Tracing its roots back to 1859 as one of America's oldest financial institutions, Equitable Holdings (NYSE:EQH) provides retirement planning, asset management, and life insurance products through its two main franchises, Equitable and AllianceBernstein.

Equitable Holdings operates through six segments that serve different client needs. The Individual Retirement segment offers variable annuity products like Structured Capital Strategies, which provides market exposure with downside protection. Group Retirement focuses on tax-deferred investment services for educational institutions, municipalities, non-profits, and small to medium-sized businesses, primarily through 403(b), 457(b), and 401(k) plans.

Through AllianceBernstein, the Investment Management and Research segment delivers diversified investment management services globally via three channels: Institutions (serving pension plans, foundations, and governments), Retail (through financial intermediaries), and Private Wealth Management (for high-net-worth individuals and families). The firm's investment expertise spans equity, fixed income, alternative investments, and multi-asset strategies, with increasing focus on ESG-oriented portfolios.

The Protection Solutions segment provides life insurance products—primarily Variable Universal Life and Indexed Universal Life—and employee benefits like group life, dental, and disability insurance for small and medium-sized businesses. The newer Wealth Management segment offers financial planning, investment advisory services, and insurance products through approximately 4,400 financial advisors operating from over 80 branch locations nationwide.

Equitable's distribution network includes both affiliated channels (Equitable Advisors and Bernstein Financial Advisors) and third-party relationships with banks, broker-dealers, and insurance carriers, giving the company access to over 150,000 financial professionals. This extensive distribution capability allows Equitable to reach diverse client segments, from individual retirement savers to institutional investors managing billions in assets.

4. Life Insurance

Life insurance companies collect premiums from policyholders in exchange for providing a future death benefit or retirement income stream. Interest rates matter for the sector (and make it cyclical), with higher rates allowing insurers to reinvest their fixed-income portfolios at more attractive yields and vice versa. Additionally, favorable demographic shifts, such as an aging population, are driving strong demand for retirement products while AI and data analytics offer significant opportunities to improve underwriting accuracy and operational efficiency. Conversely, the industry faces headwinds from persistent competition from agile insurtechs that threaten traditional distribution models.

Equitable Holdings competes with major financial services and insurance companies including Prudential Financial (NYSE:PRU), MetLife (NYSE:MET), and Lincoln National (NYSE:LNC) in the retirement and insurance markets. In asset management, AllianceBernstein faces competition from firms like BlackRock (NYSE:BLK), T. Rowe Price (NASDAQ:TROW), and Franklin Resources (NYSE:BEN).

5. Revenue Growth

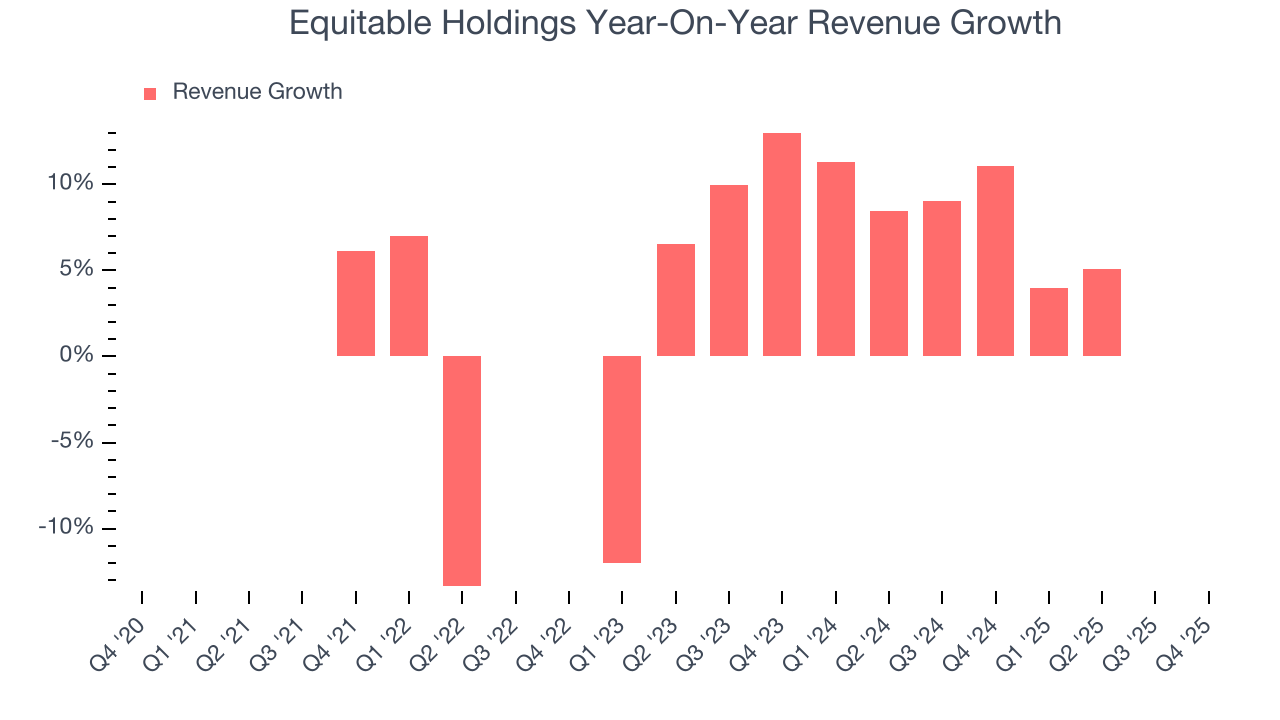

Insurance companies earn revenue from three primary sources: 1) The core insurance business itself, often called underwriting and represented in the income statement as premiums 2) Income from investing the “float” (premiums collected upfront not yet paid out as claims) in assets such as fixed-income assets and equities 3) Fees from various sources such as policy administration, annuities, or other value-added services. Regrettably, Equitable Holdings’s revenue grew at a sluggish 1.6% compounded annual growth rate over the last five years. This was below our standards and is a rough starting point for our analysis.

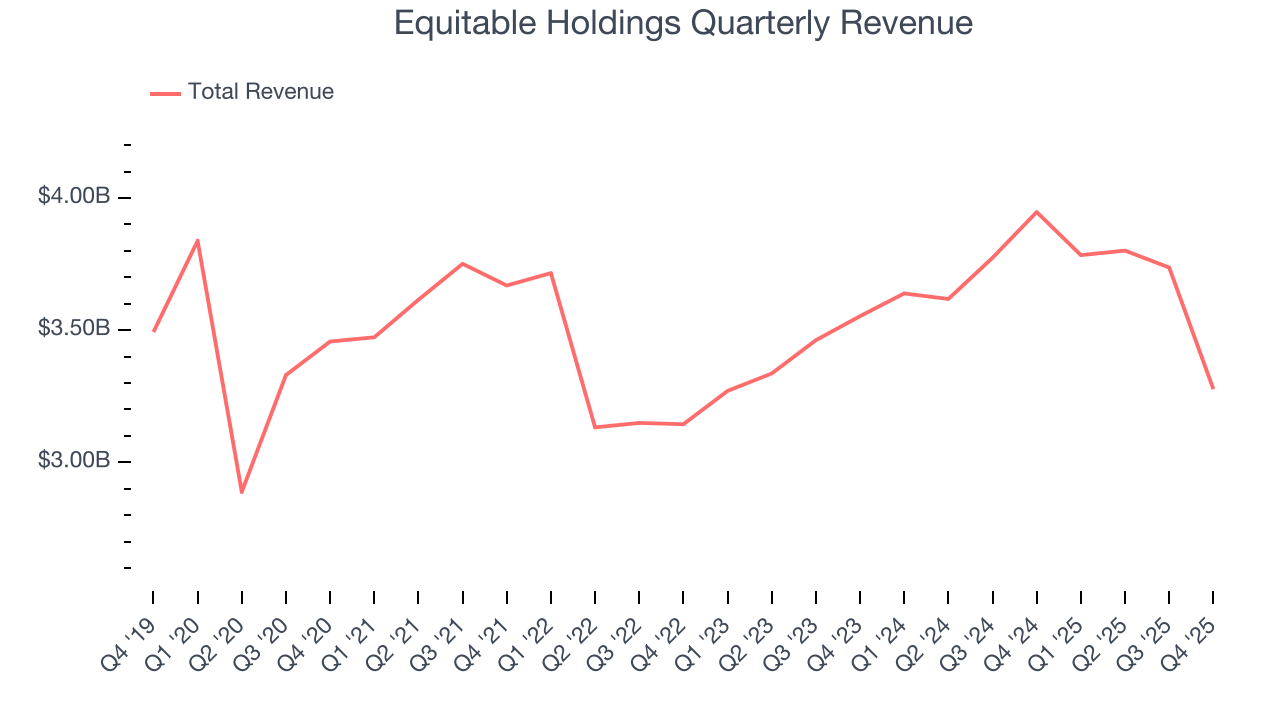

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. Equitable Holdings’s annualized revenue growth of 3.5% over the last two years is above its five-year trend, but we were still disappointed by the results.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Equitable Holdings missed Wall Street’s estimates and reported a rather uninspiring 17% year-on-year revenue decline, generating $3.28 billion of revenue.

6. Pre-Tax Profit Margin

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For insurance companies, we look at pre-tax profit rather than the operating margin that defines sectors such as consumer, tech, and industrials.

This is because insurers are balance sheet businesses, where assets and liabilities define the core economics. This means that interest income and expense should be factored into the definition of profit but taxes - which are largely out of a company’s control - should not.

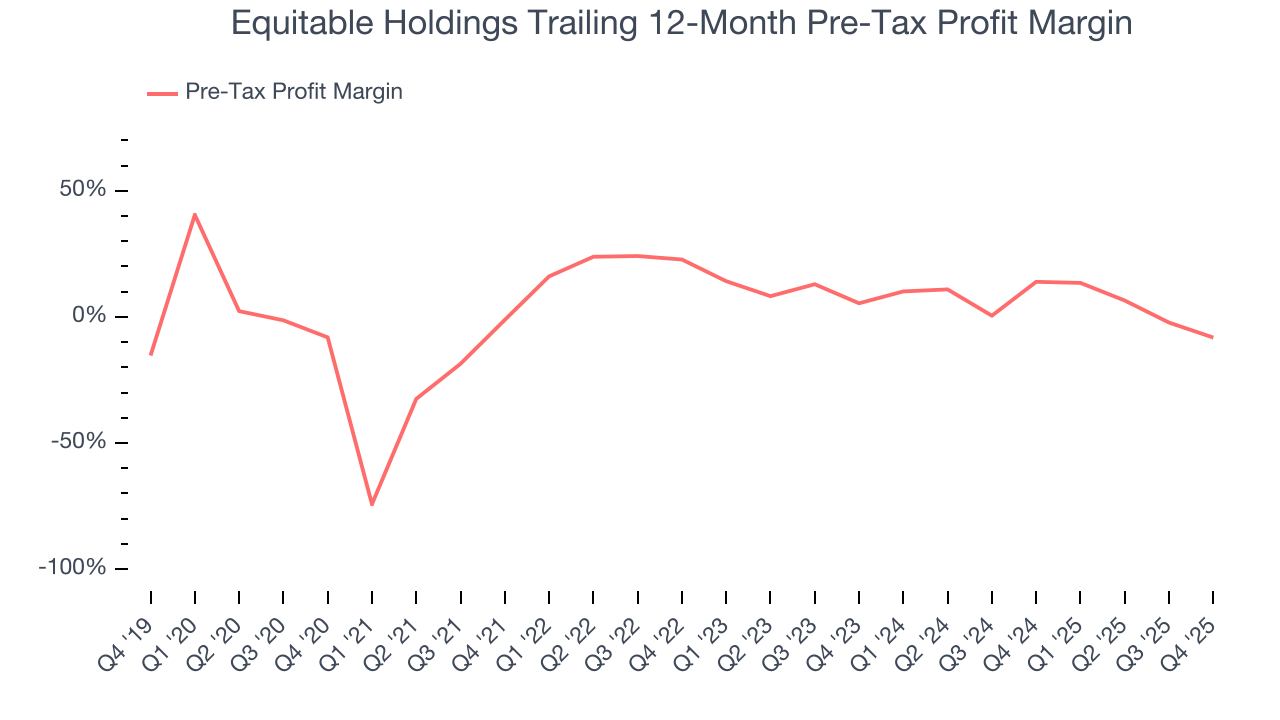

Over the last five years, Equitable Holdings’s pre-tax profit margin couldn’t build momentum, hanging around negative 8.2%. It has also declined by 13.6 percentage points on a two-year basis, showing its expenses have recently increased at a faster rate than revenue. This usually raises questions unless the company is in high-growth mode and reinvesting its profits into attractive ventures.

Equitable Holdings’s pre-tax profit margin came in at 10.5% this quarter. This result was 19.8 percentage points worse than the same quarter last year.

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

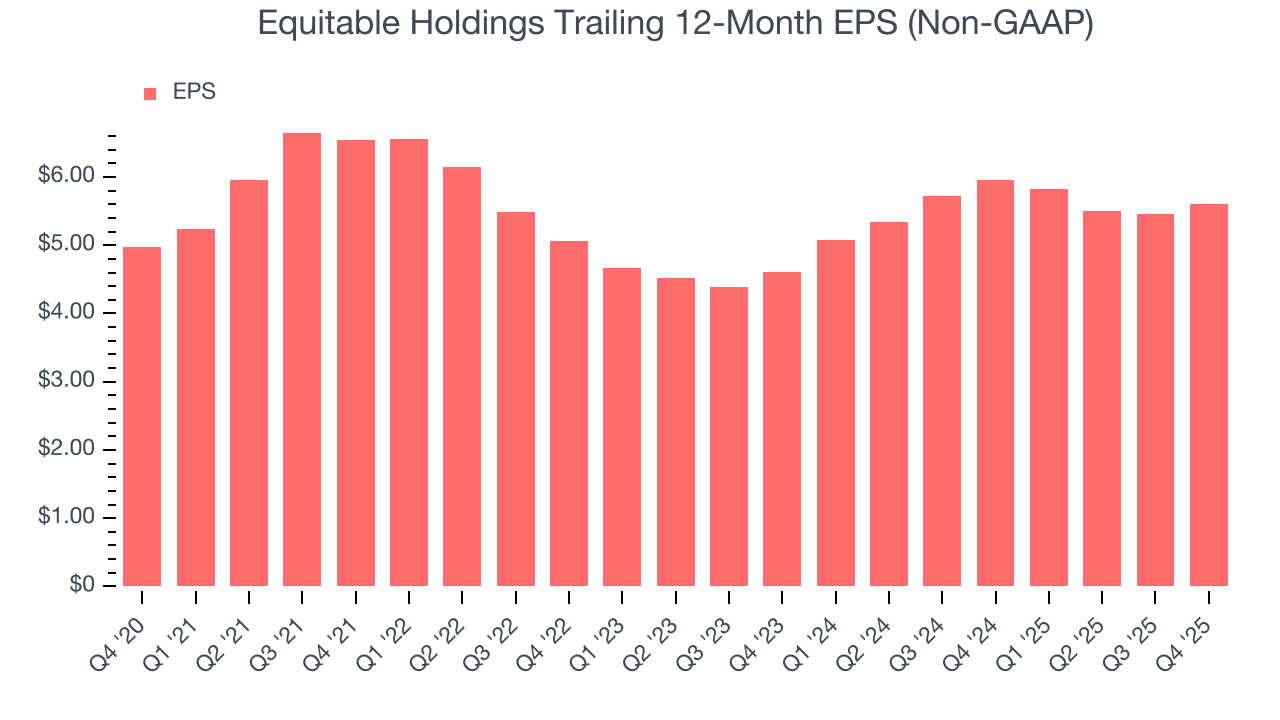

Equitable Holdings’s weak 2.5% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

Although it wasn’t great, Equitable Holdings’s two-year annual EPS growth of 10.3% topped its 3.5% two-year revenue growth.

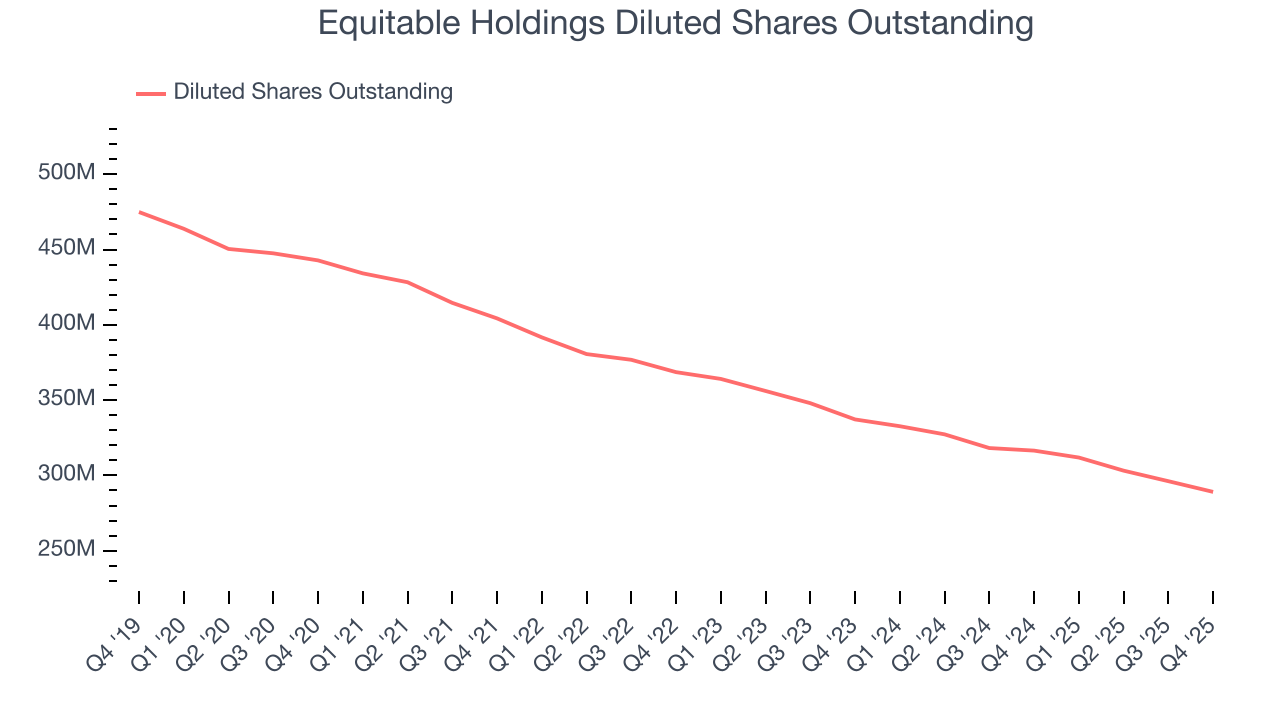

We can take a deeper look into Equitable Holdings’s earnings to better understand the drivers of its performance. A two-year view shows that Equitable Holdings has repurchased its stock, shrinking its share count by 14.3%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

In Q4, Equitable Holdings reported adjusted EPS of $1.73, up from $1.57 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects Equitable Holdings’s full-year EPS of $5.61 to grow 39.7%.

8. Balance Sheet Risk

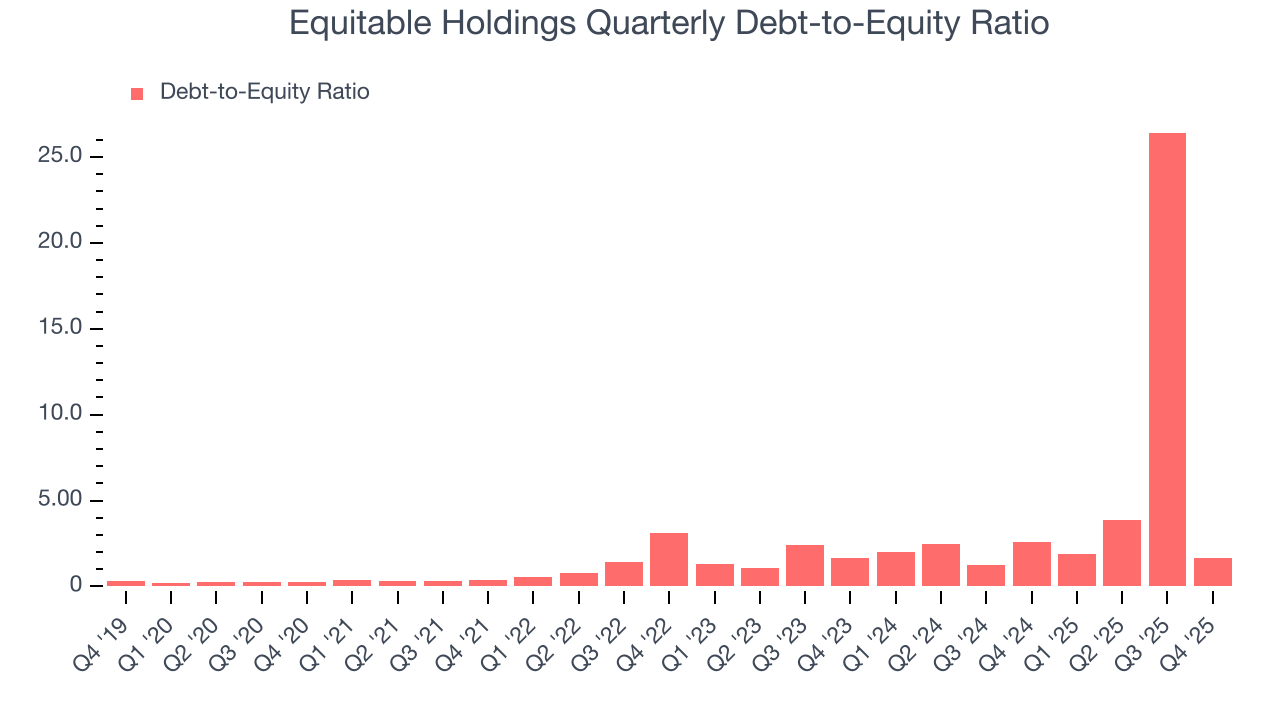

The debt-to-equity ratio is a widely used measure to assess a company's balance sheet health. A higher ratio means that a business aggressively financed its growth with debt. This can result in higher earnings (if the borrowed funds are invested profitably) but also increases risk.

If debt levels are too high, there could be difficulties in meeting obligations, especially during economic downturns or periods of rising interest rates if the debt has variable-rate payments.

Equitable Holdings currently has $4.33 billion of debt and $2.61 billion of shareholder's equity on its balance sheet, and over the past four quarters, has averaged a debt-to-equity ratio of 8.5×. We think this is dangerous - for an insurance business, anything above 1.0× raises red flags.

9. Return on Equity

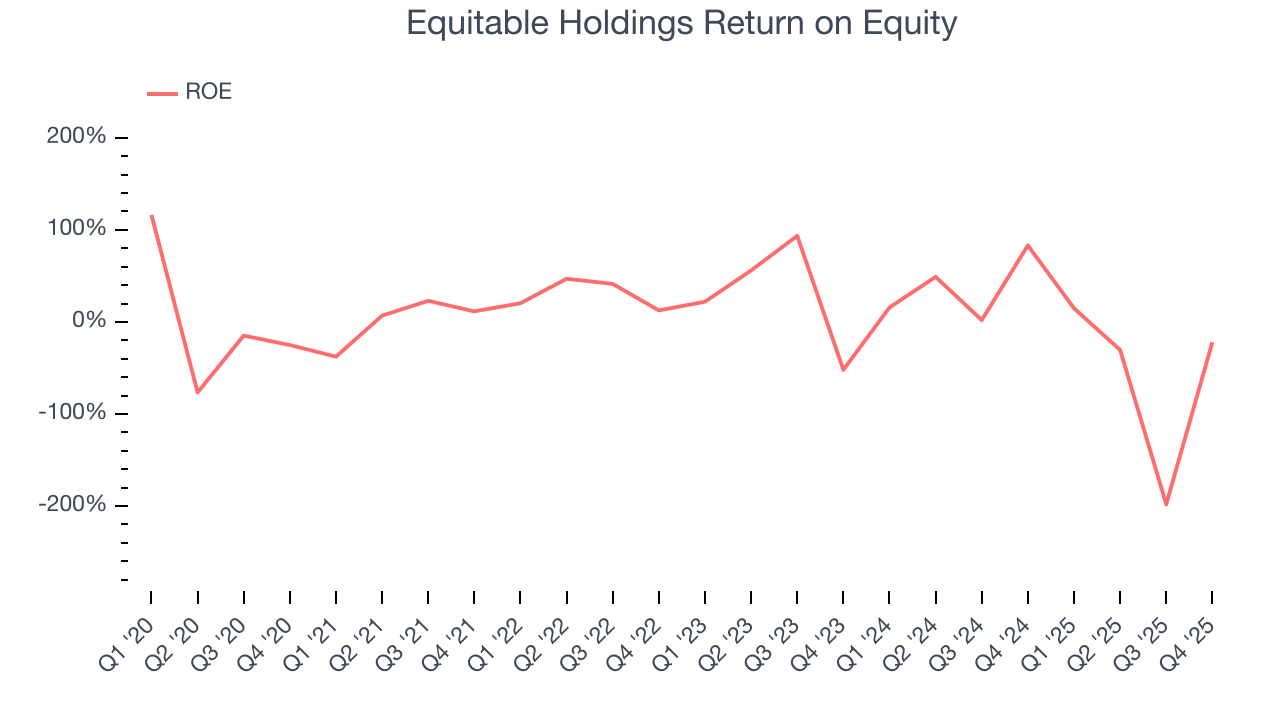

Return on equity (ROE) serves as a comprehensive measure of an insurer's performance, showing how efficiently it converts shareholder capital into profits. Strong ROE performance typically translates to better returns for investors through a combination of earnings retention, share repurchases, and dividend distributions.

Over the last five years, Equitable Holdings has averaged an ROE of 8%, uninspiring for a company operating in a sector where the average shakes out around 12.5%.

10. Key Takeaways from Equitable Holdings’s Q4 Results

We struggled to find many positives in these results. Its revenue missed and its EPS fell a bit short of Wall Street’s estimates. Overall, this quarter could have been better. The stock remained flat at $44.39 immediately following the results.

11. Is Now The Time To Buy Equitable Holdings?

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Equitable Holdings.

Equitable Holdings falls short of our quality standards. To begin with, its revenue growth was weak over the last five years. And while its projected EPS for the next year implies the company’s fundamentals will improve, the downside is its BVPS has declined over the last five years. On top of that, its weak EPS growth over the last five years shows it’s failed to produce meaningful profits for shareholders.

Equitable Holdings’s P/E ratio based on the next 12 months is 5.7x. While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $62.25 on the company (compared to the current share price of $44.39).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.