Lumen (LUMN)

We wouldn’t buy Lumen. Not only did its demand evaporate but also its negative returns on capital show it destroyed shareholder value.― StockStory Analyst Team

1. News

2. Summary

Why We Think Lumen Will Underperform

With approximately 350,000 route miles of fiber optic cable spanning North America and the Asia Pacific, Lumen Technologies (NYSE:LUMN) operates a vast fiber optic network that provides communications, cloud connectivity, security, and IT solutions to businesses and consumers.

- Products and services are facing significant end-market challenges during this cycle as sales have declined by 9.7% annually over the last five years

- Sales were less profitable over the last five years as its earnings per share fell by 30.5% annually, worse than its revenue declines

- Sales are expected to decline once again over the next 12 months as it continues working through a challenging demand environment

Lumen is skating on thin ice. We’ve identified better opportunities elsewhere.

Why There Are Better Opportunities Than Lumen

Why There Are Better Opportunities Than Lumen

Lumen trades at a stock price of $9.06. The market typically values companies like Lumen based on their anticipated profits for the next 12 months, but it expects the business to lose money. We also think the upside isn’t great compared to the potential downside here - there are more exciting stocks to buy.

Paying a premium for high-quality companies with strong long-term earnings potential is preferable to owning challenged businesses with questionable prospects.

3. Lumen (LUMN) Research Report: Q1 CY2026 Update

Telecommunications infrastructure company Lumen Technologies (NYSE:LUMN) beat Wall Street’s revenue expectations in Q1 CY2026, but sales fell by 4.4% year on year to $3.04 billion. Its GAAP profit of $0.23 per share was significantly above analysts’ consensus estimates.

Lumen (LUMN) Q1 CY2026 Highlights:

- Revenue: $3.04 billion vs analyst estimates of $2.95 billion (4.4% year-on-year decline, 2.9% beat)

- EPS (GAAP): $0.23 vs analyst estimates of -$0.18 (significant beat)

- Adjusted EBITDA: $767 million vs analyst estimates of $837.1 million (25.2% margin, 8.4% miss)

- EBITDA guidance for the full year is $3.2 billion at the midpoint, below analyst estimates of $3.37 billion

- Operating Margin: -6.6%, down from 3.4% in the same quarter last year

- Free Cash Flow was -$1.08 billion, down from $354 million in the same quarter last year

- Market Capitalization: $9.16 billion

Company Overview

With approximately 350,000 route miles of fiber optic cable spanning North America and the Asia Pacific, Lumen Technologies (NYSE:LUMN) operates a vast fiber optic network that provides communications, cloud connectivity, security, and IT solutions to businesses and consumers.

Lumen's network infrastructure serves as the backbone for its diverse portfolio of services. The company connects approximately 170,000 buildings directly to its fiber network, enabling high-speed, secure data transmission for enterprise customers. For residential and small business customers, Lumen offers internet connectivity through both fiber (branded as Quantum Fiber) and copper-based networks (under the CenturyLink brand).

Beyond basic connectivity, Lumen provides a comprehensive suite of technology solutions. Its edge computing services allow businesses to process data closer to where it's created, reducing latency for time-sensitive applications. A manufacturing company might use Lumen's edge computing to analyze production line data in real-time, enabling immediate adjustments to prevent defects. The company also offers cybersecurity services, helping organizations protect against increasingly sophisticated threats.

Lumen generates revenue through subscription-based service models, with pricing typically based on bandwidth, service level agreements, and additional features. Enterprise customers range from small businesses to global corporations requiring complex network solutions, while mass market customers include millions of residential internet subscribers.

The company organizes its business into strategic categories: "Grow" (emerging services like edge cloud and security), "Nurture" (established services like ethernet), and "Harvest" (legacy offerings like traditional voice). This approach allows Lumen to balance investment in future growth areas while maximizing returns from mature technologies.

Lumen faces ongoing challenges in transitioning from legacy copper networks to fiber infrastructure, particularly in rural areas where deployment costs are higher. The company must also navigate a complex regulatory environment, as telecommunications services are subject to oversight by the Federal Communications Commission and state regulatory commissions.

4. Terrestrial Telecommunication Services

Terrestrial telecommunication companies face an uphill battle, as they mostly sell into a deflationary market, where the price of moving a bit tends to decrease over time with better technology. Without dependable volume growth, revenue growth could be challenged. Unfortunately, broadband penetration in their core US market is quite high already. On the other hand, data consumption from streaming entertainment and 5G expansion could provide a floor on growth for the next number of years. As if that wasn't enough to worry about, competition is intense, with larger telecom providers and hyperscalers expanding their own networks.

Lumen Technologies competes with major telecommunications providers including AT&T (NYSE:T), Verizon (NYSE:VZ), and Comcast (NASDAQ:CMCSA), as well as fiber infrastructure specialists like Crown Castle (NYSE:CCI) and specialized enterprise service providers such as Zayo Group (private).

5. Revenue Growth

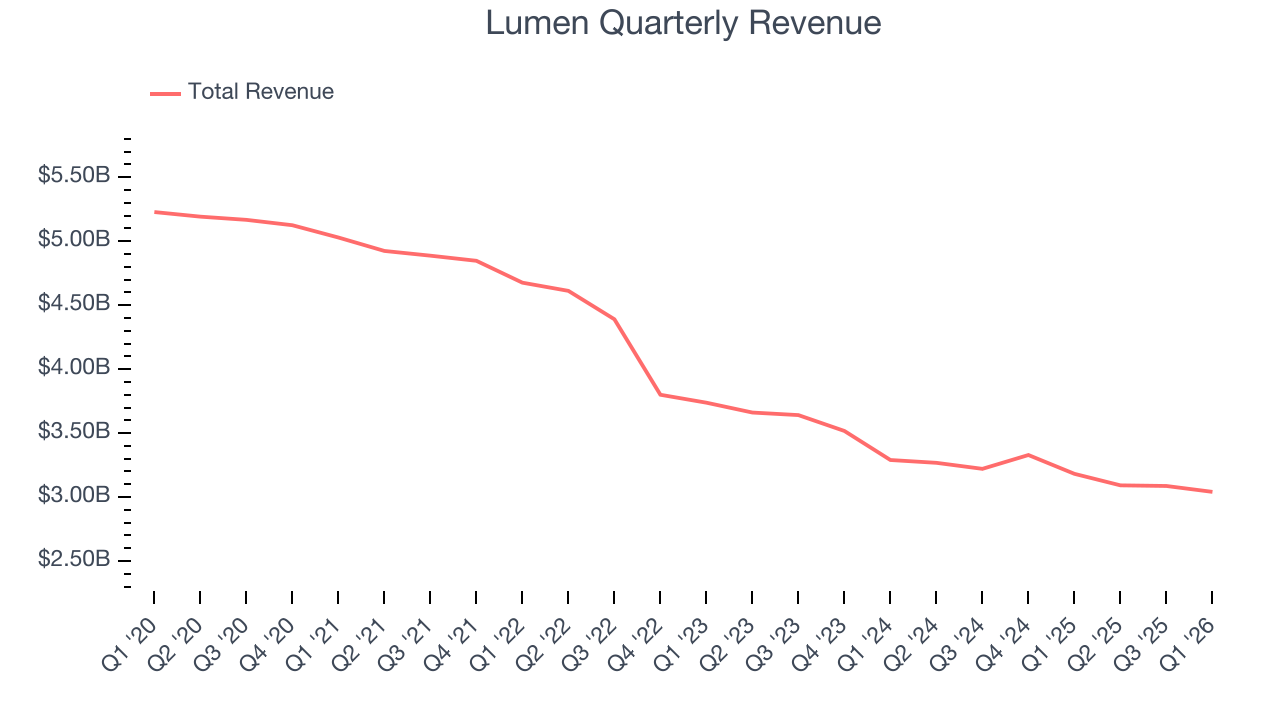

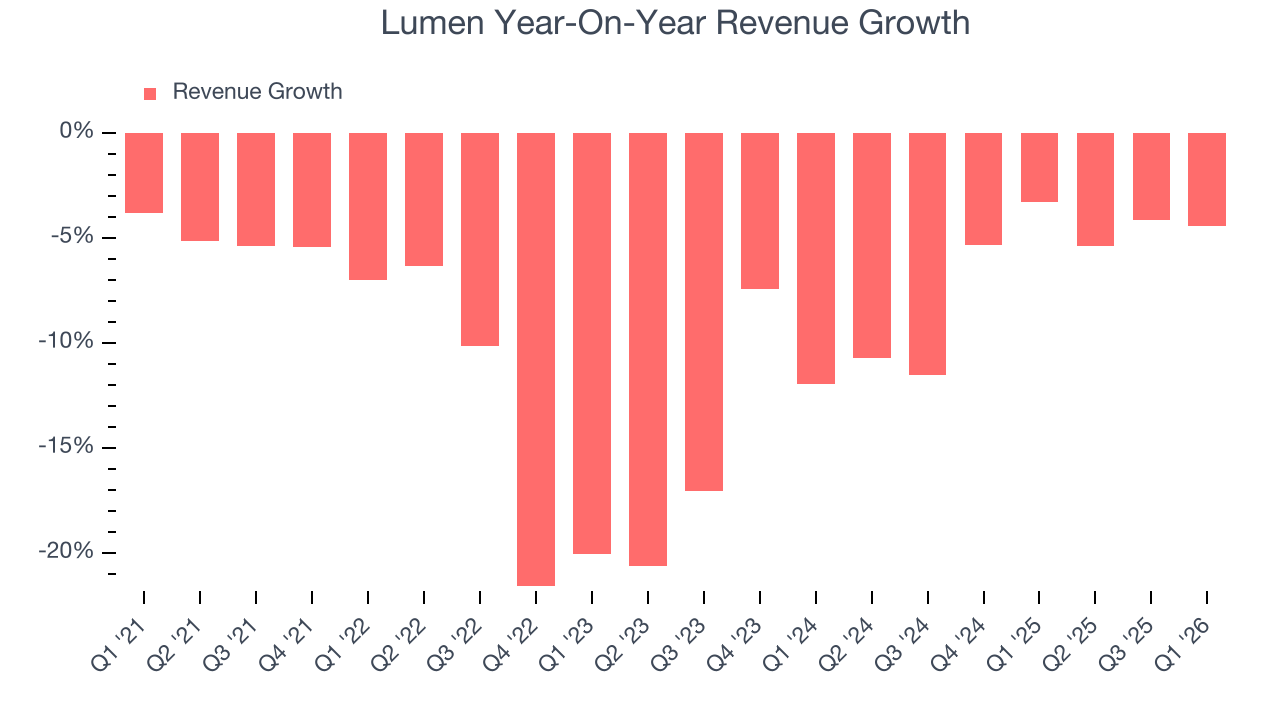

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last five years, Lumen’s demand was weak and its revenue declined by 9.7% per year. This was below our standards and suggests it’s a low quality business.

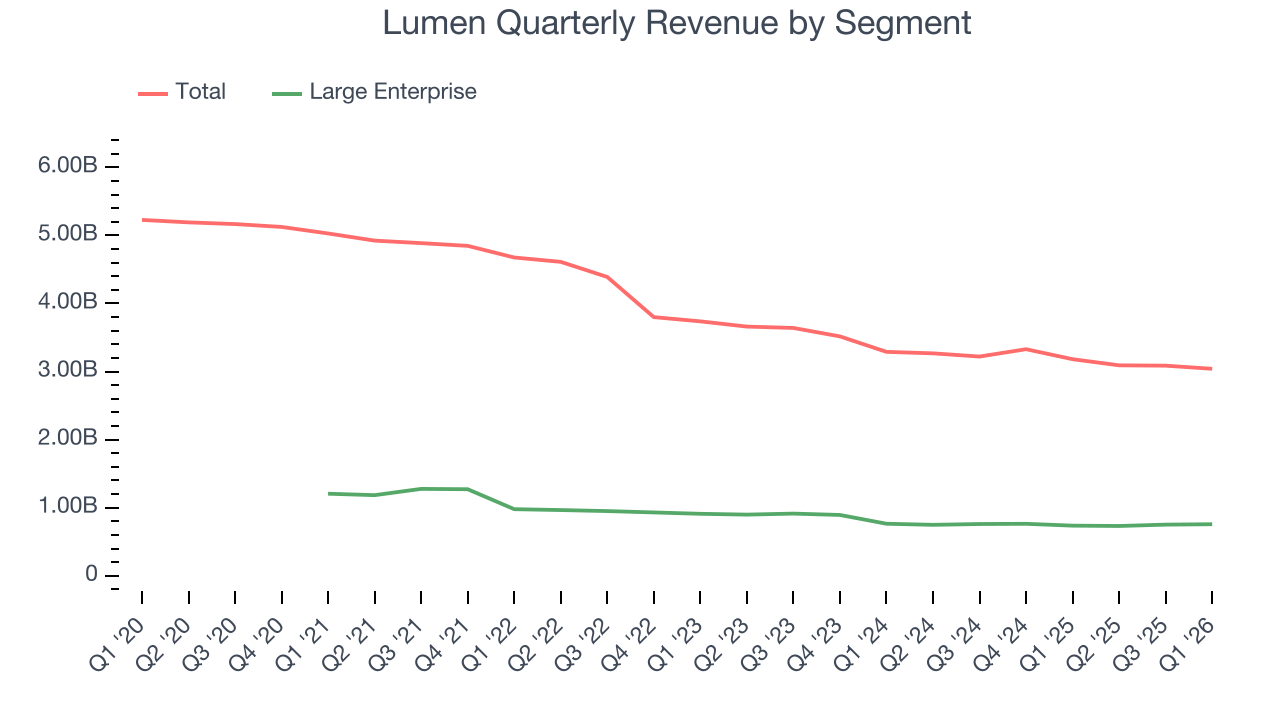

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. Lumen’s annualized revenue declines of 6.7% over the last two years suggest its demand continued shrinking.

We can better understand the company’s revenue dynamics by analyzing its most important segment, Large Enterprise. Over the last two years, Lumen’s Large Enterprise revenue (services provided to businesses) averaged 7.5% year-on-year declines. This segment has lagged the company’s overall sales.

This quarter, Lumen’s revenue fell by 4.4% year on year to $3.04 billion but beat Wall Street’s estimates by 2.9%.

Looking ahead, sell-side analysts expect revenue to decline by 7.2% over the next 12 months, similar to its two-year rate. This projection is underwhelming and suggests its newer products and services will not lead to better top-line performance yet.

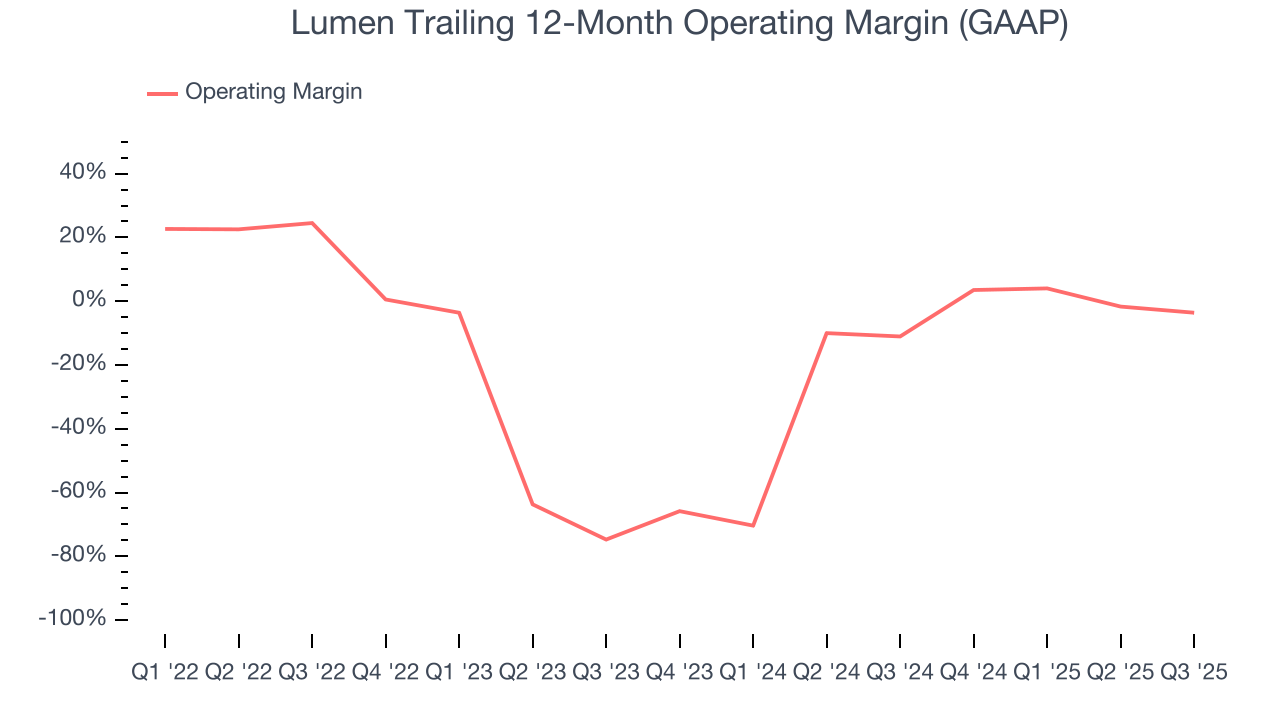

6. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Lumen’s high expenses have contributed to an average operating margin of negative 9.1% over the last five years. Unprofitable business services companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

Looking at the trend in its profitability, Lumen’s operating margin decreased by 32.2 percentage points over the last five years. Lumen’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

Lumen’s operating margin was negative 6.6% this quarter. The company's consistent lack of profits raise a flag.

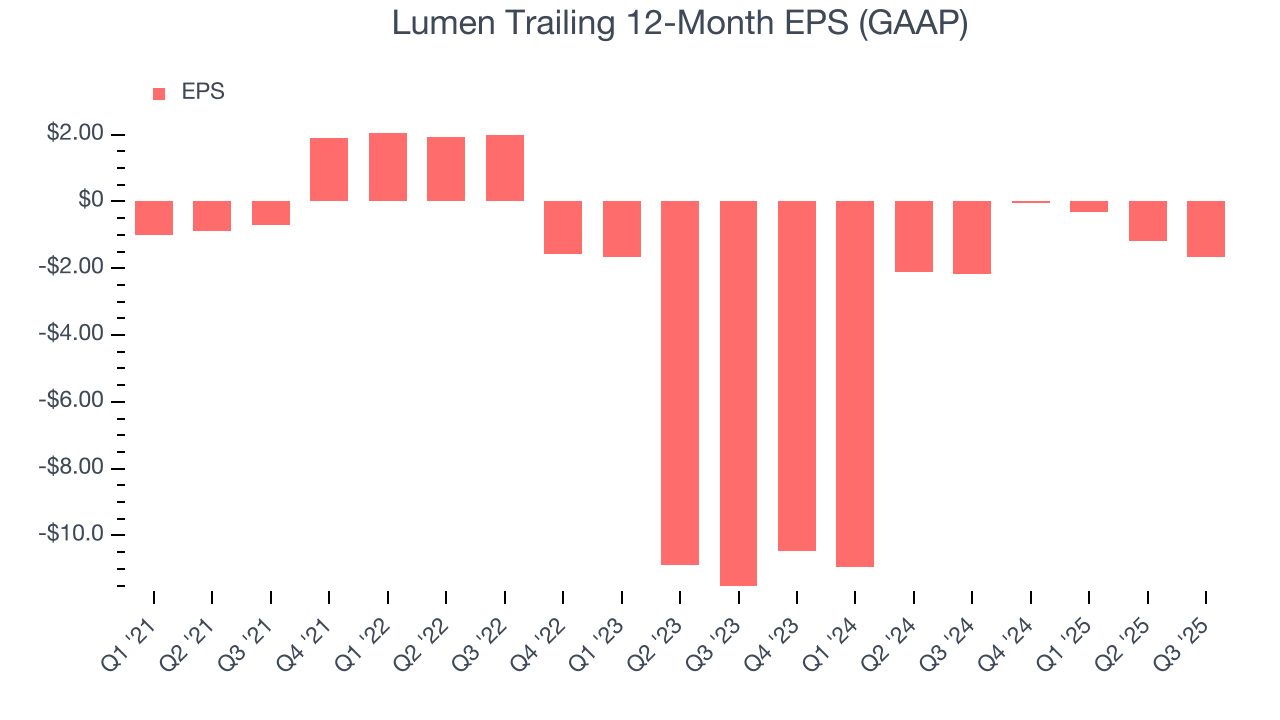

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Lumen’s earnings losses deepened over the last five years as its EPS dropped 26% annually. We tend to steer our readers away from companies with falling EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, Lumen’s low margin of safety could leave its stock price susceptible to large downswings.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Lumen, its two-year annual EPS growth of 61.6% was higher than its five-year trend. Its improving earnings is an encouraging data point.

In Q1, Lumen reported EPS of $0.23, up from negative $0.20 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. We also like to analyze expected EPS growth based on Wall Street analysts’ consensus projections, but there is insufficient data.

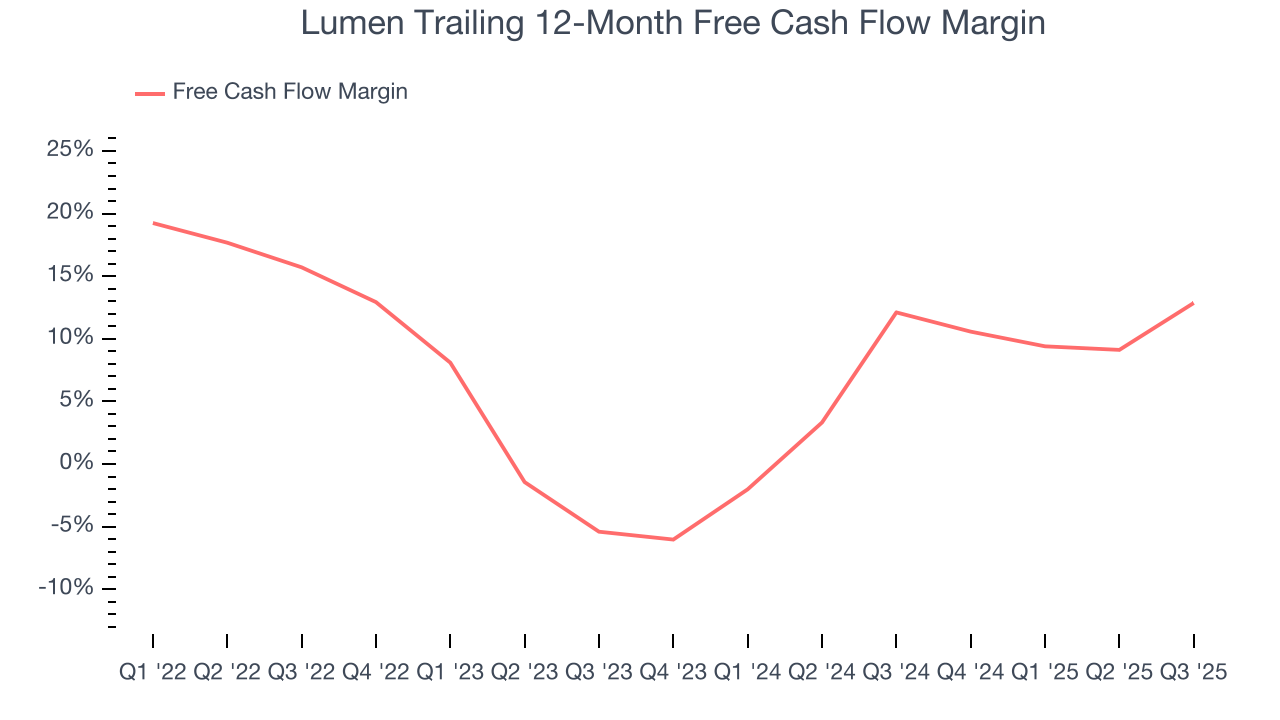

8. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Lumen has shown impressive cash profitability, giving it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 8.8% over the last five years, better than the broader business services sector. The divergence from its underwhelming operating margin stems from the add-back of non-cash charges like depreciation and stock-based compensation. GAAP operating profit expenses these line items, but free cash flow does not.

Taking a step back, we can see that Lumen’s margin dropped by 16.3 percentage points during that time. Continued declines could signal it is in the middle of an investment cycle.

Lumen burned through $1.08 billion of cash in Q1, equivalent to a negative 35.6% margin. The company’s cash flow turned negative after being positive in the same quarter last year, suggesting its historical struggles have dragged on.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Lumen’s five-year average ROIC was negative 9.8%, meaning management lost money while trying to expand the business. Its returns were among the worst in the business services sector.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Lumen’s ROIC has unfortunately decreased significantly. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

10. Key Takeaways from Lumen’s Q1 Results

It was good to see Lumen beat analysts’ EPS expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. On the other hand, EBITDA missed and EBITDA guidance came in below expectations. Zooming out, we think this was a mixed print. The market seemed to be focused on the EBITDA numbers, and the stock traded down 4.6% to $8.07 immediately following the results.

11. Is Now The Time To Buy Lumen?

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own Lumen, you should also grasp the company’s longer-term business quality and valuation.

Lumen falls short of our quality standards. For starters, its revenue has declined over the last five years. And while its projected EPS for the next year implies the company’s fundamentals will improve, the downside is its diminishing returns show management's prior bets haven't worked out. On top of that, its relatively low ROIC suggests management has struggled to find compelling investment opportunities.

Lumen’s forward price-to-sales ratio is 0.7x. The market typically values companies like Lumen based on their anticipated profits for the next 12 months, but there aren’t enough published estimates to arrive at a reliable number. You should avoid this stock for now - better opportunities lie elsewhere.

Wall Street analysts have a consensus one-year price target of $7.80 on the company (compared to the current share price of $8.07), implying they don’t see much short-term potential in Lumen.