ITT (ITT)

We admire ITT. It often invests in lucrative growth initiatives, generating robust profits and returns for shareholders.― StockStory Analyst Team

1. News

2. Summary

Why We Like ITT

Playing a crucial role in the development of the first transatlantic television transmission in 1956, ITT (NYSE:ITT) provides motion and fluid handling equipment for various industries

- Disciplined cost controls and effective management have materialized in a strong operating margin

- Market-beating returns on capital illustrate that management has a knack for investing in profitable ventures

- Earnings per share have massively outperformed its peers over the last five years, increasing by 16% annually

ITT is a market leader. The price seems fair relative to its quality, so this could be a prudent time to buy some shares.

Why Is Now The Time To Buy ITT?

High Quality

Investable

Underperform

Why Is Now The Time To Buy ITT?

ITT’s stock price of $204.19 implies a valuation ratio of 28.7x forward P/E. Valuation is above that of many industrials companies, but we think the price is justified given its business fundamentals.

By definition, where you buy a stock impacts returns. But according to our work on the topic, business quality is a much bigger determinant of market outperformance over the long term compared to entry price.

3. ITT (ITT) Research Report: Q4 CY2025 Update

Engineered components manufacturer for critical industries ITT Inc. (NYSE: ITT) reported Q4 CY2025 results beating Wall Street’s revenue expectations, with sales up 13.5% year on year to $1.05 billion. Its non-GAAP profit of $1.85 per share was 4% above analysts’ consensus estimates.

ITT (ITT) Q4 CY2025 Highlights:

- Revenue: $1.05 billion vs analyst estimates of $1.01 billion (13.5% year-on-year growth, 4.6% beat)

- Adjusted EPS: $1.85 vs analyst estimates of $1.78 (4% beat)

- Adjusted EBITDA: $250.2 million vs analyst estimates of $226.1 million (23.7% margin, 10.7% beat)

- Adjusted EPS guidance for Q1 CY2026 is $1.70 at the midpoint, above analyst estimates of $1.61

- Operating Margin: 17%, in line with the same quarter last year

- Free Cash Flow Margin: 17.8%, down from 20.1% in the same quarter last year

- Organic Revenue rose 8.6% year on year (beat)

- Market Capitalization: $15.93 billion

Company Overview

Playing a crucial role in the development of the first transatlantic television transmission in 1956, ITT (NYSE:ITT) provides motion and fluid handling equipment for various industries

The company operates through three primary segments: Motion Technologies (MT), Industrial Process (IP), and Connect & Control Technologies (CCT). The Motion Technologies segment is a manufacturer of brake pads, shims, shock absorbers, and damping technologies for the automotive and rail markets. This segment consists of several business units, including ITT Friction Technologies, Wolverine Advanced Materials, KONI, and Axtone. MT's products cater to a wide range of vehicles, from passenger cars and light commercial vehicles to heavy-duty commercial and military vehicles, buses, and trains.

The Industrial Process segment focuses on manufacturing industrial pumps, valves, and monitoring and control systems, as well as providing aftermarket services. IP serves a diverse customer base in markets such as energy, chemical and petrochemical, pharmaceutical, general industrial, mining, pulp and paper, food and beverage, and biopharmaceutical. The segment offers both configured-to-order and standards-based products, with a significant portion of its revenue derived from aftermarket solutions.

The Connect & Control Technologies segment designs and manufactures engineered connectors and specialized products for critical applications in aerospace, defense, industrial, transportation, medical, and energy markets. CCT's product portfolio includes connectors for data, signal, and power transfer, as well as control products such as actuators, valves, and shock absorbers.

Recent acquisitions have included Micro-Mode Products, Inc., a specialty designer and manufacturer of high-bandwidth radio frequency connectors for harsh environment defense and space applications. This acquisition strengthens ITT's position in the aerospace and defense markets. Additionally, the company acquired Svanehøj Group A/S, a supplier of pumps and related aftermarket services with leading positions in cryogenic applications for the marine sector, bolstering its Industrial Process segment.

4. Gas and Liquid Handling

Gas and liquid handling companies possess the technical know-how and specialized equipment to handle valuable (and sometimes dangerous) substances. Lately, water conservation and carbon capture–which requires hydrogen and other gasses as well as specialized infrastructure–have been trending up, creating new demand for products such as filters, pumps, and valves. On the other hand, gas and liquid handling companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

Competitors offering similar products include Illinois Tool Works (NYSE:ITW), Colfax (NYSE:CFX), and Fronius (private).

5. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, ITT’s 9.7% annualized revenue growth over the last five years was solid. Its growth beat the average industrials company and shows its offerings resonate with customers, a helpful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. ITT’s annualized revenue growth of 9.5% over the last two years aligns with its five-year trend, suggesting its demand was predictably strong.

ITT also reports organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, ITT’s organic revenue averaged 5.7% year-on-year growth. Because this number is lower than its two-year revenue growth, we can see that some mixture of acquisitions and foreign exchange rates boosted its headline results.

This quarter, ITT reported year-on-year revenue growth of 13.5%, and its $1.05 billion of revenue exceeded Wall Street’s estimates by 4.6%.

Looking ahead, sell-side analysts expect revenue to grow 7.1% over the next 12 months, a slight deceleration versus the last two years. This projection is underwhelming and suggests its products and services will see some demand headwinds. At least the company is tracking well in other measures of financial health.

6. Gross Margin & Pricing Power

ITT’s gross margin is good compared to other industrials businesses and signals it sells differentiated products, not commodities. As you can see below, it averaged an impressive 33.5% gross margin over the last five years. Said differently, ITT paid its suppliers $66.49 for every $100 in revenue.

This quarter, ITT’s gross profit margin was 35.5%, up 1.4 percentage points year on year. On a wider time horizon, the company’s full-year margin has remained steady over the past four quarters, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

7. Operating Margin

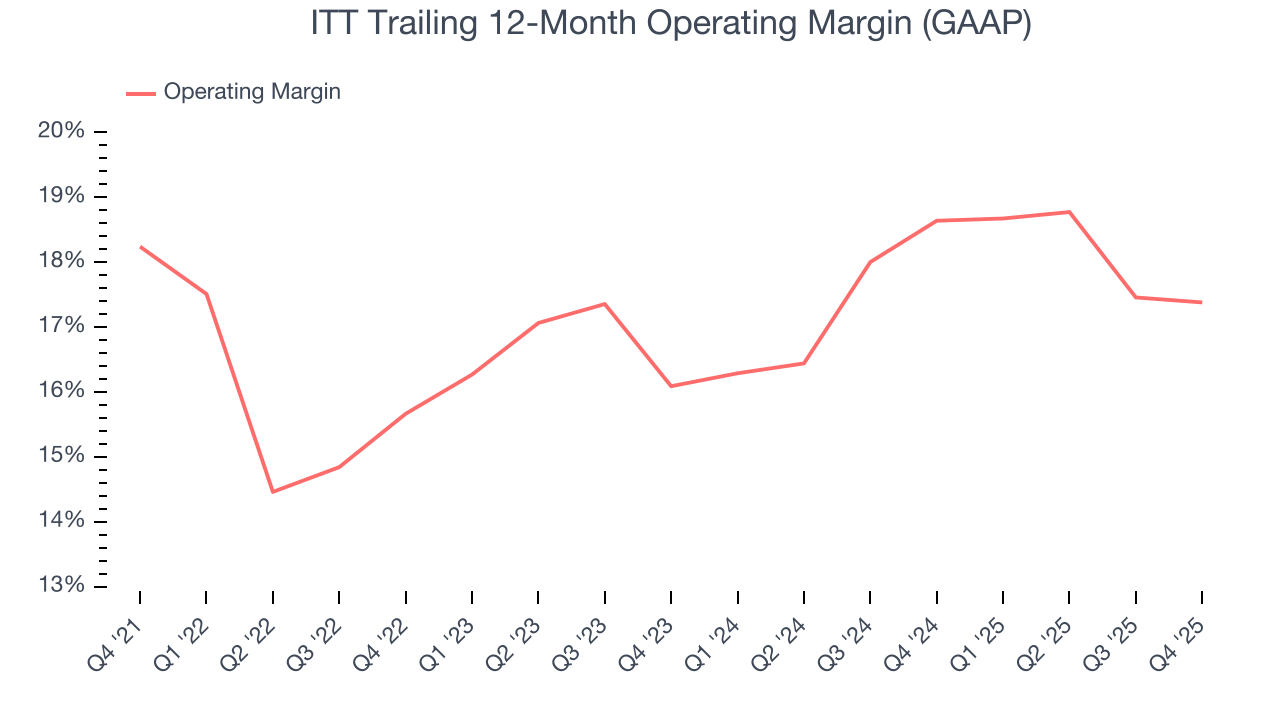

ITT’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 17.2% over the last five years. This profitability was elite for an industrials business thanks to its efficient cost structure and economies of scale. This is seen in its fast historical revenue growth and healthy gross margin, which is why we look at all three data points together.

Analyzing the trend in its profitability, ITT’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, ITT generated an operating margin profit margin of 17%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

8. Earnings Per Share

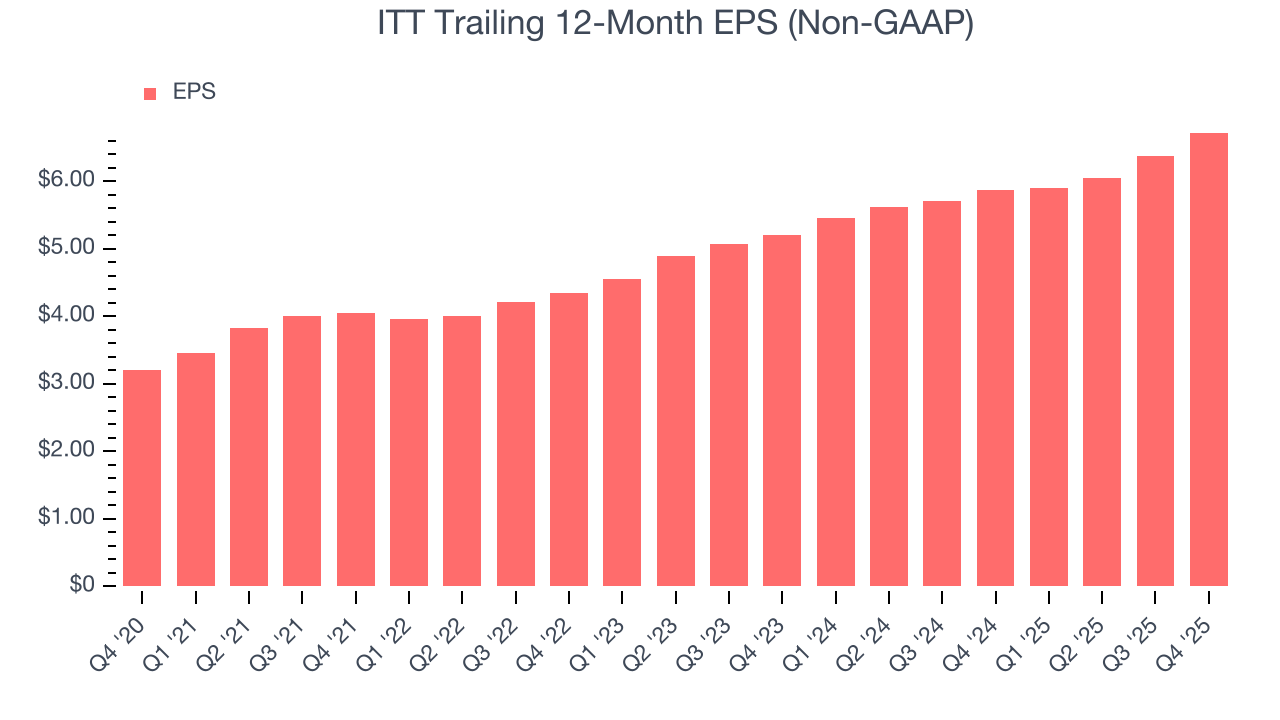

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

ITT’s EPS grew at a spectacular 16% compounded annual growth rate over the last five years, higher than its 9.7% annualized revenue growth. However, this alone doesn’t tell us much about its business quality because its operating margin didn’t improve.

Diving into the nuances of ITT’s earnings can give us a better understanding of its performance. A five-year view shows that ITT has repurchased its stock, shrinking its share count by 7.1%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For ITT, its two-year annual EPS growth of 13.6% was lower than its five-year trend. We still think its growth was good and hope it can accelerate in the future.

In Q4, ITT reported adjusted EPS of $1.85, up from $1.50 in the same quarter last year. This print beat analysts’ estimates by 4%. Over the next 12 months, Wall Street expects ITT’s full-year EPS of $6.72 to grow 7.8%.

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

ITT has shown impressive cash profitability, enabling it to ride out cyclical downturns more easily while maintaining its investments in new and existing offerings. The company’s free cash flow margin averaged 9% over the last five years, better than the broader industrials sector.

Taking a step back, we can see that ITT’s margin expanded by 17.6 percentage points during that time. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability was flat.

ITT’s free cash flow clocked in at $187.4 million in Q4, equivalent to a 17.8% margin. The company’s cash profitability regressed as it was 2.3 percentage points lower than in the same quarter last year, but it’s still above its five-year average. We wouldn’t put too much weight on this quarter’s decline because investment needs can be seasonal, causing short-term swings. Long-term trends carry greater meaning.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

ITT’s five-year average ROIC was 19.4%, placing it among the best industrials companies. This illustrates its management team’s ability to invest in highly profitable ventures and produce tangible results for shareholders.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, ITT’s ROIC averaged 3.3 percentage point decreases over the last few years. Only time will tell if its new bets can bear fruit and potentially reverse the trend.

11. Balance Sheet Assessment

One of the best ways to mitigate bankruptcy risk is to hold more cash than debt.

ITT is a profitable, well-capitalized company with $1.74 billion of cash and $782.8 million of debt on its balance sheet. This $960.1 million net cash position is 6% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from ITT’s Q4 Results

We were impressed that both revenue and EPS in the quarter beat analysts’ EBITDA expectations this quarter. We were also excited its EPS guidance outperformed Wall Street’s estimates. Zooming out, we think this quarter featured some important positives. The stock remained flat at $185.15 immediately following the results.

13. Is Now The Time To Buy ITT?

Updated: February 26, 2026 at 10:31 PM EST

When considering an investment in ITT, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

ITT is an amazing business ranking highly on our list. For starters, its revenue growth was solid over the last five years, and analysts believe it can continue growing at these levels. And while its diminishing returns show management's recent bets still have yet to bear fruit, its rising cash profitability gives it more optionality. Additionally, ITT’s impressive operating margins show it has a highly efficient business model.

ITT’s P/E ratio based on the next 12 months is 28.7x. Scanning the industrials space today, ITT’s fundamentals really stand out, and we like it at this price.

Wall Street analysts have a consensus one-year price target of $233 on the company (compared to the current share price of $204.19), implying they see 14.1% upside in buying ITT in the short term.