Ladder Capital (LADR)

Ladder Capital faces an uphill battle. Its weak sales growth and low returns on capital show it struggled to generate demand and profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think Ladder Capital Will Underperform

Founded during the 2008 financial crisis when traditional lenders retreated from commercial real estate, Ladder Capital (NYSE:LADR) is a real estate investment trust that originates commercial real estate loans, owns commercial properties, and invests in real estate securities.

- Customers postponed purchases of its products and services this cycle as its revenue declined by 9.7% annually over the last two years

- Sales were less profitable over the last two years as its earnings per share fell by 20.4% annually, worse than its revenue declines

- Tangible book value per share was flat over the last five years, indicating it’s failed to build equity value this cycle

Ladder Capital falls short of our expectations. We’re hunting for superior stocks elsewhere.

Why There Are Better Opportunities Than Ladder Capital

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Ladder Capital

At $10.47 per share, Ladder Capital trades at 0.9x forward P/B. This multiple is cheaper than most banking peers, but we think this is justified.

We’d rather pay up for companies with elite fundamentals than get a bargain on weak ones. Cheap stocks can be value traps, and as their performance deteriorates, they will stay cheap or get even cheaper.

3. Ladder Capital (LADR) Research Report: Q4 CY2025 Update

Commercial real estate lender Ladder Capital (NYSE:LADR) missed Wall Street’s revenue expectations in Q4 CY2025, with sales falling 26.4% year on year to $50.47 million. Its non-GAAP profit of $0.17 per share was 28.3% below analysts’ consensus estimates.

Ladder Capital (LADR) Q4 CY2025 Highlights:

- Net Interest Income: $22.33 million vs analyst estimates of $25.9 million (18% year-on-year decline, 13.8% miss)

- Revenue: $50.47 million vs analyst estimates of $55.58 million (26.4% year-on-year decline, 9.2% miss)

- Adjusted EPS: $0.17 vs analyst expectations of $0.24 (28.3% miss)

- Market Capitalization: $1.41 billion

Company Overview

Founded during the 2008 financial crisis when traditional lenders retreated from commercial real estate, Ladder Capital (NYSE:LADR) is a real estate investment trust that originates commercial real estate loans, owns commercial properties, and invests in real estate securities.

Ladder Capital operates through three complementary business segments: loans, real estate ownership, and securities investments. The company's primary focus is originating first mortgage loans for commercial properties that are typically in transition phases such as renovation, repositioning, or lease-up. These loans generally feature floating interest rates and terms ranging from one to five years, tailored to property owners' specific needs.

Beyond lending, Ladder Capital directly owns a substantial portfolio of commercial real estate, including 151 single-tenant net leased properties and 53 diversified commercial properties. The net leased properties are primarily occupied by necessity-based businesses where tenants handle most property expenses, creating a reliable income stream for Ladder.

In its securities business, Ladder invests predominantly in AAA-rated commercial mortgage-backed securities (CMBS) with relatively short durations. These investments provide stable interest income and enhance the company's liquidity position.

A typical Ladder Capital client might be a real estate developer who has purchased an office building requiring significant renovations before it can attract premium tenants. Ladder would provide a floating-rate loan that gives the developer time to complete improvements and stabilize the property's income before refinancing with a longer-term loan.

Ladder Capital generates revenue through interest income on its loan portfolio, rental income from its owned properties, and returns on its securities investments. This diversified approach allows the company to shift capital allocation between segments based on market conditions and relative opportunities.

4. Thrifts & Mortgage Finance

Thrifts & Mortgage Finance institutions operate by accepting deposits and extending loans primarily for residential mortgages, earning revenue through interest rate spreads (difference between lending rates and borrowing costs) and origination fees. The industry benefits from demographic tailwinds as millennials enter prime homebuying age, technological advancements streamlining the loan approval process, and potential interest rate stabilization improving affordability. However, significant headwinds include net interest margin compression during rate volatility, increased competition from fintech disruptors offering digital-first experiences, mounting regulatory compliance costs, and potential housing market corrections that could impact loan portfolios and default rates.

Ladder Capital competes with other commercial real estate finance companies and REITs such as Blackstone Mortgage Trust (NYSE:BXMT), Starwood Property Trust (NYSE:STWD), and KKR Real Estate Finance Trust (NYSE:KREF), as well as traditional banks and insurance companies that provide commercial real estate financing.

5. Sales Growth

In general, banks make money from two primary sources. The first is net interest income, which is interest earned on loans, mortgages, and investments in securities minus interest paid out on deposits. The second source is non-interest income, which can come from bank account, credit card, wealth management, investing banking, and trading fees. Unfortunately, Ladder Capital’s 10% annualized revenue growth over the last five years was mediocre. This was below our standard for the banking sector and is a rough starting point for our analysis.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. Ladder Capital’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 9.7% annually.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Ladder Capital missed Wall Street’s estimates and reported a rather uninspiring 26.4% year-on-year revenue decline, generating $50.47 million of revenue.

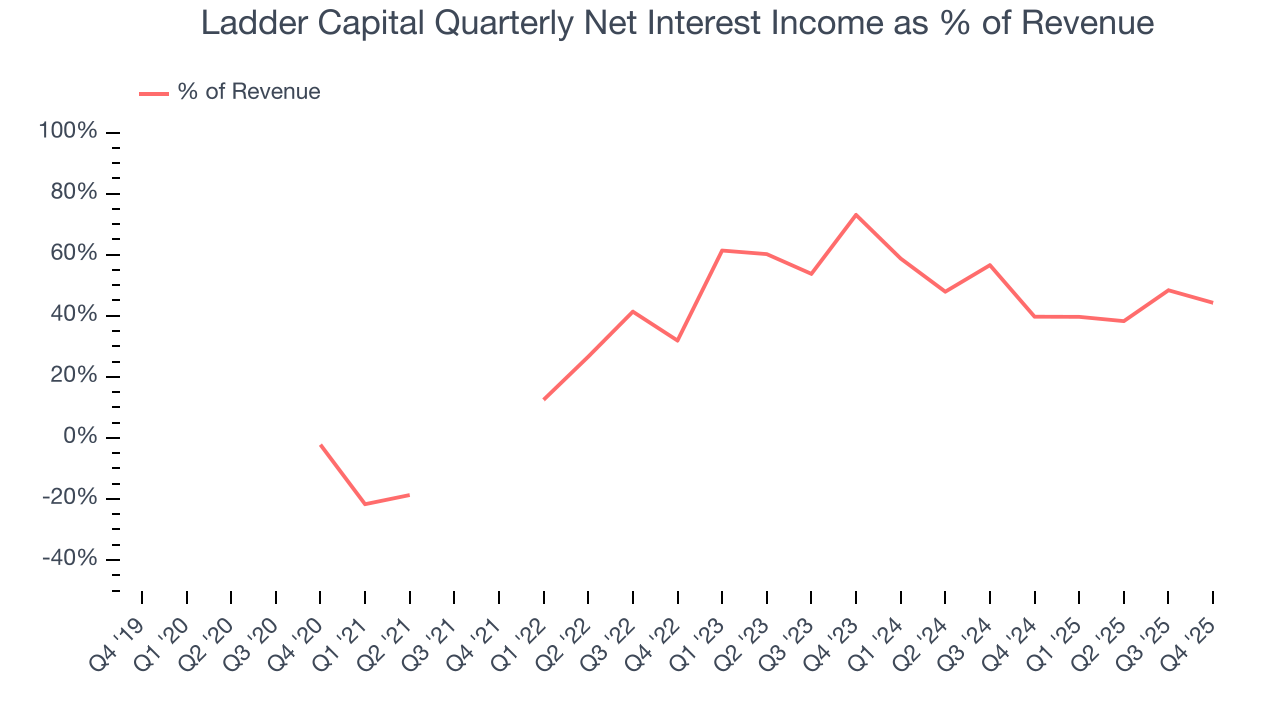

Net interest income made up 35.2% of the company’s total revenue during the last five years, meaning Ladder Capital is well diversified and has a variety of income streams driving its overall growth. Nevertheless, net interest income is critical to analyze for banks because they’re considered a higher-quality, more recurring revenue source by investors.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.6. Earnings Per Share

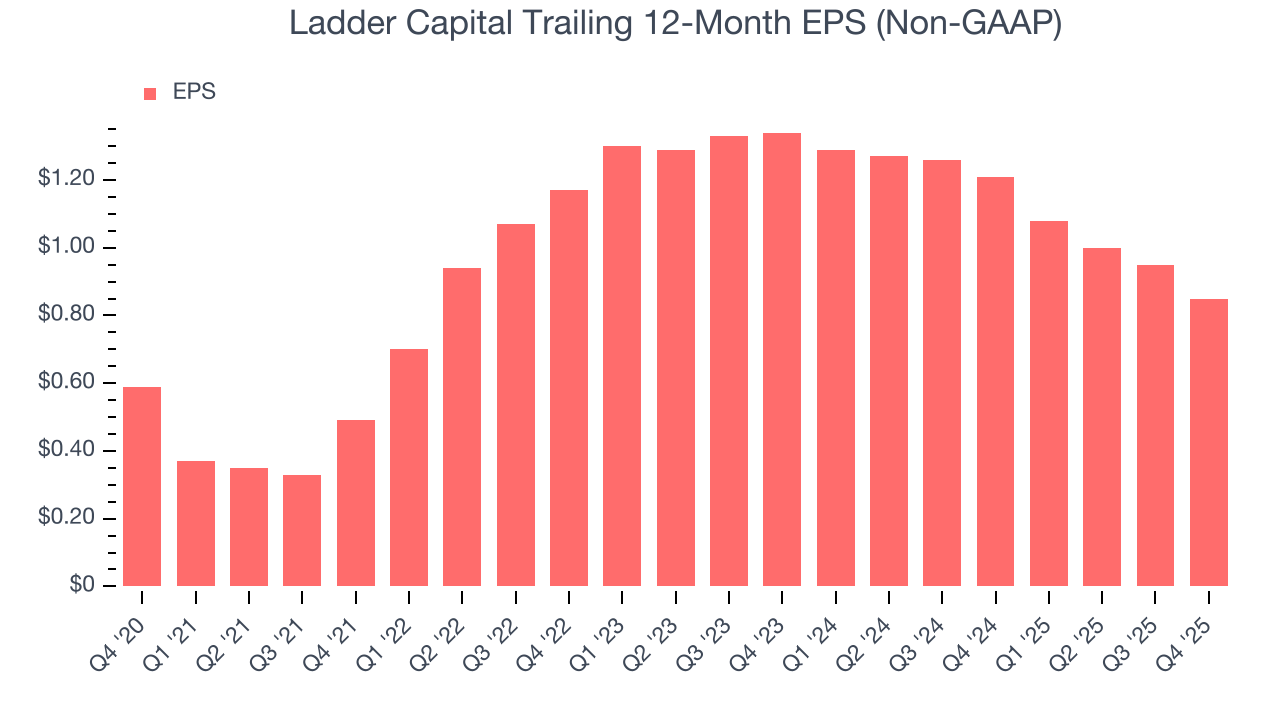

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Ladder Capital’s EPS grew at an unimpressive 7.6% compounded annual growth rate over the last five years, lower than its 10% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Ladder Capital, its two-year annual EPS declines of 20.4% show it’s continued to underperform. These results were bad no matter how you slice the data.

In Q4, Ladder Capital reported adjusted EPS of $0.17, down from $0.27 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects Ladder Capital’s full-year EPS of $0.85 to grow 30%.

7. Tangible Book Value Per Share (TBVPS)

Banks are balance sheet-driven businesses because they generate earnings primarily through borrowing and lending. They’re also valued based on their balance sheet strength and ability to compound book value (another name for shareholders’ equity) over time.

Because of this, tangible book value per share (TBVPS) emerges as the critical performance benchmark. By excluding intangible assets with uncertain liquidation values, this metric captures real, liquid net worth per share. On the other hand, EPS is often distorted by mergers and flexible loan loss accounting. TBVPS provides clearer performance insights.

Ladder Capital’s TBVPS was flat over the last five years. The last two years unveil a similar pattern as TBVPS was roughly flat at $11.66 per share.

Over the next 12 months, Consensus estimates call for Ladder Capital’s TBVPS to grow by 17.6% to $13.72, top-notch growth rate.

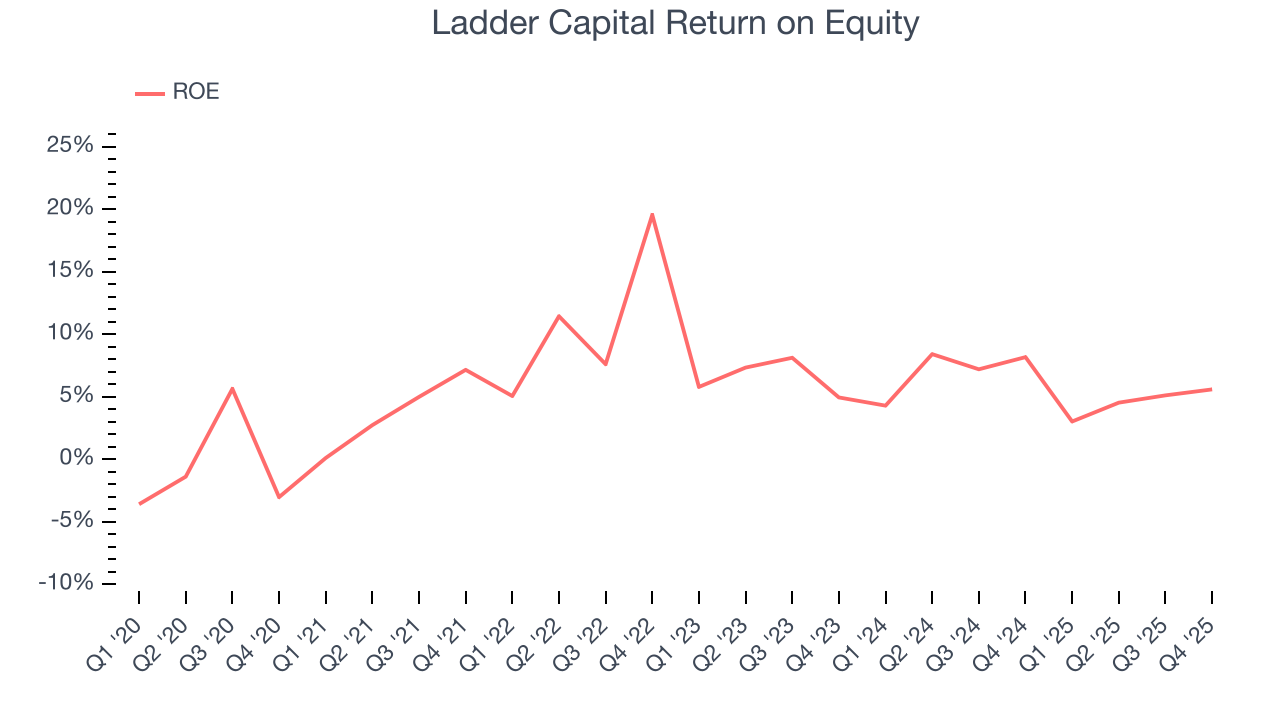

8. Return on Equity

Return on equity, or ROE, quantifies bank profitability relative to shareholder equity - an essential capital source for these institutions. Over extended periods, superior ROE performance drives faster shareholder wealth compounding through reinvestment, share repurchases, and dividend growth.

Over the last five years, Ladder Capital has averaged an ROE of 6.6%, uninspiring for a company operating in a sector where the average shakes out around 7.5%.

9. Key Takeaways from Ladder Capital’s Q4 Results

We struggled to find many positives in these results. Its revenue missed and its net interest income fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock remained flat at $10.95 immediately after reporting.

10. Is Now The Time To Buy Ladder Capital?

Updated: March 3, 2026 at 12:14 AM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Ladder Capital.

We see the value of companies driving economic growth, but in the case of Ladder Capital, we’re out. For starters, its revenue growth was mediocre over the last five years, and analysts don’t see anything changing over the next 12 months. While its net interest income growth was exceptional over the last five years, the downside is its TBVPS growth was weak over the last five years. On top of that, its relatively low ROE suggests management has struggled to find compelling investment opportunities.

Ladder Capital’s P/B ratio based on the next 12 months is 0.9x. While this valuation is fair, the upside isn’t great compared to the potential downside. There are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $12.50 on the company (compared to the current share price of $10.47).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.