3M (MMM)

We wouldn’t buy 3M. Its sales and profitability have plummeted, suggesting it struggled to scale down its costs as demand faded.― StockStory Analyst Team

1. News

2. Summary

Why We Think 3M Will Underperform

Producers of the first asthma inhaler, 3M Company (NYSE:MMM) is a global conglomerate known for products in industries like healthcare, safety, electronics, and consumer goods.

- Products and services are facing significant end-market challenges during this cycle as sales have declined by 5.4% annually over the last five years

- Falling earnings per share over the last five years has some investors worried as stock prices ultimately follow EPS over the long term

- Organic sales performance over the past two years indicates the company may need to make strategic adjustments or rely on M&A to catalyze faster growth

3M doesn’t meet our quality standards. More profitable opportunities exist elsewhere.

Why There Are Better Opportunities Than 3M

Why There Are Better Opportunities Than 3M

3M is trading at $167.74 per share, or 19.9x forward P/E. 3M’s valuation may seem like a bargain, especially when stacked up against other industrials companies. We remind you that you often get what you pay for, though.

Cheap stocks can look like great bargains at first glance, but you often get what you pay for. These mediocre businesses often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. 3M (MMM) Research Report: Q4 CY2025 Update

Industrial conglomerate 3M (NYSE:MMM) reported Q4 CY2025 results exceeding the market’s revenue expectations, with sales up 5.6% year on year to $6.13 billion. Its non-GAAP profit of $1.83 per share was 1.7% above analysts’ consensus estimates.

3M (MMM) Q4 CY2025 Highlights:

- Revenue: $6.13 billion vs analyst estimates of $5.94 billion (5.6% year-on-year growth, 3.3% beat)

- Adjusted EPS: $1.83 vs analyst estimates of $1.80 (1.7% beat)

- Adjusted EPS guidance for the upcoming financial year 2026 is $8.60 at the midpoint, in line with analyst estimates

- Operating Margin: 13%, down from 18.7% in the same quarter last year

- Free Cash Flow Margin: 21.8%, down from 23% in the same quarter last year

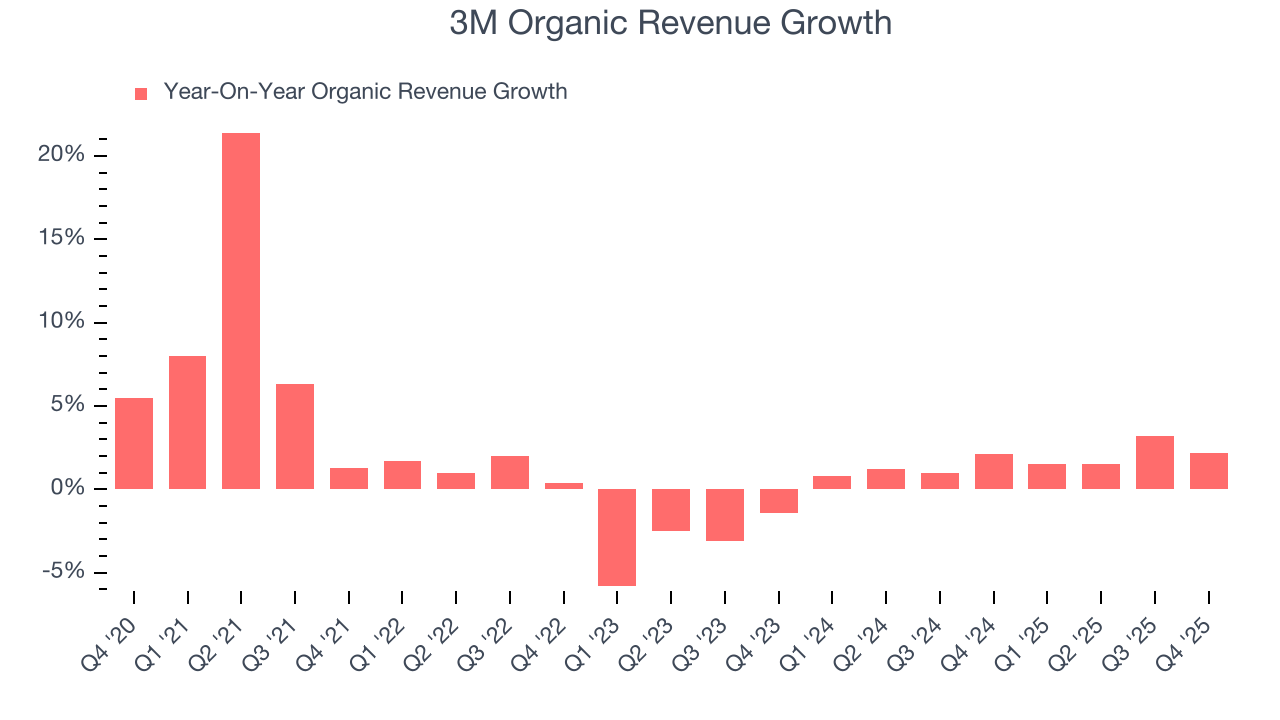

- Organic Revenue rose 2.2% year on year (miss)

- Market Capitalization: $89.14 billion

Company Overview

Producers of the first asthma inhaler, 3M Company (NYSE:MMM) is a global conglomerate known for products in industries like healthcare, safety, electronics, and consumer goods.

3M Company, originally known as Minnesota Mining and Manufacturing Company, was founded by five businessmen seeking to mine corundum. Initial attempts at mining were unsuccessful, leading the company to shift its focus to sandpaper production. Following this, 3M began developing its own adhesive backing for sandpaper, marking its first major product innovation.

The company continued to expand its product line and, in 1925, introduced its first major invention, masking tape, followed by Scotch-brand transparent tape in 1930. These products set the stage for 3M's growth into a diversified manufacturer. In the post-war era, 3M's research and development led to the creation of many iconic products, such as Post-it Notes and Thinsulate insulation. The company continued to expand globally utilizing acquisitions to move into new markets such as its acquisition of Riker Laboratories, which marked its entry into the pharmaceutical space. In 2002, on the company’s 100th anniversary, the company changed its legal name to "3M Company".

Today, 3M Company offers a diverse range of products that span multiple industries, driven by its continuous strategy of product and selective acquisitions. Its portfolio includes consumer products like Post-it Notes and Scotch tape, healthcare solutions such as medical adhesives, dental products and N95 respirators, as well as industrial items like abrasives and adhesives used in automotive and electronics manufacturing. Additionally, 3M provides advanced materials for the construction and transportation sectors, and technologies for improving air and water quality.

The company generates revenue not only from the direct sale of these products but also from ongoing customer contracts for software and maintenance services, ensuring a continuous engagement with its customer base. 3M sells through direct sales, distributors, and online channels and engages in various types of contracts (supply agreements, government contracts, and project-based contracts) where volume discounts are offered for bulk purchases.

4. General Industrial Machinery

Automation that increases efficiency and connected equipment that collects analyzable data have been trending, creating new demand for general industrial machinery companies. Those who innovate and create digitized solutions can spur sales and speed up replacement cycles, but all general industrial machinery companies are still at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

Competitors offering similar products include Honeywell (NYSE:HON), Illinois Tool Works (NYSE:ITW), and Dupont (NYSE:DD).

5. Revenue Growth

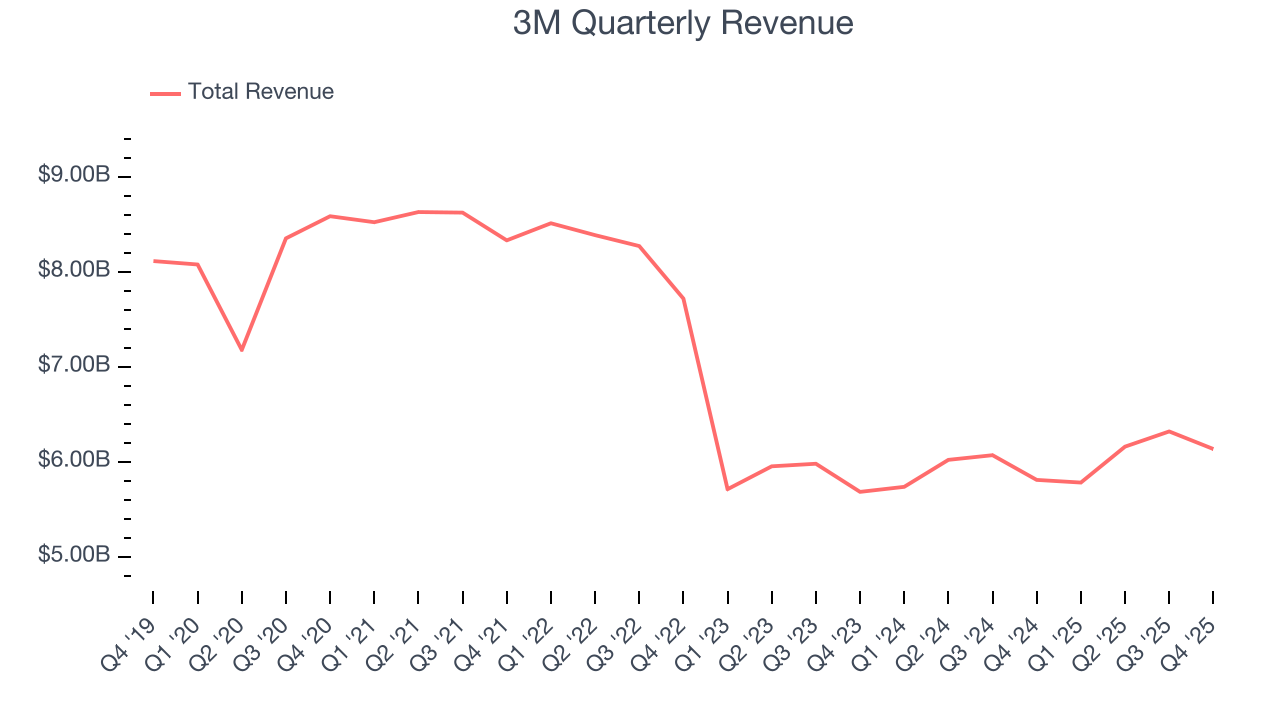

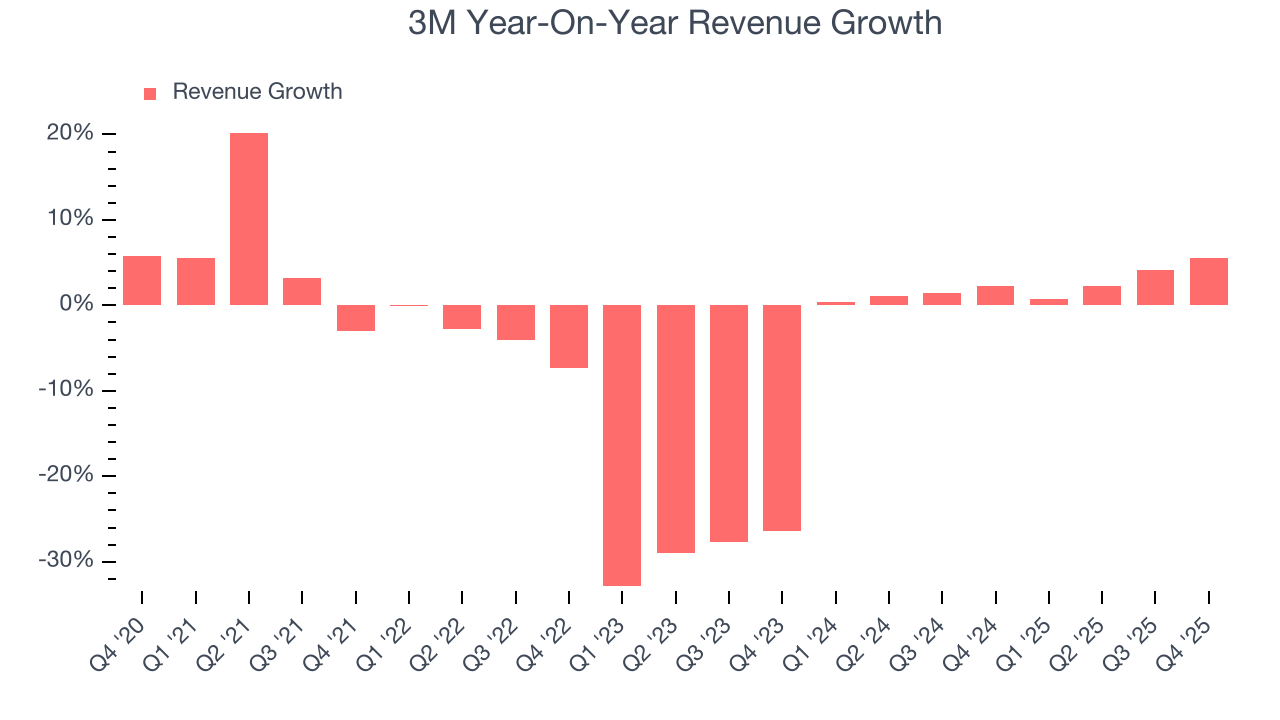

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years. 3M struggled to consistently generate demand over the last five years as its sales dropped at a 5.4% annual rate. This wasn’t a great result and is a sign of lacking business quality.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. 3M’s annualized revenue growth of 2.3% over the last two years is above its five-year trend, but we were still disappointed by the results.

3M also reports organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, 3M’s organic revenue averaged 1.7% year-on-year growth. Because this number aligns with its two-year revenue growth, we can see the company’s core operations (not acquisitions and divestitures) drove most of its results.

This quarter, 3M reported year-on-year revenue growth of 5.6%, and its $6.13 billion of revenue exceeded Wall Street’s estimates by 3.3%.

Looking ahead, sell-side analysts expect revenue to grow 2.7% over the next 12 months, similar to its two-year rate. This projection is underwhelming and suggests its newer products and services will not lead to better top-line performance yet.

6. Gross Margin & Pricing Power

Gross profit margin is a critical metric to track because it sheds light on its pricing power, complexity of products, and ability to procure raw materials, equipment, and labor.

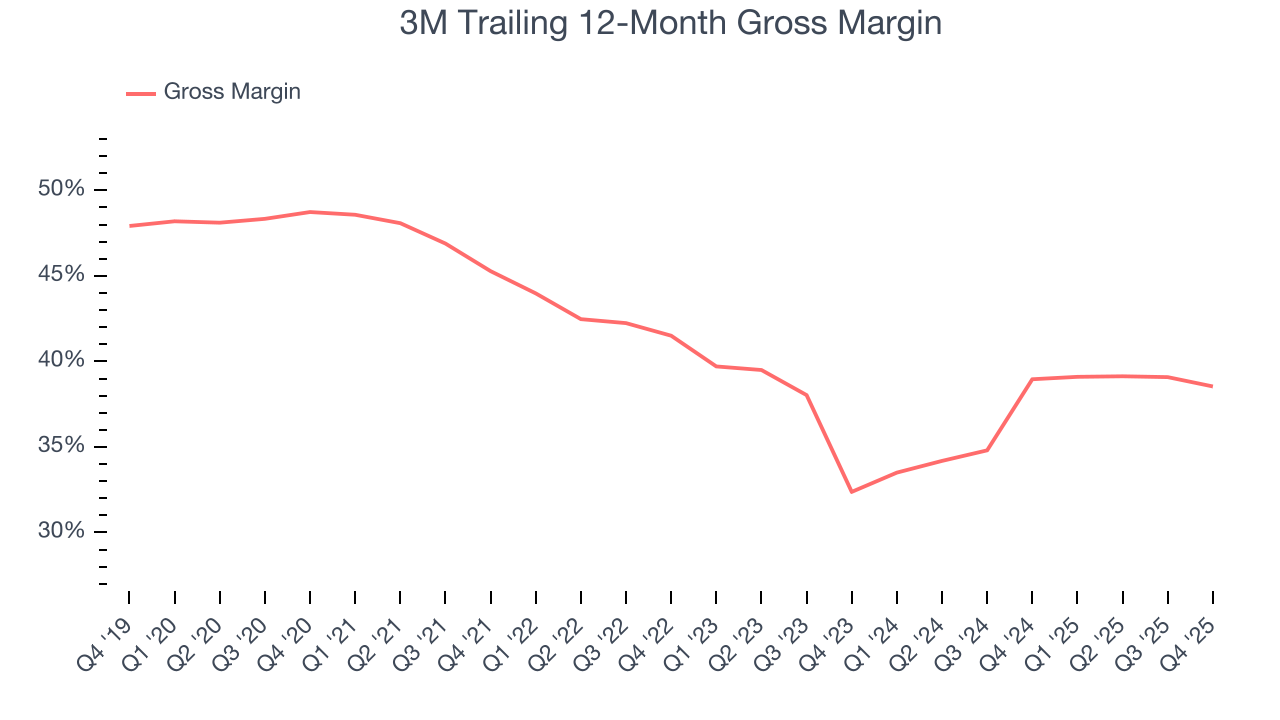

3M’s unit economics are great compared to the broader industrials sector and signal that it enjoys product differentiation through quality or brand. As you can see below, it averaged an excellent 39.9% gross margin over the last five years. Said differently, roughly $39.94 was left to spend on selling, marketing, R&D, and general administrative overhead for every $100 in revenue.

In Q4, 3M produced a 33.6% gross profit margin, marking a 2 percentage point decrease from 35.5% in the same quarter last year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

7. Operating Margin

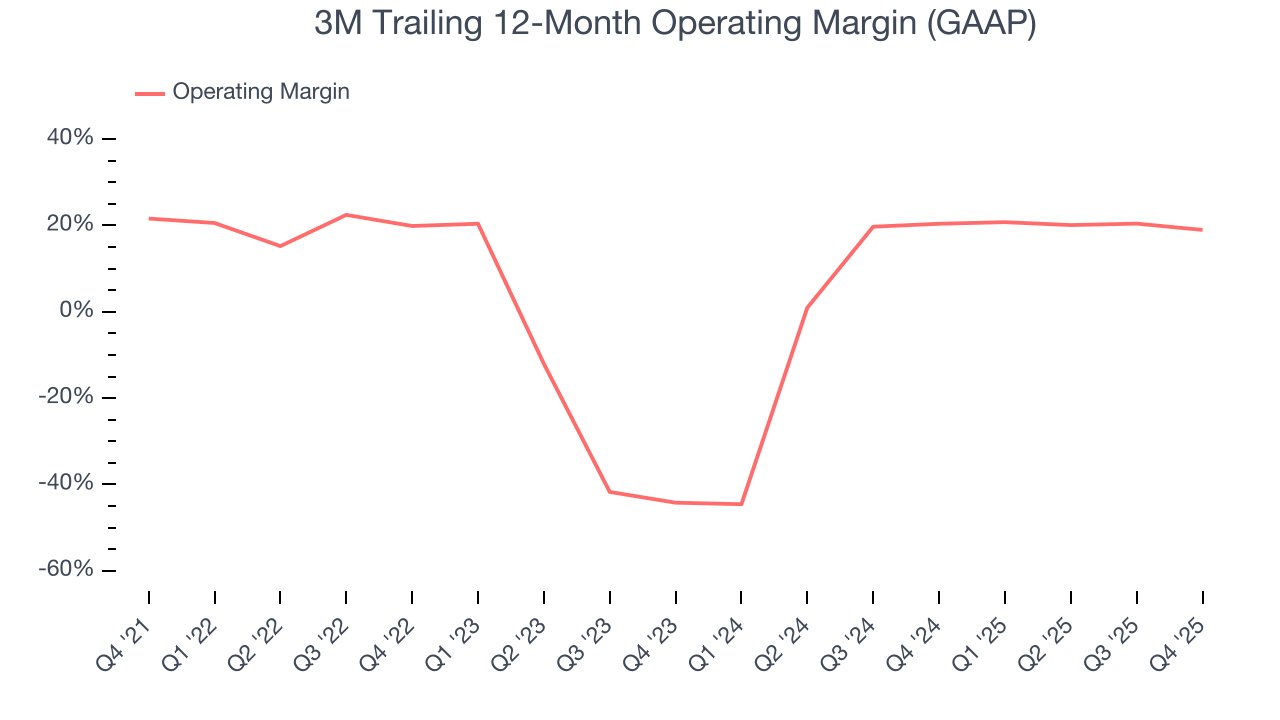

3M has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 9.4%, higher than the broader industrials sector.

Analyzing the trend in its profitability, 3M’s operating margin decreased by 2.6 percentage points over the last five years. Even though its historical margin was healthy, shareholders will want to see 3M become more profitable in the future.

This quarter, 3M generated an operating margin profit margin of 13%, down 5.7 percentage points year on year. Since 3M’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

8. Earnings Per Share

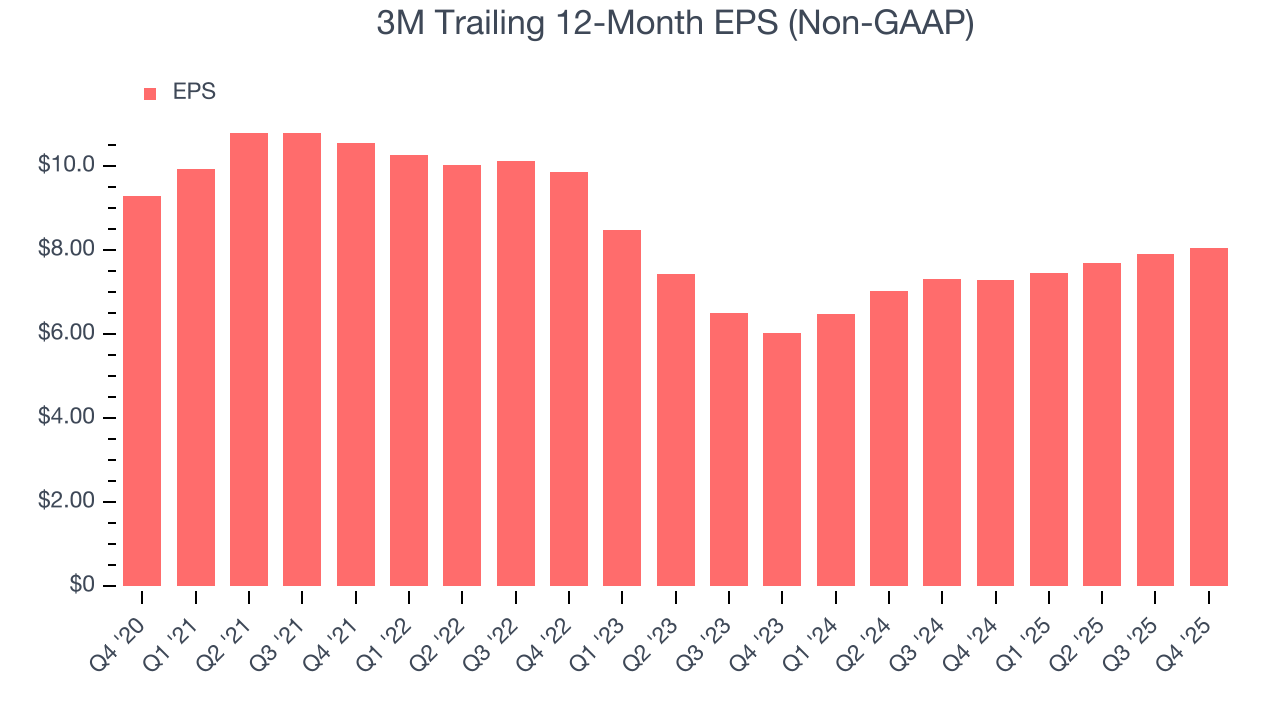

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for 3M, its EPS and revenue declined by 2.8% and 5.4% annually over the last five years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, 3M’s low margin of safety could leave its stock price susceptible to large downswings.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For 3M, its two-year annual EPS growth of 15.6% was higher than its five-year trend. This acceleration made it one of the faster-growing industrials companies in recent history.

In Q4, 3M reported adjusted EPS of $1.83, up from $1.68 in the same quarter last year. This print beat analysts’ estimates by 1.7%. Over the next 12 months, Wall Street expects 3M’s full-year EPS of $8.06 to grow 6.6%.

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

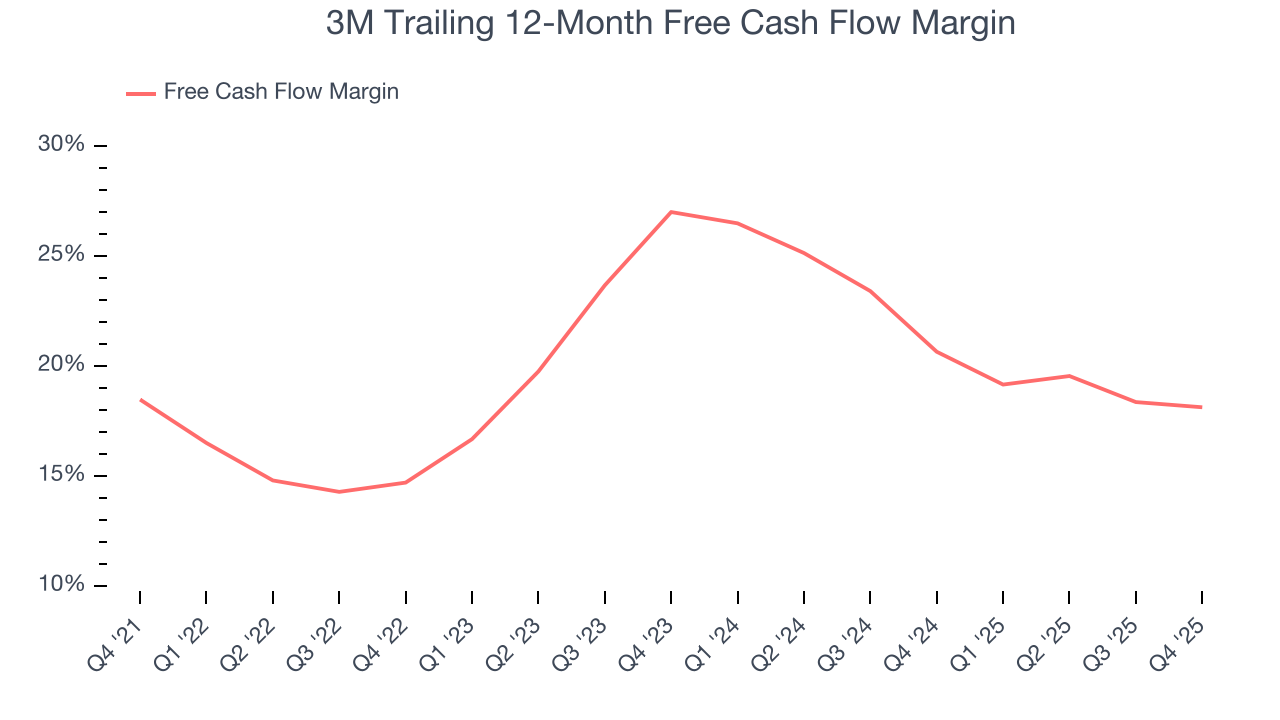

3M has shown terrific cash profitability, putting it in an advantageous position to invest in new products, return capital to investors, and consolidate the market during industry downturns. The company’s free cash flow margin was among the best in the industrials sector, averaging 19.3% over the last five years.

3M’s free cash flow clocked in at $1.34 billion in Q4, equivalent to a 21.8% margin. The company’s cash profitability regressed as it was 1.2 percentage points lower than in the same quarter last year, but it’s still above its five-year average. We wouldn’t read too much into this quarter’s decline because investment needs can be seasonal, leading to short-term swings. Long-term trends are more important.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

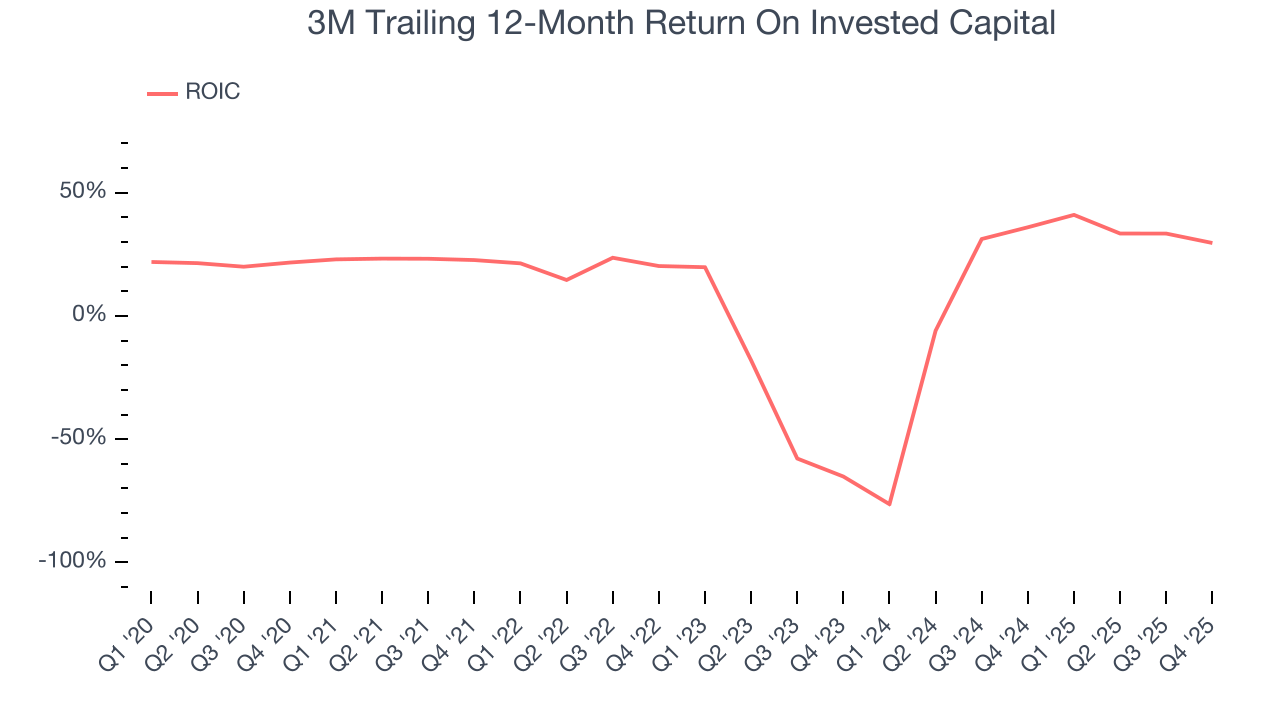

3M historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 8.7%, somewhat low compared to the best industrials companies that consistently pump out 20%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. 3M’s ROIC has increased significantly over the last few years. This is a good sign, and we hope the company can continue improving.

11. Key Takeaways from 3M’s Q4 Results

We enjoyed seeing 3M beat analysts’ revenue expectations this quarter. Looking ahead, full-year EPS was in line with expectations. Overall, this print was fine but not too impressive. The market seemed to be hoping for more, and the stock traded down 1.4% to $165.45 immediately after reporting.

12. Is Now The Time To Buy 3M?

Before deciding whether to buy 3M or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

3M isn’t a terrible business, but it doesn’t pass our quality test. To kick things off, its revenue has declined over the last five years. And while its powerful free cash flow generation enables it to stay ahead of the competition through consistent reinvestment of profits, the downside is its declining EPS over the last five years makes it a less attractive asset to the public markets. On top of that, its organic revenue growth has disappointed.

3M’s P/E ratio based on the next 12 months is 19.5x. Beauty is in the eye of the beholder, but our analysis shows the upside isn’t great compared to the potential downside. We're pretty confident there are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $175.91 on the company (compared to the current share price of $165.45).