Matson (MATX)

We’re skeptical of Matson. Its poor sales growth and falling returns on capital suggest its growth opportunities are shrinking.― StockStory Analyst Team

1. News

2. Summary

Why We Think Matson Will Underperform

Founded by a Swedish orphan, Matson (NYSE:MATX) is a provider of ocean transportation and logistics services.

- Demand will likely be soft over the next 12 months as Wall Street’s estimates imply tepid growth of 2.6%

- Gross margin of 28.4% reflects its high production costs

- One positive is that its successful business model is illustrated by its impressive operating margin

Matson fails to meet our quality criteria. There are more appealing investments to be made.

Why There Are Better Opportunities Than Matson

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Matson

Matson’s stock price of $153.03 implies a valuation ratio of 11.9x forward P/E. This multiple is cheaper than most industrials peers, but we think this is justified.

Our advice is to pay up for elite businesses whose advantages are tailwinds to earnings growth. Don’t get sucked into lower-quality businesses just because they seem like bargains. These mediocre businesses often never achieve a higher multiple as hoped, a phenomenon known as a “value trap”.

3. Matson (MATX) Research Report: Q4 CY2025 Update

Maritime transportation company Matson (NYSE:MATX) reported Q4 CY2025 results topping the market’s revenue expectations, but sales fell by 4.3% year on year to $851.9 million. Its GAAP profit of $4.60 per share was 24.8% above analysts’ consensus estimates.

Matson (MATX) Q4 CY2025 Highlights:

- Revenue: $851.9 million vs analyst estimates of $847.3 million (4.3% year-on-year decline, 0.5% beat)

- EPS (GAAP): $4.60 vs analyst estimates of $3.69 (24.8% beat)

- Adjusted EBITDA: $197.1 million vs analyst estimates of $189.3 million (23.1% margin, 4.1% beat)

- Operating Margin: 16.9%, down from 17.9% in the same quarter last year

- Free Cash Flow was -$99.5 million, down from $48.5 million in the same quarter last year

- Market Capitalization: $5.13 billion

Company Overview

Founded by a Swedish orphan, Matson (NYSE:MATX) is a provider of ocean transportation and logistics services.

Matson was established to fill a niche in maritime shipping between the U.S. mainland and Hawaii, a route that lacked efficient service options. Matson's entry into this market improved the timeliness and reliability of shipping services for these routes.

Today, Matson offers a range of logistics and shipping services, primarily focused on routes connecting the continental U.S. with Hawaii, Alaska, Guam, Micronesia, and select South Pacific islands. The company provides services such as container shipping, supply chain management, and logistics solutions. For instance, expedited services for perishable goods transport between the U.S. West Coast and Hawaii illustrate its role in supporting local markets with timely deliveries critical for freshness.

Matson’s revenue is derived from freight and logistics services, with an emphasis on ocean transportation. The business model centers on leveraging its fleet and strategic geographic focus to serve unique market needs effectively. While most of the revenue is tied to shipping contracts, the nature of its services provides some recurring revenue through ongoing client engagements, such as regular freight services for businesses and government contracts.

4. Marine Transportation

The growth of e-commerce and global trade continues to drive demand for shipping services, presenting opportunities for marine transportation companies. While ocean freight is more fuel efficient and therefore cheaper than its air and ground counterparts, it results in slower delivery times, presenting a trade off. To improve transit speeds, the industry continues to invest in digitization to optimize fleets and routes. However, marine transportation companies are still at the whim of economic cycles. Consumer spending, for example, can greatly impact the demand for these companies’ offerings while fuel costs can influence profit margins. Geopolitical tensions can also affect access to trade routes, and if certain countries are banned from using passageways like the Panama Canal, costs can spiral out of control.

Competitors in the maritime transportation industry include Kirby Corporation (NYSE:KEX), ZIM Integrated Shipping Services (NYSE:ZIM), Danaos Corporation (NYSE:DAC).

5. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last five years, Matson grew its sales at a mediocre 7% compounded annual growth rate. This fell short of our benchmark for the industrials sector and is a rough starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Matson’s recent performance shows its demand has slowed as its annualized revenue growth of 4% over the last two years was below its five-year trend. We’re wary when companies in the sector see decelerations in revenue growth, as it could signal changing consumer tastes aided by low switching costs.

This quarter, Matson’s revenue fell by 4.3% year on year to $851.9 million but beat Wall Street’s estimates by 0.5%.

Looking ahead, sell-side analysts expect revenue to grow 2.6% over the next 12 months, similar to its two-year rate. This projection doesn't excite us and indicates its products and services will see some demand headwinds.

6. Gross Margin & Pricing Power

Matson’s gross margin is slightly below the average industrials company, giving it less room to invest in areas such as research and development. As you can see below, it averaged a 28.4% gross margin over the last five years. Said differently, Matson had to pay a chunky $71.65 to its suppliers for every $100 in revenue.

This quarter, Matson’s gross profit margin was 24.8% , marking a 1.9 percentage point decrease from 26.7% in the same quarter last year. Matson’s full-year margin has also been trending down over the past 12 months, decreasing by 2.2 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs (such as raw materials and manufacturing expenses).

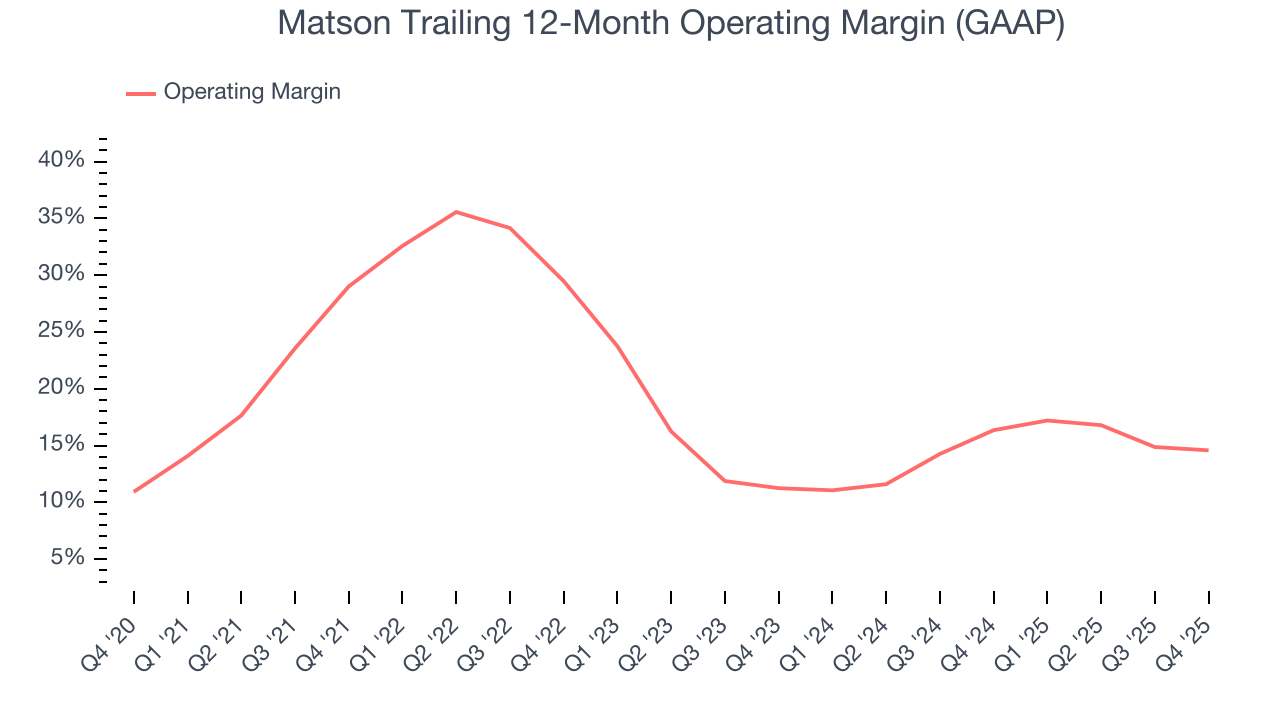

7. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Matson has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 21%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Analyzing the trend in its profitability, Matson’s operating margin decreased by 14.4 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Matson generated an operating margin profit margin of 16.9%, down 1 percentage points year on year. Since Matson’s gross margin decreased more than its operating margin, we can assume its recent inefficiencies were driven more by weaker leverage on its cost of sales rather than increased marketing, R&D, and administrative overhead expenses.

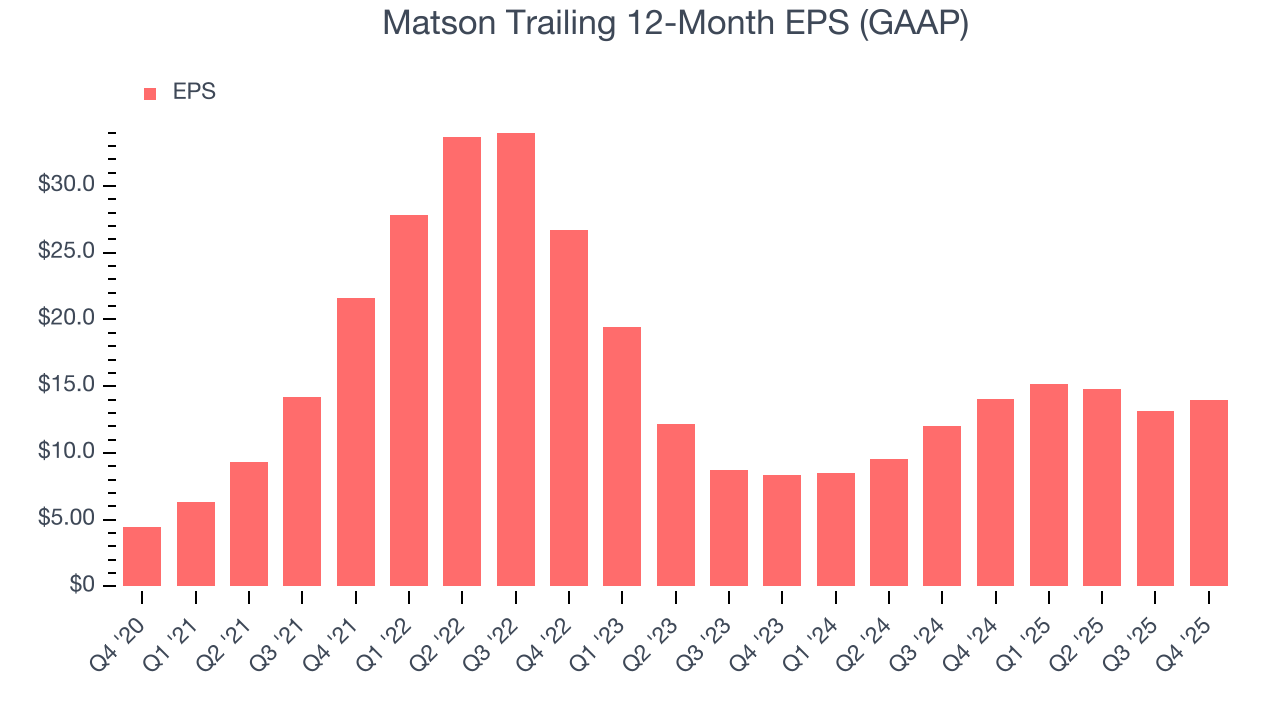

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Matson’s EPS grew at an astounding 25.7% compounded annual growth rate over the last five years, higher than its 7% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Diving into the nuances of Matson’s earnings can give us a better understanding of its performance. A five-year view shows that Matson has repurchased its stock, shrinking its share count by 28.8%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Matson, its two-year annual EPS growth of 29% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q4, Matson reported EPS of $4.60, up from $3.80 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Matson’s full-year EPS of $13.94 to shrink by 6%.

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Matson has shown terrific cash profitability, putting it in an advantageous position to invest in new products, return capital to investors, and consolidate the market during industry downturns. The company’s free cash flow margin was among the best in the industrials sector, averaging 13.3% over the last five years.

Taking a step back, we can see that Matson’s margin dropped by 17.1 percentage points during that time. If its declines continue, it could signal increasing investment needs and capital intensity.

Matson burned through $99.5 million of cash in Q4, equivalent to a negative 11.7% margin. The company’s cash flow turned negative after being positive in the same quarter last year, suggesting its historical struggles have dragged on.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Although Matson hasn’t been the highest-quality company lately, it found a few growth initiatives in the past that worked out wonderfully. Its five-year average ROIC was 25.6%, splendid for an industrials business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Matson’s ROIC has unfortunately decreased significantly. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

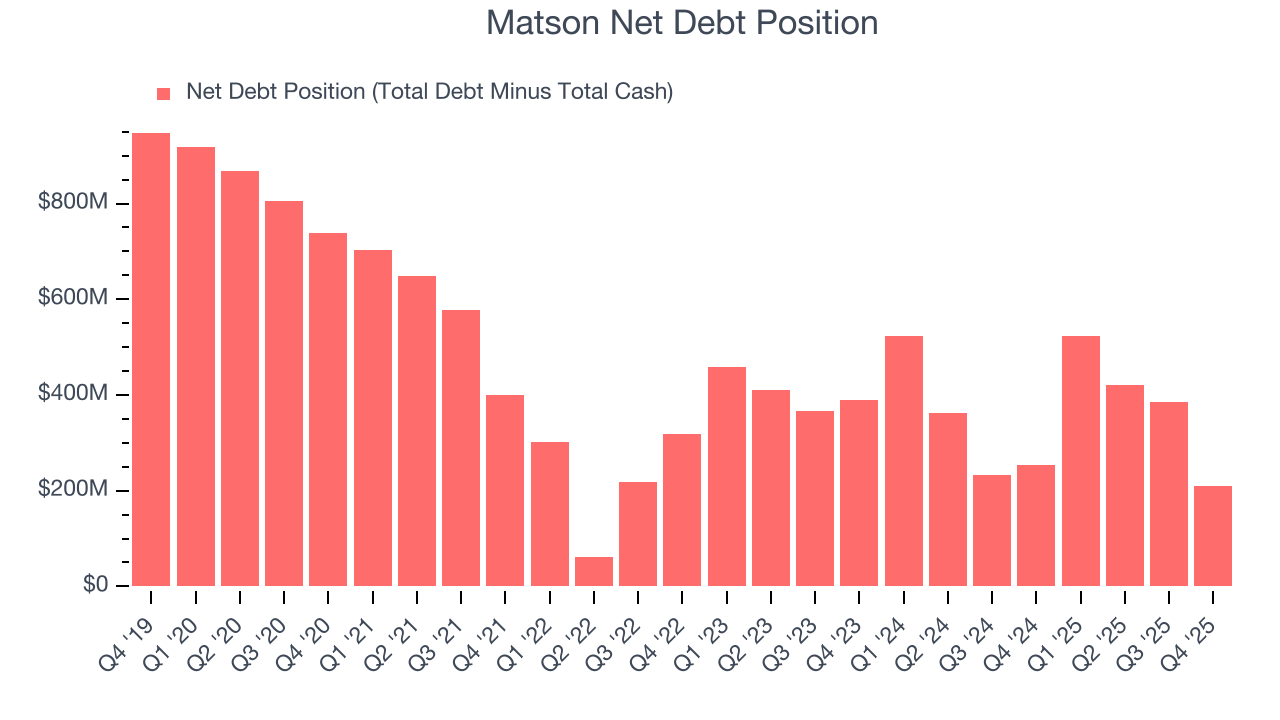

11. Balance Sheet Assessment

Matson reported $141.9 million of cash and $351.8 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $704.7 million of EBITDA over the last 12 months, we view Matson’s 0.3× net-debt-to-EBITDA ratio as safe. We also see its $14.7 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Matson’s Q4 Results

It was good to see Matson beat analysts’ EPS expectations this quarter. We were also glad its EBITDA outperformed Wall Street’s estimates. Zooming out, we think this quarter featured some important positives. The stock remained flat at $166.07 immediately after reporting.

13. Is Now The Time To Buy Matson?

Updated: March 8, 2026 at 11:42 PM EDT

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own Matson, you should also grasp the company’s longer-term business quality and valuation.

Matson isn’t a terrible business, but it doesn’t pass our bar. For starters, its revenue growth was mediocre over the last five years, and analysts expect its demand to deteriorate over the next 12 months. While its impressive operating margins show it has a highly efficient business model, the downside is its diminishing returns show management's prior bets haven't worked out. On top of that, its projected EPS for the next year is lacking.

Matson’s P/E ratio based on the next 12 months is 11.9x. While this valuation is fair, the upside isn’t great compared to the potential downside. We're fairly confident there are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $213 on the company (compared to the current share price of $153.03).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.