Forestar Group (FOR)

Forestar Group is in for a bumpy ride. Its weak sales growth and low returns on capital show it struggled to generate demand and profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think Forestar Group Will Underperform

As a majority-owned subsidiary of homebuilding giant D.R. Horton, Forestar Group (NYSE:FOR) develops and sells finished residential lots to homebuilders, focusing primarily on land acquisition and development for single-family homes.

- 12.3% annual revenue growth over the last five years was slower than its consumer discretionary peers

- Sales are projected to remain flat over the next 12 months as demand decelerates from its two-year trend

- Operating margin falls short of the industry average, and the smaller profit dollars make it harder to react to unexpected market developments

Forestar Group’s quality is not up to our standards. There are more promising alternatives.

Why There Are Better Opportunities Than Forestar Group

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Forestar Group

At $27.50 per share, Forestar Group trades at 9.1x forward P/E. Forestar Group’s valuation may seem like a great deal, but we think there are valid reasons why it’s so cheap.

Cheap stocks can look like a great deal at first glance, but they can be value traps. They often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Forestar Group (FOR) Research Report: Q4 CY2025 Update

Residential lot developer Forestar Group (NYSE:FOR) reported Q4 CY2025 results exceeding the market’s revenue expectations, with sales up 9% year on year to $273 million. The company expects the full year’s revenue to be around $1.65 billion, close to analysts’ estimates. Its GAAP profit of $0.30 per share was 5.5% below analysts’ consensus estimates.

Forestar Group (FOR) Q4 CY2025 Highlights:

- Revenue: $273 million vs analyst estimates of $267.5 million (9% year-on-year growth, 2.1% beat)

- EPS (GAAP): $0.30 vs analyst expectations of $0.32 (5.5% miss)

- Operating Margin: 6.8%, down from 8.1% in the same quarter last year

- Sales Volumes fell 16.7% year on year (-25.9% in the same quarter last year)

- Market Capitalization: $1.39 billion

Company Overview

As a majority-owned subsidiary of homebuilding giant D.R. Horton, Forestar Group (NYSE:FOR) develops and sells finished residential lots to homebuilders, focusing primarily on land acquisition and development for single-family homes.

Forestar operates across 59 markets in 24 states, strategically selecting land parcels, securing necessary entitlements, and developing the infrastructure required for residential communities. The company typically invests in short-duration projects that can be developed in phases, allowing them to match lot delivery with market demand. This approach enables homebuilders to avoid tying up capital in land while still ensuring a pipeline of buildable lots.

The company's business model centers on the full development cycle: acquiring raw land, obtaining zoning approvals and permits, installing infrastructure (roads, utilities, and drainage systems), and delivering finished lots ready for home construction. Forestar's target market primarily consists of lots for entry-level and first-time move-up homes—the largest segments of the new home market—as well as active adult communities and build-to-rent operators.

Beyond traditional lot development, Forestar also engages in strategic short-term investments through "lot banking" (purchasing finished lots) and "land banking" (acquiring undeveloped land) to efficiently utilize available capital before deploying it into longer-term projects. This approach provides flexibility in their capital allocation while maintaining a steady pipeline of development opportunities. The company's relationship with D.R. Horton provides a reliable customer base while still serving other national, regional, and local homebuilders.

4. Real Estate Services

Technology has been a double-edged sword in real estate services. On the one hand, internet listings are effective at disseminating information far and wide, casting a wide net for buyers and sellers to increase the chances of transactions. On the other hand, digitization in the real estate market could potentially disintermediate key players like agents who use information asymmetries to their advantage.

Forestar Group's competitors include other land developers and lot suppliers such as St. Joe Company (NYSE:JOE), Five Point Holdings (NYSE:FPH), and privately-held land development companies that operate in regional markets. The company also competes with homebuilders that maintain their own land development operations.

5. Revenue Growth

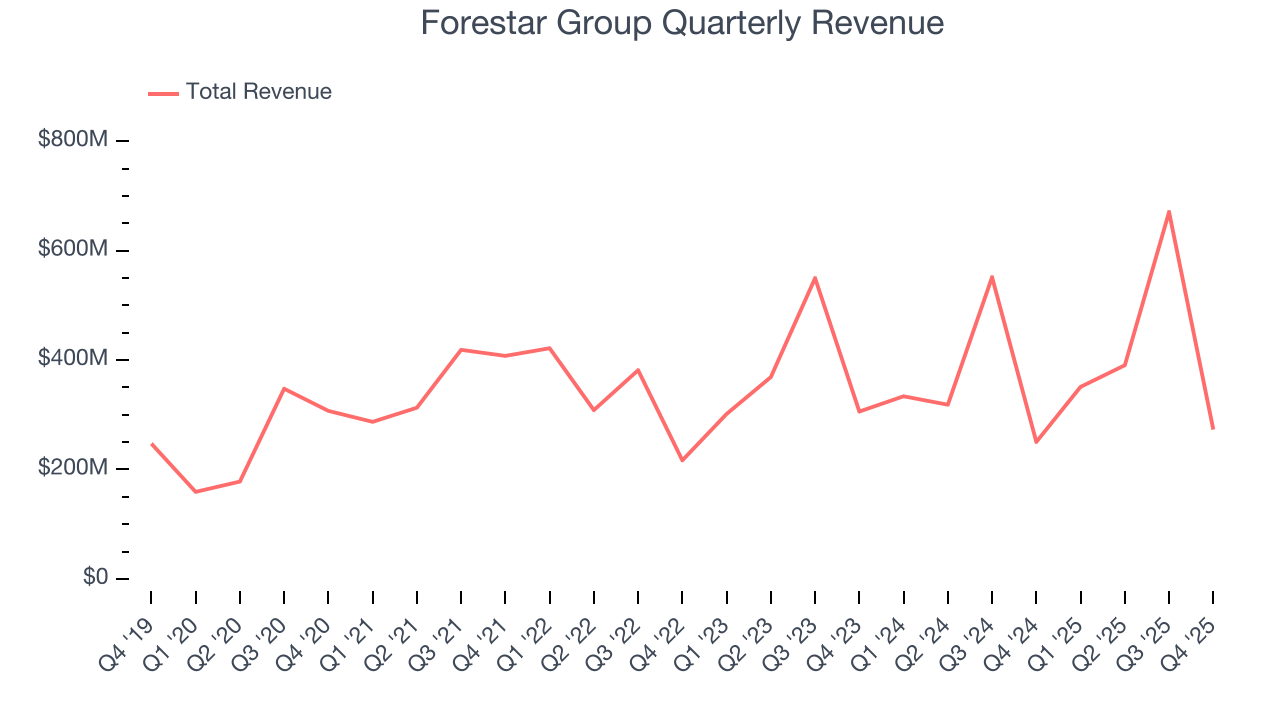

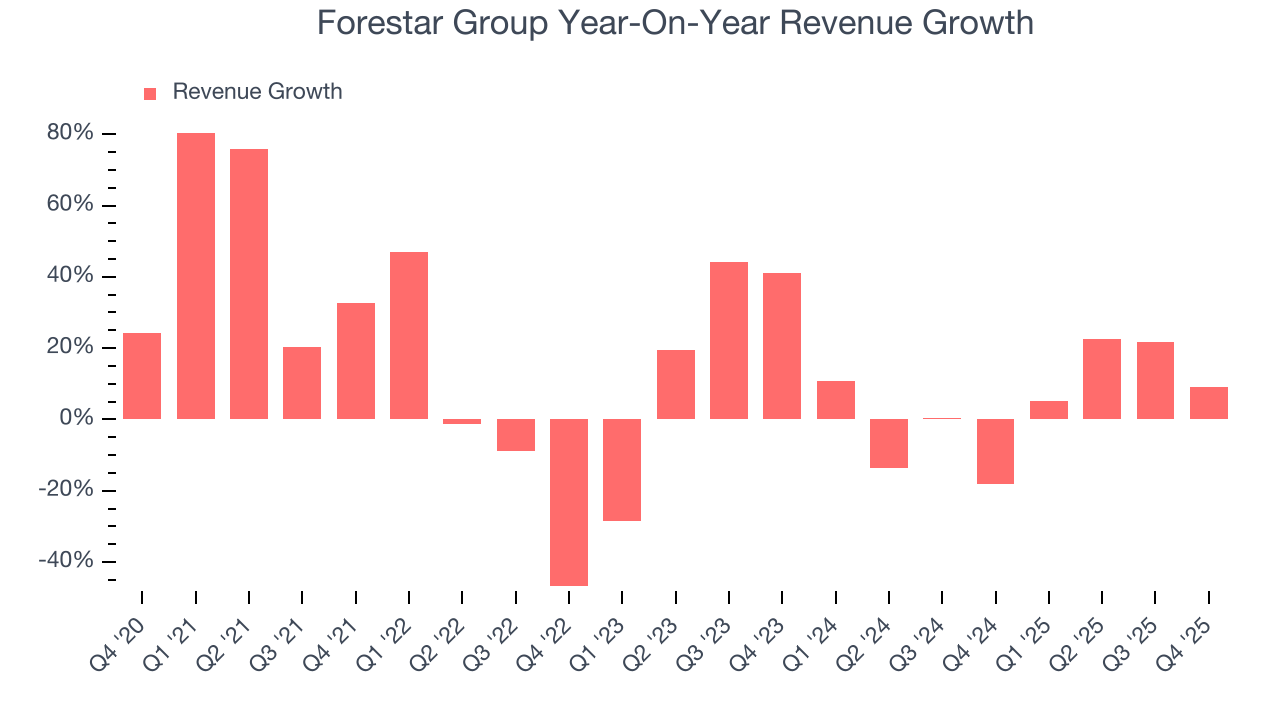

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Forestar Group grew its sales at a 11.2% compounded annual growth rate. Although this growth is acceptable on an absolute basis, it fell short of our standards for the consumer discretionary sector, which enjoys a number of secular tailwinds.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Forestar Group’s recent performance shows its demand has slowed as its annualized revenue growth of 5.1% over the last two years was below its five-year trend.

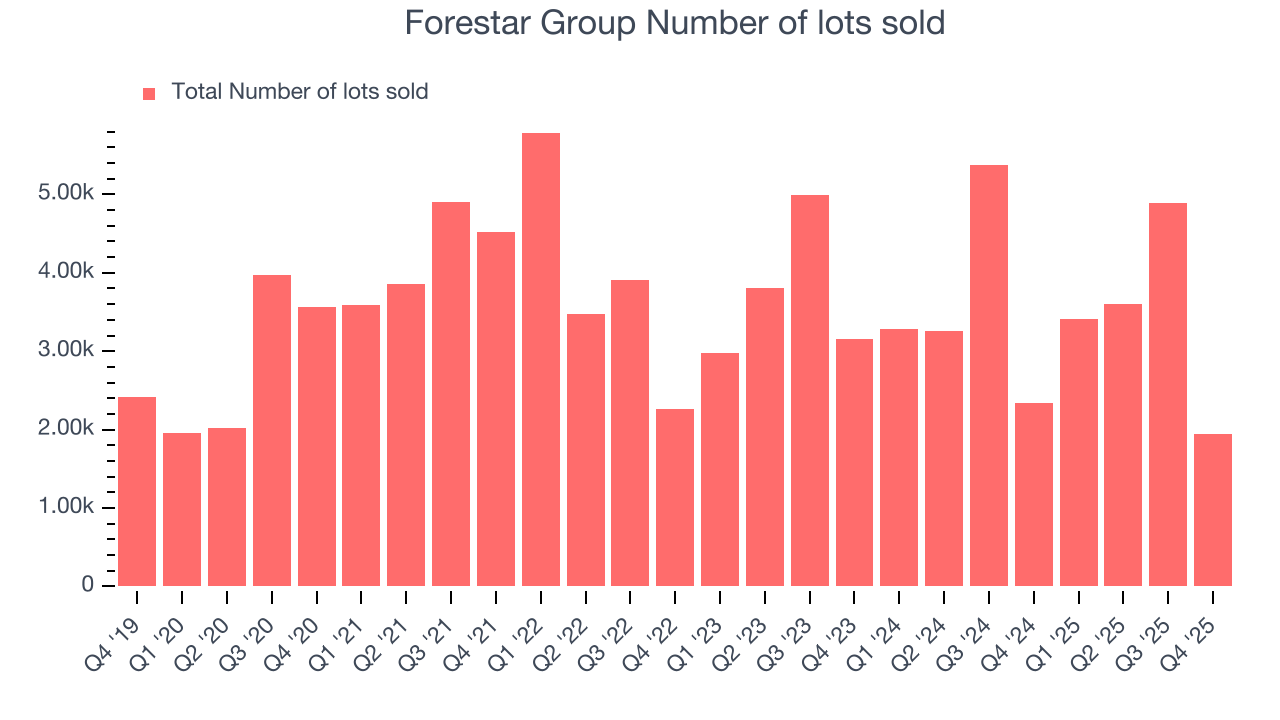

We can better understand the company’s revenue dynamics by analyzing its number of number of lots sold, which reached 1,944 in the latest quarter. Over the last two years, Forestar Group’s number of lots sold averaged 4.2% year-on-year declines. Because this number is lower than its revenue growth, we can see the company benefited from price increases.

This quarter, Forestar Group reported year-on-year revenue growth of 9%, and its $273 million of revenue exceeded Wall Street’s estimates by 2.1%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and indicates its products and services will face some demand challenges.

6. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

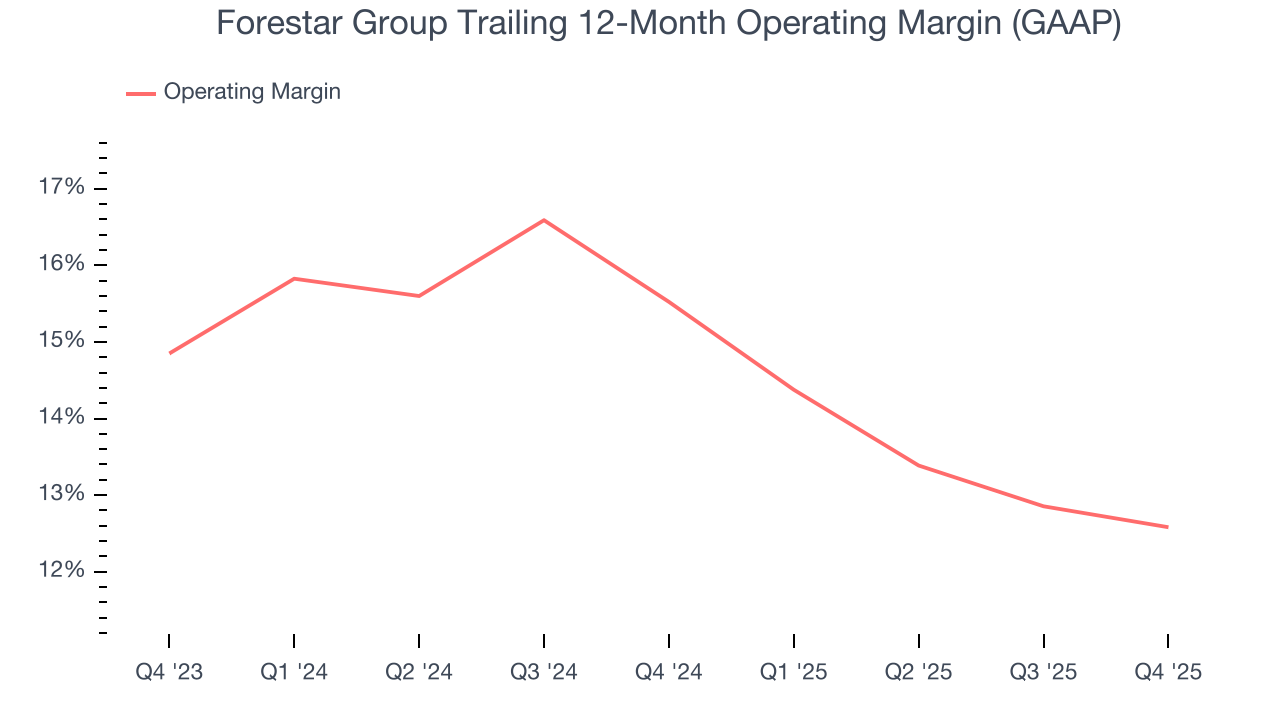

Forestar Group’s operating margin has shrunk over the last 12 months and averaged 13.9% over the last two years. The company’s profitability was mediocre for a consumer discretionary business and shows it couldn’t pass its higher operating expenses onto its customers.

This quarter, Forestar Group generated an operating margin profit margin of 6.8%, down 1.3 percentage points year on year. This reduction is quite minuscule and indicates the company’s overall cost structure has been relatively stable.

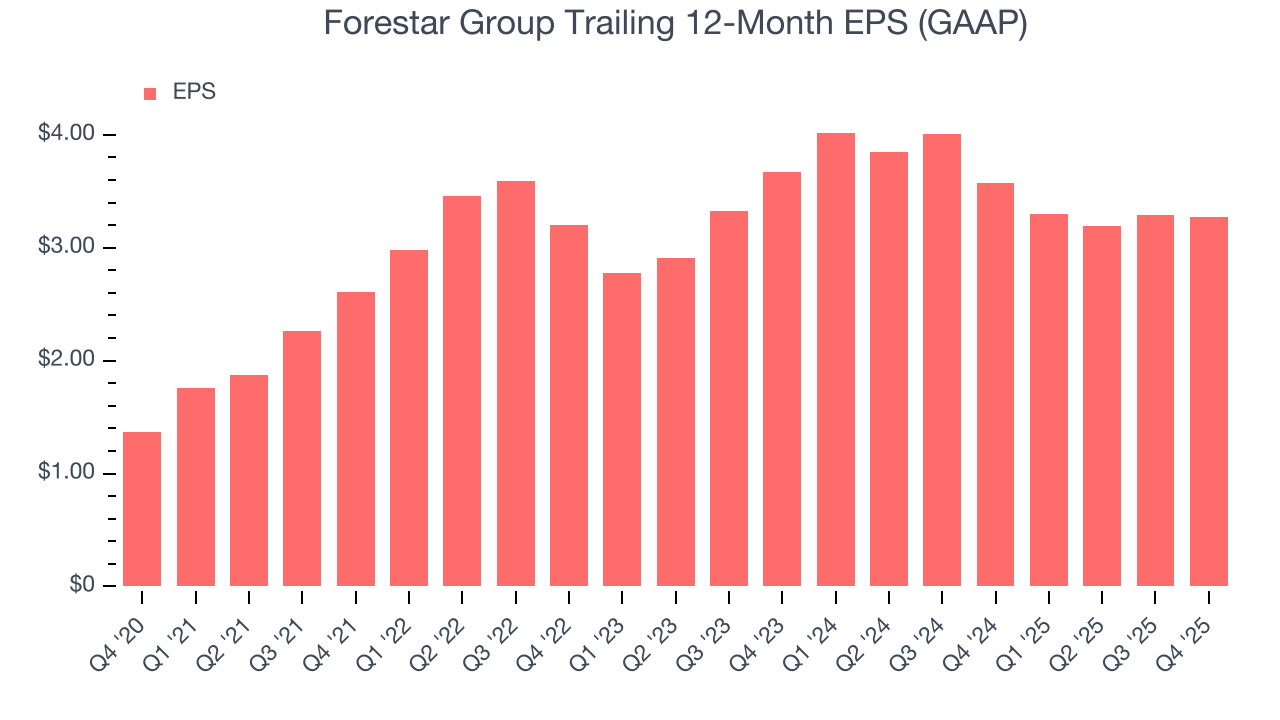

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Forestar Group’s EPS grew at a weak 19% compounded annual growth rate over the last five years. This performance was better than its flat revenue, but we take it with a grain of salt because its operating margin didn’t improve and it didn’t repurchase its shares, meaning the delta came from reduced interest expenses or taxes.

In Q4, Forestar Group reported EPS of $0.30, down from $0.32 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects Forestar Group’s full-year EPS of $3.27 to shrink by 1.8%.

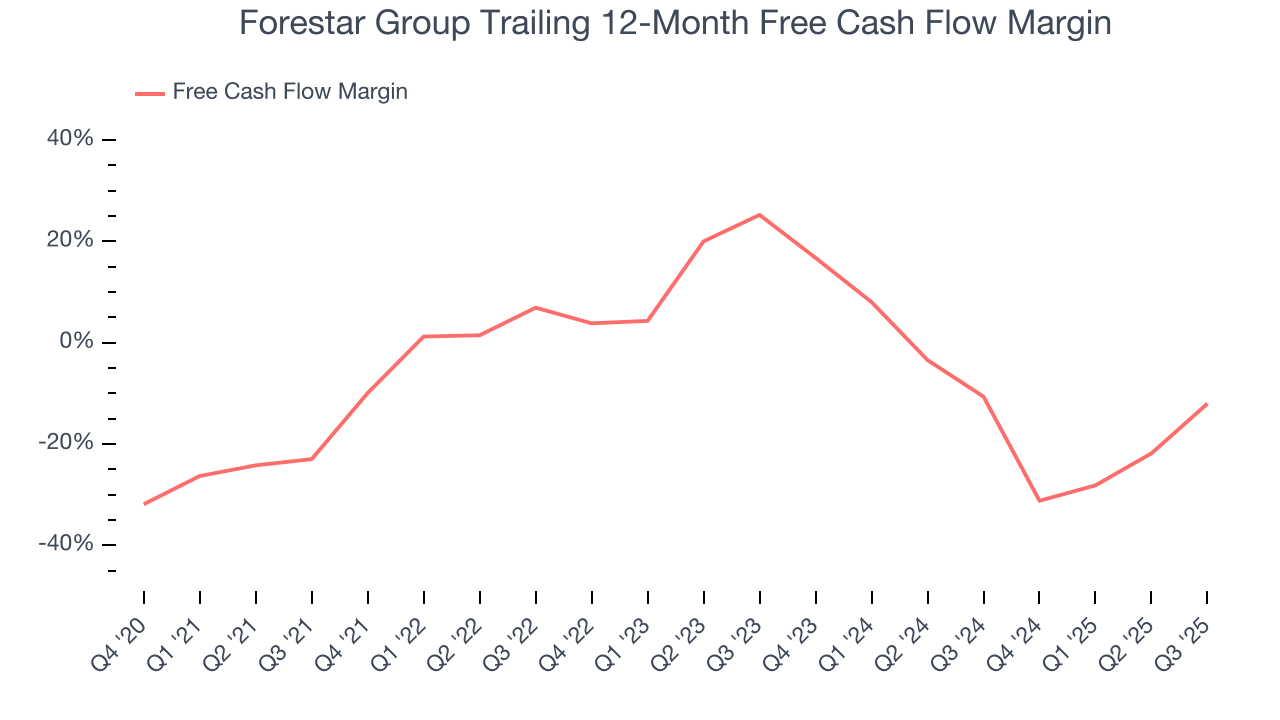

8. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Over the last two years, Forestar Group’s demanding reinvestments to stay relevant have drained its resources, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 7.1%, meaning it lit $7.10 of cash on fire for every $100 in revenue.

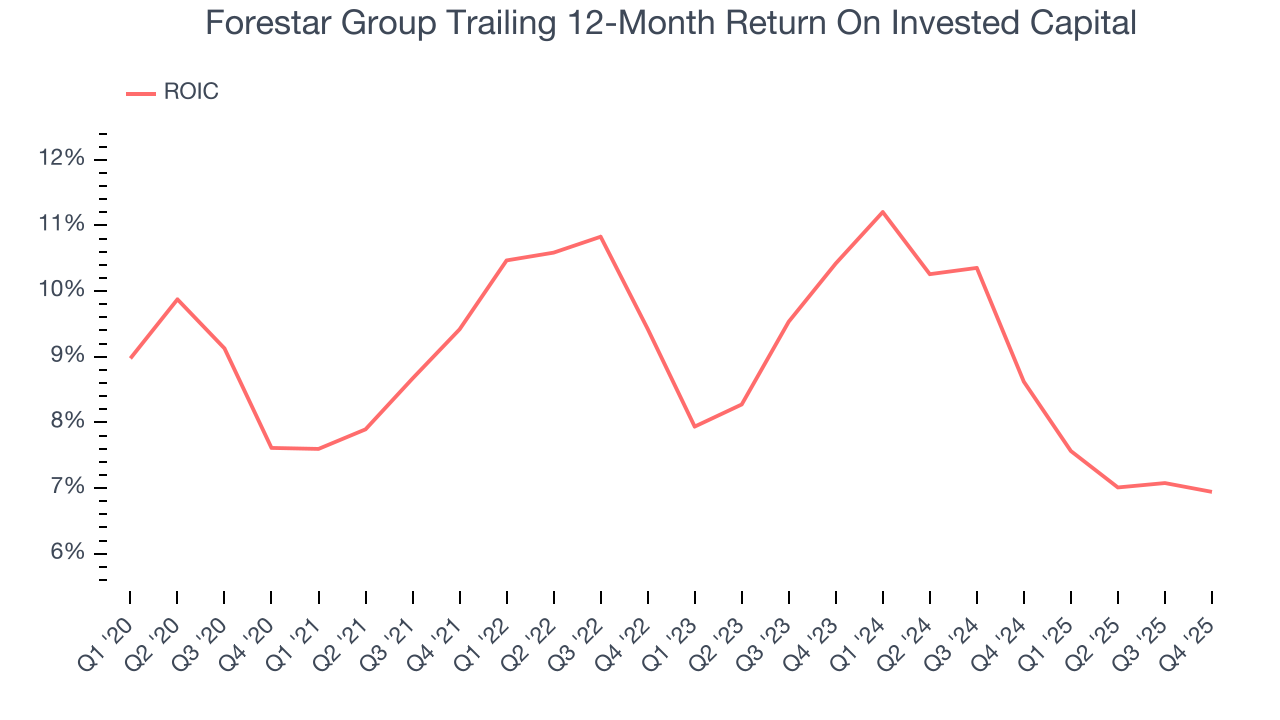

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Forestar Group historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 9%, somewhat low compared to the best consumer discretionary companies that consistently pump out 25%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Forestar Group’s ROIC averaged 1.6 percentage point decreases each year. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

10. Key Takeaways from Forestar Group’s Q4 Results

It was encouraging to see Forestar Group beat analysts’ revenue expectations this quarter. On the other hand, its EPS missed. Overall, this was a mixed quarter. The stock remained flat at $27.50 immediately following the results.

11. Is Now The Time To Buy Forestar Group?

Updated: January 20, 2026 at 6:56 AM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

Forestar Group falls short of our quality standards. First off, its revenue growth was weak over the last five years, and analysts expect its demand to deteriorate over the next 12 months. On top of that, Forestar Group’s , and its projected EPS for the next year is lacking.

Forestar Group’s P/E ratio based on the next 12 months is 8.6x. While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $32.25 on the company (compared to the current share price of $27.50).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.