Kennametal (KMT)

Kennametal is in for a bumpy ride. Its weak sales growth and low returns on capital show it struggled to generate demand and profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think Kennametal Will Underperform

Involved in manufacturing hard tips of anti-tank projectiles in World War II, Kennametal (NYSE:KMT) is a provider of industrial materials and tools for various sectors.

- Annual sales declines of 2.3% for the past two years show its products and services struggled to connect with the market during this cycle

- Sales were less profitable over the last two years as its earnings per share fell by 4.7% annually, worse than its revenue declines

- Absence of organic revenue growth over the past two years suggests it may have to lean into acquisitions to drive its expansion

Kennametal lacks the business quality we seek. We’d rather invest in businesses with stronger moats.

Why There Are Better Opportunities Than Kennametal

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Kennametal

Kennametal’s stock price of $36.33 implies a valuation ratio of 20.8x forward P/E. This multiple is cheaper than most industrials peers, but we think this is justified.

We’d rather pay up for companies with elite fundamentals than get a bargain on weak ones. Cheap stocks can be value traps, and as their performance deteriorates, they will stay cheap or get even cheaper.

3. Kennametal (KMT) Research Report: Q4 CY2025 Update

Industrial materials and tools company Kennametal (NYSE:KMT) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 9.8% year on year to $529.5 million. Guidance for next quarter’s revenue was optimistic at $555 million at the midpoint, 2.2% above analysts’ estimates. Its non-GAAP profit of $0.47 per share was 24.3% above analysts’ consensus estimates.

Kennametal (KMT) Q4 CY2025 Highlights:

- Revenue: $529.5 million vs analyst estimates of $524.4 million (9.8% year-on-year growth, 1% beat)

- Adjusted EPS: $0.47 vs analyst estimates of $0.38 (24.3% beat)

- The company lifted its revenue guidance for the full year to $2.22 billion at the midpoint from $2.14 billion, a 4% increase

- Management raised its full-year Adjusted EPS guidance to $2.25 at the midpoint, a 50% increase

- Operating Margin: 9.9%, up from 6.6% in the same quarter last year

- Free Cash Flow Margin: 8%, similar to the same quarter last year

- Organic Revenue rose 10% year on year (beat)

- Market Capitalization: $2.72 billion

Company Overview

Involved in manufacturing hard tips of anti-tank projectiles in World War II, Kennametal (NYSE:KMT) is a provider of industrial materials and tools for various sectors.

Initially established in 1938 with a focus on products for cutting tools, the company sought to expand its product line through continuous investment into research and development. In specific, this enabled the company to expand its advanced material offerings which has been foundational for its growth. Today, its products have different uses across the aerospace, automotive, and energy industries. The company also works with government entities, particularly for projects related to aerospace, energy, and infrastructure.

Kennametal’s cutting tools enable manufacturers to cut, shape, and finish metal components. Tools like drill bits or mining cutters are used by metal fabricators and mining operators. In addition to cutting tools are its engineered components and wear-resistant materials. These include wear-resistant inserts, metal alloys, and ceramic materials designed to withstand extreme temperatures, corrosive environments, and other applications.

The company uses distributors, a direct sales team, and digital platforms to reach customers. Its partnerships and alliances have also strengthened the company’s market presence and helped drive growth. In terms of contracts, Kennametal offers different types of contracts (supply agreements, long-term service, joint development agreements) to adhere to specific needs.

4. Professional Tools and Equipment

Automation that increases efficiency and connected equipment that collects analyzable data have been trending, creating new demand. Some professional tools and equipment companies also provide software to accompany measurement or automated machinery, adding a stream of recurring revenues to their businesses. On the other hand, professional tools and equipment companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

Competitors offering similar products include Xylem (NYSE:XYL), A.O. Smith (NYSE:AOS), and Watts Water (NYSE:WTS).

5. Revenue Growth

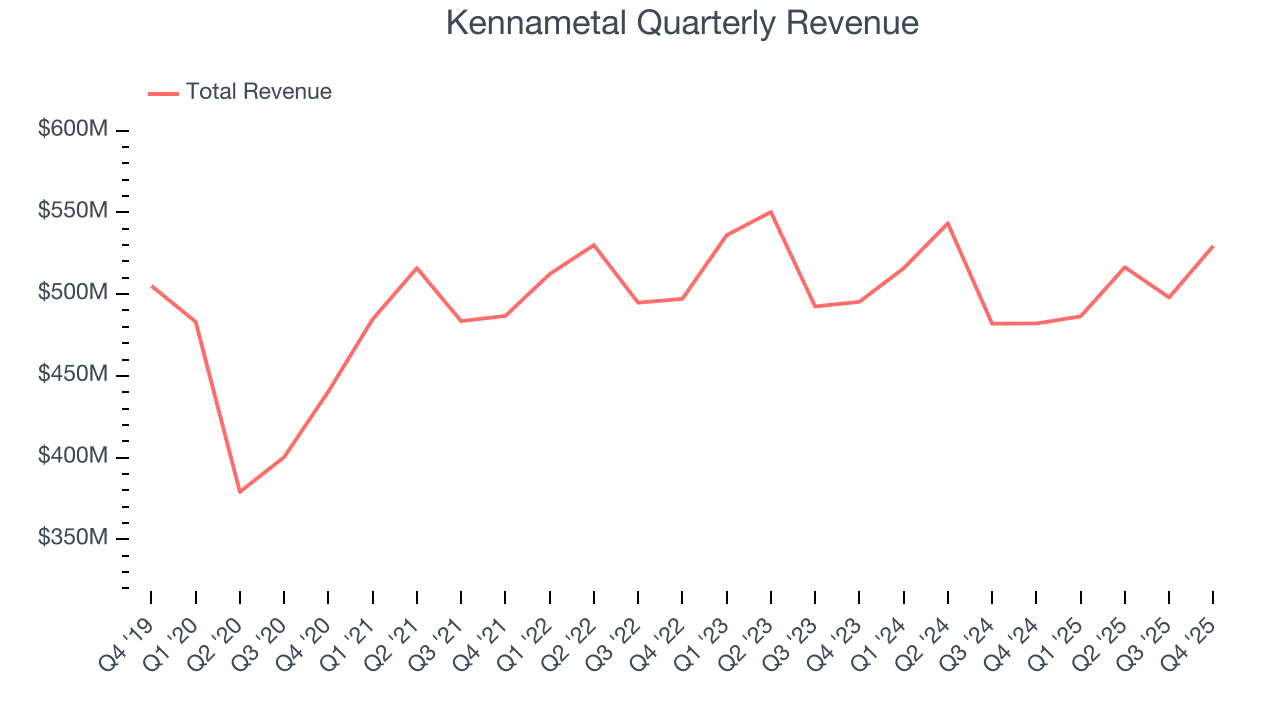

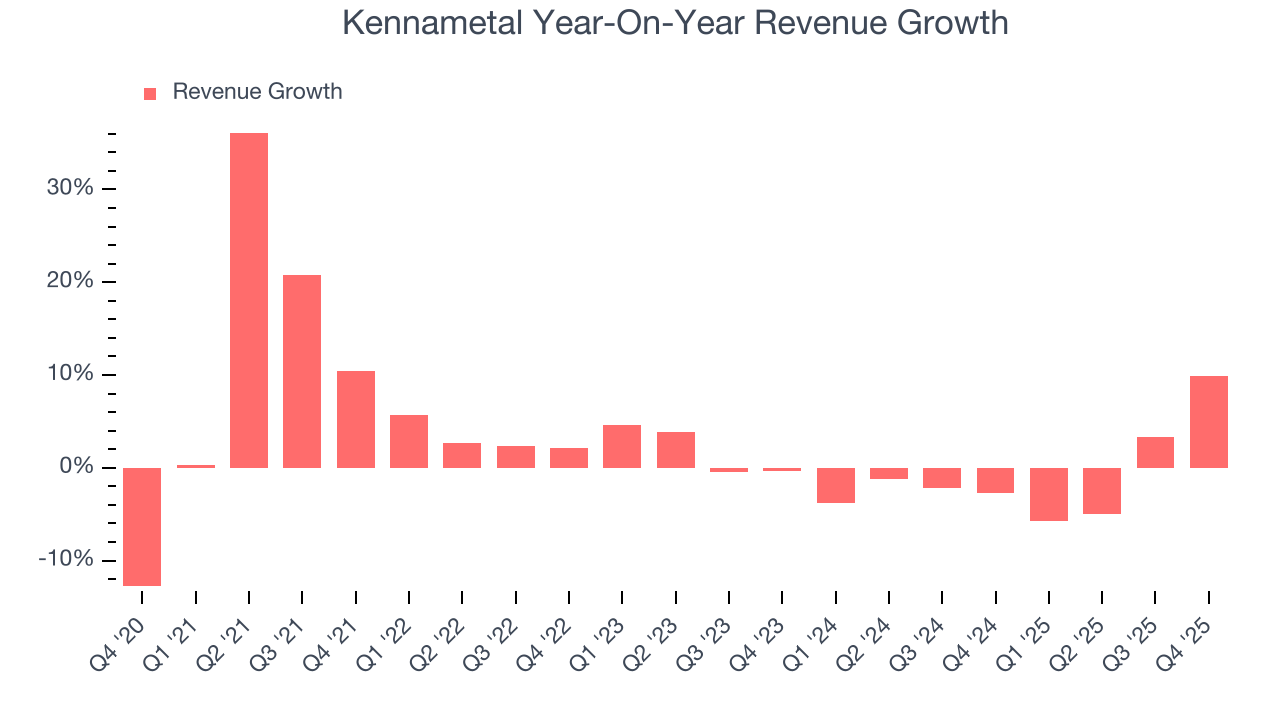

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years. Regrettably, Kennametal’s sales grew at a sluggish 3.6% compounded annual growth rate over the last five years. This fell short of our benchmark for the industrials sector and is a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Kennametal’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 1.1% annually.

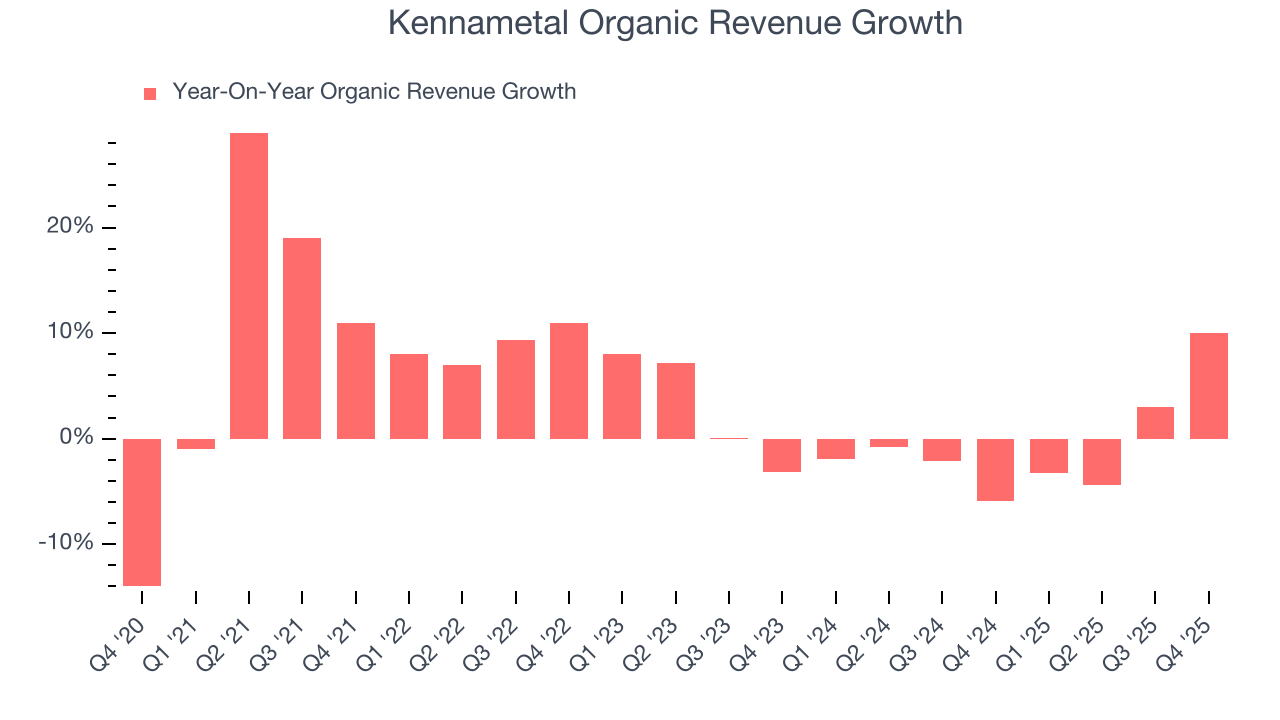

We can dig further into the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, Kennametal’s organic revenue was flat. Because this number aligns with its two-year revenue growth, we can see the company’s core operations (not acquisitions and divestitures) drove most of its results.

This quarter, Kennametal reported year-on-year revenue growth of 9.8%, and its $529.5 million of revenue exceeded Wall Street’s estimates by 1%. Company management is currently guiding for a 14.1% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 8.9% over the next 12 months, an improvement versus the last two years. This projection is above average for the sector and indicates its newer products and services will spur better top-line performance.

6. Gross Margin & Pricing Power

Cost of sales for an industrials business is usually comprised of the direct labor, raw materials, and supplies needed to offer a product or service. These costs can be impacted by inflation and supply chain dynamics.

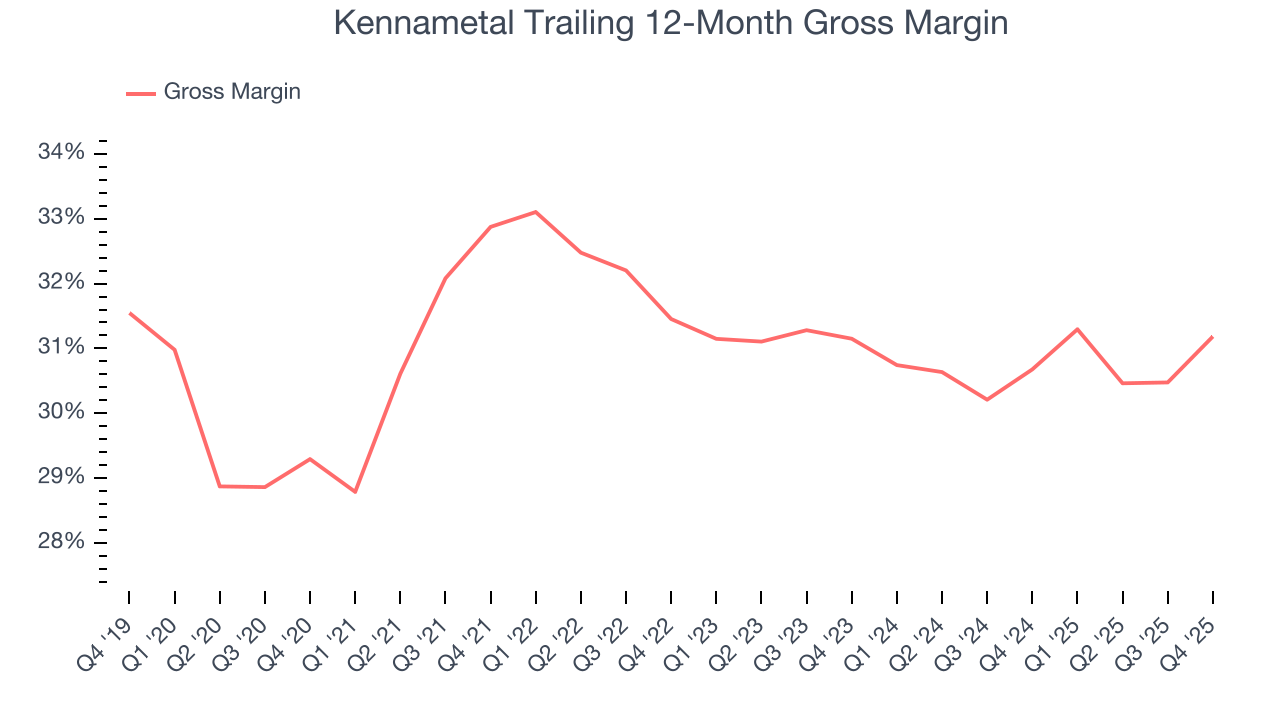

Kennametal’s unit economics are better than the typical industrials business, signaling its products are somewhat differentiated through quality or brand.As you can see below, it averaged a decent 31.5% gross margin over the last five years. That means for every $100 in revenue, roughly $31.46 was left to spend on selling, marketing, R&D, and general administrative overhead.

This quarter, Kennametal’s gross profit margin was 32.8%, marking a 2.7 percentage point increase from 30.1% in the same quarter last year. On a wider time horizon, the company’s full-year margin has remained steady over the past four quarters, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

7. Operating Margin

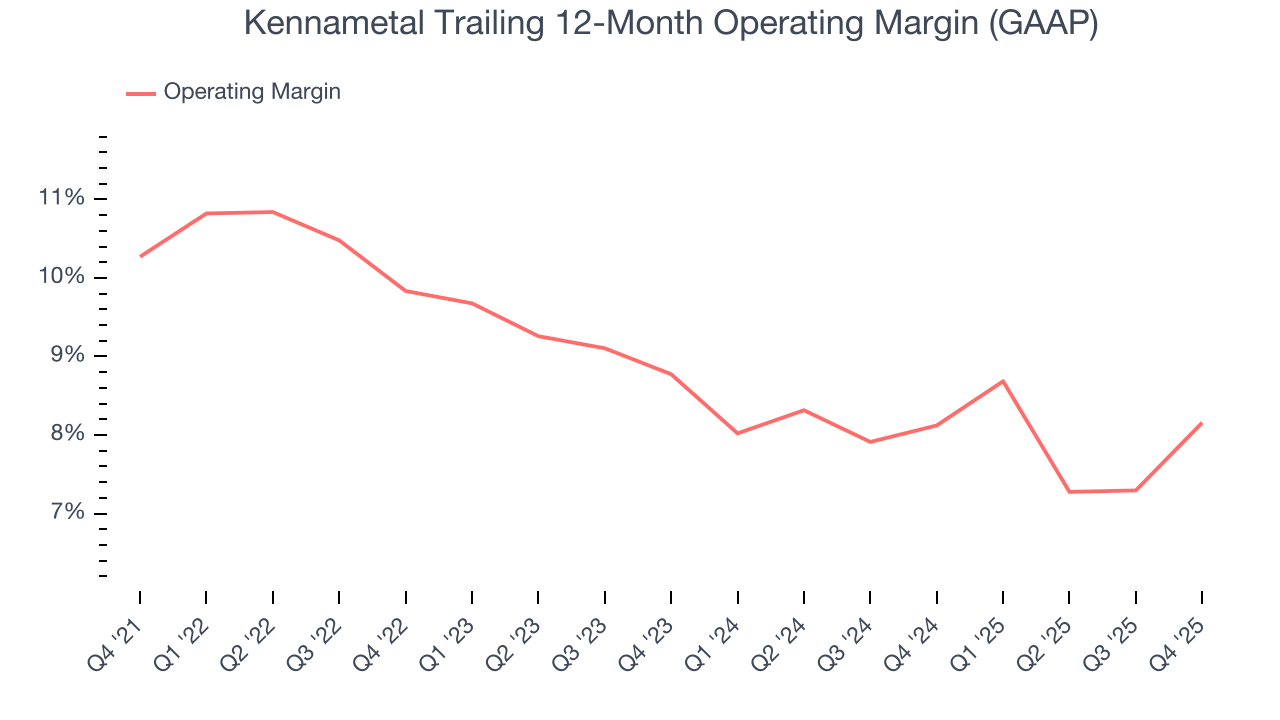

Kennametal has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 9%, higher than the broader industrials sector.

Analyzing the trend in its profitability, Kennametal’s operating margin decreased by 2.1 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Kennametal generated an operating margin profit margin of 9.9%, up 3.4 percentage points year on year. The increase was encouraging, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

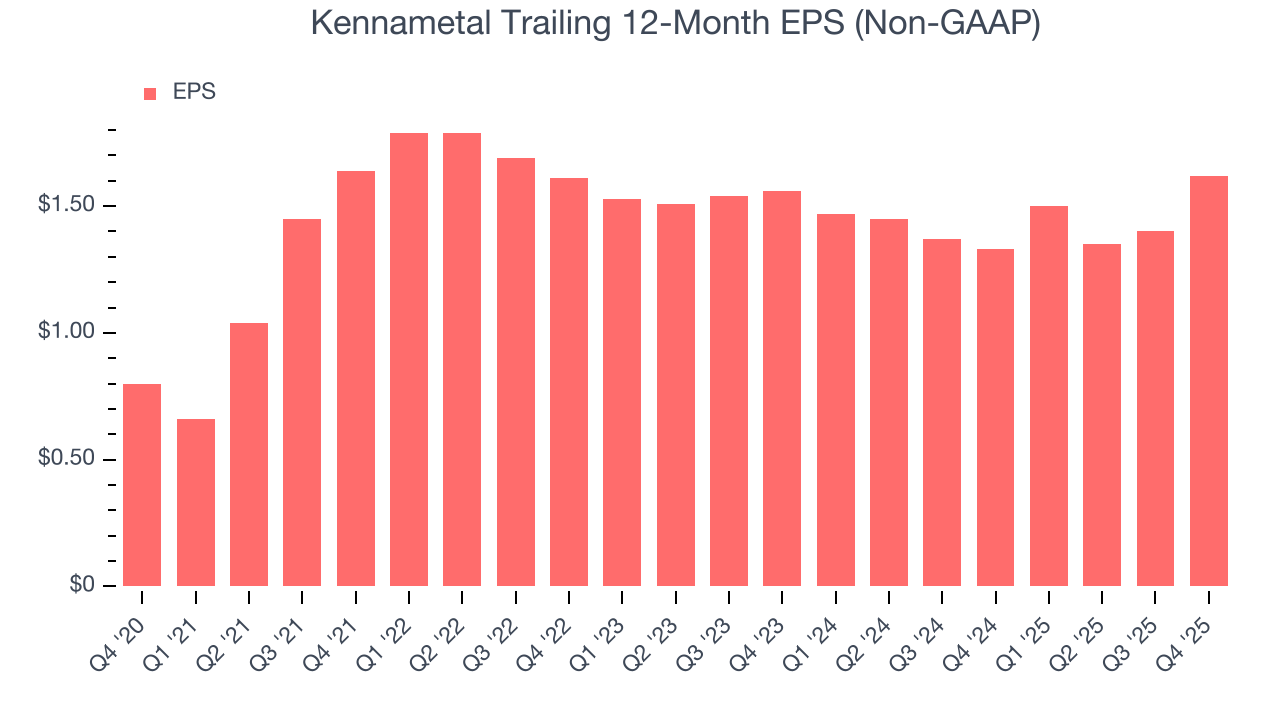

Kennametal’s EPS grew at a spectacular 15.2% compounded annual growth rate over the last five years, higher than its 3.6% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

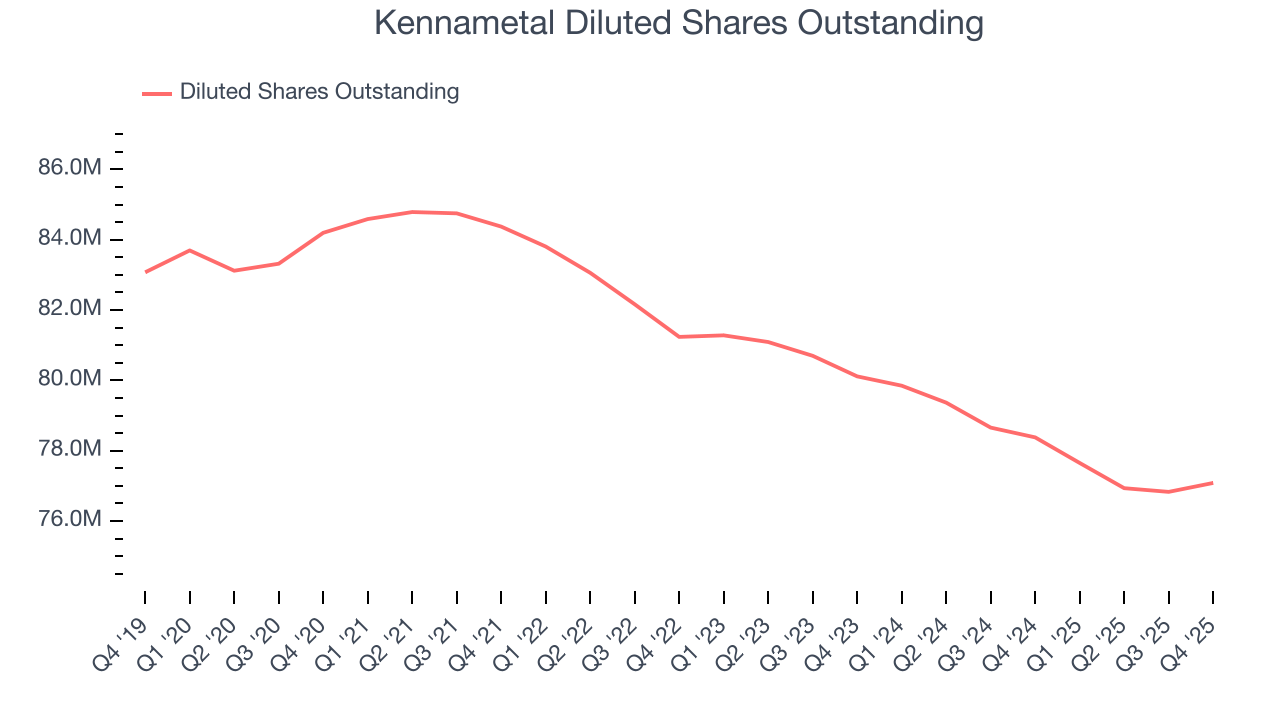

Diving into Kennametal’s quality of earnings can give us a better understanding of its performance. A five-year view shows that Kennametal has repurchased its stock, shrinking its share count by 8.4%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Kennametal, its two-year annual EPS growth of 1.9% was lower than its five-year trend. We hope its growth can accelerate in the future.

In Q4, Kennametal reported adjusted EPS of $0.47, up from $0.25 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Kennametal’s full-year EPS of $1.62 to grow 10.5%.

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

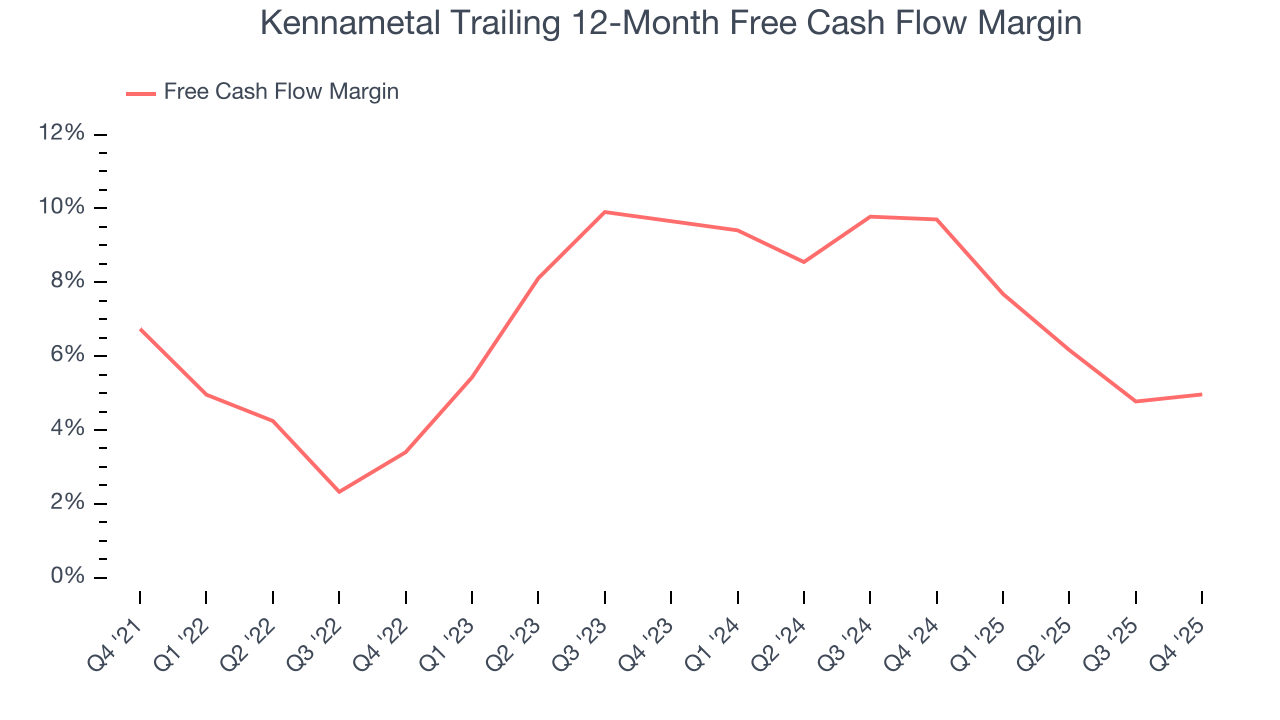

Kennametal has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 6.9% over the last five years, slightly better than the broader industrials sector.

Taking a step back, we can see that Kennametal’s margin dropped by 1.8 percentage points during that time. Continued declines could signal it is in the middle of an investment cycle.

Kennametal’s free cash flow clocked in at $42.4 million in Q4, equivalent to a 8% margin. This cash profitability was in line with the comparable period last year and above its five-year average.

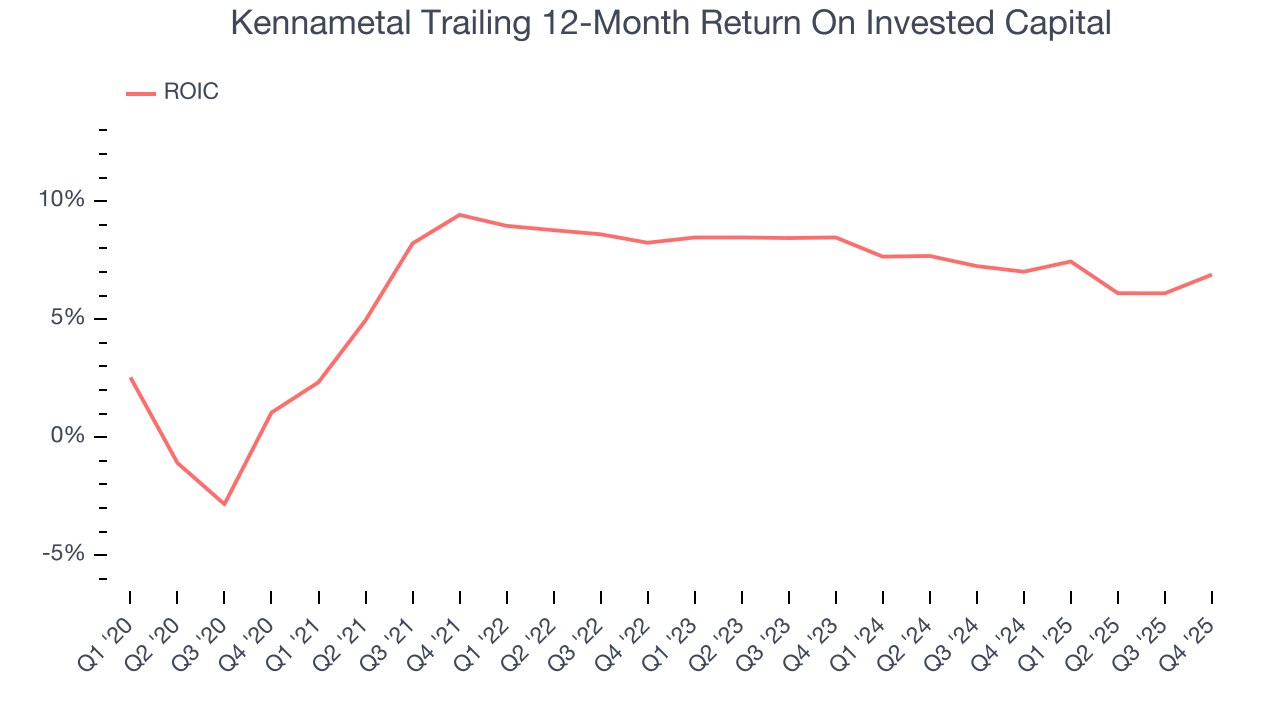

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Kennametal historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 8%, somewhat low compared to the best industrials companies that consistently pump out 20%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Kennametal’s ROIC averaged 1.9 percentage point decreases over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

11. Key Takeaways from Kennametal’s Q4 Results

We were impressed by Kennametal’s optimistic full-year EPS guidance, which blew past analysts’ expectations. We were also glad its full-year revenue guidance trumped Wall Street’s estimates. Zooming out, we think this quarter featured some important positives. The stock traded up 2.2% to $36.55 immediately after reporting.

12. Is Now The Time To Buy Kennametal?

Updated: February 4, 2026 at 6:59 AM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Kennametal.

Kennametal falls short of our quality standards. To kick things off, its revenue growth was weak over the last five years. And while its spectacular EPS growth over the last five years shows its profits are trickling down to shareholders, the downside is its flat organic revenue disappointed. On top of that, its mediocre ROIC lags the market and is a headwind for its stock price.

Kennametal’s P/E ratio based on the next 12 months is 20x. While this valuation is fair, the upside isn’t great compared to the potential downside. There are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $30.25 on the company (compared to the current share price of $36.55).