Kyndryl (KD)

Kyndryl doesn’t excite us. Not only did its demand evaporate but also its negative returns on capital show it destroyed shareholder value.― StockStory Analyst Team

1. News

2. Summary

Why We Think Kyndryl Will Underperform

Born from IBM's managed infrastructure services business in a 2021 spinoff, Kyndryl (NYSE:KD) is the world's largest IT infrastructure services provider that designs, builds, and manages technology environments for enterprise customers.

- Sales tumbled by 4.8% annually over the last five years, showing market trends are working against its favor during this cycle

- Poor expense management has led to adjusted operating margin losses

- A bright spot is that its enormous revenue base of $15.01 billion provides significant distribution advantages

Kyndryl’s quality is insufficient. Better businesses are for sale in the market.

Why There Are Better Opportunities Than Kyndryl

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Kyndryl

Kyndryl is trading at $23.66 per share, or 7.9x forward P/E. Kyndryl’s valuation may seem like a great deal, but we think there are valid reasons why it’s so cheap.

We’d rather pay up for companies with elite fundamentals than get a bargain on weak ones. Cheap stocks can be value traps, and as their performance deteriorates, they will stay cheap or get even cheaper.

3. Kyndryl (KD) Research Report: Q4 CY2025 Update

IT infrastructure services provider Kyndryl (NYSE:KD) fell short of the market’s revenue expectations in Q4 CY2025 as sales rose 3.1% year on year to $3.86 billion. Its non-GAAP profit of $0.52 per share was 13.7% below analysts’ consensus estimates.

Kyndryl (KD) Q4 CY2025 Highlights:

- Revenue: $3.86 billion vs analyst estimates of $3.90 billion (3.1% year-on-year growth, 1% miss)

- Adjusted EPS: $0.52 vs analyst expectations of $0.60 (13.7% miss)

- Adjusted EBITDA: $696 million vs analyst estimates of $701.2 million (18% margin, 0.7% miss)

- Operating Margin: 2.9%, down from 6.6% in the same quarter last year

- Free Cash Flow Margin: 5.6%, similar to the same quarter last year

- Market Capitalization: $5.37 billion

Company Overview

Born from IBM's managed infrastructure services business in a 2021 spinoff, Kyndryl (NYSE:KD) is the world's largest IT infrastructure services provider that designs, builds, and manages technology environments for enterprise customers.

Kyndryl operates across six core service domains: cloud services, core enterprise and zCloud, applications, data and AI, digital workplace, security and resiliency, and network and edge services. The company essentially serves as the backbone that keeps its clients' critical IT systems running smoothly while helping them modernize their technology infrastructure.

For cloud services, Kyndryl helps enterprises navigate complex multi-cloud environments, integrating services from various providers into unified systems. Its core enterprise services maintain and modernize traditional infrastructure, including mainframe environments that still power many large organizations. Through its application and data services, Kyndryl assists companies in managing vast quantities of enterprise data and implementing AI solutions while maintaining security and regulatory compliance.

A typical Kyndryl customer might be a global bank that needs to maintain legacy systems while simultaneously migrating certain workloads to the cloud. Kyndryl would design the migration strategy, implement the technical changes, and then provide ongoing management of the hybrid environment.

The company generates revenue through long-term service contracts, with nearly half its business coming from financial services clients. Other significant customer segments include technology and telecom companies (20%), retail and travel (15%), and industrial sector clients (10%).

With operations in over 60 countries and thousands of enterprise customers, Kyndryl leverages its global scale and deep technical expertise to deliver consistent service worldwide. The company maintains strategic partnerships with major technology providers including Microsoft, Google Cloud, Amazon Web Services, SAP, VMware, and others to enhance its service offerings.

4. IT Services & Consulting

IT Services & Consulting companies stand to benefit from increasing enterprise demand for digital transformation, AI-driven automation, and cybersecurity resilience. Many enterprises can't attack these topics alone and need IT services and consulting on everything from technical advice to implementation. Challenges in meeting these needs will include finding talent in specialized and evolving IT fields. While AI and automation can enhance productivity, they also threaten to commoditize certain consulting functions. Another ongoing challenge will be pricing pressures from offshore IT service providers, which have lower labor costs and increasingly equal access to advanced technology like AI.

Kyndryl competes with global IT services providers like Accenture (NYSE: ACN), IBM (NYSE: IBM), DXC Technology (NYSE: DXC), and Infosys (NYSE: INFY), as well as cloud service providers that offer managed infrastructure services.

5. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years.

With $15.12 billion in revenue over the past 12 months, Kyndryl is a behemoth in the business services sector and benefits from economies of scale, giving it an edge in distribution. This also enables it to gain more leverage on its fixed costs than smaller competitors and the flexibility to offer lower prices. However, its scale is a double-edged sword because finding new avenues for growth becomes difficult when you already have a substantial market presence. To accelerate sales, Kyndryl likely needs to optimize its pricing or lean into new offerings and international expansion.

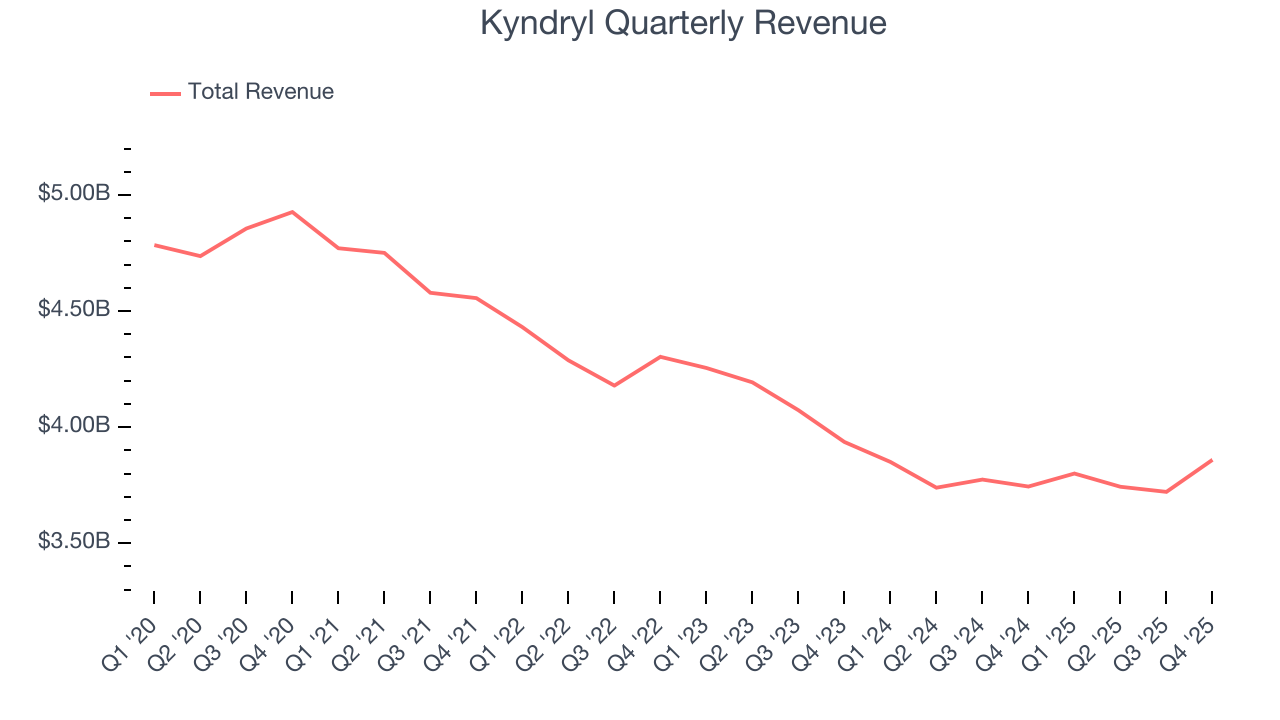

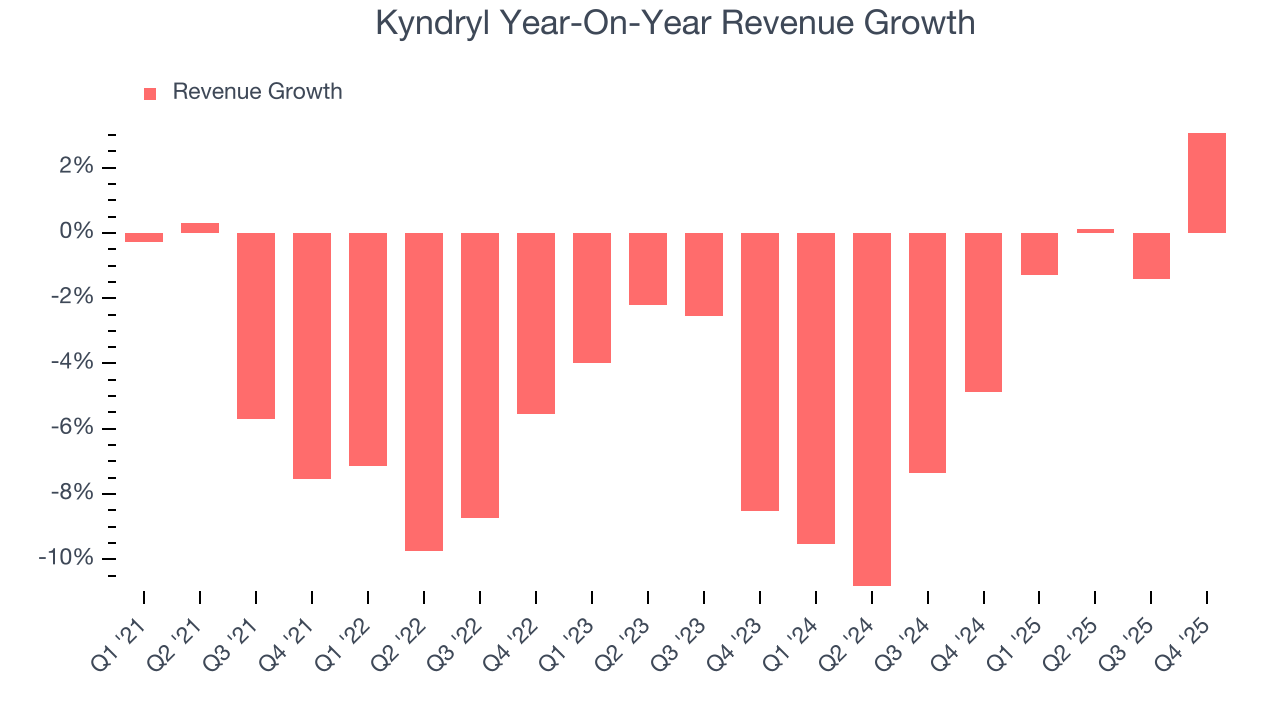

As you can see below, Kyndryl’s revenue declined by 4.8% per year over the last five years, a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. Kyndryl’s annualized revenue declines of 4.1% over the last two years align with its five-year trend, suggesting its demand has consistently shrunk.

This quarter, Kyndryl’s revenue grew by 3.1% year on year to $3.86 billion, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 4.8% over the next 12 months. Although this projection implies its newer products and services will catalyze better top-line performance, it is still below the sector average.

6. Operating Margin

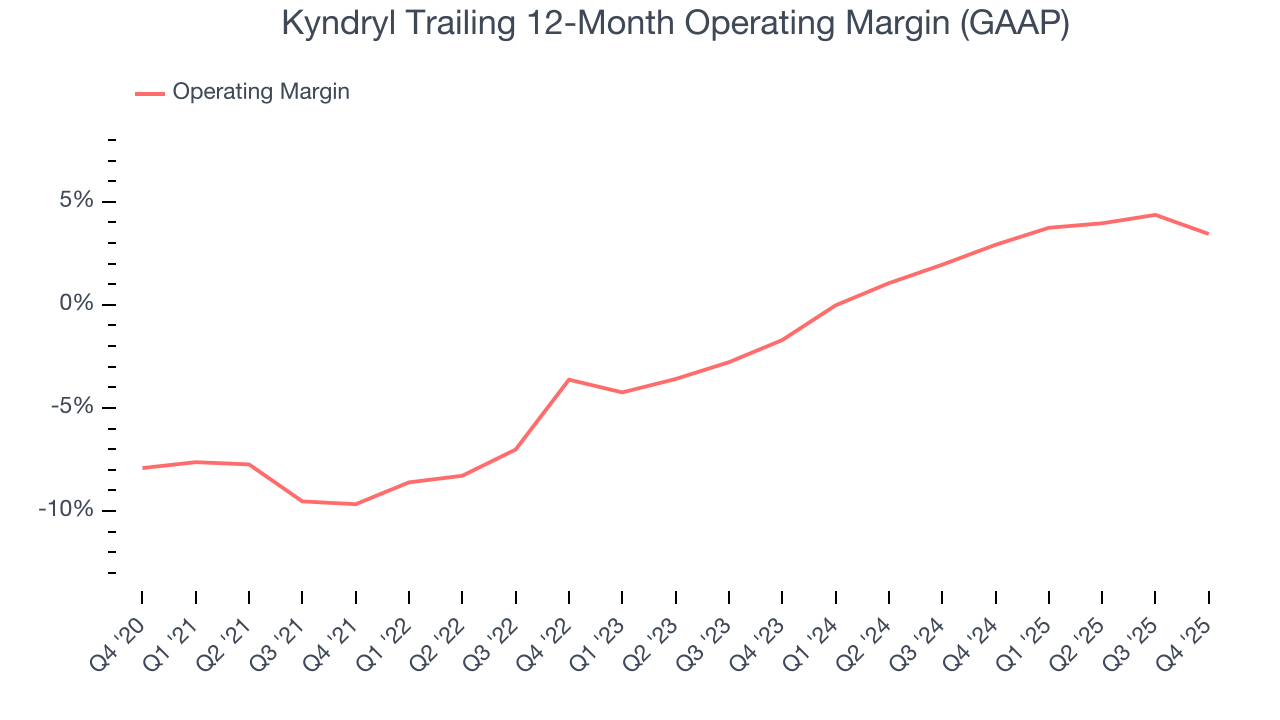

Although Kyndryl was profitable this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average operating margin of negative 2.1% over the last five years. Unprofitable business services companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

On the plus side, Kyndryl’s operating margin rose by 13.1 percentage points over the last five years. Still, it will take much more for the company to show consistent profitability.

In Q4, Kyndryl generated an operating margin profit margin of 2.9%, down 3.7 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

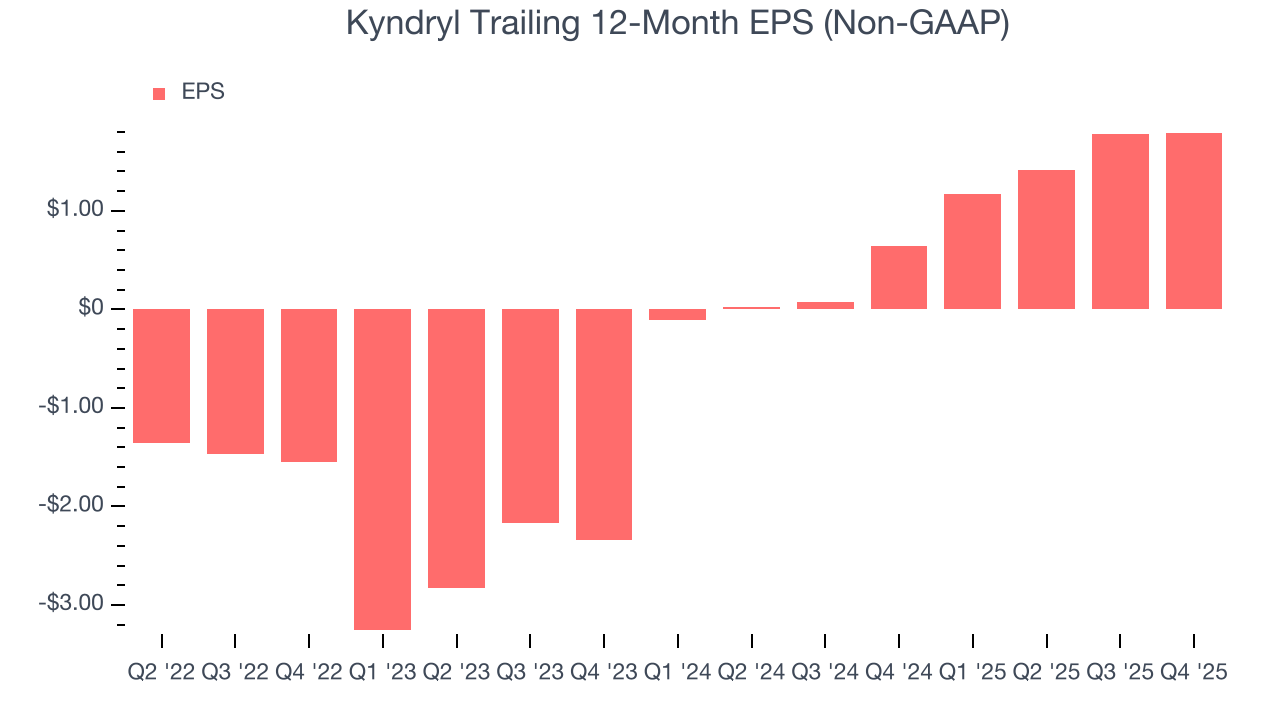

Kyndryl’s full-year EPS flipped from negative to positive over the last four years. This is encouraging and shows it’s at a critical moment in its life.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Kyndryl, its two-year annual EPS growth of 66.3% was higher than its four-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q4, Kyndryl reported adjusted EPS of $0.52, up from $0.51 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates, but we care more about long-term adjusted EPS growth than short-term movements. Over the next 12 months, Wall Street expects Kyndryl’s full-year EPS of $1.79 to grow 81.7%.

8. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

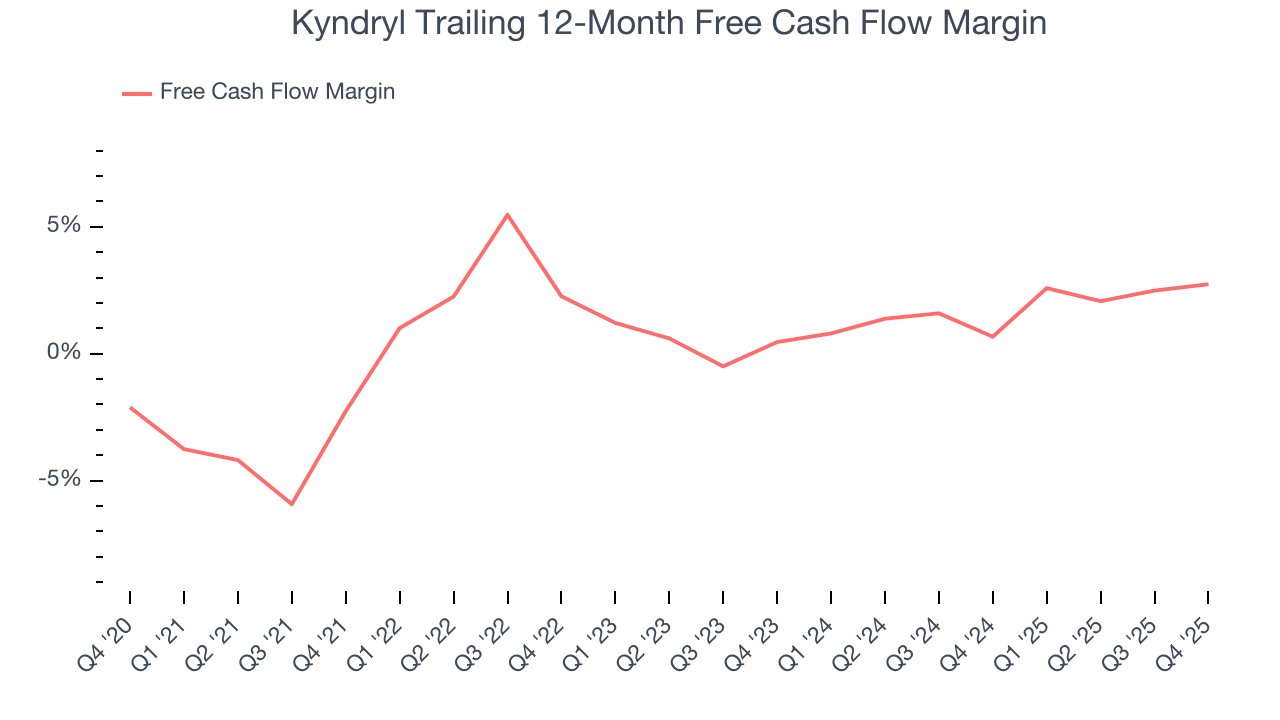

Kyndryl broke even from a free cash flow perspective over the last five years, giving the company limited opportunities to return capital to shareholders.

Taking a step back, an encouraging sign is that Kyndryl’s margin expanded by 5 percentage points during that time. We have no doubt shareholders would like to continue seeing its cash conversion rise as it gives the company more optionality.

Kyndryl’s free cash flow clocked in at $217 million in Q4, equivalent to a 5.6% margin. This cash profitability was in line with the comparable period last year and above its five-year average.

9. Return on Invested Capital (ROIC)

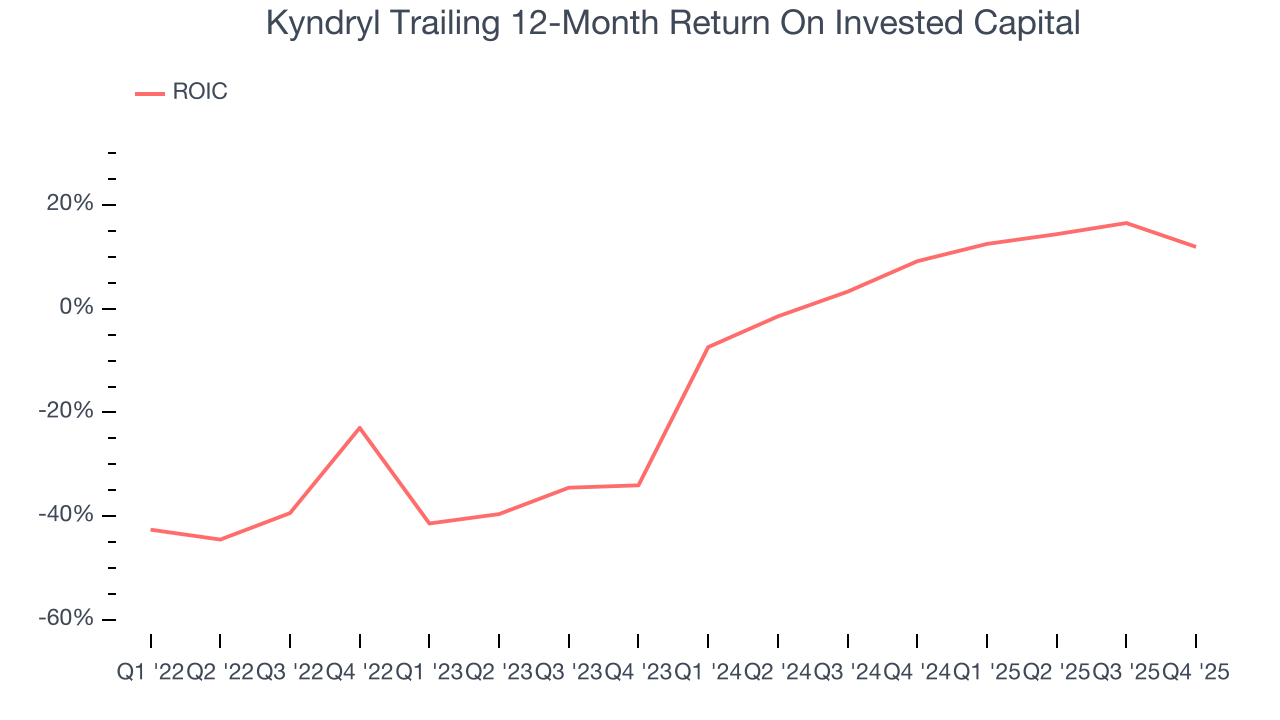

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Kyndryl’s four-year average ROIC was negative 9%, meaning management lost money while trying to expand the business. Its returns were among the worst in the business services sector.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Kyndryl’s ROIC has increased. This is a good sign, but we recognize its lack of profitable growth during the COVID era was the primary reason for the change.

10. Balance Sheet Assessment

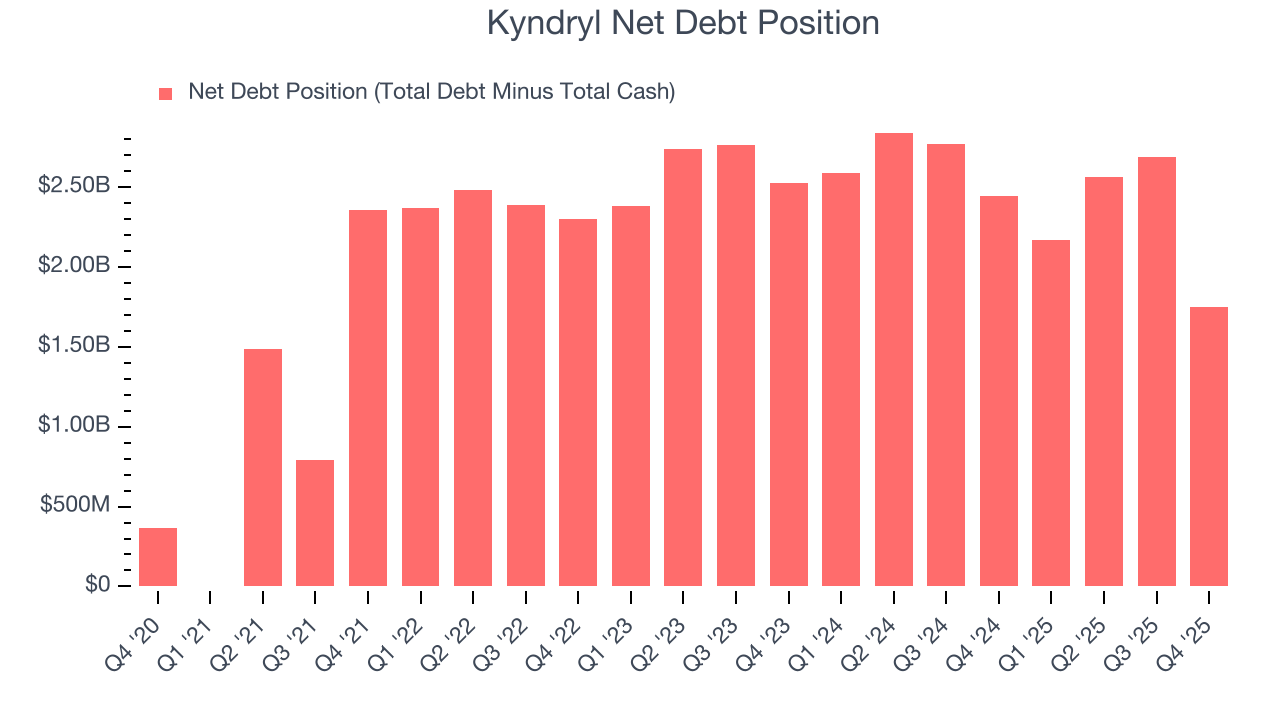

Kyndryl reported $1.35 billion of cash and $3.1 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $2.68 billion of EBITDA over the last 12 months, we view Kyndryl’s 0.7× net-debt-to-EBITDA ratio as safe. We also see its $41 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Kyndryl’s Q4 Results

We struggled to find many positives in these results. Its EPS missed and its revenue fell slightly short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 25.1% to $17.59 immediately following the results.

12. Is Now The Time To Buy Kyndryl?

Updated: February 9, 2026 at 7:14 AM EST

Before investing in or passing on Kyndryl, we urge you to understand the company’s business quality (or lack thereof), valuation, and the latest quarterly results - in that order.

Kyndryl isn’t a terrible business, but it doesn’t pass our bar. For starters, its revenue has declined over the last five years. And while its scale makes it a trusted partner with negotiating leverage, the downside is its relatively low ROIC suggests management has struggled to find compelling investment opportunities. On top of that, its operating margins reveal poor profitability compared to other business services companies.

Kyndryl’s P/E ratio based on the next 12 months is 7.2x. While this valuation is optically cheap, the potential downside is big given its shaky fundamentals. We're fairly confident there are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $37.67 on the company (compared to the current share price of $17.59).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.