Altria (MO)

Altria piques our interest. Its robust cash flows and returns on capital showcase its management team’s strong investing abilities.― StockStory Analyst Team

1. News

2. Summary

Why Altria Is Interesting

Best known for its Marlboro brand of cigarettes, Altria (NYSE:MO) offers tobacco and nicotine products.

- Differentiated product offerings are difficult to replicate at scale and result in a best-in-class gross margin of 70.9%

- Disciplined cost controls and effective management have materialized in a strong operating margin

- One pitfall is its products fail to spark excitement with consumers, as seen in its flat sales over the last three years

Altria has some respectable qualities. If you like the stock, the valuation seems fair.

Why Is Now The Time To Buy Altria?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Altria?

Altria is trading at $61.85 per share, or 11x forward P/E. Altria’s current valuation is below that of most consumer staples companies, but this doesn’t make it a bargain. Instead, the price is warranted for the quality you get.

Now could be a good time to invest if you believe in the story.

3. Altria (MO) Research Report: Q3 CY2025 Update

Tobacco company Altria (NYSE:MO) fell short of the market’s revenue expectations in Q3 CY2025, with sales falling 1.7% year on year to $5.25 billion. Its non-GAAP profit of $1.45 per share was in line with analysts’ consensus estimates.

Altria (MO) Q3 CY2025 Highlights:

- Revenue: $5.25 billion vs analyst estimates of $5.32 billion (1.7% year-on-year decline, 1.3% miss)

- Adjusted EPS: $1.45 vs analyst estimates of $1.45 (in line)

- Management slightly raised its full-year Adjusted EPS guidance to $5.41 at the midpoint

- Operating Margin: 63.3%, up from 59% in the same quarter last year

- Market Capitalization: $104.1 billion

Company Overview

Best known for its Marlboro brand of cigarettes, Altria (NYSE:MO) offers tobacco and nicotine products.

The company was founded more than 200 years ago as a small tobacco shop in London. Altria expanded significantly in the 20th century, establishing dominance in the US market with iconic brands like Marlboro. Over the years, Altria has diversified through acquisitions and strategic partnerships, including investments in alcohol and cannabis.

Today, Altria's product portfolio centers around tobacco and nicotine products. Its flagship product is still Marlboro cigarettes, which generates the bulk of its revenue. It also offers smokeless tobacco products like Copenhagen and Skoal, as well as nicotine pouches under the on! brand. In recent years, the company has ventured into alternative nicotine delivery systems, including heated tobacco devices (IQOS, in partnership with Philip Morris International (NYSE:PM)) and vaping products.

Altria has continued its efforts to pivot from traditional cigarettes to reduced-risk products, following regulatory pressures and declining cigarette sales over decades due to the health risks associated with smoking.

4. Beverages, Alcohol, and Tobacco

These companies' performance is influenced by brand strength, marketing strategies, and shifts in consumer preferences. Changing consumption patterns are particularly relevant and can be seen in the rise of cannabis, craft beer, and vaping or the steady decline of soda and cigarettes. Companies that spend on innovation to meet consumers where they are with regards to trends can reap huge demand benefits while those who ignore trends can see stagnant volumes. Finally, with the advent of the social media, the cost of starting a brand from scratch is much lower, meaning that new entrants can chip away at the market shares of established players.

Competitors in the tobacco and nicotine industry include Phillip Morris (NYSE:PM), British American Tobacco (LSE:BAT), and Imperial Brands (LSE:IMB).

5. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years.

With $20.17 billion in revenue over the past 12 months, Altria is one of the most widely recognized consumer staples companies. Its influence over consumers gives it negotiating leverage with distributors, enabling it to pick and choose where it sells its products (a luxury many don’t have). However, its scale is a double-edged sword because it’s harder to find incremental growth when your existing brands have penetrated most of the market. To accelerate sales, Altria likely needs to optimize its pricing or lean into new products and international expansion.

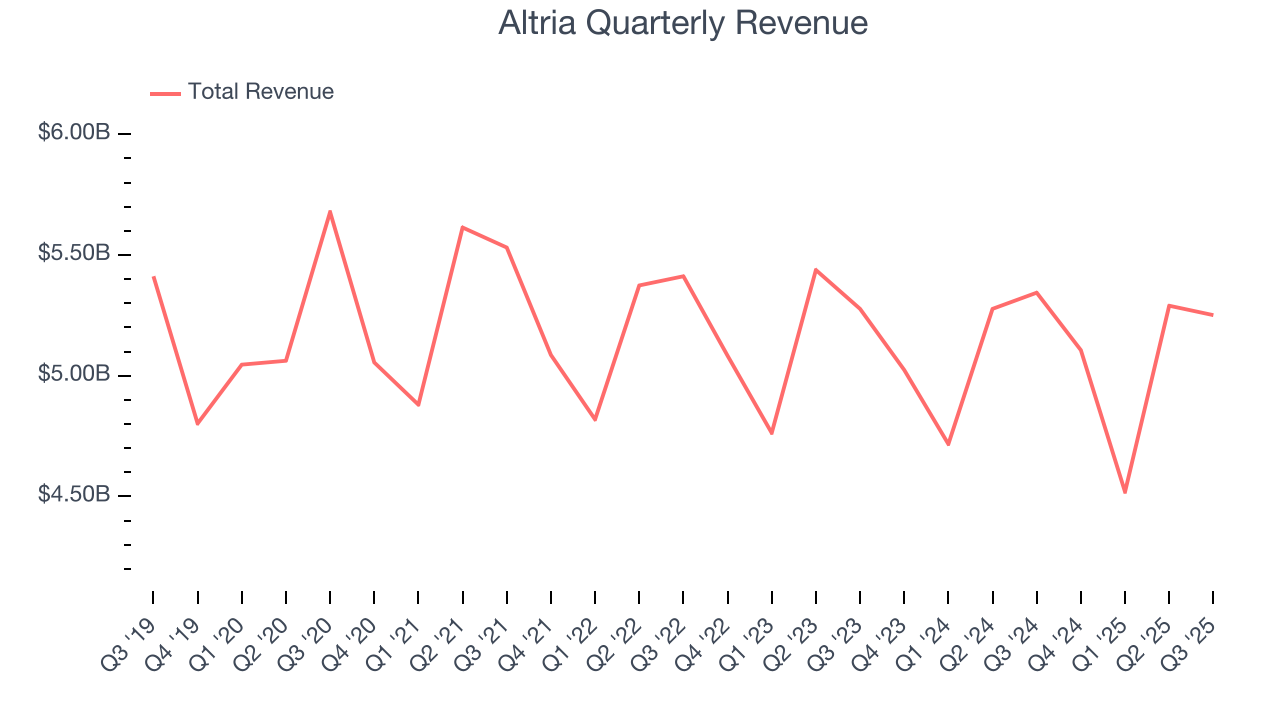

As you can see below, Altria struggled to increase demand as its $20.17 billion of sales for the trailing 12 months was close to its revenue three years ago. This shows demand was soft, a rough starting point for our analysis.

This quarter, Altria missed Wall Street’s estimates and reported a rather uninspiring 1.7% year-on-year revenue decline, generating $5.25 billion of revenue.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. While this projection suggests its newer products will spur better top-line performance, it is still below average for the sector. At least the company is tracking well in other measures of financial health.

6. Gross Margin & Pricing Power

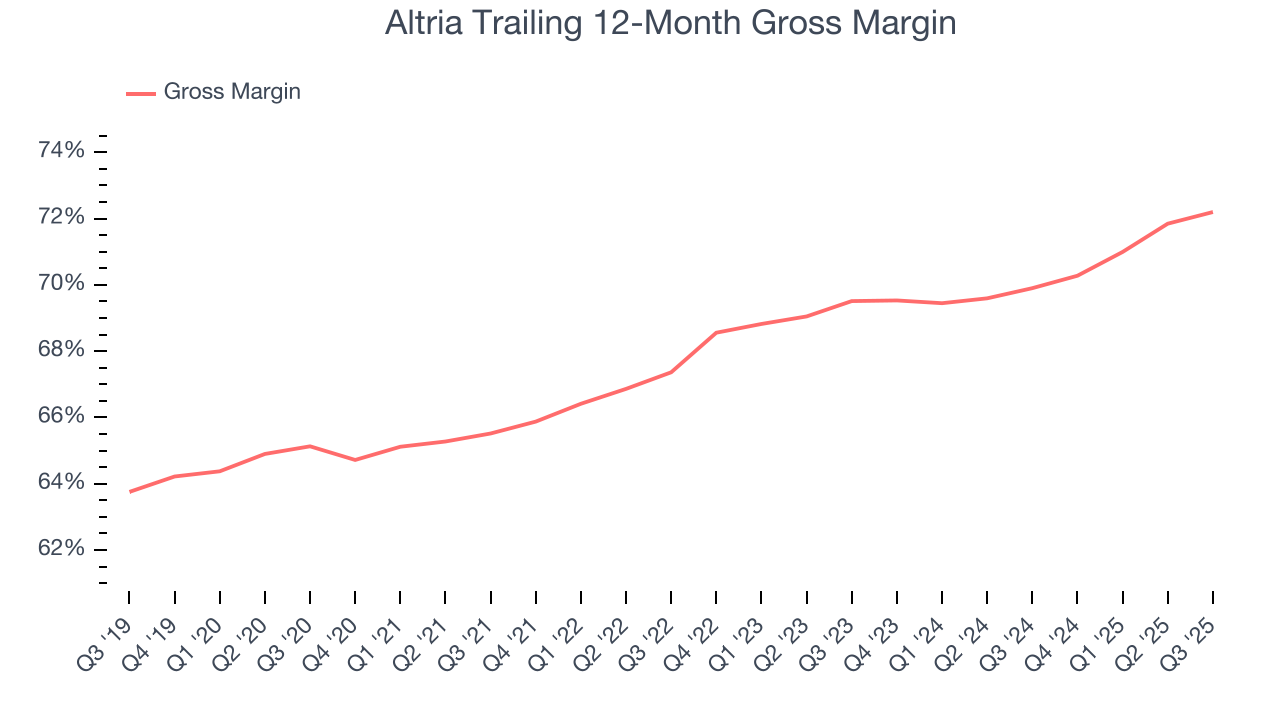

Altria has best-in-class unit economics for a consumer staples company, enabling it to invest in areas such as marketing and talent to grow its brand. As you can see below, it averaged an elite 71% gross margin over the last two years. That means Altria only paid its suppliers $28.96 for every $100 in revenue.

Altria’s gross profit margin came in at 72.6% this quarter, up 1.3 percentage points year on year. Altria’s full-year margin has also been trending up over the past 12 months, increasing by 2.3 percentage points. If this move continues, it could suggest better unit economics due to some combination of stable to improving pricing power and input costs (such as raw materials).

7. Operating Margin

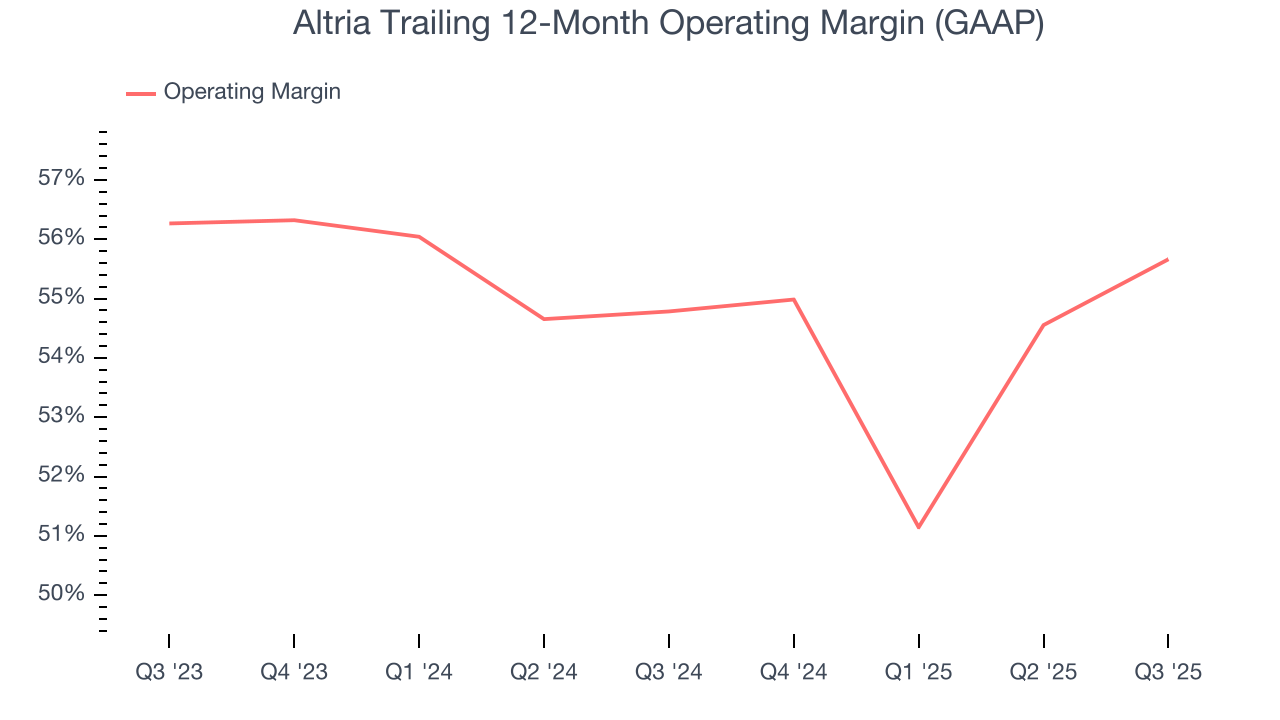

Altria’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 55.2% over the last two years. This profitability was elite for a consumer staples business thanks to its efficient cost structure and economies of scale. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Altria’s operating margin might fluctuated slightly but has generally stayed the same over the last year, highlighting the consistency of its expense base.

In Q3, Altria generated an operating margin profit margin of 63.3%, up 4.3 percentage points year on year. The increase was encouraging, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, and administrative overhead.

8. Earnings Per Share

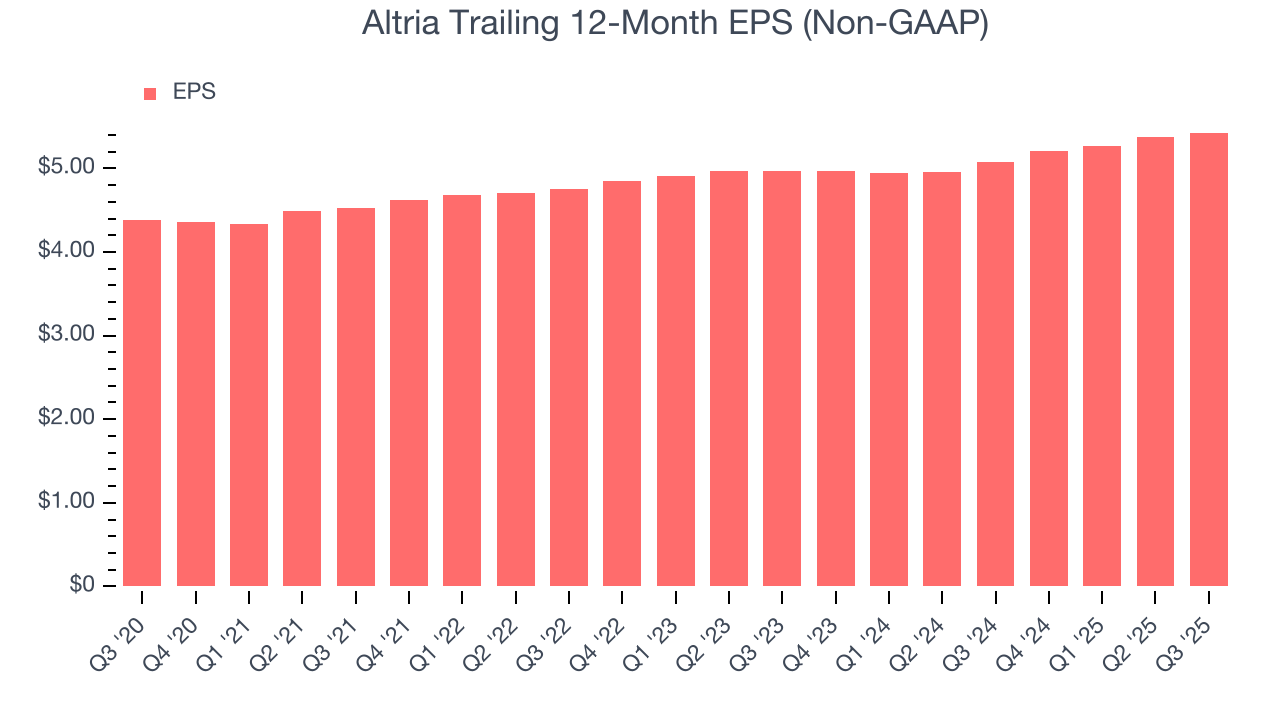

We track the change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

In Q3, Altria reported adjusted EPS of $1.45, up from $1.40 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects Altria’s full-year EPS of $5.43 to grow 2%.

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

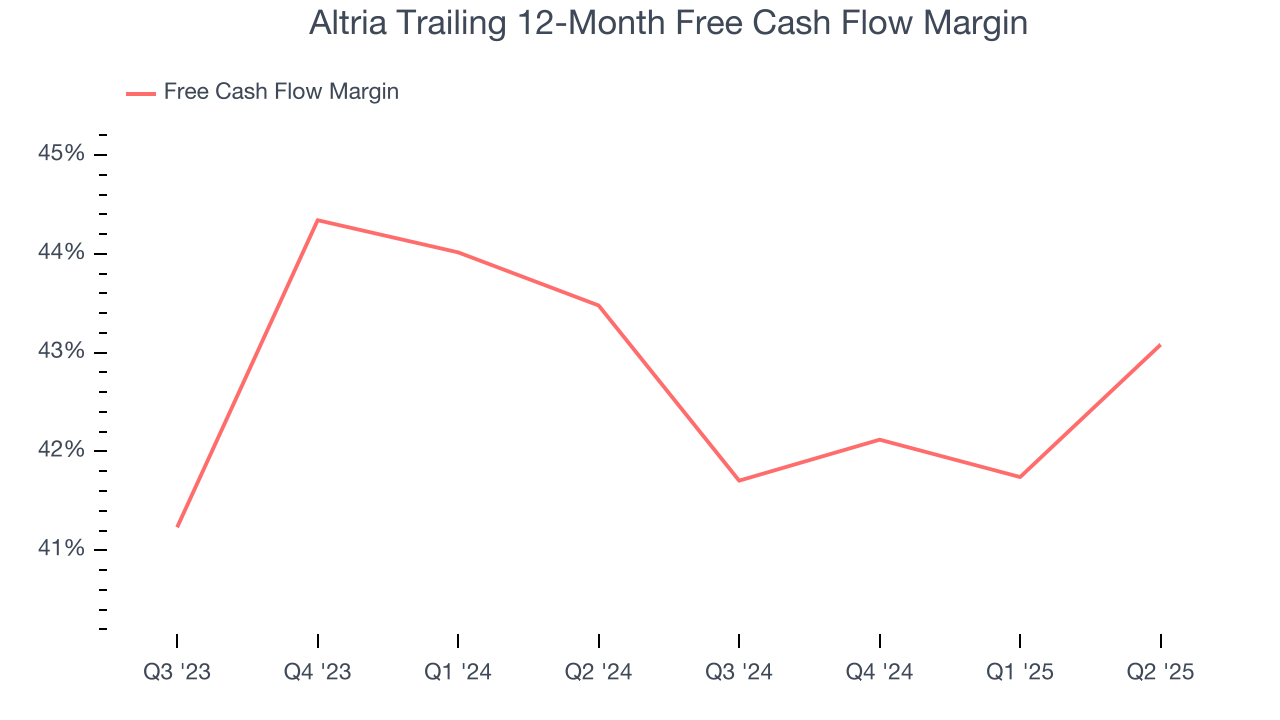

Altria has shown terrific cash profitability, driven by its lucrative business model that enables it to reinvest, return capital to investors, and stay ahead of the competition. The company’s free cash flow margin was among the best in the consumer staples sector, averaging an eye-popping 41.5% over the last two years.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

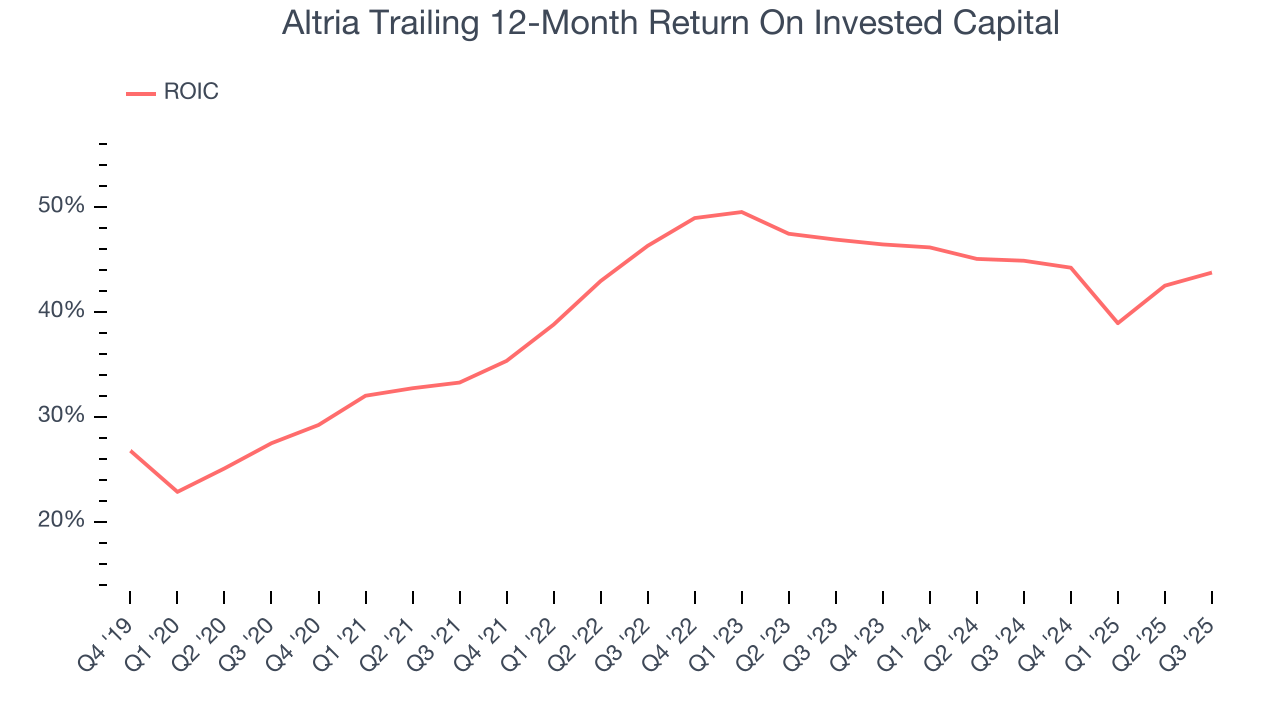

Altria’s five-year average ROIC was 43%, placing it among the best consumer staples companies. This illustrates its management team’s ability to invest in highly profitable ventures and produce tangible results for shareholders.

11. Balance Sheet Assessment

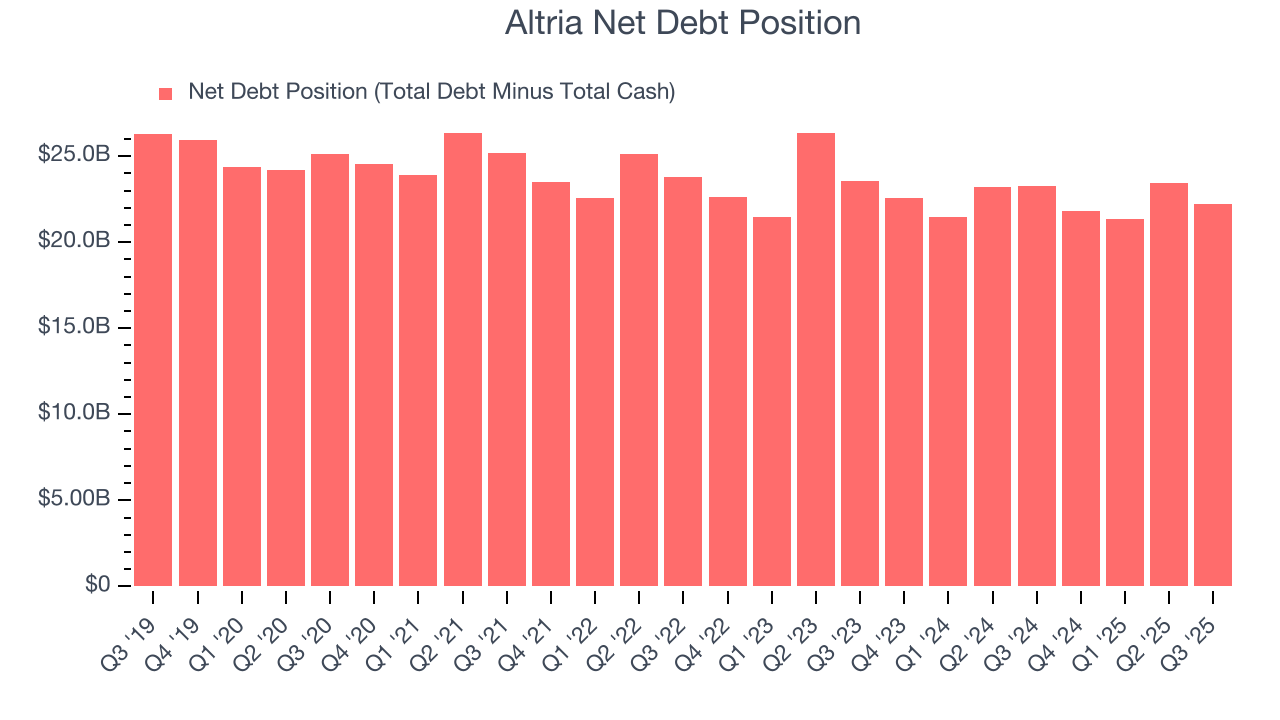

Altria reported $3.47 billion of cash and $25.7 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $12.76 billion of EBITDA over the last 12 months, we view Altria’s 1.7× net-debt-to-EBITDA ratio as safe. We also see its $513 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Altria’s Q3 Results

We struggled to find many positives in these results. Its revenue missed and its gross margin fell slightly short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 5.9% to $58.29 immediately after reporting.

13. Is Now The Time To Buy Altria?

Updated: January 24, 2026 at 9:46 PM EST

Before deciding whether to buy Altria or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

In our opinion, Altria is a solid company. Although its revenue has declined over the last three years, its admirable gross margins are a wonderful starting point for the overall profitability of the business. And while its projected EPS for the next year is lacking, its impressive operating margins show it has a highly efficient business model.

Altria’s P/E ratio based on the next 12 months is 11x. When scanning the consumer staples space, Altria trades at a fair valuation. For those confident in the business and its management team, this is a good time to invest.

Wall Street analysts have a consensus one-year price target of $62.58 on the company (compared to the current share price of $61.85).