Hercules Capital (HTGC)

Hercules Capital faces an uphill battle. Its decelerating revenue growth and even worse EPS performance give us little confidence it can beat the market.― StockStory Analyst Team

1. News

2. Summary

Why We Think Hercules Capital Will Underperform

Named after the mythological hero known for his strength, Hercules Capital (NYSE:HTGC) is a business development company that provides debt financing to venture capital-backed and growth-stage technology and life sciences companies.

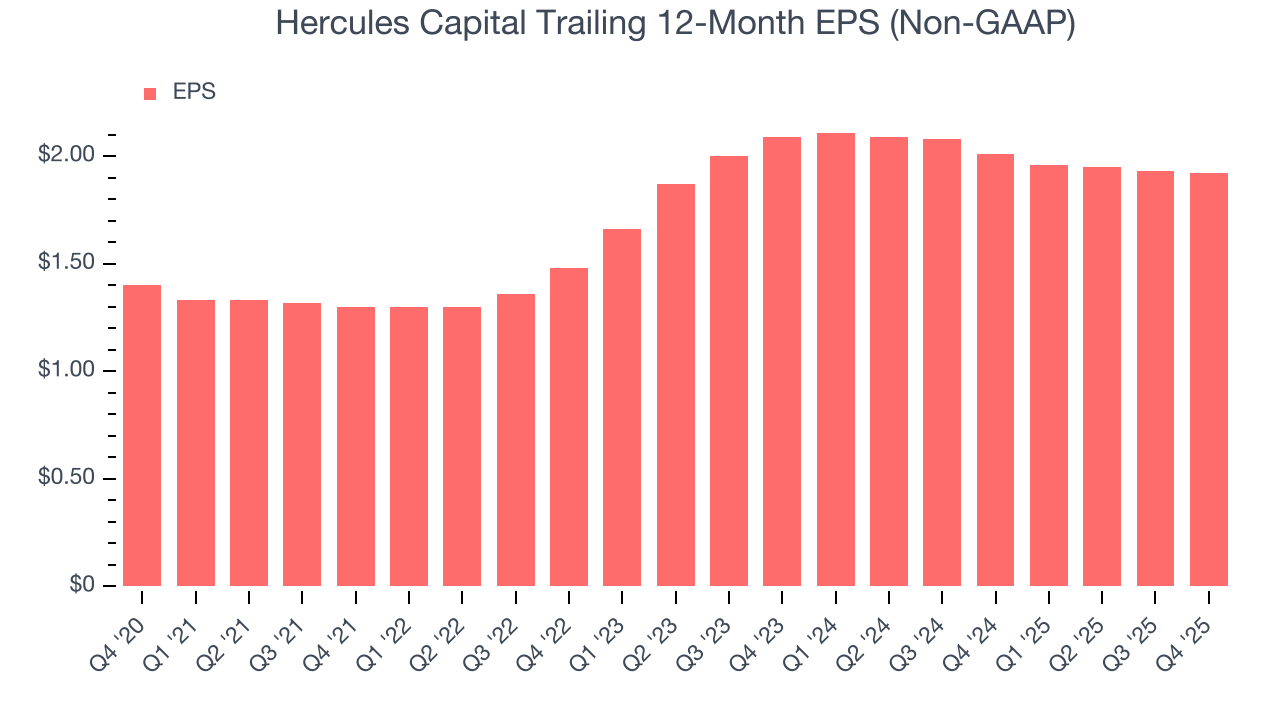

- Performance over the past two years shows its incremental sales were much less profitable, as its earnings per share fell by 4.2% annually

- A consolation is that its ROE punches in at 14.3%, illustrating management’s expertise in identifying profitable investments

Hercules Capital’s quality is inadequate. We’re on the lookout for more interesting opportunities.

Why There Are Better Opportunities Than Hercules Capital

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Hercules Capital

Hercules Capital’s stock price of $15.72 implies a valuation ratio of 8.5x forward P/E. This sure is a cheap multiple, but you get what you pay for.

Cheap stocks can look like great bargains at first glance, but you often get what you pay for. These mediocre businesses often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Hercules Capital (HTGC) Research Report: Q4 CY2025 Update

Specialty finance company Hercules Capital (NYSE:HTGC) fell short of the market’s revenue expectations in Q4 CY2025, but sales rose 12.8% year on year to $137.4 million. Its non-GAAP profit of $0.48 per share was 2.5% below analysts’ consensus estimates.

Hercules Capital (HTGC) Q4 CY2025 Highlights:

- Revenue: $137.4 million vs analyst estimates of $141.5 million (12.8% year-on-year growth, 2.9% miss)

- Operating Income: $86.98 million (63.3% margin, 7.2% year-on-year growth)

- Adjusted EPS: $0.48 vs analyst expectations of $0.49 (2.5% miss)

- Market Capitalization: $2.80 billion

Company Overview

Named after the mythological hero known for his strength, Hercules Capital (NYSE:HTGC) is a business development company that provides debt financing to venture capital-backed and growth-stage technology and life sciences companies.

Hercules Capital operates as a specialty finance firm focused on providing senior secured loans to high-growth, innovative companies in technology, life sciences, and sustainable and renewable technology industries. These loans typically range from $15 million to $100 million and serve as an alternative to equity financing for companies that need capital but want to avoid further ownership dilution.

The company's business model centers on identifying promising ventures that have already secured equity backing from established venture capital firms. This approach allows Hercules to leverage the due diligence and oversight provided by these equity investors while offering complementary debt financing. For example, a biotech company that has completed early clinical trials might secure a Hercules loan to fund its Phase III trials without having to issue additional shares.

Hercules generates revenue primarily through interest payments on its loans, which typically carry higher rates than conventional bank financing, reflecting the higher risk profile of growth-stage companies. The firm also often receives warrant coverage or equity participation rights as part of its financing packages, providing potential upside if portfolio companies succeed.

As a business development company (BDC), Hercules operates under regulations requiring it to distribute at least 90% of its taxable income to shareholders as dividends. This structure makes it a potential income-generating investment vehicle. The company maintains investment professionals with deep sector expertise who evaluate potential borrowers based on their technology, market opportunity, management team, and existing investor support.

4. Specialty Finance

Specialty finance companies provide targeted lending or financial services for specific industries or needs. They benefit from expertise in particular sectors, often reduced competition in specialized niches, and tailored underwriting that can yield higher margins. Challenges include concentration risk in specific industries, difficulty achieving scale efficiencies, and potential vulnerability during sector-specific downturns affecting their specialized markets.

Hercules Capital competes with other business development companies like Ares Capital (NASDAQ:ARCC), TriplePoint Venture Growth (NYSE:TPVG), and Horizon Technology Finance (NASDAQ:HRZN), as well as with venture debt providers such as Silicon Valley Bank (now part of First Citizens BancShares) and specialized divisions of larger financial institutions.

5. Revenue Growth

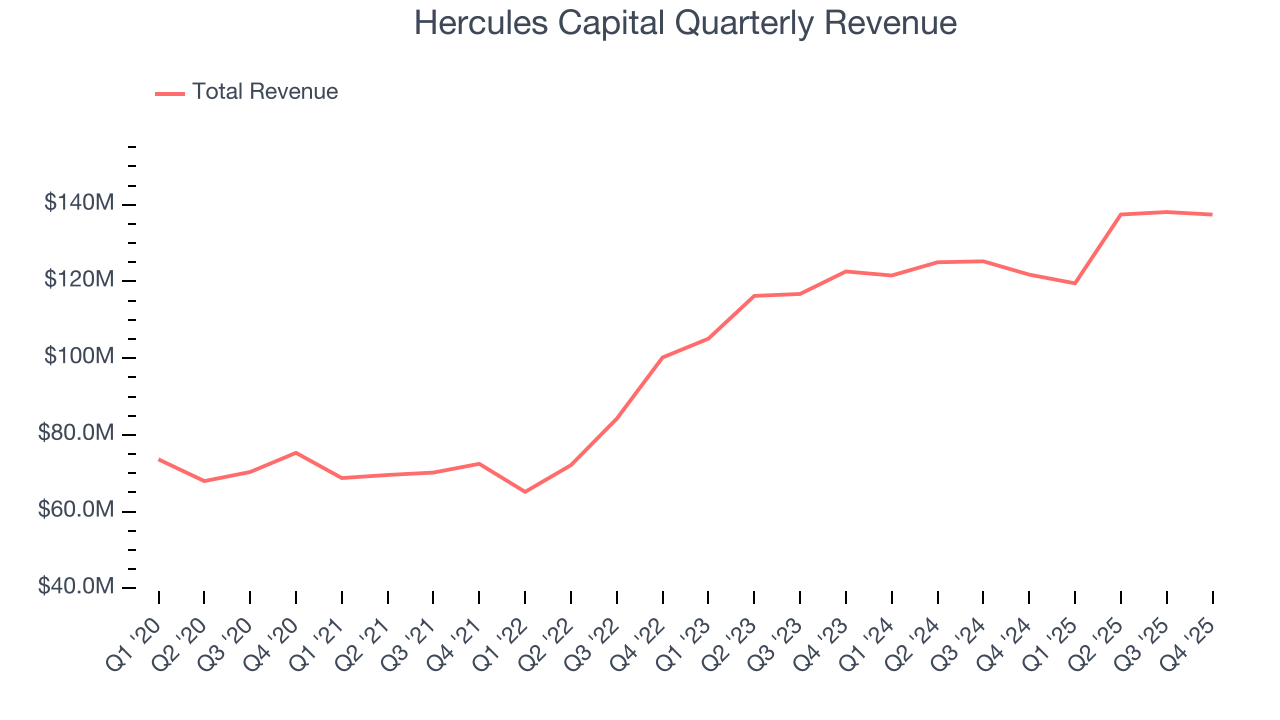

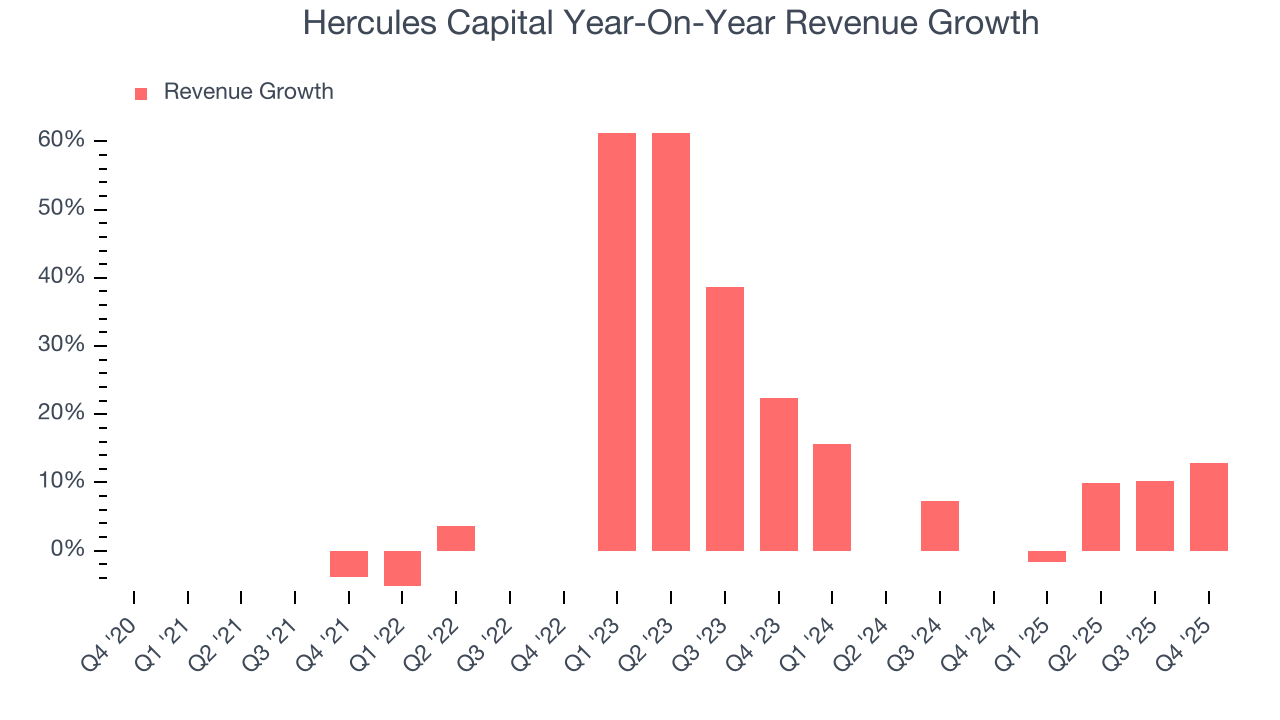

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Hercules Capital grew its revenue at a solid 13.1% compounded annual growth rate. Its growth beat the average financials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. Hercules Capital’s annualized revenue growth of 7.5% over the last two years is below its five-year trend, but we still think the results were respectable.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Hercules Capital’s revenue grew by 12.8% year on year to $137.4 million but fell short of Wall Street’s estimates.

6. Operating Margin

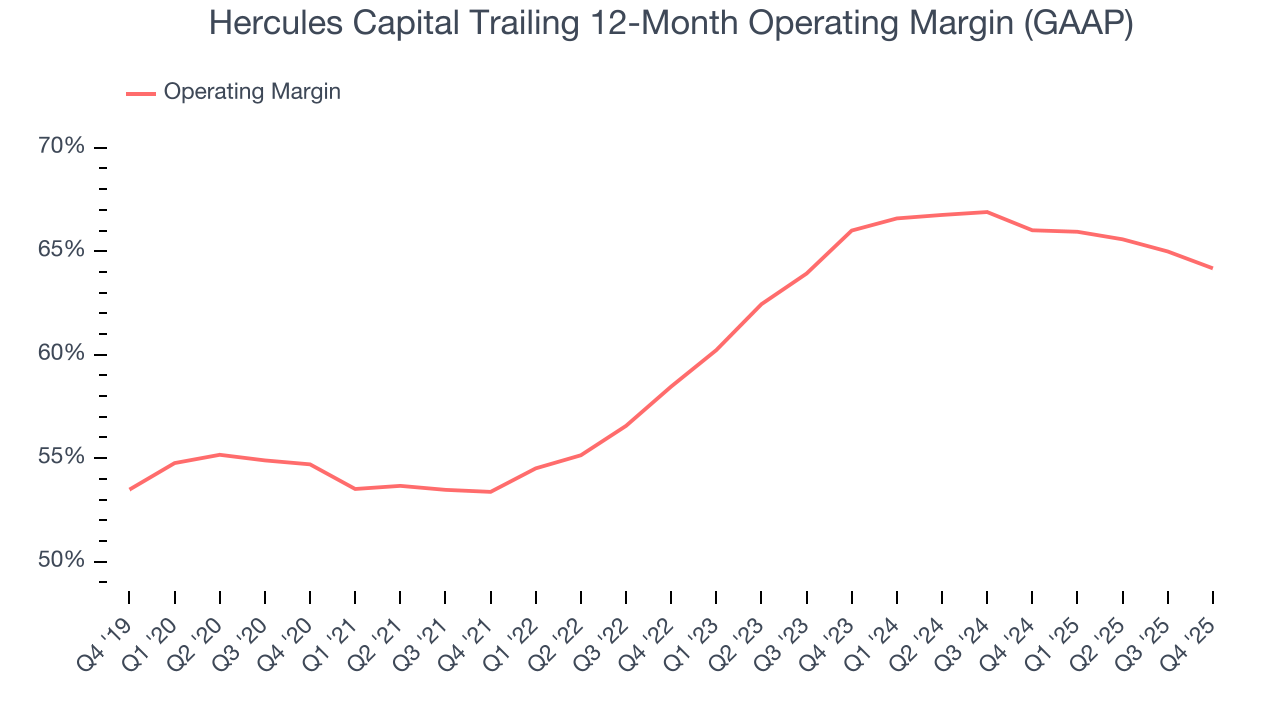

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Over the last five years, Hercules Capital’s operating margin has fallen by 10.8 percentage points, going from 53.4% to 64.2%. However, the company gave back some of its expense savings as its operating margin declined by 1.8 percentage points on a two-year basis.

In Q4, Hercules Capital’s operating margin was 63.3%. This result was 3.3 percentage points worse than the same quarter last year.

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Hercules Capital’s EPS grew at an unimpressive 6.5% compounded annual growth rate over the last five years, lower than its 13.1% annualized revenue growth. However, its operating margin actually improved during this time, telling us that non-fundamental factors such as interest expenses and taxes affected its ultimate earnings.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

Hercules Capital’s two-year annual EPS declines of 4.2% were bad and lower than its 7.5% two-year revenue growth.

We can take a deeper look into Hercules Capital’s earnings to better understand the drivers of its performance. Hercules Capital’s operating margin has declined over the last two years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, Hercules Capital reported adjusted EPS of $0.48, down from $0.49 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects Hercules Capital’s full-year EPS of $1.92 to grow 2.5%.

8. Return on Equity

Return on equity (ROE) reveals the profit generated per dollar of shareholder equity, which represents a key source of bank funding. Banks maintaining elevated ROE levels tend to accelerate wealth creation for shareholders via earnings retention, buybacks, and distributions.

Over the last five years, Hercules Capital has averaged an ROE of 14.3%, healthy for a company operating in a sector where the average shakes out around 10% and those putting up 25%+ are greatly admired. This is a bright spot for Hercules Capital.

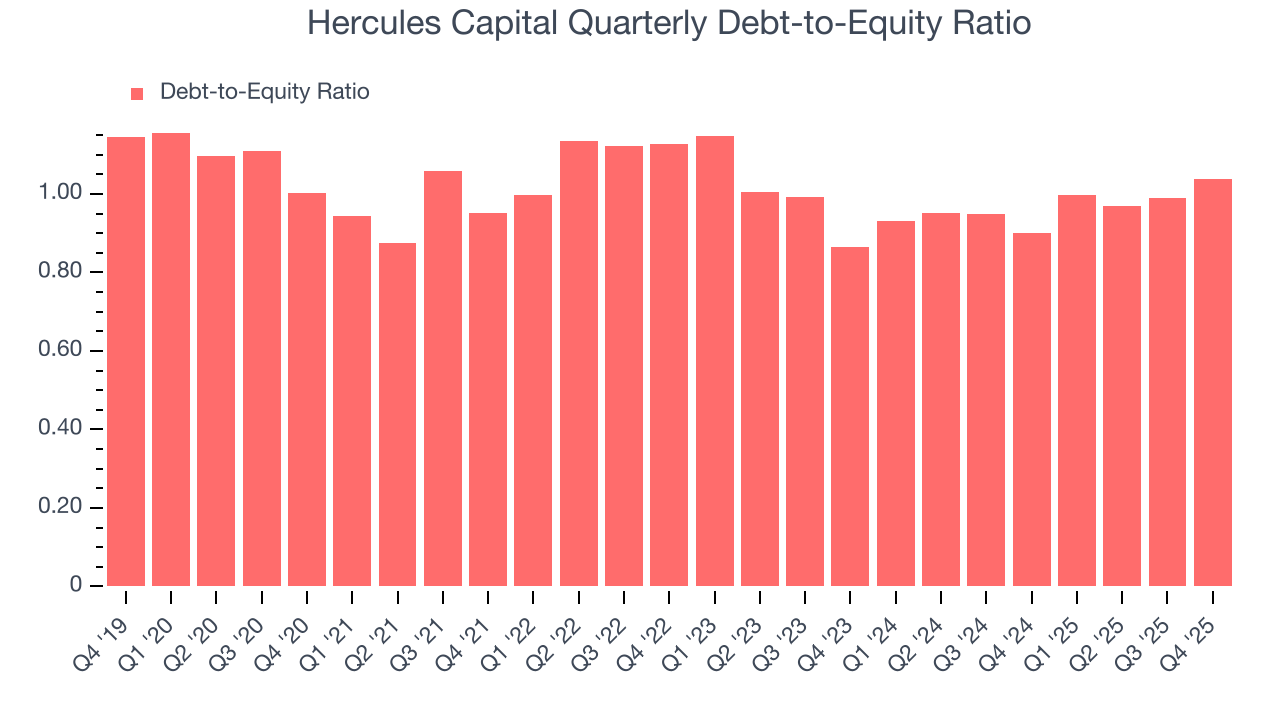

9. Balance Sheet Assessment

The debt-to-equity ratio is a widely used measure to assess a company's balance sheet health. A higher ratio means that a business aggressively financed its growth with debt. This can result in higher earnings (if the borrowed funds are invested profitably) but also increases risk.

If debt levels are too high, there could be difficulties in meeting obligations, especially during economic downturns or periods of rising interest rates if the debt has variable-rate payments.

Hercules Capital currently has $2.30 billion of debt and $2.22 billion of shareholder's equity on its balance sheet, and over the past four quarters, has averaged a debt-to-equity ratio of 1×. We think this is safe and raises no red flags. In general, we’re comfortable with any ratio below 3.5× for a financials business.

10. Key Takeaways from Hercules Capital’s Q4 Results

We struggled to find many positives in these results. Its revenue missed and its EPS fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock remained flat at $15.72 immediately after reporting.

11. Is Now The Time To Buy Hercules Capital?

Updated: February 15, 2026 at 11:49 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Hercules Capital.

We see the value of companies driving economic growth, but in the case of Hercules Capital, we’re out. Although its revenue growth was solid over the last five years, it’s expected to deteriorate over the next 12 months and its unimpressive EPS growth over the last five years shows it’s failed to produce meaningful profits for shareholders.

Hercules Capital’s P/E ratio based on the next 12 months is 8.5x. While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $20.31 on the company (compared to the current share price of $15.72).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.