HA Sustainable Infrastructure Capital (HASI)

HA Sustainable Infrastructure Capital doesn’t impress us. Its low returns on capital raise concerns about its ability to deliver profits, a must for quality companies.― StockStory Analyst Team

1. News

2. Summary

Why HA Sustainable Infrastructure Capital Is Not Exciting

With a proprietary "CarbonCount" metric that quantifies the environmental impact of each dollar invested, HA Sustainable Infrastructure Capital (NYSE:HASI) is an investment firm that finances and develops climate-positive infrastructure projects across renewable energy, energy efficiency, and ecological restoration.

- Low return on equity reflects management’s struggle to allocate funds effectively

- High net-debt-to-EBITDA ratio of 27× increases the risk of forced asset sales or dilutive financing if operational performance weakens

HA Sustainable Infrastructure Capital’s quality doesn’t meet our hurdle. There are more promising alternatives.

Why There Are Better Opportunities Than HA Sustainable Infrastructure Capital

High Quality

Investable

Underperform

Why There Are Better Opportunities Than HA Sustainable Infrastructure Capital

At $39.84 per share, HA Sustainable Infrastructure Capital trades at 12.2x forward P/E. This multiple is cheaper than most financials peers, but we think this is justified.

Cheap stocks can look like a great deal at first glance, but they can be value traps. They often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. HA Sustainable Infrastructure Capital (HASI) Research Report: Q4 CY2025 Update

Climate investment firm HA Sustainable Infrastructure Capital (NYSE:HASI) announced better-than-expected revenue in Q4 CY2025, with sales up 3.4% year on year to $114.8 million. Its non-GAAP profit of $0.67 per share was 1.6% above analysts’ consensus estimates.

HA Sustainable Infrastructure Capital (HASI) Q4 CY2025 Highlights:

- Revenue: $114.8 million vs analyst estimates of $93.46 million (3.4% year-on-year growth, 22.8% beat)

- Pre-tax Profit: -$65.96 million (-57.4% margin)

- Adjusted EPS: $0.67 vs analyst estimates of $0.66 (1.6% beat)

- Market Capitalization: $4.69 billion

Company Overview

With a proprietary "CarbonCount" metric that quantifies the environmental impact of each dollar invested, HA Sustainable Infrastructure Capital (NYSE:HASI) is an investment firm that finances and develops climate-positive infrastructure projects across renewable energy, energy efficiency, and ecological restoration.

HASI structures its investments across three primary climate markets. In the Behind-the-Meter segment, which represents nearly half its portfolio, the company finances distributed energy projects like solar installations, battery storage systems, and energy efficiency upgrades for buildings. Its Grid-Connected investments focus on utility-scale renewable energy projects such as solar and wind farms that feed into the power grid. The third segment, Fuels, Transport, and Nature, targets emissions reduction in sectors beyond electricity generation, including renewable natural gas facilities and ecological restoration projects.

The company employs various investment structures, including equity investments in project entities, secured debt financing, and direct ownership of land leased to renewable energy projects. HASI quantifies the environmental impact of its investments using a proprietary metric called CarbonCount, which measures the estimated carbon emissions avoided per dollar invested.

As a climate-focused investment firm, HASI maintains relationships with renewable energy developers, utilities, and energy service companies that provide ongoing investment opportunities. For example, HASI might finance a commercial solar installation that allows a business to reduce its electricity costs while generating renewable energy, or provide capital for a utility-scale wind farm that sells power to the grid.

HASI funds its investments through multiple financing sources, including corporate bonds, bank debt, and equity. The company's status as a Real Estate Investment Trust (REIT) requires it to distribute at least 90% of its taxable income to shareholders annually, making it a potential option for income-focused investors interested in the renewable energy sector.

4. Specialty Finance

Specialty finance companies provide targeted lending or financial services for specific industries or needs. They benefit from expertise in particular sectors, often reduced competition in specialized niches, and tailored underwriting that can yield higher margins. Challenges include concentration risk in specific industries, difficulty achieving scale efficiencies, and potential vulnerability during sector-specific downturns affecting their specialized markets.

HASI's competitors include other renewable energy and infrastructure investors such as Brookfield Renewable Partners (NYSE:BEP), NextEra Energy Partners (NYSE:NEP), and Clearway Energy (NYSE:CWEN), as well as larger asset managers with dedicated renewable energy investment platforms.

5. Revenue Growth

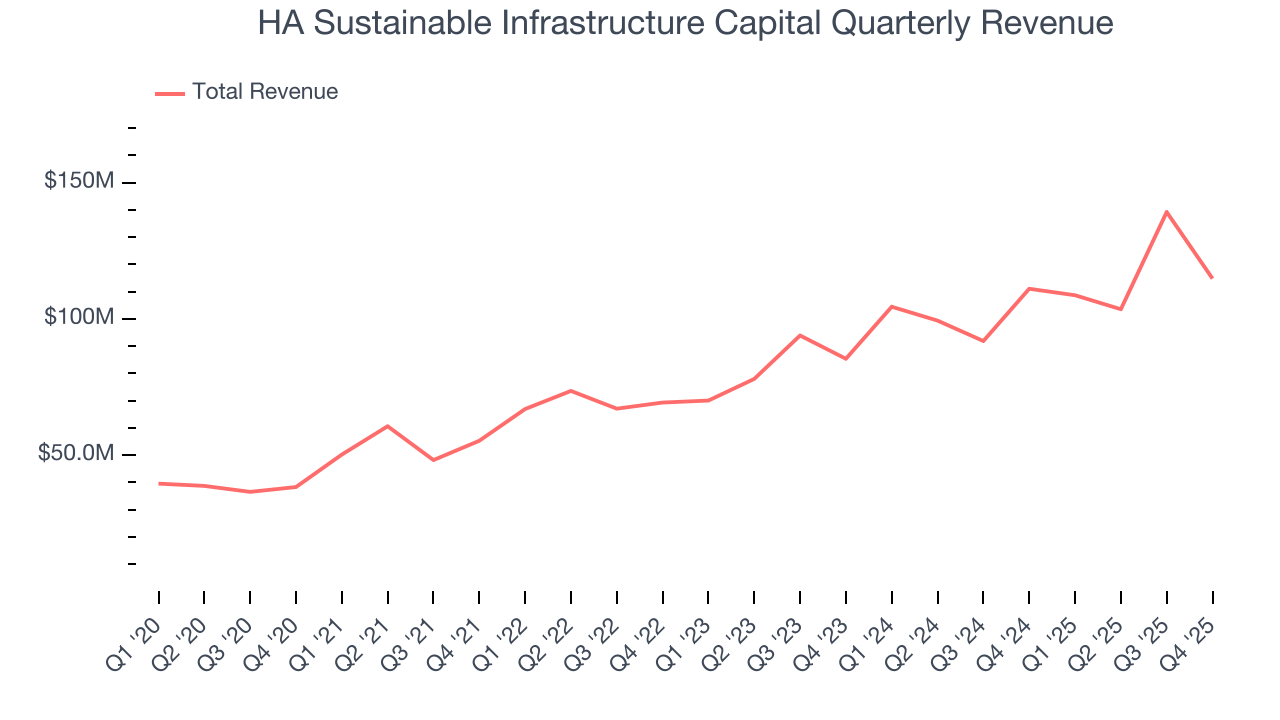

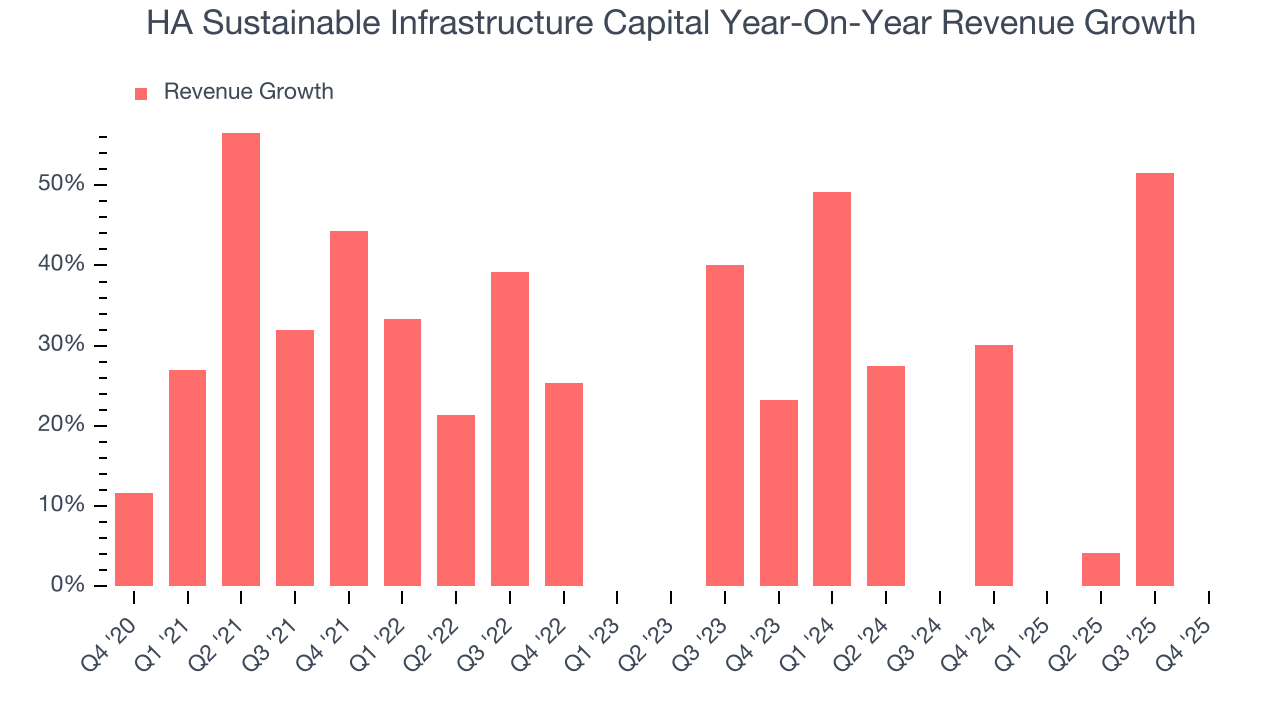

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Thankfully, HA Sustainable Infrastructure Capital’s 24.9% annualized revenue growth over the last five years was exceptional. Its growth beat the average financials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. HA Sustainable Infrastructure Capital’s annualized revenue growth of 19.4% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, HA Sustainable Infrastructure Capital reported modest year-on-year revenue growth of 3.4% but beat Wall Street’s estimates by 22.8%.

6. Pre-Tax Profit Margin

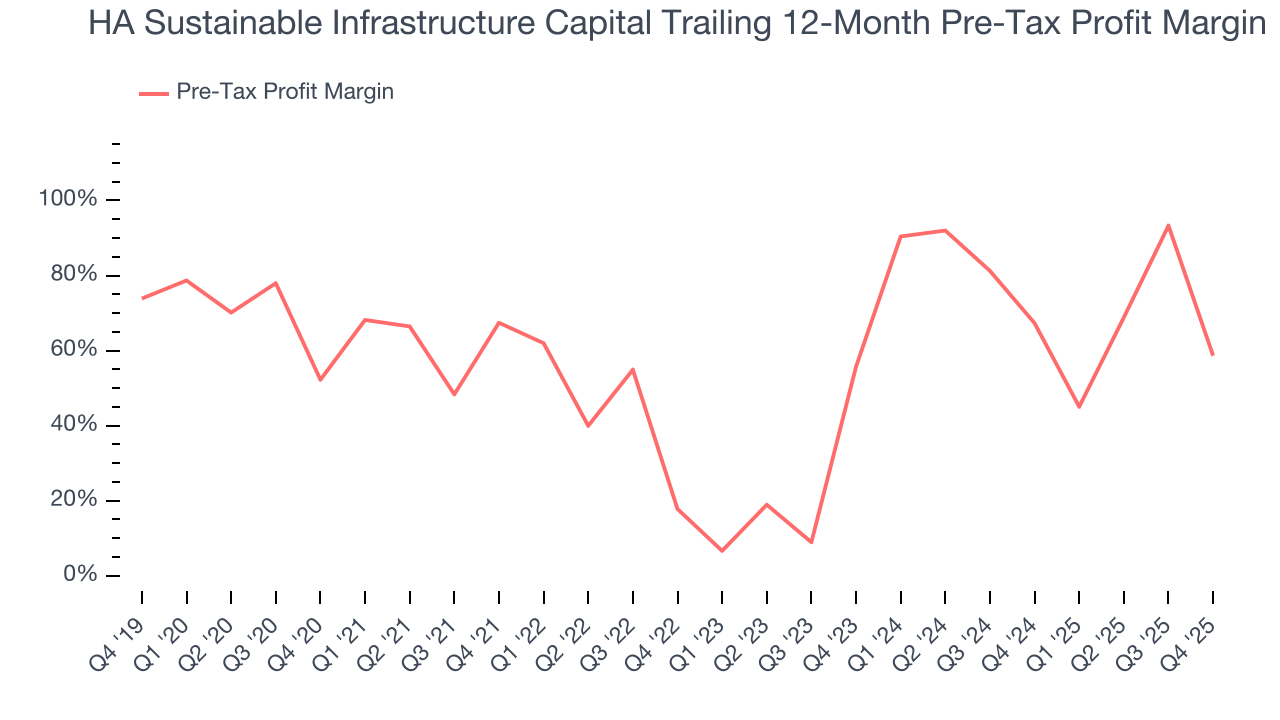

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For Specialty Finance companies, we look at pre-tax profit rather than the operating margin that defines sectors such as consumer, tech, and industrials.

Interest income and expenses play a big role in financial institutions' profitability, so they should be factored into the definition of profit. Taxes, however, should not as they are largely out of a company's control. This is pre-tax profit by definition.

Over the last five years, HA Sustainable Infrastructure Capital’s pre-tax profit margin has fallen by 6.4 percentage points, going from 67.4% to 58.6%. It has also expanded by 2.9 percentage points on a two-year basis, showing its expenses have consistently grown at a slower rate than revenue. This typically signals prudent management.

HA Sustainable Infrastructure Capital’s pre-tax profit margin came in at negative 57.4% this quarter. This result was 140.3 percentage points worse than the same quarter last year.

7. Earnings Per Share

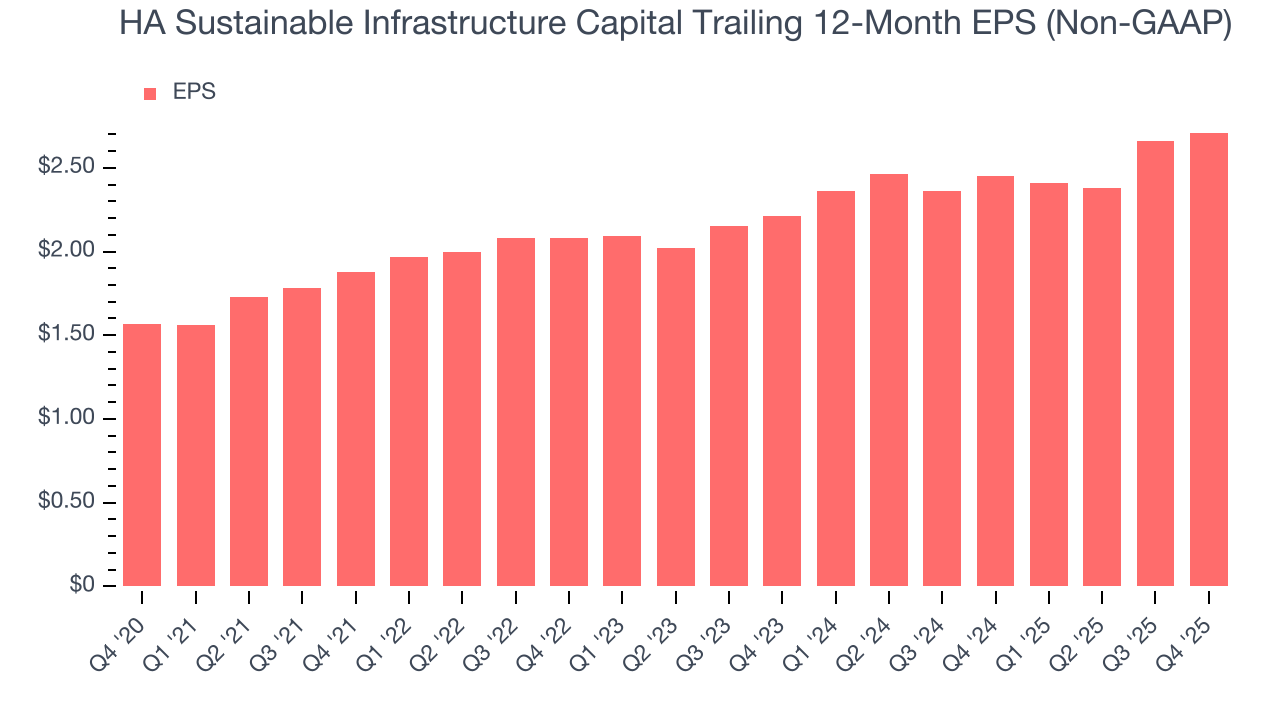

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

HA Sustainable Infrastructure Capital’s EPS grew at a decent 11.5% compounded annual growth rate over the last five years. Despite its pre-tax profit margin improvement during that time, this performance was lower than its 24.9% annualized revenue growth, telling us that non-fundamental factors such as interest and taxes affected its ultimate earnings.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For HA Sustainable Infrastructure Capital, its two-year annual EPS growth of 10.7% is similar to its five-year trend, implying stable earnings power.

In Q4, HA Sustainable Infrastructure Capital reported adjusted EPS of $0.67, up from $0.62 in the same quarter last year. This print beat analysts’ estimates by 1.6%. Over the next 12 months, Wall Street expects HA Sustainable Infrastructure Capital’s full-year EPS of $2.71 to grow 8.4%.

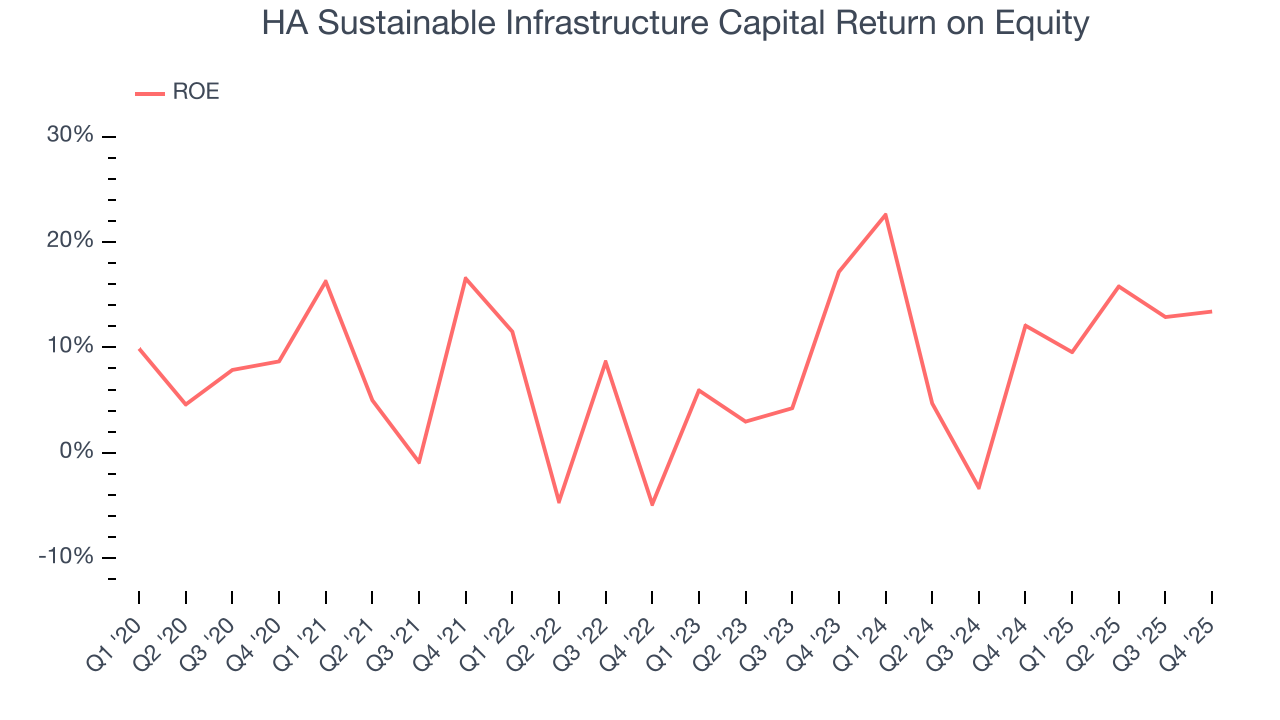

8. Return on Equity

Return on equity, or ROE, tells us how much profit a company generates for each dollar of shareholder equity, a key funding source for banks. Over a long period, banks with high ROE tend to compound shareholder wealth faster through retained earnings, buybacks, and dividends.

Over the last five years, HA Sustainable Infrastructure Capital has averaged an ROE of 8.3%, uninspiring for a company operating in a sector where the average shakes out around 10%.

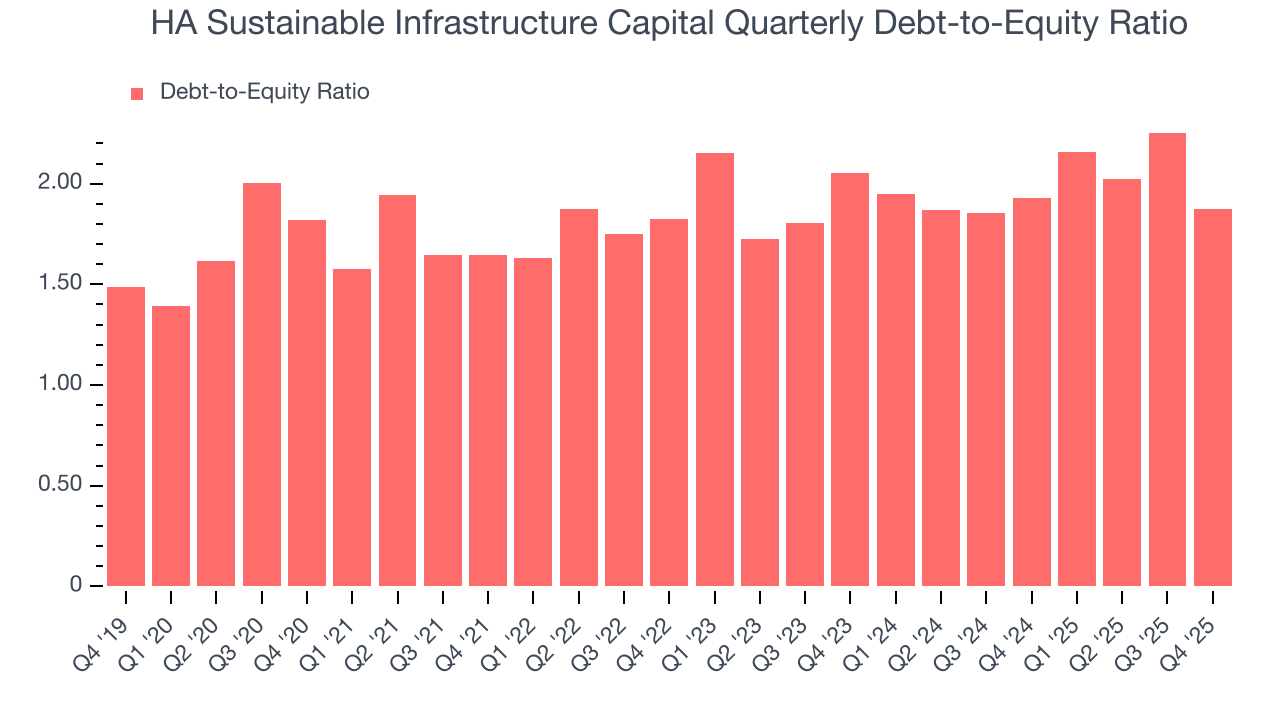

9. Balance Sheet Assessment

The debt-to-equity ratio is a widely used measure to assess a company's balance sheet health. A higher ratio means that a business aggressively financed its growth with debt. This can result in higher earnings (if the borrowed funds are invested profitably) but also increases risk.

If debt levels are too high, there could be difficulties in meeting obligations, especially during economic downturns or periods of rising interest rates if the debt has variable-rate payments.

HA Sustainable Infrastructure Capital currently has $4.98 billion of debt and $2.66 billion of shareholder's equity on its balance sheet, and over the past four quarters, has averaged a debt-to-equity ratio of 2.1×. We think this is safe and raises no red flags. In general, we’re comfortable with any ratio below 3.5× for a financials business.

10. Key Takeaways from HA Sustainable Infrastructure Capital’s Q4 Results

We were impressed by how significantly HA Sustainable Infrastructure Capital blew past analysts’ revenue expectations this quarter. Zooming out, we think this quarter featured some important positives. The stock traded up 7.1% to $38.38 immediately after reporting.

11. Is Now The Time To Buy HA Sustainable Infrastructure Capital?

Updated: February 14, 2026 at 12:00 AM EST

Before investing in or passing on HA Sustainable Infrastructure Capital, we urge you to understand the company’s business quality (or lack thereof), valuation, and the latest quarterly results - in that order.

HA Sustainable Infrastructure Capital is a pretty decent company if you ignore its balance sheet. First off, its revenue growth was exceptional over the last five years. And while HA Sustainable Infrastructure Capital’s mediocre ROE lags the market and is a headwind for its stock price, its expanding pre-tax profit margin shows the business has become more efficient.

HA Sustainable Infrastructure Capital’s P/E ratio based on the next 12 months is 12.2x. All that said, we’d hold off for now because its balance sheet concerns us. We recommend investors interested in the company wait until it generates sufficient cash flows or raises money before getting involved.

Wall Street analysts have a consensus one-year price target of $41.93 on the company (compared to the current share price of $39.84).