Vail Resorts (MTN)

We wouldn’t buy Vail Resorts. Its weak sales growth and low returns on capital show it struggled to generate demand and profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think Vail Resorts Will Underperform

Founded by two Aspen, Colorado ski patrol guides, Vail Resorts (NYSE:MTN) is a mountain resort company offering luxury experiences in over 30 locations across the globe.

- Lackluster 10.2% annual revenue growth over the last five years indicates the company is losing ground to competitors

- Low free cash flow margin gives it little breathing room, constraining its ability to self-fund growth or return capital to shareholders

- Low returns on capital reflect management’s struggle to allocate funds effectively

Vail Resorts doesn’t live up to our standards. We’re hunting for superior stocks elsewhere.

Why There Are Better Opportunities Than Vail Resorts

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Vail Resorts

Vail Resorts’s stock price of $138.38 implies a valuation ratio of 21.1x forward P/E. While valuation is appropriate for the quality you get, we’re still not buyers.

We’d rather invest in similarly-priced but higher-quality companies with more reliable earnings growth.

3. Vail Resorts (MTN) Research Report: Q3 CY2025 Update

Luxury ski resort company Vail Resorts (NYSE:MTN) missed Wall Street’s revenue expectations in Q3 CY2025 as sales rose 4.1% year on year to $271 million. Its GAAP loss of $5.20 per share was 0.6% below analysts’ consensus estimates.

Vail Resorts (MTN) Q3 CY2025 Highlights:

- Revenue: $271 million vs analyst estimates of $274.3 million (4.1% year-on-year growth, 1.2% miss)

- EPS (GAAP): -$5.20 vs analyst expectations of -$5.17 (0.6% miss)

- Adjusted EBITDA: -$128.2 million (-47.3% margin, 2.9% year-on-year decline)

- Operating Margin: -77.4%, in line with the same quarter last year

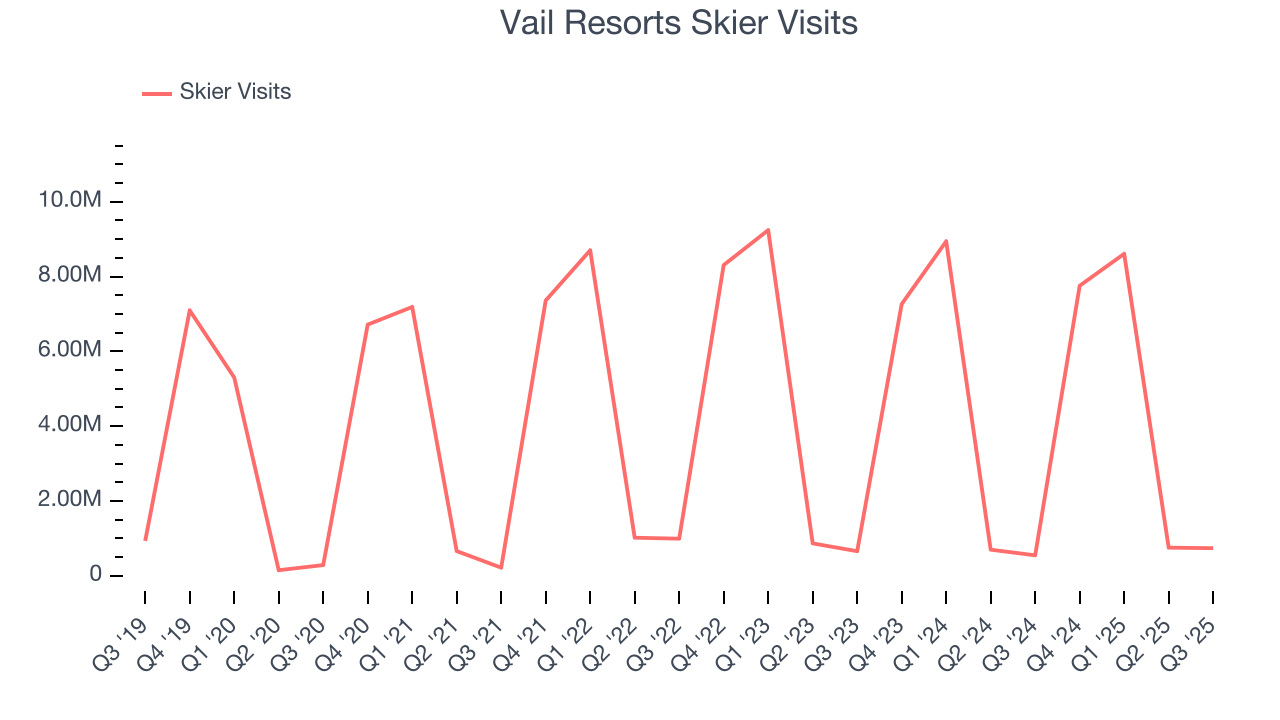

- Skier Visits: 739,000, up 191,000 year on year

- Market Capitalization: $5.23 billion

Company Overview

Founded by two Aspen, Colorado ski patrol guides, Vail Resorts (NYSE:MTN) is a mountain resort company offering luxury experiences in over 30 locations across the globe.

Vail Resorts emerged from the vision of Pete Seibert and Earl Eaton. Inspired by the breathtaking beauty of the Colorado Rockies, they envisioned a world-class skiing destination that would cater to those seeking both adventure and luxury. The duo's dream, however, was not merely to introduce another ski destination, but to elevate the entire skiing experience.

While many resorts pride themselves on either their slopes or amenities, Vail Resorts has meticulously created a blend of both. The company uses advanced snowmaking systems to ensure optimal ski conditions and complements its slopes with fine dining experiences epitomizing alpine luxury. Beyond skiing, Vail introduces guests to a variety of cultural and recreational experiences to provide guests with memorable experiences regardless of the season.

Vail Resorts's business model leverages a combination of mountain operations, lodging, and real estate. Its diversified revenue streams include lift ticket sales, ski school services, dining, retail, and lodging sales.

4. Leisure Facilities

Leisure facilities companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted their spending from "things" to "experiences". Leisure facilities seek to benefit but must innovate to do so because of the industry's high competition and capital intensity.

Competitors offering luxury ski resort experiences include Alterra Mountain Company and Boyne Resorts while companies offering cheaper leisure experiences include SeaWorld (NYSE:SEAS) and Six Flags (NYSE:SIX).

5. Revenue Growth

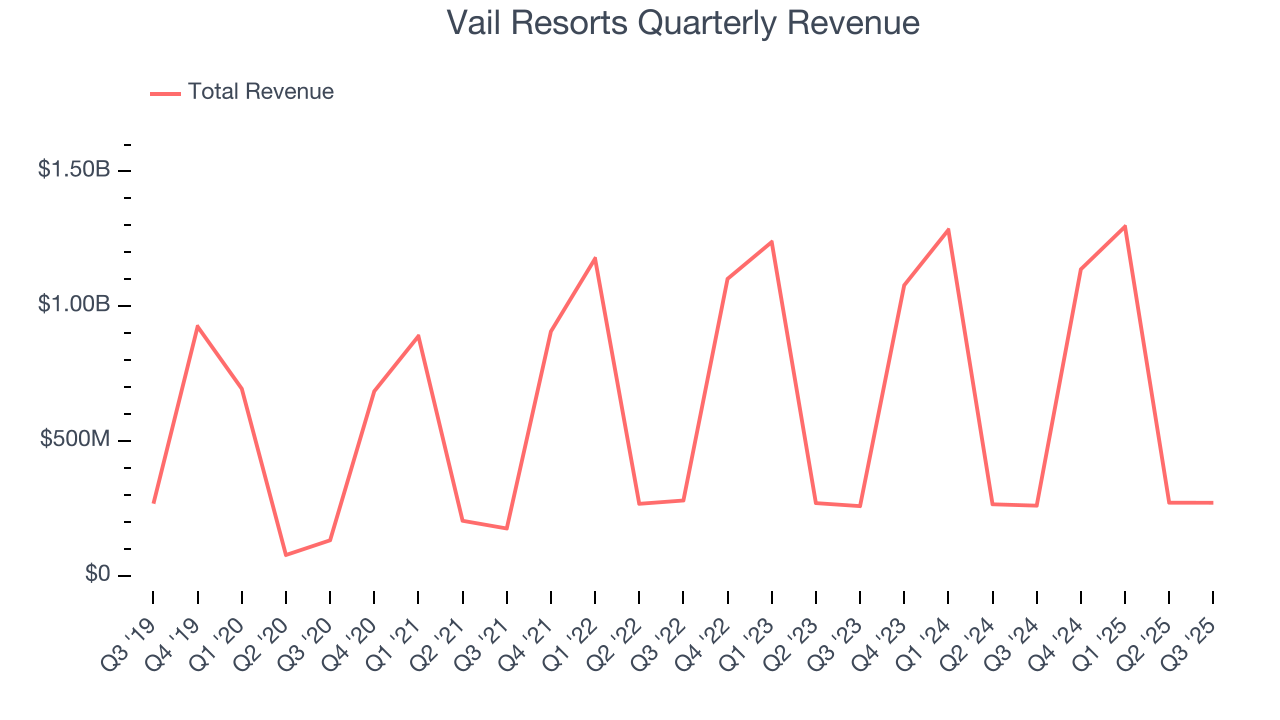

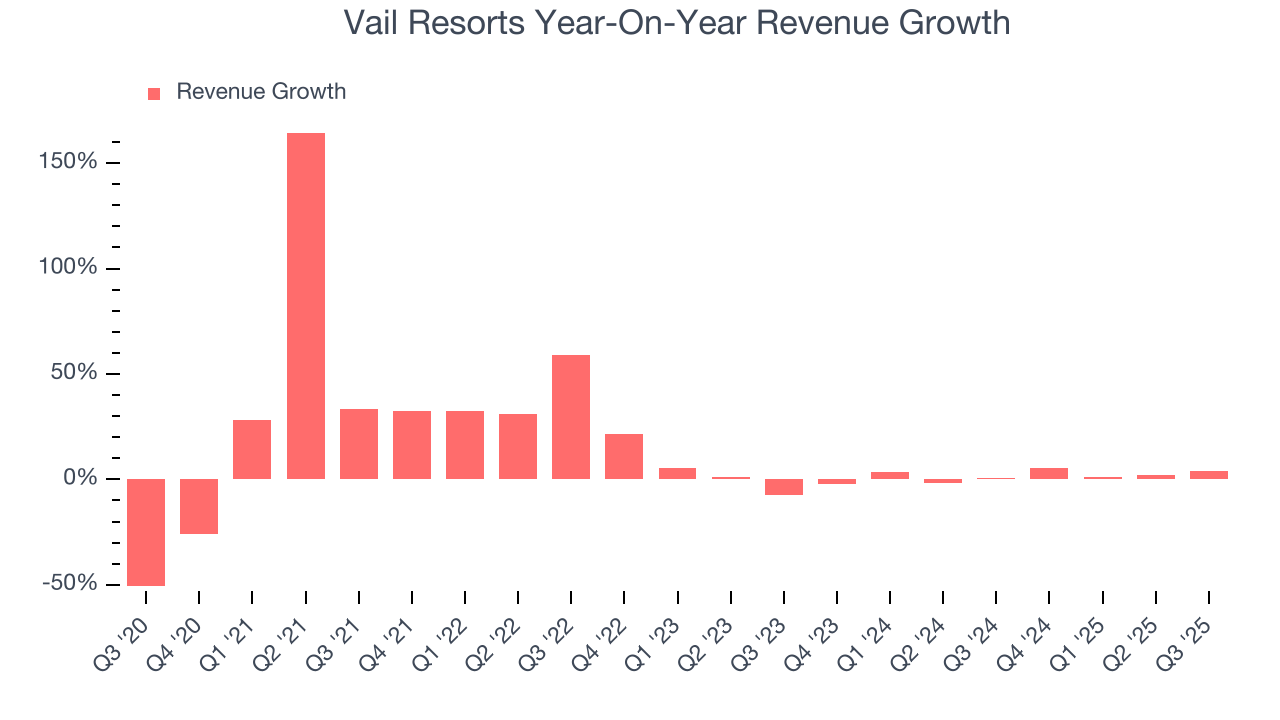

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, Vail Resorts grew its sales at a 10.2% annual rate. Although this growth is acceptable on an absolute basis, it fell short of our standards for the consumer discretionary sector, which enjoys a number of secular tailwinds.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Vail Resorts’s recent performance shows its demand has slowed as its annualized revenue growth of 1.8% over the last two years was below its five-year trend. Note that COVID hurt Vail Resorts’s business in 2020 and part of 2021, and it bounced back in a big way thereafter.

Vail Resorts also discloses its number of skier visits, which reached 739,000 in the latest quarter. Over the last two years, Vail Resorts’s skier visits were flat. Because this number is lower than its revenue growth during the same period, we can see the company’s monetization has risen.

This quarter, Vail Resorts’s revenue grew by 4.1% year on year to $271 million, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 1.1% over the next 12 months, similar to its two-year rate. This projection is underwhelming and implies its newer products and services will not lead to better top-line performance yet.

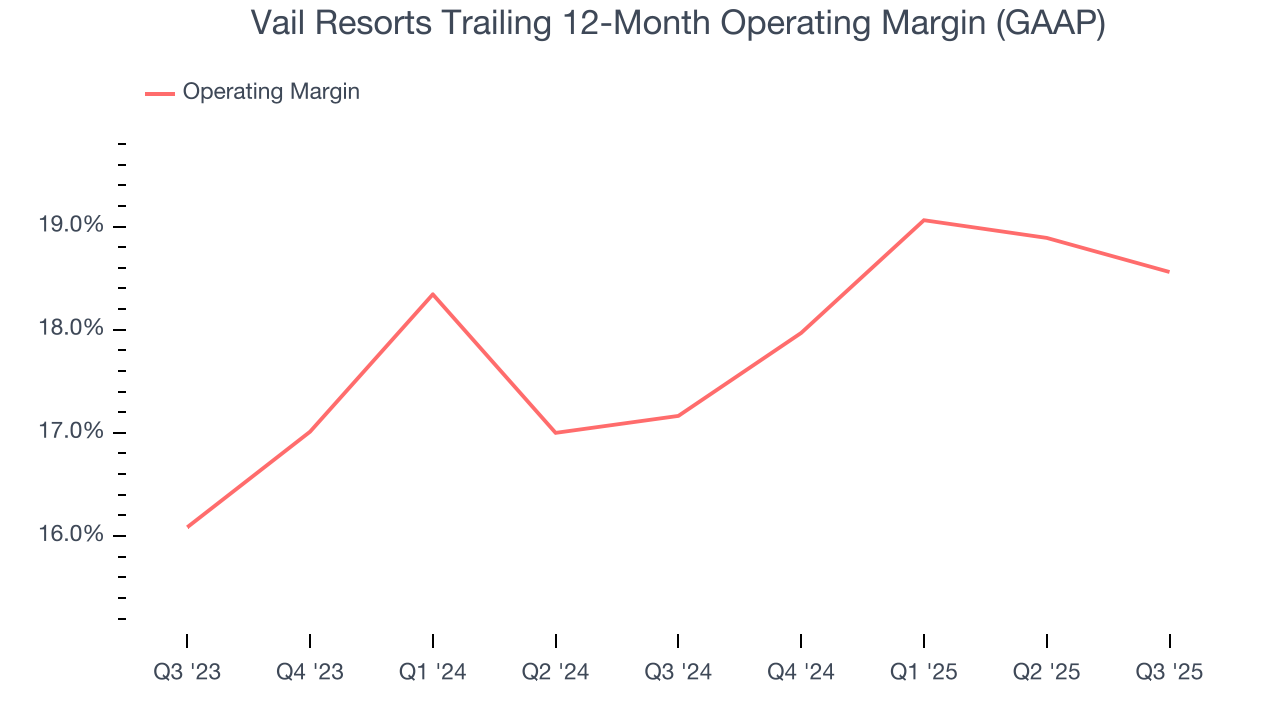

6. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Vail Resorts’s operating margin has risen over the last 12 months and averaged 17.9% over the last two years. The company’s higher efficiency is a breath of fresh air, but its suboptimal cost structure means it still sports inadequate profitability for a consumer discretionary business.

In Q3, Vail Resorts generated an operating margin profit margin of negative 77.4%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

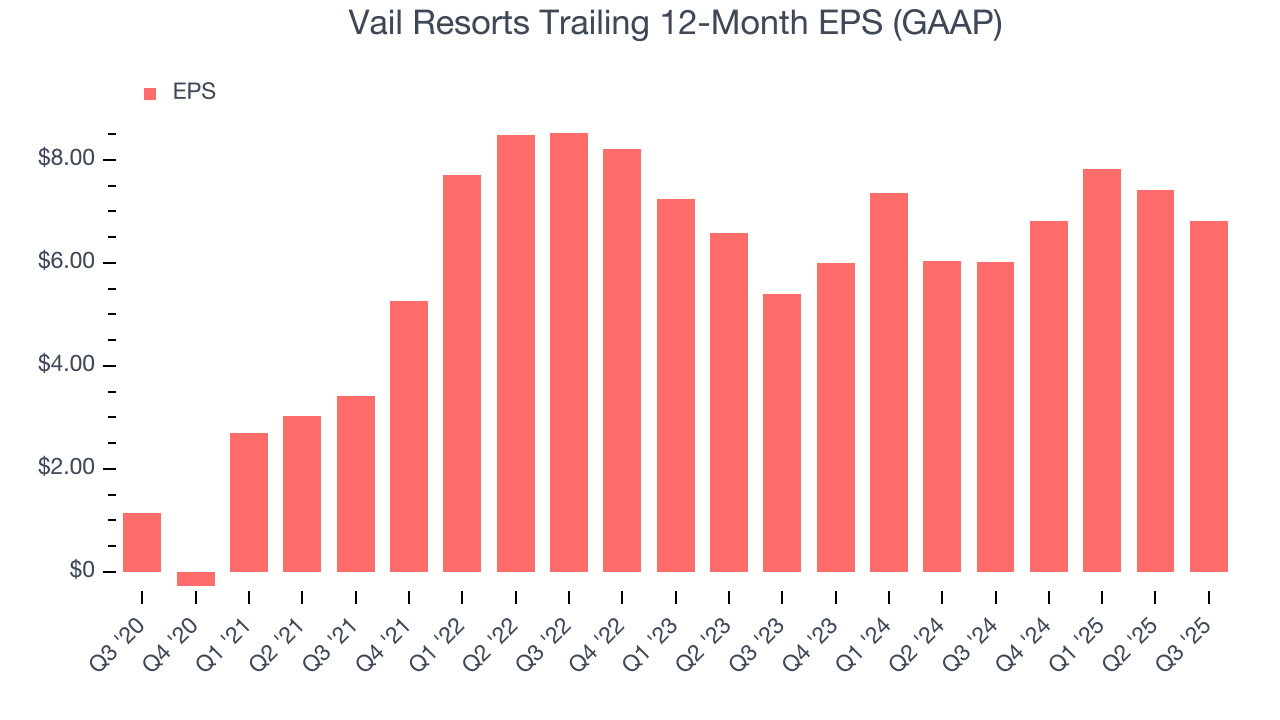

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Vail Resorts’s EPS grew at a solid 43% compounded annual growth rate over the last five years, higher than its 10.2% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

In Q3, Vail Resorts reported EPS of negative $5.20, down from negative $4.61 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects Vail Resorts’s full-year EPS of $6.82 to stay about the same.

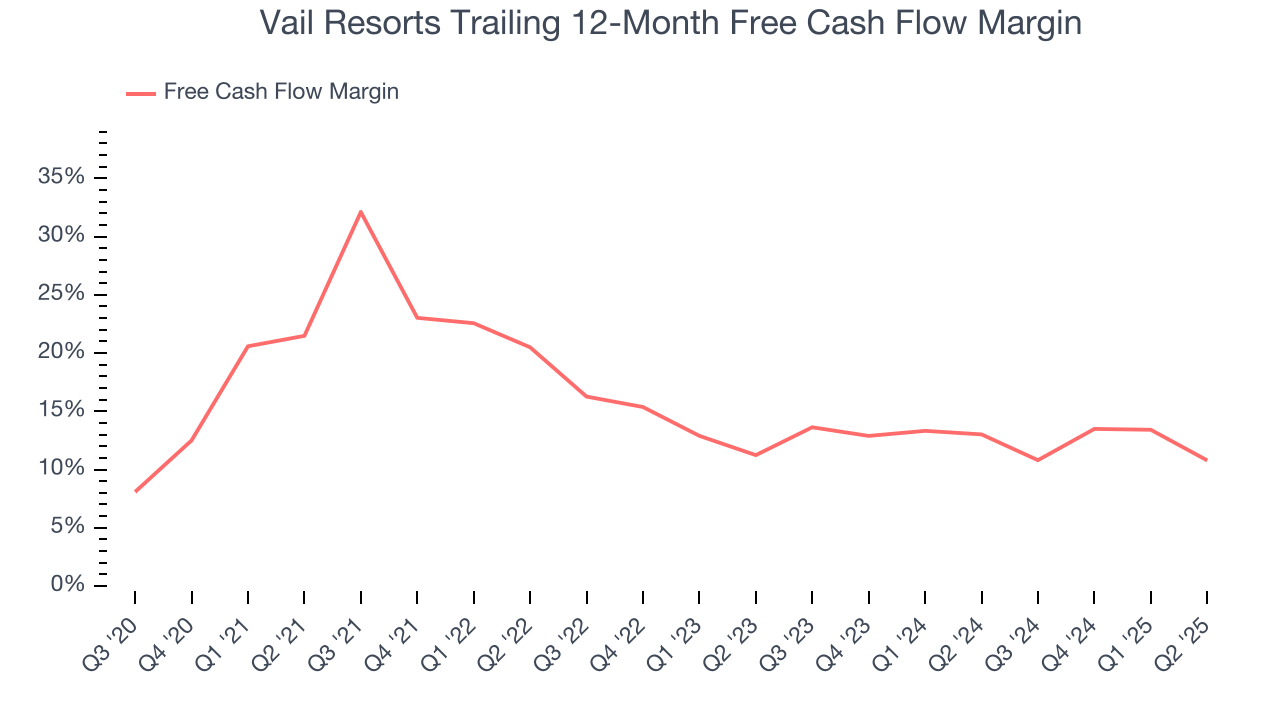

8. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Vail Resorts has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 7.5%, lousy for a consumer discretionary business.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Vail Resorts historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 14.4%, somewhat low compared to the best consumer discretionary companies that consistently pump out 25%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Vail Resorts’s ROIC has stayed the same over the last few years. If the company wants to become an investable business, it must improve its returns by generating more profitable growth.

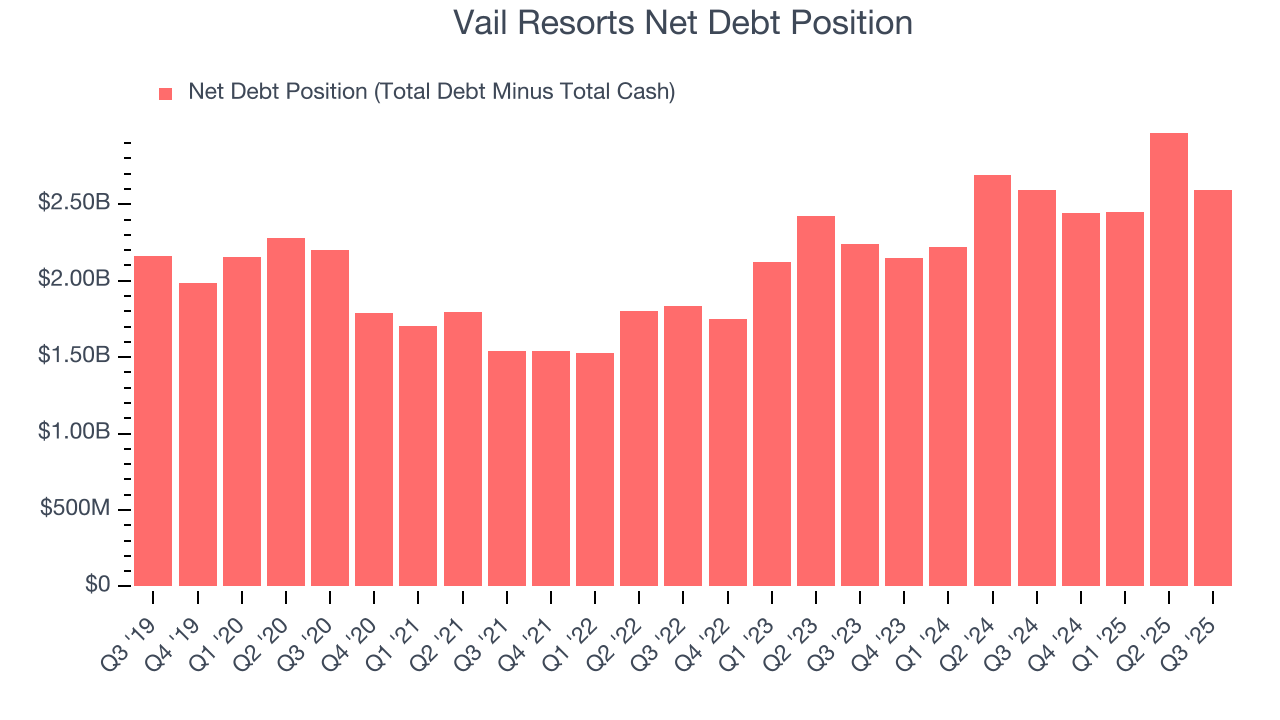

10. Balance Sheet Assessment

Vail Resorts reported $581.5 million of cash and $3.17 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $859.2 million of EBITDA over the last 12 months, we view Vail Resorts’s 3.0× net-debt-to-EBITDA ratio as safe. We also see its $173.1 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Vail Resorts’s Q3 Results

We were impressed by how significantly Vail Resorts blew past analysts’ skier visits expectations this quarter. We were also happy its EBITDA outperformed Wall Street’s estimates. On the other hand, its revenue slightly missed. Overall, this was a mixed quarter. The stock remained flat at $142.00 immediately following the results.

12. Is Now The Time To Buy Vail Resorts?

Updated: January 26, 2026 at 10:00 PM EST

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own Vail Resorts, you should also grasp the company’s longer-term business quality and valuation.

Vail Resorts doesn’t pass our quality test. First off, its revenue growth was weak over the last five years, and analysts expect its demand to deteriorate over the next 12 months. On top of that, Vail Resorts’s number of skier visits has disappointed, and its projected EPS for the next year is lacking.

Vail Resorts’s P/E ratio based on the next 12 months is 20.5x. This valuation multiple is fair, but we don’t have much confidence in the company. There are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $174.64 on the company (compared to the current share price of $137.38).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.