Gray Television (GTN)

Gray Television is in for a bumpy ride. Its sales have underperformed and its low returns on capital show it has few growth opportunities.― StockStory Analyst Team

1. News

2. Summary

Why We Think Gray Television Will Underperform

Specializing in local media coverage, Gray Television (NYSE:GTN) is a broadcast company supplying digital media to various markets in the United States.

- Sales trends were unexciting over the last five years as its 9.1% annual growth was below the typical consumer discretionary company

- Earnings per share fell by 29.8% annually over the last five years while its revenue grew, showing its incremental sales were much less profitable

- High net-debt-to-EBITDA ratio of 6× could force the company to raise capital at unfavorable terms if market conditions deteriorate

Gray Television’s quality is inadequate. We’re hunting for superior stocks elsewhere.

Why There Are Better Opportunities Than Gray Television

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Gray Television

Gray Television is trading at $4.43 per share, or 7x forward EV-to-EBITDA. The current valuation may be appropriate, but we’re still not buyers of the stock.

Paying a premium for high-quality companies with strong long-term earnings potential is preferable to owning challenged businesses with questionable prospects.

3. Gray Television (GTN) Research Report: Q3 CY2025 Update

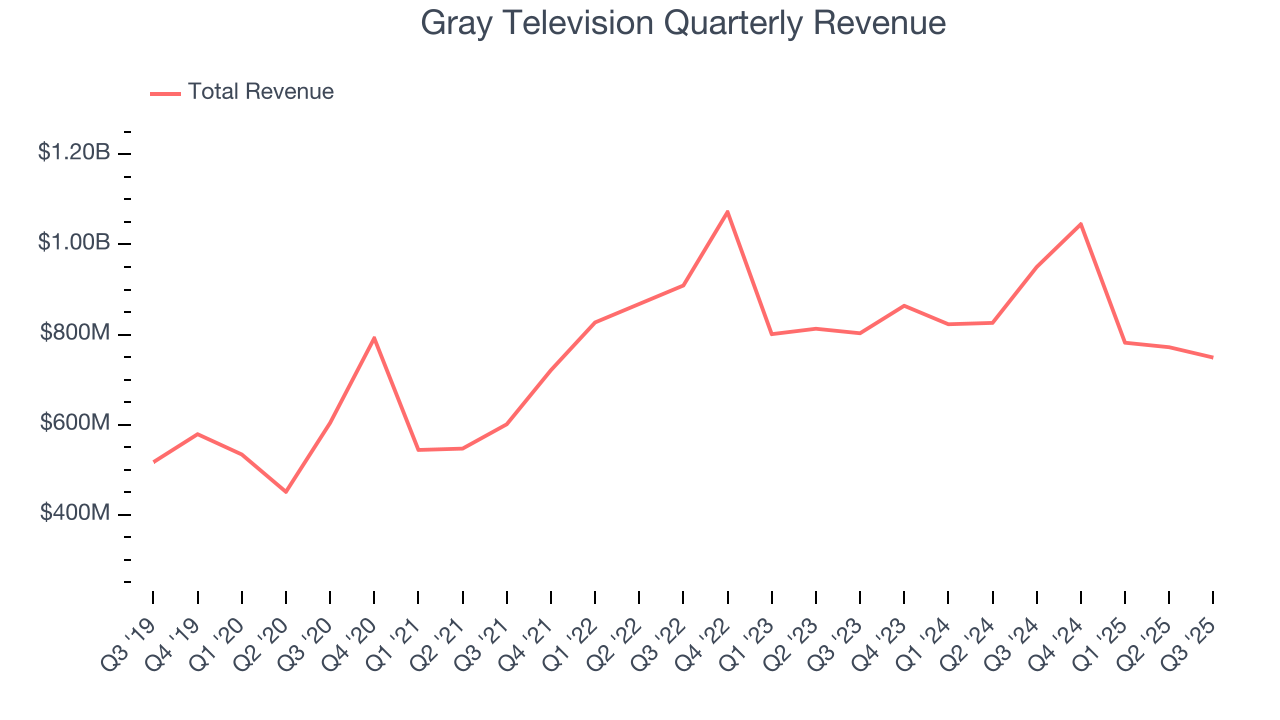

Local television broadcasting and media company Gray Television (NYSE:GTN) met Wall Streets revenue expectations in Q3 CY2025, but sales fell by 21.2% year on year to $749 million. On the other hand, next quarter’s revenue guidance of $774.5 million was less impressive, coming in 4.8% below analysts’ estimates. Its GAAP loss of $0.24 per share was 50% above analysts’ consensus estimates.

Gray Television (GTN) Q3 CY2025 Highlights:

- Revenue: $749 million vs analyst estimates of $746.1 million (21.2% year-on-year decline, in line)

- EPS (GAAP): -$0.24 vs analyst estimates of -$0.48 (50% beat)

- Adjusted EBITDA: $162 million vs analyst estimates of $138.8 million (21.6% margin, 16.7% beat)

- Revenue Guidance for Q4 CY2025 is $774.5 million at the midpoint, below analyst estimates of $813.3 million

- Operating Margin: 13.6%, down from 26.3% in the same quarter last year

- Market Capitalization: $478.1 million

Company Overview

Specializing in local media coverage, Gray Television (NYSE:GTN) is a broadcast company supplying digital media to various markets in the United States.

Gray Television was established to provide localized television broadcasting to underserved markets. From its inception, the company has recognized the need for communities to have access to news, information, and entertainment that reflect their specific interests and needs.

The company's offerings include local news, weather, sports, and entertainment programming across its network of stations. This focus on local content fills a critical gap in a media landscape often dominated by national narratives, ensuring communities receive relevant, region-specific information.

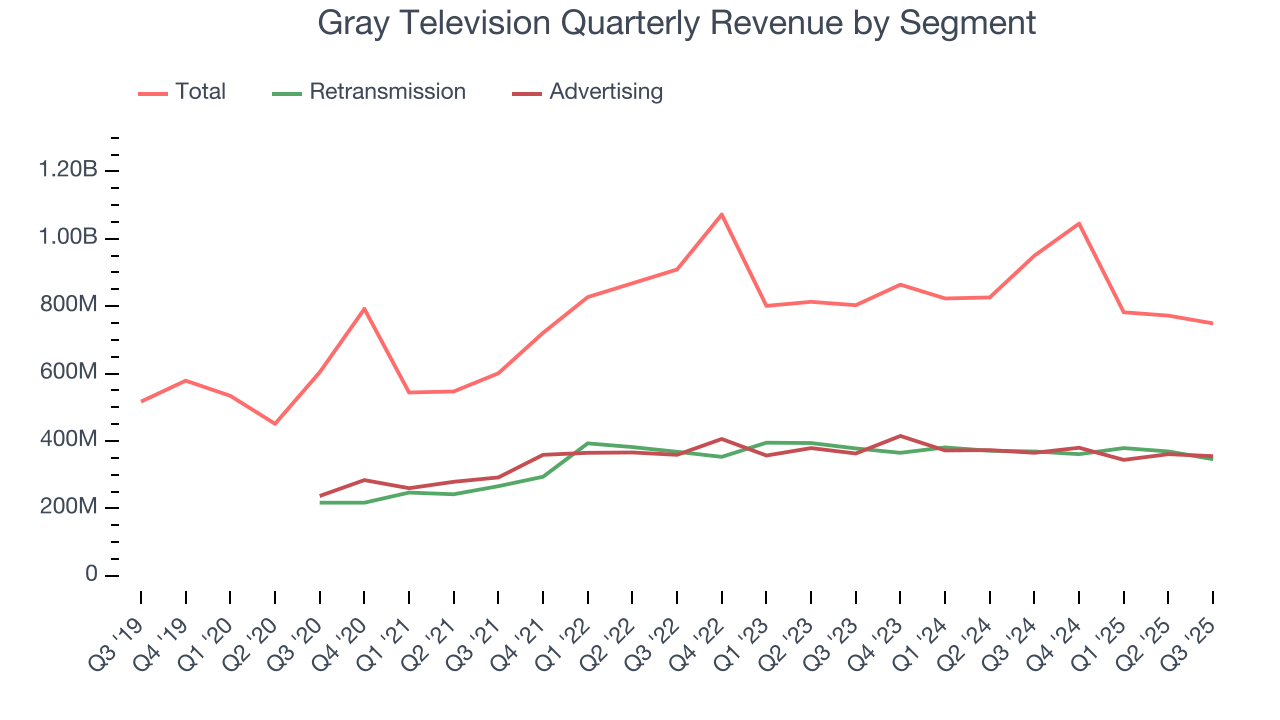

The company generates revenue through advertising and digital media affiliate fees, where business partners pay Gray Television to access its content.

4. Broadcasting

Broadcasting companies have been facing secular headwinds in the form of consumers abandoning traditional television and radio in favor of streaming services. As a result, many broadcasting companies have evolved by forming distribution agreements with major streaming platforms so they can get in on part of the action, but will these subscription revenues be as high quality and high margin as their legacy revenues? Only time will tell which of these broadcasters will survive the sea changes of technological advancement and fragmenting consumer attention.

Competitors in the local television broadcasting industry include Nexstar Media (NASDAQ:NXST), Sinclair (NASDAQ: SBGI), and TEGNA (NYSE: TGNA).

5. Revenue Growth

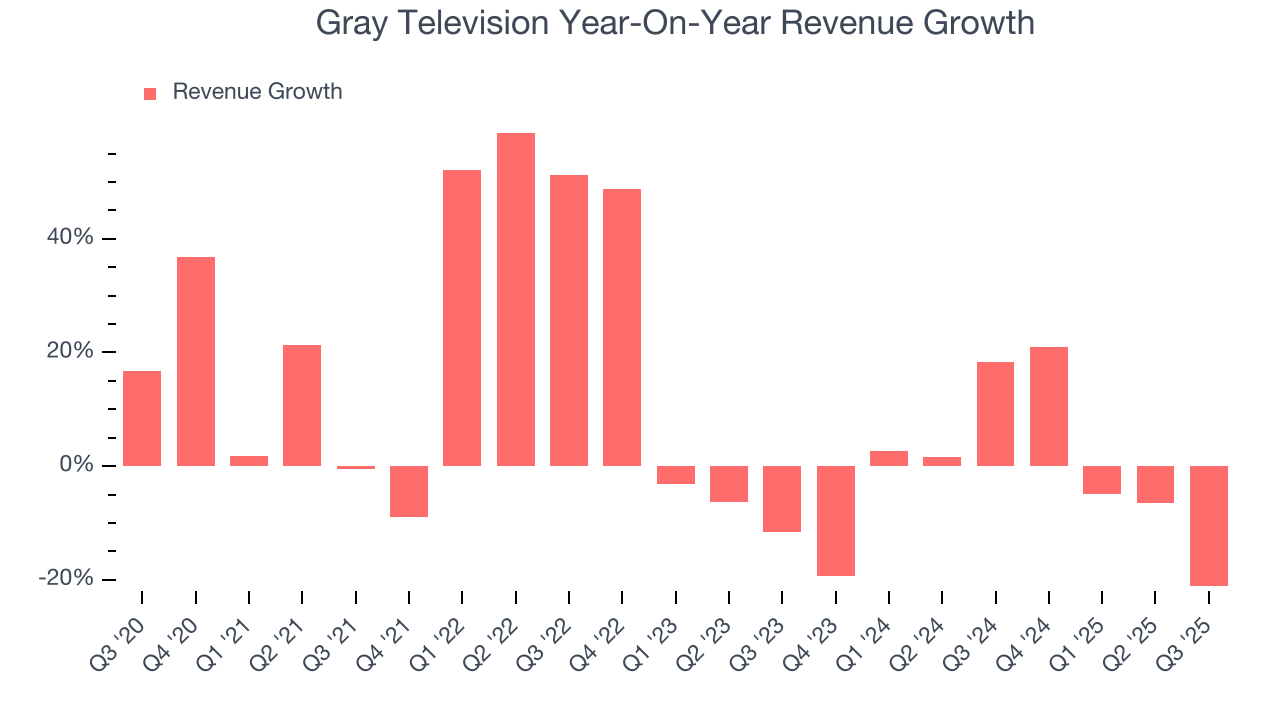

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Regrettably, Gray Television’s sales grew at a tepid 9.1% compounded annual growth rate over the last five years. This was below our standard for the consumer discretionary sector and is a poor baseline for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Gray Television’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 2% annually.

We can better understand the company’s revenue dynamics by analyzing its most important segments, Retransmission and Advertising, which are 46.2% and 47.4% of revenue. Over the last two years, Gray Television’s Retransmission revenue (affiliate and licensing fees) averaged 2.1% year-on-year declines while its Advertising revenue (marketing services) averaged 2.1% declines.

This quarter, Gray Television reported a rather uninspiring 21.2% year-on-year revenue decline to $749 million of revenue, in line with Wall Street’s estimates. Company management is currently guiding for a 25.9% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to decline by 1.5% over the next 12 months, similar to its two-year rate. This projection is underwhelming and indicates its newer products and services will not catalyze better top-line performance yet.

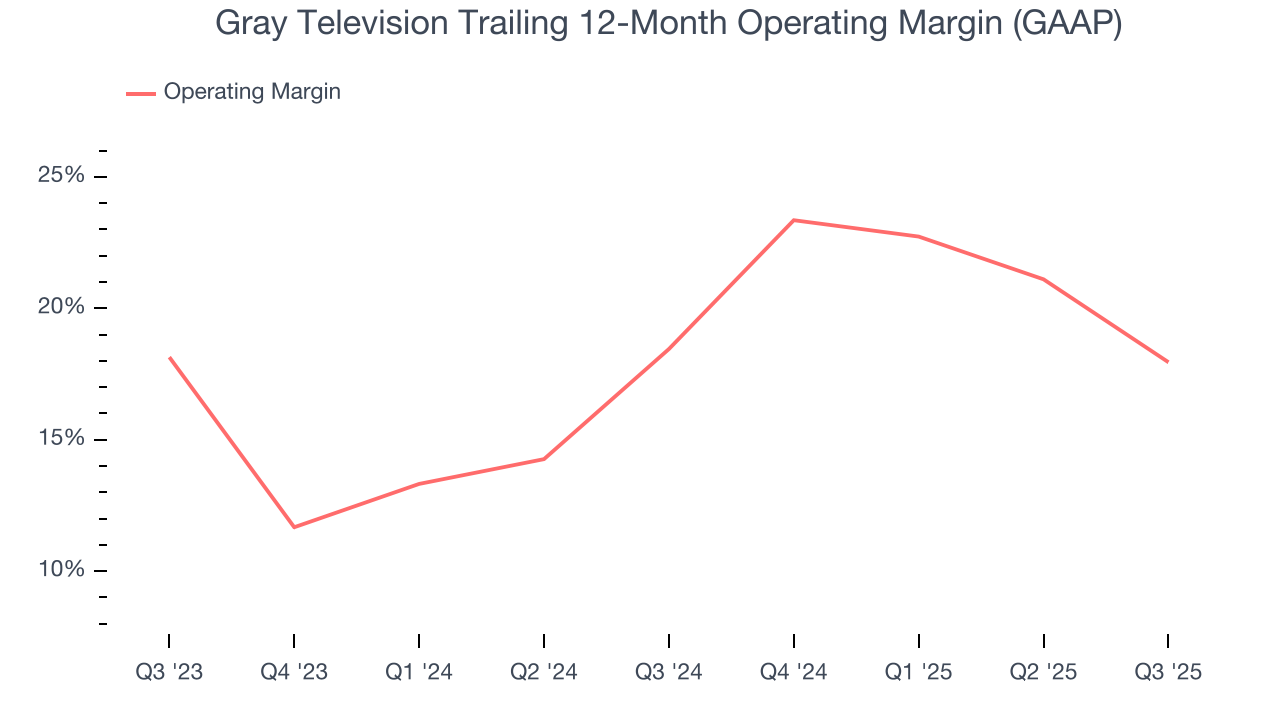

6. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Gray Television’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 18.2% over the last two years. This profitability was top-notch for a consumer discretionary business, showing it’s an well-run company with an efficient cost structure.

In Q3, Gray Television generated an operating margin profit margin of 13.6%, down 12.7 percentage points year on year. This contraction shows it was less efficient because its expenses increased relative to its revenue.

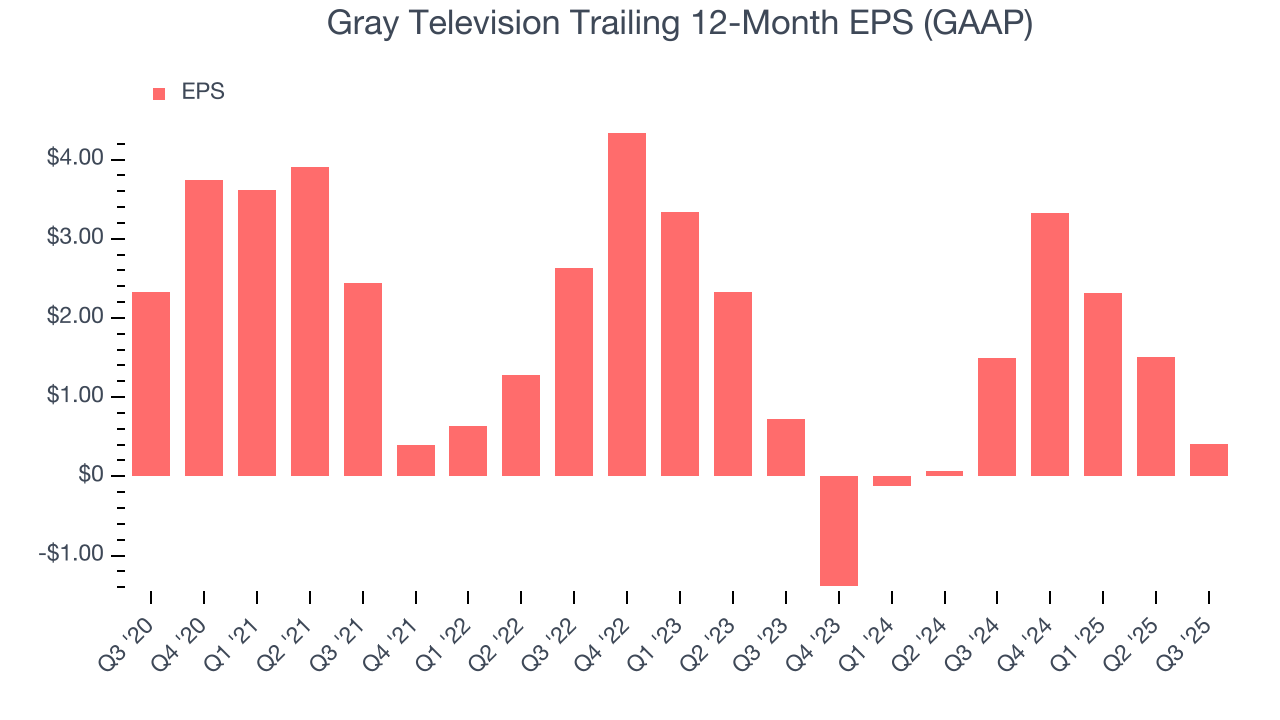

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Gray Television, its EPS declined by 29.4% annually over the last five years while its revenue grew by 9.1%. This tells us the company became less profitable on a per-share basis as it expanded.

In Q3, Gray Television reported EPS of negative $0.24, down from $0.86 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects Gray Television’s full-year EPS of $0.41 to shrink by 18.3%.

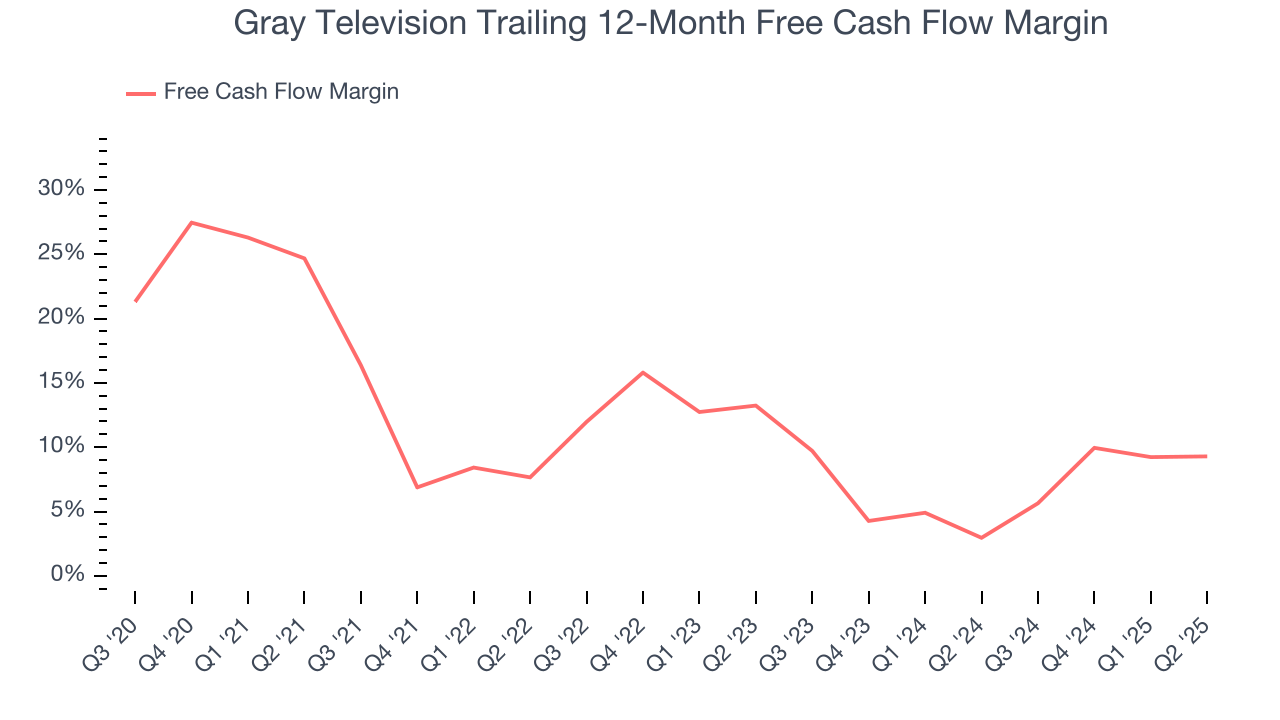

8. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Gray Television has shown weak cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 6.6%, subpar for a consumer discretionary business. The divergence from its good operating margin stems from its capital-intensive business model, which requires Gray Television to make large cash investments in working capital and capital expenditures.

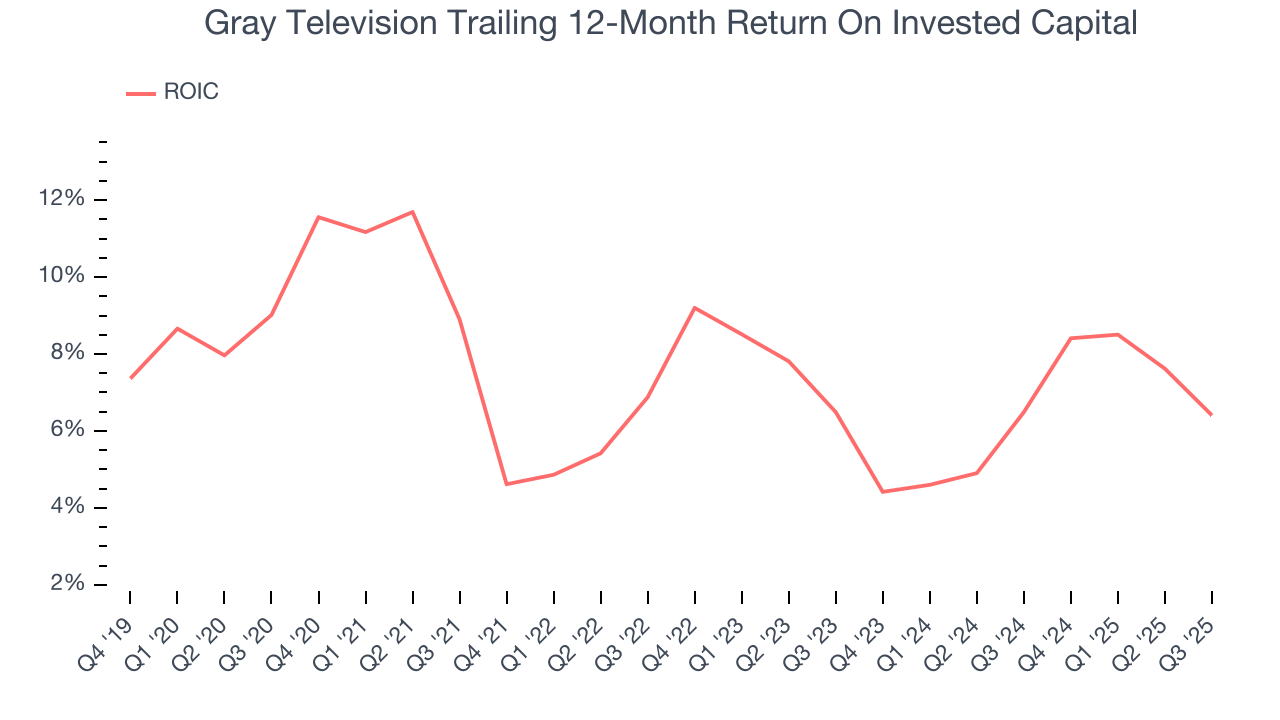

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Gray Television historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 7%, somewhat low compared to the best consumer discretionary companies that consistently pump out 25%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. On average, Gray Television’s ROIC decreased by 1.4 percentage points annually over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

10. Balance Sheet Risk

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

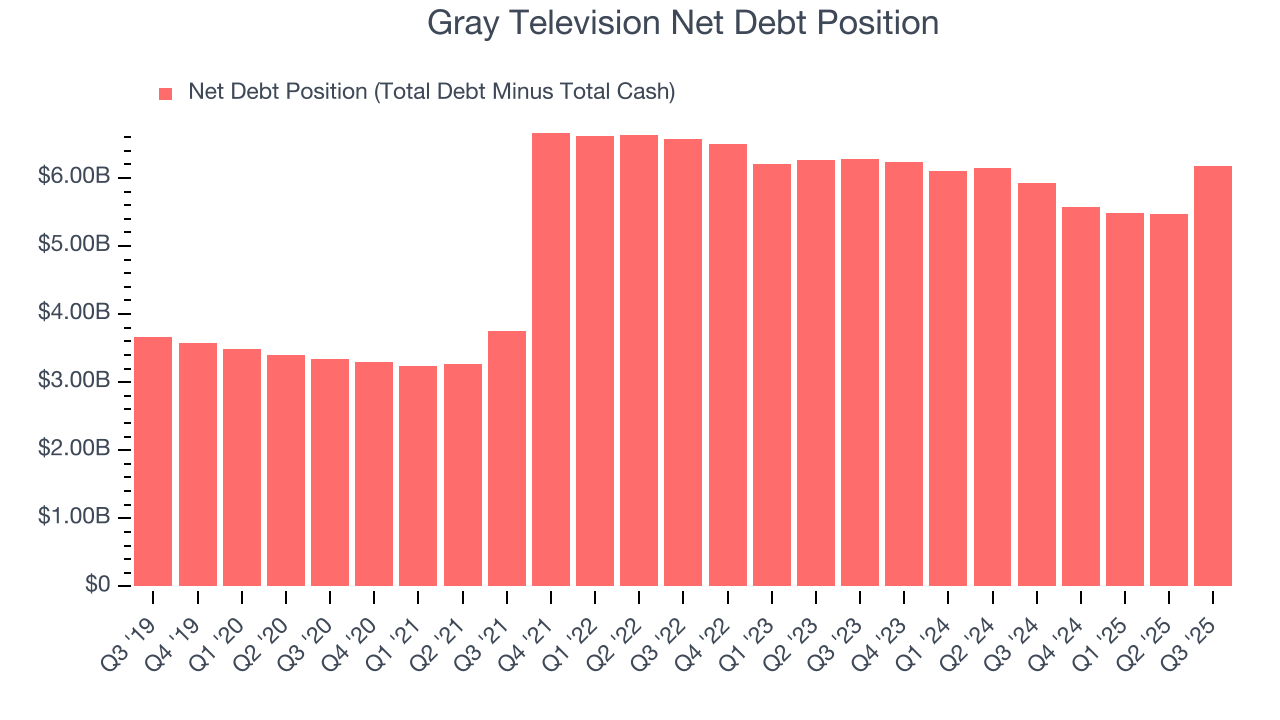

Gray Television’s $6.35 billion of debt exceeds the $182 million of cash on its balance sheet. Furthermore, its 7× net-debt-to-EBITDA ratio (based on its EBITDA of $876 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. Gray Television could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope Gray Television can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

11. Key Takeaways from Gray Television’s Q3 Results

It was good to see Gray Television beat analysts’ EPS expectations this quarter. We were also glad its EBITDA outperformed Wall Street’s estimates. On the other hand, its revenue guidance for next quarter missed and its full-year revenue guidance fell slightly short of Wall Street’s estimates. Zooming out, we think this was a mixed quarter. Investors were likely hoping for more, and shares traded down 5.7% to $4.36 immediately following the results.

12. Is Now The Time To Buy Gray Television?

Updated: January 20, 2026 at 10:10 PM EST

When considering an investment in Gray Television, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

Gray Television doesn’t pass our quality test. For starters, its revenue growth was weak over the last five years, and analysts expect its demand to deteriorate over the next 12 months. On top of that, Gray Television’s Forecasted free cash flow margin for next year suggests the company will fail to improve its cash conversion, and its declining EPS over the last five years makes it a less attractive asset to the public markets.

Gray Television’s EV-to-EBITDA ratio based on the next 12 months is 7x. This valuation multiple is fair, but we don’t have much confidence in the company. There are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $6.40 on the company (compared to the current share price of $4.43).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.