Altria (MO)

Altria is intriguing. Its robust cash flows and returns on capital showcase its management team’s strong investing abilities.― StockStory Analyst Team

1. News

2. Summary

Why Altria Is Interesting

Best known for its Marlboro brand of cigarettes, Altria (NYSE:MO) offers tobacco and nicotine products.

- Products command premium prices and lead to a best-in-class gross margin of 70.9%

- Successful business model is illustrated by its impressive operating margin

- On the other hand, its products fail to spark excitement with consumers, as seen in its flat sales over the last three years

Altria shows some potential. If you like the stock, the valuation seems reasonable.

Why Is Now The Time To Buy Altria?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Altria?

Altria is trading at $63.07 per share, or 11.5x forward P/E. Altria’s current valuation is below that of most consumer staples companies, but this doesn’t make it a bargain. Instead, the price is warranted for the quality you get.

This could be a good time to invest if you think there are underappreciated aspects of the business.

3. Altria (MO) Research Report: Q4 CY2025 Update

Tobacco company Altria (NYSE:MO) reported revenue ahead of Wall Streets expectations in Q4 CY2025, with sales up 14.5% year on year to $5.85 billion. Its non-GAAP profit of $1.30 per share was 1.3% below analysts’ consensus estimates.

Altria (MO) Q4 CY2025 Highlights:

- Revenue: $5.85 billion vs analyst estimates of $5.01 billion (14.5% year-on-year growth, 16.6% beat)

- Adjusted EPS: $1.30 vs analyst expectations of $1.32 (1.3% miss)

- Adjusted EPS guidance for the upcoming financial year 2026 is $5.64 at the midpoint, beating analyst estimates by 0.9%

- Operating Margin: 30%, down from 56.4% in the same quarter last year

- Market Capitalization: $106 billion

Company Overview

Best known for its Marlboro brand of cigarettes, Altria (NYSE:MO) offers tobacco and nicotine products.

The company was founded more than 200 years ago as a small tobacco shop in London. Altria expanded significantly in the 20th century, establishing dominance in the US market with iconic brands like Marlboro. Over the years, Altria has diversified through acquisitions and strategic partnerships, including investments in alcohol and cannabis.

Today, Altria's product portfolio centers around tobacco and nicotine products. Its flagship product is still Marlboro cigarettes, which generates the bulk of its revenue. It also offers smokeless tobacco products like Copenhagen and Skoal, as well as nicotine pouches under the on! brand. In recent years, the company has ventured into alternative nicotine delivery systems, including heated tobacco devices (IQOS, in partnership with Philip Morris International (NYSE:PM)) and vaping products.

Altria has continued its efforts to pivot from traditional cigarettes to reduced-risk products, following regulatory pressures and declining cigarette sales over decades due to the health risks associated with smoking.

4. Beverages, Alcohol, and Tobacco

These companies' performance is influenced by brand strength, marketing strategies, and shifts in consumer preferences. Changing consumption patterns are particularly relevant and can be seen in the rise of cannabis, craft beer, and vaping or the steady decline of soda and cigarettes. Companies that spend on innovation to meet consumers where they are with regards to trends can reap huge demand benefits while those who ignore trends can see stagnant volumes. Finally, with the advent of the social media, the cost of starting a brand from scratch is much lower, meaning that new entrants can chip away at the market shares of established players.

Competitors in the tobacco and nicotine industry include Phillip Morris (NYSE:PM), British American Tobacco (LSE:BAT), and Imperial Brands (LSE:IMB).

5. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years.

With $20.91 billion in revenue over the past 12 months, Altria is one of the most widely recognized consumer staples companies. Its influence over consumers gives it negotiating leverage with distributors, enabling it to pick and choose where it sells its products (a luxury many don’t have). However, its scale is a double-edged sword because there are only so many big store chains to sell into, making it harder to find incremental growth. To expand meaningfully, Altria likely needs to tweak its prices, innovate with new products, or enter new markets.

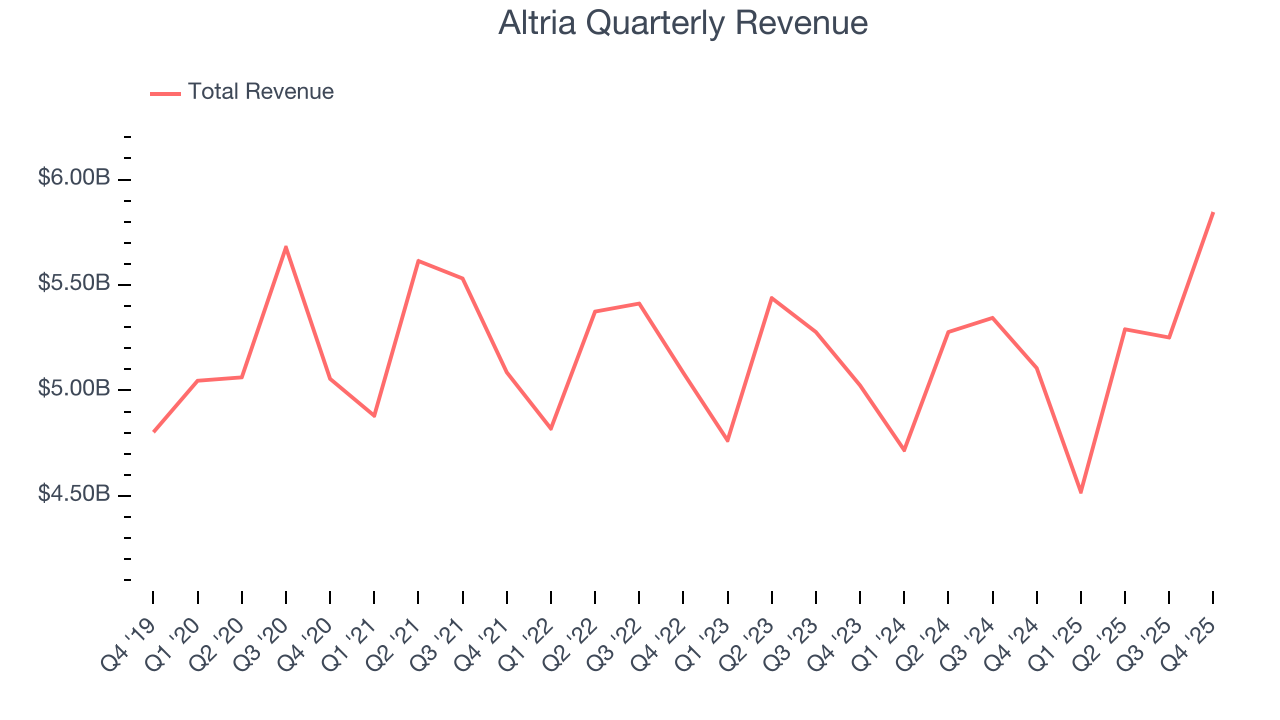

As you can see below, Altria struggled to increase demand as its $20.91 billion of sales for the trailing 12 months was close to its revenue three years ago. This shows demand was soft, a rough starting point for our analysis.

This quarter, Altria reported year-on-year revenue growth of 14.5%, and its $5.85 billion of revenue exceeded Wall Street’s estimates by 16.6%.

Looking ahead, sell-side analysts expect revenue to decline by 3.6% over the next 12 months, a deceleration versus the last three years. This projection is underwhelming and suggests its products will see some demand headwinds. At least the company is tracking well in other measures of financial health.

6. Gross Margin & Pricing Power

Altria has best-in-class unit economics for a consumer staples company, enabling it to invest in areas such as marketing and talent to grow its brand. As you can see below, it averaged an elite 71.7% gross margin over the last two years. That means Altria only paid its suppliers $28.29 for every $100 in revenue.

Altria produced a 75.2% gross profit margin in Q4, up 4.6 percentage points year on year. Altria’s full-year margin has also been trending up over the past 12 months, increasing by 3.1 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold (such as manufacturing expenses).

7. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

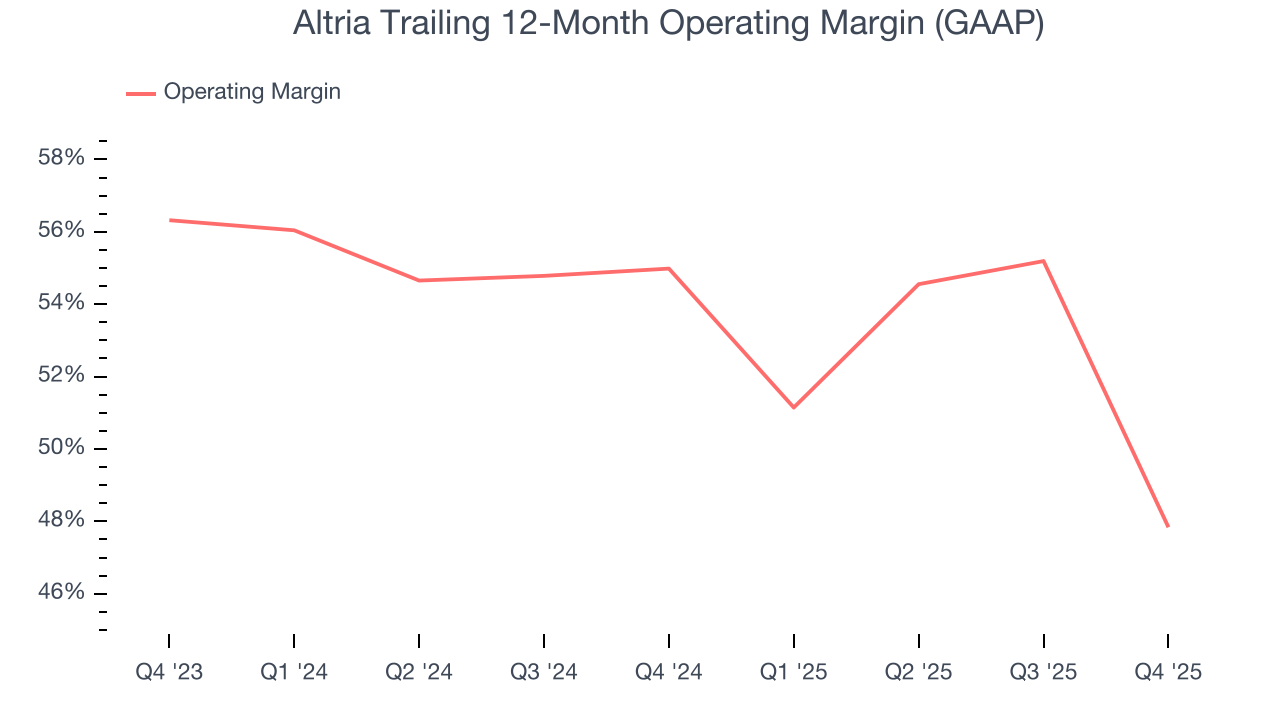

Altria has been a well-oiled machine over the last two years. It demonstrated elite profitability for a consumer staples business, boasting an average operating margin of 51.4%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, Altria’s operating margin decreased by 7.1 percentage points over the last year. Even though its historical margin was healthy, shareholders will want to see Altria become more profitable in the future.

In Q4, Altria generated an operating margin profit margin of 30%, down 26.5 percentage points year on year. Conversely, its revenue and gross margin actually rose, so we can assume it was less efficient because its operating expenses like marketing, and administrative overhead grew faster than its revenue.

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

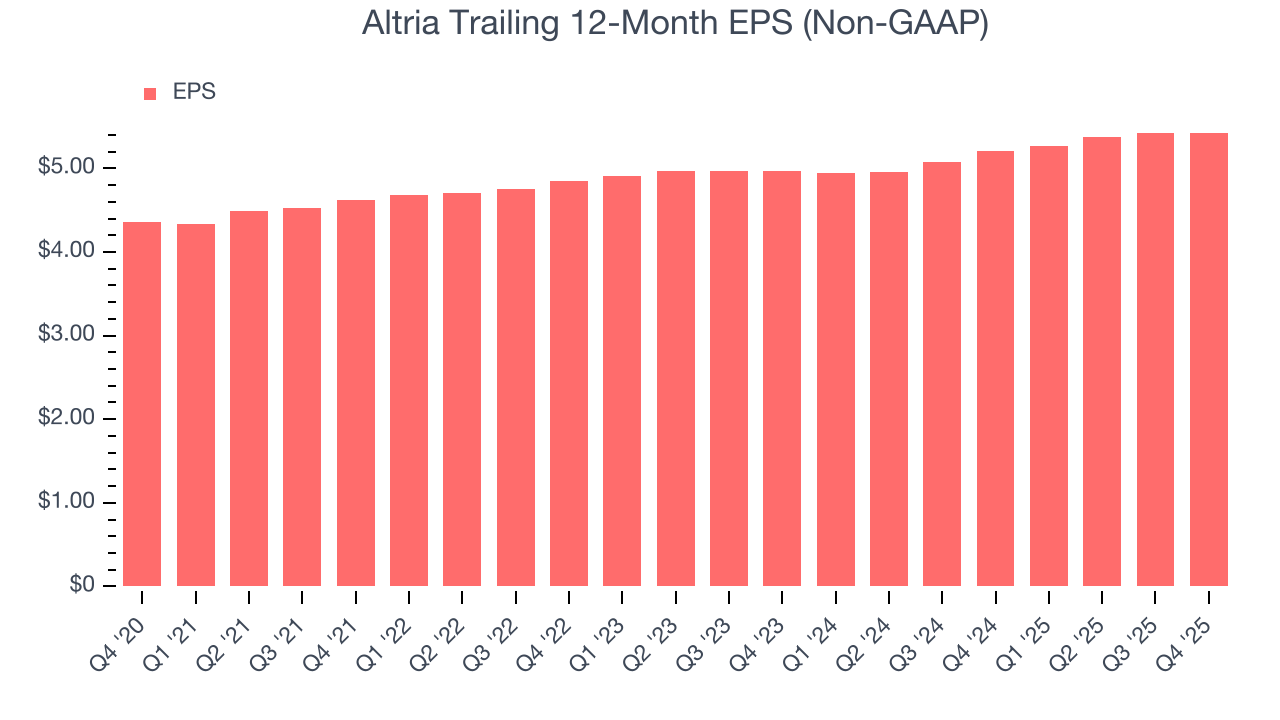

Altria’s EPS grew at an unimpressive 3.8% compounded annual growth rate over the last three years. This performance was better than its flat revenue but doesn’t tell us much about its business quality because its operating margin didn’t improve.

In Q4, Altria reported adjusted EPS of $1.30, in line with the same quarter last year. This print slightly missed analysts’ estimates. Over the next 12 months, Wall Street expects Altria’s full-year EPS of $5.42 to grow 2.7%.

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

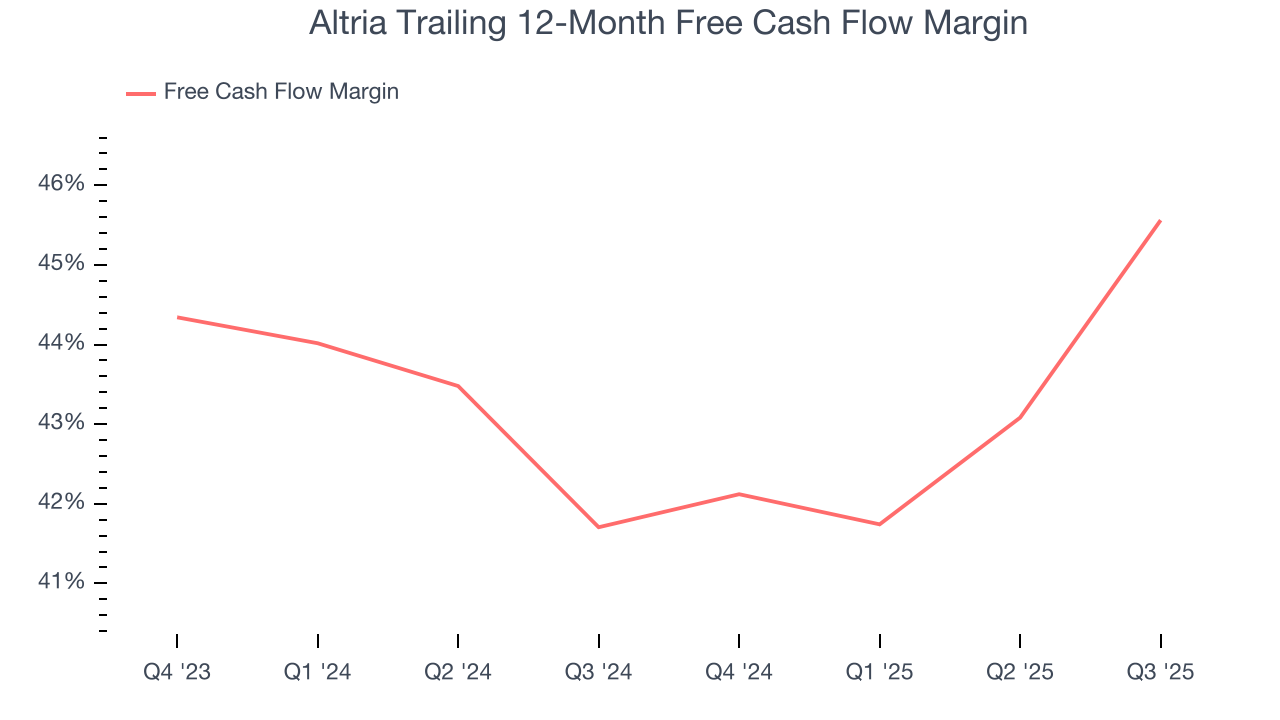

Altria has shown terrific cash profitability, driven by its lucrative business model that enables it to reinvest, return capital to investors, and stay ahead of the competition. The company’s free cash flow margin was among the best in the consumer staples sector, averaging an eye-popping 40.9% over the last two years.

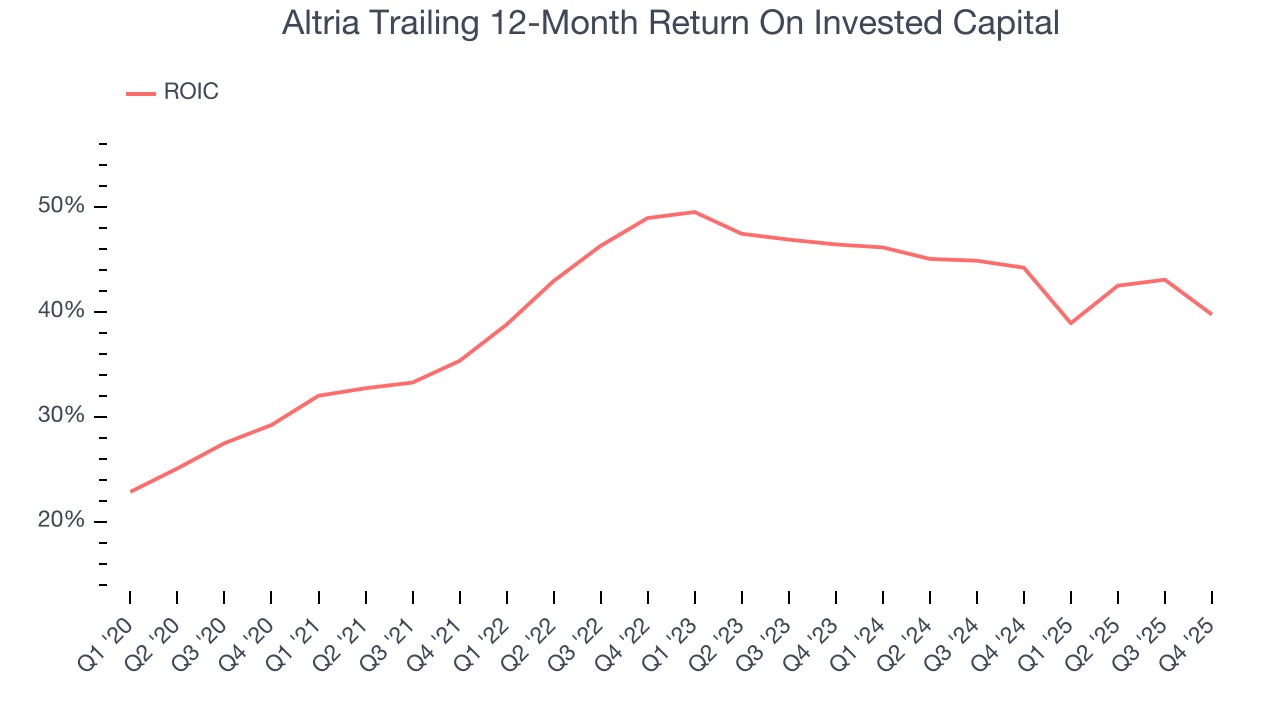

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Altria’s five-year average ROIC was 43%, placing it among the best consumer staples companies. This illustrates its management team’s ability to invest in highly profitable ventures and produce tangible results for shareholders.

11. Key Takeaways from Altria’s Q4 Results

We were impressed by how significantly Altria blew past analysts’ revenue expectations this quarter. We were also glad its gross margin outperformed Wall Street’s estimates. On the other hand, its EPS slightly missed. Overall, this print had some key positives. Investors were likely hoping for more, and shares traded down 2.5% to $61.53 immediately following the results.

12. Is Now The Time To Buy Altria?

Updated: January 29, 2026 at 8:13 AM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Altria.

Altria possesses a number of positive attributes. Although its revenue growth was weak over the last three years and analysts expect growth to slow over the next 12 months, its admirable gross margins are a wonderful starting point for the overall profitability of the business. And while its declining operating margin shows the business has become less efficient, its impressive operating margins show it has a highly efficient business model.

Altria’s P/E ratio based on the next 12 months is 11.3x. When scanning the consumer staples space, Altria trades at a fair valuation. If you believe in the company and its growth potential, now is an opportune time to buy shares.

Wall Street analysts have a consensus one-year price target of $62.92 on the company (compared to the current share price of $61.53), implying they see 2.3% upside in buying Altria in the short term.