Hyster-Yale Materials Handling (HY)

Hyster-Yale Materials Handling is in for a bumpy ride. Its sales have underperformed and its low returns on capital show it has few growth opportunities.― StockStory Analyst Team

1. News

2. Summary

Why We Think Hyster-Yale Materials Handling Will Underperform

Playing a significant role in the development of the hydraulic lift truck, Hyster-Yale (NYSE:HY) designs, manufactures, and sells materials handling equipment to various sectors.

- Annual sales declines of 2% for the past two years show its products and services struggled to connect with the market during this cycle

- Falling earnings per share over the last five years has some investors worried as stock prices ultimately follow EPS over the long term

- Sales are projected to tank by 6.4% over the next 12 months as its demand continues evaporating

Hyster-Yale Materials Handling doesn’t meet our quality criteria. We see more lucrative opportunities elsewhere.

Why There Are Better Opportunities Than Hyster-Yale Materials Handling

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Hyster-Yale Materials Handling

Hyster-Yale Materials Handling’s stock price of $33.51 implies a valuation ratio of 13.9x forward EV-to-EBITDA. This multiple is high given its weaker fundamentals.

Paying up for elite businesses with strong earnings potential is better than investing in lower-quality companies with shaky fundamentals. That’s how you avoid big downside over the long term.

3. Hyster-Yale Materials Handling (HY) Research Report: Q3 CY2025 Update

Lift truck and material handling solutions manufacturer Hyster-Yale Materials Handling (NYSE:HY) reported Q3 CY2025 results exceeding the market’s revenue expectations, but sales fell by 3.6% year on year to $979.1 million. Its non-GAAP loss of $0.09 per share was 35.7% above analysts’ consensus estimates.

Hyster-Yale Materials Handling (HY) Q3 CY2025 Highlights:

- Revenue: $979.1 million vs analyst estimates of $955.7 million (3.6% year-on-year decline, 2.5% beat)

- Adjusted EPS: -$0.09 vs analyst estimates of -$0.14 (35.7% beat)

- Adjusted EBITDA: $15.1 million vs analyst estimates of $22.1 million (1.5% margin, 31.7% miss)

- Operating Margin: 0.2%, down from 3.2% in the same quarter last year

- Free Cash Flow Margin: 3.8%, down from 5.9% in the same quarter last year

- Market Capitalization: $631.4 million

Company Overview

Playing a significant role in the development of the hydraulic lift truck, Hyster-Yale (NYSE:HY) designs, manufactures, and sells materials handling equipment to various sectors.

Hyster-Yale Materials Handling, Inc. is an integrated company that specializes in the design, engineering, manufacturing, and servicing of a line of lift trucks and related solutions.

The company operates through its subsidiary Hyster-Yale Group, Inc. (HYG) and is headquartered in Cleveland, Ohio. Hyster-Yale's product portfolio includes lift trucks, attachments, hydrogen fuel cell power products, telematics, automation, and fleet management services.

The company's operations are divided into three main segments based on geographical regions: the Americas, EMEA (Europe, Middle East, and Africa), and JAPIC (Japan, Asia, Pacific, India, and China). In addition to its core lift truck business, the company operates Bolzoni S.p.A., a leading producer of attachments, forks, and lift tables, and Nuvera Fuel Cells, LLC, which focuses on the design and manufacture of hydrogen fuel cell stacks and engines.

The company operates 11+ lift truck manufacturing and assembly facilities globally, with additional facilities for Bolzoni's operations. Additionally, the company operates a joint venture with Wells Fargo Financial Leasing, Inc. to provide dealer and customer financing in the United States, which helps facilitate sales and provides an additional revenue stream through fees and remarketing profits.

4. Professional Tools and Equipment

Automation that increases efficiency and connected equipment that collects analyzable data have been trending, creating new demand. Some professional tools and equipment companies also provide software to accompany measurement or automated machinery, adding a stream of recurring revenues to their businesses. On the other hand, professional tools and equipment companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

Competitors offering similar products include Toyota Material Handling (NYSE:TM), Crown Holdings (NYSE:CCK), and CLARK Material Handling (private).

5. Revenue Growth

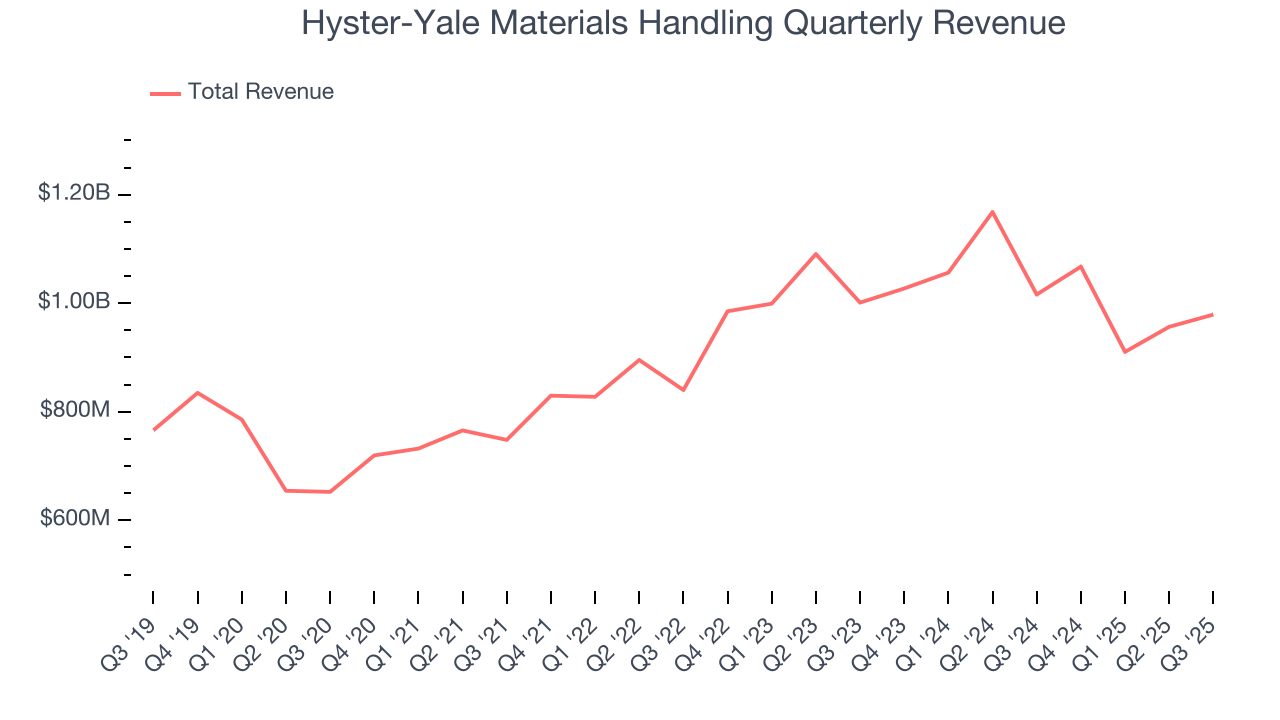

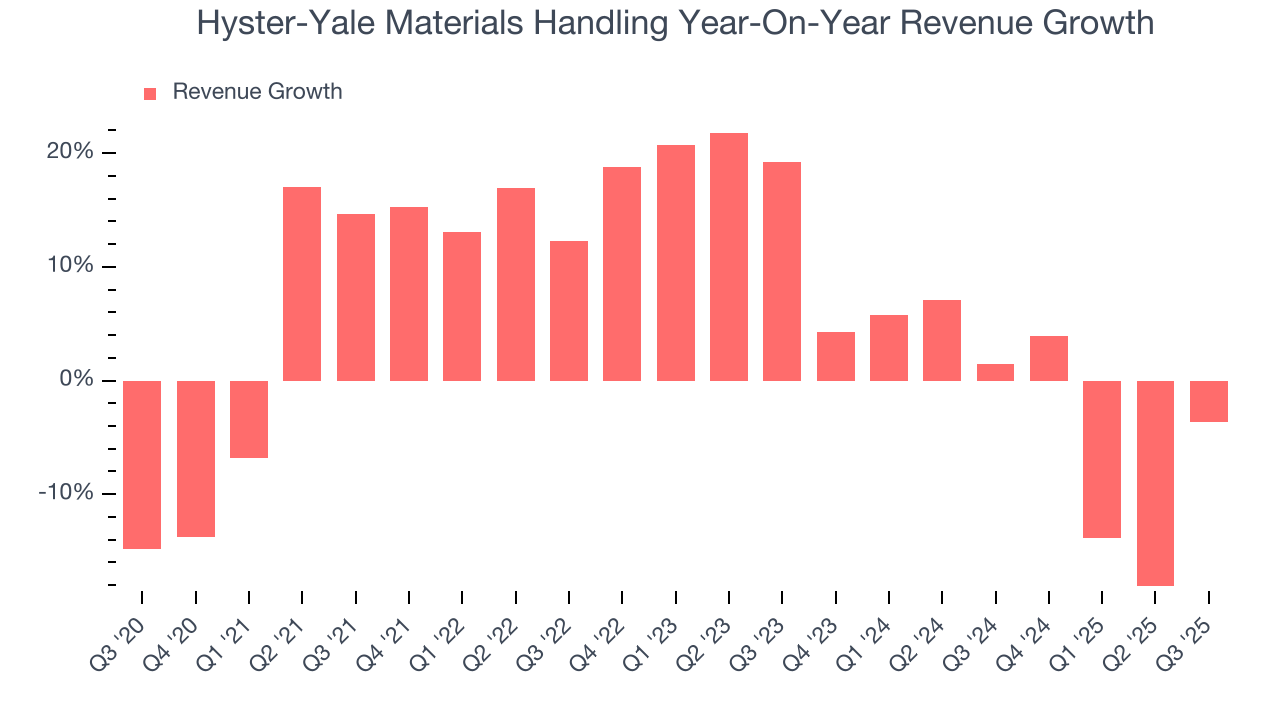

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years. Regrettably, Hyster-Yale Materials Handling’s sales grew at a tepid 6% compounded annual growth rate over the last five years. This fell short of our benchmark for the industrials sector and is a tough starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Hyster-Yale Materials Handling’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 2% annually.

This quarter, Hyster-Yale Materials Handling’s revenue fell by 3.6% year on year to $979.1 million but beat Wall Street’s estimates by 2.5%.

Looking ahead, sell-side analysts expect revenue to decline by 3.3% over the next 12 months, similar to its two-year rate. This projection is underwhelming and indicates its products and services will face some demand challenges.

6. Gross Margin & Pricing Power

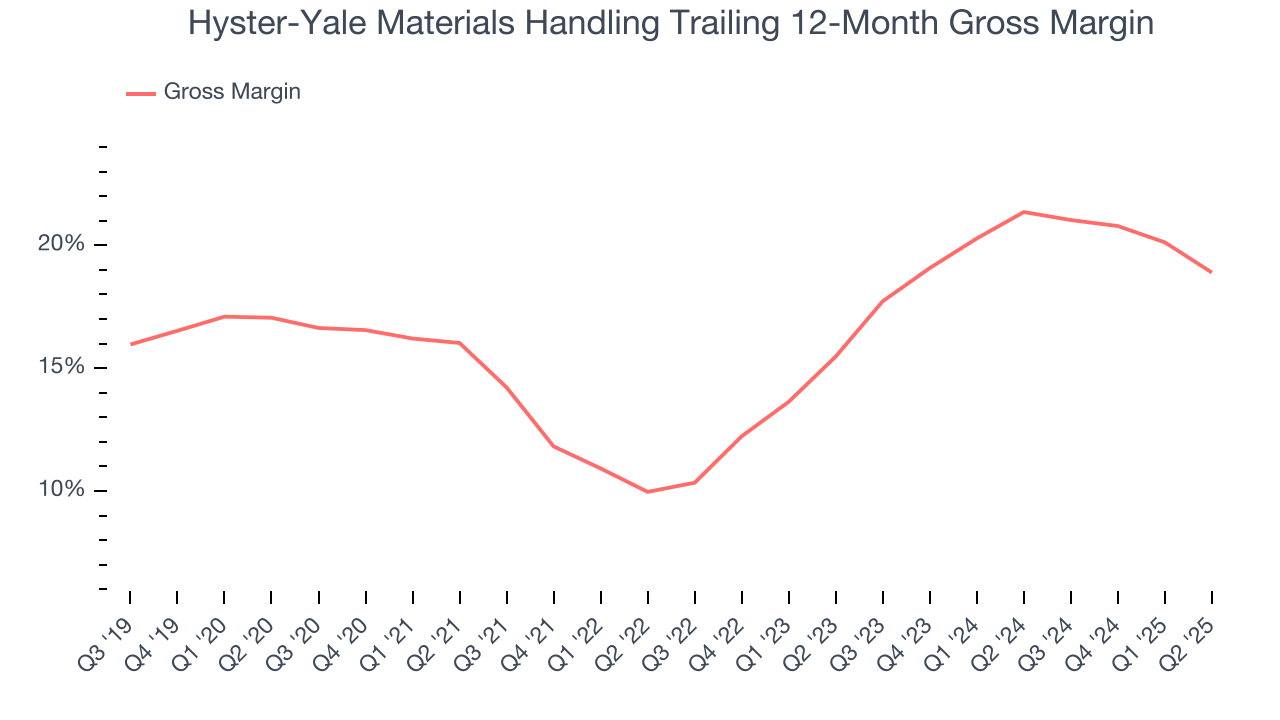

Hyster-Yale Materials Handling has bad unit economics for an industrials business, signaling it operates in a competitive market. As you can see below, it averaged a 16.7% gross margin over the last five years. That means Hyster-Yale Materials Handling paid its suppliers a lot of money ($83.30 for every $100 in revenue) to run its business.

7. Operating Margin

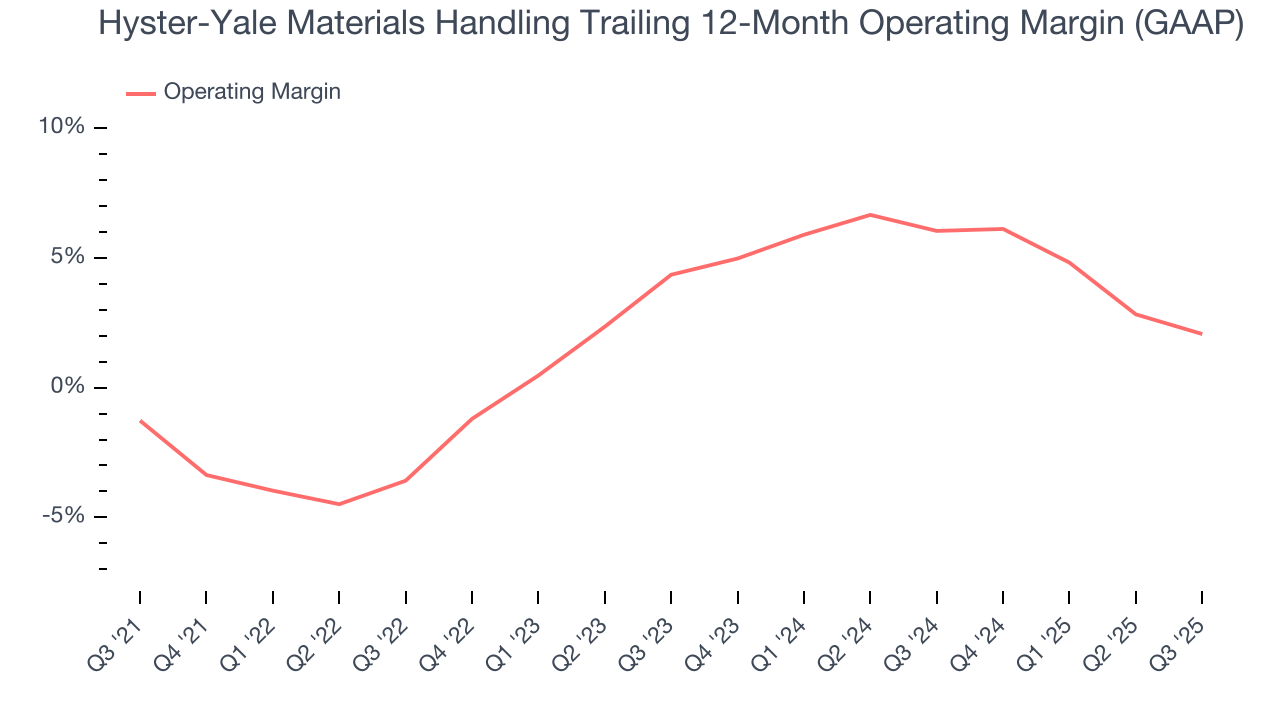

Hyster-Yale Materials Handling was profitable over the last five years but held back by its large cost base. Its average operating margin of 1.9% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

On the plus side, Hyster-Yale Materials Handling’s operating margin rose by 3.3 percentage points over the last five years, as its sales growth gave it operating leverage.

In Q3, Hyster-Yale Materials Handling’s breakeven margin was down 3 percentage points year on year. The contraction shows it was less efficient because its expenses increased relative to its revenue.

8. Earnings Per Share

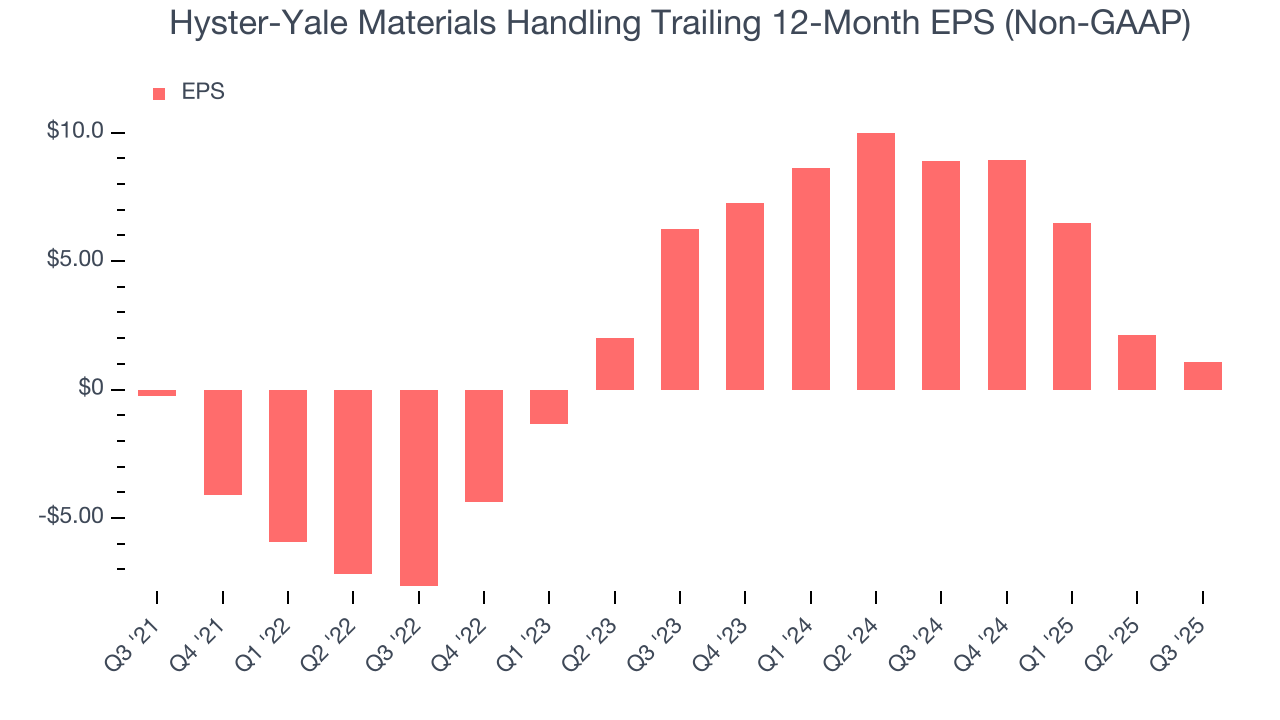

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for Hyster-Yale Materials Handling, its EPS declined by 2.6% annually over the last five years while its revenue grew by 6%. However, its operating margin actually improved during this time, telling us that non-fundamental factors such as interest expenses and taxes affected its ultimate earnings.

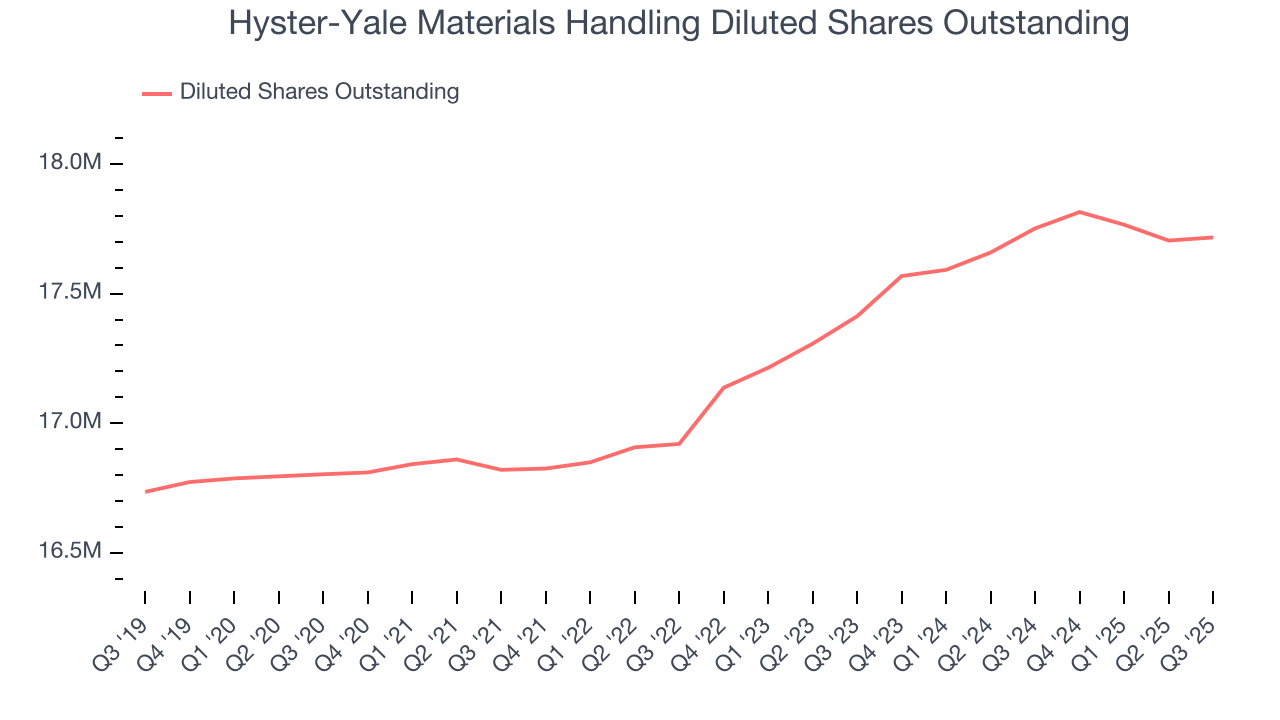

Diving into the nuances of Hyster-Yale Materials Handling’s earnings can give us a better understanding of its performance. A five-year view shows Hyster-Yale Materials Handling has diluted its shareholders, growing its share count by 5.4%. This dilution overshadowed its increased operational efficiency and has led to lower per share earnings. Taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Hyster-Yale Materials Handling, its two-year annual EPS declines of 58.7% show it’s continued to underperform. These results were bad no matter how you slice the data.

In Q3, Hyster-Yale Materials Handling reported adjusted EPS of negative $0.09, down from $0.97 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. We also like to analyze expected EPS growth based on Wall Street analysts’ consensus projections, but there is insufficient data.

9. Cash Is King

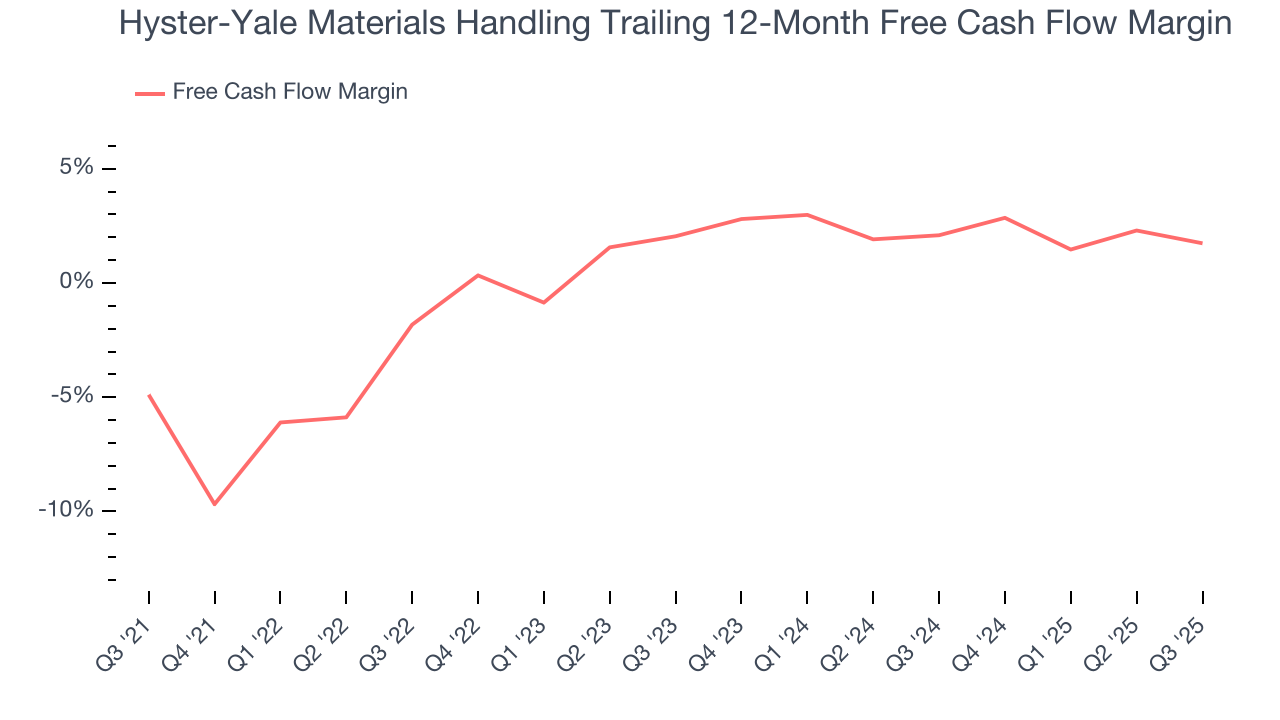

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Hyster-Yale Materials Handling broke even from a free cash flow perspective over the last five years, giving the company limited opportunities to return capital to shareholders.

Taking a step back, an encouraging sign is that Hyster-Yale Materials Handling’s margin expanded by 6.6 percentage points during that time. The company’s improvement shows it’s heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability.

Hyster-Yale Materials Handling’s free cash flow clocked in at $37.1 million in Q3, equivalent to a 3.8% margin. The company’s cash profitability regressed as it was 2.1 percentage points lower than in the same quarter last year, but it’s still above its five-year average. We wouldn’t put too much weight on this quarter’s decline because investment needs can be seasonal, causing short-term swings. Long-term trends are more important.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Hyster-Yale Materials Handling historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 4.5%, lower than the typical cost of capital (how much it costs to raise money) for industrials companies.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Hyster-Yale Materials Handling’s ROIC has increased. This is a good sign, but we recognize its lack of profitable growth during the COVID era was the primary reason for the change.

11. Balance Sheet Assessment

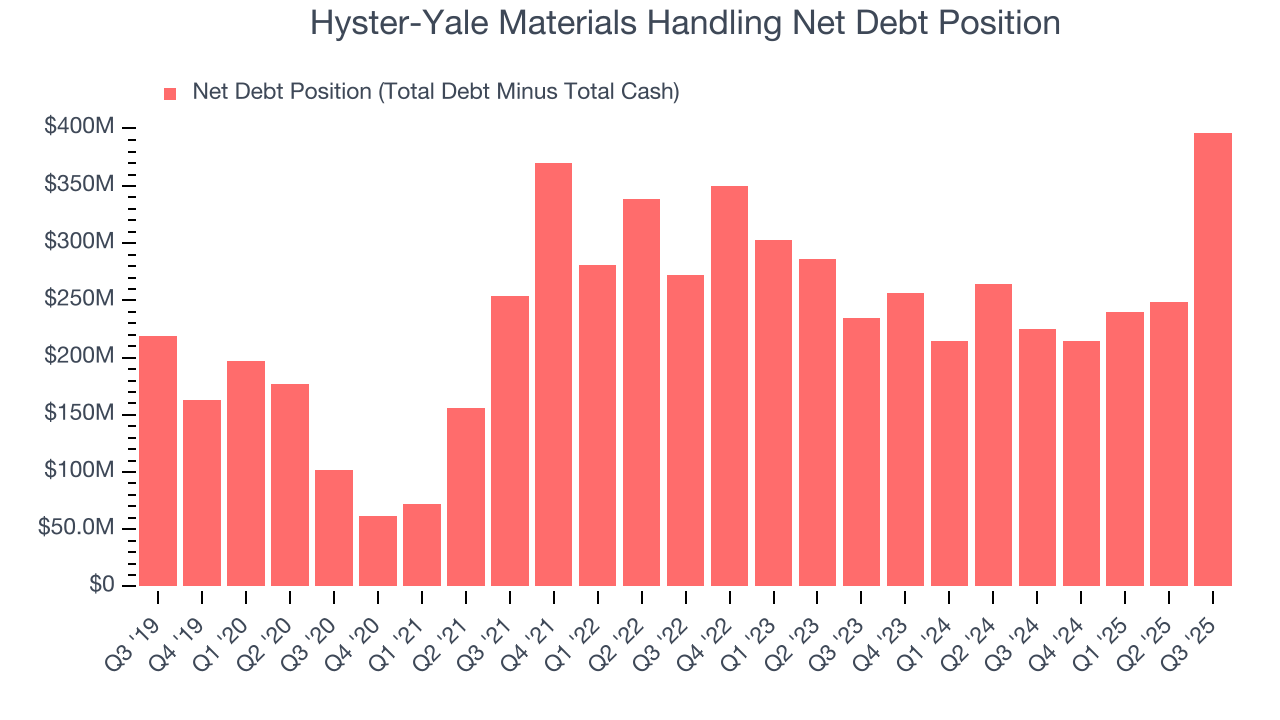

Hyster-Yale Materials Handling reported $71.1 million of cash and $467.8 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $136 million of EBITDA over the last 12 months, we view Hyster-Yale Materials Handling’s 2.9× net-debt-to-EBITDA ratio as safe. We also see its $23.3 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Hyster-Yale Materials Handling’s Q3 Results

It was good to see Hyster-Yale Materials Handling beat analysts’ EPS expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. On the other hand, its EBITDA missed. Overall, this print had some key positives. The market seemed to be hoping for more, and the stock traded down 1.4% to $34.15 immediately after reporting.

13. Is Now The Time To Buy Hyster-Yale Materials Handling?

Updated: January 24, 2026 at 10:00 PM EST

Are you wondering whether to buy Hyster-Yale Materials Handling or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

We cheer for all companies making their customers lives easier, but in the case of Hyster-Yale Materials Handling, we’ll be cheering from the sidelines. To begin with, its revenue growth was uninspiring over the last five years, and analysts expect its demand to deteriorate over the next 12 months. And while its rising cash profitability gives it more optionality, the downside is its projected EPS for the next year is lacking. On top of that, its declining EPS over the last five years makes it a less attractive asset to the public markets.

Hyster-Yale Materials Handling’s EV-to-EBITDA ratio based on the next 12 months is 13.9x. This multiple tells us a lot of good news is priced in - we think there are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $36.50 on the company (compared to the current share price of $33.51).