ESAB (ESAB)

We aren’t fans of ESAB. Its growth has been lacking and its free cash flow margin has caved, suggesting it’s struggling to adapt.― StockStory Analyst Team

1. News

2. Summary

Why We Think ESAB Will Underperform

Having played a significant role in the construction of the iconic Sydney Opera House, ESAB (NYSE:ESAB) manufactures and sells welding and cutting equipment for numerous industries.

- Absence of organic revenue growth over the past two years suggests it may have to lean into acquisitions to drive its expansion

- Annual revenue growth of 4.1% over the last four years was below our standards for the industrials sector

- One positive is that its excellent operating margin highlights the strength of its business model, and it turbocharged its profits by achieving some fixed cost leverage

ESAB’s quality is insufficient. More profitable opportunities exist elsewhere.

Why There Are Better Opportunities Than ESAB

High Quality

Investable

Underperform

Why There Are Better Opportunities Than ESAB

At $107.82 per share, ESAB trades at 20x forward P/E. This multiple is cheaper than most industrials peers, but we think this is justified.

Cheap stocks can look like a great deal at first glance, but they can be value traps. They often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. ESAB (ESAB) Research Report: Q3 CY2025 Update

Welding and cutting equipment manufacturer ESAB (NYSE:ESAB) reported revenue ahead of Wall Streets expectations in Q3 CY2025, with sales up 8.1% year on year to $727.8 million. Its non-GAAP profit of $1.32 per share was 3.7% above analysts’ consensus estimates.

ESAB (ESAB) Q3 CY2025 Highlights:

- Revenue: $727.8 million vs analyst estimates of $696 million (8.1% year-on-year growth, 4.6% beat)

- Adjusted EPS: $1.32 vs analyst estimates of $1.27 (3.7% beat)

- Adjusted EBITDA: $133.4 million vs analyst estimates of $129.9 million (18.3% margin, 2.7% beat)

- Management slightly raised its full-year Adjusted EPS guidance to $5.25 at the midpoint

- EBITDA guidance for the full year is $537.5 million at the midpoint, in line with analyst expectations

- Operating Margin: 14.6%, down from 15.7% in the same quarter last year

- Free Cash Flow Margin: 9.6%, down from 13.4% in the same quarter last year

- Organic Revenue rose 2% year on year vs analyst estimates of flat growth (156.7 basis point beat)

- Market Capitalization: $7.35 billion

Company Overview

Having played a significant role in the construction of the iconic Sydney Opera House, ESAB (NYSE:ESAB) manufactures and sells welding and cutting equipment for numerous industries.

ESAB Corporation was founded in 1904 by Oscar Kjellberg. Kjellberg invented the world’s first coated welding electrode, which significantly advanced the welding industry and set the foundation for ESAB's product offerings. Throughout the 20th century, ESAB expanded globally, acquiring numerous companies and diversifying its product line to include not only welding consumables but also cutting equipment, automation, and associated technology.

Today, ESAB offers a diverse range of products focused on enhancing productivity in various industries through cutting, joining, and automated welding solutions. Its lineup includes welding consumables like electrodes, both cored and solid wires, and fluxes crafted from specialized materials. ESAB is also known for its cutting consumables, which encompass electrodes, nozzles, shields, and tips. Its equipment portfolio ranges from portable welding machines to expansive, customized automated cutting and welding systems. Additionally, ESAB integrates software and digital solutions that aid customers in increasing productivity, monitoring welding operations remotely, and digitizing documentation. These products are distributed globally across industries such as general industry, infrastructure, renewable energy, and transportation through both independent distributors and direct sales channels.

ESAB generates its revenue through the sale of its wide-ranging welding and cutting equipment and consumables. These products are sold globally across multiple industries, including infrastructure, energy, and transportation. Significantly, ESAB benefits from a recurring revenue stream through the sales of its consumables, such as welding wires, electrodes, and fluxes. These consumables are essential for continuous operation in welding activities, generating repeat purchases and contributing to the company’s financial sustainability.

4. Professional Tools and Equipment

Automation that increases efficiency and connected equipment that collects analyzable data have been trending, creating new demand. Some professional tools and equipment companies also provide software to accompany measurement or automated machinery, adding a stream of recurring revenues to their businesses. On the other hand, professional tools and equipment companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

Competitors offering similar products include Lincoln Electric (NASDAQ:LECO), ITW (NYSE:ITW), and Colfax (NYSE:CFX).

5. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Regrettably, ESAB’s sales grew at a sluggish 4.1% compounded annual growth rate over the last four years. This was below our standard for the industrials sector and is a rough starting point for our analysis.

Long-term growth is the most important, but within industrials, a stretched historical view may miss new industry trends or demand cycles. ESAB’s recent performance shows its demand has slowed as its revenue was flat over the last two years.

We can dig further into the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, ESAB’s organic revenue averaged 1% year-on-year growth. Because this number aligns with its two-year revenue growth, we can see the company’s core operations (not acquisitions and divestitures) drove most of its results.

This quarter, ESAB reported year-on-year revenue growth of 8.1%, and its $727.8 million of revenue exceeded Wall Street’s estimates by 4.6%.

Looking ahead, sell-side analysts expect revenue to grow 5.5% over the next 12 months. While this projection indicates its newer products and services will catalyze better top-line performance, it is still below the sector average.

6. Gross Margin & Pricing Power

ESAB’s unit economics are great compared to the broader industrials sector and signal that it enjoys product differentiation through quality or brand. As you can see below, it averaged an excellent 36.1% gross margin over the last five years. Said differently, roughly $36.08 was left to spend on selling, marketing, R&D, and general administrative overhead for every $100 in revenue.

ESAB produced a 37% gross profit margin in Q3, in line with the same quarter last year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

7. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

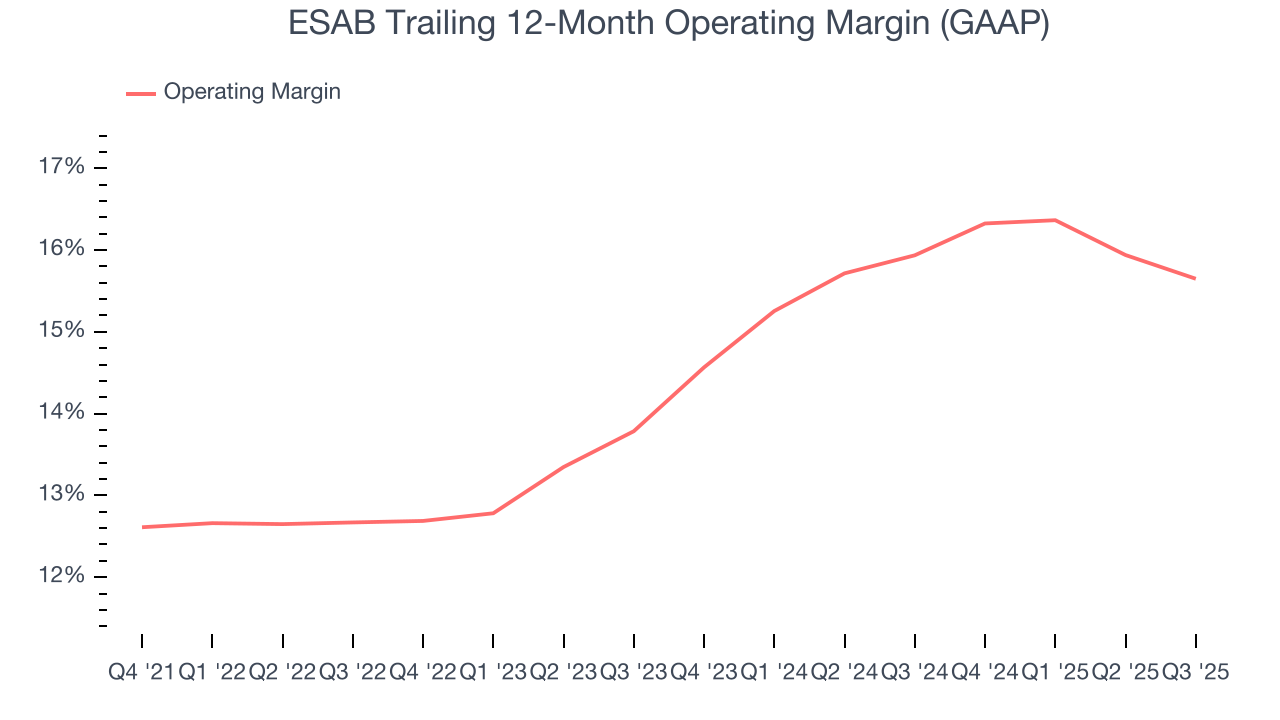

ESAB has been an efficient company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 14.3%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, ESAB’s operating margin rose by 2.4 percentage points over the last five years, as its sales growth gave it operating leverage.

In Q3, ESAB generated an operating margin profit margin of 14.6%, down 1.1 percentage points year on year. Since ESAB’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

8. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

ESAB has shown impressive cash profitability, enabling it to ride out cyclical downturns more easily while maintaining its investments in new and existing offerings. The company’s free cash flow margin averaged 8.8% over the last five years, better than the broader industrials sector.

Taking a step back, we can see that ESAB’s margin dropped by 3.2 percentage points during that time. If its declines continue, it could signal increasing investment needs and capital intensity.

ESAB’s free cash flow clocked in at $70.2 million in Q3, equivalent to a 9.6% margin. The company’s cash profitability regressed as it was 3.8 percentage points lower than in the same quarter last year, suggesting its historical struggles have dragged on.

9. Balance Sheet Assessment

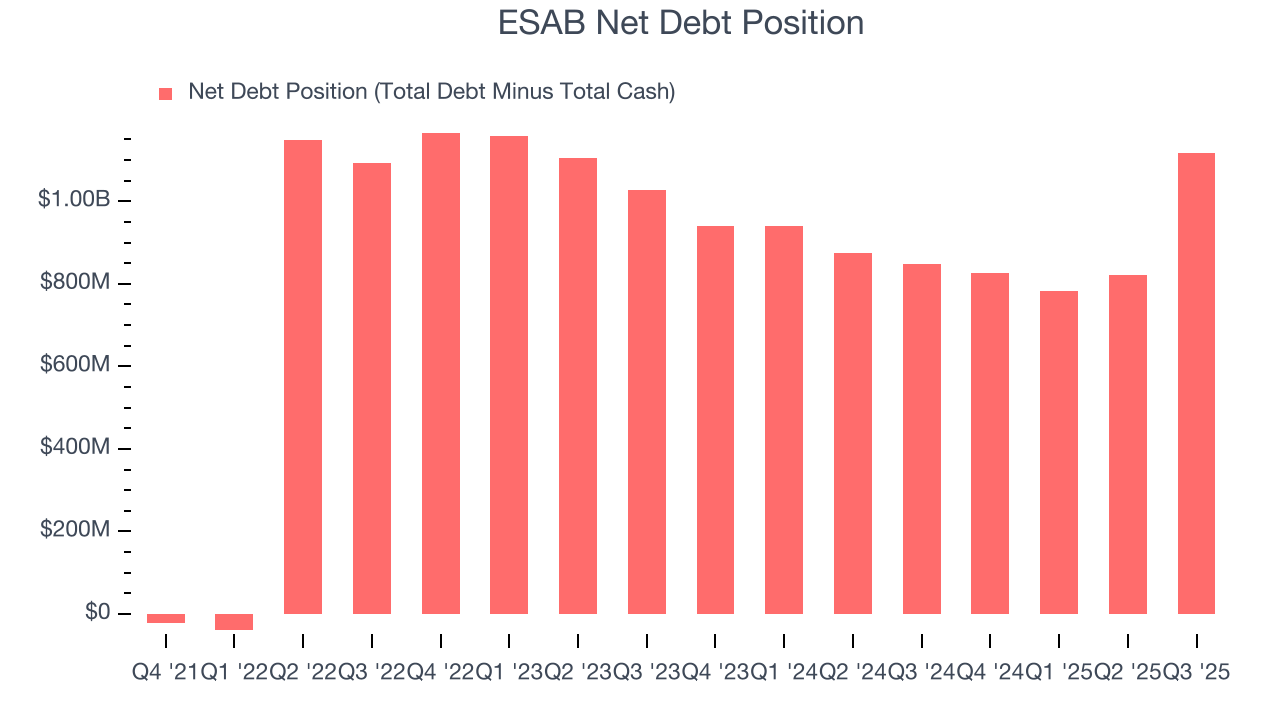

ESAB reported $218.2 million of cash and $1.34 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $542 million of EBITDA over the last 12 months, we view ESAB’s 2.1× net-debt-to-EBITDA ratio as safe. We also see its $32.48 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

10. Key Takeaways from ESAB’s Q3 Results

We were impressed by how significantly ESAB blew past analysts’ revenue expectations this quarter. We were also glad its organic revenue outperformed Wall Street’s estimates. Overall, we think this was a solid quarter with some key areas of upside. The stock remained flat at $121.14 immediately after reporting.

11. Is Now The Time To Buy ESAB?

Updated: March 6, 2026 at 10:47 PM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

ESAB isn’t a terrible business, but it doesn’t pass our bar. To begin with, its revenue growth was uninspiring over the last four years. While its strong operating margins show it’s a well-run business, the downside is its flat organic revenue disappointed. On top of that, its cash profitability fell over the last five years.

ESAB’s P/E ratio based on the next 12 months is 20x. While this valuation is fair, the upside isn’t great compared to the potential downside. We're pretty confident there are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $147.20 on the company (compared to the current share price of $107.82).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.