Merck (MRK)

We like Merck. Its high free cash flow margin and returns on capital show it can produce cash and invest it wisely.― StockStory Analyst Team

1. News

2. Summary

Why We Like Merck

With roots dating back to 1891 and a portfolio that includes the blockbuster cancer immunotherapy Keytruda, Merck (NYSE:MRK) develops and sells prescription medicines, vaccines, and animal health products across oncology, infectious diseases, cardiovascular, and other therapeutic areas.

- Dominant market position is represented by its $64.23 billion in revenue, which creates significant barriers to entry in this highly regulated industry

- Successful business model is illustrated by its impressive adjusted operating margin

- Impressive free cash flow profitability enables the company to fund new investments or reward investors with share buybacks/dividends, and its growing cash flow gives it even more resources to deploy

Merck is a standout company. The valuation looks reasonable when considering its quality, so this might be a prudent time to buy some shares.

Why Is Now The Time To Buy Merck?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Merck?

At $113.68 per share, Merck trades at 21.2x forward P/E. Looking at the healthcare space, we think the valuation is fair - potentially even too low - for the business quality.

By definition, where you buy a stock impacts returns. Compared to entry price, business quality matters much more for long-term market outperformance. Buying in at a great price helps, nevertheless.

3. Merck (MRK) Research Report: Q4 CY2025 Update

Global pharmaceutical company Merck (NYSE:MRK) reported revenue ahead of Wall Streets expectations in Q4 CY2025, with sales up 5% year on year to $16.4 billion. On the other hand, the company’s full-year revenue guidance of $66.25 billion at the midpoint came in 2% below analysts’ estimates. Its non-GAAP profit of $2.04 per share was 1.5% above analysts’ consensus estimates.

Merck (MRK) Q4 CY2025 Highlights:

- Revenue: $16.4 billion vs analyst estimates of $16.12 billion (5% year-on-year growth, 1.8% beat)

- Adjusted EPS: $2.04 vs analyst estimates of $2.01 (1.5% beat)

- Adjusted EPS guidance for the upcoming financial year 2026 is $5.08 at the midpoint, missing analyst estimates by 9.8%

- Operating Margin: 20.9%, down from 27.5% in the same quarter last year

- Constant Currency Revenue rose 4% year on year (9% in the same quarter last year)

- Market Capitalization: $281.4 billion

Company Overview

With roots dating back to 1891 and a portfolio that includes the blockbuster cancer immunotherapy Keytruda, Merck (NYSE:MRK) develops and sells prescription medicines, vaccines, and animal health products across oncology, infectious diseases, cardiovascular, and other therapeutic areas.

Merck operates through two primary business segments: Pharmaceutical and Animal Health. The Pharmaceutical segment, which generates the majority of revenue, encompasses human health products including both prescription medications and vaccines. Its flagship product Keytruda has become one of the world's top-selling drugs, approved for treating numerous cancer types by targeting the body's immune system to fight tumors.

The company's vaccine portfolio includes Gardasil, which helps prevent HPV-related cancers, and various other vaccines for diseases like pneumococcal infections, rotavirus, and measles. Beyond oncology and vaccines, Merck markets medications for infectious diseases, cardiovascular conditions, diabetes, and hospital acute care.

A physician might prescribe Merck's Keytruda to a patient with advanced melanoma after traditional treatments have failed, potentially helping their immune system recognize and attack cancer cells. For a child's routine vaccination schedule, a pediatrician might administer Merck's M-M-R II vaccine to protect against measles, mumps, and rubella.

The Animal Health segment provides veterinary pharmaceuticals, vaccines, and health management solutions for both livestock and companion animals. Products range from antibiotics and parasiticides to vaccines and digital monitoring systems. A cattle farmer might use Merck's Bovilis vaccines to protect herds from infectious diseases, while a pet owner might receive Bravecto from their veterinarian to protect their dog from fleas and ticks for up to 12 weeks.

Merck invests heavily in research and development, with annual R&D expenses exceeding $30 billion. The company maintains research programs across multiple therapeutic areas and has a robust clinical pipeline with numerous candidates in late-stage development. Merck sells its products globally through various channels, including wholesalers, retailers, hospitals, physicians, veterinarians, and government agencies.

4. Branded Pharmaceuticals

Looking ahead, the branded pharmaceutical industry is positioned for tailwinds from advancements in precision medicine, increasing adoption of AI to enhance drug development efficiency, and growing global demand for treatments addressing chronic and rare diseases. However, headwinds include heightened regulatory scrutiny, pricing pressures from governments and insurers, and the looming patent cliffs for key blockbuster drugs. Patent cliffs bring about competition from generics, forcing branded pharmaceutical companies back to the drawing board to find the next big thing.

Merck's primary competitors in the pharmaceutical space include Pfizer (NYSE:PFE), Johnson & Johnson (NYSE:JNJ), Novartis (NYSE:NVS), Roche (OTCQX:RHHBY), Bristol Myers Squibb (NYSE:BMY), and AstraZeneca (NASDAQ:AZN). In animal health, Merck competes with Zoetis (NYSE:ZTS), Elanco (NYSE:ELAN), and Boehringer Ingelheim.

5. Economies of Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With $65.01 billion in revenue over the past 12 months, Merck is one of the most scaled enterprises in healthcare. This is particularly important because branded pharmaceuticals companies are volume-driven businesses due to their low margins.

6. Revenue Growth

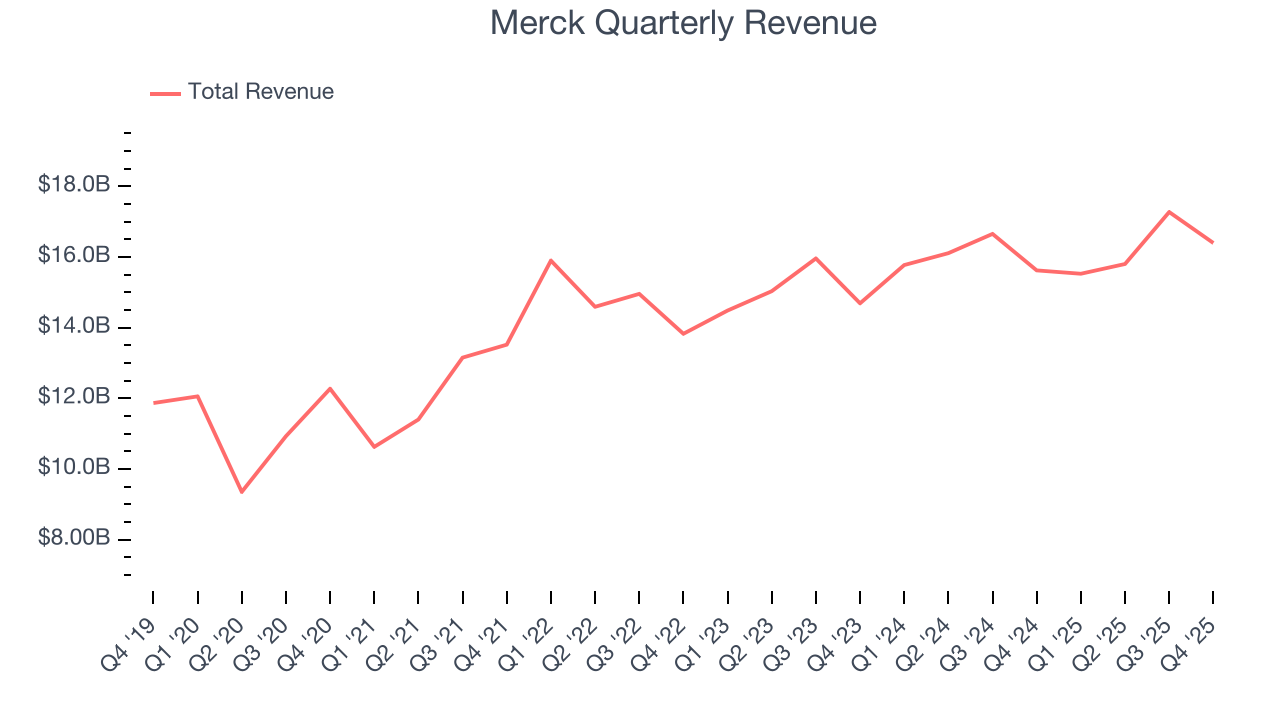

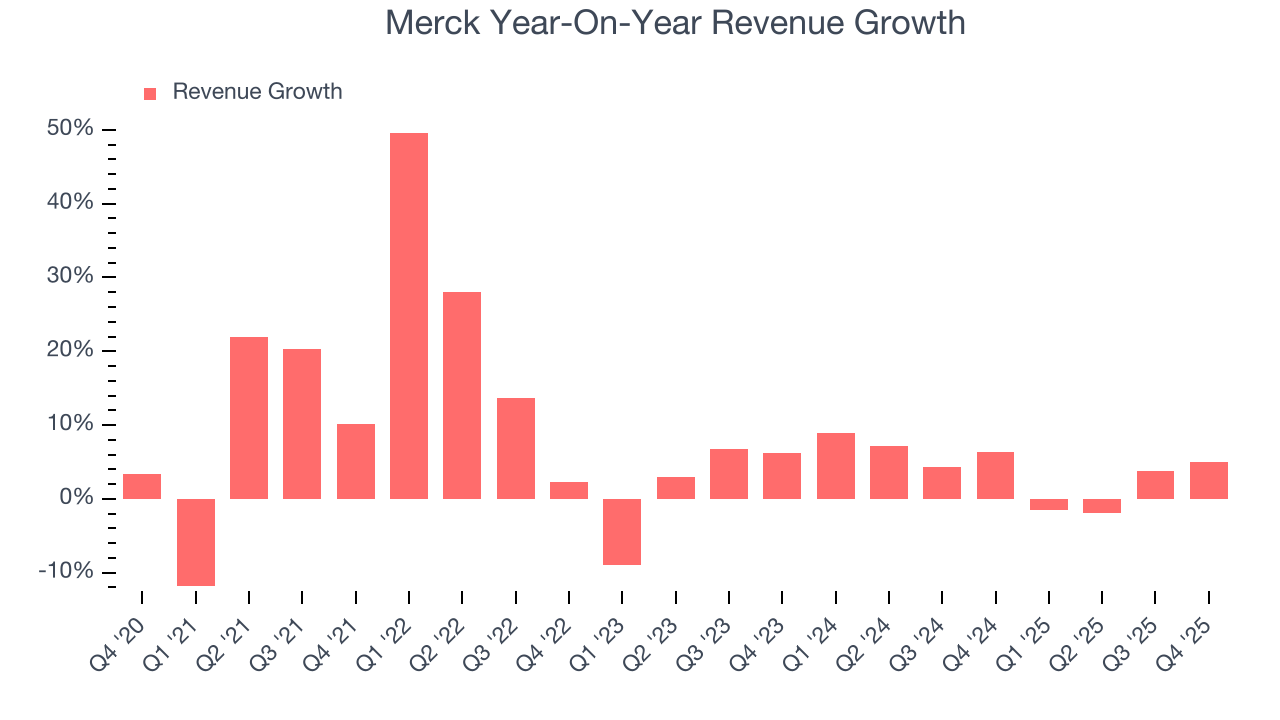

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Thankfully, Merck’s 7.8% annualized revenue growth over the last five years was decent. Its growth was slightly above the average healthcare company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Merck’s recent performance shows its demand has slowed as its annualized revenue growth of 3.9% over the last two years was below its five-year trend.

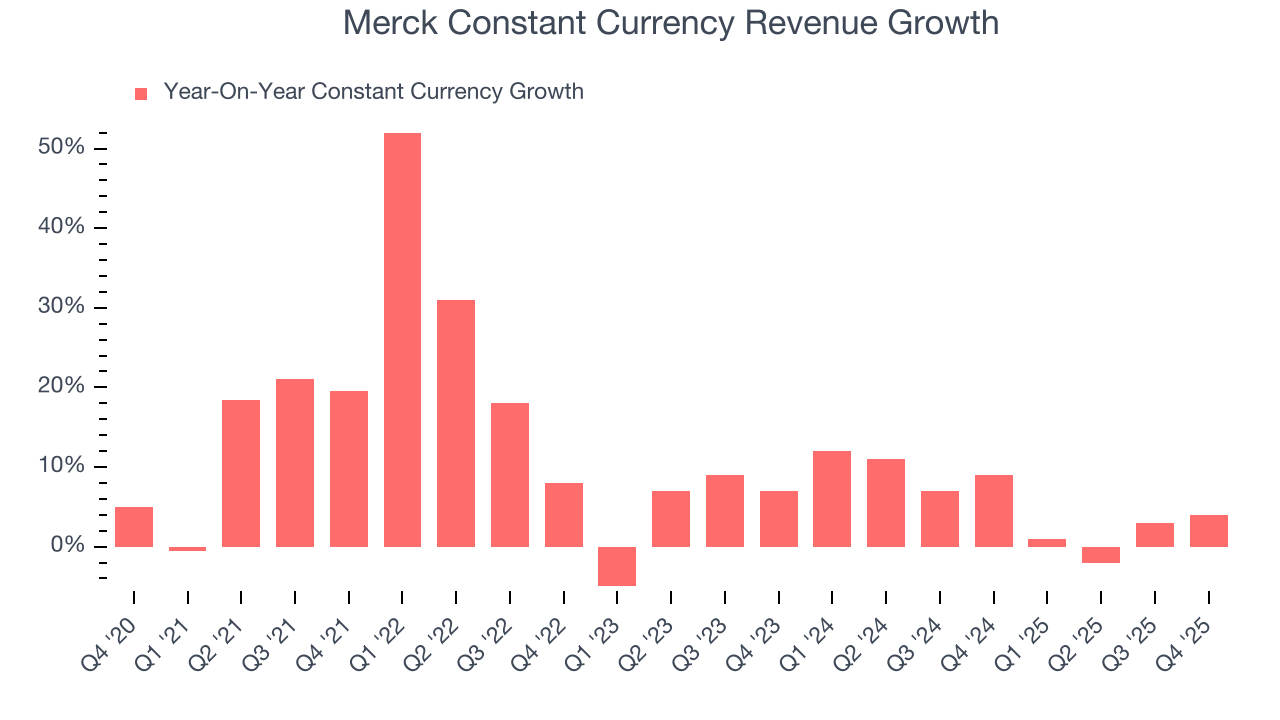

We can better understand the company’s sales dynamics by analyzing its constant currency revenue, which excludes currency movements that are outside their control and not indicative of demand. Over the last two years, its constant currency sales averaged 5.6% year-on-year growth. Because this number is better than its normal revenue growth, we can see that foreign exchange rates have been a headwind for Merck.

This quarter, Merck reported modest year-on-year revenue growth of 5% but beat Wall Street’s estimates by 1.8%.

Looking ahead, sell-side analysts expect revenue to grow 3.3% over the next 12 months, similar to its two-year rate. This projection doesn't excite us and implies its newer products and services will not lead to better top-line performance yet. At least the company is tracking well in other measures of financial health.

7. Operating Margin

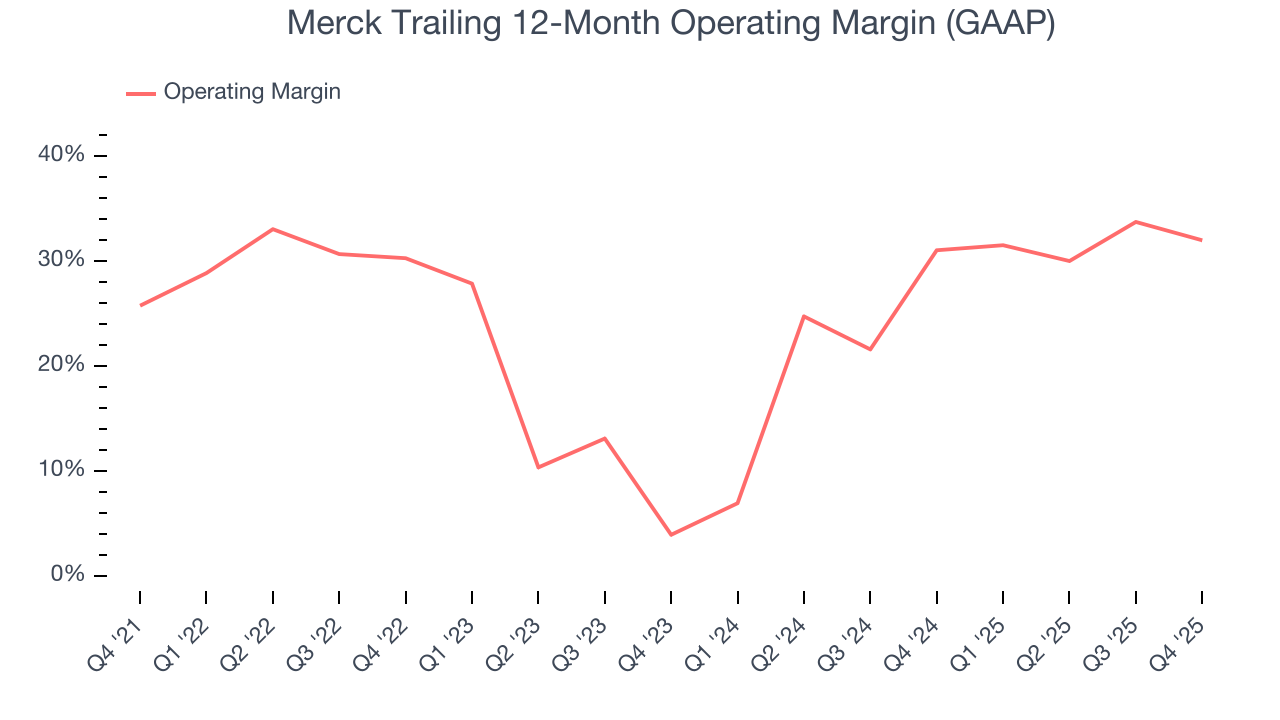

Merck has been an efficient company over the last five years. It was one of the more profitable businesses in the healthcare sector, boasting an average operating margin of 24.7%.

Analyzing the trend in its profitability, Merck’s operating margin rose by 6.2 percentage points over the last five years, as its sales growth gave it operating leverage. This performance was mostly driven by its recent improvements as the company’s margin has increased by 28.1 percentage points on a two-year basis. These data points are very encouraging and show momentum is on its side.

In Q4, Merck generated an operating margin profit margin of 20.9%, down 6.6 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

8. Earnings Per Share

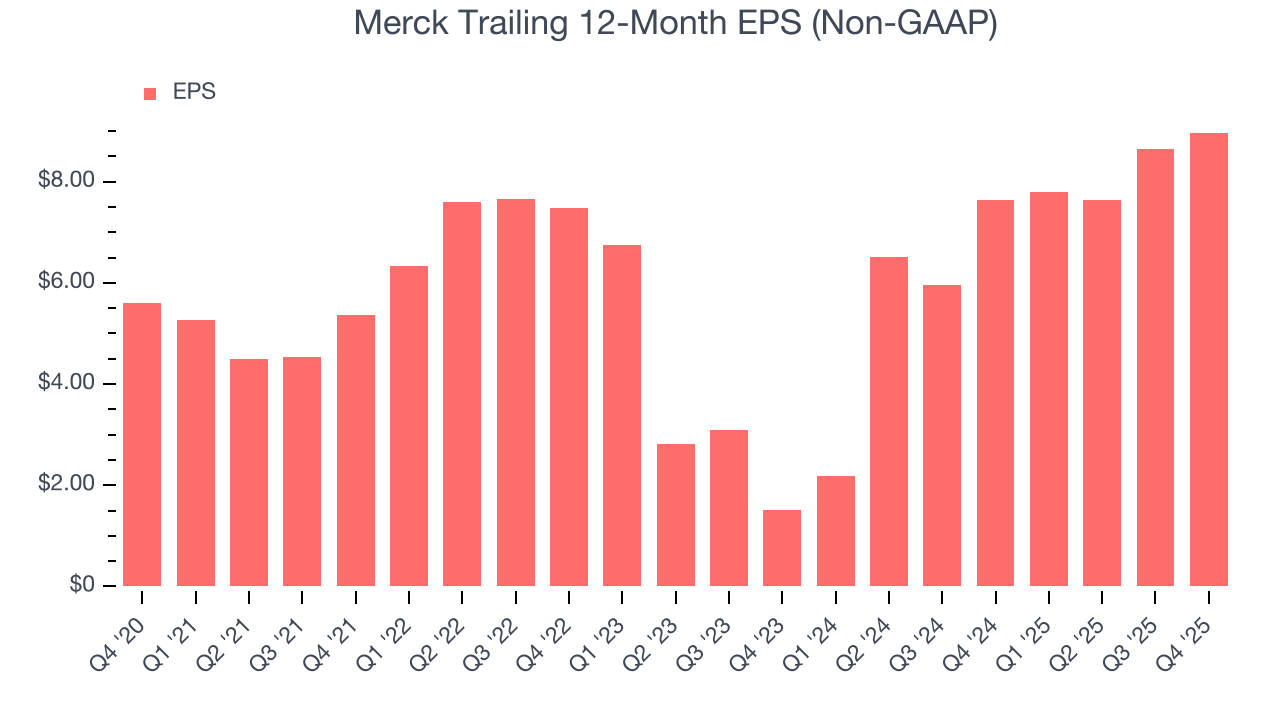

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Merck’s EPS grew at a remarkable 9.9% compounded annual growth rate over the last five years, higher than its 7.8% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

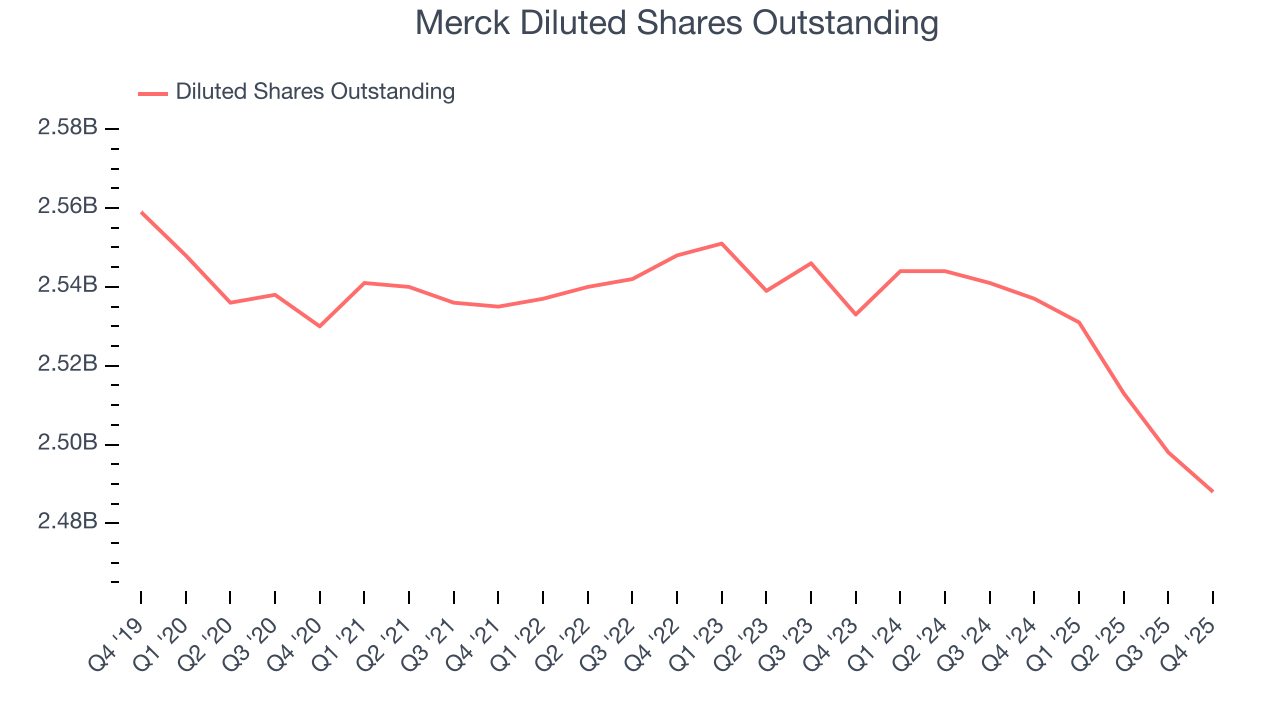

We can take a deeper look into Merck’s earnings to better understand the drivers of its performance. As we mentioned earlier, Merck’s operating margin declined this quarter but expanded by 6.2 percentage points over the last five years. Its share count also shrank by 1.7%, and these factors together are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

In Q4, Merck reported adjusted EPS of $2.04, up from $1.72 in the same quarter last year. This print beat analysts’ estimates by 1.5%. Over the next 12 months, Wall Street expects Merck’s full-year EPS of $8.97 to shrink by 40.6%.

9. Cash Is King

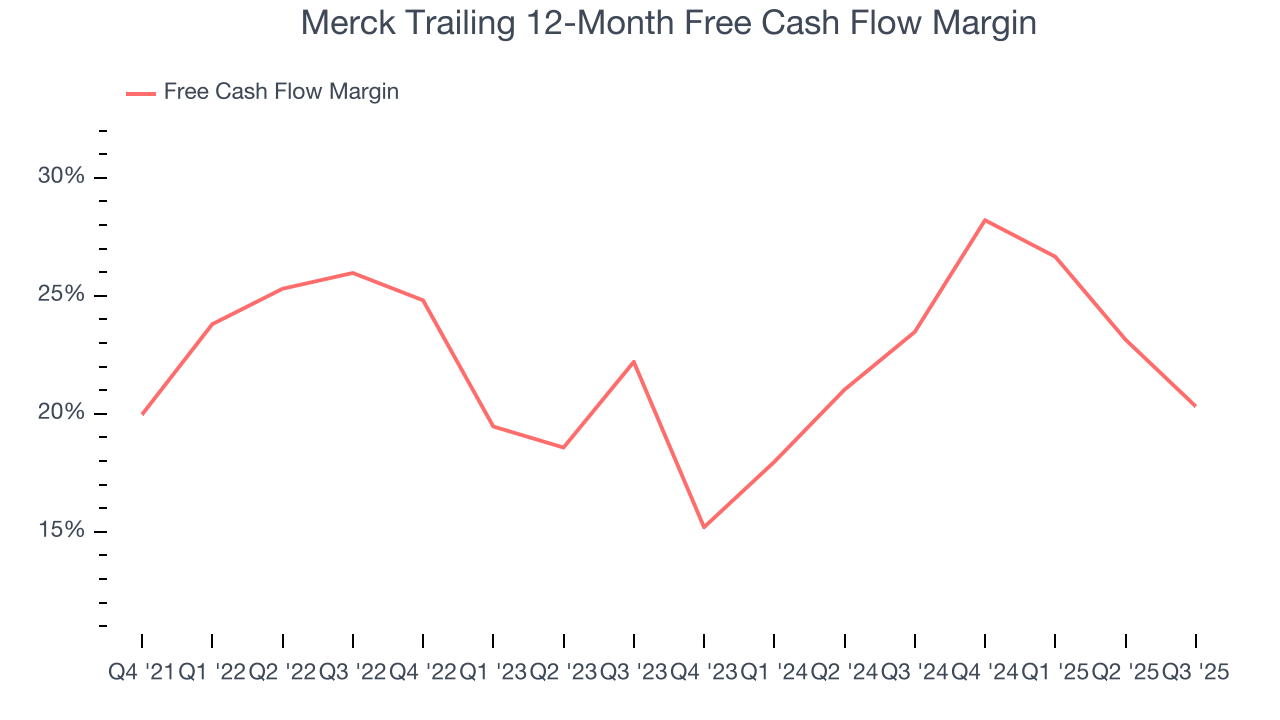

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Merck has shown robust cash profitability, giving it an edge over its competitors and the ability to reinvest or return capital to investors. The company’s free cash flow margin averaged 22.1% over the last five years, quite impressive for a healthcare business.

Taking a step back, we can see that Merck’s margin expanded by 5.1 percentage points during that time. This is encouraging because it gives the company more optionality.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Merck’s five-year average ROIC was 16.6%, beating other healthcare companies by a wide margin. This illustrates its management team’s ability to invest in attractive growth opportunities and produce tangible results for shareholders.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Merck’s ROIC has decreased over the last few years. Only time will tell if its new bets can bear fruit and potentially reverse the trend.

11. Key Takeaways from Merck’s Q4 Results

It was encouraging to see Merck beat analysts’ revenue expectations this quarter. We were also happy its constant currency revenue narrowly outperformed Wall Street’s estimates. On the other hand, its full-year EPS guidance missed and its full-year revenue guidance fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 2% to $111.05 immediately following the results.

12. Is Now The Time To Buy Merck?

Updated: February 3, 2026 at 6:48 AM EST

Before deciding whether to buy Merck or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

Merck is an amazing business ranking highly on our list. For starters, its revenue growth was decent over the last five years. And while its diminishing returns show management's recent bets still have yet to bear fruit, its scale makes it a trusted partner with negotiating leverage. On top of that, Merck’s rising cash profitability gives it more optionality.

Merck’s P/E ratio based on the next 12 months is 21.3x. Looking at the healthcare landscape today, Merck’s fundamentals really stand out, and we like it at this price.

Wall Street analysts have a consensus one-year price target of $117.58 on the company (compared to the current share price of $111.05), implying they see 5.9% upside in buying Merck in the short term.