Gorman-Rupp (GRC)

Gorman-Rupp piques our interest. Its robust backlog growth shows it has a long tail of demand that will fuel sales for many quarters.― StockStory Analyst Team

1. News

2. Summary

Why Gorman-Rupp Is Interesting

Powering fluid dynamics since 1934, Gorman-Rupp (NYSE:GRC) has evolved from its Ohio origins into a global manufacturer and seller of pumps and pump systems.

- Annual revenue growth of 13.5% over the last five years was superb and indicates its market share increased during this cycle

- Demand is greater than supply as the company’s 12.7% average backlog growth over the past two years shows it’s securing new contracts and accumulating more orders than it can fulfill

- A blemish is its projected sales growth of 4.3% for the next 12 months suggests sluggish demand

Gorman-Rupp is close to becoming a high-quality business. If you’ve been itching to buy the stock, the valuation looks reasonable.

Why Is Now The Time To Buy Gorman-Rupp?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Gorman-Rupp?

Gorman-Rupp is trading at $59.65 per share, or 26.4x forward P/E. Compared to other industrials companies, we think this multiple is fair for the revenue growth you get.

If you think the market is undervaluing the company, now could be a good time to build a position.

3. Gorman-Rupp (GRC) Research Report: Q4 CY2025 Update

Gorman-Rupp (NYSE:GRC) manufactures and sells pumps globally. met Wall Streets revenue expectations in Q4 CY2025, with sales up 2.4% year on year to $166.6 million. Its non-GAAP profit of $0.55 per share was 27.9% above analysts’ consensus estimates.

Gorman-Rupp (GRC) Q4 CY2025 Highlights:

- Revenue: $166.6 million vs analyst estimates of $167.1 million (2.4% year-on-year growth, in line)

- Adjusted EPS: $0.55 vs analyst estimates of $0.43 (27.9% beat)

- Adjusted EBITDA: $31.51 million vs analyst estimates of $27.29 million (18.9% margin, 15.5% beat)

- Operating Margin: 14.9%, up from 13.4% in the same quarter last year

- Free Cash Flow Margin: 6.1%, up from 3.2% in the same quarter last year

- Market Capitalization: $1.57 billion

Company Overview

Powering fluid dynamics since 1934, Gorman-Rupp (NYSE:GRC) has evolved from its Ohio origins into a global manufacturer and seller of pumps and pump systems.

The company's product line caters to a range of applications, including water, wastewater, construction, dewatering, industrial, petroleum, original equipment, agriculture, fire suppression, HVAC, military, and other liquid-handling needs.

Gorman-Rupp's features products such as pump models that vary greatly in size and capacity. The company produces different pump types, including self-priming centrifugal, standard centrifugal, magnetic drive centrifugal, axial and mixed-flow, vertical turbine line shaft, submersible, high-pressure booster, rotary gear, rotary vein, diaphragm, bellows, and oscillating pumps.

The company's pumps are powered by different drives, from small electric motors to large internal combustion engines, allowing for versatility in application. Many of Gorman-Rupp's larger units are designed as fully-integrated water and wastewater pumping stations, showcasing the company's capability to provide complete solutions.

4. Gas and Liquid Handling

Gas and liquid handling companies possess the technical know-how and specialized equipment to handle valuable (and sometimes dangerous) substances. Lately, water conservation and carbon capture–which requires hydrogen and other gasses as well as specialized infrastructure–have been trending up, creating new demand for products such as filters, pumps, and valves. On the other hand, gas and liquid handling companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

Competitors of Gorman-Rupp include Xylem (NYSE:XYL), Flowserve (NYSE:FLS), and ITT (NYSE:ITT).

5. Revenue Growth

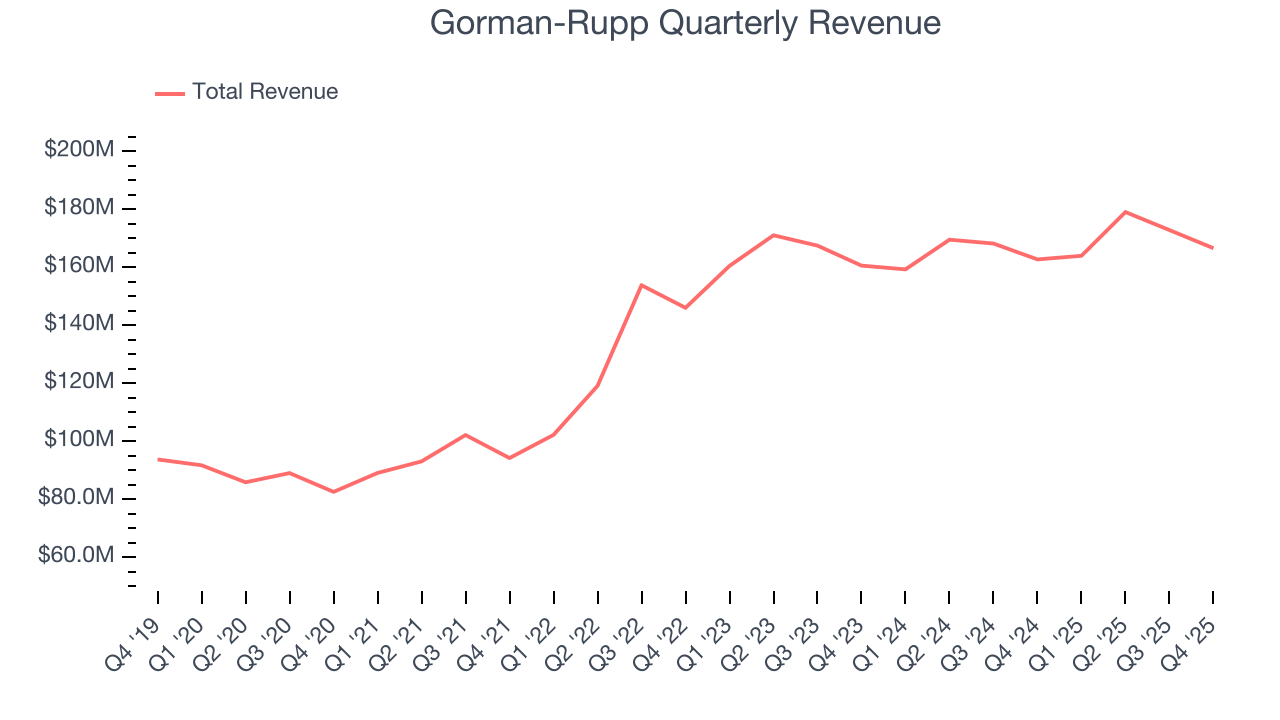

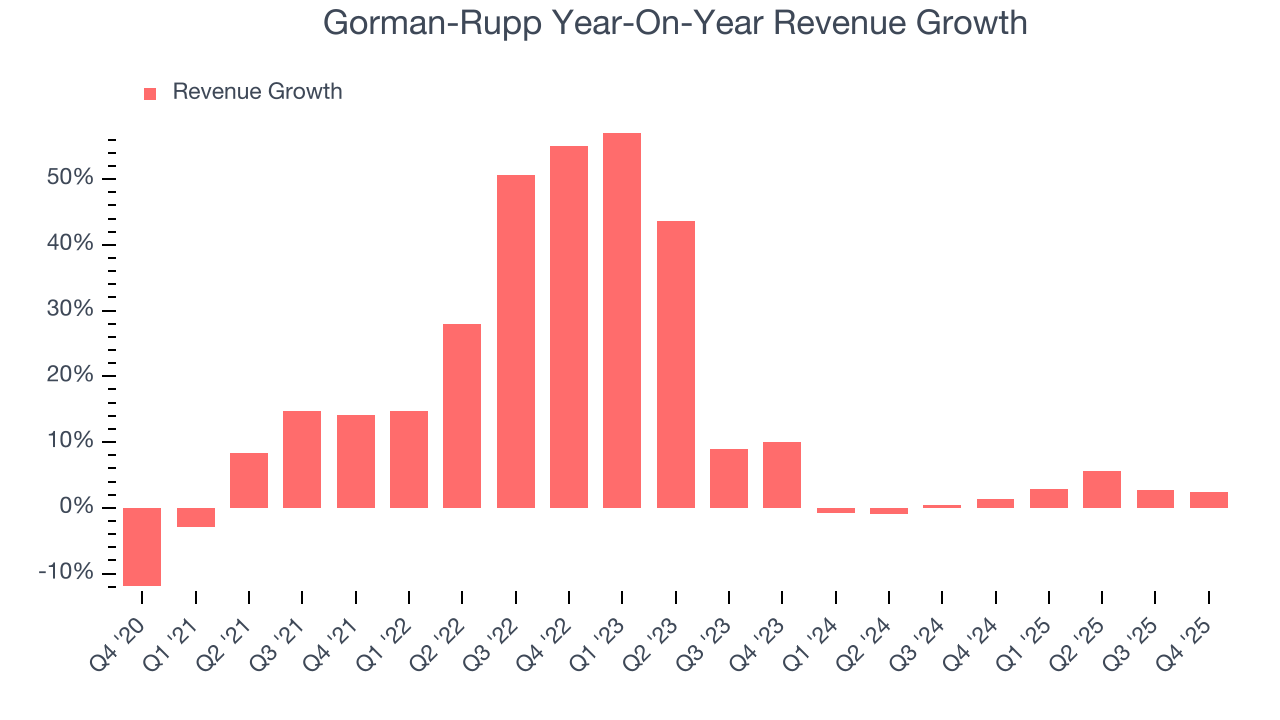

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Luckily, Gorman-Rupp’s sales grew at an exceptional 14.4% compounded annual growth rate over the last five years. Its growth beat the average industrials company and shows its offerings resonate with customers, a helpful starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Gorman-Rupp’s recent performance shows its demand has slowed significantly as its annualized revenue growth of 1.7% over the last two years was well below its five-year trend.

This quarter, Gorman-Rupp grew its revenue by 2.4% year on year, and its $166.6 million of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 4.6% over the next 12 months. Although this projection implies its newer products and services will spur better top-line performance, it is still below average for the sector. At least the company is tracking well in other measures of financial health.

6. Gross Margin & Pricing Power

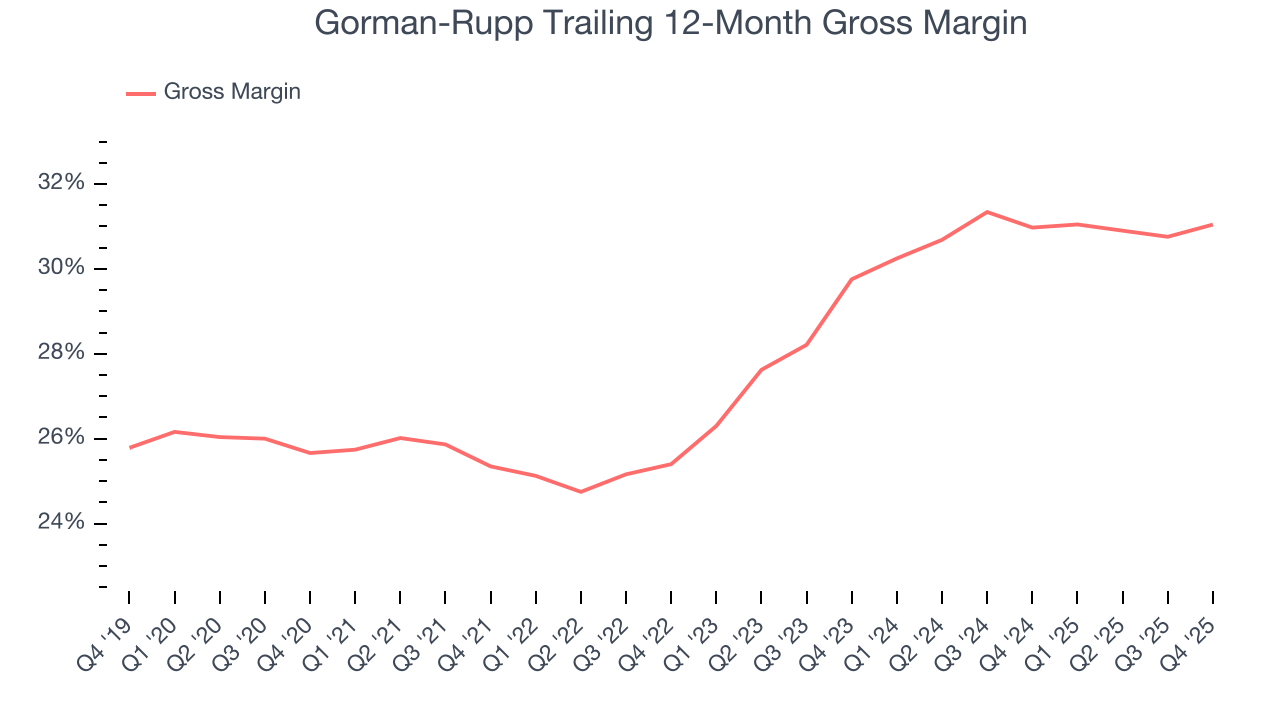

At StockStory, we prefer high gross margin businesses because they indicate the company has pricing power or differentiated products, giving it a chance to generate higher operating profits.

Gorman-Rupp’s gross margin is slightly below the average industrials company, giving it less room to invest in areas such as research and development. As you can see below, it averaged a 29% gross margin over the last five years. That means Gorman-Rupp paid its suppliers a lot of money ($71.02 for every $100 in revenue) to run its business.

Gorman-Rupp’s gross profit margin came in at 31.4% this quarter, up 1.2 percentage points year on year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

7. Operating Margin

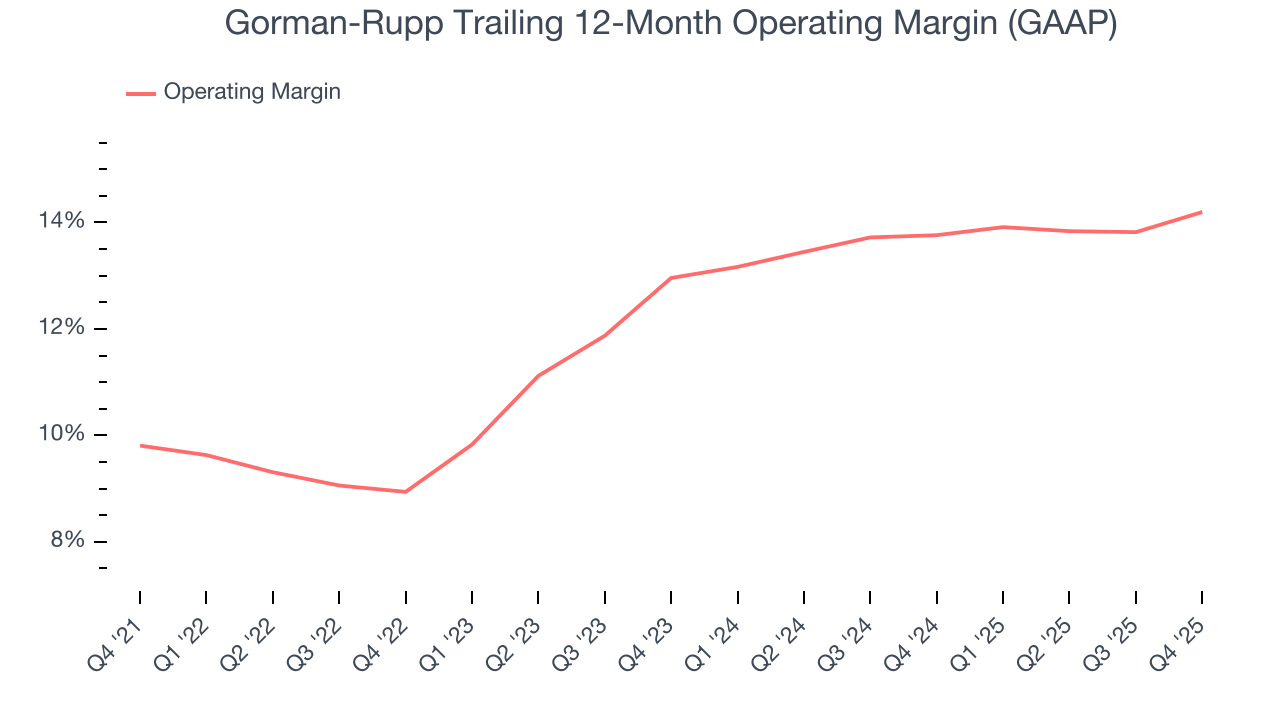

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

Gorman-Rupp has been an efficient company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 12.3%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Looking at the trend in its profitability, Gorman-Rupp’s operating margin rose by 4.4 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, Gorman-Rupp generated an operating margin profit margin of 14.9%, up 1.6 percentage points year on year. The increase was encouraging, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

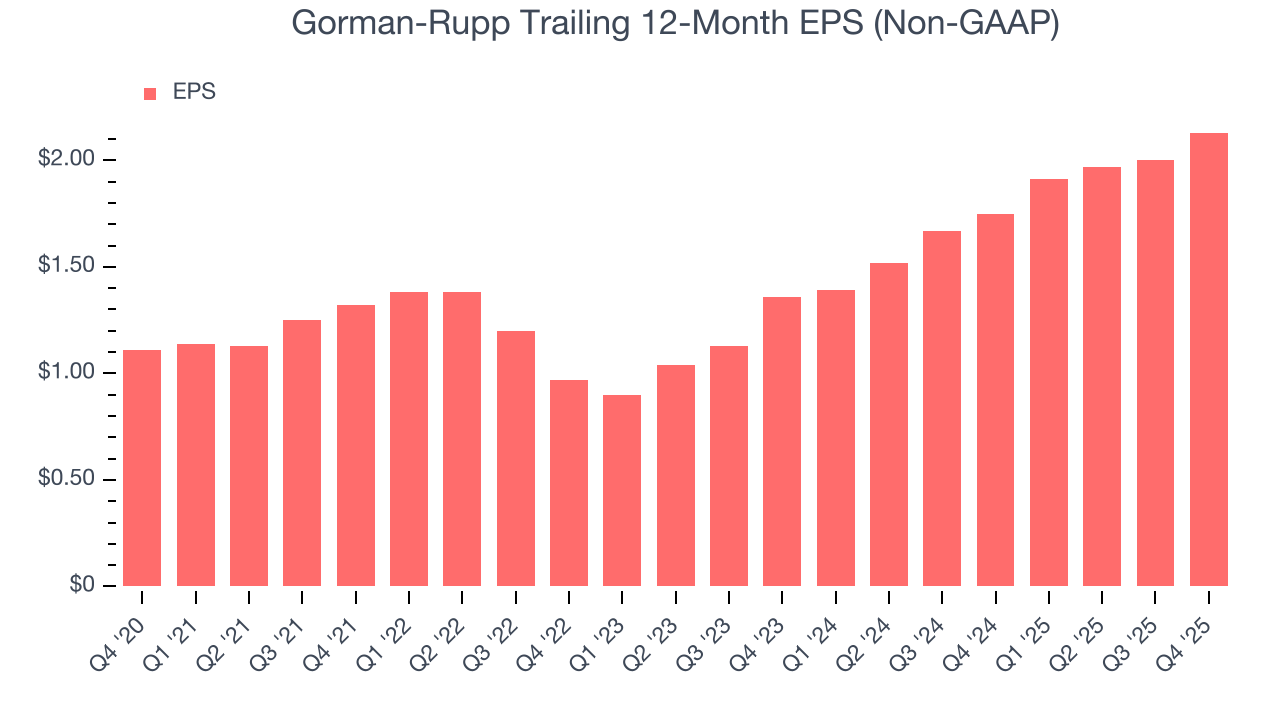

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Gorman-Rupp’s remarkable 13.9% annual EPS growth over the last five years aligns with its revenue performance. This tells us its incremental sales were profitable.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

Gorman-Rupp’s two-year annual EPS growth of 25.1% was fantastic and topped its 1.7% two-year revenue growth.

Diving into the nuances of Gorman-Rupp’s earnings can give us a better understanding of its performance. Gorman-Rupp’s operating margin has expanded over the last two years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, Gorman-Rupp reported adjusted EPS of $0.55, up from $0.42 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Gorman-Rupp’s full-year EPS of $2.13 to grow 5.6%.

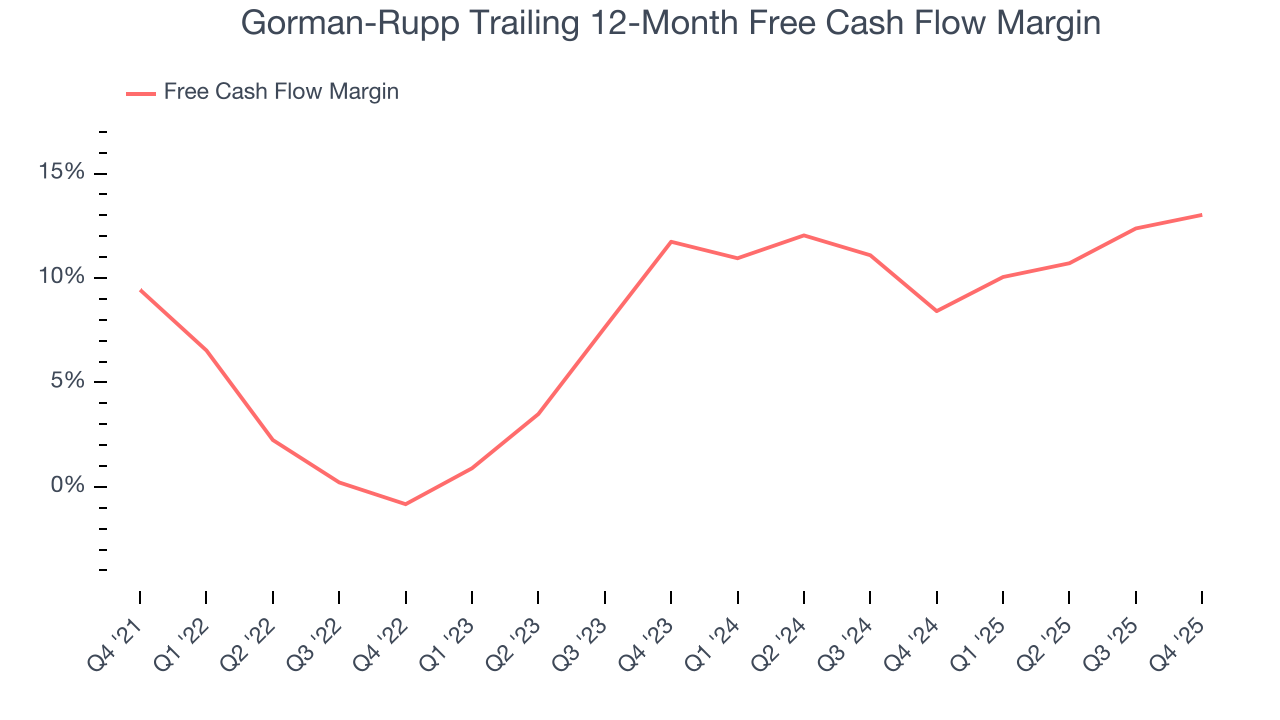

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Gorman-Rupp has shown impressive cash profitability, enabling it to ride out cyclical downturns more easily while maintaining its investments in new and existing offerings. The company’s free cash flow margin averaged 8.7% over the last five years, better than the broader industrials sector.

Taking a step back, we can see that Gorman-Rupp’s margin expanded by 3.6 percentage points during that time. This is encouraging because it gives the company more optionality.

Gorman-Rupp’s free cash flow clocked in at $10.16 million in Q4, equivalent to a 6.1% margin. This result was good as its margin was 2.9 percentage points higher than in the same quarter last year, building on its favorable historical trend.

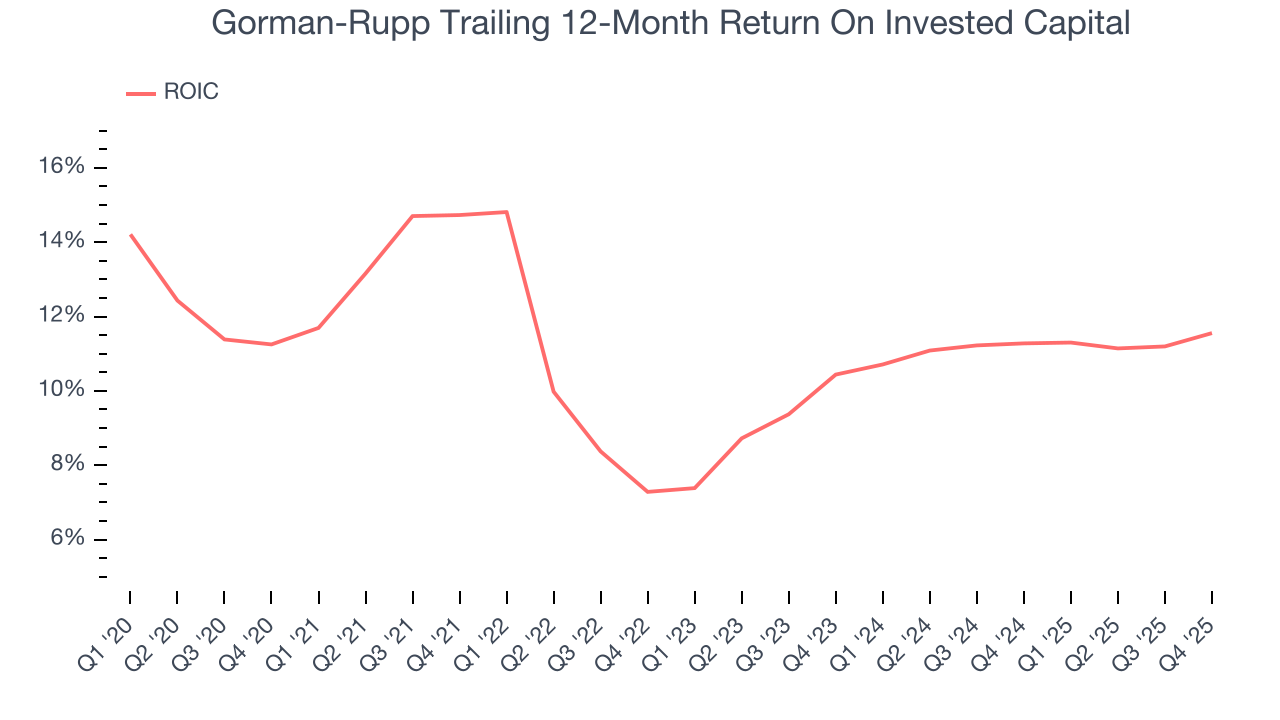

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Gorman-Rupp’s management team makes decent investment decisions and generates value for shareholders. Its five-year average ROIC was 11.1%, slightly better than typical industrials business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Uneventfully, Gorman-Rupp’s ROIC has stayed the same over the last few years. Rising returns would be ideal, but this is still a noteworthy feat since they're already high.

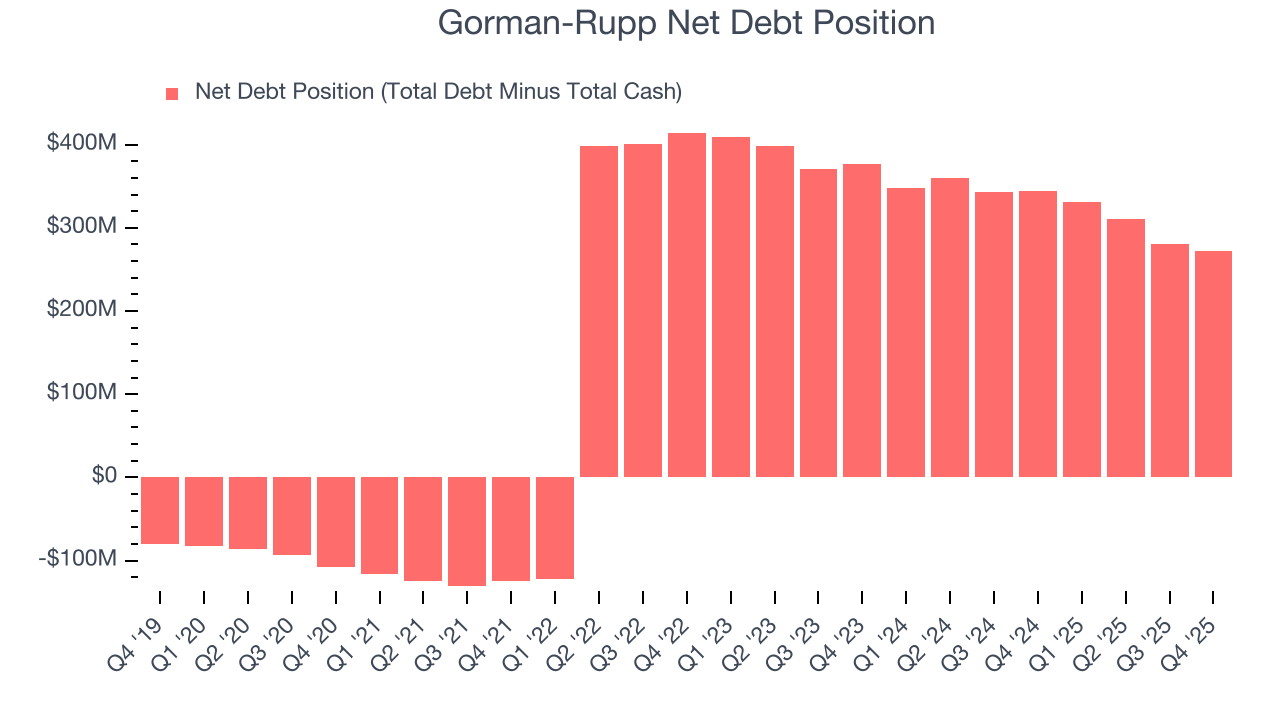

11. Balance Sheet Assessment

Gorman-Rupp reported $35.08 million of cash and $307.5 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $128.8 million of EBITDA over the last 12 months, we view Gorman-Rupp’s 2.1× net-debt-to-EBITDA ratio as safe. We also see its $12.56 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Gorman-Rupp’s Q4 Results

It was good to see Gorman-Rupp beat analysts’ EBITDA and EPS expectations this quarter despite in line revenue. Zooming out, we think this quarter featured some important positives. The stock remained flat at $59.55 immediately following the results.

13. Is Now The Time To Buy Gorman-Rupp?

Before making an investment decision, investors should account for Gorman-Rupp’s business fundamentals and valuation in addition to what happened in the latest quarter.

We think Gorman-Rupp is a good business. First off, its revenue growth was exceptional over the last five years. And while its projected EPS for the next year is lacking, its expanding operating margin shows the business has become more efficient. On top of that, its backlog growth has been splendid.

Gorman-Rupp’s P/E ratio based on the next 12 months is 26.5x. When scanning the industrials space, Gorman-Rupp trades at a fair valuation. If you trust the business and its direction, this is an ideal time to buy.

Wall Street analysts have a consensus one-year price target of $59 on the company (compared to the current share price of $59.55).