Helios (HLIO)

We wouldn’t recommend Helios. Its weak sales growth and low returns on capital show it struggled to generate demand and profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think Helios Will Underperform

Founded on the principle of treating others as one wants to be treated, Helios (NYSE:HLIO) designs, manufactures, and sells motion and electronic control components for various sectors.

- Customers postponed purchases of its products and services this cycle as its revenue declined by 1.8% annually over the last two years

- Earnings per share were flat over the last five years while its revenue grew, showing its incremental sales were less profitable

- Organic revenue growth fell short of our benchmarks over the past two years and implies it may need to improve its products, pricing, or go-to-market strategy

Helios doesn’t meet our quality standards. We’re redirecting our focus to better businesses.

Why There Are Better Opportunities Than Helios

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Helios

At $65.97 per share, Helios trades at 23.6x forward P/E. Yes, this valuation multiple is lower than that of other industrials peers, but we’ll remind you that you often get what you pay for.

We’d rather pay up for companies with elite fundamentals than get a bargain on weak ones. Cheap stocks can be value traps, and as their performance deteriorates, they will stay cheap or get even cheaper.

3. Helios (HLIO) Research Report: Q3 CY2025 Update

Motion control and electronic systems manufacturer Helios Technologies (NYSE:HLIO) reported revenue ahead of Wall Streets expectations in Q3 CY2025, with sales up 13.3% year on year to $220.3 million. Revenue guidance for the full year exceeded analysts’ estimates, but next quarter’s guidance of $197 million was less impressive, coming in 2.1% below expectations. Its non-GAAP profit of $0.72 per share was 9.8% above analysts’ consensus estimates.

Helios (HLIO) Q3 CY2025 Highlights:

- Revenue: $220.3 million vs analyst estimates of $212.5 million (13.3% year-on-year growth, 3.7% beat)

- Adjusted EPS: $0.72 vs analyst estimates of $0.66 (9.8% beat)

- Adjusted EBITDA: $45.1 million vs analyst estimates of $42.36 million (20.5% margin, 6.5% beat)

- Revenue Guidance for Q4 CY2025 is $197 million at the midpoint, below analyst estimates of $201.2 million

- Management raised its full-year Adjusted EPS guidance to $2.47 at the midpoint, a 2.7% increase

- Operating Margin: 0.6%, down from 11.4% in the same quarter last year

- Free Cash Flow Margin: 8.4%, down from 14.8% in the same quarter last year

- Organic Revenue rose 12% year on year vs analyst estimates of 7.5% growth (454.1 basis point beat)

- Market Capitalization: $1.84 billion

Company Overview

Founded on the principle of treating others as one wants to be treated, Helios (NYSE:HLIO) designs, manufactures, and sells motion and electronic control components for various sectors.

The company is structured into two main segments: Hydraulics and Electronics. These segments serve markets including construction, material handling, agriculture, industrial equipment, energy, recreational vehicles, marine, and health and wellness.

The Hydraulics segment produces components for controlling fluid flow and pressure in hydraulic systems, as well as products for fluid conveyance. This includes items such as cartridge valves, manifolds, and quick release couplings. The Electronics segment focuses on creating customized control systems, displays, wire harnesses, and software solutions for a range of applications.

Helios has been working to transition from a holding company model to an integrated operating company. This shift involves implementing the Helios Business System framework, which aims to enhance customer focus, global operations, market diversification, and talent development. However, the success and impact of this transition remain to be fully realized.

The company's revenue is derived from both segments, with Hydraulics typically contributing a larger share. Helios sells through direct channels to original equipment manufacturers (OEMs) and through distributor networks. The company has made several purchases in recent years, including NEM S.r.l., Joyonway, Taimi R&D, Daman Products Company, Schultes Precision Manufacturing, and i3 Product Development. These acquisitions aim to expand product offerings, enhance technological capabilities, and access new markets.

4. Gas and Liquid Handling

Gas and liquid handling companies possess the technical know-how and specialized equipment to handle valuable (and sometimes dangerous) substances. Lately, water conservation and carbon capture–which requires hydrogen and other gasses as well as specialized infrastructure–have been trending up, creating new demand for products such as filters, pumps, and valves. On the other hand, gas and liquid handling companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

Competitors offering similar products include Parker-Hannifin (NYSE:PH), Eaton (NYSE:ETN), and Rexnord (NYSE:RXN).

5. Revenue Growth

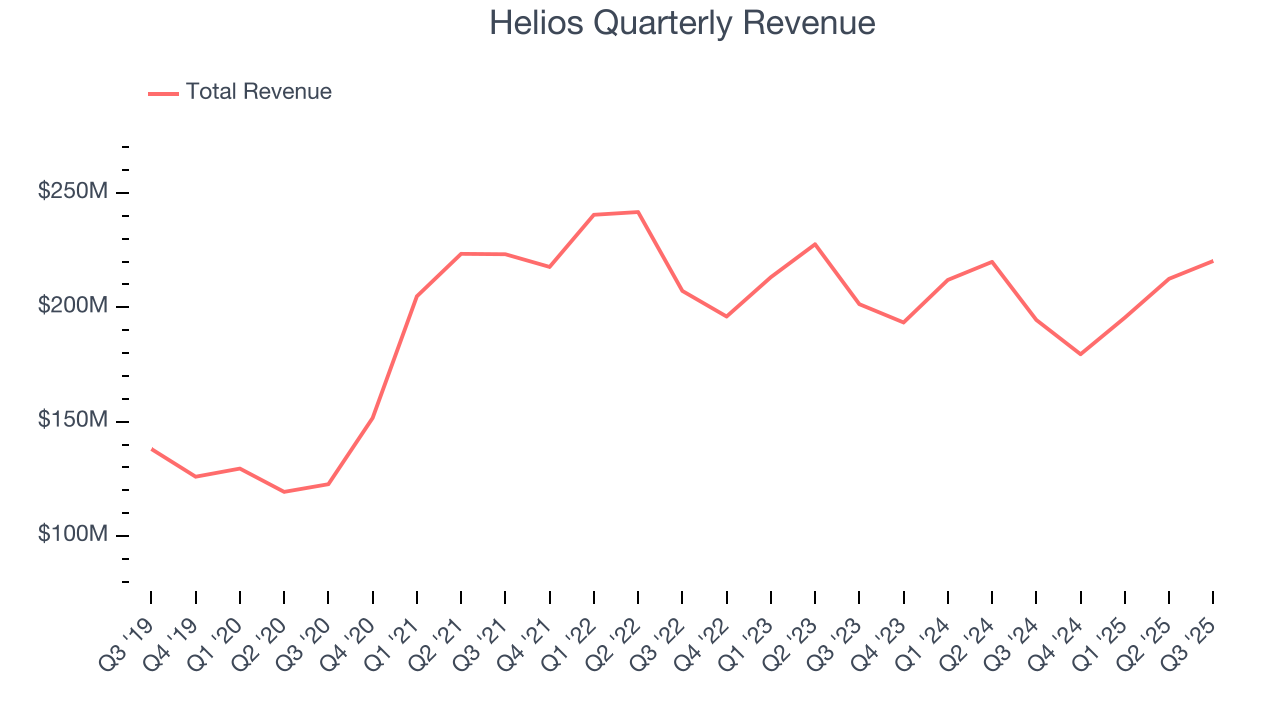

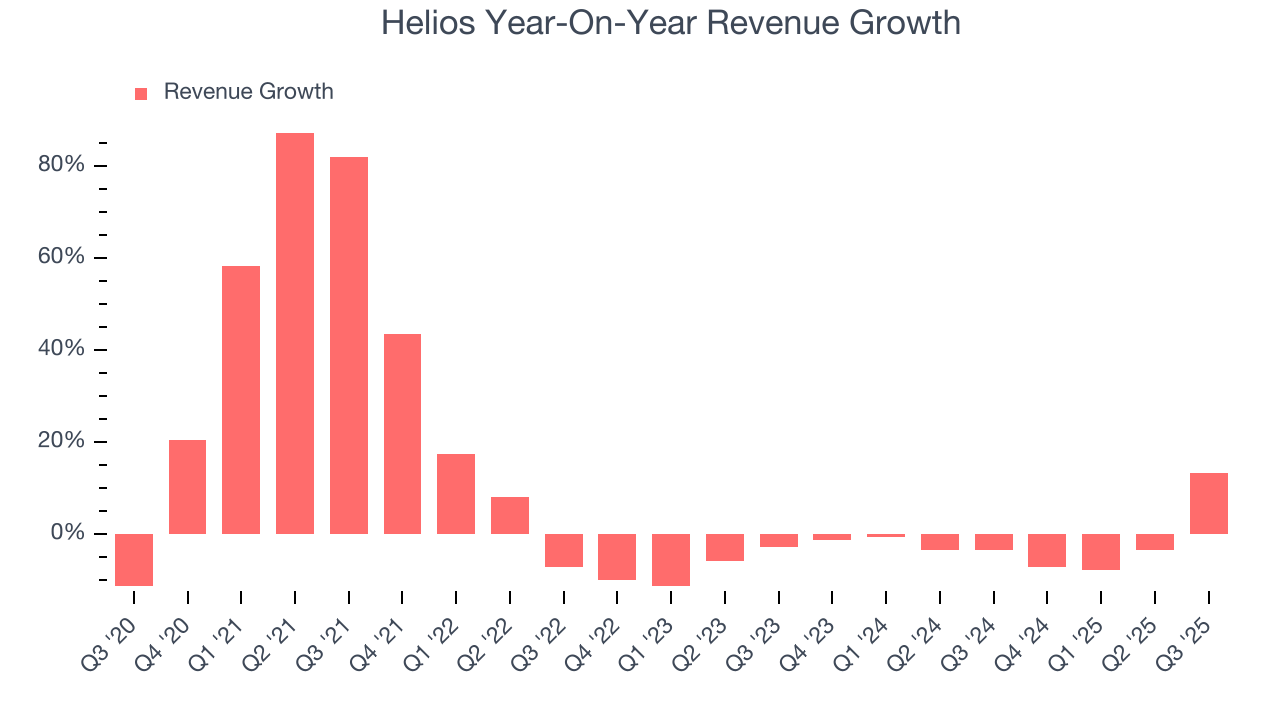

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, Helios grew its sales at a solid 10.2% compounded annual growth rate. Its growth beat the average industrials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Helios’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 1.8% over the last two years.

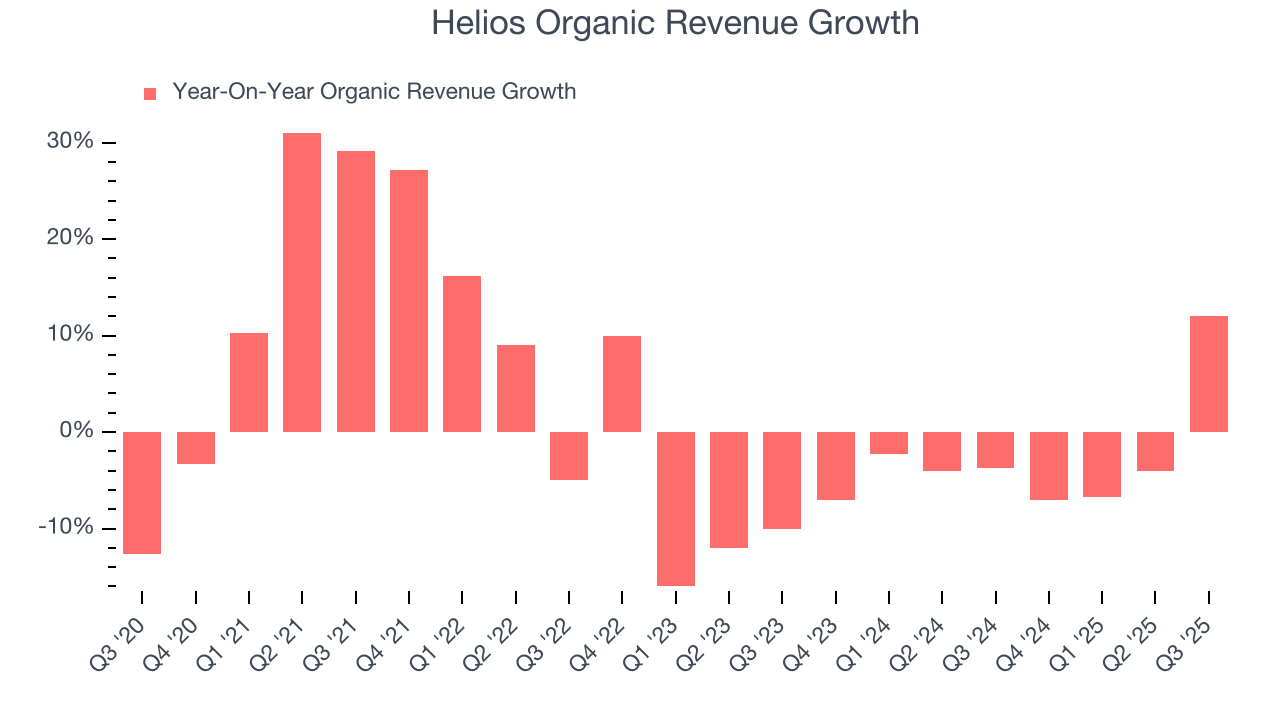

Helios also reports organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, Helios’s organic revenue averaged 2.8% year-on-year declines. Because this number aligns with its two-year revenue growth, we can see the company’s core operations (not acquisitions and divestitures) drove most of its results.

This quarter, Helios reported year-on-year revenue growth of 13.3%, and its $220.3 million of revenue exceeded Wall Street’s estimates by 3.7%. Company management is currently guiding for a 9.7% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to remain flat over the next 12 months. Although this projection implies its newer products and services will fuel better top-line performance, it is still below the sector average.

6. Gross Margin & Pricing Power

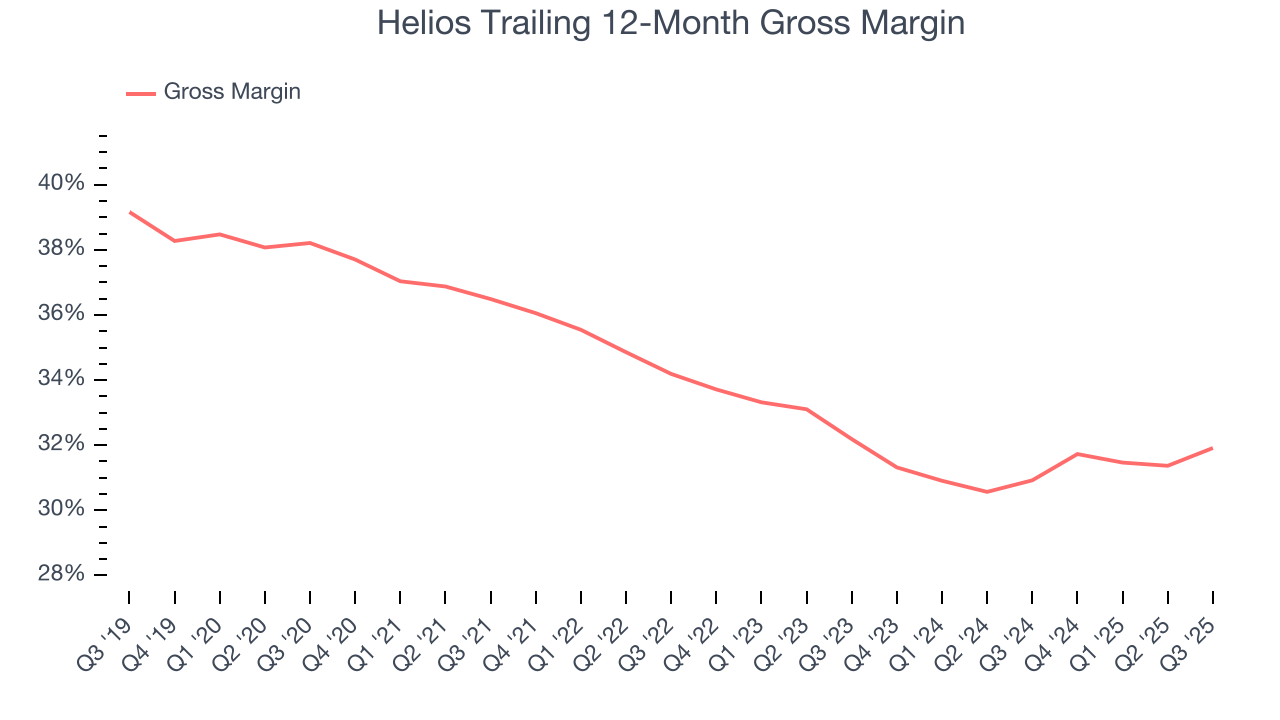

Helios’s gross margin is good compared to other industrials businesses and signals it sells differentiated products, not commodities. As you can see below, it averaged an impressive 33.1% gross margin over the last five years. That means for every $100 in revenue, roughly $33.15 was left to spend on selling, marketing, R&D, and general administrative overhead.

Helios’s gross profit margin came in at 33.1% this quarter, up 2 percentage points year on year. On a wider time horizon, the company’s full-year margin has remained steady over the past four quarters, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

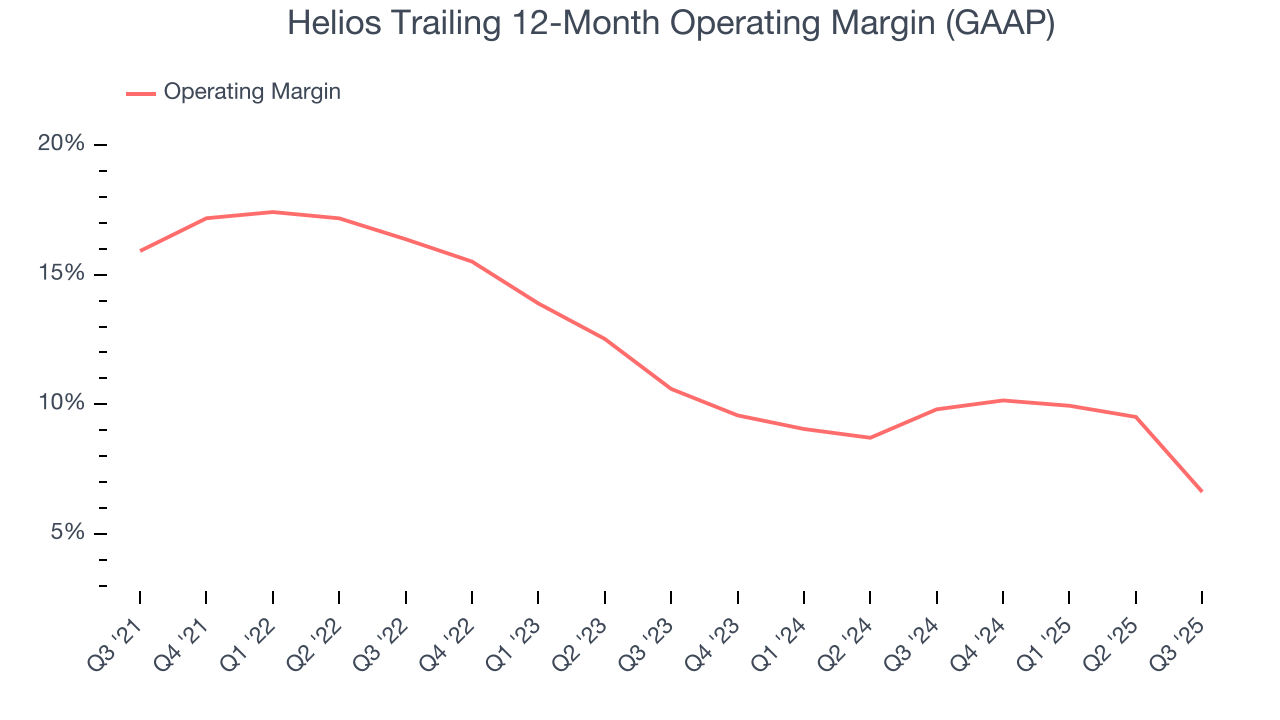

7. Operating Margin

Helios has been an efficient company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 11.9%. This result isn’t too surprising as its gross margin gives it a favorable starting point.

Looking at the trend in its profitability, Helios’s operating margin decreased by 9.3 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q3, Helios’s breakeven margin was down 10.8 percentage points year on year. Conversely, its revenue and gross margin actually rose, so we can assume it was less efficient because its operating expenses like marketing, R&D, and administrative overhead grew faster than its revenue.

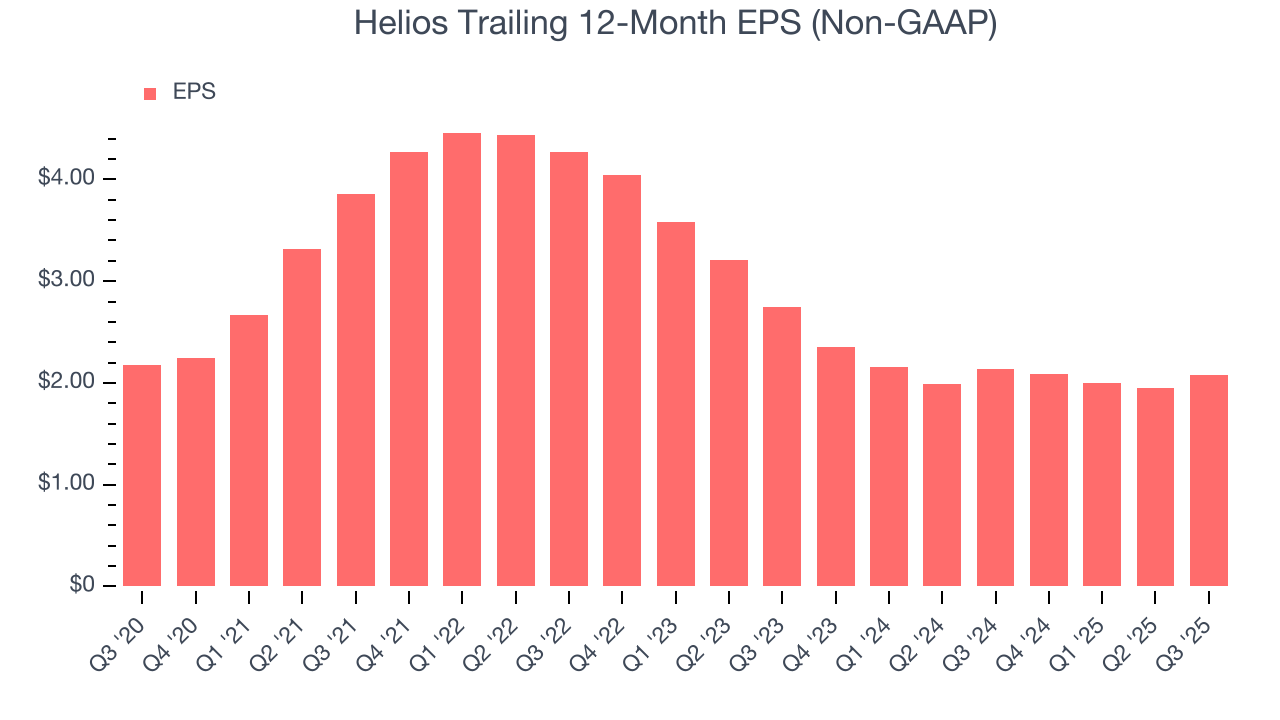

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

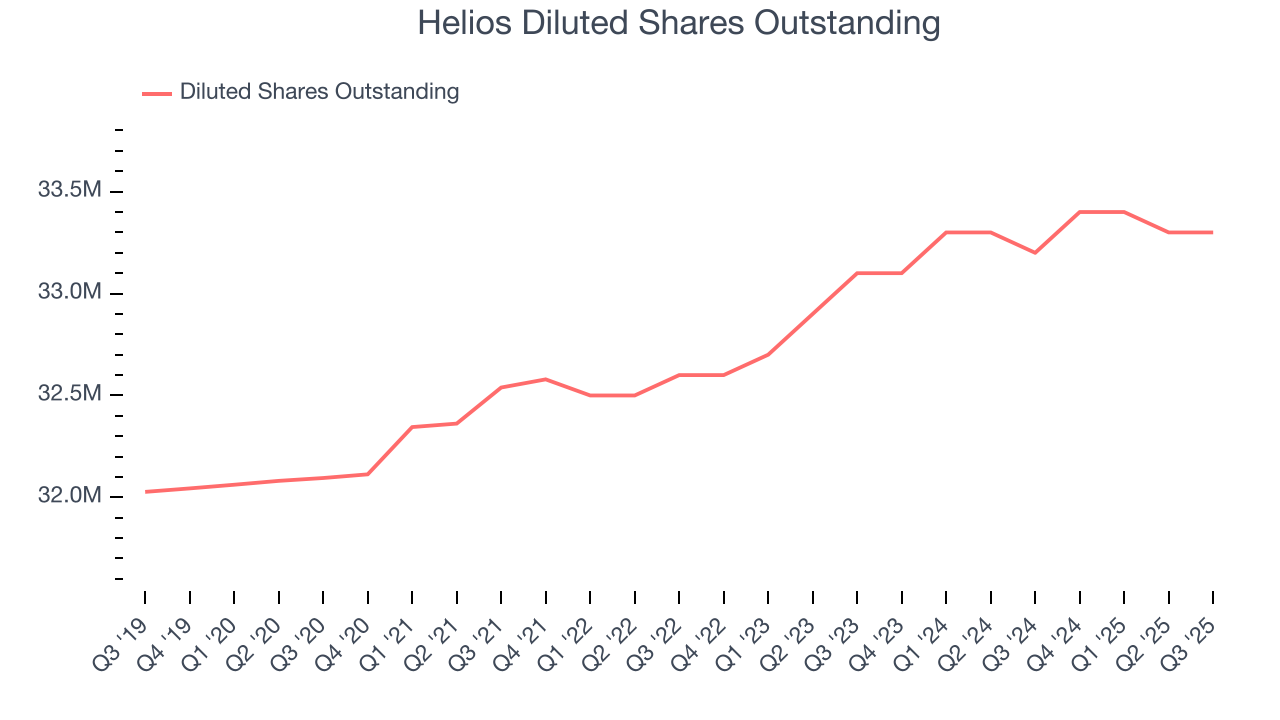

Helios’s flat EPS over the last five years was below its 10.2% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

We can take a deeper look into Helios’s earnings to better understand the drivers of its performance. As we mentioned earlier, Helios’s operating margin declined by 9.3 percentage points over the last five years. Its share count also grew by 3.8%, meaning the company not only became less efficient with its operating expenses but also diluted its shareholders.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Helios, its two-year annual EPS declines of 13% show its recent history was to blame for its underperformance over the last five years. These results were bad no matter how you slice the data.

In Q3, Helios reported adjusted EPS of $0.72, up from $0.59 in the same quarter last year. This print beat analysts’ estimates by 9.8%. Over the next 12 months, Wall Street expects Helios’s full-year EPS of $2.08 to grow 49.3%.

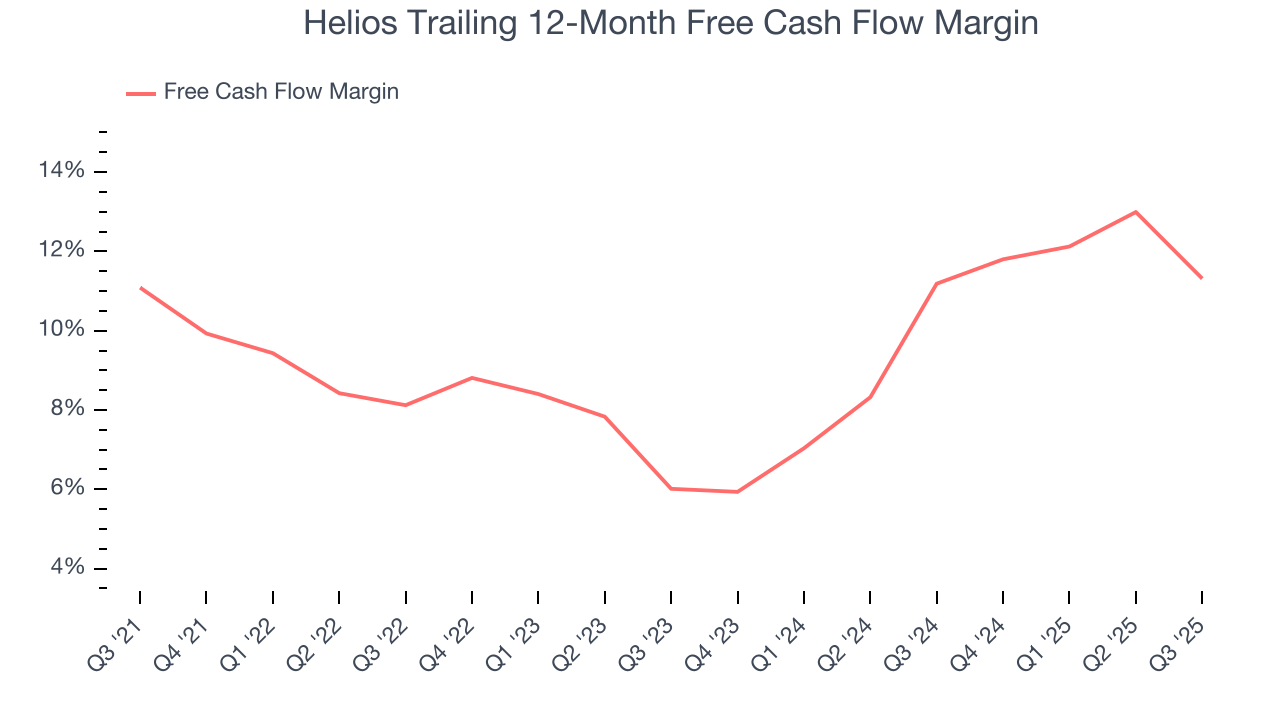

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Helios has shown impressive cash profitability, enabling it to ride out cyclical downturns more easily while maintaining its investments in new and existing offerings. The company’s free cash flow margin averaged 9.5% over the last five years, better than the broader industrials sector.

Helios’s free cash flow clocked in at $18.6 million in Q3, equivalent to a 8.4% margin. The company’s cash profitability regressed as it was 6.4 percentage points lower than in the same quarter last year, prompting us to pay closer attention. Short-term fluctuations typically aren’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

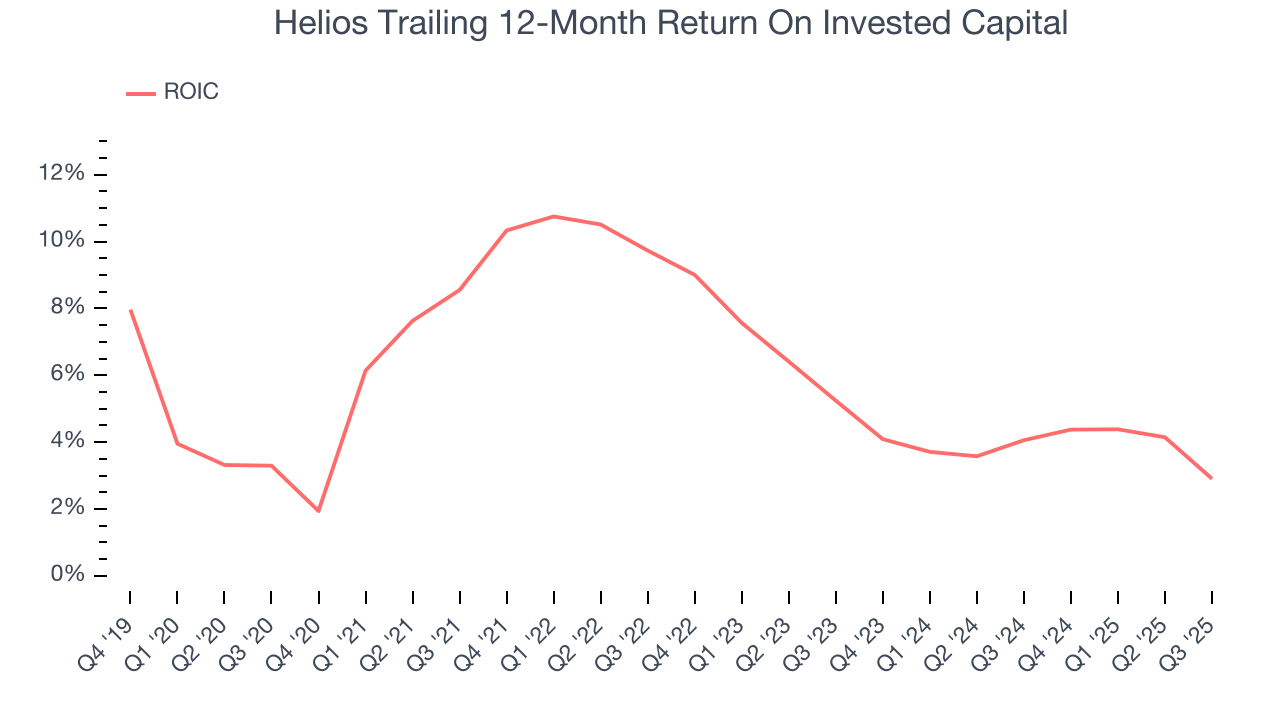

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Helios historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 6.1%, somewhat low compared to the best industrials companies that consistently pump out 20%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Helios’s ROIC has decreased over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

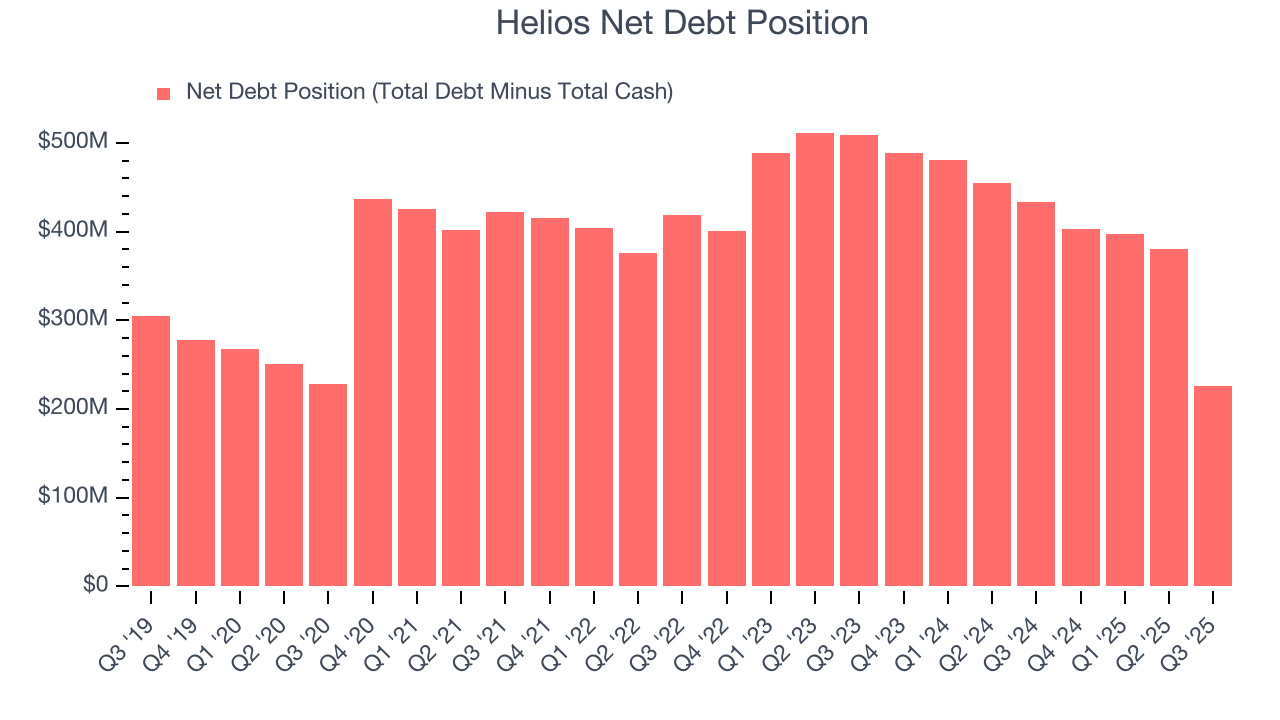

11. Balance Sheet Assessment

Helios reported $54.9 million of cash and $280.3 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $149.6 million of EBITDA over the last 12 months, we view Helios’s 1.5× net-debt-to-EBITDA ratio as safe. We also see its $15.1 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Helios’s Q3 Results

We were impressed by how significantly Helios blew past analysts’ organic revenue expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates by a wide margin. On the other hand, its EPS guidance for next quarter missed and its revenue guidance for next quarter fell short of Wall Street’s estimates. Overall, we think this was still a decent quarter with some key metrics above expectations. The stock traded up 1.4% to $57.43 immediately after reporting.

13. Is Now The Time To Buy Helios?

Updated: January 23, 2026 at 10:54 PM EST

Before making an investment decision, investors should account for Helios’s business fundamentals and valuation in addition to what happened in the latest quarter.

We cheer for all companies making their customers lives easier, but in the case of Helios, we’ll be cheering from the sidelines. Although its revenue growth was solid over the last five years, it’s expected to deteriorate over the next 12 months and its diminishing returns show management's prior bets haven't worked out. And while the company’s projected EPS for the next year implies the company’s fundamentals will improve, the downside is its weak EPS growth over the last five years shows it’s failed to produce meaningful profits for shareholders.

Helios’s P/E ratio based on the next 12 months is 23.6x. At this valuation, there’s a lot of good news priced in - we think there are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $69.17 on the company (compared to the current share price of $65.97).