Lazard (LAZ)

Lazard is a sound business. Its top-tier ROE showcases its ability to seek out and invest in ventures that yield significant returns.― StockStory Analyst Team

1. News

2. Summary

Why Lazard Is Interesting

Tracing its roots back to 1848 when it began as a dry goods merchant in New Orleans, Lazard (NYSE:LAZ) is a global financial advisory and asset management firm that provides strategic advice to corporations, governments, institutions, and wealthy individuals.

- ROE punches in at 29%, illustrating management’s expertise in identifying profitable investments

- A downside is its incremental sales over the last five years were much less profitable as its earnings per share fell by 3.1% annually while its revenue grew

Lazard has the potential to be a high-quality business. If you like the stock, the valuation looks reasonable.

Why Is Now The Time To Buy Lazard?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Lazard?

Lazard is trading at $51.37 per share, or 17.4x forward P/E. When stacked up against other financials companies, we think Lazard’s multiple is fair for the fundamentals you get.

This could be a good time to invest if you think there are underappreciated aspects of the business.

3. Lazard (LAZ) Research Report: Q3 CY2025 Update

Financial advisory firm Lazard (NYSE:LAZ) beat Wall Street’s revenue expectations in Q3 CY2025, with sales up 15.8% year on year to $748.1 million. Its non-GAAP profit of $0.56 per share was 27.7% above analysts’ consensus estimates.

Lazard (LAZ) Q3 CY2025 Highlights:

- Assets Under Management: $264.5 billion vs analyst estimates of $257.3 billion (6.8% year-on-year growth, 2.8% beat)

- Revenue: $748.1 million vs analyst estimates of $714.1 million (15.8% year-on-year growth, 4.8% beat)

- Pre-tax Profit: $94.93 million (12.7% margin, 41.1% year-on-year decline)

- Adjusted EPS: $0.56 vs analyst estimates of $0.44 (27.7% beat)

- Market Capitalization: $4.7 billion

Company Overview

Tracing its roots back to 1848 when it began as a dry goods merchant in New Orleans, Lazard (NYSE:LAZ) is a global financial advisory and asset management firm that provides strategic advice to corporations, governments, institutions, and wealthy individuals.

Lazard operates through two main business segments: Financial Advisory and Asset Management. The Financial Advisory business helps clients navigate mergers and acquisitions, capital structure issues, restructuring, and sovereign advisory matters. When a corporation considers acquiring another company, Lazard evaluates potential targets, analyzes valuations, and proposes financial structures. Similarly, when a business is considering a sale, Lazard advises on the process, prepares materials, identifies potential buyers, and assists in negotiations.

For companies facing financial distress, Lazard reviews operations, evaluates debt capacity, and helps structure amendments to debt agreements. The firm also provides shareholder advisory services, helping companies prepare for and respond to activist investors. For example, when a multinational corporation faces pressure from activist shareholders questioning its strategy, Lazard might analyze the company's position, provide insights on shareholder perspectives, and advise on potential responses.

In its Asset Management segment, Lazard offers investment solutions across equity, fixed income, and alternative investments. The firm employs fundamental security selection approaches, conducting global research to develop market insights and evaluate opportunities. Lazard manages assets for institutional clients like pension funds and sovereign wealth funds, as well as for individual investors through various distribution channels.

Lazard generates revenue through advisory fees in its Financial Advisory business and management fees based on assets under management in its Asset Management business. The firm maintains offices across major financial centers worldwide, allowing it to serve clients globally while providing local expertise.

4. Investment Banking & Brokerage

Investment banks and brokerages facilitate capital raises, mergers and acquisitions, and securities trading. The sector benefits from corporate activity during economic expansion, increased retail trading participation, and advisory opportunities in emerging sectors. Headwinds include economic cycle vulnerability affecting deal flow, compressed trading commissions due to electronic platforms, and regulatory capital requirements constraining certain higher-risk activities.

Lazard's competitors in financial advisory include Goldman Sachs (NYSE:GS), Morgan Stanley (NYSE:MS), JPMorgan Chase (NYSE:JPM), and boutique investment banks like Evercore (NYSE:EVR) and PJT Partners (NYSE:PJT). In asset management, it competes with firms such as BlackRock (NYSE:BLK), T. Rowe Price (NASDAQ:TROW), and Franklin Resources (NYSE:BEN).

5. Revenue Growth

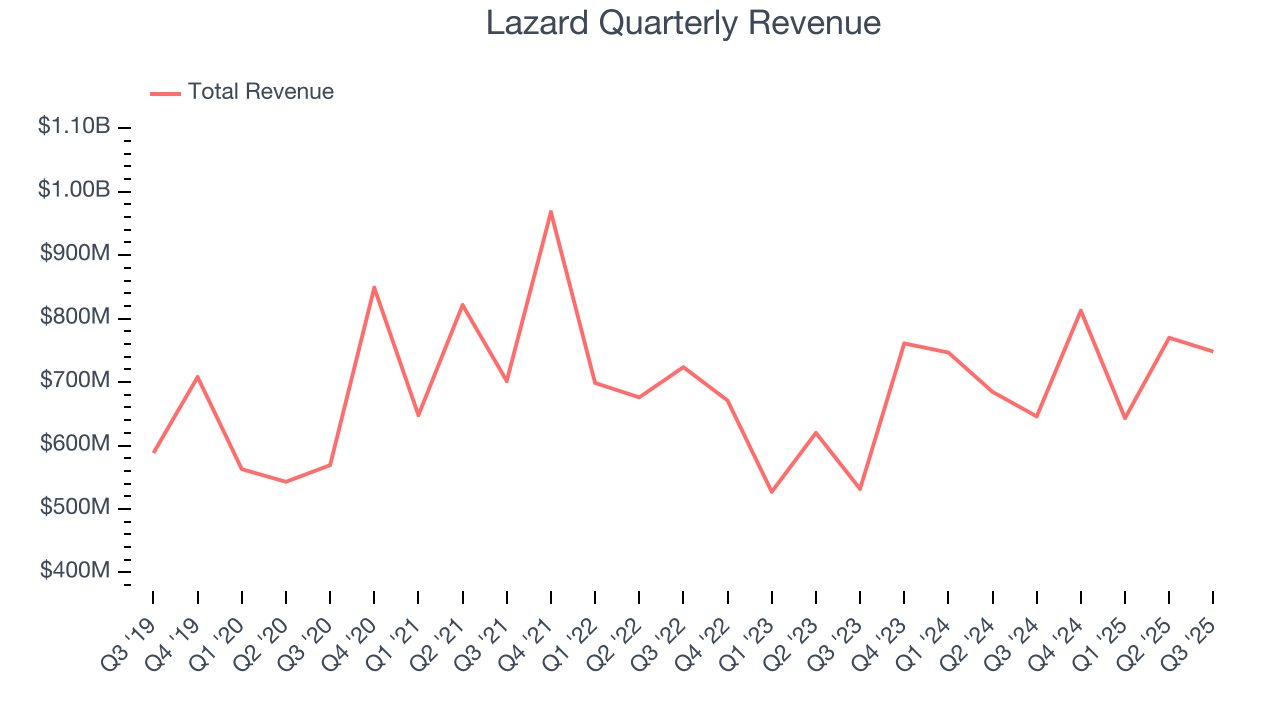

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Regrettably, Lazard’s revenue grew at a tepid 4.5% compounded annual growth rate over the last five years. This fell short of our benchmark for the financials sector and is a poor baseline for our analysis.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. Lazard’s annualized revenue growth of 12.5% over the last two years is above its five-year trend, suggesting its demand recently accelerated.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Lazard reported year-on-year revenue growth of 15.8%, and its $748.1 million of revenue exceeded Wall Street’s estimates by 4.8%.

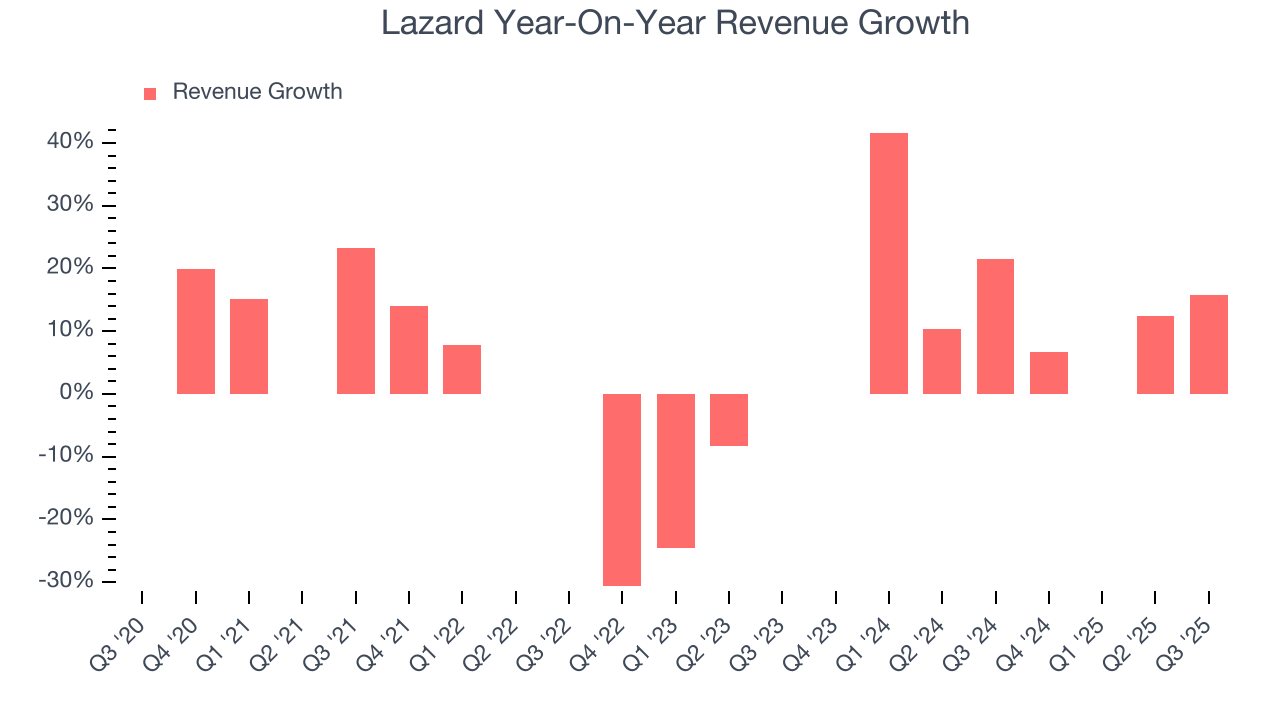

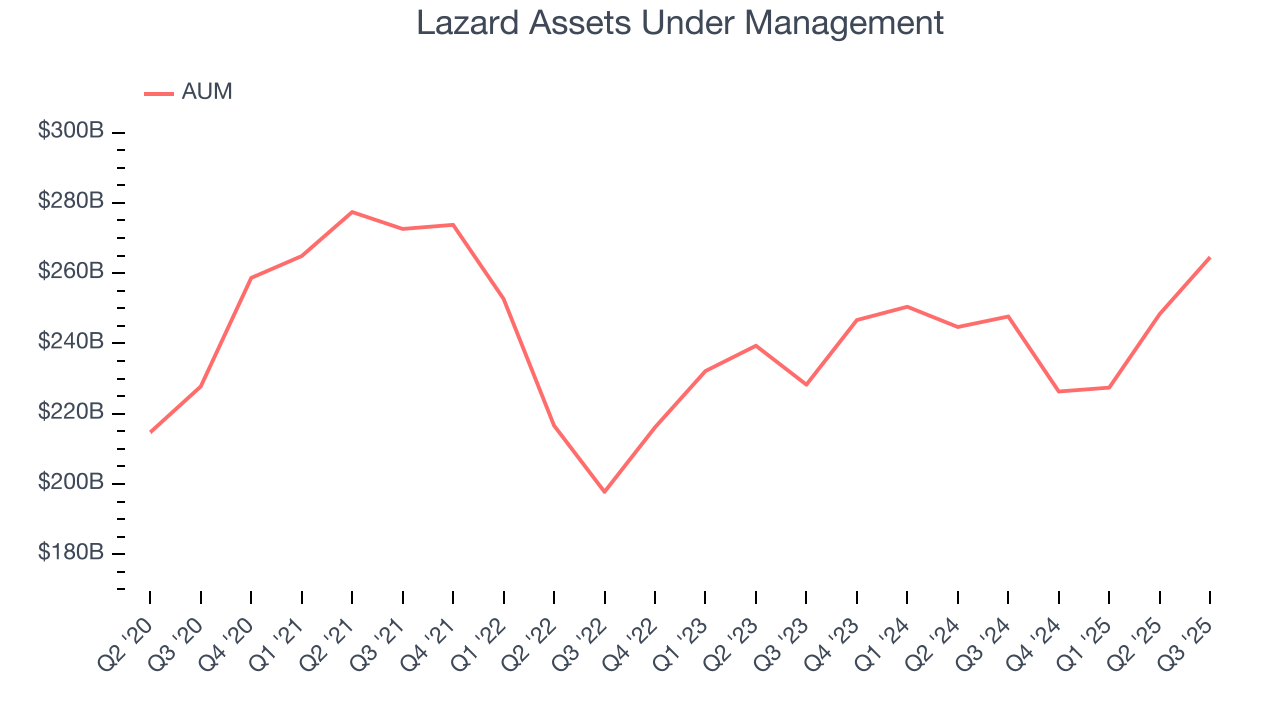

6. Assets Under Management (AUM)

Assets Under Management (AUM) is the cornerstone of a financial firm's investment division, representing all client capital under its stewardship. Management fees on this AUM create reliable, recurring revenue that maintains stability even when investment performance struggles, though prolonged poor returns can eventually affect asset retention and growth.

Lazard’s AUM has declined at an annual rate of 2.6% over the last four years, much worse than the broader financials industry. When analyzing Lazard’s AUM over the last two years, we can see that growth accelerated to 2.7% annually. Fundraising or short-term investment performance were net detractors to the company over this shorter period since assets grew slower than total revenue. Keep in mind that asset growth can be erratic and seasonal, so we don't rely on it too heavily for our business quality analysis.

Lazard’s AUM punched in at $264.5 billion this quarter, beating analysts’ expectations by 2.8%. This print was 6.8% higher than the same quarter last year.

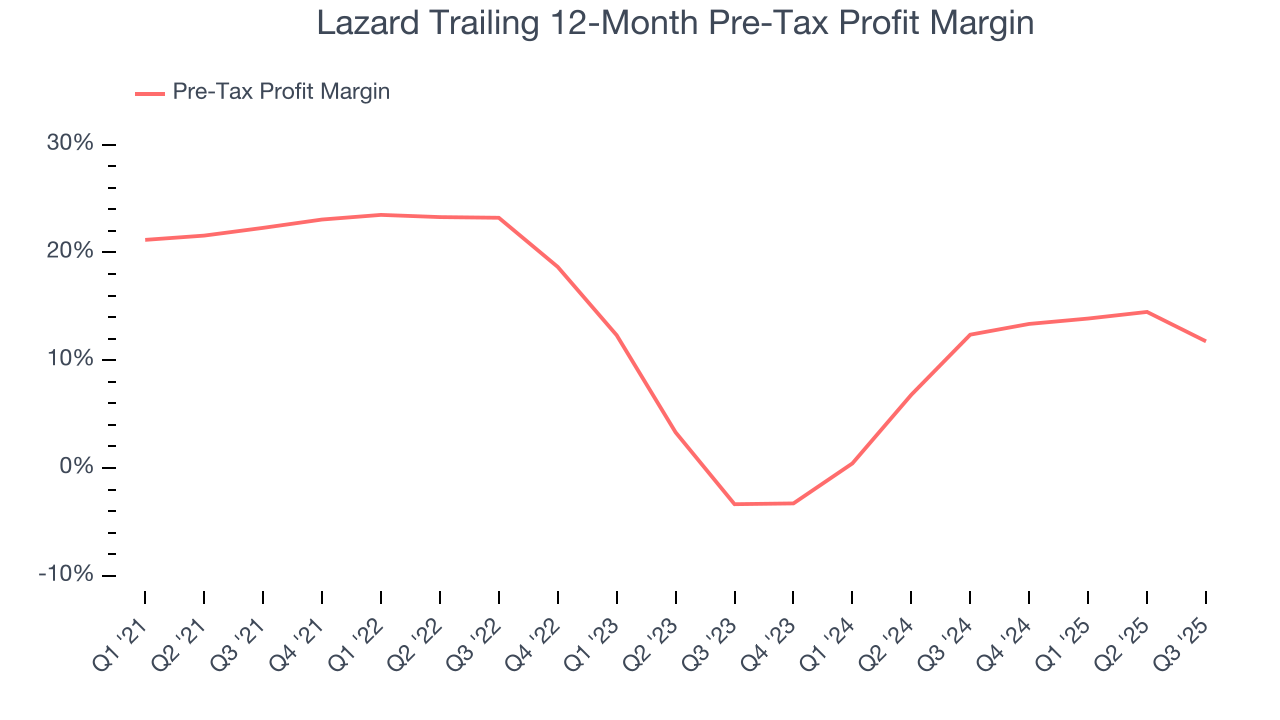

7. Pre-Tax Profit Margin

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For Investment Banking & Brokerage companies, we look at pre-tax profit rather than the operating margin that defines sectors such as consumer, tech, and industrials.

Financials companies manage interest-bearing assets and liabilities, making the interest income and expenses included in pre-tax profit essential to their profit calculation. Taxes, being external factors beyond management control, are appropriately excluded from this alternative margin measure.

Over the last four years, Lazard’s pre-tax profit margin has risen by 10.5 percentage points, going from 22.3% to 11.8%. Luckily, it seems the company has recently taken steps to address its expense base as its pre-tax profit margin expanded by 15.1 percentage points on a two-year basis.

Lazard’s pre-tax profit margin came in at 12.7% this quarter. This result was 12.3 percentage points worse than the same quarter last year.

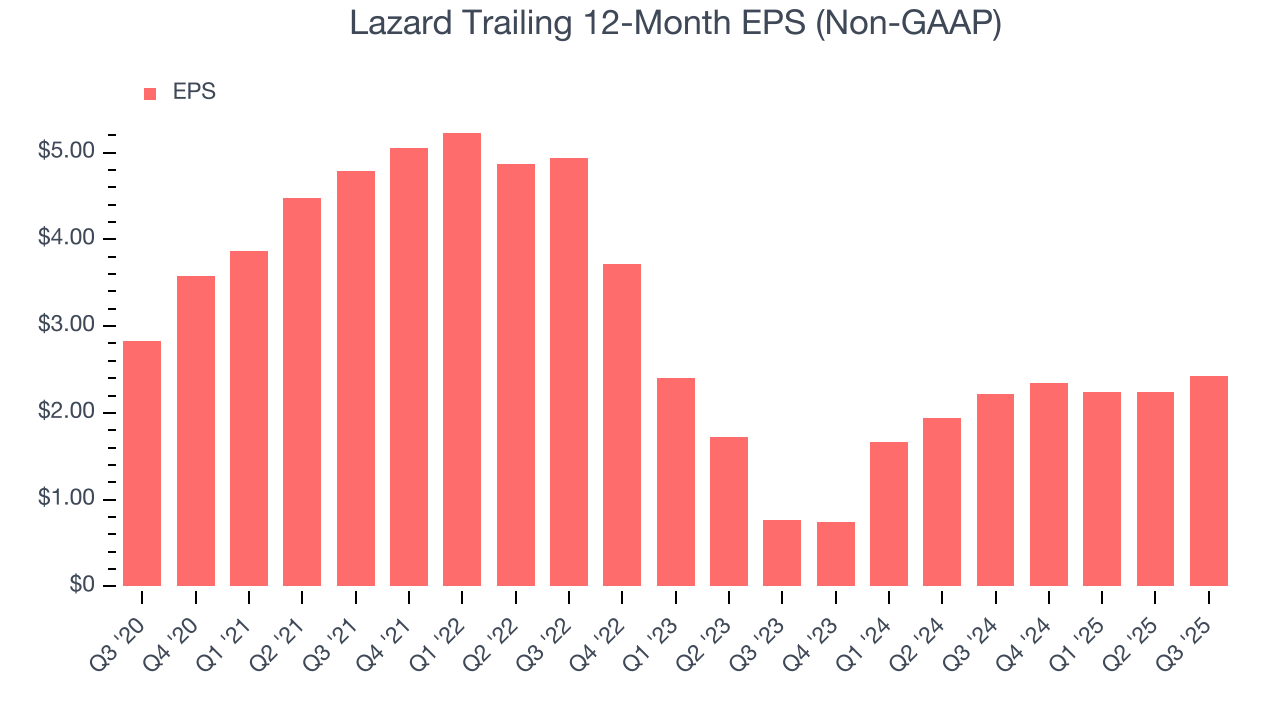

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Lazard, its EPS declined by 3.1% annually over the last five years while its revenue grew by 4.5%. This tells us the company became less profitable on a per-share basis as it expanded due to factors such as interest expenses and taxes.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Lazard, its two-year annual EPS growth of 77.3% was higher than its five-year trend. This acceleration made it one of the faster-growing financials companies in recent history.

In Q3, Lazard reported adjusted EPS of $0.56, up from $0.38 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Lazard’s full-year EPS of $2.42 to grow 47%.

9. Return on Equity

Return on equity (ROE) reveals the profit generated per dollar of shareholder equity, which represents a key source of bank funding. Banks maintaining elevated ROE levels tend to accelerate wealth creation for shareholders via earnings retention, buybacks, and distributions.

Over the last five years, Lazard has averaged an ROE of 28.8%, exceptional for a company operating in a sector where the average shakes out around 10% and those putting up 25%+ are greatly admired. This is a bright spot for Lazard.

10. Balance Sheet Assessment

The debt-to-equity ratio is a widely used measure to assess a company's balance sheet health. A higher ratio means that a business aggressively financed its growth with debt. This can result in higher earnings (if the borrowed funds are invested profitably) but also increases risk.

If debt levels are too high, there could be difficulties in meeting obligations, especially during economic downturns or periods of rising interest rates if the debt has variable-rate payments.

Lazard has no debt, so leverage is not an issue here.

11. Key Takeaways from Lazard’s Q3 Results

It was good to see Lazard beat analysts’ EPS expectations this quarter. We were also glad its AUM outperformed Wall Street’s estimates. Zooming out, we think this was a good print with some key areas of upside. The stock traded up 5.5% to $52.49 immediately after reporting.

12. Is Now The Time To Buy Lazard?

Updated: January 23, 2026 at 10:45 PM EST

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own Lazard, you should also grasp the company’s longer-term business quality and valuation.

We think Lazard is a solid business. Although its revenue growth was uninspiring over the last five years, its growth over the next 12 months is expected to be higher. And while Lazard’s declining pre-tax profit margin shows the business has become less efficient, its stellar ROE suggests it has been a well-run company historically.

Lazard’s P/E ratio based on the next 12 months is 17.4x. When scanning the financials space, Lazard trades at a fair valuation. If you’re a fan of the business and management team, now is a good time to scoop up some shares.

Wall Street analysts have a consensus one-year price target of $57.14 on the company (compared to the current share price of $51.37), implying they see 11.2% upside in buying Lazard in the short term.