Topgolf Callaway (MODG)

Topgolf Callaway faces an uphill battle. Not only has its sales growth been weak but also its negative returns on capital show it destroyed value.― StockStory Analyst Team

1. News

2. Summary

Why We Think Topgolf Callaway Will Underperform

Formed between the merger of Callaway and Topgolf, Topgolf Callaway (NYSE:MODG) sells golf equipment and operates technology-driven golf entertainment venues.

- Sales tumbled by 2.1% annually over the last two years, showing consumer trends are working against its favor

- Incremental sales over the last five years were much less profitable as its earnings per share fell by 15.3% annually while its revenue grew

- Sales are projected to tank by 4.3% over the next 12 months as its demand continues evaporating

Topgolf Callaway’s quality doesn’t meet our hurdle. We’d rather invest in businesses with stronger moats.

Why There Are Better Opportunities Than Topgolf Callaway

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Topgolf Callaway

Topgolf Callaway’s stock price of $11.60 implies a valuation ratio of 4.7x forward EV-to-EBITDA. This sure is a cheap multiple, but you get what you pay for.

Our advice is to pay up for elite businesses whose advantages are tailwinds to earnings growth. Don’t get sucked into lower-quality businesses just because they seem like bargains. These mediocre businesses often never achieve a higher multiple as hoped, a phenomenon known as a “value trap”.

3. Topgolf Callaway (MODG) Research Report: Q3 CY2025 Update

Golf entertainment and gear company Topgolf Callaway (NYSE:MODG) reported Q3 CY2025 results beating Wall Street’s revenue expectations, but sales fell by 7.8% year on year to $934 million. The company expects next quarter’s revenue to be around $783 million, close to analysts’ estimates. Its non-GAAP loss of $0.05 per share was 76.9% above analysts’ consensus estimates.

Topgolf Callaway (MODG) Q3 CY2025 Highlights:

- Revenue: $934 million vs analyst estimates of $913.2 million (7.8% year-on-year decline, 2.3% beat)

- Adjusted EPS: -$0.05 vs analyst estimates of -$0.22 (76.9% beat)

- Adjusted EBITDA: $114.4 million vs analyst estimates of $87.63 million (12.2% margin, 30.5% beat)

- Revenue Guidance for Q4 CY2025 is $783 million at the midpoint, roughly in line with what analysts were expecting

- EBITDA guidance for the full year is $500 million at the midpoint, above analyst estimates of $468.1 million

- Operating Margin: 3%, in line with the same quarter last year

- Free Cash Flow Margin: 17.4%, up from 10.8% in the same quarter last year

- Market Capitalization: $1.70 billion

Company Overview

Formed between the merger of Callaway and Topgolf, Topgolf Callaway (NYSE:MODG) sells golf equipment and operates technology-driven golf entertainment venues.

Callaway, known for its golf equipment, merged with Topgolf in 2021 to broaden its reach within the golf industry. The merger allowed Callaway to tap into the casual player market as Topgolf seeks to lower golf's steep learning curve and intimidating atmosphere.

Topgolf attempts to enhance traditional golf experiences by infusing technology and entertainment. Its venues' main attraction is the driving range, which features swing-tracking technology and mini-games suited for players of all levels. There are also spaces for dining and socializing where customers can purchase food and beverages.

By integrating Callaway's product line and Topgolf Callaway's apparel segment, which includes brands such as TravisMatthew, Topgolf has expanded its revenue streams to include sales of golf gear and equipment, complementing its income from gameplay reservations, event hosting, and dining services. The company also sells its swing-tracking technology, Top Tracer, to third-party driving ranges. This strategy positions Topgolf Callaway to provide a comprehensive golf experience.

4. Leisure Facilities

Leisure facilities companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted their spending from "things" to "experiences". Leisure facilities seek to benefit but must innovate to do so because of the industry's high competition and capital intensity.

Competitors of Topgolf Callaway (NYSE:MODG) include TaylorMade Golf, Acushnet (NASDAQ:GOLF), and Johnson Outdoors (NASDAQ:JOUT).

5. Revenue Growth

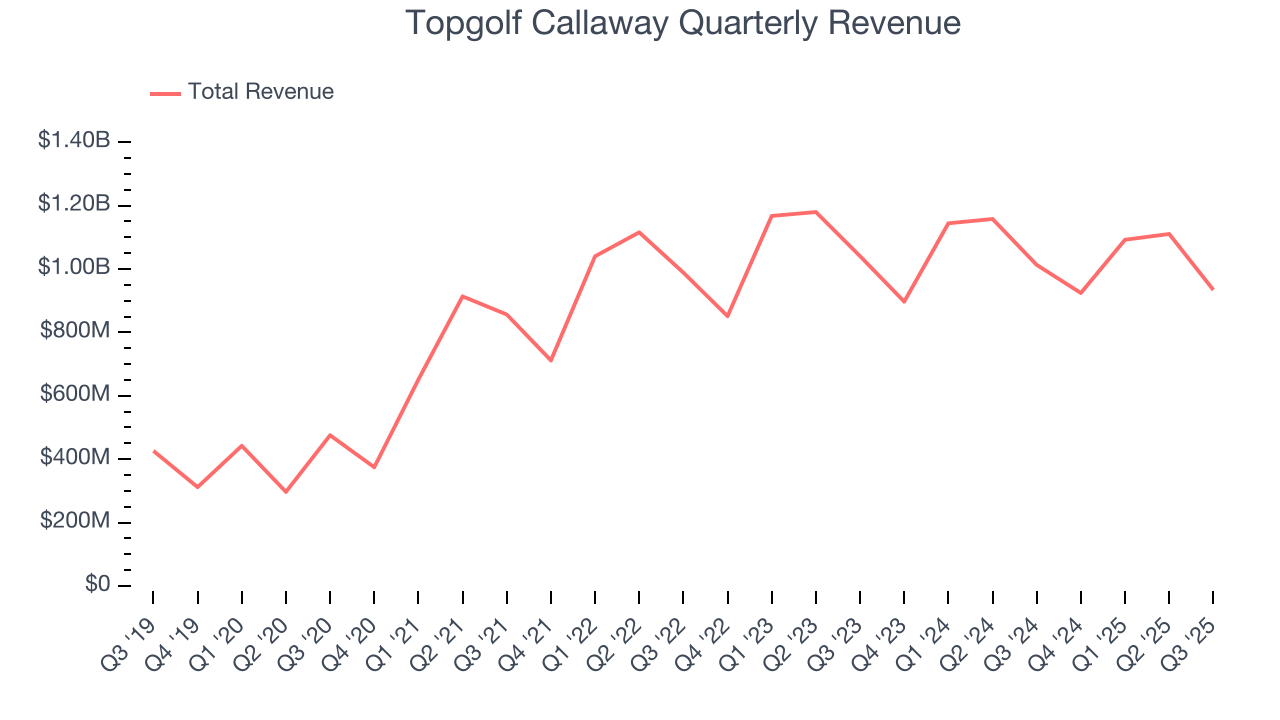

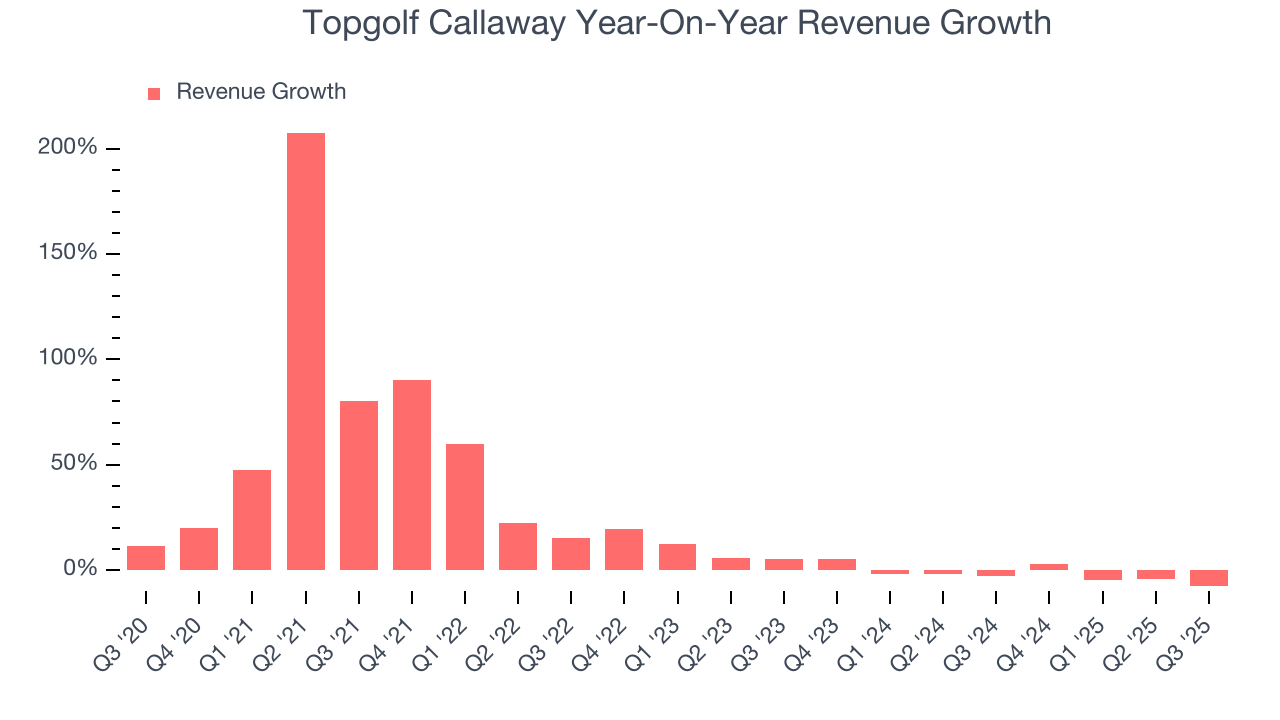

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years. Luckily, Topgolf Callaway’s sales grew at an impressive 21.6% compounded annual growth rate over the last five years. Its growth beat the average consumer discretionary company and shows its offerings resonate with customers.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Topgolf Callaway’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 2.1% over the last two years. Note that COVID hurt Topgolf Callaway’s business in 2020 and part of 2021, and it bounced back in a big way thereafter.

This quarter, Topgolf Callaway’s revenue fell by 7.8% year on year to $934 million but beat Wall Street’s estimates by 2.3%. Company management is currently guiding for a 15.3% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to decline by 4.2% over the next 12 months, a slight deceleration versus the last two years. This projection doesn't excite us and implies its products and services will see some demand headwinds.

6. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

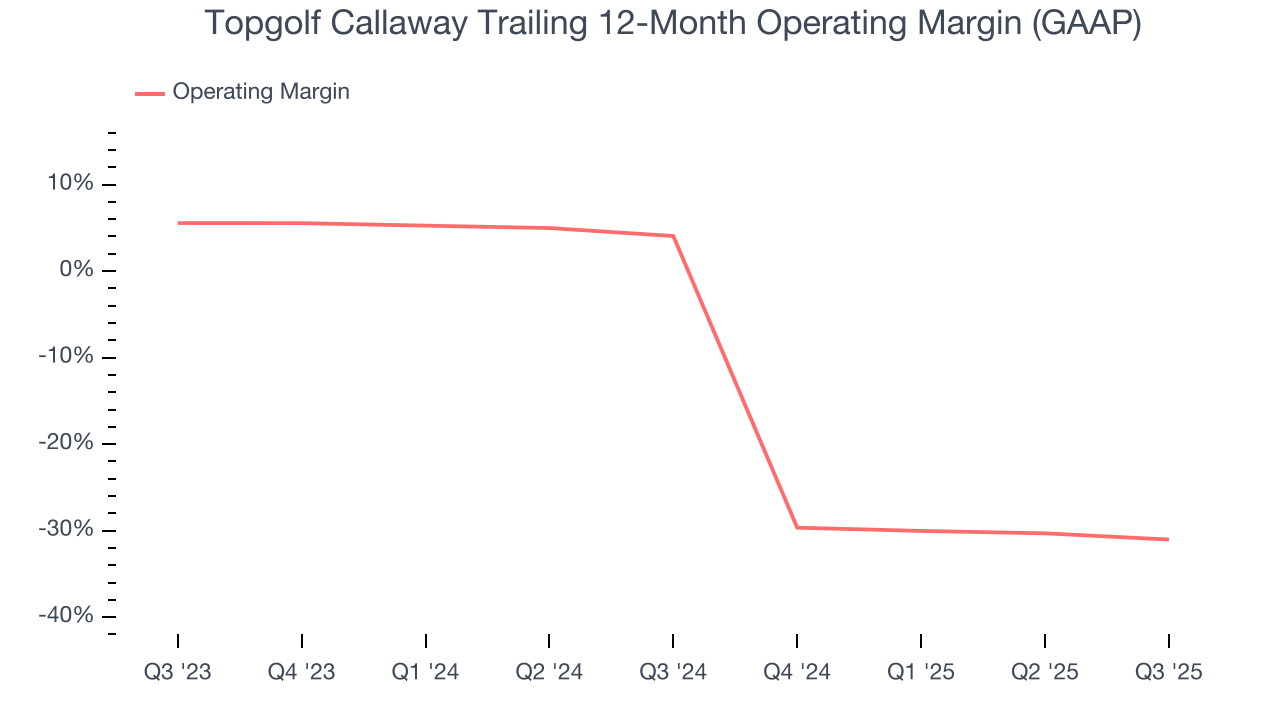

Topgolf Callaway’s operating margin has been trending down over the last 12 months and averaged negative 13.2% over the last two years. Unprofitable, high-growth companies warrant extra scrutiny, especially if their margins fall because they’re spending loads of money to stay relevant, an unsustainable practice.

This quarter, Topgolf Callaway generated an operating margin profit margin of 3%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Topgolf Callaway, its EPS declined by 15.3% annually over the last five years while its revenue grew by 21.6%. This tells us the company became less profitable on a per-share basis as it expanded.

In Q3, Topgolf Callaway reported adjusted EPS of negative $0.05, down from $0.02 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects Topgolf Callaway to perform poorly. Analysts forecast its full-year EPS of negative $0.03 will tumble to negative $0.48.

8. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

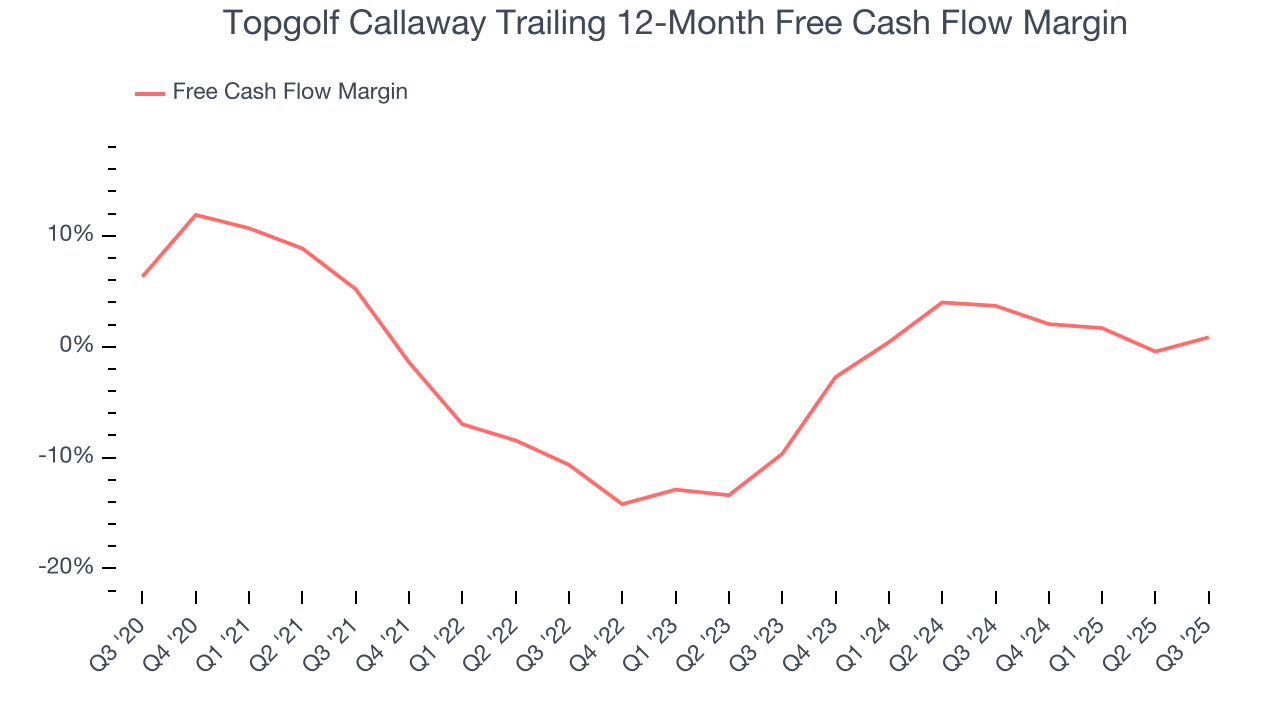

Topgolf Callaway has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 2.3%, lousy for a consumer discretionary business.

Topgolf Callaway’s free cash flow clocked in at $162.1 million in Q3, equivalent to a 17.4% margin. This result was good as its margin was 6.5 percentage points higher than in the same quarter last year, but we wouldn’t put too much weight on the short term because investment needs can be seasonal, causing temporary swings. Long-term trends trump fluctuations.

Over the next year, analysts predict Topgolf Callaway’s cash conversion will improve. Their consensus estimates imply its breakeven free cash flow margin for the last 12 months will increase to 4.2%, giving it more money to invest.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Topgolf Callaway’s five-year average ROIC was negative 2.2%, meaning management lost money while trying to expand the business. Its returns were among the worst in the consumer discretionary sector.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Topgolf Callaway’s ROIC has unfortunately decreased significantly. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

10. Balance Sheet Assessment

Topgolf Callaway reported $865.6 million of cash and $2.83 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $578.9 million of EBITDA over the last 12 months, we view Topgolf Callaway’s 3.4× net-debt-to-EBITDA ratio as safe. We also see its $228.2 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Topgolf Callaway’s Q3 Results

We were impressed by Topgolf Callaway’s optimistic EBITDA guidance for next quarter, which blew past analysts’ expectations. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its Active Lifestyle revenue missed. Zooming out, we think this was a good print with some key areas of upside. The stock traded up 6.8% to $9.90 immediately after reporting.

12. Is Now The Time To Buy Topgolf Callaway?

Updated: December 4, 2025 at 9:58 PM EST

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own Topgolf Callaway, you should also grasp the company’s longer-term business quality and valuation.

We see the value of companies helping consumers, but in the case of Topgolf Callaway, we’re out. First off, its revenue growth was weak over the last five years, and analysts expect its demand to deteriorate over the next 12 months. On top of that, Topgolf Callaway’s constant currency sales performance has disappointed, and its declining EPS over the last five years makes it a less attractive asset to the public markets.

Topgolf Callaway’s EV-to-EBITDA ratio based on the next 12 months is 4.7x. While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $12.50 on the company (compared to the current share price of $11.60).