EVERTEC (EVTC)

We admire EVERTEC. Its superb 29.9% ROE illustrates its skill in making high-return investments.― StockStory Analyst Team

1. News

2. Summary

Why We Like EVERTEC

Operating one of Latin America's leading PIN debit networks called ATH, EVERTEC (NYSE:EVTC) is a payment transaction processor and financial technology provider that enables merchants and financial institutions across Latin America and the Caribbean to accept and process electronic payments.

- Market-beating return on equity illustrates that management has a knack for investing in profitable ventures

- Annual revenue growth of 15.8% over the past two years was outstanding, reflecting market share gains this cycle

- Earnings per share have outperformed the peer group average over the last two years, increasing by 13.1% annually

EVERTEC is a top-tier company. The valuation seems reasonable in light of its quality, so this could be a prudent time to buy some shares.

Why Is Now The Time To Buy EVERTEC?

High Quality

Investable

Underperform

Why Is Now The Time To Buy EVERTEC?

EVERTEC’s stock price of $25.89 implies a valuation ratio of 7.3x forward P/E. This multiple is cheap, and we think the stock is a bargain considering its quality characteristics.

We at StockStory love when high-quality companies go on sale because it enables investors to profit from earnings growth and a potential re-rating - the coveted “double play”.

3. EVERTEC (EVTC) Research Report: Q4 CY2025 Update

Payment processing company EVERTEC (NYSE:EVTC) reported Q4 CY2025 results exceeding the market’s revenue expectations, with sales up 13.1% year on year to $244.8 million. The company’s full-year revenue guidance of $1.03 billion at the midpoint came in 5.5% above analysts’ estimates. Its non-GAAP profit of $0.93 per share was 2.8% above analysts’ consensus estimates.

EVERTEC (EVTC) Q4 CY2025 Highlights:

- Revenue: $244.8 million vs analyst estimates of $237 million (13.1% year-on-year growth, 3.3% beat)

- Pre-tax Profit: $38.68 million (15.8% margin)

- Adjusted EPS: $0.93 vs analyst estimates of $0.90 (2.8% beat)

- Adjusted EPS guidance for the upcoming financial year 2026 is $3.90 at the midpoint, beating analyst estimates by 4%

- Market Capitalization: $1.62 billion

Company Overview

Operating one of Latin America's leading PIN debit networks called ATH, EVERTEC (NYSE:EVTC) is a payment transaction processor and financial technology provider that enables merchants and financial institutions across Latin America and the Caribbean to accept and process electronic payments.

EVERTEC's business spans the entire payment processing value chain, offering both front-end and back-end solutions. On the merchant side, the company provides acquiring services that allow businesses to accept debit, credit, prepaid, and electronic benefit transfer cards through physical point-of-sale terminals and digital channels. For financial institutions, EVERTEC delivers card issuing and processing services, ATM management, fraud monitoring, and network switching capabilities.

The company's proprietary ATH network connects merchants with card issuers, facilitating the routing and processing of transactions. Through ATH Movil and ATH Business, EVERTEC also enables person-to-person and person-to-business mobile payments, similar to services like Venmo or Zelle in the United States.

Beyond payments, EVERTEC offers business process management solutions to financial institutions, corporations, and governments. These include core banking systems, software for managing financial products like investments and mutual funds, digital onboarding tools, and cash processing services. In fact, EVERTEC is the only non-bank provider of cash processing services to the U.S. Federal Reserve in the Caribbean.

The company generates revenue primarily through multi-year contracts with customers, creating a recurring revenue stream. While Puerto Rico represents EVERTEC's largest market, the company has been expanding throughout Latin America through organic growth and strategic acquisitions. Recent purchases include Sinqia, a Brazilian financial software provider, and paySmart, which offers prepaid card processing services in Brazil. These acquisitions align with EVERTEC's strategy to diversify geographically and broaden its product offerings.

4. Payment Processing

Payment processors facilitate transactions between merchants, consumers, and financial institutions. Growth comes from e-commerce expansion, declining cash usage globally, and value-added services beyond basic processing. Headwinds include margin pressure from merchant negotiating power, rapid technological change requiring investment, and emerging competition from technology companies entering the payments ecosystem.

EVERTEC competes with global payment processors like Fidelity National Information Services (NYSE: FIS), Fiserv (NASDAQ: FISV), and Global Payments (NYSE: GPN), as well as digital payment providers such as PayPal (NASDAQ: PYPL) and Block (NYSE: SQ). In Latin America, the company also faces competition from regional players like dLocal (NASDAQ: DLO) and Rappi.

5. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, EVERTEC grew its revenue at a solid 12.8% compounded annual growth rate. Its growth surpassed the average financials company and shows its offerings resonate with customers, a great starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. EVERTEC’s annualized revenue growth of 15.8% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, EVERTEC reported year-on-year revenue growth of 13.1%, and its $244.8 million of revenue exceeded Wall Street’s estimates by 3.3%.

6. Pre-Tax Profit Margin

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For Payment Processing companies, we look at pre-tax profit rather than the operating margin that defines sectors such as consumer, tech, and industrials.

Interest income and expenses play a big role in financial institutions' profitability, so they should be factored into the definition of profit. Taxes, however, should not as they are largely out of a company's control. This is pre-tax profit by definition.

Over the last five years, EVERTEC’s pre-tax profit margin has risen by 7.7 percentage points, going from 30.8% to 16.6%. Luckily, it seems the company has recently taken steps to address its expense base as its pre-tax profit margin expanded by 4.3 percentage points on a two-year basis.

EVERTEC’s pre-tax profit margin came in at 15.8% this quarter. This result was 3.8 percentage points worse than the same quarter last year.

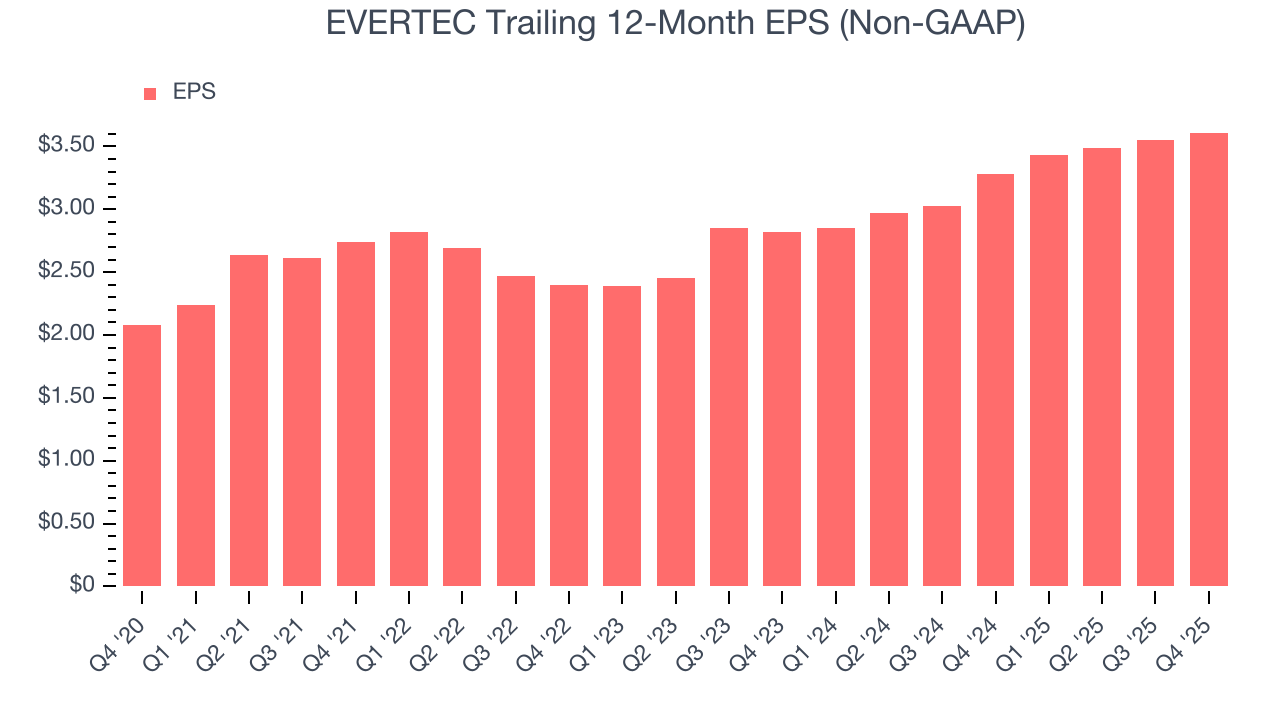

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

EVERTEC’s decent 11.7% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For EVERTEC, its two-year annual EPS growth of 13.1% was higher than its five-year trend. This acceleration made it one of the faster-growing financials companies in recent history.

In Q4, EVERTEC reported adjusted EPS of $0.93, up from $0.87 in the same quarter last year. This print beat analysts’ estimates by 2.8%. Over the next 12 months, Wall Street expects EVERTEC’s full-year EPS of $3.61 to grow 4%.

8. Return on Equity

Return on equity (ROE) reveals the profit generated per dollar of shareholder equity, which represents a key source of bank funding. Banks maintaining elevated ROE levels tend to accelerate wealth creation for shareholders via earnings retention, buybacks, and distributions.

Over the last five years, EVERTEC has averaged an ROE of 30.4%, exceptional for a company operating in a sector where the average shakes out around 10% and those putting up 25%+ are greatly admired. This shows EVERTEC has a strong competitive moat.

9. Balance Sheet Assessment

The debt-to-equity ratio is a widely used measure to assess a company's balance sheet health. A higher ratio means that a business aggressively financed its growth with debt. This can result in higher earnings (if the borrowed funds are invested profitably) but also increases risk.

If debt levels are too high, there could be difficulties in meeting obligations, especially during economic downturns or periods of rising interest rates if the debt has variable-rate payments.

EVERTEC currently has $1.13 billion of debt and $621.6 million of shareholder's equity on its balance sheet, and over the past four quarters, has averaged a debt-to-equity ratio of 1.7×. We think this is safe and raises no red flags. In general, we’re comfortable with any ratio below 3.5× for a financials business.

10. Key Takeaways from EVERTEC’s Q4 Results

We were impressed by EVERTEC’s optimistic full-year revenue guidance, which blew past analysts’ expectations. We were also glad its full-year EPS guidance exceeded Wall Street’s estimates. Zooming out, we think this was a good print with some key areas of upside. The stock traded up 2.4% to $26.39 immediately following the results.

11. Is Now The Time To Buy EVERTEC?

Updated: March 9, 2026 at 1:28 AM EDT

Are you wondering whether to buy EVERTEC or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

EVERTEC is a rock-solid business worth owning. First of all, the company’s revenue growth was solid over the last five years. And while its declining pre-tax profit margin shows the business has become less efficient, its stellar ROE suggests it has been a well-run company historically. Additionally, EVERTEC’s decent EPS growth over the last five years shows its profits are trickling down to shareholders.

EVERTEC’s P/E ratio based on the next 12 months is 7.3x. Looking at the financials space today, EVERTEC’s fundamentals really stand out, and we like it at this bargain price.

Wall Street analysts have a consensus one-year price target of $32.60 on the company (compared to the current share price of $25.89), implying they see 25.9% upside in buying EVERTEC in the short term.