Graco (GGG)

We’re cautious of Graco. Its weak sales growth and declining returns on capital show its demand and profits are shrinking.― StockStory Analyst Team

1. News

2. Summary

Why We Think Graco Will Underperform

Founded in 1926, Graco (NYSE:GGG) is an industrial company specializing in the development and manufacturing of fluid-handling systems and products.

- Projected sales growth of 6% for the next 12 months suggests sluggish demand

- Muted 6.6% annual revenue growth over the last five years shows its demand lagged behind its industrials peers

- The good news is that its superior product capabilities and pricing power lead to a best-in-class gross margin of 52%

Graco’s quality is not up to our standards. Better stocks can be found in the market.

Why There Are Better Opportunities Than Graco

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Graco

At $86.56 per share, Graco trades at 28.2x forward P/E. Not only is Graco’s multiple richer than most industrials peers, but it’s also expensive for its revenue characteristics.

There are stocks out there similarly priced with better business quality. We prefer owning these.

3. Graco (GGG) Research Report: Q3 CY2025 Update

Fluid and coating equipment company Graco (NYSE:GGG) missed Wall Street’s revenue expectations in Q3 CY2025 as sales rose 4.7% year on year to $543.4 million. Its non-GAAP profit of $0.73 per share was in line with analysts’ consensus estimates.

Graco (GGG) Q3 CY2025 Highlights:

- Revenue: $543.4 million vs analyst estimates of $560.4 million (4.7% year-on-year growth, 3% miss)

- Adjusted EPS: $0.73 vs analyst estimates of $0.74 (in line)

- Operating Margin: 30.3%, up from 28.1% in the same quarter last year

- Market Capitalization: $13.9 billion

Company Overview

Founded in 1926, Graco (NYSE:GGG) is an industrial company specializing in the development and manufacturing of fluid-handling systems and products.

Graco, originally founded as Gray Company, by brothers Russell and Leil Gray in Minneapolis, began by manufacturing an air-powered grease gun to overcome the limitations of hand-powered versions in cold weather. During World War II, the company capitalized on the demand for defense-based lubricating solutions, setting the stage for post-war expansion into new areas like paint pumps and industrial fluids handling. By the mid-1950s, Graco had diversified its offerings to meet fluid handling needs across various industries, and in 1957, the introduction of the airless spray gun further accelerated its growth. The company went public in 1969 and officially changed its name to Graco, continuing its expansion with strategic acquisitions like H.G. Fischer & Co., a move that enhanced its capabilities in electrostatic finishing technologies, a major shift in automotive painting techniques.

Graco's diverse product offerings can logically be broken down into three distinct business categories: contractor, industrial, and process. Graco’s contractor equipment includes architectural coatings such as paints, textures, and highly viscous materials to walls and outdoor surfaces. The primary end users for the Contractor segment are professional painters and specialty contractors in the construction and maintenance industries, in addition to do-it-yourself homeowners. Graco’s industrial products offer solutions for applying paints, coatings, sealants, and adhesives. These products are vital in various manufacturing processes, including automotive assembly, vehicle components, wood and metal products, and other heavy industries. Additionally, Graco provides powder finishing systems under the Gema® and SAT™ brands, which are used to coat metallic surfaces in applications such as window frames, automotive components, and furniture. Key users include manufacturers in construction, home appliances, and custom project coating industries. The company’s process category focuses on the movement and dispensation of a wide range of fluids and materials. This segment’s products include pumps, valves, meters, and accessories used in the processing of chemicals, oil and natural gas, water, and other vital resources. The primary markets served are food and beverage, dairy, pharmaceutical, cosmetics, semiconductors, and more.

Graco generates revenue through the sale of its range of fluid handling products. Products are primarily marketed to end-users via an extensive network of third-party distributors globally, although some direct sales occur. Graco consistently employs a targeted acquisition strategy to enhance its product offerings and capabilities in its end-user markets. By integrating these acquisitions into its existing operations or managing them as standalone entities, Graco continuously expands its manufacturing and distribution capabilities. For example, in recent years, Graco completed several acquisitions, including one in 2022 and one in 2021.

4. Gas and Liquid Handling

Gas and liquid handling companies possess the technical know-how and specialized equipment to handle valuable (and sometimes dangerous) substances. Lately, water conservation and carbon capture–which requires hydrogen and other gasses as well as specialized infrastructure–have been trending up, creating new demand for products such as filters, pumps, and valves. On the other hand, gas and liquid handling companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

Other companies offering fluid handling or dispensing products include Carlisle Companies (NYSE:CSL), Nordson (NASDAQ:NDSN), and Flowserve (NYSE:FLS).

5. Revenue Growth

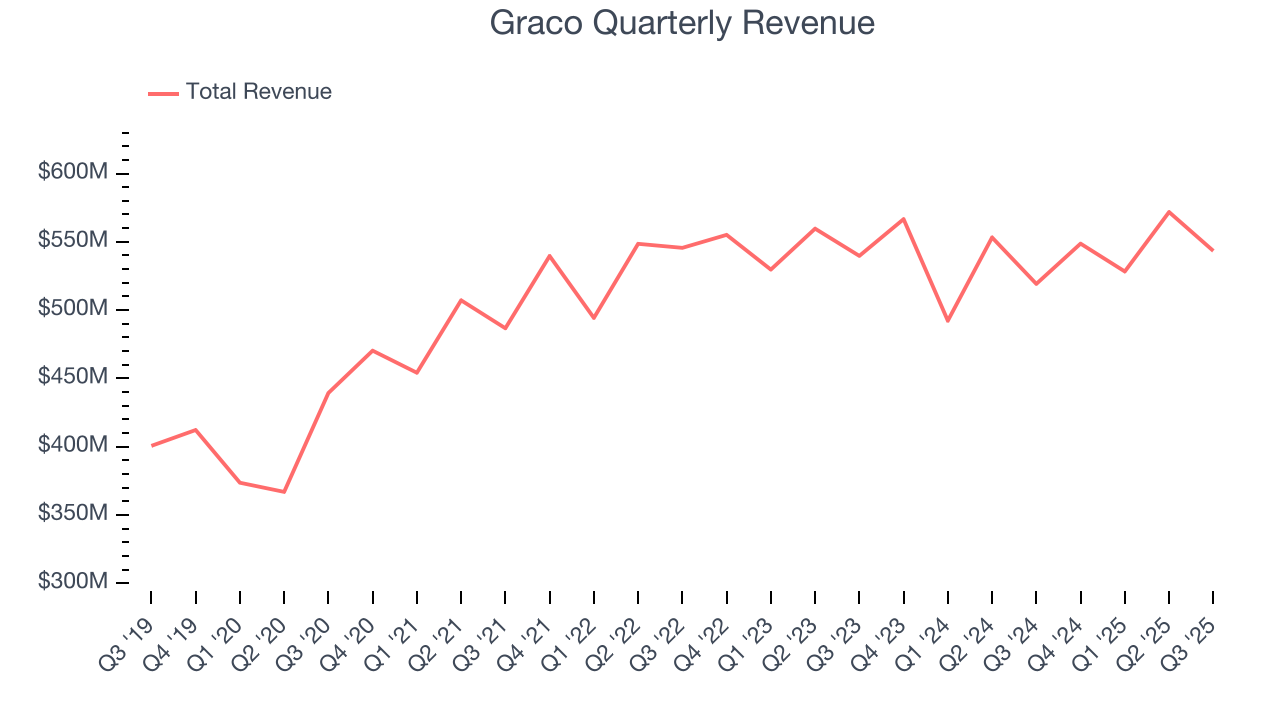

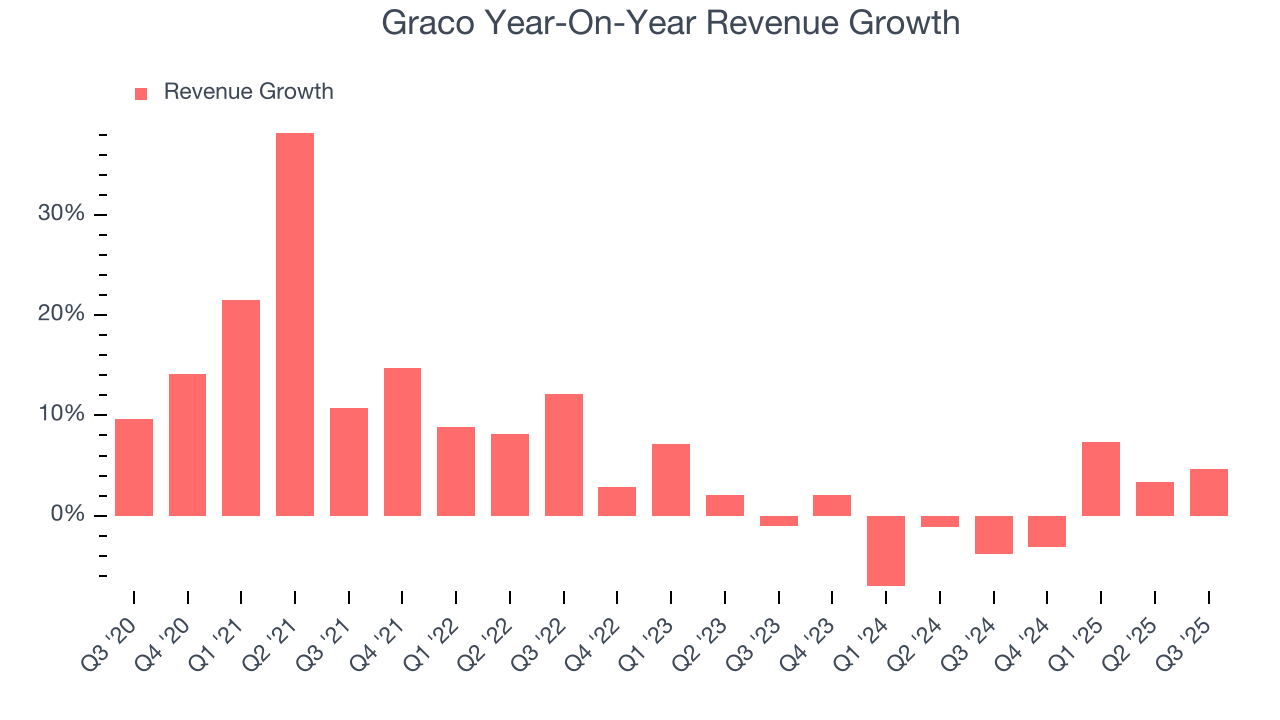

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Graco grew its sales at a mediocre 6.6% compounded annual growth rate. This was below our standard for the industrials sector and is a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Graco’s recent performance shows its demand has slowed as its revenue was flat over the last two years.

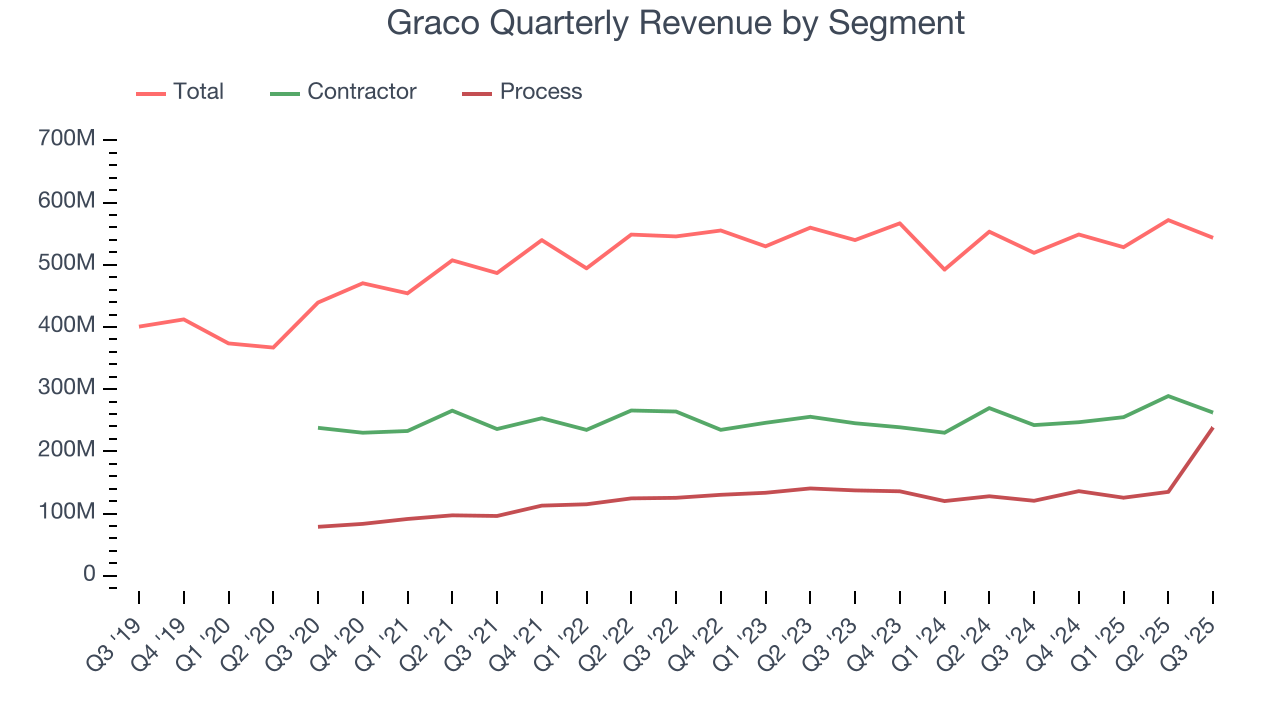

We can dig further into the company’s revenue dynamics by analyzing its most important segments, Contractor and Process, which are 48.3% and 43.9% of revenue. Over the last two years, Graco’s Contractor revenue averaged 3.7% year-on-year growth while its Process revenue (pumps, valves, hoses) averaged 10.2% growth.

This quarter, Graco’s revenue grew by 4.7% year on year to $543.4 million, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 5.6% over the next 12 months. While this projection implies its newer products and services will spur better top-line performance, it is still below average for the sector.

6. Gross Margin & Pricing Power

At StockStory, we prefer high gross margin businesses because they indicate the company has pricing power or differentiated products, giving it a chance to generate higher operating profits.

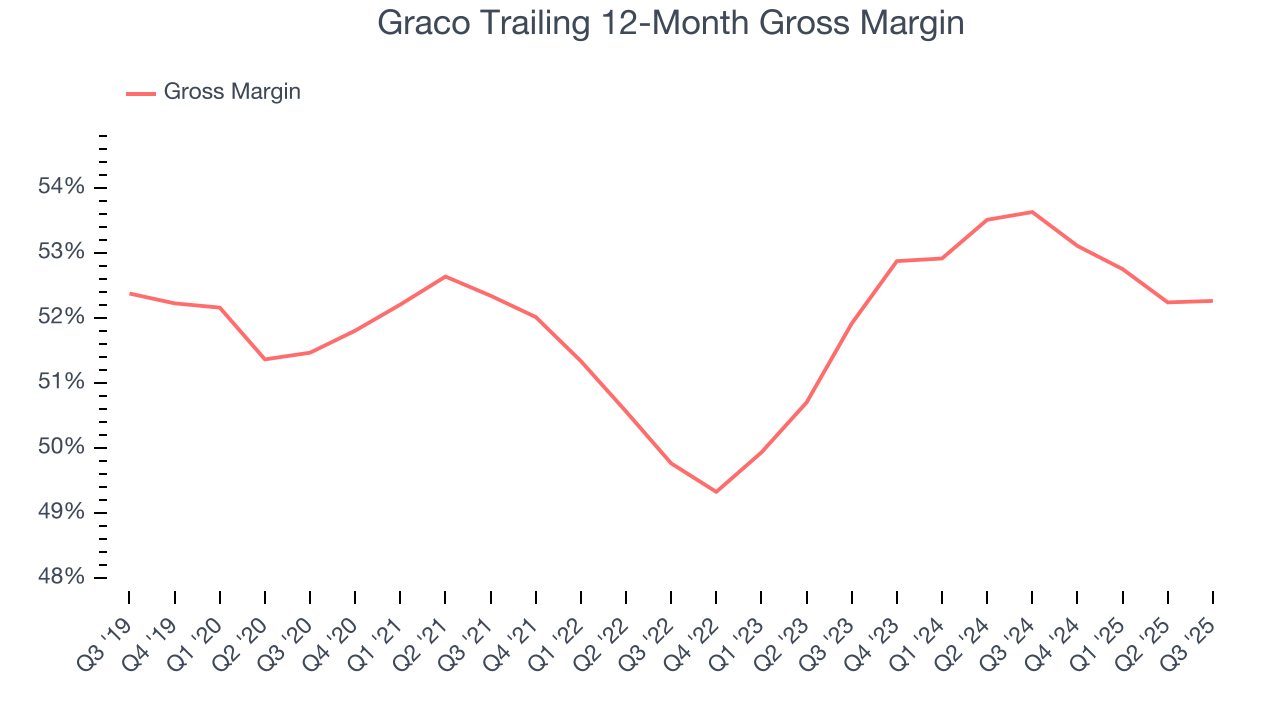

Graco has best-in-class unit economics for an industrials company, enabling it to invest in areas such as research and development. Its margin also signals it sells differentiated products, not commodities. As you can see below, it averaged an elite 52% gross margin over the last five years. Said differently, roughly $51.98 was left to spend on selling, marketing, R&D, and general administrative overhead for every $100 in revenue.

Graco’s gross profit margin came in at 53.2% this quarter, in line with the same quarter last year. Zooming out, Graco’s full-year margin has been trending down over the past 12 months, decreasing by 1.4 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs (such as raw materials and manufacturing expenses).

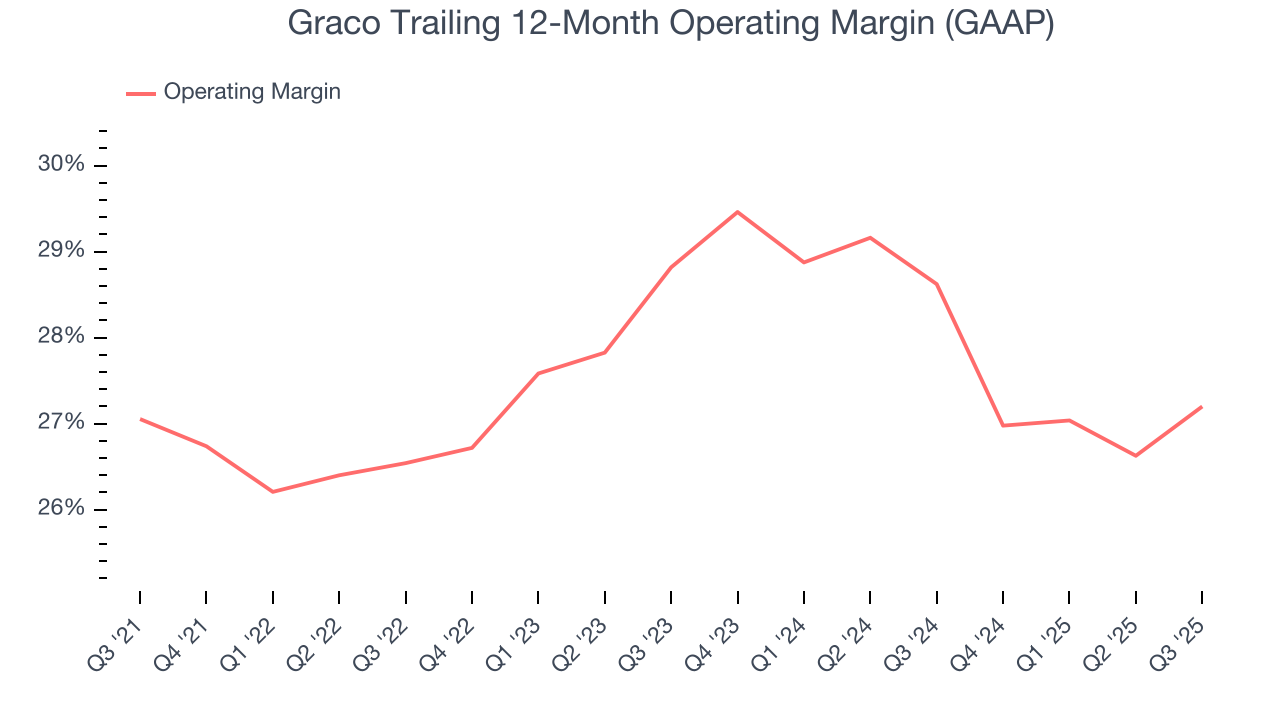

7. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Graco’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 27.7% over the last five years. This profitability was elite for an industrials business thanks to its efficient cost structure and economies of scale. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Graco’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Graco generated an operating margin profit margin of 30.3%, up 2.2 percentage points year on year. The increase was encouraging, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

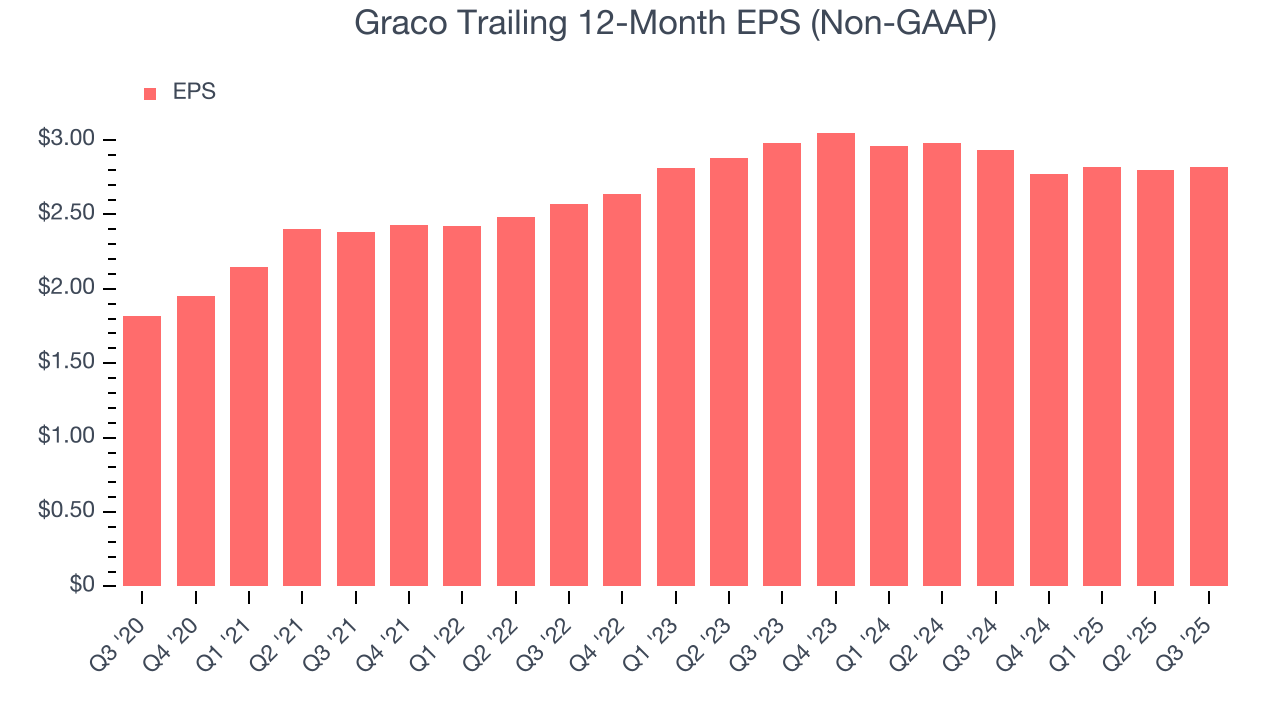

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

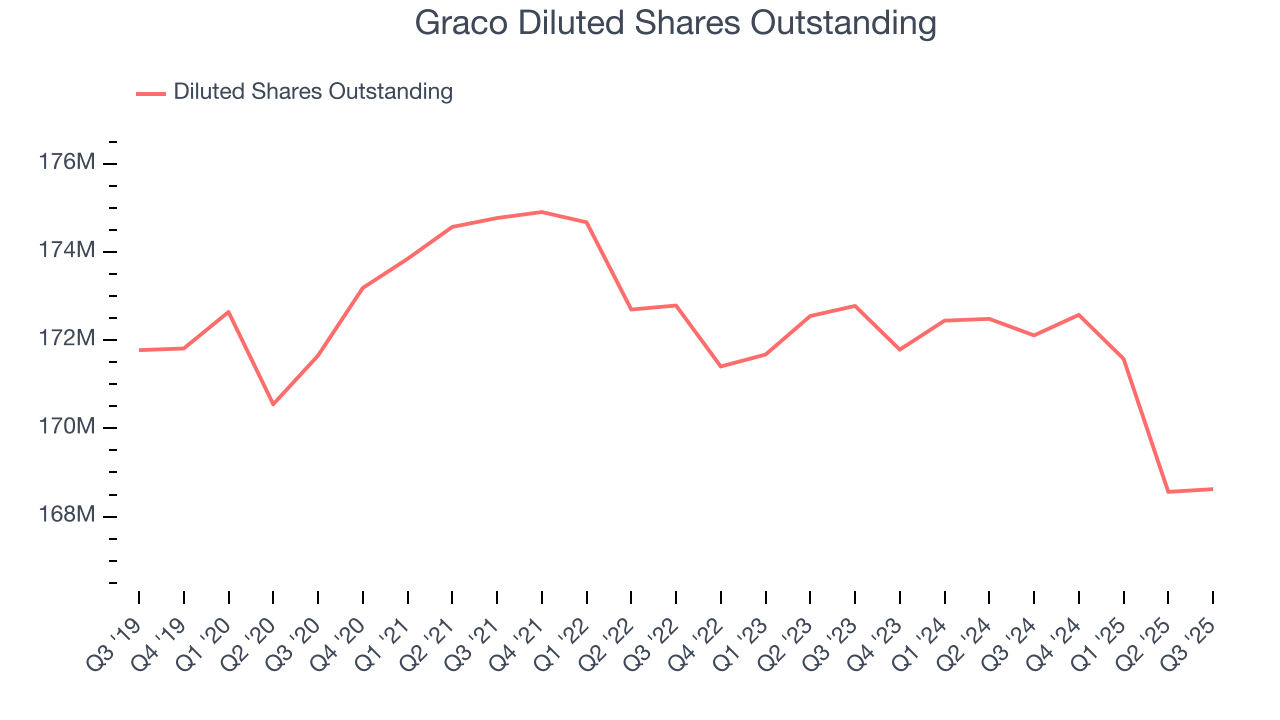

Graco’s EPS grew at a decent 9.2% compounded annual growth rate over the last five years, higher than its 6.6% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into Graco’s earnings quality to better understand the drivers of its performance. A five-year view shows that Graco has repurchased its stock, shrinking its share count by 1.8%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Graco, its two-year annual EPS declines of 2.7% mark a reversal from its five-year trend. We hope Graco can return to earnings growth in the future.

In Q3, Graco reported adjusted EPS of $0.73, up from $0.71 in the same quarter last year. Despite growing year on year, this print slightly missed analysts’ estimates, but we care more about long-term adjusted EPS growth than short-term movements. Over the next 12 months, Wall Street expects Graco’s full-year EPS of $2.82 to grow 10.2%.

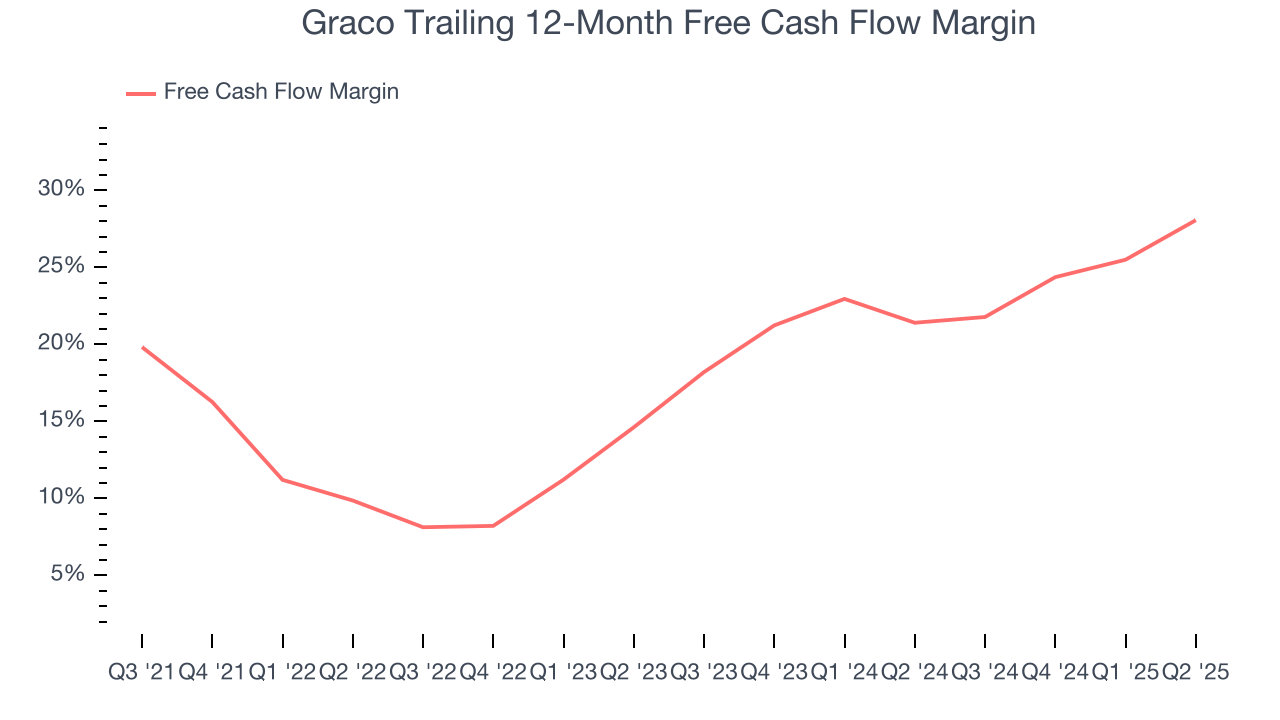

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Graco has shown terrific cash profitability, putting it in an advantageous position to invest in new products, return capital to investors, and consolidate the market during industry downturns. The company’s free cash flow margin was among the best in the industrials sector, averaging 18.6% over the last five years.

Taking a step back, we can see that Graco’s margin expanded by 8.3 percentage points during that time. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability was flat.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Although Graco hasn’t been the highest-quality company lately, it found a few growth initiatives in the past that worked out wonderfully. Its five-year average ROIC was 32%, splendid for an industrials business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Graco’s ROIC has unfortunately decreased. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

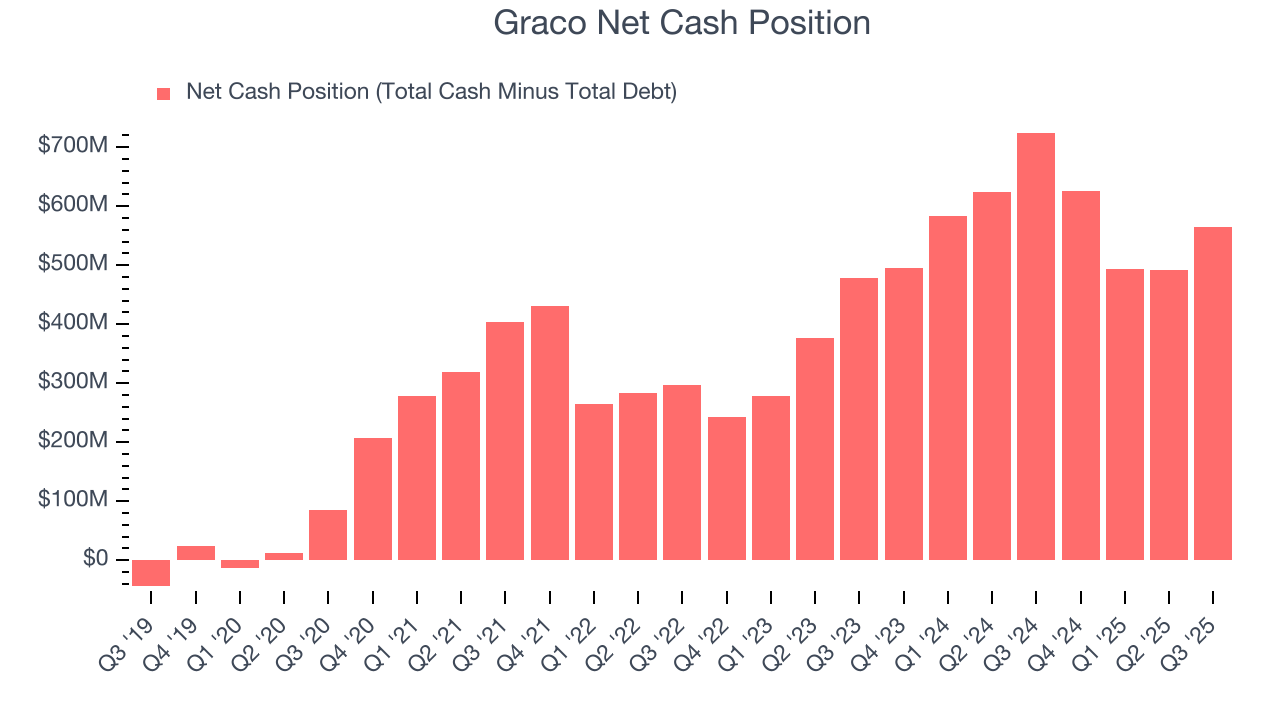

11. Balance Sheet Assessment

Companies with more cash than debt have lower bankruptcy risk.

Graco is a profitable, well-capitalized company with $618.7 million of cash and $54.18 million of debt on its balance sheet. This $564.5 million net cash position is 4.2% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from Graco’s Q3 Results

On the other hand, its and its revenue fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock remained flat at $81.62 immediately after reporting.

13. Is Now The Time To Buy Graco?

Updated: January 24, 2026 at 10:34 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Graco.

Graco isn’t a terrible business, but it isn’t one of our picks. To begin with, its revenue growth was mediocre over the last five years, and analysts don’t see anything changing over the next 12 months. And while Graco’s admirable gross margins indicate the mission-critical nature of its offerings, its diminishing returns show management's prior bets haven't worked out.

Graco’s P/E ratio based on the next 12 months is 28.2x. Investors with a higher risk tolerance might like the company, but we think the potential downside is too great. We're pretty confident there are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $91.22 on the company (compared to the current share price of $86.56).