IBM (IBM)

IBM is intriguing. Although its sales growth has been weak, its profitability gives it the flexibility to ride out cycles.― StockStory Analyst Team

1. News

2. Summary

Why IBM Is Interesting

With a corporate history spanning over a century and once known for its iconic mainframe computers, IBM (NYSE:IBM) provides hybrid cloud computing platforms, AI solutions, consulting services, and enterprise infrastructure to help businesses modernize their operations.

- Dominant market position is represented by its $67.54 billion in revenue and gives it fixed cost leverage when sales grow

- Impressive free cash flow profitability enables the company to fund new investments or reward investors with share buybacks/dividends, and its recently improved profitability means it has even more resources to invest or distribute

- A drawback is its annual sales growth of 4.1% over the last five years lagged behind its business services peers as its large revenue base made it difficult to generate incremental demand

IBM is close to becoming a high-quality business. This company is a good candidate for your watchlist.

Why Should You Watch IBM

High Quality

Investable

Underperform

Why Should You Watch IBM

IBM is trading at $316.72 per share, or 23.9x forward P/E. IBM’s valuation is richer than that of other business services companies, on average.

IBM can improve its fundamentals over time by putting up good numbers quarter after quarter, year after year. Once that happens, we’ll be happy to recommend the stock.

3. IBM (IBM) Research Report: Q4 CY2025 Update

Technology and consulting giant IBM (NYSE:IBM) announced better-than-expected revenue in Q4 CY2025, with sales up 12.1% year on year to $19.69 billion. Its non-GAAP profit of $4.52 per share was 5.4% above analysts’ consensus estimates.

IBM (IBM) Q4 CY2025 Highlights:

- Revenue: $19.69 billion vs analyst estimates of $19.21 billion (12.1% year-on-year growth, 2.5% beat)

- Adjusted EPS: $4.52 vs analyst estimates of $4.29 (5.4% beat)

- Adjusted EBITDA: $6.5 billion vs analyst estimates of $6.19 billion (33% margin, 5.1% beat)

- 2026 Guidance: "We enter 2026 with momentum and in a position of strength, giving us confidence in our full-year expectations of more than 5 percent constant currency revenue growth and an increase of about $1 billion in year-over-year free cash flow"

- Operating Margin: 21.1%, down from 22.3% in the same quarter last year

- Free Cash Flow Margin: 32.9%, down from 35.1% in the same quarter last year

- Market Capitalization: $274.7 billion

Company Overview

With a corporate history spanning over a century and once known for its iconic mainframe computers, IBM (NYSE:IBM) provides hybrid cloud computing platforms, AI solutions, consulting services, and enterprise infrastructure to help businesses modernize their operations.

IBM operates through four main business segments that work together to deliver its hybrid cloud and AI strategy. The Software segment offers solutions for hybrid cloud environments, data management, automation, and cybersecurity, including the Red Hat portfolio with its OpenShift platform that allows businesses to build and manage applications across different computing environments.

The Consulting segment helps clients implement technology solutions and transform business processes, working with both IBM's own technologies and those from ecosystem partners like Salesforce, SAP, and Microsoft. Consultants use methodologies like the IBM Garage to co-create solutions with clients that leverage AI and automation.

The Infrastructure segment provides the hardware foundation for enterprise computing, including the zSystems mainframes that process millions of secure transactions for banks, airlines, and retailers. This segment also includes Power servers optimized for data-intensive workloads, storage solutions, and infrastructure support services.

The Financing segment helps clients acquire IBM products and services through various financing options, typically for mission-critical systems that support core business operations.

IBM's research division, one of the world's largest corporate research organizations, continues to drive innovation in emerging technologies. A business might use IBM's technology stack to modernize its IT infrastructure, deploy AI models to improve customer service, and engage IBM consultants to redesign workflows that take advantage of these capabilities—all while using IBM financing to manage the investment.

4. IT Services & Consulting

IT Services & Consulting companies stand to benefit from increasing enterprise demand for digital transformation, AI-driven automation, and cybersecurity resilience. Many enterprises can't attack these topics alone and need IT services and consulting on everything from technical advice to implementation. Challenges in meeting these needs will include finding talent in specialized and evolving IT fields. While AI and automation can enhance productivity, they also threaten to commoditize certain consulting functions. Another ongoing challenge will be pricing pressures from offshore IT service providers, which have lower labor costs and increasingly equal access to advanced technology like AI.

IBM competes with cloud and software providers like Microsoft (NASDAQ:MSFT), Amazon Web Services (NASDAQ:AMZN), and Oracle (NYSE:ORCL); consulting firms such as Accenture (NYSE:ACN) and Capgemini; and hardware manufacturers including Dell Technologies (NYSE:DELL) and Hewlett Packard Enterprise (NYSE:HPE).

5. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

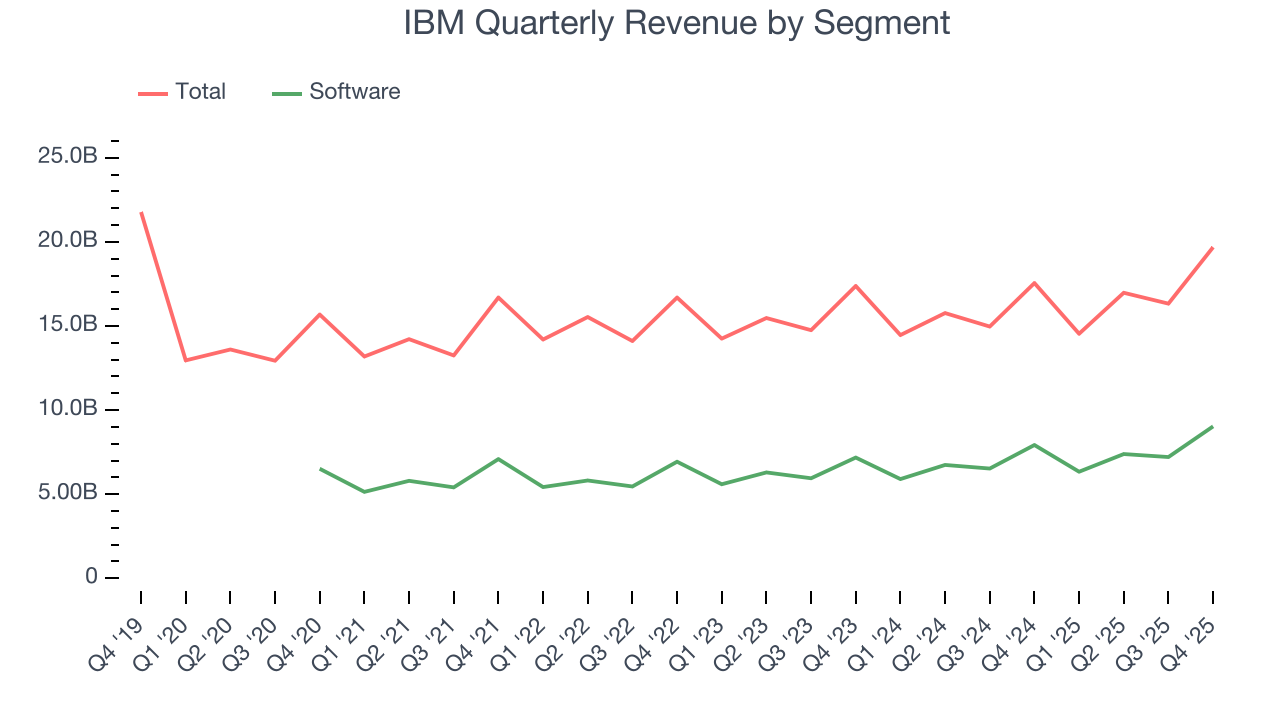

With $67.54 billion in revenue over the past 12 months, IBM is a behemoth in the business services sector and benefits from economies of scale, giving it an edge in distribution. This also enables it to gain more leverage on its fixed costs than smaller competitors and the flexibility to offer lower prices. However, its scale is a double-edged sword because finding new avenues for growth becomes difficult when you already have a substantial market presence. To accelerate sales, IBM likely needs to optimize its pricing or lean into new offerings and international expansion.

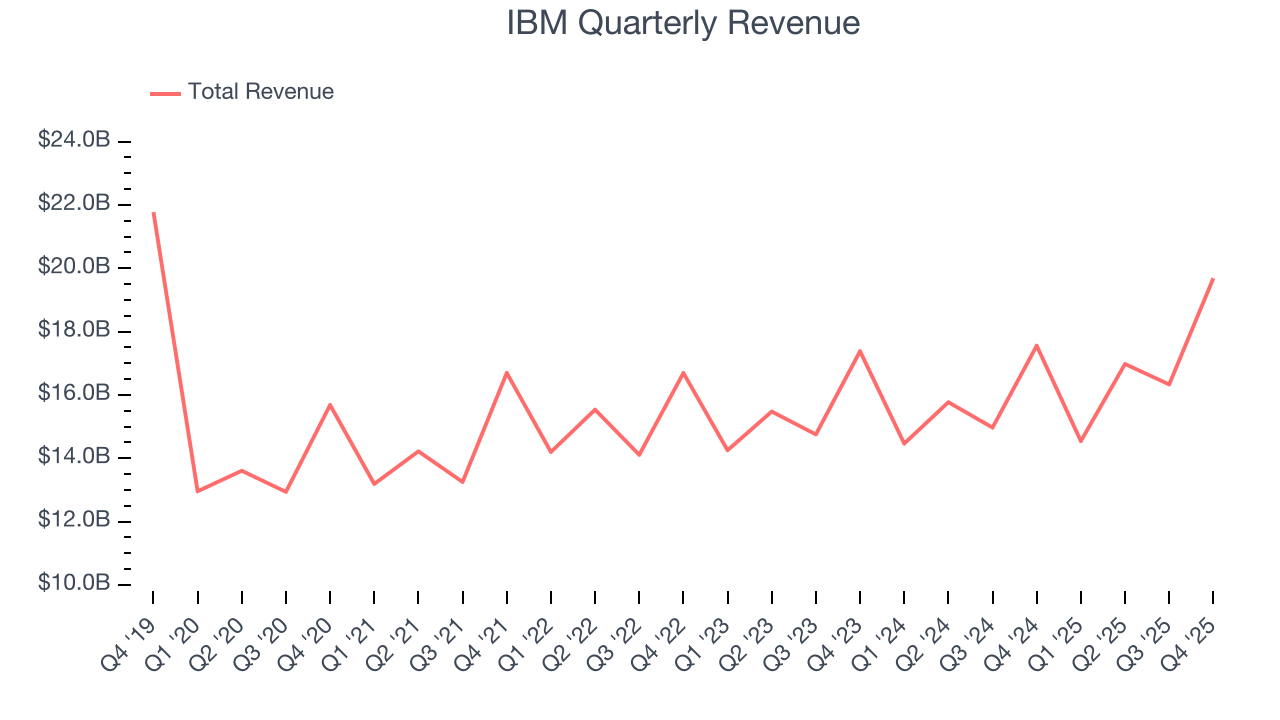

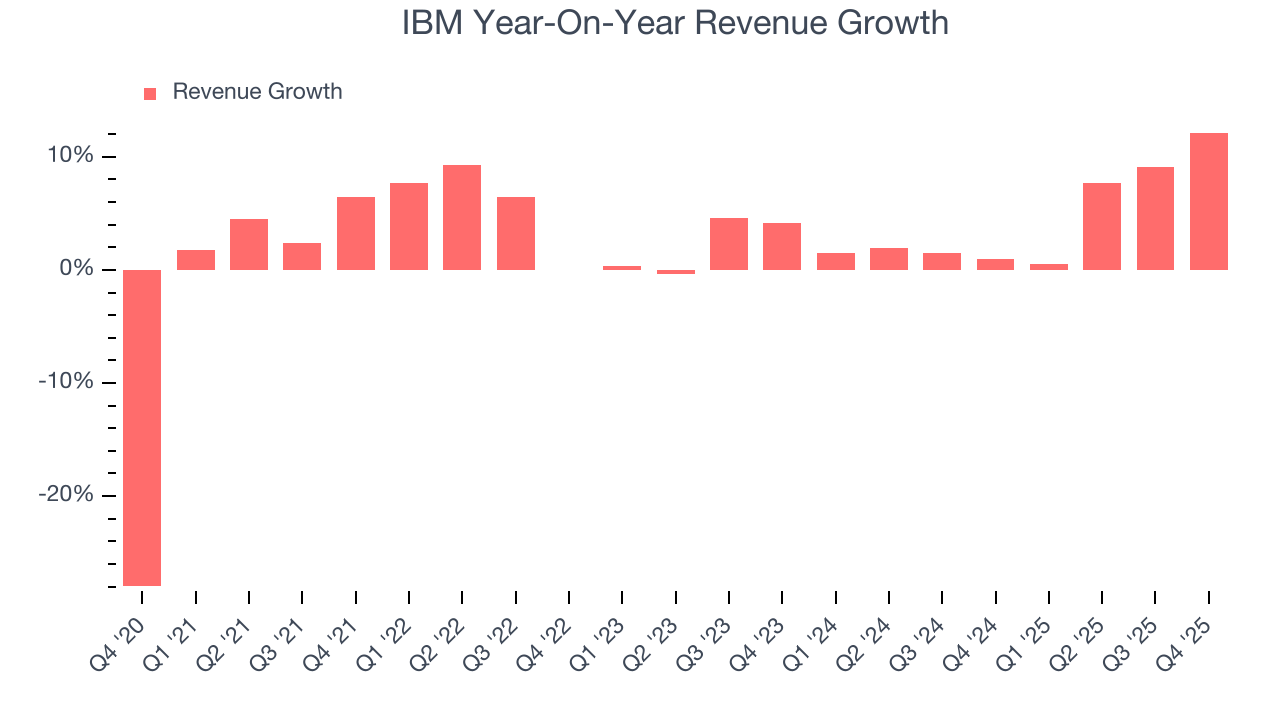

As you can see below, IBM grew its sales at a mediocre 4.1% compounded annual growth rate over the last five years. This shows it couldn’t generate demand in any major way and is a tough starting point for our analysis.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. IBM’s annualized revenue growth of 4.5% over the last two years aligns with its five-year trend, suggesting its demand was consistently weak.

We can dig further into the company’s revenue dynamics by analyzing its most important segment, Software. Over the last two years, IBM’s Software revenue averaged 9.3% year-on-year growth. This segment has outperformed its total sales during the same period, lifting the company’s performance.

This quarter, IBM reported year-on-year revenue growth of 12.1%, and its $19.69 billion of revenue exceeded Wall Street’s estimates by 2.5%.

Looking ahead, sell-side analysts expect revenue to grow 4% over the next 12 months, similar to its two-year rate. This projection is underwhelming and implies its newer products and services will not accelerate its top-line performance yet.

6. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

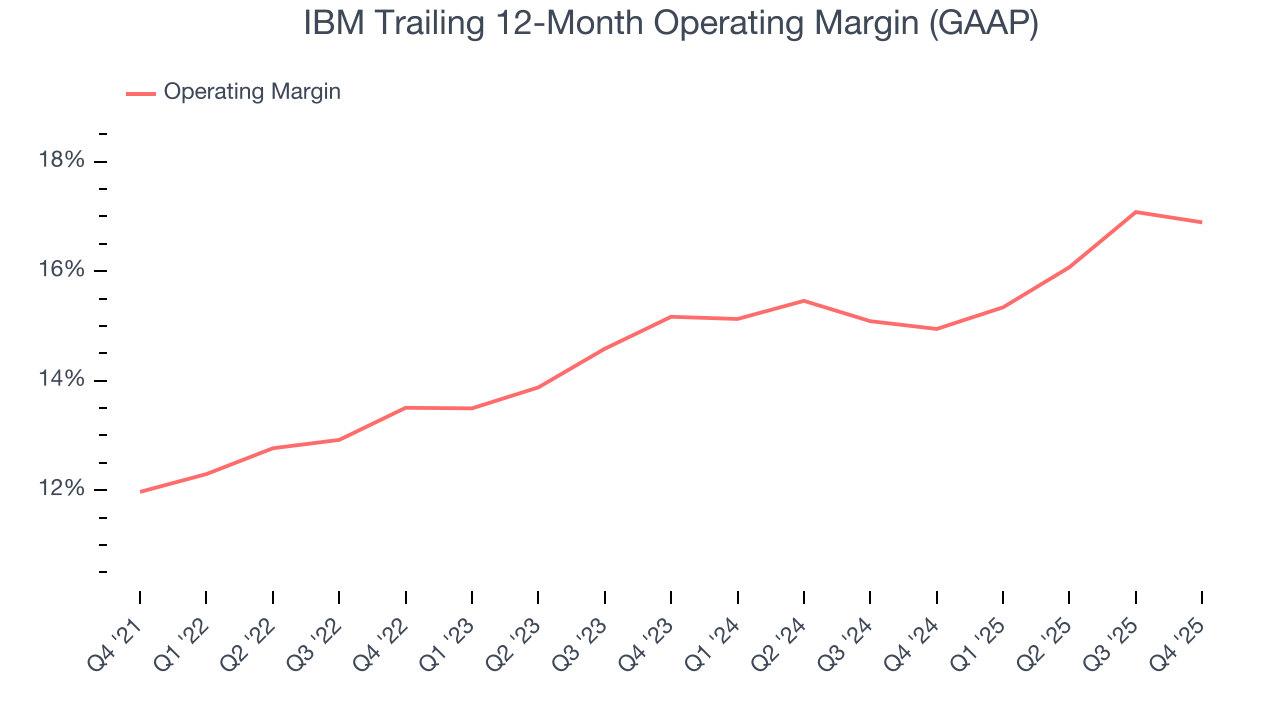

IBM has been an efficient company over the last five years. It was one of the more profitable businesses in the business services sector, boasting an average operating margin of 14.6%.

Analyzing the trend in its profitability, IBM’s operating margin rose by 4.9 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, IBM generated an operating margin profit margin of 21.1%, down 1.2 percentage points year on year. This reduction is quite minuscule and indicates the company’s overall cost structure has been relatively stable.

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

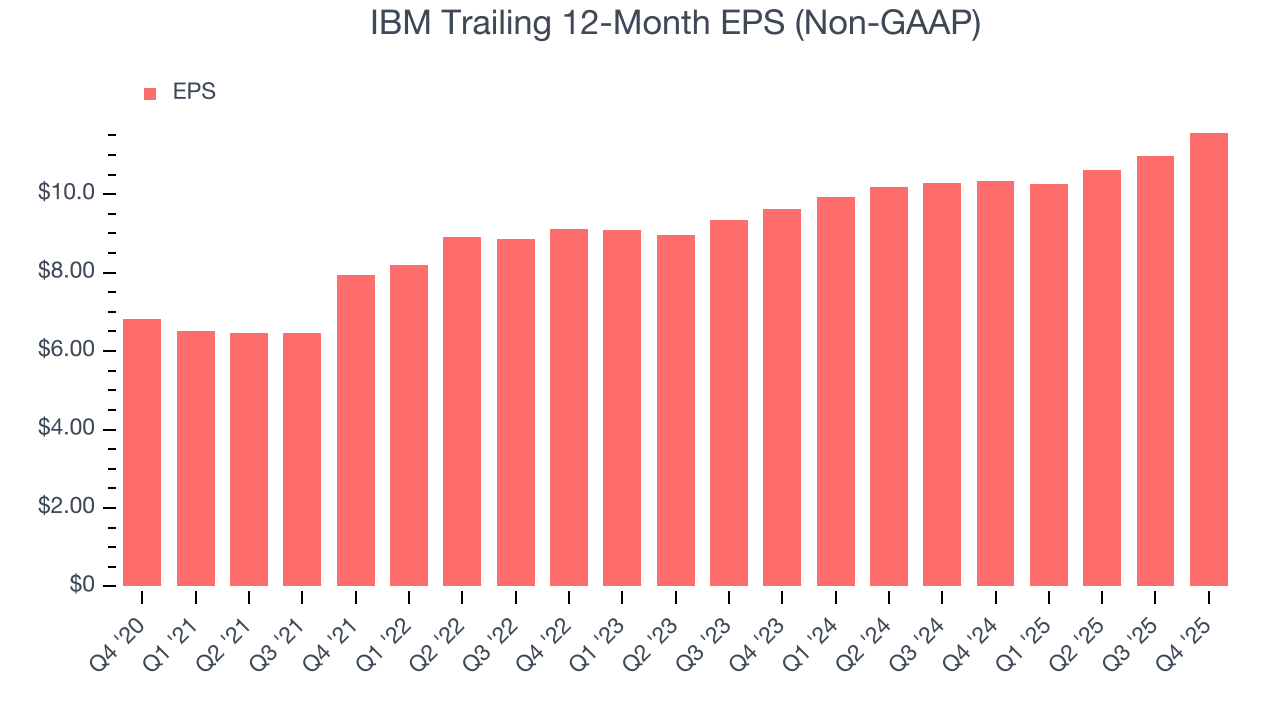

IBM’s EPS grew at a remarkable 11.1% compounded annual growth rate over the last five years, higher than its 4.1% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Diving into the nuances of IBM’s earnings can give us a better understanding of its performance. As we mentioned earlier, IBM’s operating margin declined this quarter but expanded by 4.9 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For IBM, its two-year annual EPS growth of 9.7% was lower than its five-year trend. We hope its growth can accelerate in the future.

In Q4, IBM reported adjusted EPS of $4.52, up from $3.92 in the same quarter last year. This print beat analysts’ estimates by 5.4%. Over the next 12 months, Wall Street expects IBM’s full-year EPS of $11.57 to grow 6.1%.

8. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

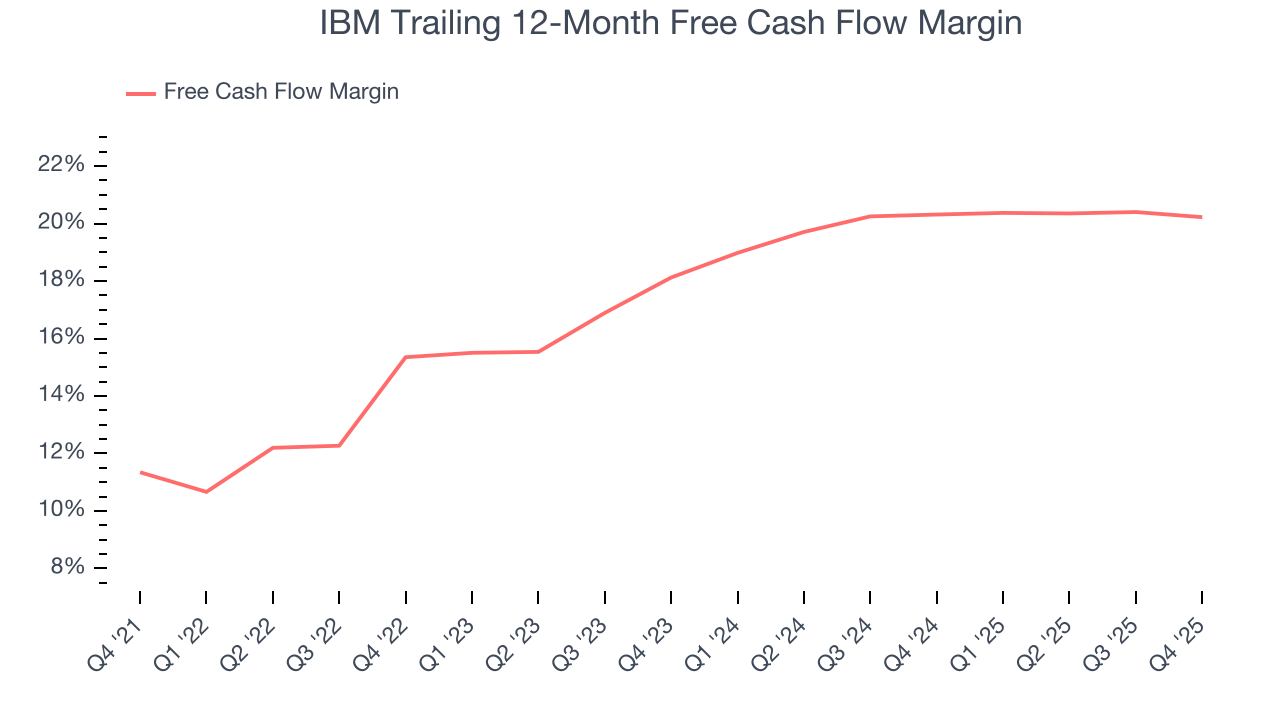

IBM has shown terrific cash profitability, enabling it to reinvest, return capital to investors, and stay ahead of the competition while maintaining an ample cushion. The company’s free cash flow margin was among the best in the business services sector, averaging 17.2% over the last five years.

Taking a step back, we can see that IBM’s margin expanded by 8.9 percentage points during that time. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability.

IBM’s free cash flow clocked in at $6.48 billion in Q4, equivalent to a 32.9% margin. The company’s cash profitability regressed as it was 2.2 percentage points lower than in the same quarter last year, but it’s still above its five-year average. We wouldn’t read too much into this quarter’s decline because investment needs can be seasonal, leading to short-term swings. Long-term trends carry greater meaning.

9. Return on Invested Capital (ROIC)

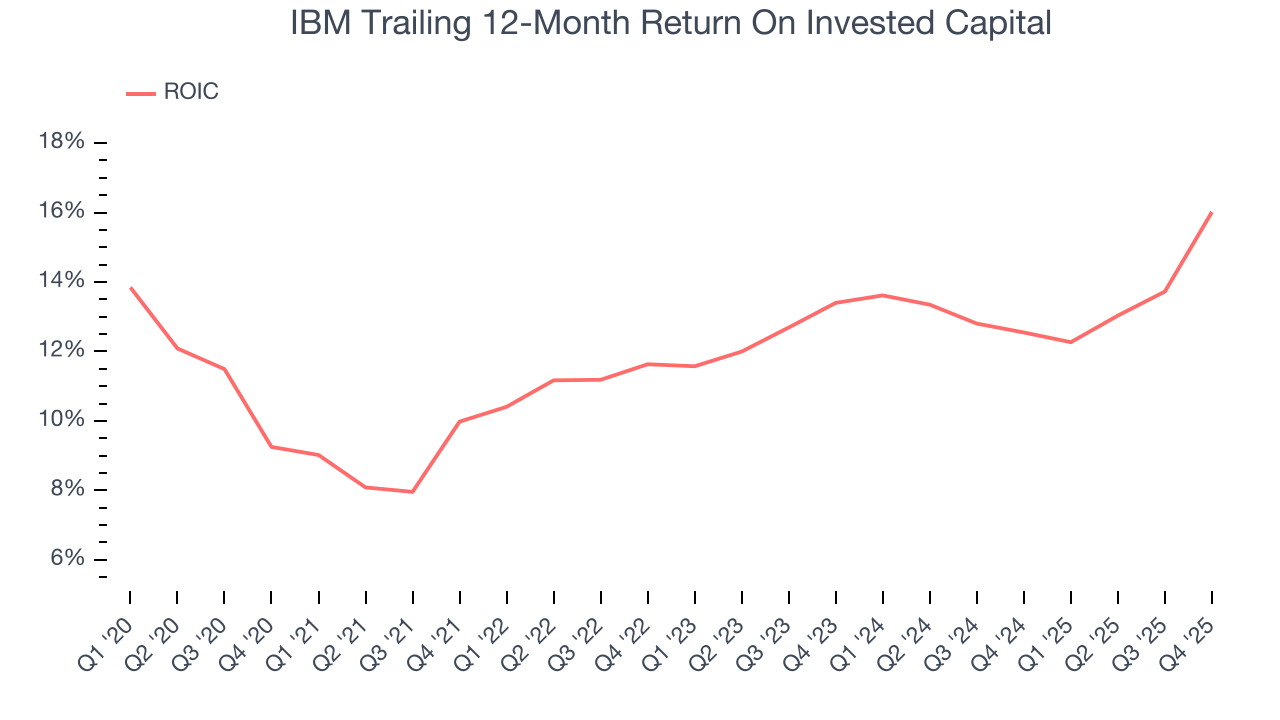

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

IBM’s management team makes decent investment decisions and generates value for shareholders. Its five-year average ROIC was 12.7%, slightly better than typical business services business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Fortunately, IBM’s ROIC averaged 3.5 percentage point increases over the last few years. This is a good sign, and if its returns keep rising, there’s a chance it could evolve into an investable business.

10. Balance Sheet Assessment

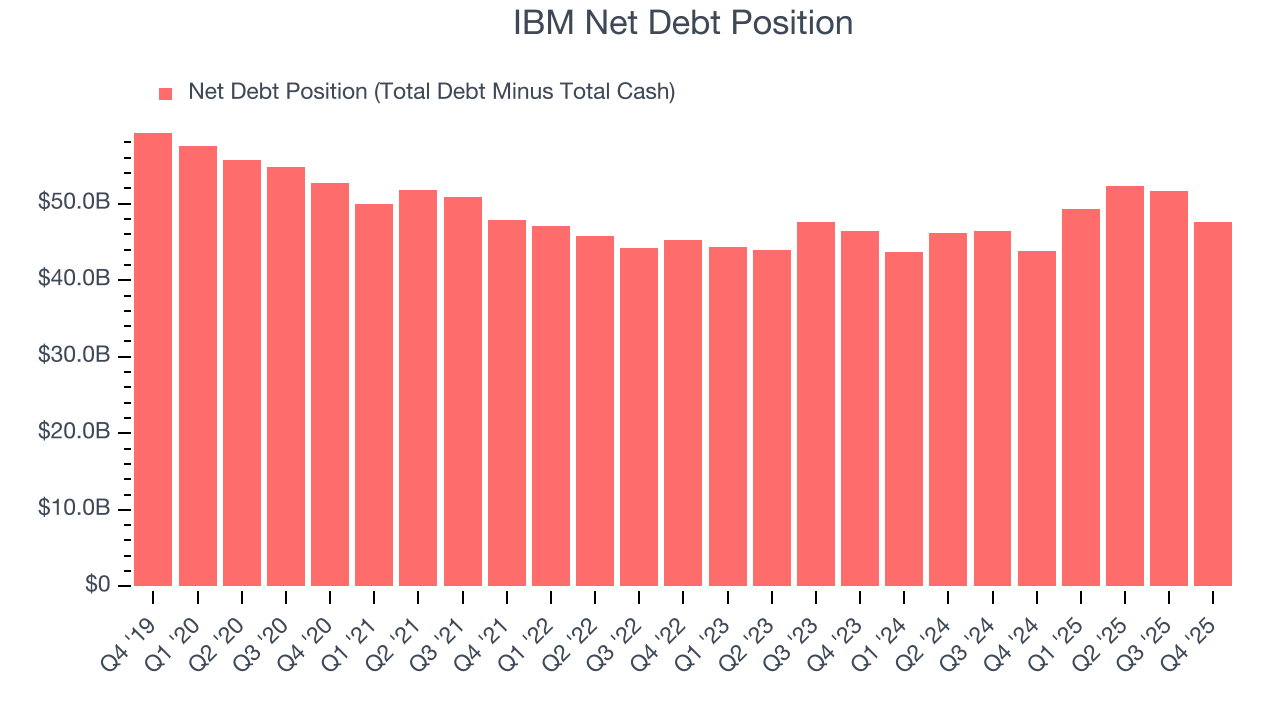

IBM reported $14.47 billion of cash and $62.06 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $19.21 billion of EBITDA over the last 12 months, we view IBM’s 2.5× net-debt-to-EBITDA ratio as safe. We also see its $466 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from IBM’s Q4 Results

It was encouraging to see IBM beat analysts’ revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. Full-year 2026 guidance calling for at least 5% constant-currency revenue growth and $1 billion of free cash flow was also encouraging. Overall, this print had some key positives. The stock traded up 7.9% to $317.48 immediately after reporting.

12. Is Now The Time To Buy IBM?

Updated: January 28, 2026 at 10:13 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in IBM.

IBM is a fine business. Although its revenue growth was mediocre over the last five years, its scale makes it a trusted partner with negotiating leverage. On top of that, its powerful free cash flow generation enables it to stay ahead of the competition through consistent reinvestment of profits.

IBM’s P/E ratio based on the next 12 months is 23.9x. This valuation tells us it’s a bit of a market darling with a lot of good news priced in. Add this one to your watchlist and come back to it later.

Wall Street analysts have a consensus one-year price target of $305.16 on the company (compared to the current share price of $316.72).