IMAX (IMAX)

We’re not sold on IMAX. Its poor returns on capital indicate it barely generated any profits, a must for high-quality companies.― StockStory Analyst Team

1. News

2. Summary

Why IMAX Is Not Exciting

Originally developed for World Expo '67 in Montreal as an innovative projection system, IMAX (NYSE:IMAX) provides proprietary large-format cinema technology and systems that deliver immersive movie experiences with enhanced image quality and sound.

- Low returns on capital reflect management’s struggle to allocate funds effectively

- Modest revenue base of $377.7 million gives it less fixed cost leverage and fewer distribution channels than larger companies

- A bright spot is that its incremental sales significantly boosted profitability as its annual earnings per share growth of 23.4% over the last five years outstripped its revenue performance

IMAX is skating on thin ice. More profitable opportunities exist elsewhere.

Why There Are Better Opportunities Than IMAX

High Quality

Investable

Underperform

Why There Are Better Opportunities Than IMAX

IMAX’s stock price of $36.17 implies a valuation ratio of 22.6x forward P/E. Not only does IMAX trade at a premium to companies in the business services space, but this multiple is also high for its fundamentals.

We’d rather invest in similarly-priced but higher-quality companies with more reliable earnings growth.

3. IMAX (IMAX) Research Report: Q3 CY2025 Update

Premium cinema technology company IMAX (NYSE:IMAX) reported revenue ahead of Wall Street’s expectations in Q3 CY2025, with sales up 16.6% year on year to $106.7 million. Its non-GAAP profit of $0.47 per share was 20.3% above analysts’ consensus estimates.

IMAX (IMAX) Q3 CY2025 Highlights:

- Revenue: $106.7 million vs analyst estimates of $106.1 million (16.6% year-on-year growth, 0.6% beat)

- Adjusted EPS: $0.47 vs analyst estimates of $0.39 (20.3% beat)

- Adjusted EBITDA: $47.96 million vs analyst estimates of $44.09 million (45% margin, 8.8% beat)

- Operating Margin: 27.2%, up from 21.2% in the same quarter last year

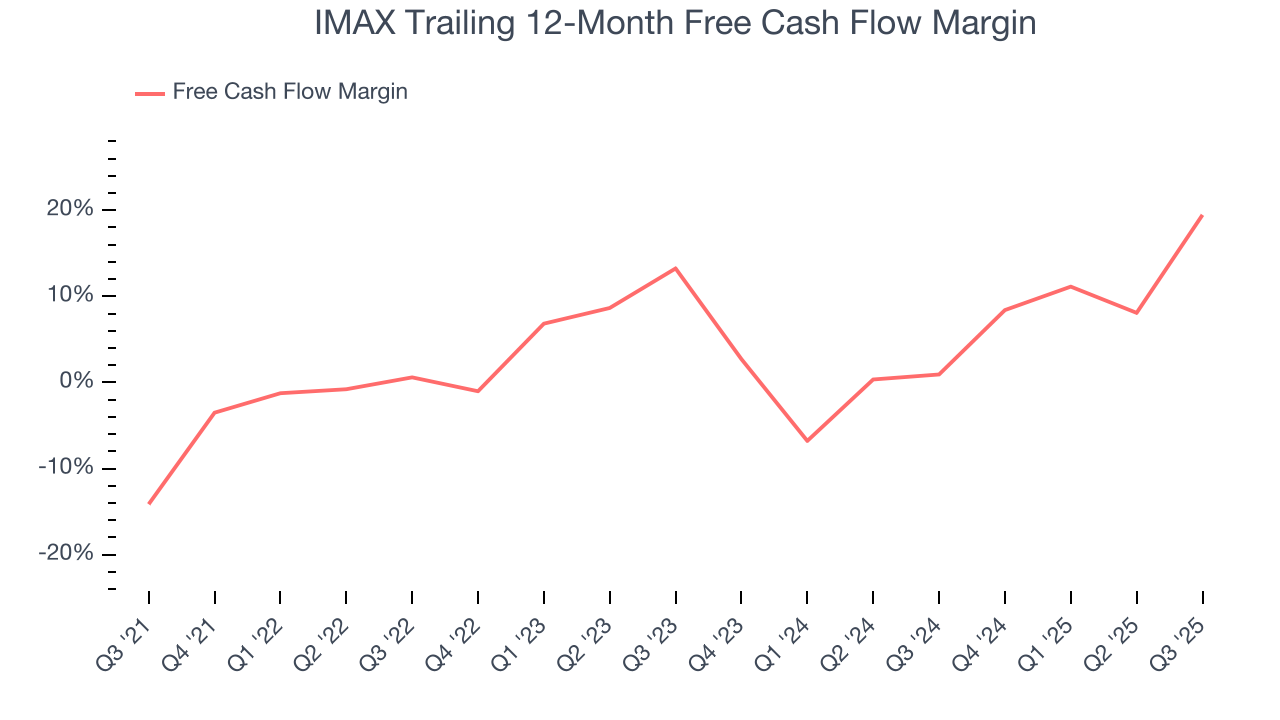

- Free Cash Flow Margin: 60.7%, up from 22.5% in the same quarter last year

- Market Capitalization: $1.72 billion

Company Overview

Originally developed for World Expo '67 in Montreal as an innovative projection system, IMAX (NYSE:IMAX) provides proprietary large-format cinema technology and systems that deliver immersive movie experiences with enhanced image quality and sound.

IMAX operates as a technology platform that transforms conventional films into visually stunning, immersive experiences through its proprietary digital remastering process. The company's business model centers on selling or leasing its premium projection systems to theater operators worldwide, while also generating revenue from film distribution and maintenance services.

The IMAX system includes specialized projectors, screens, sound systems, and theater designs that collectively create what the company markets as "The IMAX Experience." Its laser-based digital projection systems deliver sharper images with deeper contrast and wider color ranges than standard cinema projectors. The company's proprietary sound technology uses uncompressed audio and custom speaker configurations to ensure optimal sound quality throughout the theater.

Filmmakers increasingly collaborate with IMAX through its "Filmed For IMAX" program, where movies are shot using IMAX-certified cameras to take advantage of the format's expanded aspect ratio, showing up to 26% more image on standard IMAX screens and up to 67% more in select locations. For example, Christopher Nolan's "Oppenheimer" was filmed with IMAX 70mm cameras, creating a distinctive viewing experience that drove significant audience demand.

IMAX generates revenue through multiple channels: selling or leasing its systems to exhibitors, collecting fees for digitally remastering films, providing ongoing maintenance services, and distributing documentary films. The company has also expanded into streaming technology with its IMAX Enhanced program, which brings aspects of the IMAX experience to home entertainment through partnerships with streaming platforms and device manufacturers.

With a global network spanning 90 countries and territories, IMAX has established particularly strong presence in international markets, which represent 76% of its commercial multiplex installations. The company has been especially successful in China, where it operates 807 systems through partnerships with major exhibitors like Wanda Film.

4. Traditional Media & Publishing

The sector faces structural headwinds from declining linear TV viewership, shifts in advertising spend toward digital platforms, and ongoing challenges in monetizing print and broadcast content. However, for companies that invest wisely, tailwinds can include AI, the power of which can result in more personalized content creation and more detailed audience analysis. These can create a flywheel of success where one feeds into the other. Still there are outstanding questions around AI-generated content oversight, and the regulatory framework around this could evolve in unseen ways over the next few years.

IMAX competes with premium cinema format providers like Dolby Laboratories' Dolby Cinema (NYSE:DLB), 4DX by CJ 4DPLEX, and ScreenX. In the broader theatrical exhibition space, it also faces competition from major theater chains with their own premium large format offerings, such as AMC's (NYSE:AMC) Dolby Cinema and PRIME at AMC, and Regal's RPX.

5. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $377.7 million in revenue over the past 12 months, IMAX is a small player in the business services space, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and numerous distribution channels. On the bright side, it can grow faster because it has more room to expand.

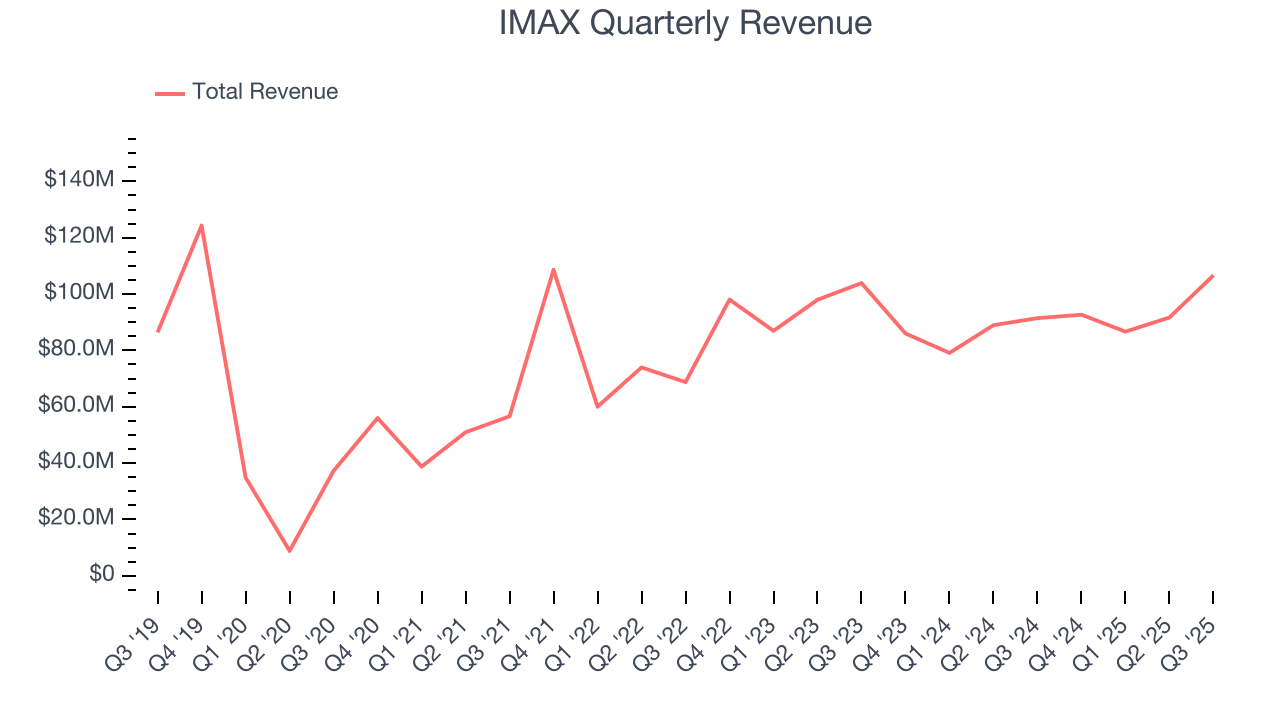

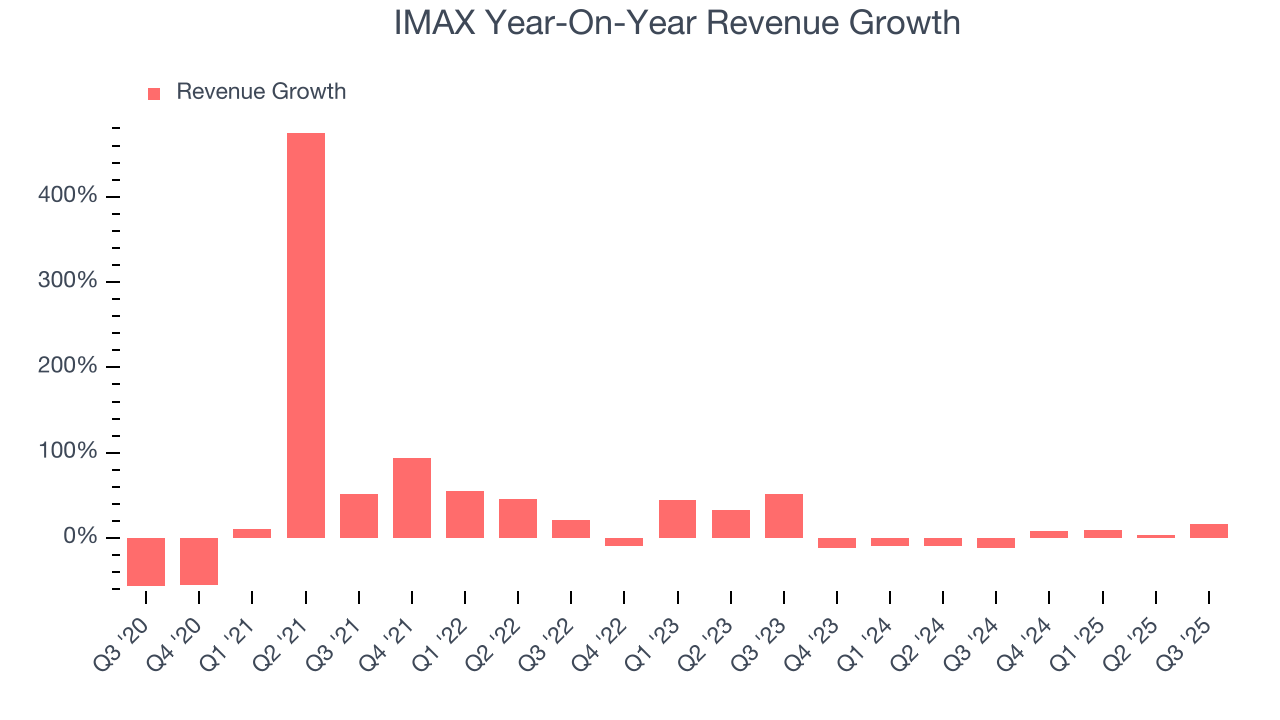

As you can see below, IMAX’s sales grew at an excellent 13% compounded annual growth rate over the last five years. This is an encouraging starting point for our analysis because it shows IMAX’s demand was higher than many business services companies.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. IMAX’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 1.2% over the last two years.

This quarter, IMAX reported year-on-year revenue growth of 16.6%, and its $106.7 million of revenue exceeded Wall Street’s estimates by 0.6%.

Looking ahead, sell-side analysts expect revenue to grow 13.3% over the next 12 months, an improvement versus the last two years. This projection is noteworthy and indicates its newer products and services will fuel better top-line performance.

6. Operating Margin

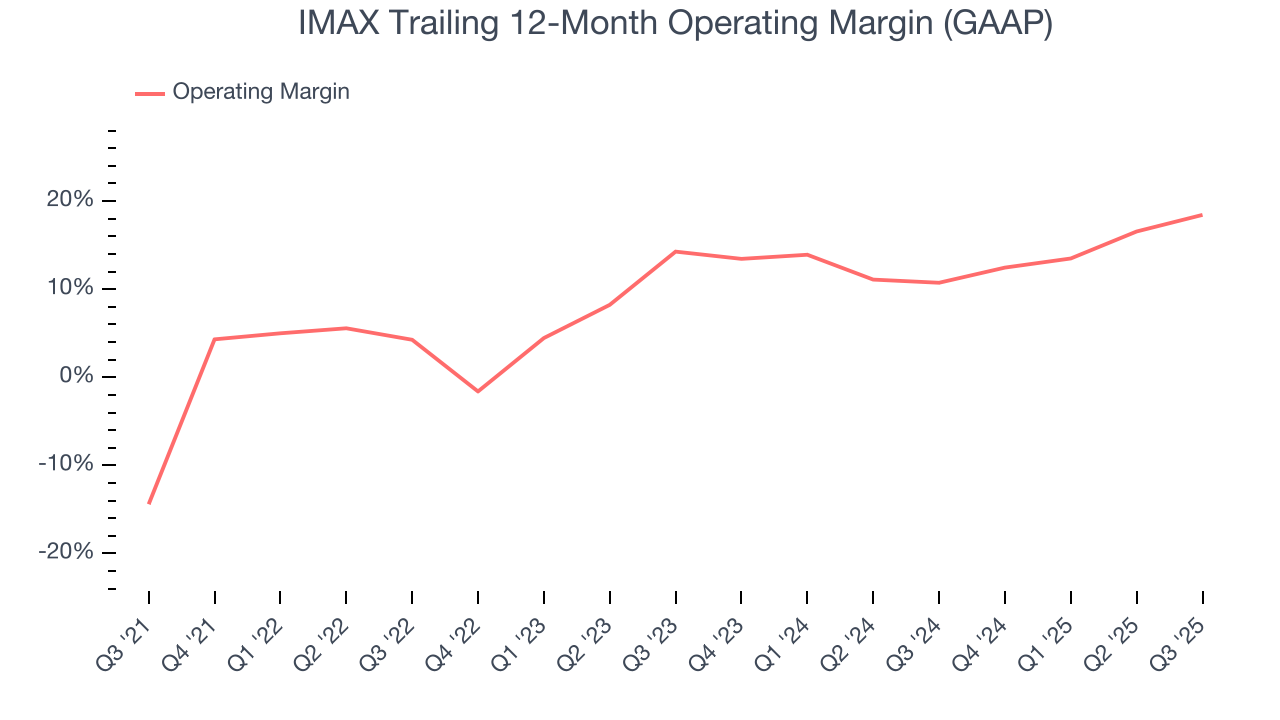

IMAX was profitable over the last five years but held back by its large cost base. Its average operating margin of 9% was weak for a business services business.

On the plus side, IMAX’s operating margin rose by 32.8 percentage points over the last five years, as its sales growth gave it immense operating leverage.

In Q3, IMAX generated an operating margin profit margin of 27.2%, up 6 percentage points year on year. This increase was a welcome development and shows it was more efficient.

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

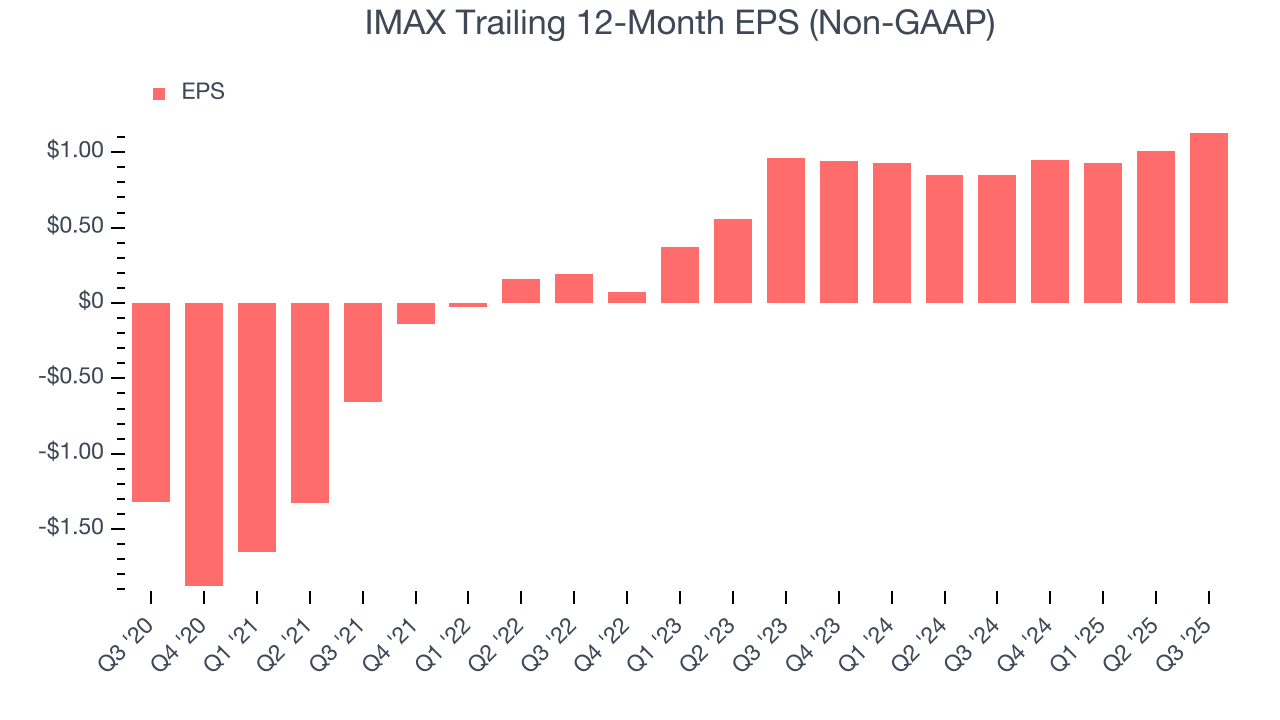

IMAX’s full-year EPS flipped from negative to positive over the last five years. This is a good sign and shows it’s at an inflection point.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

IMAX’s EPS grew at an unimpressive 8.5% compounded annual growth rate over the last two years. On the bright side, this performance was higher than its 1.2% annualized revenue declines and tells us management adapted its cost structure in response to a challenging demand environment.

We can take a deeper look into IMAX’s earnings to better understand the drivers of its performance. IMAX’s operating margin has expanded over the last two years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q3, IMAX reported adjusted EPS of $0.47, up from $0.35 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects IMAX’s full-year EPS of $1.13 to grow 42.3%.

8. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

IMAX has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 6.2% over the last five years, slightly better than the broader business services sector.

Taking a step back, we can see that IMAX’s margin expanded by 33.6 percentage points during that time. This is encouraging because it gives the company more optionality.

IMAX’s free cash flow clocked in at $64.77 million in Q3, equivalent to a 60.7% margin. This result was good as its margin was 38.2 percentage points higher than in the same quarter last year, building on its favorable historical trend.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

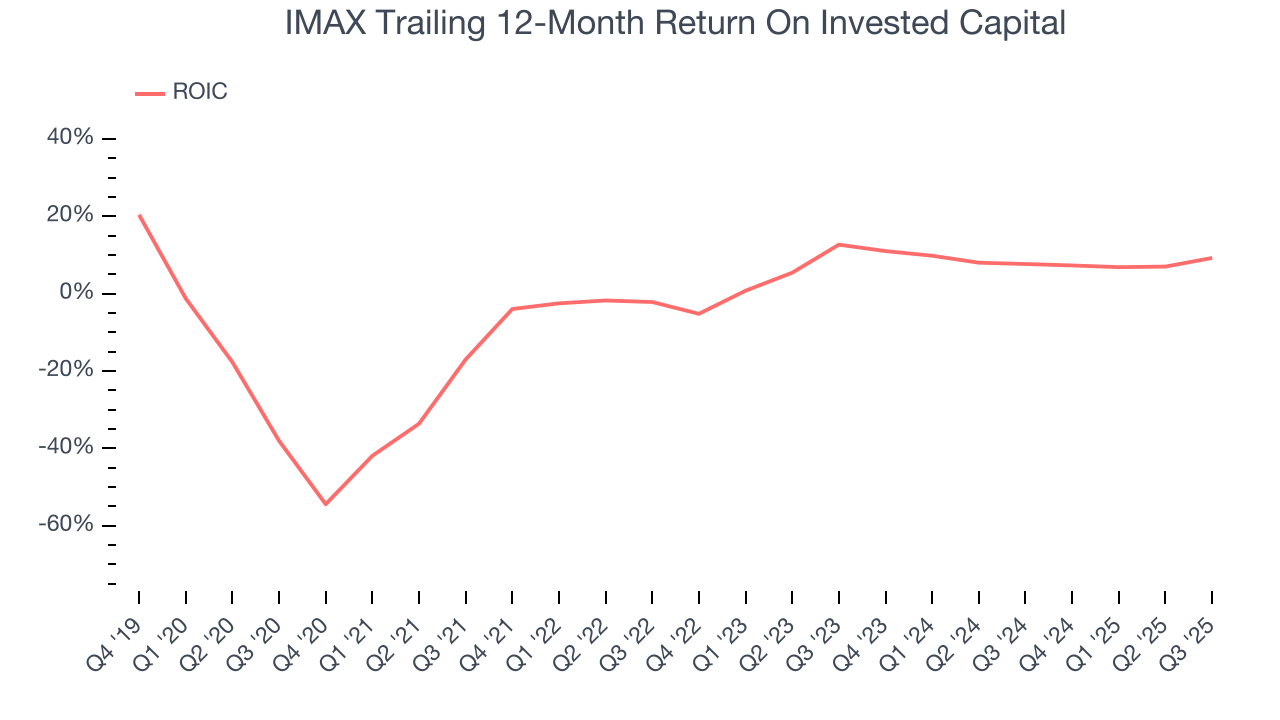

Although IMAX has shown solid business quality lately, it historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 2.1%, lower than the typical cost of capital (how much it costs to raise money) for business services companies.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, IMAX’s ROIC has increased significantly. its rising ROIC is a good sign and could suggest its competitive advantage or profitable growth opportunities are expanding.

10. Balance Sheet Assessment

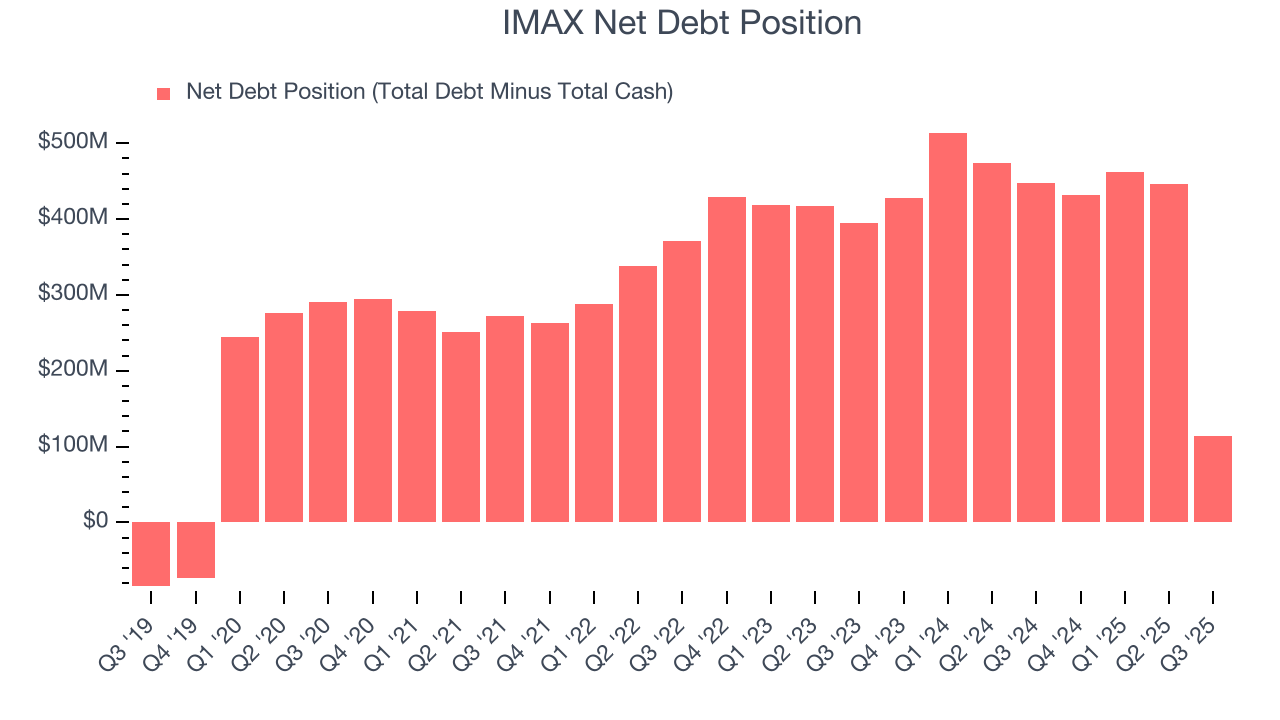

IMAX reported $143.1 million of cash and $257.2 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $146.9 million of EBITDA over the last 12 months, we view IMAX’s 0.8× net-debt-to-EBITDA ratio as safe. We also see its $1.96 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from IMAX’s Q3 Results

It was good to see IMAX beat analysts’ EPS expectations this quarter. We were also happy its revenue narrowly outperformed Wall Street’s estimates. Zooming out, we think this quarter featured some important positives. The stock traded up 3.2% to $33.10 immediately after reporting.

12. Is Now The Time To Buy IMAX?

Updated: December 4, 2025 at 11:05 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in IMAX.

IMAX isn’t a bad business, but we’re not clamoring to buy it here and now. To kick things off, its revenue growth was impressive over the last five years. And while IMAX’s relatively low ROIC suggests management has struggled to find compelling investment opportunities, its rising cash profitability gives it more optionality.

IMAX’s P/E ratio based on the next 12 months is 22.6x. This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're pretty confident there are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $38.62 on the company (compared to the current share price of $36.17).