JELD-WEN (JELD)

JELD-WEN is in for a bumpy ride. Its falling revenue and negative returns on capital suggest it’s destroying value as demand fizzles out.― StockStory Analyst Team

1. News

2. Summary

Why We Think JELD-WEN Will Underperform

Founded in the 1960s as a general wood-making company, JELD-WEN (NYSE:JELD) manufactures doors, windows, and other related building products.

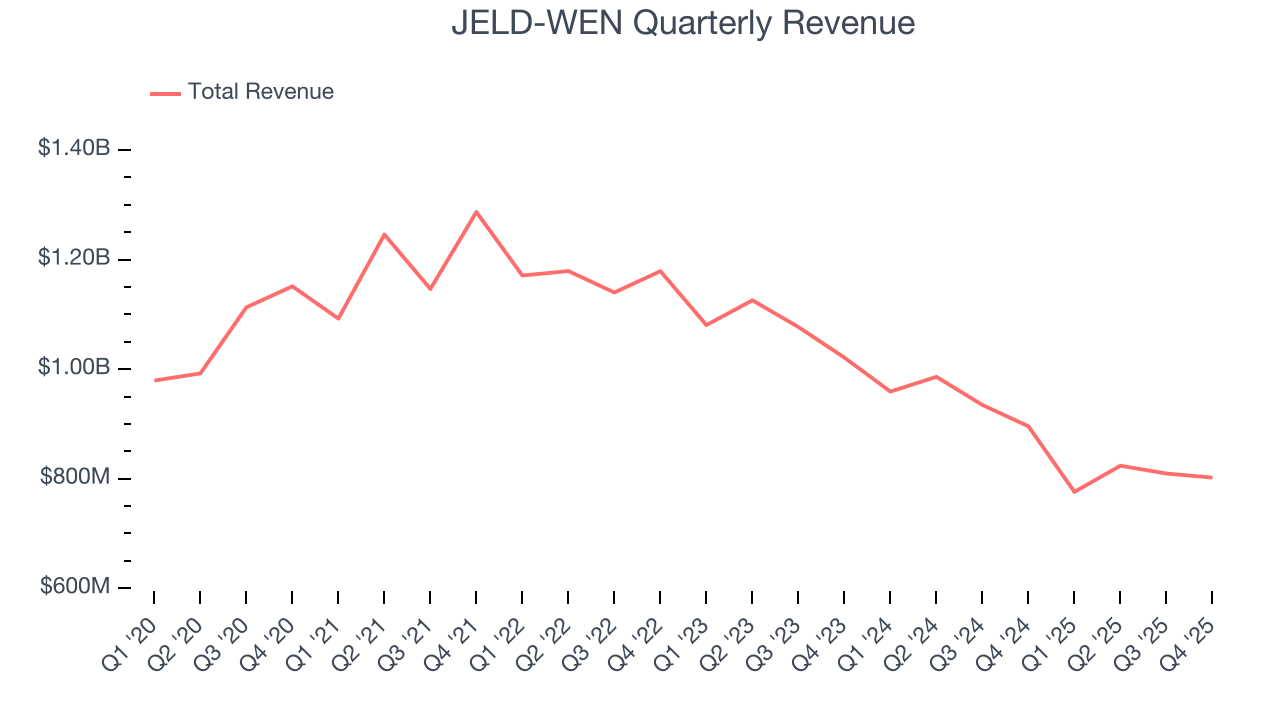

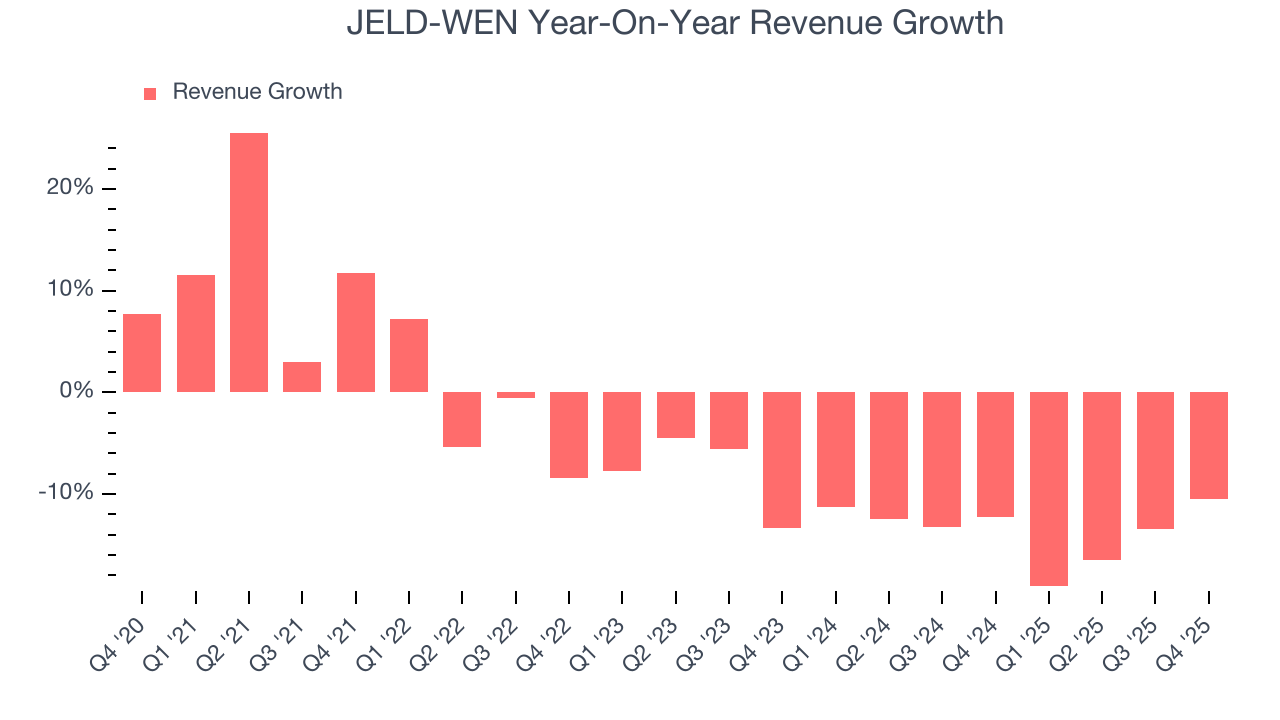

- Sales tumbled by 5.4% annually over the last five years, showing market trends are working against its favor during this cycle

- Performance over the past five years shows each sale was less profitable as its earnings per share dropped by 20.4% annually, worse than its revenue

- Unfavorable liquidity position could lead to additional equity financing that dilutes shareholders

JELD-WEN’s quality doesn’t meet our hurdle. There are more profitable opportunities elsewhere.

Why There Are Better Opportunities Than JELD-WEN

High Quality

Investable

Underperform

Why There Are Better Opportunities Than JELD-WEN

JELD-WEN is trading at $2.16 per share, or 7.9x forward EV-to-EBITDA. This multiple is cheaper than most industrials peers, but we think this is justified.

Cheap stocks can look like a great deal at first glance, but they can be value traps. They often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. JELD-WEN (JELD) Research Report: Q4 CY2025 Update

Building products manufacturer JELD-WEN (NYSE:JELD) announced better-than-expected revenue in Q4 CY2025, but sales fell by 10.5% year on year to $802 million. On the other hand, the company’s full-year revenue guidance of $3.03 billion at the midpoint came in 2.4% below analysts’ estimates. Its GAAP loss of $0.47 per share was 60% below analysts’ consensus estimates.

JELD-WEN (JELD) Q4 CY2025 Highlights:

- Revenue: $802 million vs analyst estimates of $745.2 million (10.5% year-on-year decline, 7.6% beat)

- EPS (GAAP): -$0.47 vs analyst expectations of -$0.29 (60% miss)

- Adjusted EBITDA: $14.8 million vs analyst estimates of $7.91 million (1.8% margin, 87.1% beat)

- EBITDA guidance for the upcoming financial year 2026 is $125 million at the midpoint, below analyst estimates of $145.4 million

- Operating Margin: -1.8%, up from -5.7% in the same quarter last year

- Free Cash Flow was $3.3 million, up from -$27.51 million in the same quarter last year

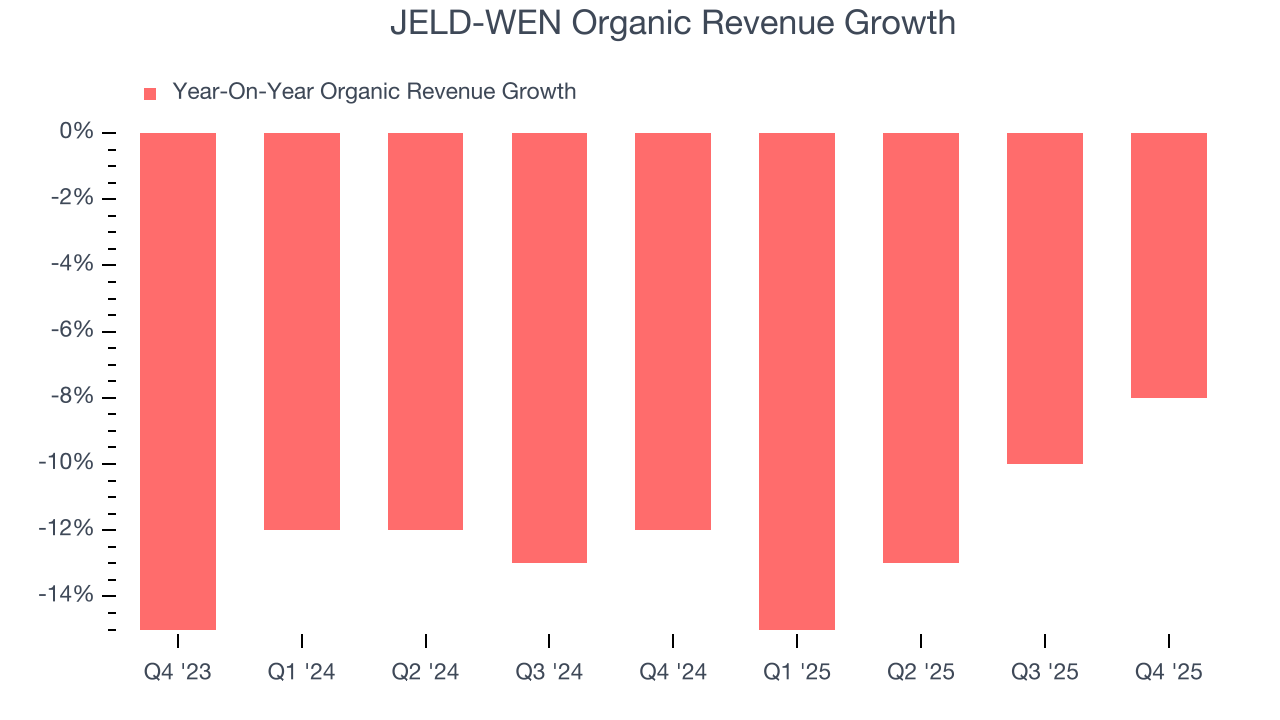

- Organic Revenue fell 8% year on year

- Market Capitalization: $191.4 million

Company Overview

Founded in the 1960s as a general wood-making company, JELD-WEN (NYSE:JELD) manufactures doors, windows, and other related building products.

The company serves the North American and European construction market with building materials. Simply put, its products give homebuilders the materials and products needed to build new homes and remodel existing ones.

JELD-WEN’s products include interior and exterior doors like patio doors and sliding door systems. It also offers non-residential doors made of steel, glass, and fiberglass to meet the often custom needs of enterprise customers. Its window products range from wood and vinyl residential windows to multi-pane windows with high-performance glazing that boast superior energy efficiency. The company’s offerings try to strike a balance between utility and aesthetics.

Door and window sales constitute the vast majority of JELD-WEN’s revenue. While the company does provide some installation services, they do not generate a meaningful portion of sales.

4. Home Construction Materials

Traditionally, home construction materials companies have built economic moats with expertise in specialized areas, brand recognition, and strong relationships with contractors. More recently, advances to address labor availability and job site productivity have spurred innovation that is driving incremental demand. However, these companies are at the whim of residential construction volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates. Additionally, the costs of raw materials can be driven by a myriad of worldwide factors and greatly influence the profitability of home construction materials companies.

Competitors offering door and window building materials include Masonite (NYSE:DOOR), and private companies Pella and Ply Gem.

5. Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, JELD-WEN’s demand was weak and its revenue declined by 5.4% per year. This wasn’t a great result and suggests it’s a low quality business.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. JELD-WEN’s recent performance shows its demand remained suppressed as its revenue has declined by 13.6% annually over the last two years.

We can dig further into the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, JELD-WEN’s organic revenue averaged 11.9% year-on-year declines. Because this number is better than its two-year revenue growth, we can see that some mixture of divestitures and foreign exchange rates dampened its headline results.

This quarter, JELD-WEN’s revenue fell by 10.5% year on year to $802 million but beat Wall Street’s estimates by 7.6%.

Looking ahead, sell-side analysts expect revenue to decline by 3.5% over the next 12 months. While this projection is better than its two-year trend, it’s tough to feel optimistic about a company facing demand difficulties.

6. Gross Margin & Pricing Power

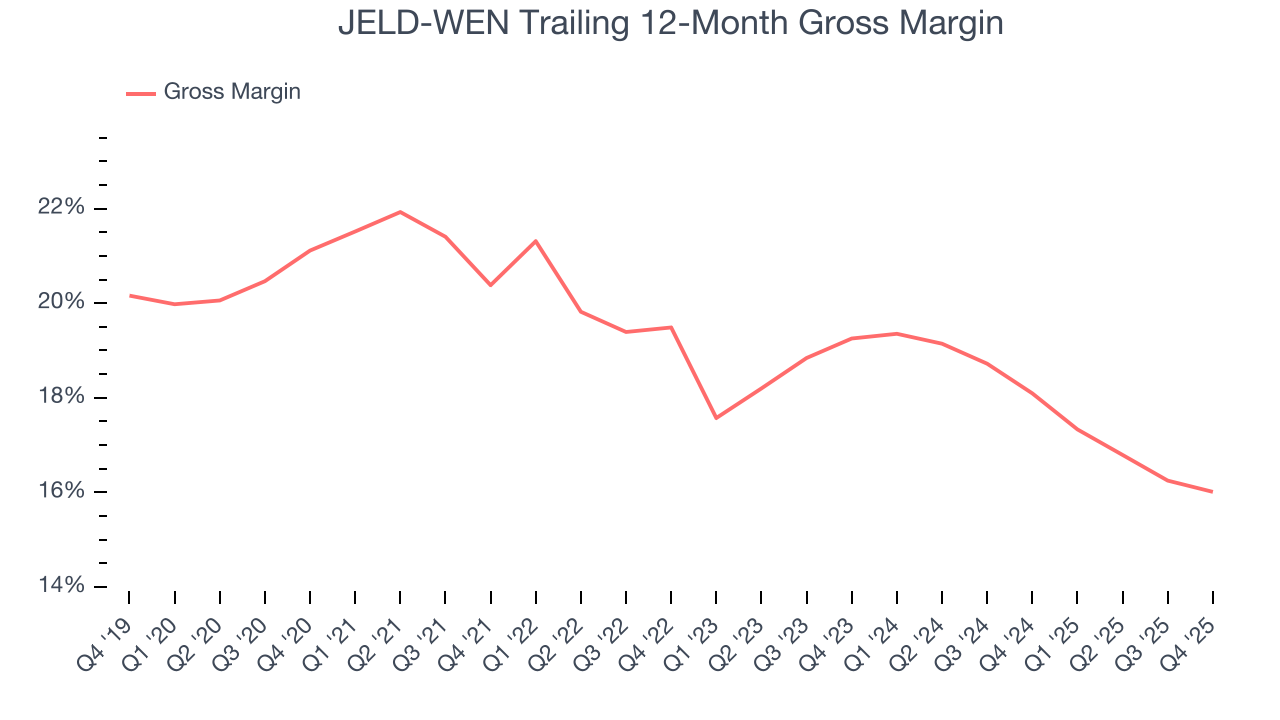

JELD-WEN has bad unit economics for an industrials business, signaling it operates in a competitive market. As you can see below, it averaged a 18.9% gross margin over the last five years. Said differently, JELD-WEN had to pay a chunky $81.15 to its suppliers for every $100 in revenue.

In Q4, JELD-WEN produced a 14.7% gross profit margin , marking a 1 percentage point decrease from 15.7% in the same quarter last year. JELD-WEN’s full-year margin has also been trending down over the past 12 months, decreasing by 2.1 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs (such as raw materials and manufacturing expenses).

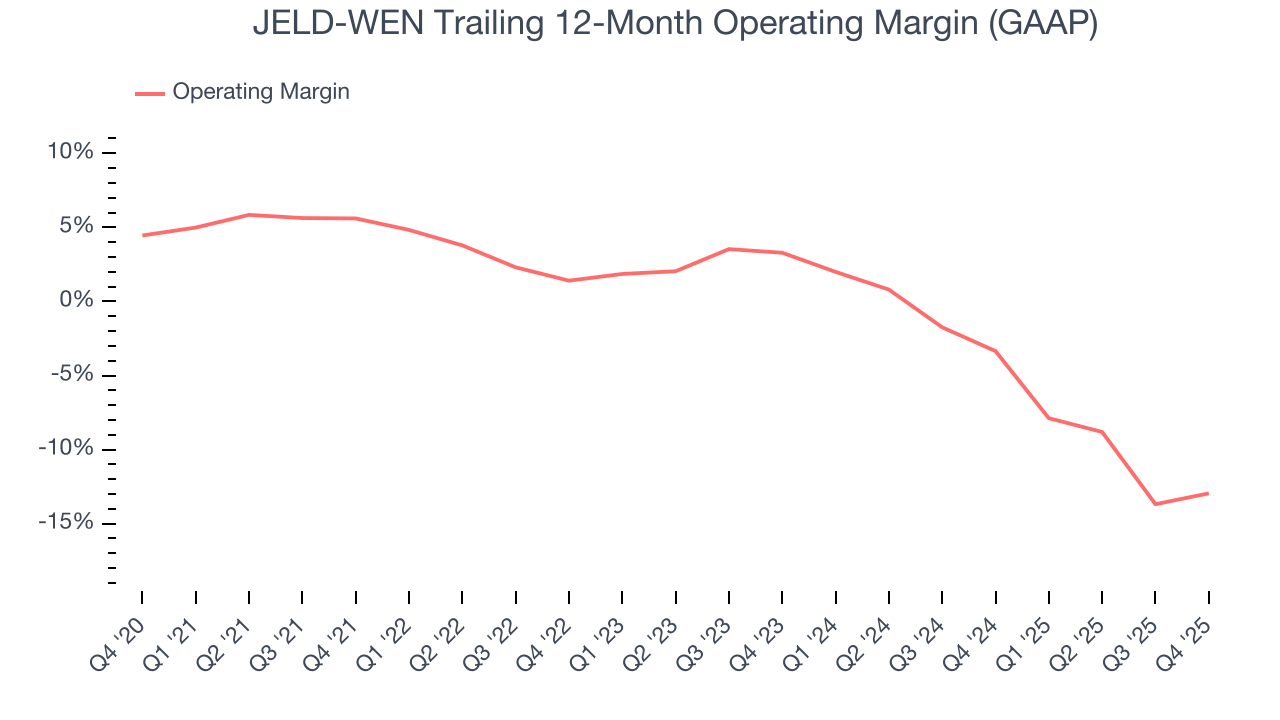

7. Operating Margin

JELD-WEN was roughly breakeven when averaging the last five years of quarterly operating profits, one of the worst outcomes in the industrials sector. This result isn’t too surprising given its low gross margin as a starting point.

Looking at the trend in its profitability, JELD-WEN’s operating margin decreased by 18.6 percentage points over the last five years. JELD-WEN’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

This quarter, JELD-WEN generated a negative 1.8% operating margin. The company's consistent lack of profits raise a flag.

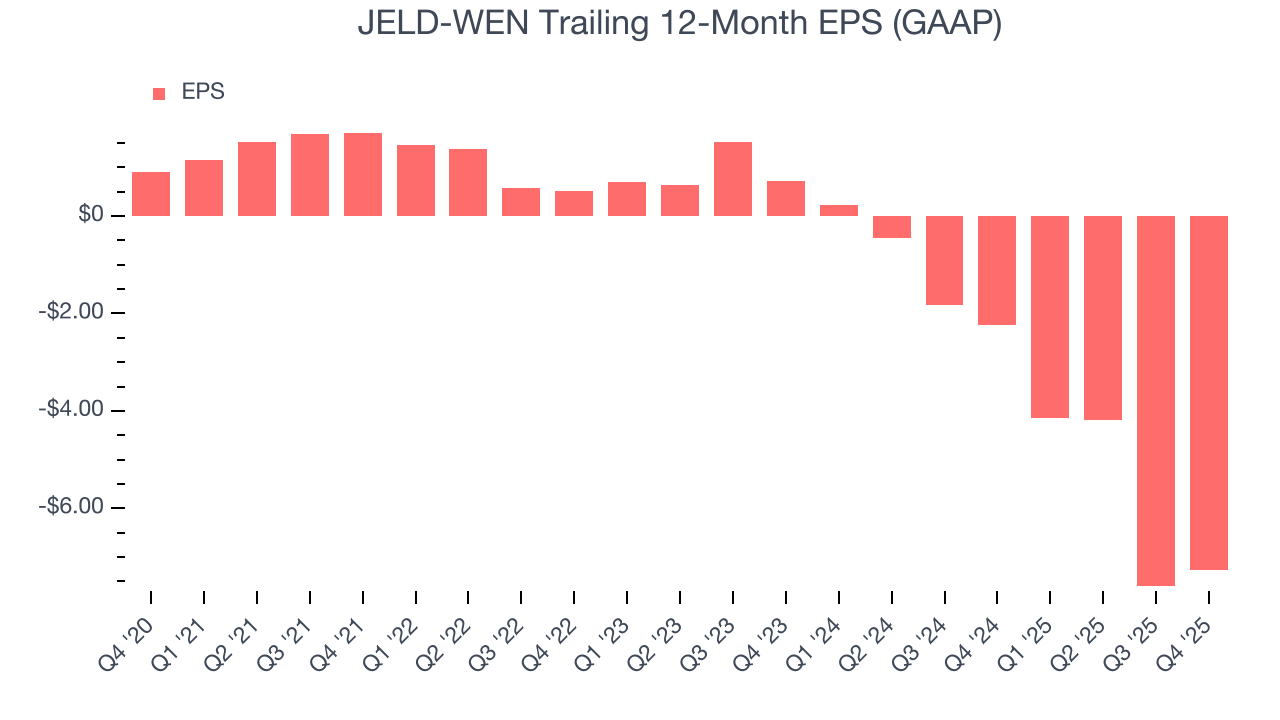

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for JELD-WEN, its EPS declined by 58.7% annually over the last five years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

We can take a deeper look into JELD-WEN’s earnings to better understand the drivers of its performance. As we mentioned earlier, JELD-WEN’s operating margin expanded this quarter but declined by 18.6 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For JELD-WEN, its two-year annual EPS declines of 247% show it’s continued to underperform. These results were bad no matter how you slice the data.

In Q4, JELD-WEN reported EPS of negative $0.47, up from negative $0.81 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates. Over the next 12 months, Wall Street expects JELD-WEN to improve its earnings losses. Analysts forecast its full-year EPS of negative $7.27 will advance to negative $0.14.

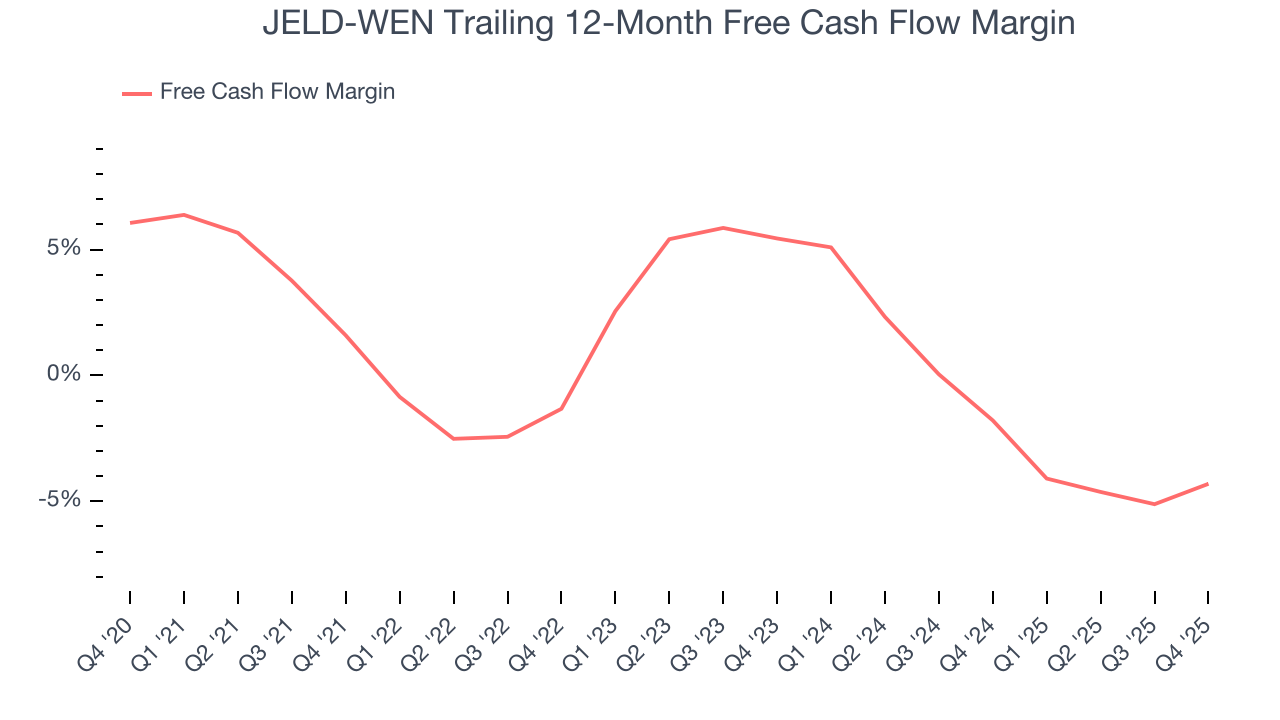

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

JELD-WEN broke even from a free cash flow perspective over the last five years, giving the company limited opportunities to return capital to shareholders.

Taking a step back, we can see that JELD-WEN’s margin dropped by 5.9 percentage points during that time. Almost any movement in the wrong direction is undesirable because of its already low cash conversion. If the trend continues, it could signal it’s in the middle of a big investment cycle.

JELD-WEN broke even from a free cash flow perspective in Q4. This result was good as its margin was 3.5 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, causing temporary swings. Long-term trends trump fluctuations.

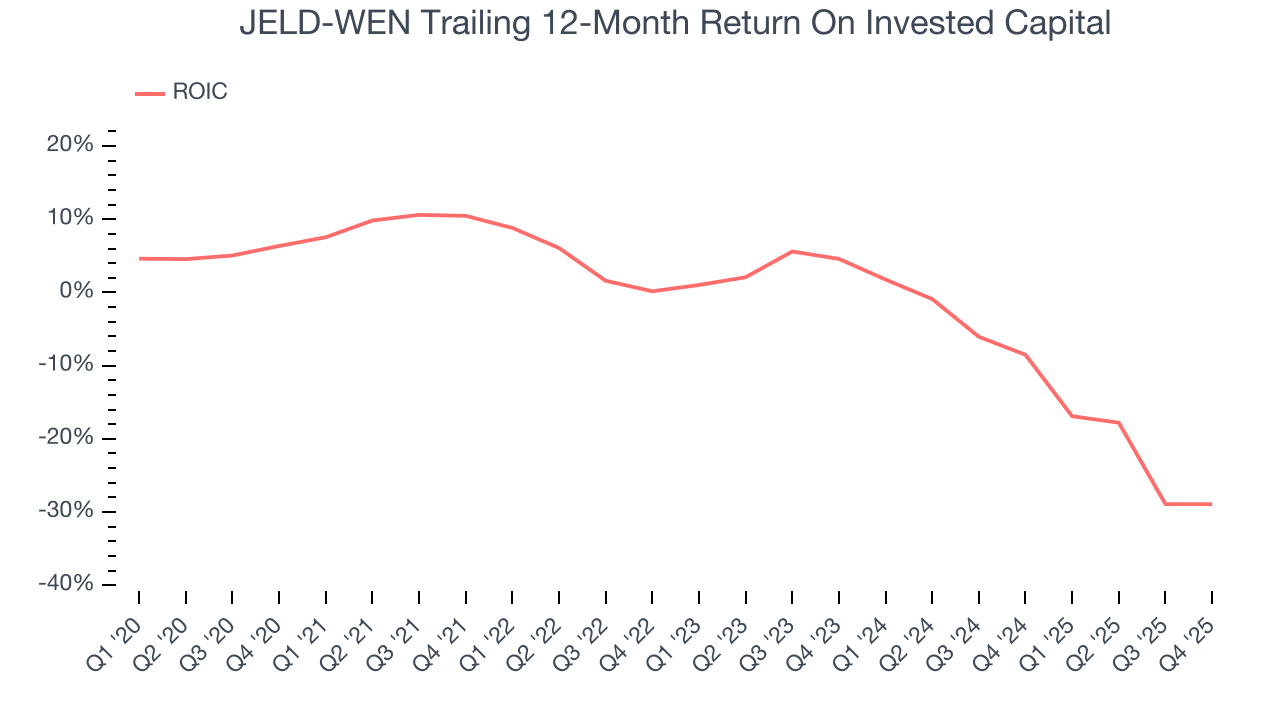

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

JELD-WEN’s five-year average ROIC was negative 4.4%, meaning management lost money while trying to expand the business. Its returns were among the worst in the industrials sector.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, JELD-WEN’s ROIC has unfortunately decreased significantly. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

11. Balance Sheet Risk

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

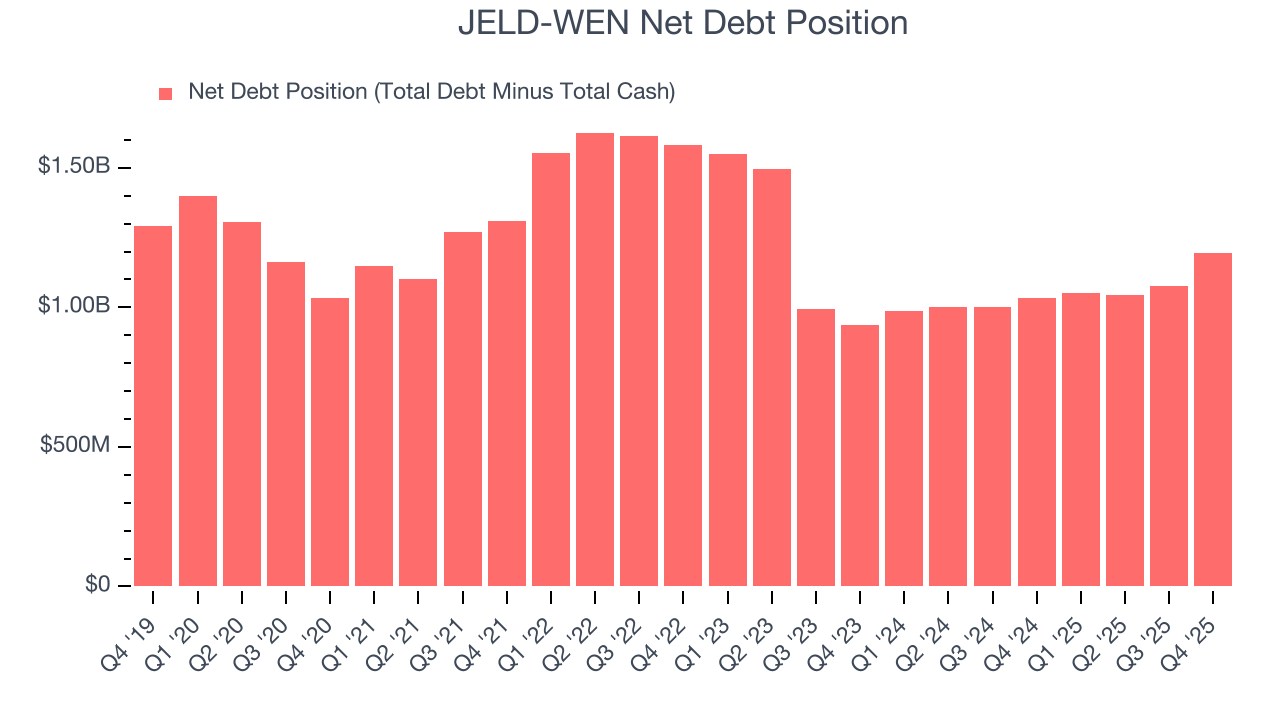

JELD-WEN burned through $138.3 million of cash over the last year, and its $1.33 billion of debt exceeds the $138.2 million of cash on its balance sheet. This is a deal breaker for us because indebted loss-making companies spell trouble.

Unless the JELD-WEN’s fundamentals change quickly, it might find itself in a position where it must raise capital from investors to continue operating. Whether that would be favorable is unclear because dilution is a headwind for shareholder returns.

We remain cautious of JELD-WEN until it generates consistent free cash flow or any of its announced financing plans materialize on its balance sheet.

12. Key Takeaways from JELD-WEN’s Q4 Results

We liked that JELD-WEN beat analysts’ EBITDA expectations this quarter on better-than-expected revenue. On the other hand, its full-year EBITDA guidance missed. Overall, this quarter was mixed, and the guidance could weigh on shares. The stock remained flat at $2.10 immediately after reporting.

13. Is Now The Time To Buy JELD-WEN?

Updated: February 17, 2026 at 10:45 PM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

We see the value of companies helping their customers, but in the case of JELD-WEN, we’re out. To begin with, its revenue has declined over the last five years. While its projected EPS for the next year implies the company’s fundamentals will improve, the downside is its diminishing returns show management's prior bets haven't worked out. On top of that, its relatively low ROIC suggests management has struggled to find compelling investment opportunities.

JELD-WEN’s EV-to-EBITDA ratio based on the next 12 months is 7.9x. At this valuation, there’s a lot of good news priced in - we think there are better opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $2.81 on the company (compared to the current share price of $2.16).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.