Ibotta (IBTA)

Ibotta is a sound business. Although its forecasted growth is weak, its strong margins enable it to navigate pockets of soft demand.― StockStory Analyst Team

1. News

2. Summary

Why Ibotta Is Interesting

Originally launched as a way to make grocery shopping more rewarding for budget-conscious consumers, Ibotta (NYSE:IBTA) is a mobile shopping app that allows consumers to earn cash back on everyday purchases by completing tasks and submitting receipts.

- Healthy adjusted operating margin shows it’s a well-run company with efficient processes

- Solid free cash flow generation relative to most peers grants it various reinvestment opportunities, and its rising cash conversion increases its margin of safety

- On the other hand, its sales are projected to tank by 9.7% over the next 12 months as demand evaporates

Ibotta is close to becoming a high-quality business. If you’re a believer, the valuation looks reasonable.

Why Is Now The Time To Buy Ibotta?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Ibotta?

At $23.86 per share, Ibotta trades at 19.8x forward P/E. Compared to other business services companies, we think this multiple is fair for the quality you get.

Now could be a good time to invest if you believe in the story.

3. Ibotta (IBTA) Research Report: Q3 CY2025 Update

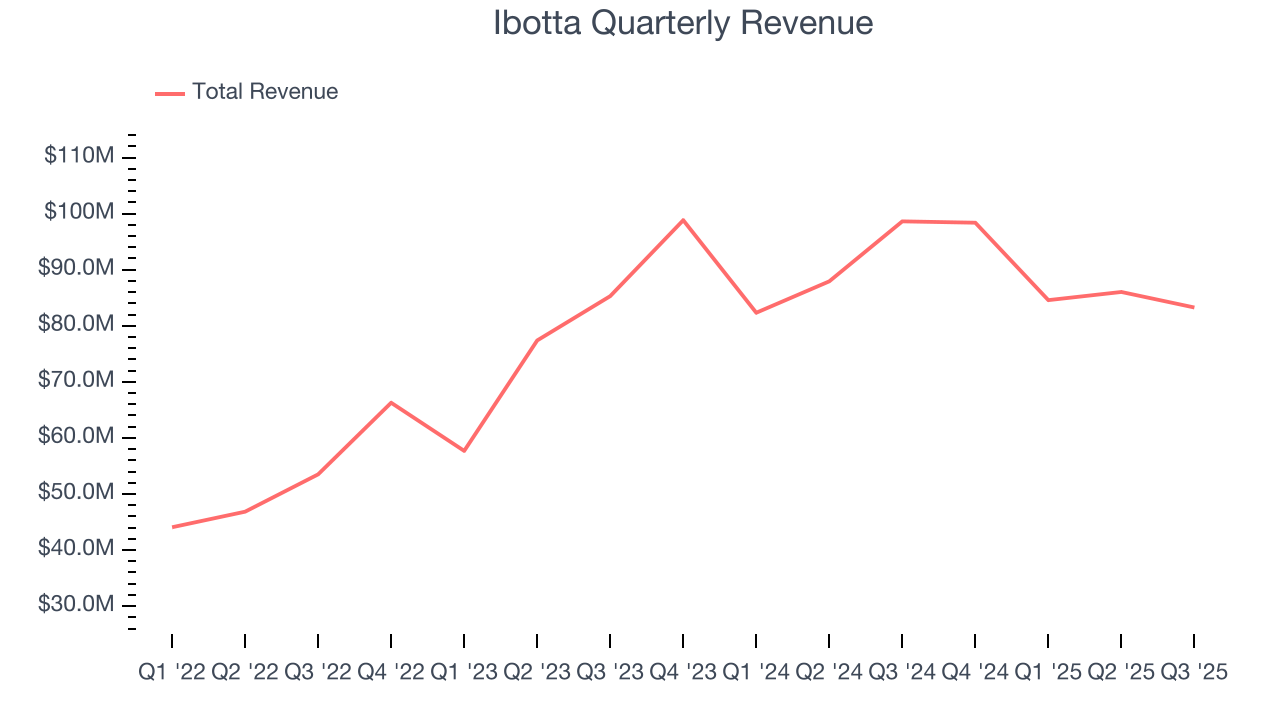

Cash-back rewards platform Ibotta (NYSE:IBTA) reported Q3 CY2025 results topping the market’s revenue expectations, but sales fell by 15.6% year on year to $83.26 million. On the other hand, next quarter’s revenue guidance of $82.5 million was less impressive, coming in 1.9% below analysts’ estimates. Its GAAP profit of $0.05 per share was significantly above analysts’ consensus estimates.

Ibotta (IBTA) Q3 CY2025 Highlights:

- Revenue: $83.26 million vs analyst estimates of $81.91 million (15.6% year-on-year decline, 1.6% beat)

- EPS (GAAP): $0.05 vs analyst estimates of $0 (significant beat)

- Adjusted EBITDA: $16.61 million vs analyst estimates of $12.2 million (20% margin, 36.2% beat)

- Revenue Guidance for Q4 CY2025 is $82.5 million at the midpoint, below analyst estimates of $84.14 million

- EBITDA guidance for Q4 CY2025 is $10.5 million at the midpoint, below analyst estimates of $11.46 million

- Operating Margin: 2.8%, down from 21% in the same quarter last year

- Free Cash Flow Margin: 12.7%, down from 37.2% in the same quarter last year

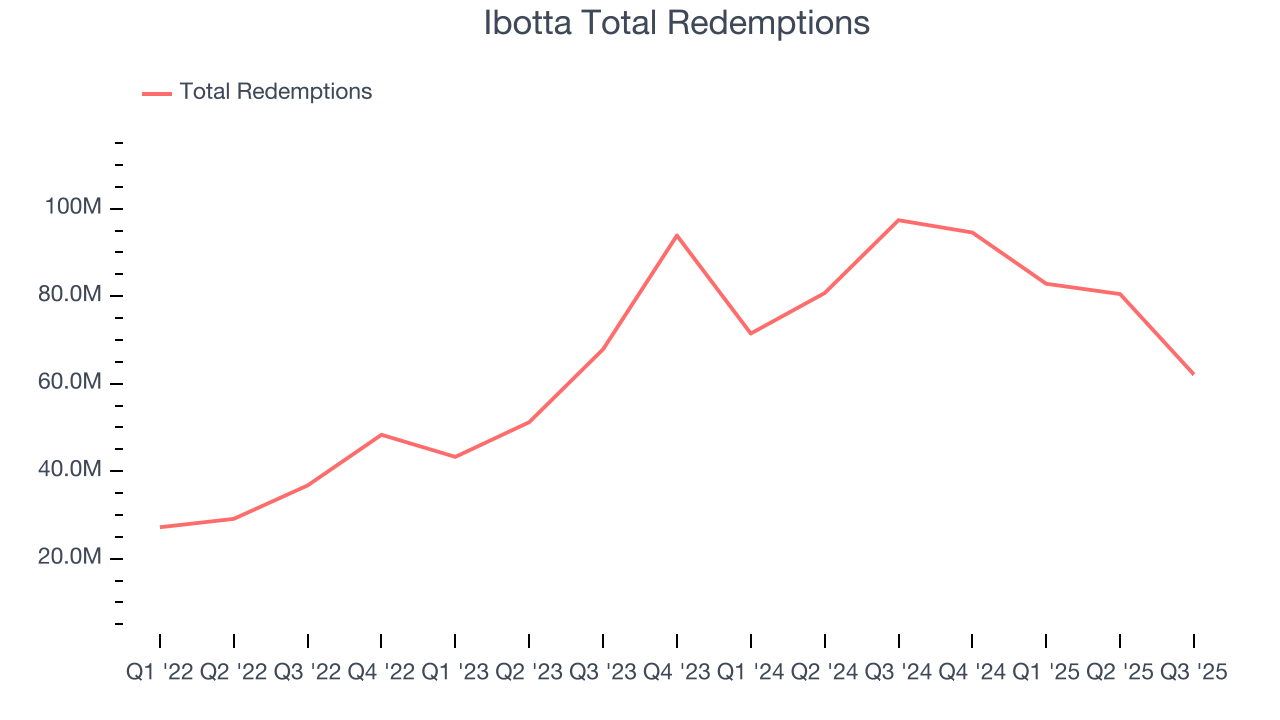

- Total Redemptions: 62.1 million, down 35.27 million year on year

- Market Capitalization: $882.9 million

Company Overview

Originally launched as a way to make grocery shopping more rewarding for budget-conscious consumers, Ibotta (NYSE:IBTA) is a mobile shopping app that allows consumers to earn cash back on everyday purchases by completing tasks and submitting receipts.

Ibotta operates at the intersection of retail, advertising, and financial technology. The platform works by partnering with consumer packaged goods (CPG) companies, retailers, and brands who pay to promote their products through targeted offers on the Ibotta app. When users purchase these promoted items and verify their purchases by uploading receipts or linking loyalty accounts, they receive cash back rewards that can be transferred to their bank accounts or redeemed as gift cards.

The company's business model creates value for multiple stakeholders. For consumers, it provides financial incentives on purchases they would likely make anyway. For brands and retailers, it offers a performance-based marketing channel that drives sales and provides valuable consumer purchase data. Ibotta only gets paid when a consumer actually buys a product, making it an attractive alternative to traditional advertising for brands seeking measurable returns on their marketing investments.

A typical Ibotta user might open the app before heading to the grocery store, browse available offers (like $1 back on a specific brand of cereal or 50 cents back on any brand of milk), add these offers to their account, and then upload their receipt after shopping to claim their rewards. The company has expanded beyond groceries to include cash back opportunities at restaurants, travel sites, online retailers, and subscription services.

Ibotta's technology platform incorporates elements of machine learning to personalize offers based on user shopping patterns and preferences. The company has built an extensive network of partnerships with major retailers including Walmart, Target, Kroger, and Amazon, as well as with hundreds of consumer brands.

Beyond its consumer app, Ibotta also operates the Ibotta Performance Network (IPN), which extends its cash back offers to partner platforms and retailer websites, allowing brands to reach consumers through multiple digital touchpoints. This network approach has helped Ibotta scale its reach beyond its direct user base.

4. Advertising & Marketing Services

The sector is on the precipice of both disruption and growth as AI, programmatic advertising, and data-driven marketing reshape how things are done. For example, the advent of the Internet broadly and programmatic advertising specifically means that brand building is not a relationship business anymore but instead one based on data and technology, which could hurt traditional ad agencies. On the other hand, the companies in the sector that beef up their tech chops by automating the buying of ad inventory or facilitating omnichannel marketing, for example, stand to benefit. With or without advances in digitization and AI, the sector is still highly levered to the macro, and economic uncertainty may lead to fluctuating ad spend, particularly in cyclical industries.

Ibotta competes with other cash-back and shopping rewards platforms including Rakuten (formerly Ebates), Fetch Rewards, and Shopkick, as well as with credit card rewards programs and retailer-specific loyalty programs like Target Circle and Walmart+.

5. Revenue Growth

Reviewing a company’s top-line performance can reveal insights into its business quality. Growth can signal it’s capitalizing on a new product or emerging industry trend.

With $352.2 million in revenue over the past 12 months, Ibotta is a small player in the business services space, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and numerous distribution channels.

Ibotta also discloses its number of total redemptions, which reached 62.1 million in the latest quarter. Over the last two years, Ibotta’s total redemptions averaged 30.1% year-on-year growth. Because this number is higher than its revenue growth during the same period, we can see the company’s monetization has fallen.

This quarter, Ibotta’s revenue fell by 15.6% year on year to $83.26 million but beat Wall Street’s estimates by 1.6%. Company management is currently guiding for a 16.1% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to decline by 6.7% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and indicates its products and services will see some demand headwinds.

6. Operating Margin

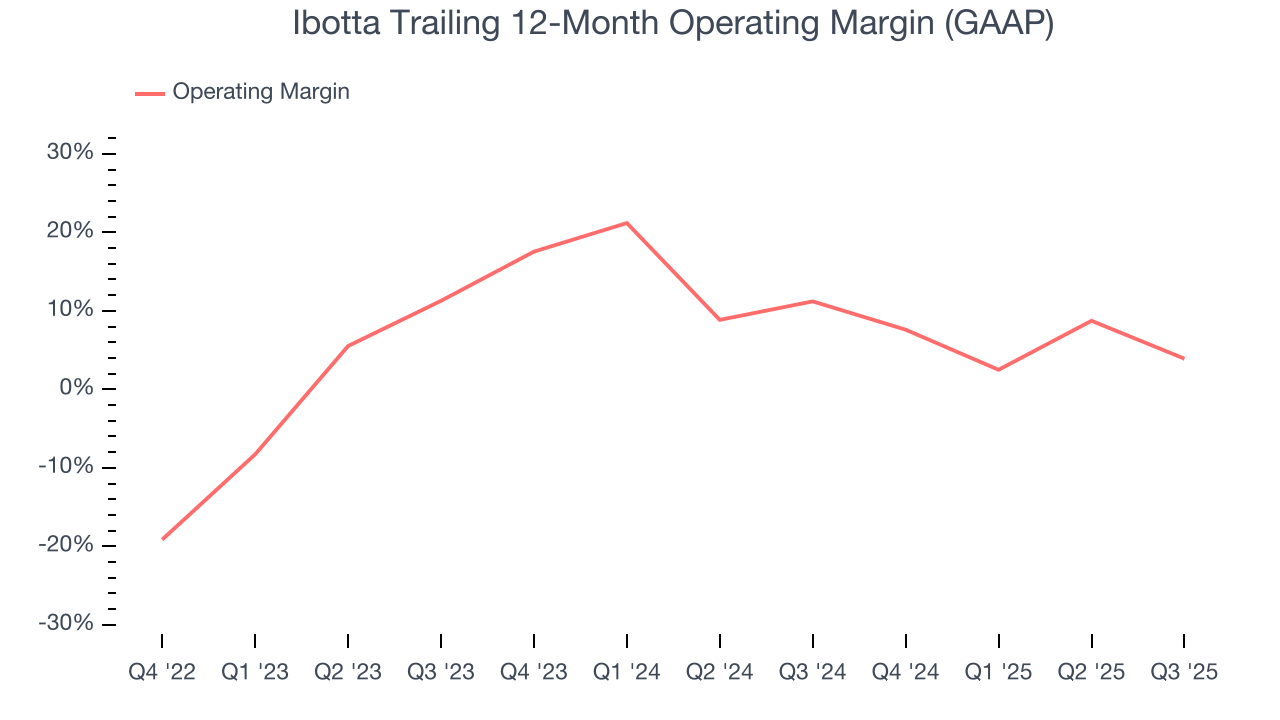

Ibotta was profitable over the last four years but held back by its large cost base. Its average operating margin of 3.9% was weak for a business services business.

On the plus side, Ibotta’s operating margin rose by 30 percentage points over the last four years.

In Q3, Ibotta generated an operating margin profit margin of 2.8%, down 18.2 percentage points year on year. This contraction shows it was less efficient because its expenses increased relative to its revenue.

7. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

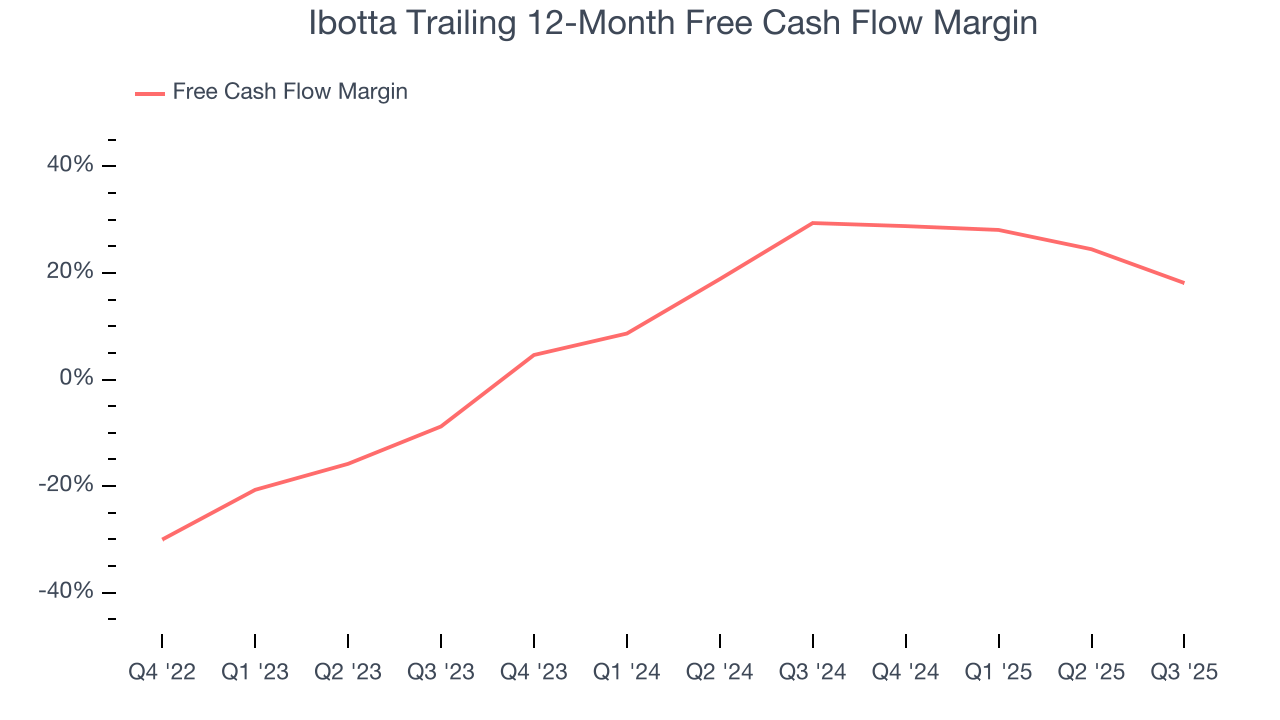

Ibotta has shown impressive cash profitability, giving it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 8.8% over the last four years, better than the broader business services sector. The divergence from its underwhelming operating margin stems from the add-back of non-cash charges like depreciation and stock-based compensation. GAAP operating profit expenses these line items, but free cash flow does not.

Taking a step back, we can see that Ibotta’s margin expanded by 48.6 percentage points during that time. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability.

Ibotta’s free cash flow clocked in at $10.59 million in Q3, equivalent to a 12.7% margin. The company’s cash profitability regressed as it was 24.5 percentage points lower than in the same quarter last year, but it’s still above its four-year average. We wouldn’t put too much weight on this quarter’s decline because investment needs can be seasonal, causing short-term swings. Long-term trends are more important.

8. Balance Sheet Assessment

One of the best ways to mitigate bankruptcy risk is to hold more cash than debt.

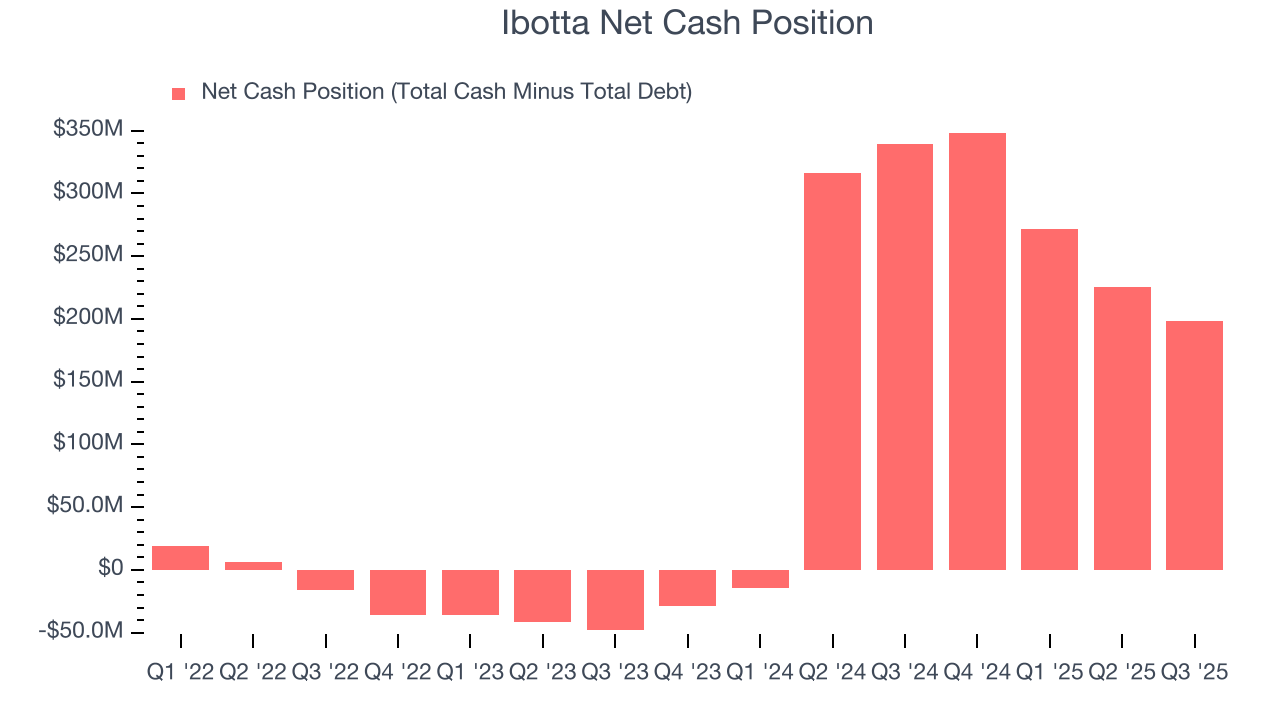

Ibotta is a profitable, well-capitalized company with $223.4 million of cash and $25.34 million of debt on its balance sheet. This $198 million net cash position is 22.4% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

9. Key Takeaways from Ibotta’s Q3 Results

It was good to see Ibotta beat analysts’ EPS expectations this quarter. We were also happy its revenue outperformed Wall Street’s estimates. On the other hand, its revenue guidance for next quarter missed. Overall, this print had some key positives. The market seemed to be hoping for more, and the stock traded down 14% to $28.13 immediately following the results.

10. Is Now The Time To Buy Ibotta?

Updated: November 26, 2025 at 12:00 AM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Ibotta.

There are some positives when it comes to Ibotta’s fundamentals. Although Ibotta’s projected EPS for the next year is lacking, its rising cash profitability gives it more optionality. On top of that, its expanding adjusted operating margin shows the business has become more efficient.

Ibotta’s P/E ratio based on the next 12 months is 18.4x. When scanning the business services space, Ibotta trades at a fair valuation. If you trust the business and its direction, this is an ideal time to buy.

Wall Street analysts have a consensus one-year price target of $28.29 on the company (compared to the current share price of $23.55), implying they see 20.1% upside in buying Ibotta in the short term.