Lucky Strike (LUCK)

Lucky Strike is in for a bumpy ride. Its weak sales growth and low returns on capital show it struggled to generate demand and profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think Lucky Strike Will Underperform

Born from the transformation of traditional bowling alleys into modern entertainment destinations, Lucky Strike (NYSE:LUCK) operates bowling alleys and other entertainment venues with upscale amenities, arcade games, and food and beverage services across North America.

- Lackluster 8.1% annual revenue growth over the last two years indicates the company is losing ground to competitors

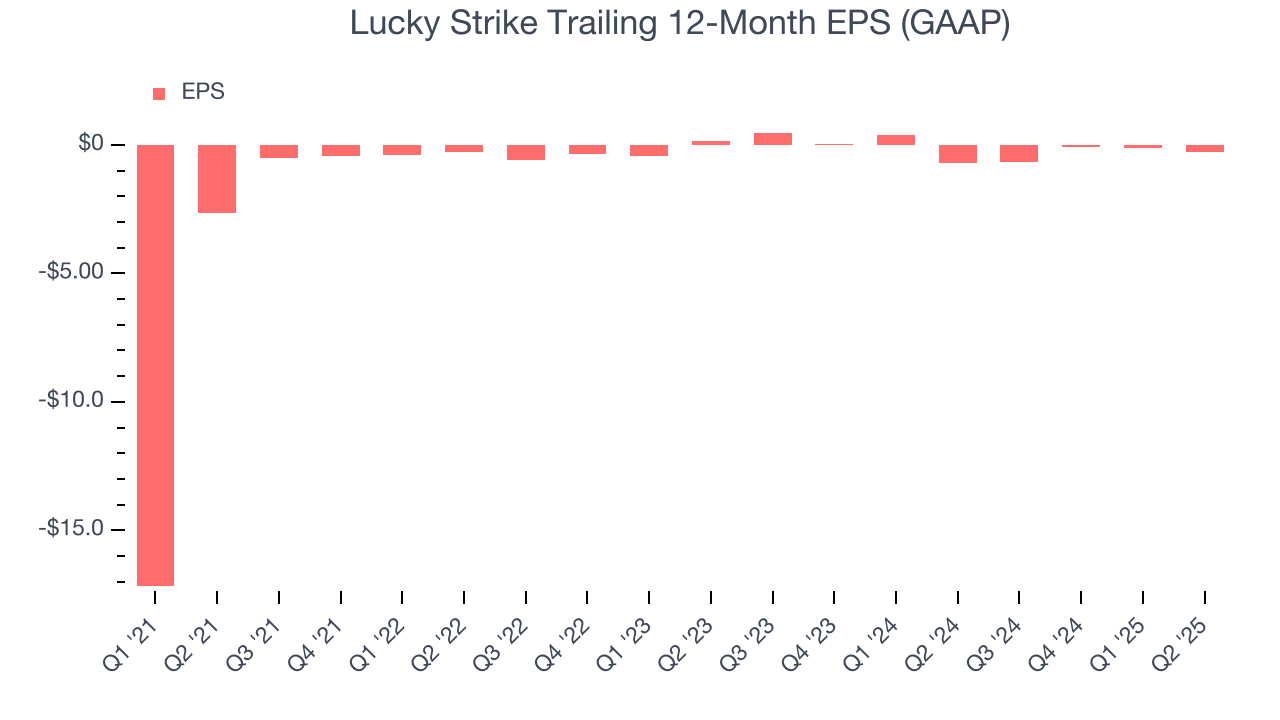

- Earnings per share have dipped by 28.1% annually over the past three years, which is concerning because stock prices follow EPS over the long term

- 7× net-debt-to-EBITDA ratio shows it’s overleveraged and increases the probability of shareholder dilution if things turn unexpectedly

Lucky Strike is in the penalty box. We’ve identified better opportunities elsewhere.

Why There Are Better Opportunities Than Lucky Strike

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Lucky Strike

At $8.10 per share, Lucky Strike trades at 60.6x forward P/E. This valuation multiple seems a bit much considering the quality you get.

There are stocks out there similarly priced with better business quality. We prefer owning these.

3. Lucky Strike (LUCK) Research Report: Q3 CY2025 Update

Entertainment venue operator Lucky Strike (NYSE:LUCK) reported Q3 CY2025 results topping the market’s revenue expectations, with sales up 12.3% year on year to $292.3 million. The company’s full-year revenue guidance of $1.29 billion at the midpoint came in 0.6% above analysts’ estimates.

Lucky Strike (LUCK) Q3 CY2025 Highlights:

- Revenue: $292.3 million vs analyst estimates of $282.9 million (12.3% year-on-year growth, 3.3% beat)

- Adjusted EBITDA: $72.65 million vs analyst estimates of $70.99 million (24.9% margin, 2.3% beat)

- The company reconfirmed its revenue guidance for the full year of $1.29 billion at the midpoint

- EBITDA guidance for the full year is $395 million at the midpoint, above analyst estimates of $390.3 million

- Operating Margin: 9.7%, up from 5% in the same quarter last year

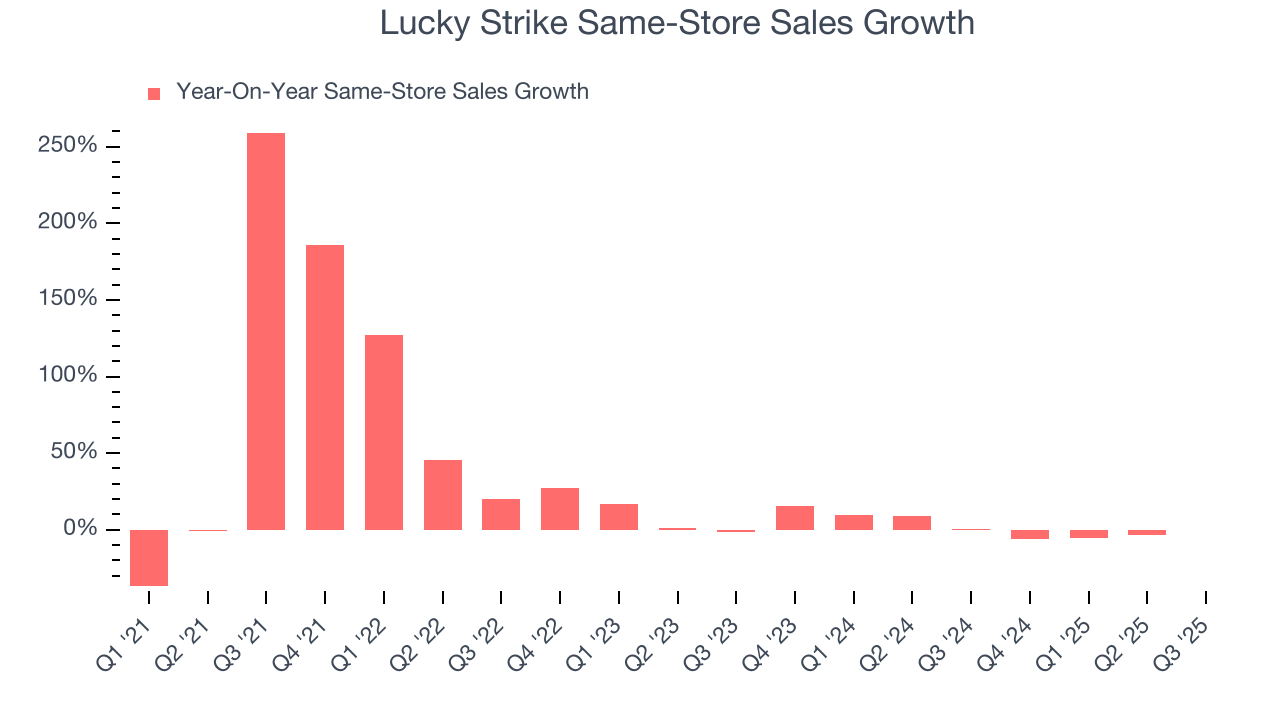

- Same-Store Sales were flat year on year, in line with the same quarter last year

- Market Capitalization: $1.16 billion

Company Overview

Born from the transformation of traditional bowling alleys into modern entertainment destinations, Lucky Strike (NYSE:LUCK) operates bowling alleys and other entertainment venues with upscale amenities, arcade games, and food and beverage services across North America.

Lucky Strike Entertainment's venues operate under several brand names, with its flagship Bowlero and Lucky Strike locations featuring premium offerings that elevate the bowling experience beyond the traditional alley concept. These upscale venues include lounge-style seating, expanded dining options, and enhanced customer service designed to appeal to both casual visitors and organized groups. A typical customer might reserve a lane for a corporate team-building event, enjoying craft cocktails and gourmet appetizers while bowling in a stylish, modern environment.

The company generates revenue through multiple streams: lane rentals, food and beverage sales, arcade game play, and event hosting services. Beyond bowling, Lucky Strike has diversified into other entertainment concepts, including Octane Raceway for go-kart enthusiasts and the Raging Waves water park, broadening its appeal across different entertainment preferences.

Acquisition forms a cornerstone of Lucky Strike's growth strategy, with the company actively purchasing existing venues and transforming them according to its premium entertainment model. This approach allows for rapid expansion while leveraging established locations in desirable markets. The company serves approximately 30 million customers annually across its North American footprint, which includes venues in the United States, Canada, and Mexico.

Lucky Strike also differentiates itself through technology integration, developing gaming applications and in-venue digital experiences that extend customer engagement beyond the physical visit. The company hosts both professional and amateur bowling tournaments, further cementing its position in the bowling community while creating additional revenue opportunities through event management and broadcasting.

4. Leisure Facilities

Leisure facilities companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted their spending from "things" to "experiences". Leisure facilities seek to benefit but must innovate to do so because of the industry's high competition and capital intensity.

Lucky Strike Entertainment competes with other entertainment venue operators like Dave & Buster's (NASDAQ:PLAY), Main Event Entertainment (owned by Dave & Buster's), Round One Entertainment, and regional family entertainment centers that combine dining, games, and activities.

5. Revenue Growth

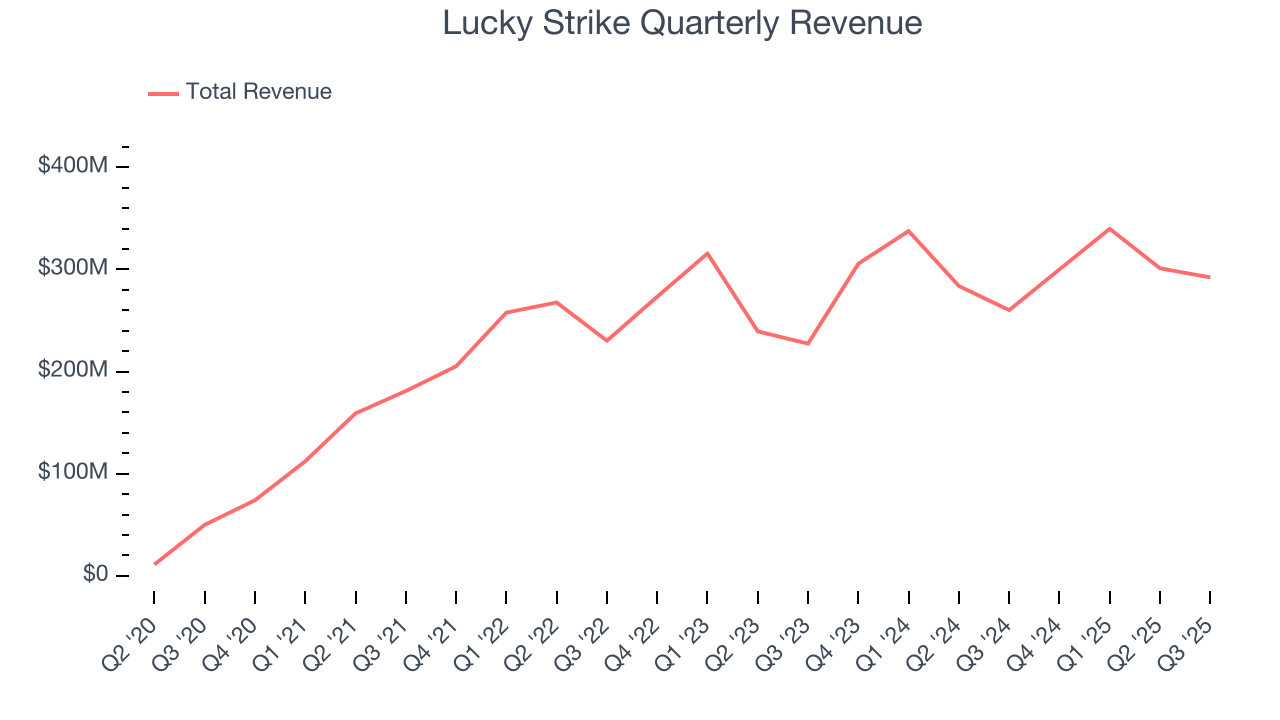

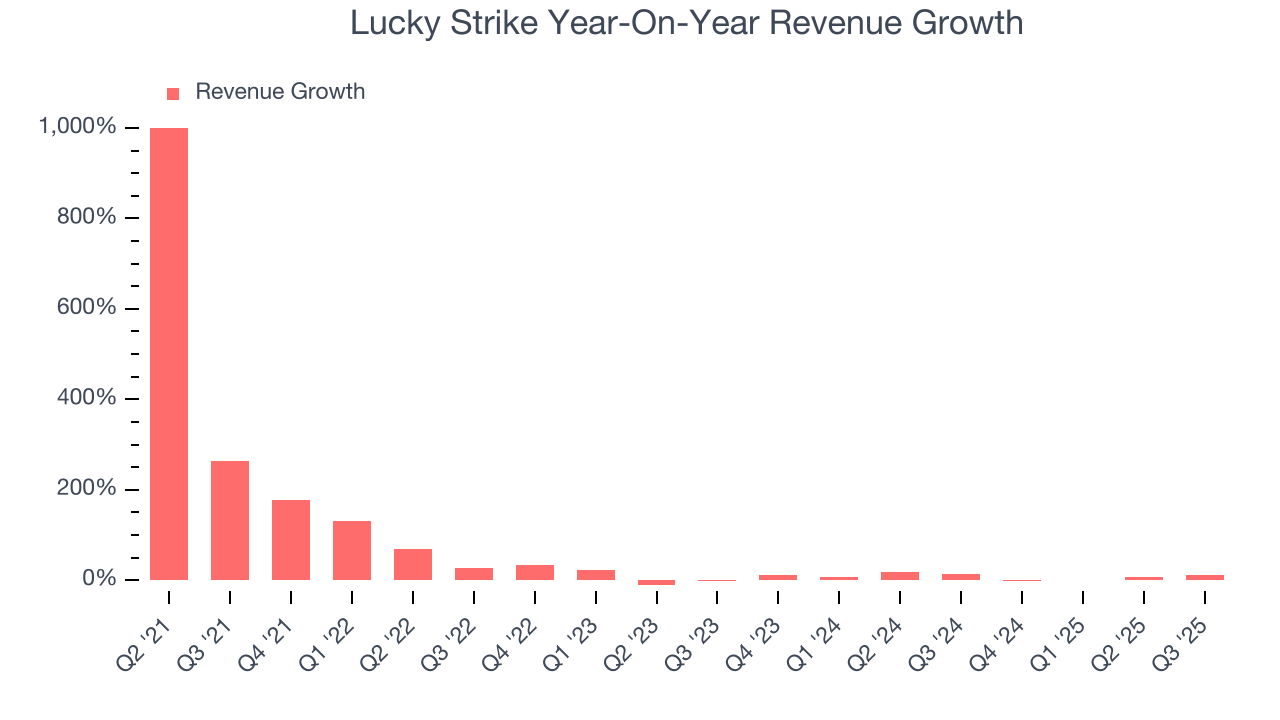

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Lucky Strike grew its sales at an incredible 57.6% compounded annual growth rate. Its growth beat the average consumer discretionary company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Lucky Strike’s recent performance shows its demand has slowed significantly as its annualized revenue growth of 8.1% over the last two years was well below its five-year trend. Note that COVID hurt Lucky Strike’s business in 2020 and part of 2021, and it bounced back in a big way thereafter.

We can dig further into the company’s revenue dynamics by analyzing its same-store sales, which show how much revenue its established locations generate. Over the last two years, Lucky Strike’s same-store sales averaged 2.4% year-on-year growth. Because this number is lower than its revenue growth, we can see the opening of new locations is boosting the company’s top-line performance.

This quarter, Lucky Strike reported year-on-year revenue growth of 12.3%, and its $292.3 million of revenue exceeded Wall Street’s estimates by 3.3%.

Looking ahead, sell-side analysts expect revenue to grow 5% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and suggests its products and services will see some demand headwinds.

6. Operating Margin

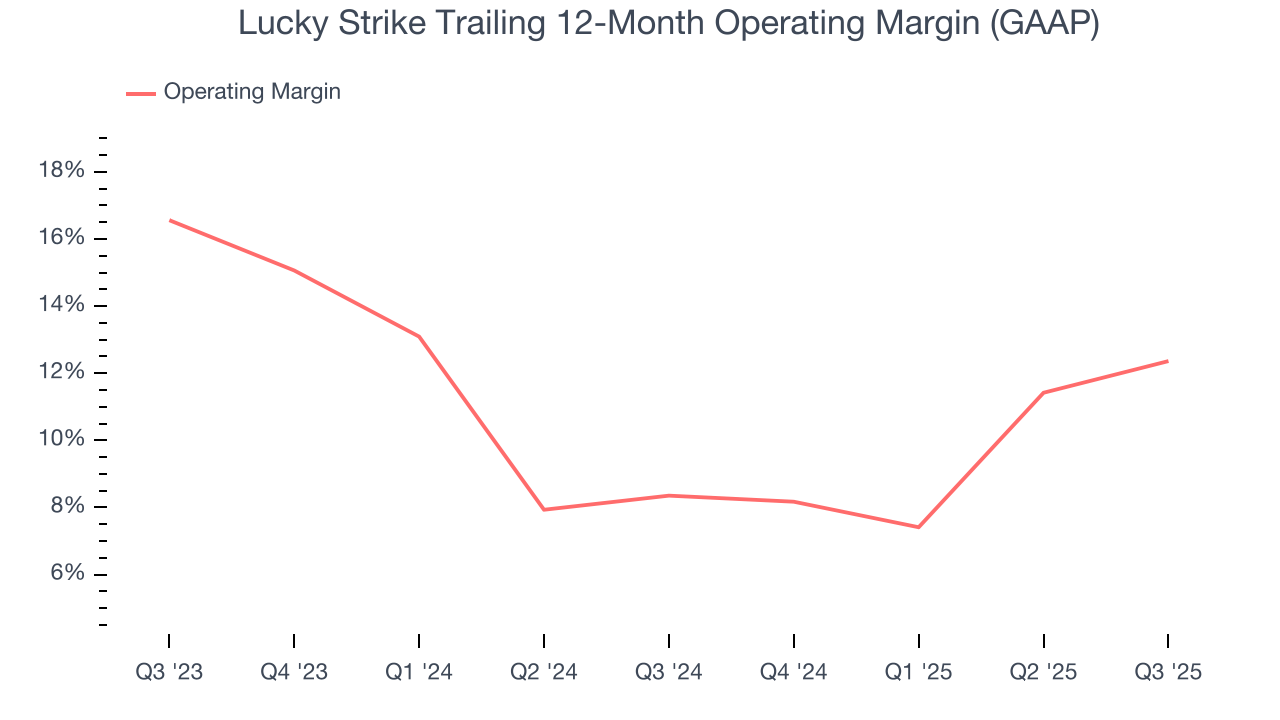

Lucky Strike’s operating margin has been trending up over the last 12 months and averaged 10.4% over the last two years. Its profitability was higher than the broader consumer discretionary sector, showing it did a decent job managing its expenses.

In Q3, Lucky Strike generated an operating margin profit margin of 9.7%, up 4.7 percentage points year on year. This increase was a welcome development and shows it was more efficient.

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Although Lucky Strike’s full-year earnings are still negative, it reduced its losses and improved its EPS by 9.4% annually over the last four years. The next few quarters will be critical for assessing its long-term profitability.

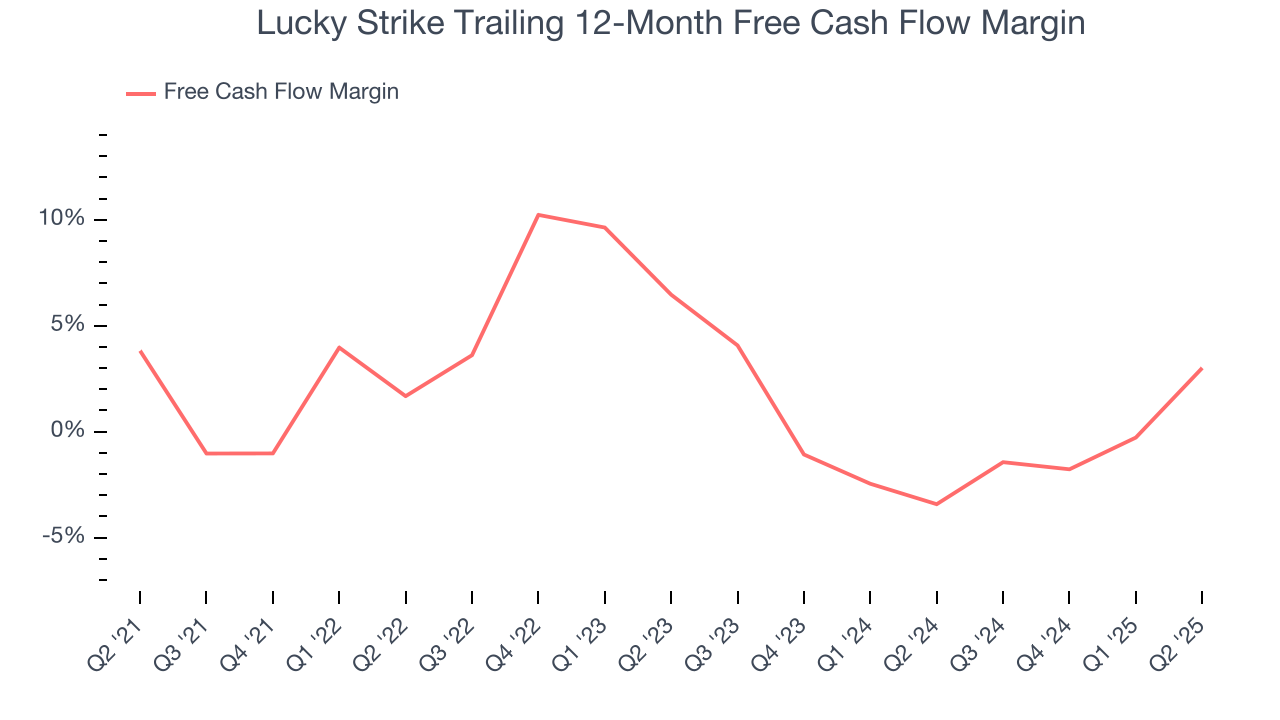

8. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Lucky Strike has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 1.5%, lousy for a consumer discretionary business.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Lucky Strike historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 14.2%, somewhat low compared to the best consumer discretionary companies that consistently pump out 25%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Lucky Strike’s ROIC has decreased significantly over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

10. Balance Sheet Risk

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

Lucky Strike’s $2.72 billion of debt exceeds the $31.03 million of cash on its balance sheet. Furthermore, its 7× net-debt-to-EBITDA ratio (based on its EBITDA of $377.4 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. Lucky Strike could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope Lucky Strike can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

11. Key Takeaways from Lucky Strike’s Q3 Results

It was encouraging to see Lucky Strike beat analysts’ revenue and EBITDA expectations this quarter. We were also glad its full-year revenue and EBITDA guidance exceeded Wall Street’s estimates. Overall, this print had some key positives. The stock remained flat at $8.07 immediately following the results.

12. Is Now The Time To Buy Lucky Strike?

Updated: January 30, 2026 at 9:55 PM EST

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own Lucky Strike, you should also grasp the company’s longer-term business quality and valuation.

Lucky Strike doesn’t pass our quality test. Although its revenue growth was impressive over the last five years, it’s expected to deteriorate over the next 12 months and its same-store sales performance has disappointed. And while the company’s projected EPS for the next year implies the company’s fundamentals will improve, the downside is its declining EPS over the last three years makes it a less attractive asset to the public markets.

Lucky Strike’s P/E ratio based on the next 12 months is 60.6x. At this valuation, there’s a lot of good news priced in - you can find more timely opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $13.35 on the company (compared to the current share price of $8.10).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.