Mirion (MIR)

Mirion is intriguing. Its sales and EPS are anticipated to grow nicely over the next 12 months, a welcome sign for investors.― StockStory Analyst Team

1. News

2. Summary

Why Mirion Is Interesting

With its technology protecting workers in over 130 countries and equipment used in 80% of cancer centers worldwide, Mirion Technologies (NYSE:MIR) provides radiation detection, measurement, and monitoring solutions for medical, nuclear energy, defense, and scientific research applications.

- Exciting sales outlook for the upcoming 12 months calls for 22.6% growth, an acceleration from its two-year trend

- Market share has increased this cycle as its 11.8% annual revenue growth over the last five years was exceptional

- One pitfall is its operating margin falls short of the industry average, and the smaller profit dollars make it harder to react to unexpected market developments

Mirion has the potential to be a high-quality business. This is a good company to add to your watchlist.

Why Should You Watch Mirion

High Quality

Investable

Underperform

Why Should You Watch Mirion

Mirion’s stock price of $22.03 implies a valuation ratio of 39.7x forward P/E. This valuation is richer than that of business services peers.

Mirion could improve its business quality by stringing together a few solid quarters. We’d be more open to buying the stock when that time comes.

3. Mirion (MIR) Research Report: Q4 CY2025 Update

Radiation safety company Mirion (NYSE:MIR) fell short of the market’s revenue expectations in Q4 CY2025, but sales rose 9.1% year on year to $277.4 million. Its non-GAAP profit of $0.15 per share was 7.8% below analysts’ consensus estimates.

Mirion (MIR) Q4 CY2025 Highlights:

- Revenue: $277.4 million vs analyst estimates of $281.2 million (9.1% year-on-year growth, 1.3% miss)

- Adjusted EPS: $0.15 vs analyst expectations of $0.16 (7.8% miss)

- Adjusted EBITDA: $77.6 million vs analyst estimates of $76.15 million (28% margin, 1.9% beat)

- Adjusted EPS guidance for the upcoming financial year 2026 is $0.53 at the midpoint, missing analyst estimates by 12.3%

- EBITDA guidance for the upcoming financial year 2026 is $292.5 million at the midpoint, in line with analyst expectations

- Operating Margin: 9.2%, down from 11.5% in the same quarter last year

- Free Cash Flow Margin: 22.8%, up from 19.3% in the same quarter last year

- Market Capitalization: $5.52 billion

Company Overview

With its technology protecting workers in over 130 countries and equipment used in 80% of cancer centers worldwide, Mirion Technologies (NYSE:MIR) provides radiation detection, measurement, and monitoring solutions for medical, nuclear energy, defense, and scientific research applications.

Mirion's business is divided into two main segments: Medical and Technologies. The Medical segment focuses on cancer diagnostics and treatment, providing quality assurance tools that ensure radiation therapy is delivered accurately and safely to patients. These include phantoms (devices that simulate human tissue), alignment lasers, and software platforms for data analytics. The segment also offers nuclear medicine equipment and radiation monitoring services for healthcare workers.

The Technologies segment serves nuclear power plants, defense organizations, and research laboratories with specialized radiation detection and measurement systems. Products range from reactor safety controls and radiation monitoring systems to portable detection devices and contamination monitors. These tools help customers maintain safety standards, comply with regulations, and protect personnel working with radioactive materials.

For example, a nuclear power plant might use Mirion's radiation monitoring systems to continuously track radiation levels throughout the facility, ensuring worker safety and preventing environmental releases. Similarly, a hospital radiation oncology department might use Mirion's quality assurance tools to verify that radiation therapy equipment delivers precisely the prescribed dose to cancer patients.

Mirion generates revenue through direct sales and distribution partners, with customers including hospitals, government agencies, military organizations, nuclear facilities, and research laboratories. The company maintains operations across 12 countries, with a significant research and development team comprising over 400 scientists and engineers who continually advance its radiation safety technologies.

The company's products address critical safety needs in highly regulated industries where precision and reliability are essential, as radiation can be both beneficial (in medical treatments) and potentially harmful if not properly controlled.

4. Specialized Technology

Companies in this sector, especially if they invest wisely, could see demand tailwinds as the world moves towards more IoT (Internet of Things), automation, and analytics. Enterprises across most industries will balk at taking these journeys solo and will enlist companies with expertise and scale in these areas. However, headwinds could include rising competition from larger technology firms, as digitization lowers barriers to entry in the space. Additionally, companies in the space will likely face evolving regulatory scrutiny over data privacy, particularly for surveillance and security technologies. This could make companies have to continually pivot and invest.

Mirion Technologies competes with companies like Thermo Fisher Scientific (NYSE: TMO), Fortive Corporation's Fluke Health Solutions (NYSE: FTV), and IBA Group in the radiation measurement and medical segments. In the nuclear safety and monitoring space, competitors include Framatome (owned by EDF), Westinghouse Electric Company, and Lockheed Martin (NYSE: LMT).

5. Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $925.4 million in revenue over the past 12 months, Mirion is a small player in the business services space, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and numerous distribution channels. On the bright side, it can grow faster because it has more room to expand.

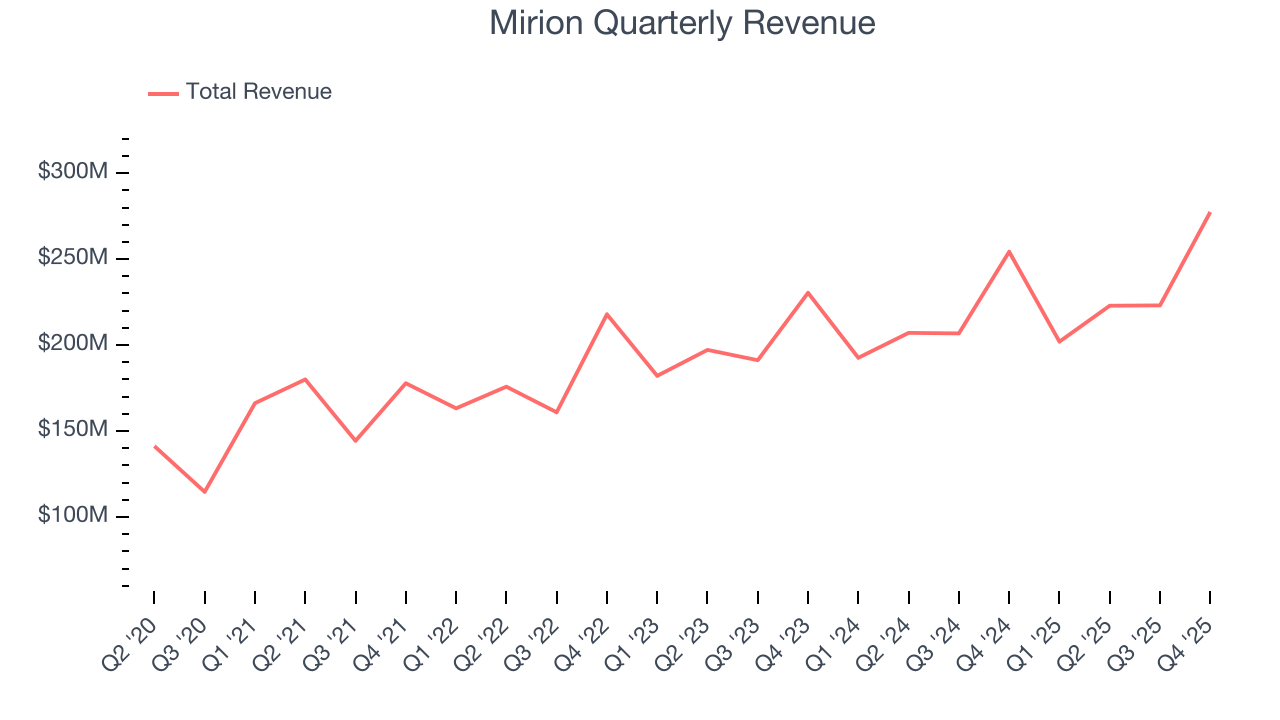

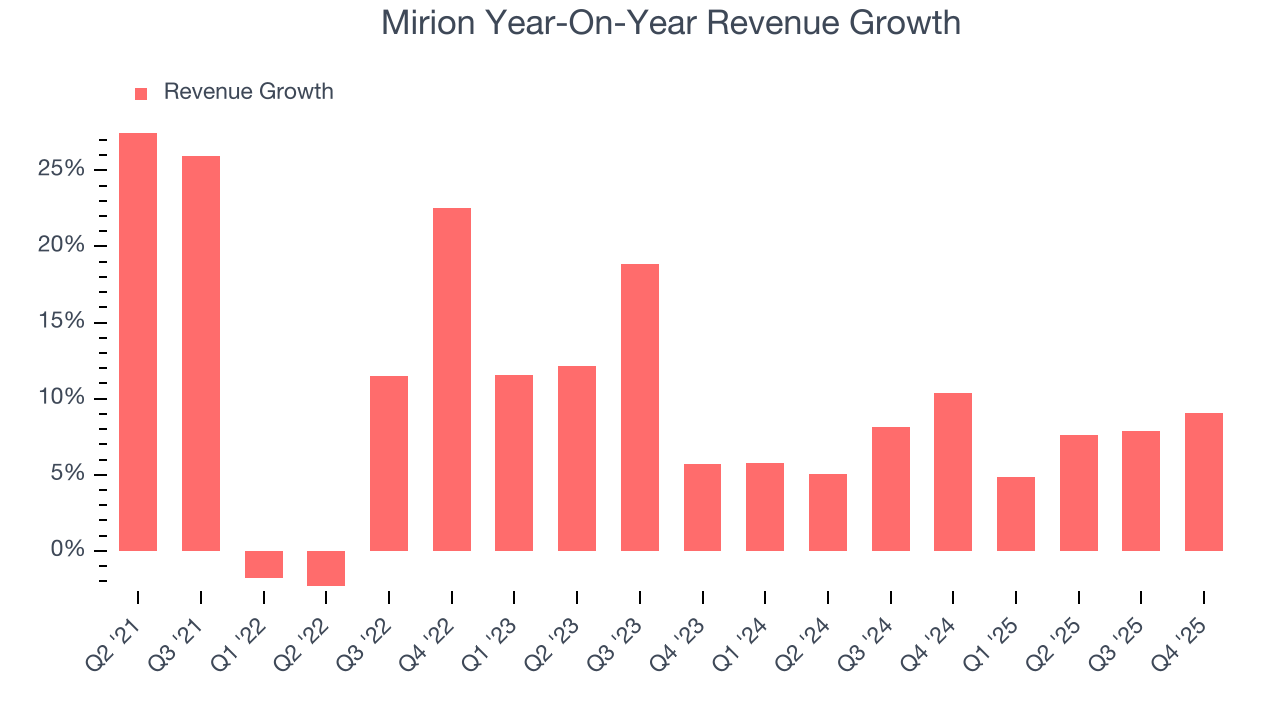

As you can see below, Mirion grew its sales at an excellent 11.8% compounded annual growth rate over the last five years. This is an encouraging starting point for our analysis because it shows Mirion’s demand was higher than many business services companies.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. Mirion’s annualized revenue growth of 7.5% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, Mirion’s revenue grew by 9.1% year on year to $277.4 million, missing Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 22.6% over the next 12 months, an improvement versus the last two years. This projection is eye-popping and implies its newer products and services will catalyze better top-line performance.

6. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

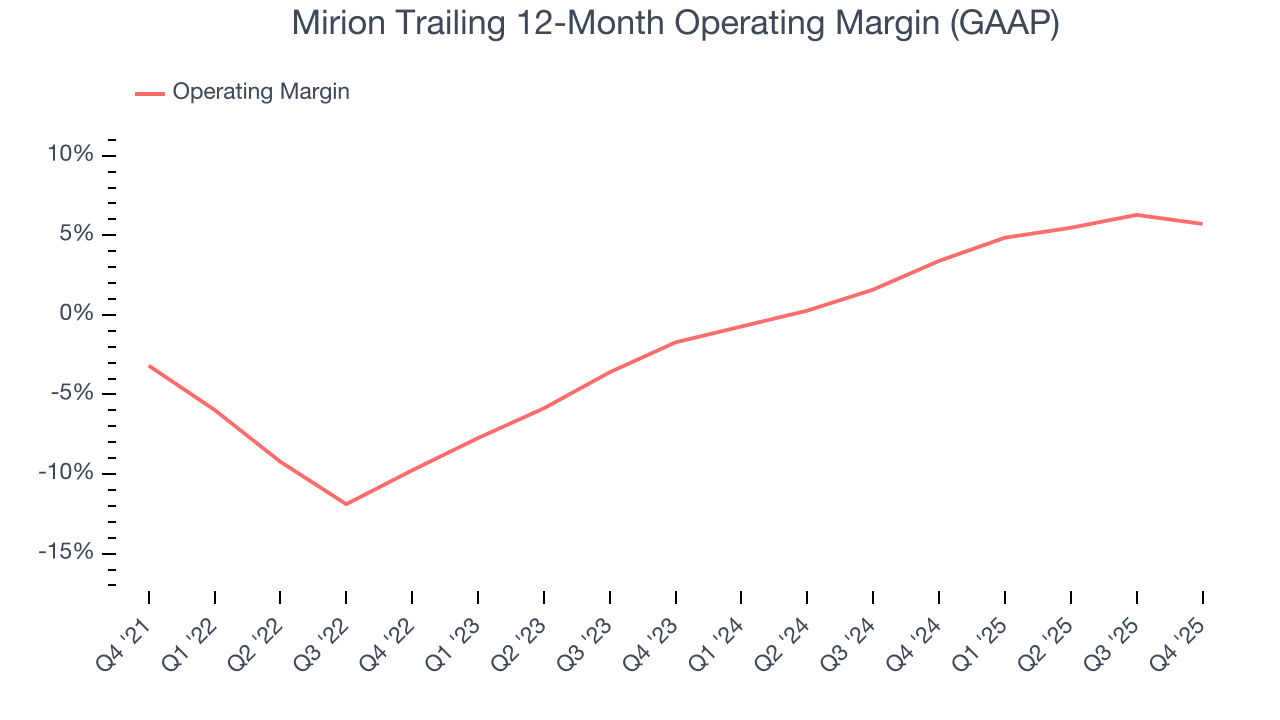

Mirion was roughly breakeven when averaging the last five years of quarterly operating profits, one of the worst outcomes in the business services sector.

On the plus side, Mirion’s operating margin rose by 8.9 percentage points over the last five years, as its sales growth gave it operating leverage.

In Q4, Mirion generated an operating margin profit margin of 9.2%, down 2.3 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

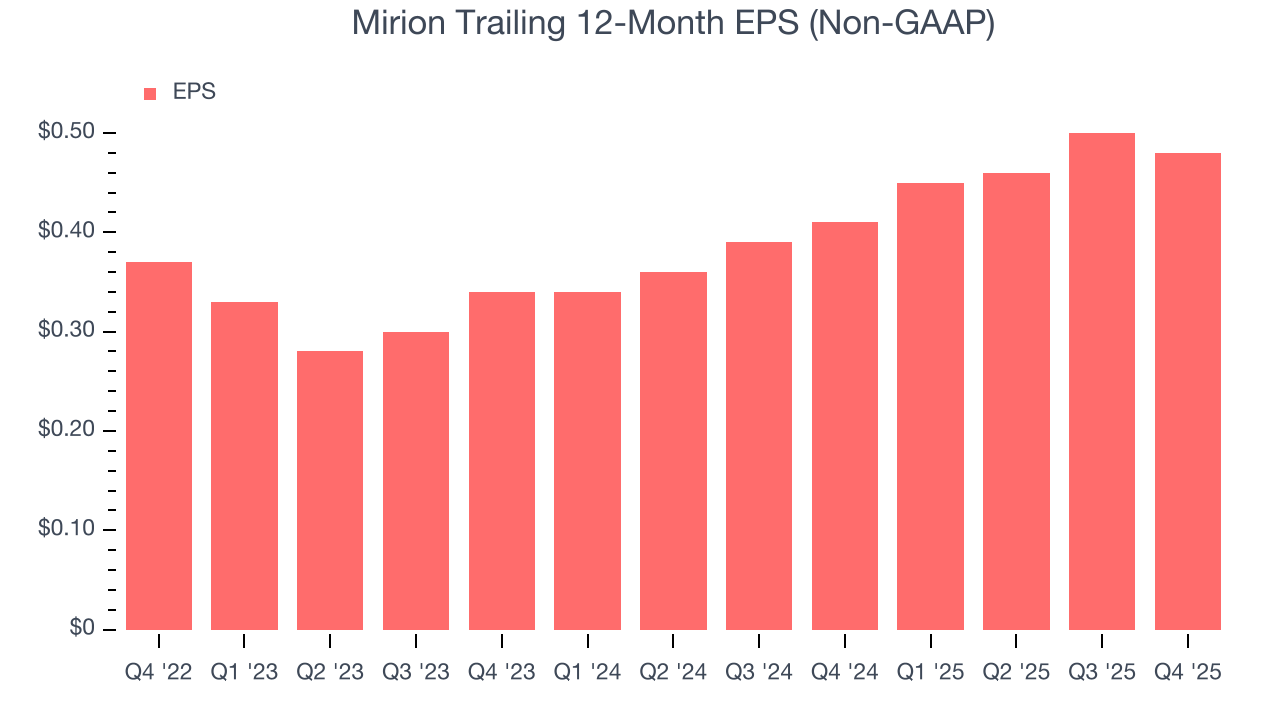

Mirion’s full-year EPS dropped 9.2%, or 3% annually, over the last three years. We’ll keep a close eye on the company as diminishing earnings could imply changing secular trends and preferences.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Mirion, its two-year annual EPS growth of 18.8% was higher than its three-year trend. This acceleration made it one of the faster-growing business services companies in recent history.

In Q4, Mirion reported adjusted EPS of $0.15, down from $0.17 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects Mirion’s full-year EPS of $0.48 to grow 26.4%.

8. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

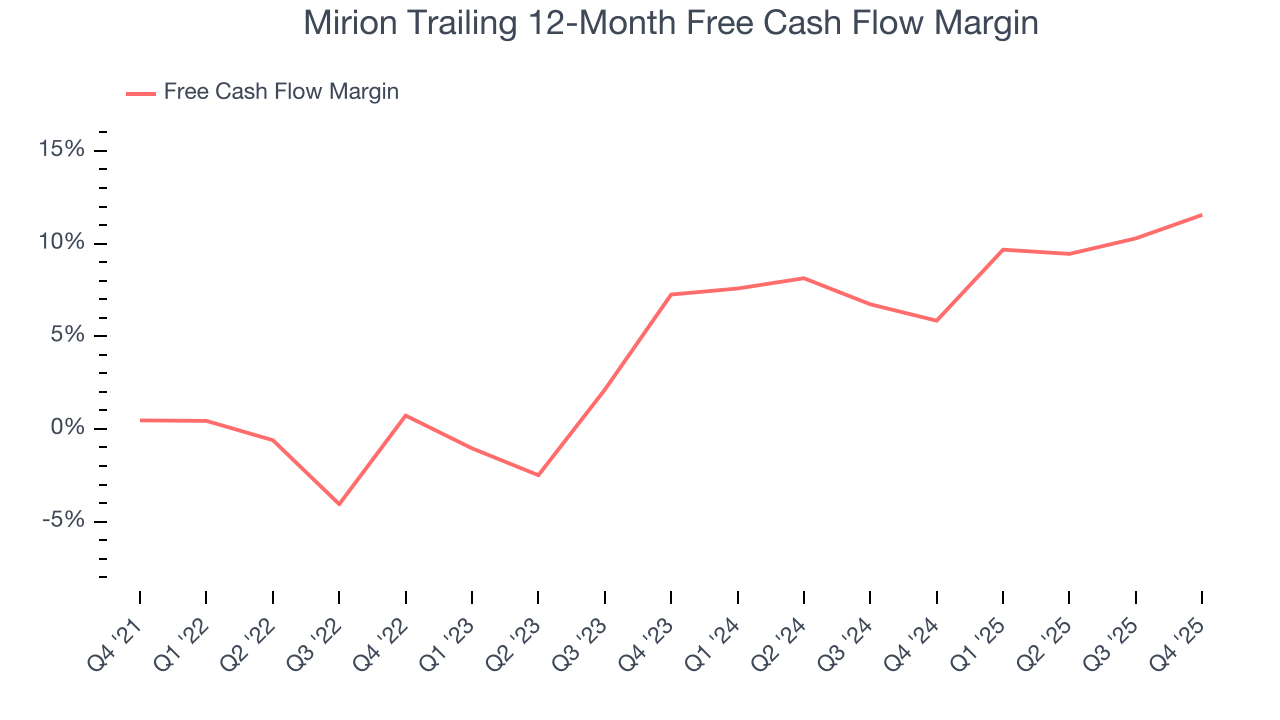

Mirion has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 5.6% over the last five years, slightly better than the broader business services sector.

Taking a step back, we can see that Mirion’s margin expanded by 11.1 percentage points during that time. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability.

Mirion’s free cash flow clocked in at $63.2 million in Q4, equivalent to a 22.8% margin. This result was good as its margin was 3.5 percentage points higher than in the same quarter last year, building on its favorable historical trend.

9. Balance Sheet Assessment

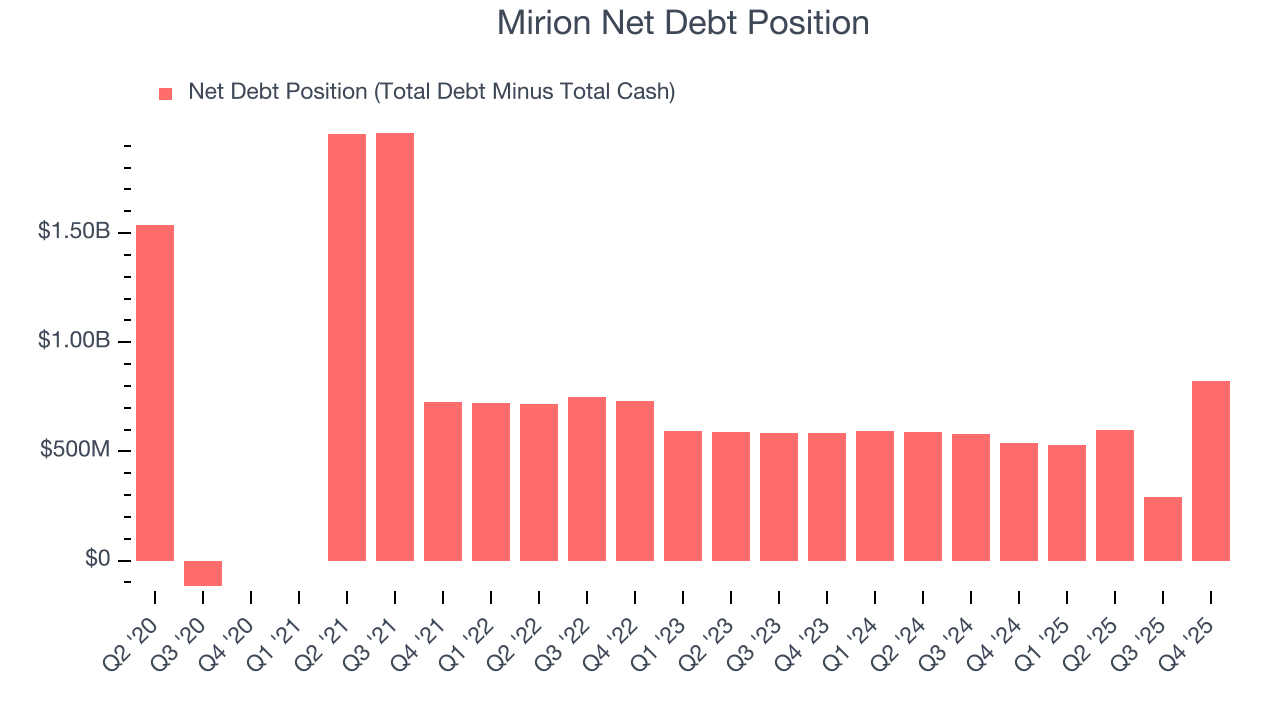

Mirion reported $412.3 million of cash and $1.23 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $227.9 million of EBITDA over the last 12 months, we view Mirion’s 3.6× net-debt-to-EBITDA ratio as safe. We also see its $27.1 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

10. Key Takeaways from Mirion’s Q4 Results

We struggled to find many positives in these results. Its full-year EPS guidance missed and its EPS fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 6.7% to $21.86 immediately following the results.

11. Is Now The Time To Buy Mirion?

Updated: February 10, 2026 at 10:25 PM EST

When considering an investment in Mirion, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

There are definitely a lot of things to like about Mirion. First off, its revenue growth was impressive over the last five years and is expected to accelerate over the next 12 months. And while its declining EPS over the last three years makes it a less attractive asset to the public markets, its rising cash profitability gives it more optionality. On top of that, its expanding operating margin shows the business has become more efficient.

Mirion’s P/E ratio based on the next 12 months is 39.7x. At this valuation, there’s a lot of good news priced in. Mirion is a good one to add to your watchlist - there are companies featuring superior fundamentals at the moment.

Wall Street analysts have a consensus one-year price target of $30.33 on the company (compared to the current share price of $22.03).