MediaAlpha (MAX)

MediaAlpha is a world-class company. Its superb revenue growth indicates its market share is increasing.― StockStory Analyst Team

1. News

2. Summary

Why We Like MediaAlpha

Powering nearly 10 million consumer referrals each month in the insurance marketplace, MediaAlpha (NYSE:MAX) operates a technology platform that connects insurance carriers with high-intent consumers shopping for property, casualty, health, and life insurance products.

- Market share has increased this cycle as its 16.6% annual revenue growth over the last five years was exceptional

- Earnings growth has massively outpaced its peers over the last four years as its EPS has compounded at 53.1% annually

- Adequate returns on capital show management makes decent investment decisions, and its returns are climbing as it finds more lucrative growth opportunities

MediaAlpha is a remarkable business. The valuation seems fair based on its quality, and we think now is the time to buy the stock.

Why Is Now The Time To Buy MediaAlpha?

High Quality

Investable

Underperform

Why Is Now The Time To Buy MediaAlpha?

At $12.95 per share, MediaAlpha trades at 9.5x forward P/E. This multiple is cheap, and we think the stock is a bargain considering its quality characteristics.

We at StockStory love when high-quality companies go on sale because it enables investors to profit from earnings growth and a potential re-rating - the coveted “double play”.

3. MediaAlpha (MAX) Research Report: Q3 CY2025 Update

Insurance customer acquisition platform MediaAlpha (NYSE:MAX) beat Wall Street’s revenue expectations in Q3 CY2025, with sales up 18.3% year on year to $306.5 million. On the other hand, next quarter’s revenue guidance of $290 million was less impressive, coming in 1.3% below analysts’ estimates. Its non-GAAP profit of $0.40 per share was 8.2% above analysts’ consensus estimates.

MediaAlpha (MAX) Q3 CY2025 Highlights:

- Revenue: $306.5 million vs analyst estimates of $284.9 million (18.3% year-on-year growth, 7.6% beat)

- Adjusted EPS: $0.40 vs analyst estimates of $0.37 (8.2% beat)

- Adjusted EBITDA: $29.08 million vs analyst estimates of $26.7 million (9.5% margin, 8.9% beat)

- Revenue Guidance for Q4 CY2025 is $290 million at the midpoint, below analyst estimates of $293.9 million

- EBITDA guidance for Q4 CY2025 is $28.5 million at the midpoint, above analyst estimates of $27.62 million

- Operating Margin: 6.4%, in line with the same quarter last year

- Free Cash Flow Margin: 7.7%, up from 3.1% in the same quarter last year

- Market Capitalization: $736.4 million

Company Overview

Powering nearly 10 million consumer referrals each month in the insurance marketplace, MediaAlpha (NYSE:MAX) operates a technology platform that connects insurance carriers with high-intent consumers shopping for property, casualty, health, and life insurance products.

MediaAlpha's programmatic marketplace serves as a crucial intermediary in the insurance industry, enabling carriers to efficiently acquire customers based on their specific targeting criteria. The company's platform processes extensive data to match insurance shoppers with the most relevant providers at precisely the moment they're actively seeking coverage, allowing carriers to align customer acquisition costs with expected customer lifetime value.

The platform supports multiple consumer engagement methods—clicks that direct consumers to an insurer's website, calls connecting consumers with insurance representatives, and leads that deliver consumer information to insurers for follow-up. These varied touchpoints accommodate different carrier acquisition strategies and consumer preferences.

For example, when someone visits an insurance comparison website and enters information about their vehicle and driving history, MediaAlpha's technology can instantly analyze this data and match the consumer with insurers most likely to provide competitive quotes for their specific profile. The platform then facilitates the referral—either sending the consumer directly to the insurer's site or arranging for an agent to contact them.

MediaAlpha earns revenue by charging a fee for each consumer referral transacted through its platform. The company operates through both Open Marketplace transactions, where it controls which referrals go to which demand partners, and Private Marketplace arrangements, where supply and demand partners contract directly with MediaAlpha facilitating the transaction.

4. Advertising & Marketing Services

The sector is on the precipice of both disruption and growth as AI, programmatic advertising, and data-driven marketing reshape how things are done. For example, the advent of the Internet broadly and programmatic advertising specifically means that brand building is not a relationship business anymore but instead one based on data and technology, which could hurt traditional ad agencies. On the other hand, the companies in the sector that beef up their tech chops by automating the buying of ad inventory or facilitating omnichannel marketing, for example, stand to benefit. With or without advances in digitization and AI, the sector is still highly levered to the macro, and economic uncertainty may lead to fluctuating ad spend, particularly in cyclical industries.

MediaAlpha's competitors include EverQuote (NASDAQ:EVER), GoHealth (NASDAQ:GOCO), SelectQuote (NYSE:SLQT), and private companies like QuinStreet and Insurance.com that facilitate insurance comparison shopping and customer acquisition for carriers.

5. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years.

With $1.12 billion in revenue over the past 12 months, MediaAlpha is a small player in the business services space, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and numerous distribution channels. On the bright side, it can grow faster because it has more room to expand.

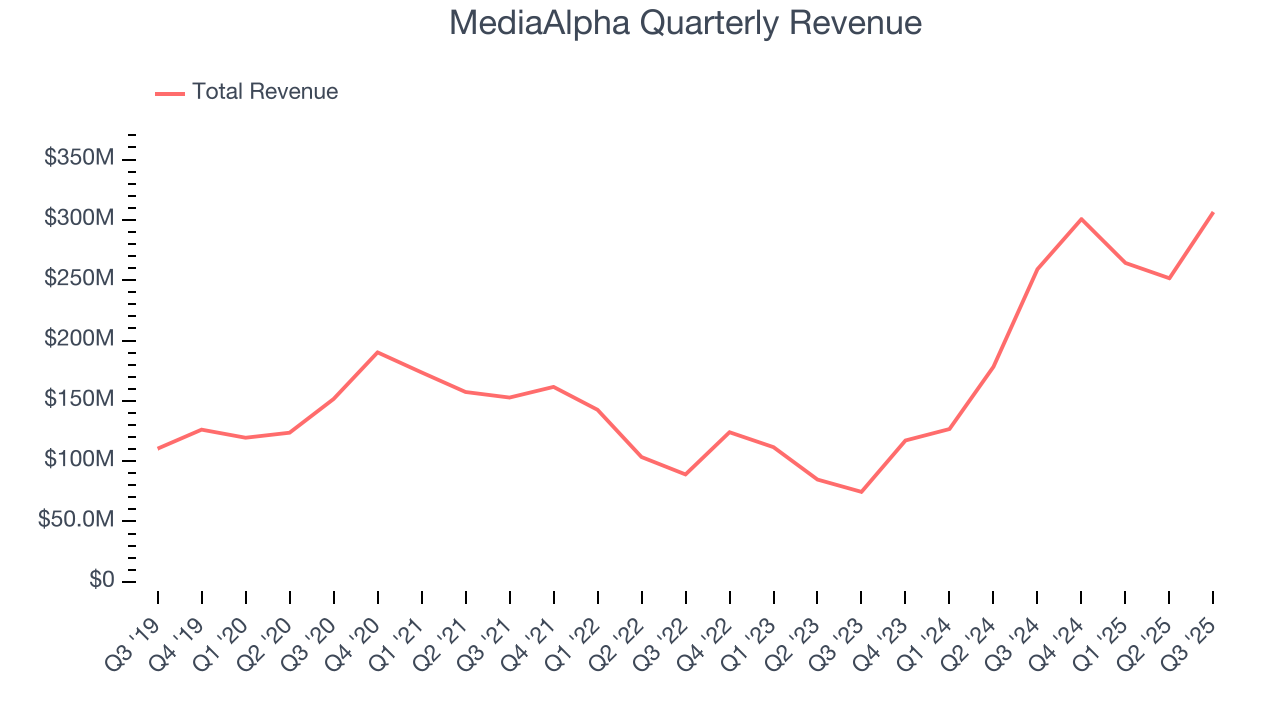

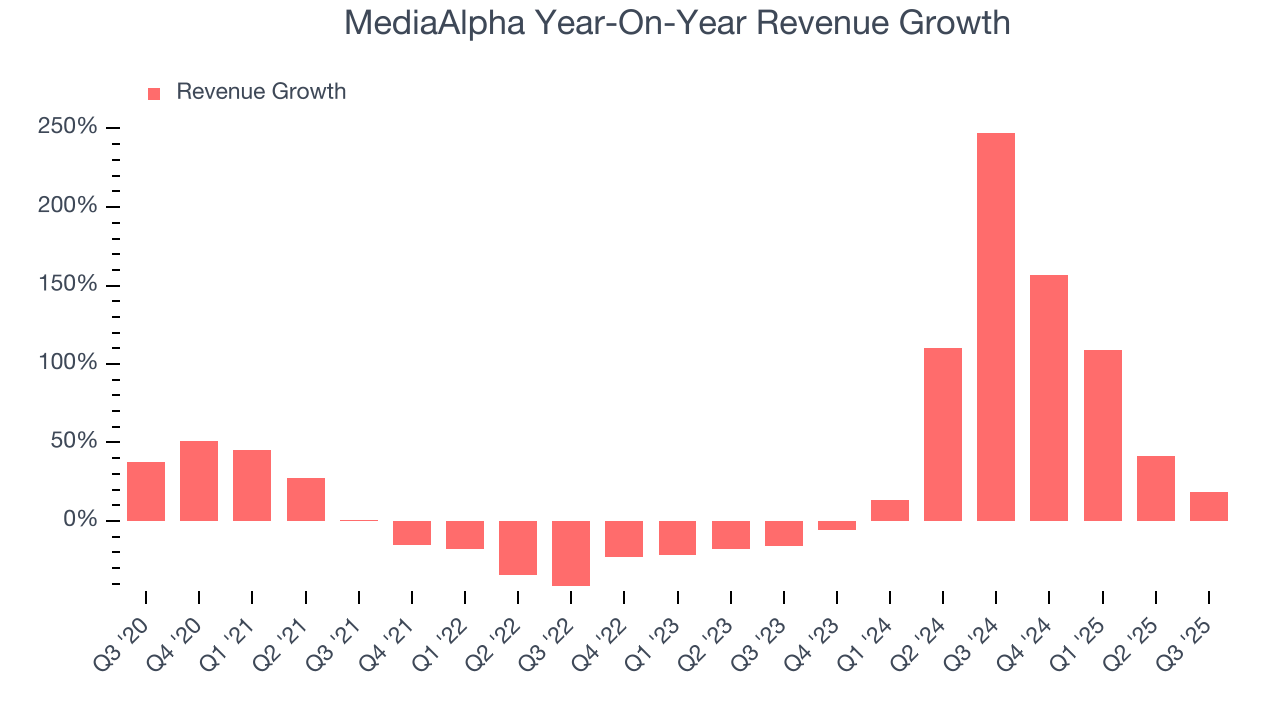

As you can see below, MediaAlpha’s 16.6% annualized revenue growth over the last five years was incredible. This is a great starting point for our analysis because it shows MediaAlpha’s demand was higher than many business services companies.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. MediaAlpha’s annualized revenue growth of 68.6% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

This quarter, MediaAlpha reported year-on-year revenue growth of 18.3%, and its $306.5 million of revenue exceeded Wall Street’s estimates by 7.6%. Company management is currently guiding for a 3.5% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 5.3% over the next 12 months, a deceleration versus the last two years. Still, this projection is above the sector average and suggests the market is baking in some success for its newer products and services.

6. Adjusted Operating Margin

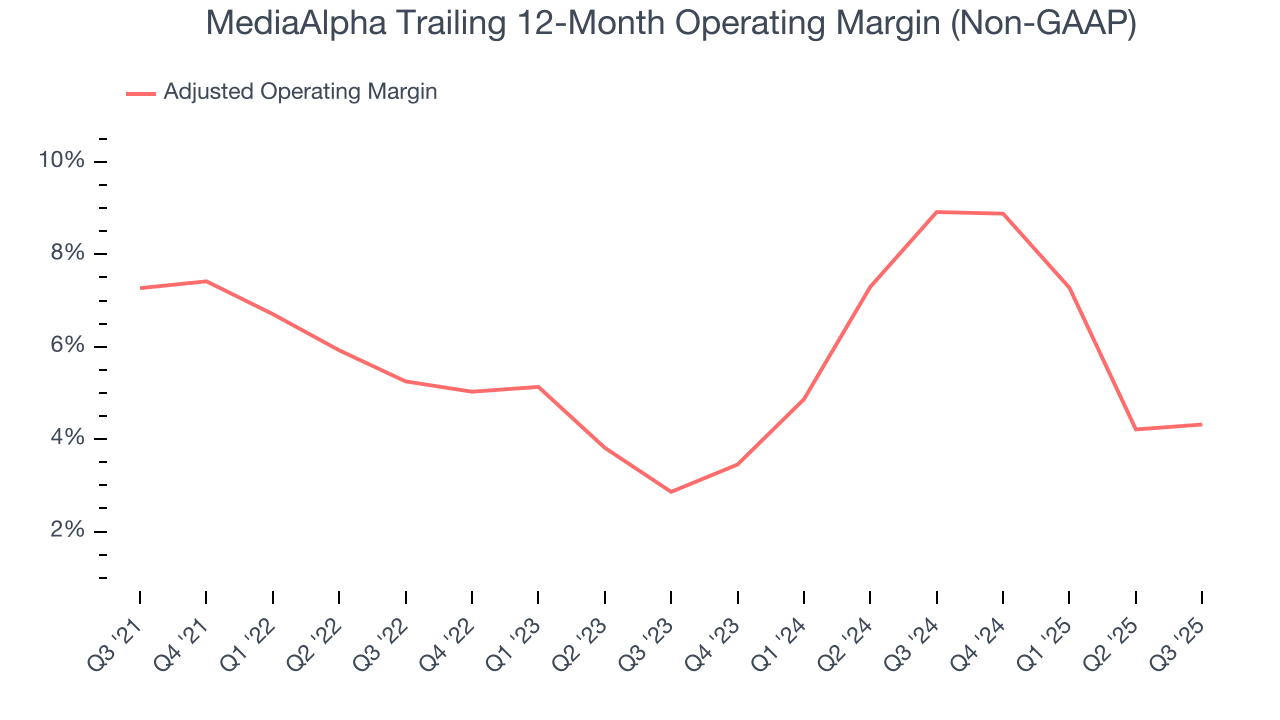

MediaAlpha was profitable over the last five years but held back by its large cost base. Its average adjusted operating margin of 5.8% was weak for a business services business.

Looking at the trend in its profitability, MediaAlpha’s adjusted operating margin decreased by 3 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. MediaAlpha’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

This quarter, MediaAlpha generated an adjusted operating margin profit margin of 8.9%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

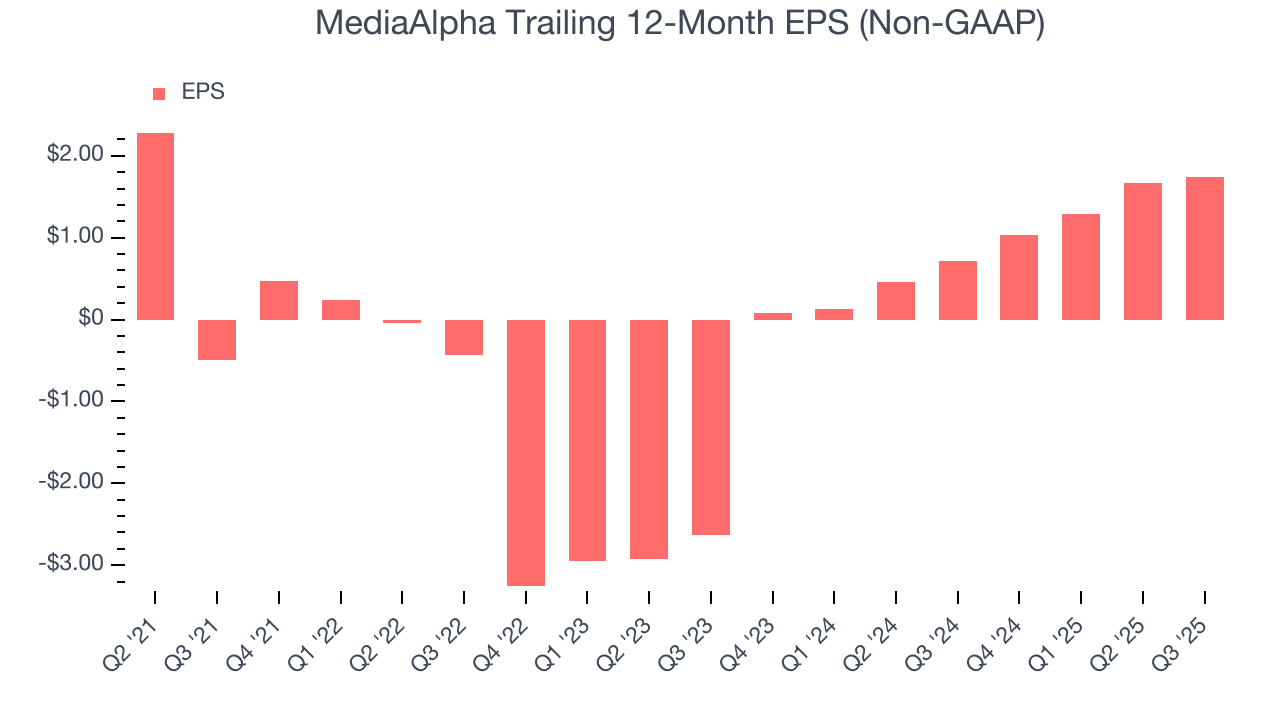

MediaAlpha’s full-year EPS flipped from negative to positive over the last four years. This is a good sign and shows it’s at an inflection point.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For MediaAlpha, its two-year annual EPS growth of 63.1% was higher than its four-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q3, MediaAlpha reported adjusted EPS of $0.40, up from $0.33 in the same quarter last year. This print beat analysts’ estimates by 8.2%. Over the next 12 months, Wall Street expects MediaAlpha’s full-year EPS of $1.74 to shrink by 21.5%. This is unusual as its revenue and operating margin are anticipated to increase, signaling the fall likely stems from "below-the-line" items such as taxes.

8. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

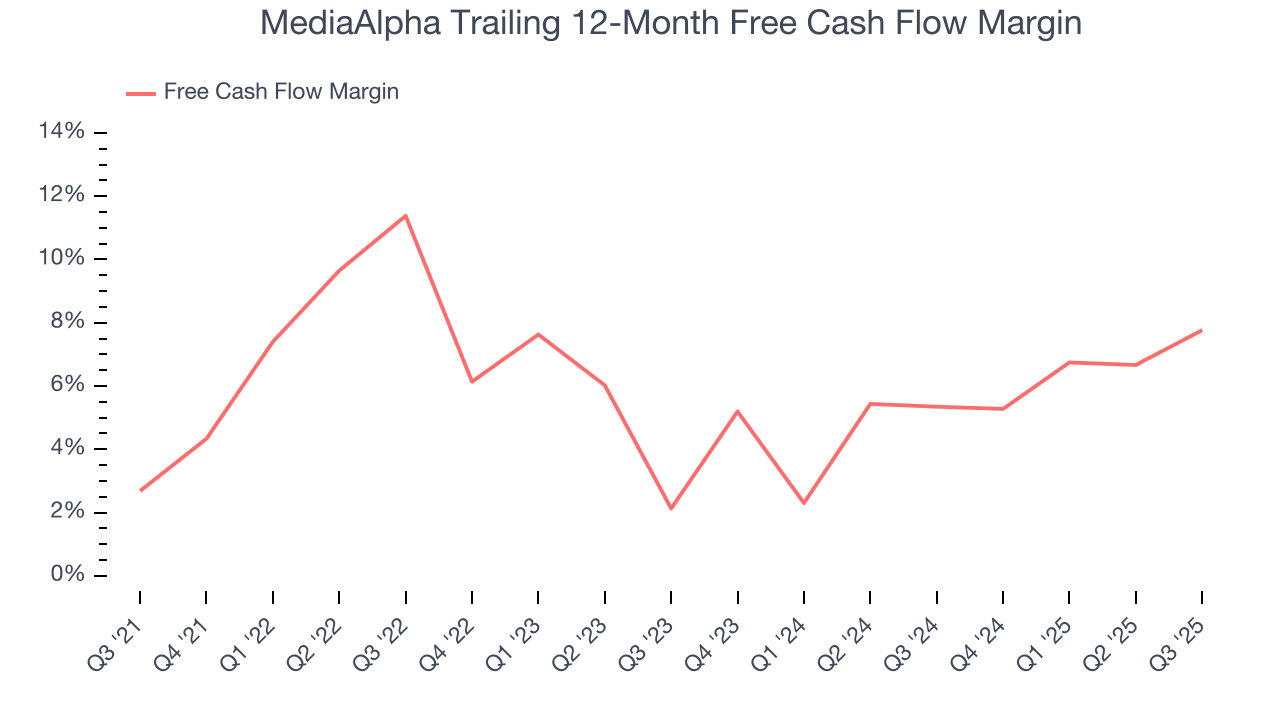

MediaAlpha has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 6.1% over the last five years, slightly better than the broader business services sector.

Taking a step back, we can see that MediaAlpha’s margin expanded by 5.1 percentage points during that time. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability fell.

MediaAlpha’s free cash flow clocked in at $23.56 million in Q3, equivalent to a 7.7% margin. This result was good as its margin was 4.6 percentage points higher than in the same quarter last year, building on its favorable historical trend.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

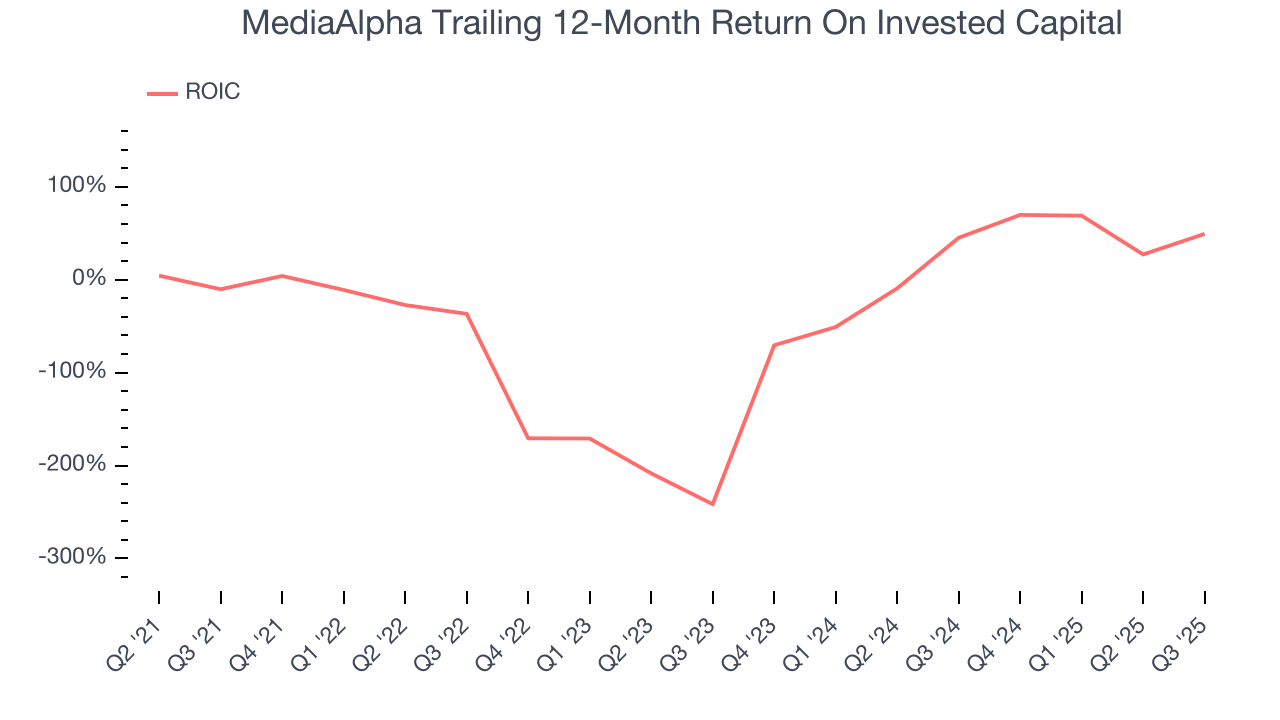

MediaAlpha’s management team makes decent investment decisions and generates value for shareholders. Its five-year average ROIC was 12%, slightly better than typical business services business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Fortunately, MediaAlpha’s ROIC has increased significantly over the last few years. This is a great sign when paired with its already strong returns. It could suggest its competitive advantage or profitable growth opportunities are expanding.

10. Balance Sheet Assessment

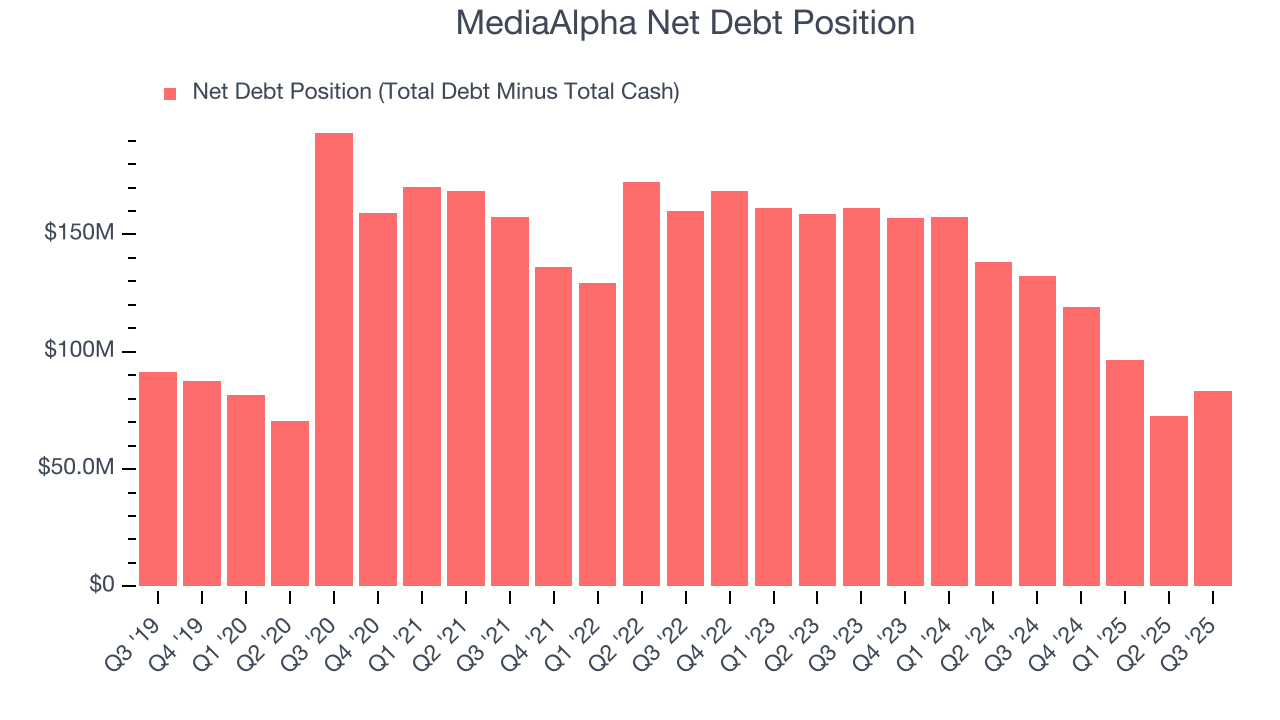

MediaAlpha reported $72.34 million of cash and $155.7 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $119.6 million of EBITDA over the last 12 months, we view MediaAlpha’s 0.7× net-debt-to-EBITDA ratio as safe. We also see its $11.83 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from MediaAlpha’s Q3 Results

We were impressed by how significantly MediaAlpha blew past analysts’ revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its revenue guidance for next quarter slightly missed. Overall, this print had some key positives. The stock remained flat at $12.95 immediately following the results.

12. Is Now The Time To Buy MediaAlpha?

Are you wondering whether to buy MediaAlpha or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

There is a lot to like about MediaAlpha. For starters, its revenue growth was exceptional over the last five years. And while its projected EPS for the next year is lacking, its rising cash profitability gives it more optionality. On top of that, MediaAlpha’s astounding EPS growth over the last four years shows its profits are trickling down to shareholders.

MediaAlpha’s P/E ratio based on the next 12 months is 9.5x. Looking across the spectrum of business services businesses, MediaAlpha’s fundamentals clearly illustrate it’s a special business. We’re pounding the table at this bargain price.

Wall Street analysts have a consensus one-year price target of $15.93 on the company (compared to the current share price of $12.95), implying they see 23% upside in buying MediaAlpha in the short term.