Genesco (GCO)

Genesco is up against the odds. Its sales have underperformed and its low returns on capital show it has few growth opportunities.― StockStory Analyst Team

1. News

2. Summary

Why We Think Genesco Will Underperform

Spanning a broad range of styles, brands, and prices, Genesco (NYSE:GCO) sells footwear, apparel, and accessories through multiple brands and banners.

- Sales trends were unexciting over the last five years as its 5.4% annual growth was below the typical consumer discretionary company

- Subpar operating margin constrains its ability to invest in process improvements or effectively respond to new competitive threats

- High net-debt-to-EBITDA ratio of 8× could force the company to raise capital at unfavorable terms if market conditions deteriorate

Genesco’s quality is insufficient. We believe there are better opportunities elsewhere.

Why There Are Better Opportunities Than Genesco

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Genesco

Genesco’s stock price of $28.98 implies a valuation ratio of 16.9x forward P/E. Genesco’s multiple may seem like a great deal among consumer discretionary peers, but we think there are valid reasons why it’s this cheap.

It’s better to pay up for high-quality businesses with higher long-term earnings potential rather than to buy lower-quality stocks because they appear cheap. These challenged businesses often don’t re-rate, a phenomenon known as a “value trap”.

3. Genesco (GCO) Research Report: Q3 CY2025 Update

Footwear, apparel, and accessories retailer Genesco (NYSE:GCO) met Wall Streets revenue expectations in Q3 CY2025, with sales up 3.3% year on year to $616.2 million. Its non-GAAP profit of $0.79 per share was 8.1% below analysts’ consensus estimates.

Genesco (GCO) Q3 CY2025 Highlights:

- “We experienced a meaningful pullback in the back half of the third quarter, as consumers retreated following the back-to-school season when there was less of a reason to shop."

- Revenue: $616.2 million vs analyst estimates of $618.4 million (3.3% year-on-year growth, in line)

- Adjusted EPS: $0.79 vs analyst expectations of $0.86 (8.1% miss)

- Management lowered its full-year Adjusted EPS guidance to $0.95 at the midpoint, a 36.7% decrease

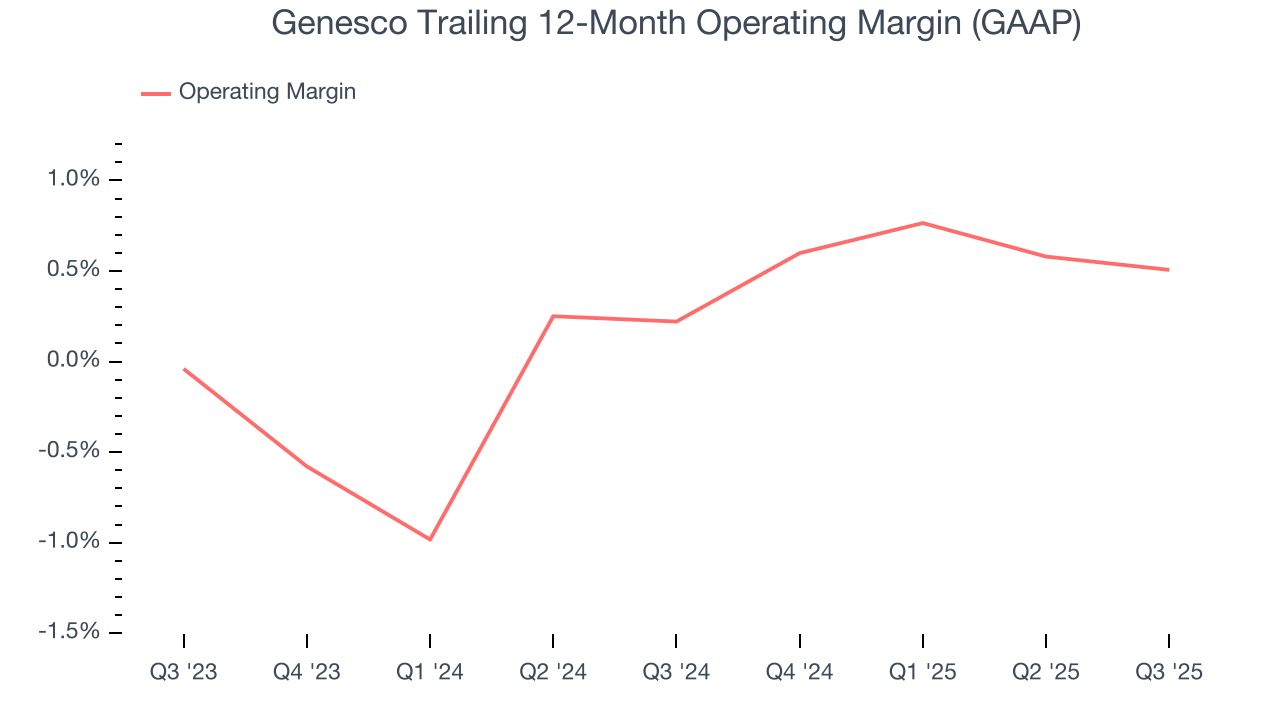

- Operating Margin: 1.4%, in line with the same quarter last year

- Locations: 1,245 at quarter end, down from 1,302 in the same quarter last year

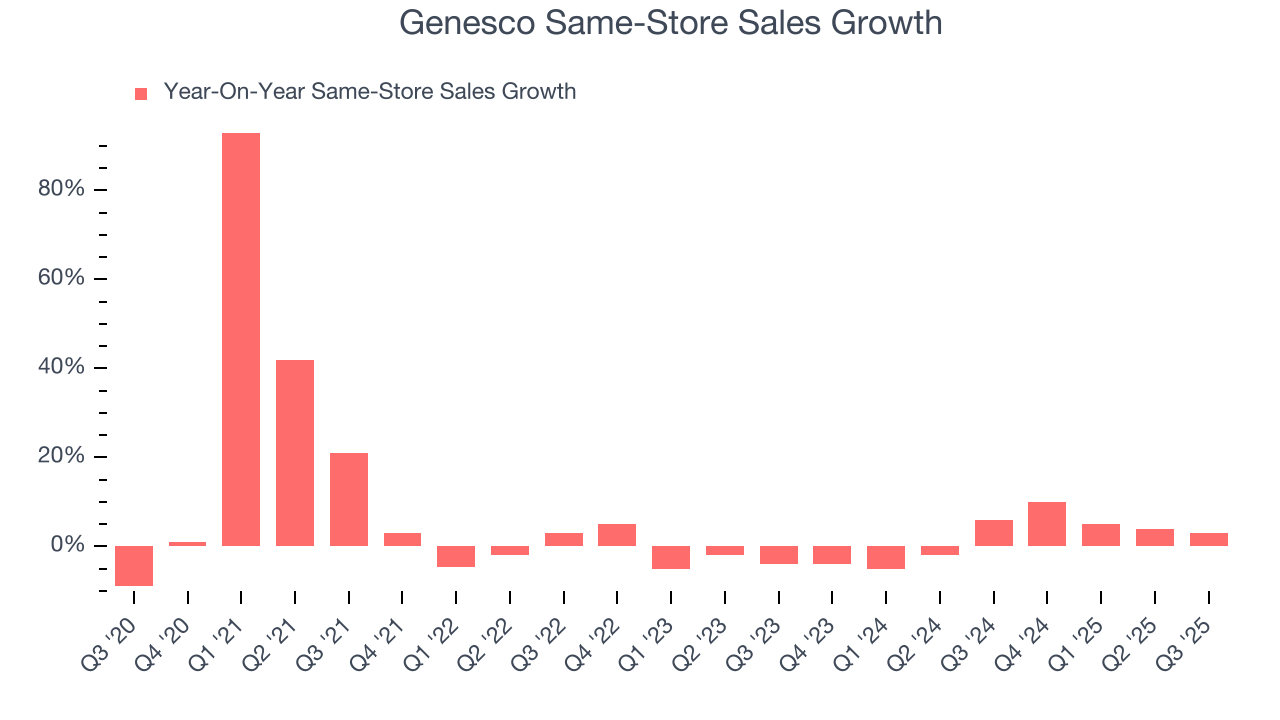

- Same-Store Sales rose 3% year on year (6% in the same quarter last year)

- Market Capitalization: $380.5 million

Company Overview

Spanning a broad range of styles, brands, and prices, Genesco (NYSE:GCO) sells footwear, apparel, and accessories through multiple brands and banners.

These include Journeys, Johnston & Murphy, and Lids, among other smaller brands. Journeys is a teen-focused shoe retailer featuring brands like Dr. Martens, Vans, and Adidas. Johnston & Murphy offers its own brand of men's dress shoes and apparel, and Lids is known for its casual hats such as baseball caps and beanies featuring sports teams.

The Genesco core customer is therefore somewhat varied. A teen shopper may head to Journeys and Lids during a trip to the mall for some new sneakers and hats while his/her dad may make his way to Johnsyon & Murphy for some new dress shoes for the office. While there is no unifying aesthetic or style, all Genesco brands tend to be mid-priced. Additionally, Genesco's stores tend to be fairly small, roughly 2,500 square feet, and located in malls and shopping centers in urban and suburban areas. Genesco supplements its physical store footprint with e-commerce presences for each of its brands, all of which were launched in 2009.

4. Footwear

Before the advent of the internet, styles changed, but consumers mainly bought shoes by visiting local brick-and-mortar shoe, department, and specialty stores. Today, not only do styles change more frequently as fads travel through social media and the internet but consumers are also shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some footwear companies have made concerted efforts to adapt while those who are slower to move may fall behind.

Retail competitors offering mid-priced footwear and accessories include Foot Locker (NYSE:FL), Designer Brands’s (NYSE:DBI) DSW banner, and TJX (NYSE:TJX).

5. Revenue Growth

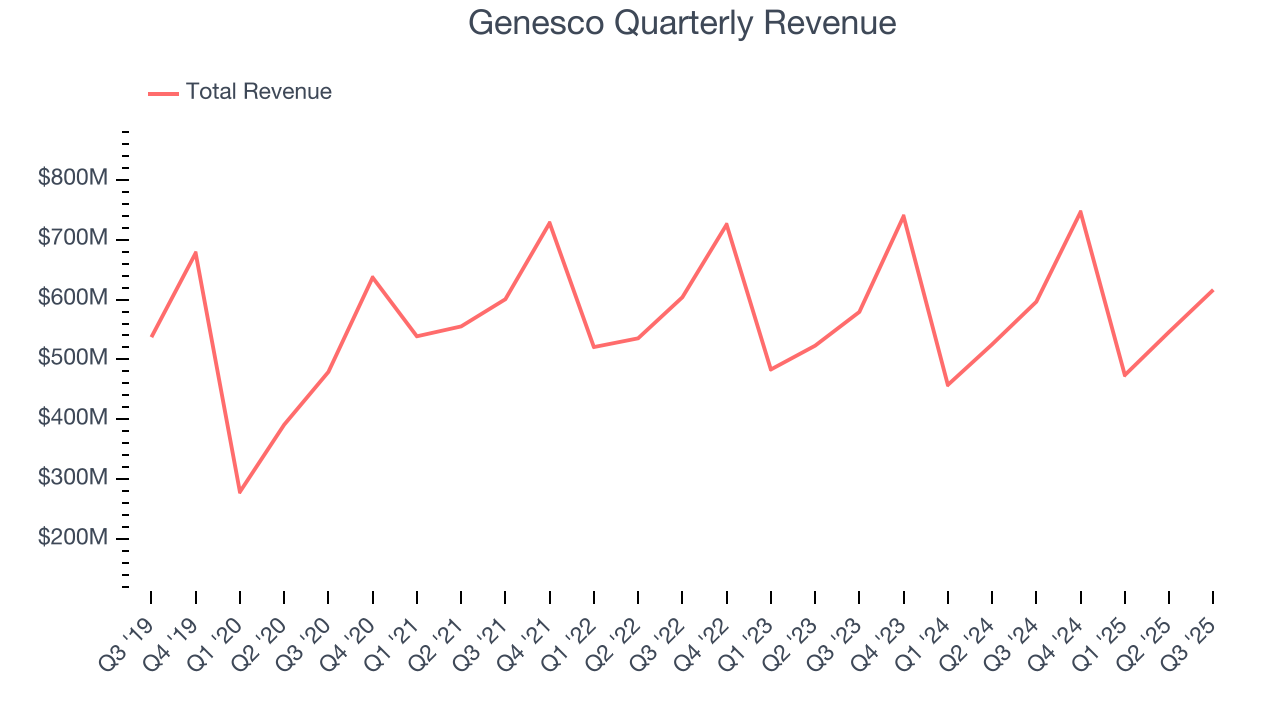

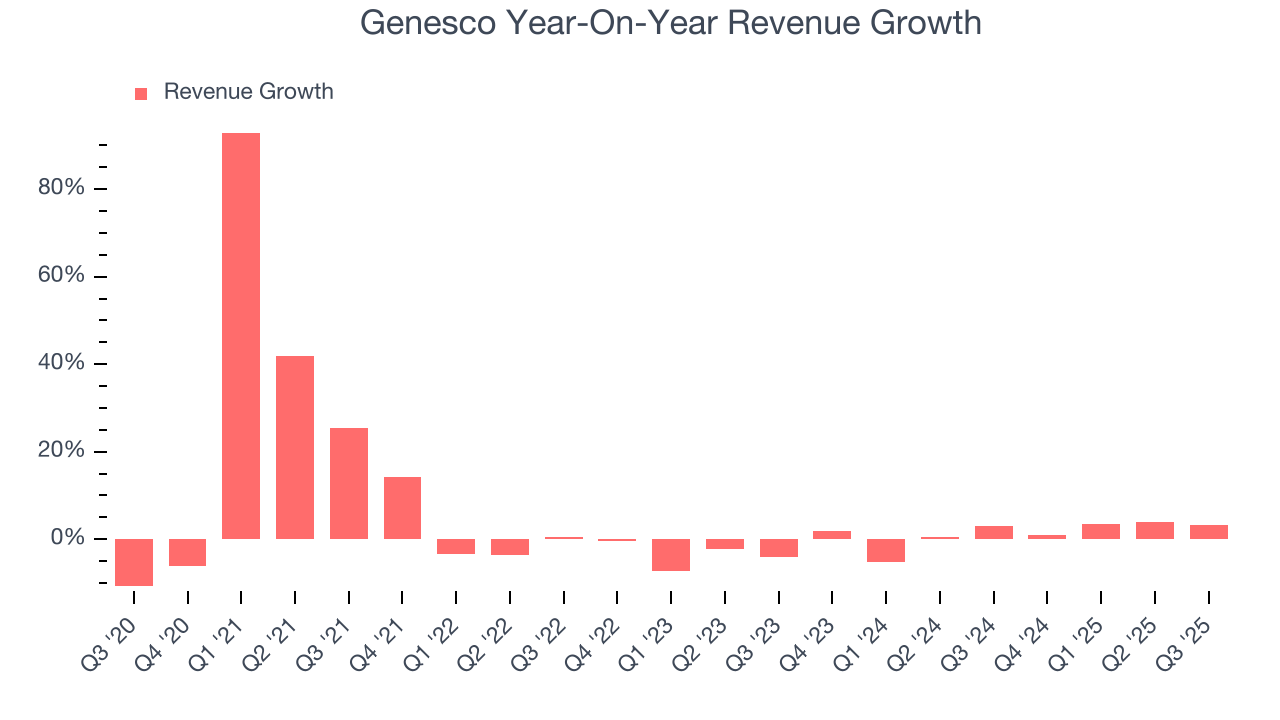

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Unfortunately, Genesco’s 5.4% annualized revenue growth over the last five years was weak. This fell short of our benchmark for the consumer discretionary sector and is a rough starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Genesco’s recent performance shows its demand has slowed as its annualized revenue growth of 1.5% over the last two years was below its five-year trend.

Genesco also reports same-store sales, which show how much revenue its established locations generate. Over the last two years, Genesco’s same-store sales averaged 2.1% year-on-year growth. This number doesn’t surprise us as it’s in line with its revenue growth.

This quarter, Genesco grew its revenue by 3.3% year on year, and its $616.2 million of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 2.5% over the next 12 months, similar to its two-year rate. This projection is underwhelming and indicates its newer products and services will not accelerate its top-line performance yet.

6. Operating Margin

Genesco’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same. The company broke even over the last two years, inadequate for a consumer discretionary business. Its large expense base and inefficient cost structure were the main culprits behind this performance.

This quarter, Genesco generated an operating margin profit margin of 1.4%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

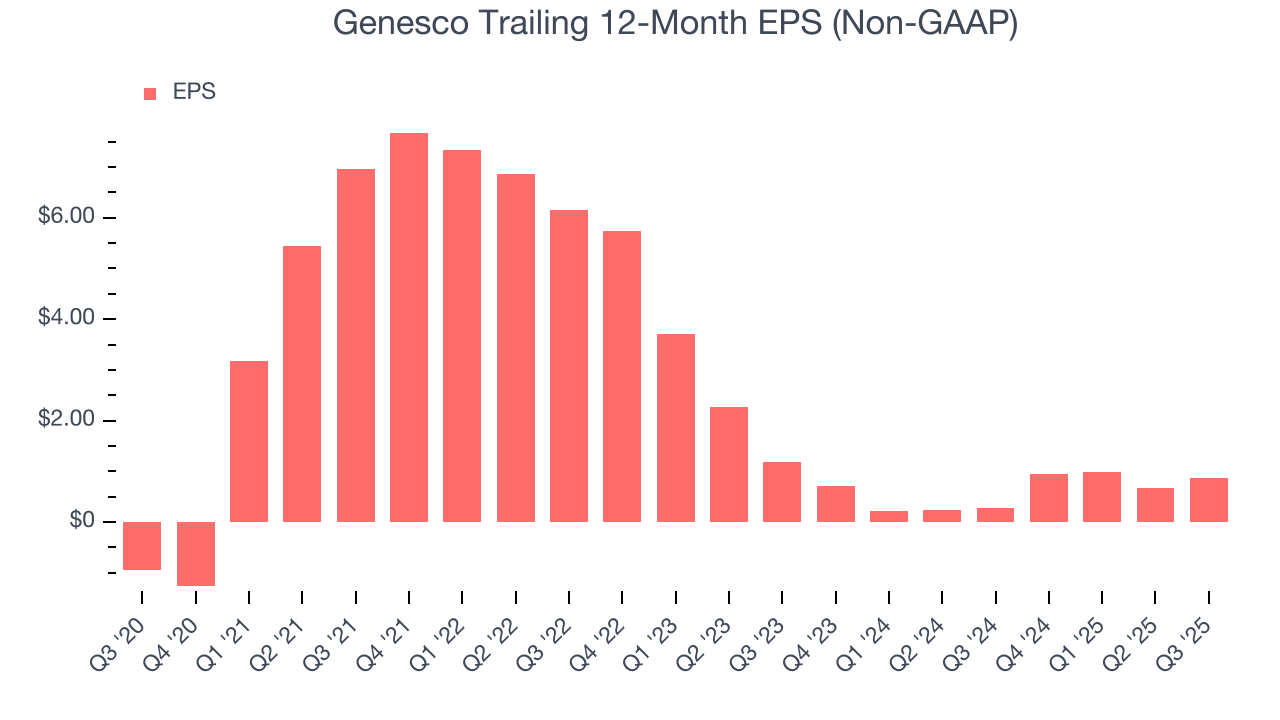

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Genesco’s full-year EPS flipped from negative to positive over the last five years. This is encouraging and shows it’s at a critical moment in its life.

In Q3, Genesco reported adjusted EPS of $0.79, up from $0.61 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates. Over the next 12 months, Wall Street expects Genesco’s full-year EPS of $0.86 to grow 136%.

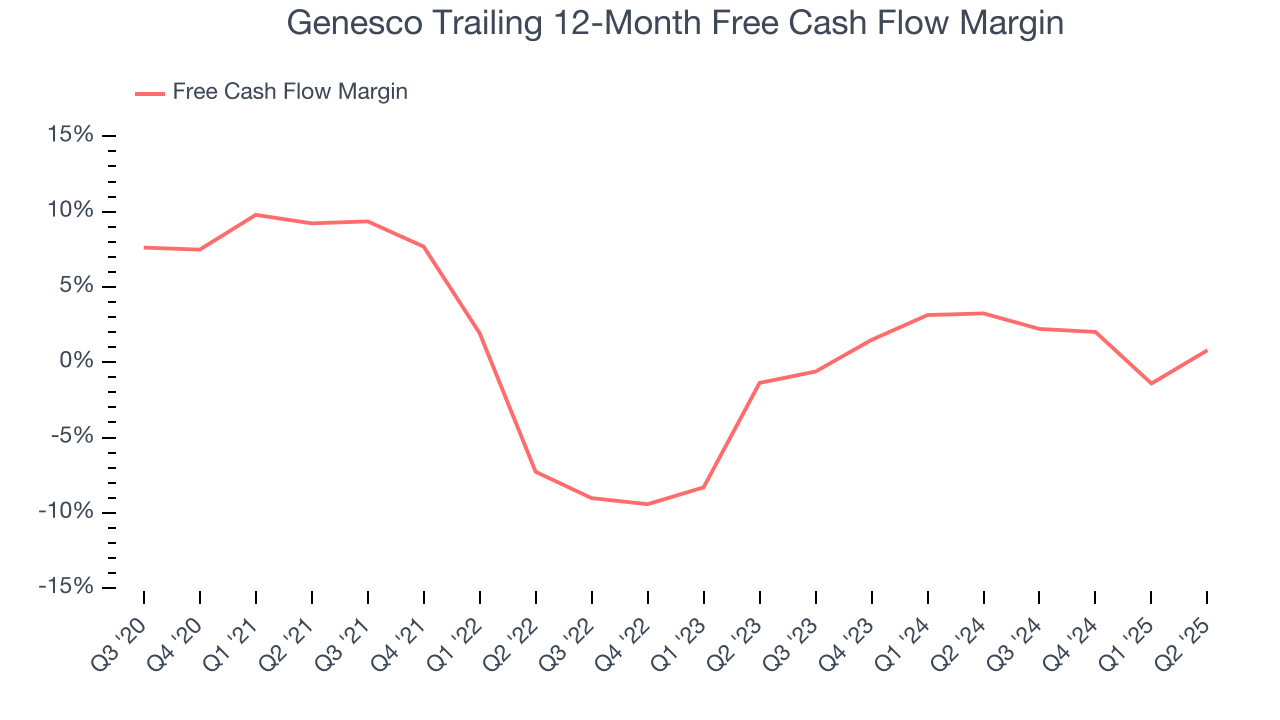

8. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Genesco has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 2.6%, lousy for a consumer discretionary business.

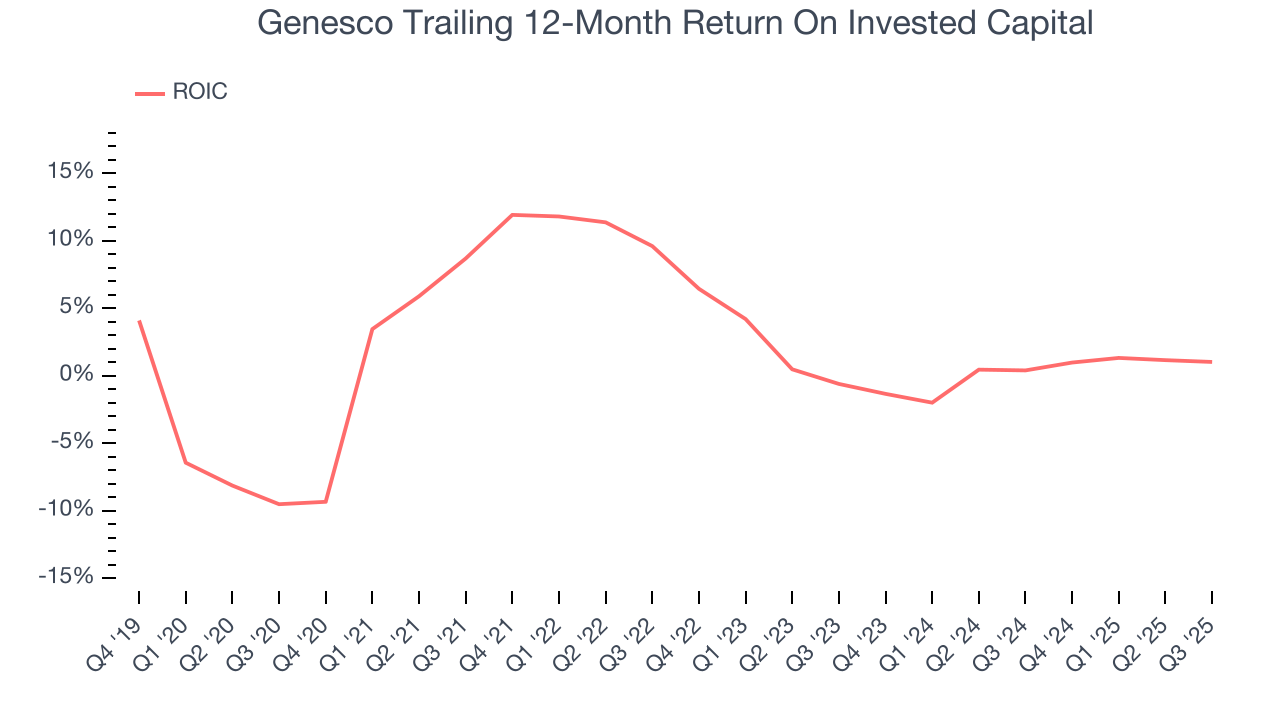

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Genesco historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 3.8%, lower than the typical cost of capital (how much it costs to raise money) for consumer discretionary companies.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Genesco’s ROIC has decreased over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

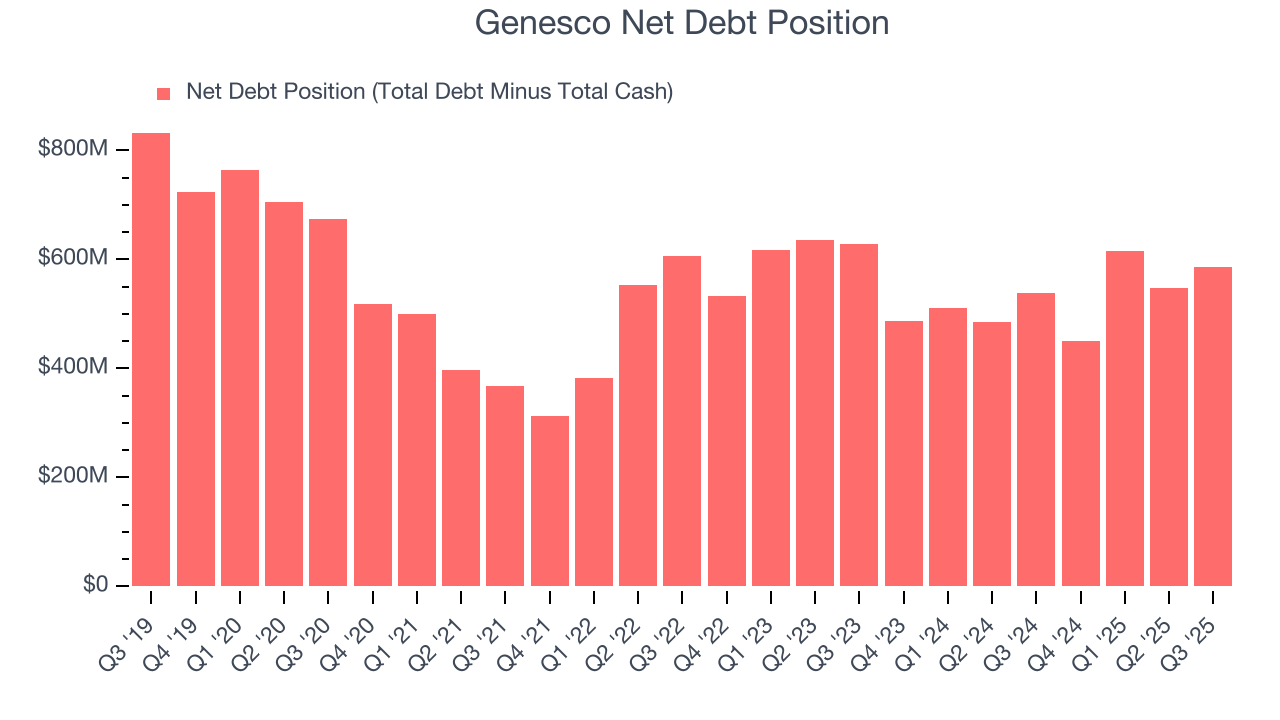

10. Balance Sheet Risk

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

Genesco’s $613.7 million of debt exceeds the $27.03 million of cash on its balance sheet. Furthermore, its 8× net-debt-to-EBITDA ratio (based on its EBITDA of $71.83 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. Genesco could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope Genesco can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

11. Key Takeaways from Genesco’s Q3 Results

We struggled to find many positives in these results. Its EPS missed and its full-year EPS guidance also fell short of Wall Street’s estimates. Management was blunt, remarking that the company “...experienced a meaningful pullback in the back half of the third quarter, as consumers retreated following the back-to-school season when there was less of a reason to shop." Overall, this was a softer quarter. The stock traded down 26.6% to $25.80 immediately following the results.

12. Is Now The Time To Buy Genesco?

Updated: January 30, 2026 at 9:37 PM EST

Before making an investment decision, investors should account for Genesco’s business fundamentals and valuation in addition to what happened in the latest quarter.

We cheer for all companies serving everyday consumers, but in the case of Genesco, we’ll be cheering from the sidelines. To kick things off, its revenue growth was weak over the last five years, and analysts expect its demand to deteriorate over the next 12 months. And while its projected EPS for the next year implies the company’s fundamentals will improve, the downside is its same-store sales performance has disappointed. On top of that, its relatively low ROIC suggests management has struggled to find compelling investment opportunities.

Genesco’s P/E ratio based on the next 12 months is 16.9x. At this valuation, there’s a lot of good news priced in - you can find more timely opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $38 on the company (compared to the current share price of $28.98).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.