Norfolk Southern (NSC)

We wouldn’t recommend Norfolk Southern. Its poor sales growth and falling returns on capital suggest its growth opportunities are shrinking.― StockStory Analyst Team

1. News

2. Summary

Why We Think Norfolk Southern Will Underperform

Starting with a single route from Virginia to North Carolina, Norfolk Southern (NYSE:NSC) is a freight transportation company operating a major railroad network across the eastern United States.

- Sales stagnated over the last two years and signal the need for new growth strategies

- Flat earnings per share over the last two years underperformed the sector average

- Demand will likely be soft over the next 12 months as Wall Street’s estimates imply tepid growth of 1.1%

Norfolk Southern doesn’t meet our quality criteria. We’re hunting for superior stocks elsewhere.

Why There Are Better Opportunities Than Norfolk Southern

Why There Are Better Opportunities Than Norfolk Southern

Norfolk Southern’s stock price of $287.27 implies a valuation ratio of 23.6x forward P/E. Yes, this valuation multiple is lower than that of other industrials peers, but we’ll remind you that you often get what you pay for.

It’s better to pay up for high-quality businesses with higher long-term earnings potential rather than to buy lower-quality stocks because they appear cheap. These challenged businesses often don’t re-rate, a phenomenon known as a “value trap”.

3. Norfolk Southern (NSC) Research Report: Q3 CY2025 Update

Freight transportation company Norfolk Southern (NYSE:NSC) met Wall Street’s revenue expectations in Q3 CY2025, with sales up 1.7% year on year to $3.10 billion. Its GAAP profit of $3.16 per share was 2.6% below analysts’ consensus estimates.

Norfolk Southern (NSC) Q3 CY2025 Highlights:

- Revenue: $3.10 billion vs analyst estimates of $3.11 billion (1.7% year-on-year growth, in line)

- EPS (GAAP): $3.16 vs analyst expectations of $3.24 (2.6% miss)

- Adjusted EBITDA: $1.45 billion vs analyst estimates of $1.47 billion (46.6% margin, 1.8% miss)

- Operating Margin: 35.4%, down from 52.3% in the same quarter last year

- Free Cash Flow Margin: 23.2%, down from 36.1% in the same quarter last year

- Market Capitalization: $64.76 billion

Company Overview

Starting with a single route from Virginia to North Carolina, Norfolk Southern (NYSE:NSC) is a freight transportation company operating a major railroad network across the eastern United States.

Norfolk Southern was established to meet the increasing demand for reliable and efficient rail transportation of goods, providing a link in the supply chain for numerous industries.

Norfolk Southern offers a wide range of freight transportation services, including the shipment of agricultural products, automotive goods, chemicals, coal, metals, and construction materials. By leveraging its rail network, the company facilitates the movement of goods across long distances, addressing logistical challenges and ensuring timely delivery. For example, Norfolk Southern's intermodal services enable the transfer of containers between rail and truck, optimizing supply chain efficiency for its customers.

The primary revenue sources for Norfolk Southern come from freight transportation services, including contracts with businesses across various sectors such as manufacturing, agriculture, and energy. The company's business model focuses on providing reliable and cost-effective transportation solutions, supported by investments in infrastructure and technology to improve operational efficiency. Norfolk Southern appeals to businesses seeking dependable rail transportation options to streamline their supply chain operations, with recurring revenue generated through long-term contracts and ongoing shipping agreements.

4. Rail Transportation

The growth of e-commerce and global trade continues to drive demand for shipping services, presenting opportunities for rail transportation companies. While moving large volumes by rail can be highly cost-efficient for customers compared to air and ground transport, this mode of transportation results in slower delivery times, presenting a trade off. To improve transit times, the industry continues to invest in digitization to optimize fleets, loads, and even braking systems. However, rail transportation companies are still at the whim of economic cycles. Consumer spending, for example, can greatly impact the demand for these companies’ offerings while fuel costs can influence profit margins.

Public competitors in the rail industry include Union Pacific (NYSE:UNP), CSX (NASDAQ:CSX), and CPKC (NYSE:CP)

5. Revenue Growth

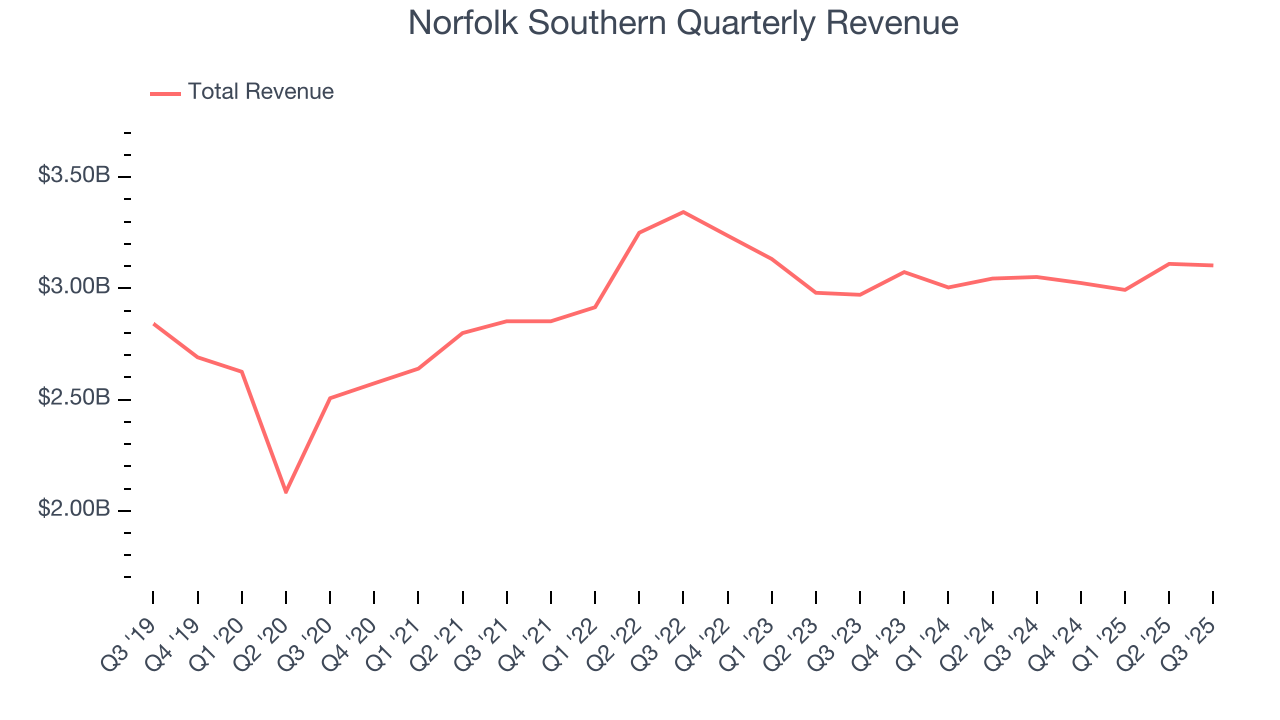

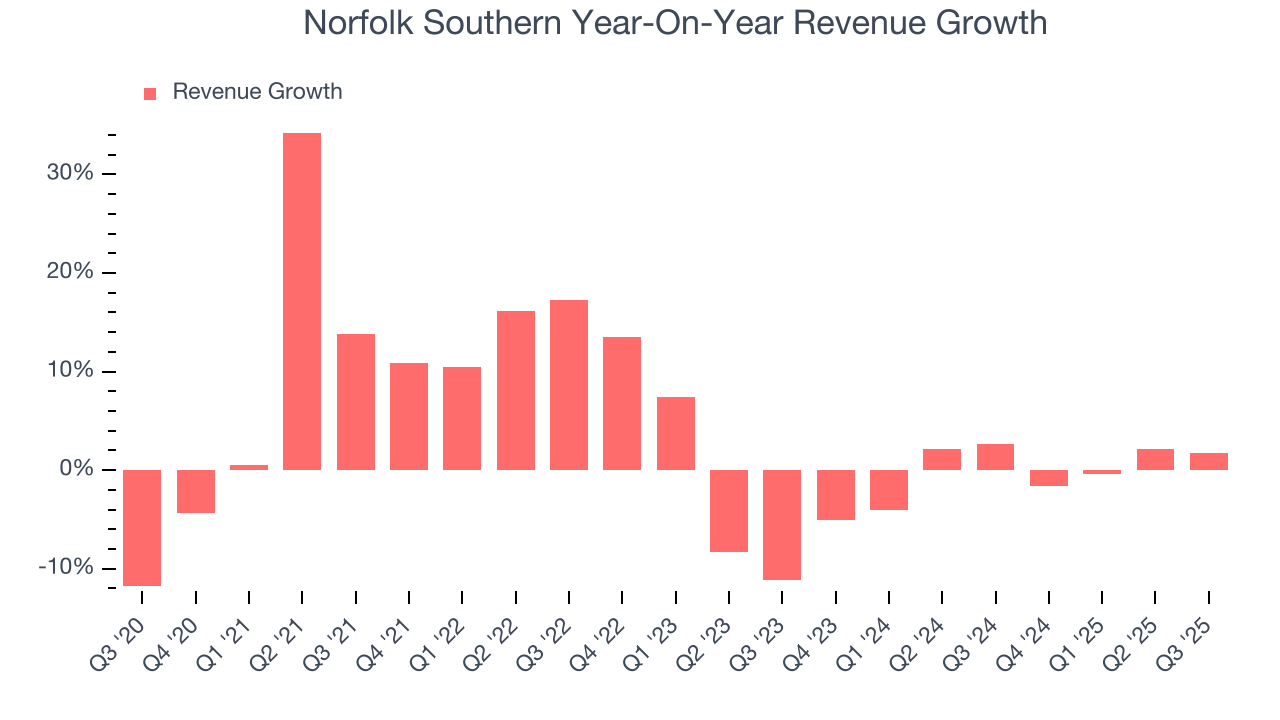

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Regrettably, Norfolk Southern’s sales grew at a sluggish 4.3% compounded annual growth rate over the last five years. This fell short of our benchmark for the industrials sector and is a tough starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Norfolk Southern’s recent performance shows its demand has slowed as its revenue was flat over the last two years. We also note many other Rail Transportation businesses have faced declining sales because of cyclical headwinds. While Norfolk Southern’s growth wasn’t the best, it did do better than its peers.

This quarter, Norfolk Southern grew its revenue by 1.7% year on year, and its $3.10 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 3.3% over the next 12 months. While this projection indicates its newer products and services will catalyze better top-line performance, it is still below average for the sector.

6. Gross Margin & Pricing Power

Cost of sales for an industrials business is usually comprised of the direct labor, raw materials, and supplies needed to offer a product or service. These costs can be impacted by inflation and supply chain dynamics.

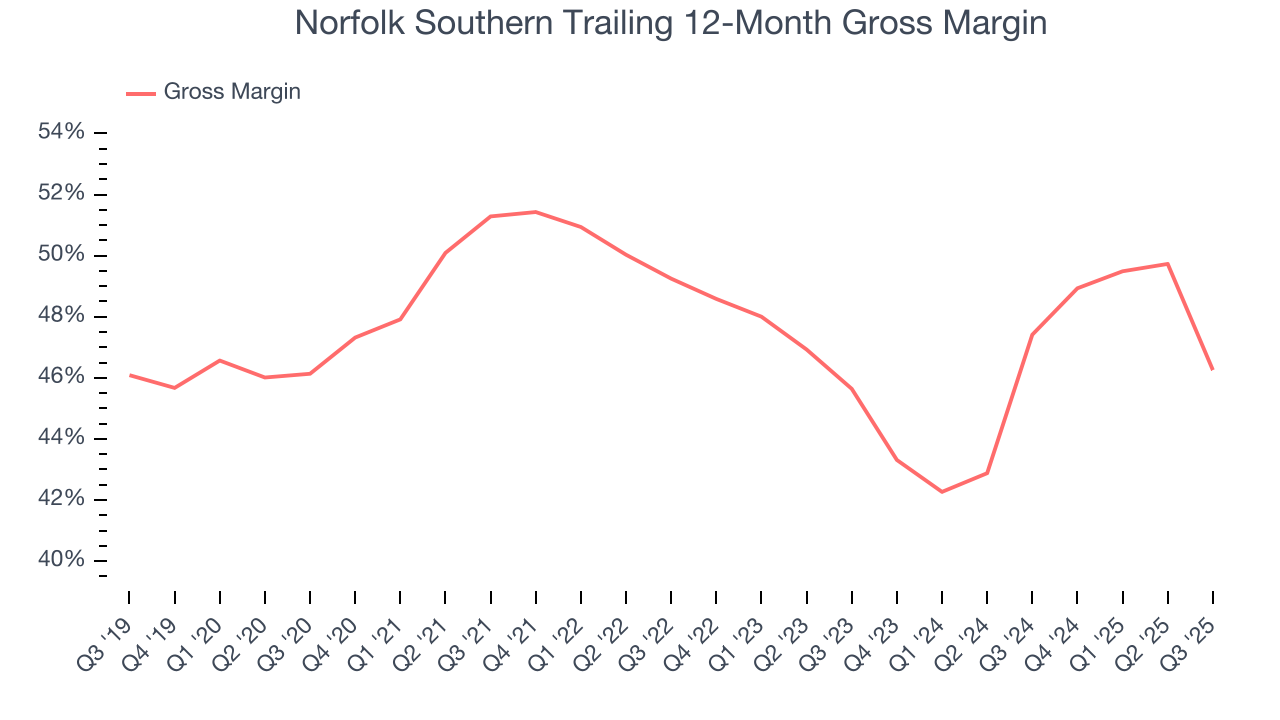

Norfolk Southern has best-in-class unit economics for an industrials company, enabling it to invest in areas such as research and development. Its margin also signals it sells differentiated products, not commodities. As you can see below, it averaged an elite 47.9% gross margin over the last five years. Said differently, roughly $47.89 was left to spend on selling, marketing, R&D, and general administrative overhead for every $100 in revenue.

Norfolk Southern’s gross profit margin came in at 47.1% this quarter, marking a 13.9 percentage point decrease from 61% in the same quarter last year. Norfolk Southern’s full-year margin has also been trending down over the past 12 months, decreasing by 1.2 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs (such as raw materials and manufacturing expenses).

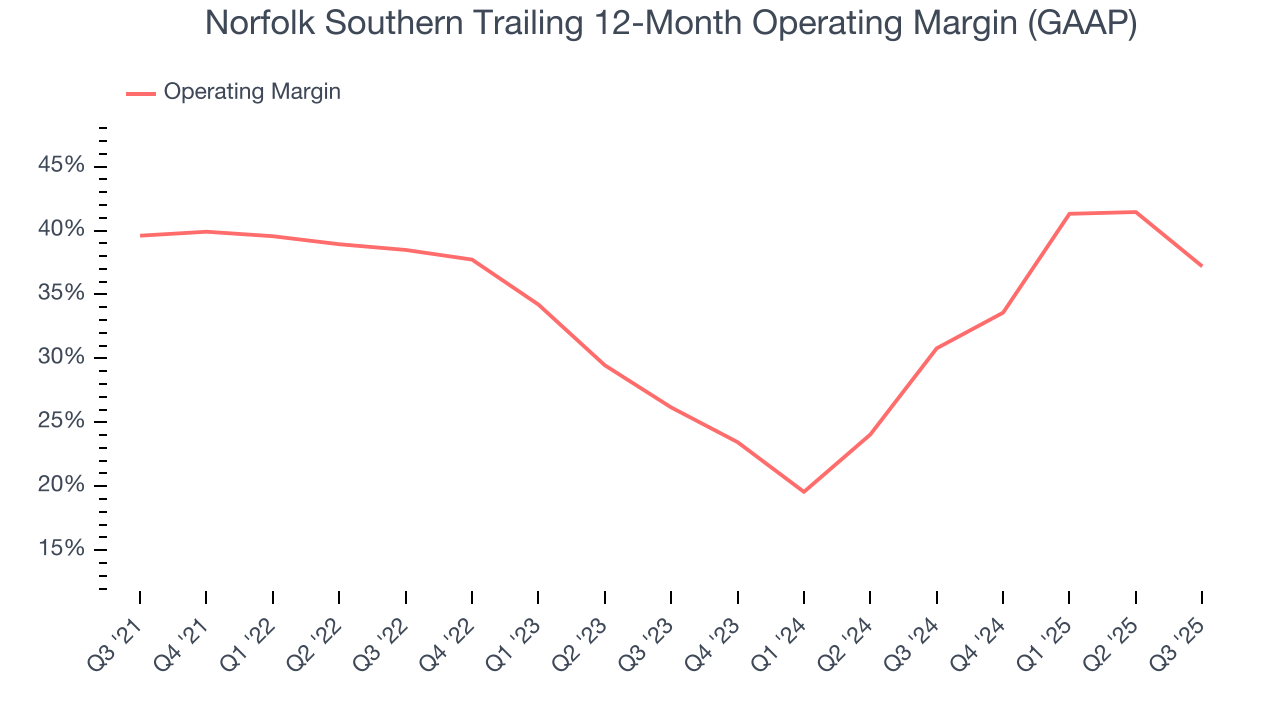

7. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Norfolk Southern has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 34.3%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Norfolk Southern’s operating margin decreased by 2.4 percentage points over the last five years. Many Rail Transportation companies also saw their margins fall (along with revenue, as mentioned above) because the cycle turned in the wrong direction. We hope Norfolk Southern can emerge from this a stronger company, as the silver lining of a downturn is that market share can be won and efficiencies found.

In Q3, Norfolk Southern generated an operating margin profit margin of 35.4%, down 16.9 percentage points year on year. Since Norfolk Southern’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

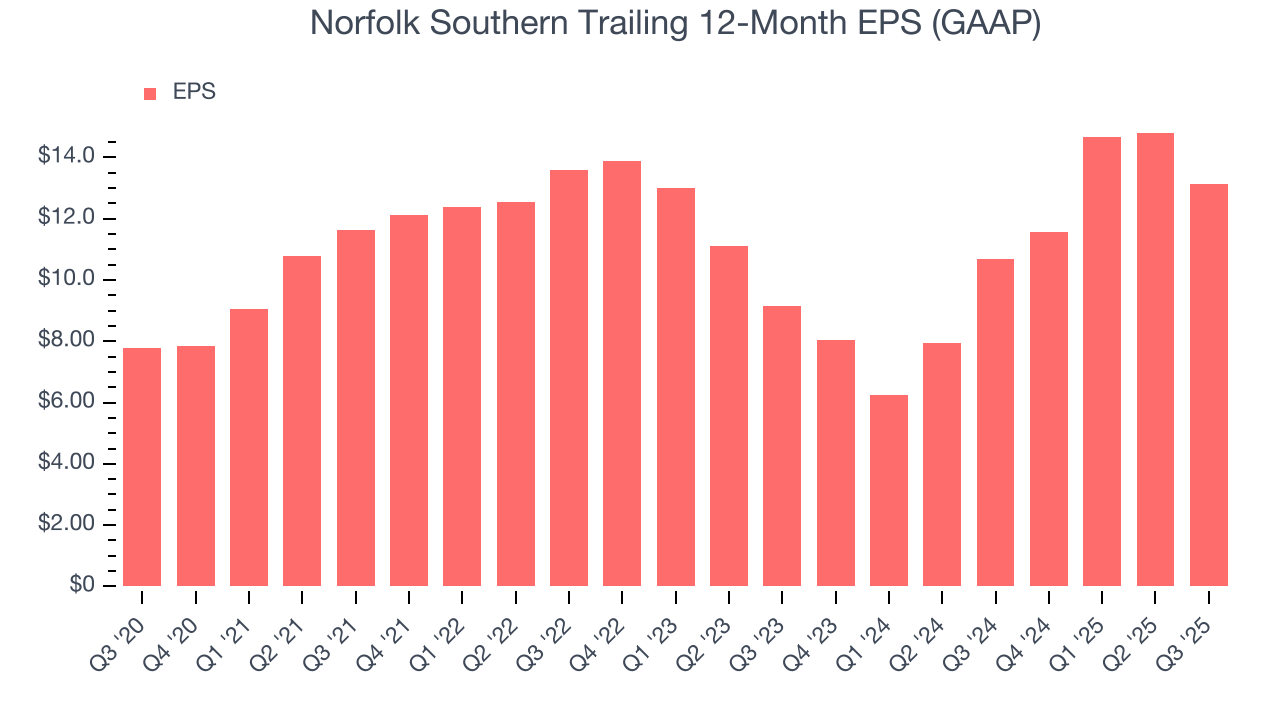

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

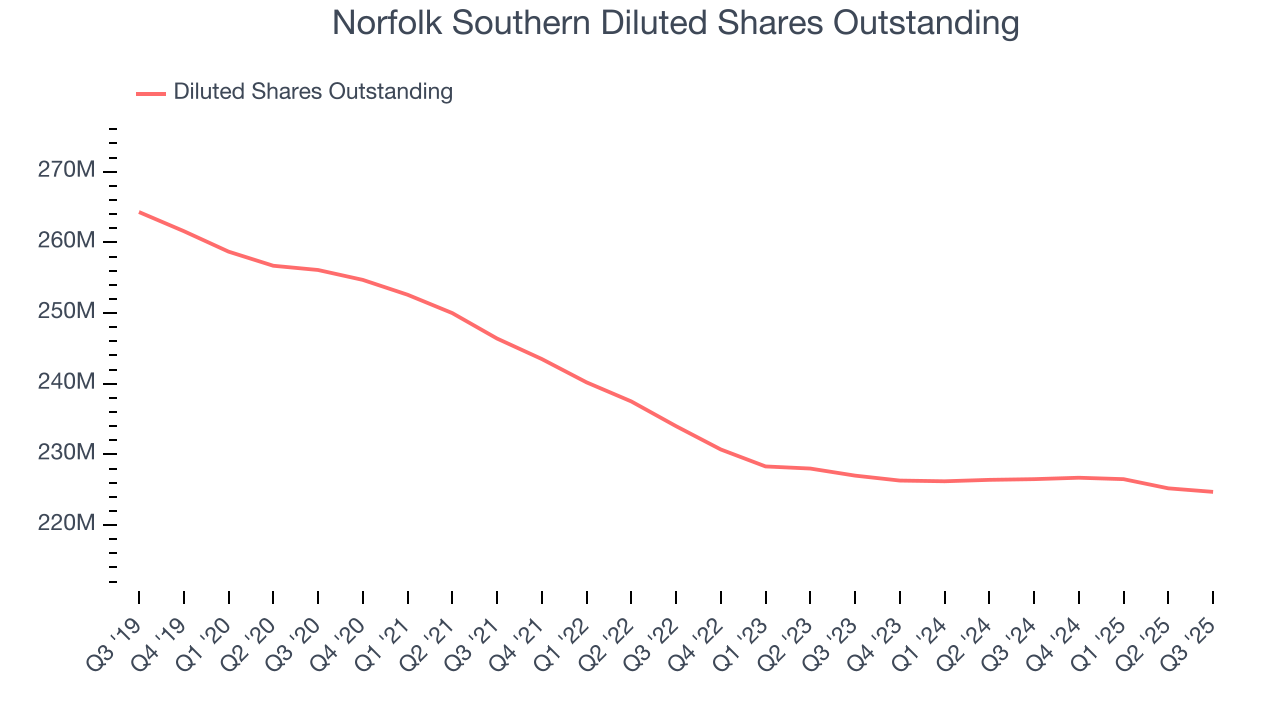

Norfolk Southern’s EPS grew at a solid 11% compounded annual growth rate over the last five years, higher than its 4.3% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Diving into Norfolk Southern’s quality of earnings can give us a better understanding of its performance. A five-year view shows that Norfolk Southern has repurchased its stock, shrinking its share count by 12.3%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Norfolk Southern, its two-year annual EPS growth of 19.8% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q3, Norfolk Southern reported EPS of $3.16, down from $4.85 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects Norfolk Southern’s full-year EPS of $13.12 to grow 1.6%.

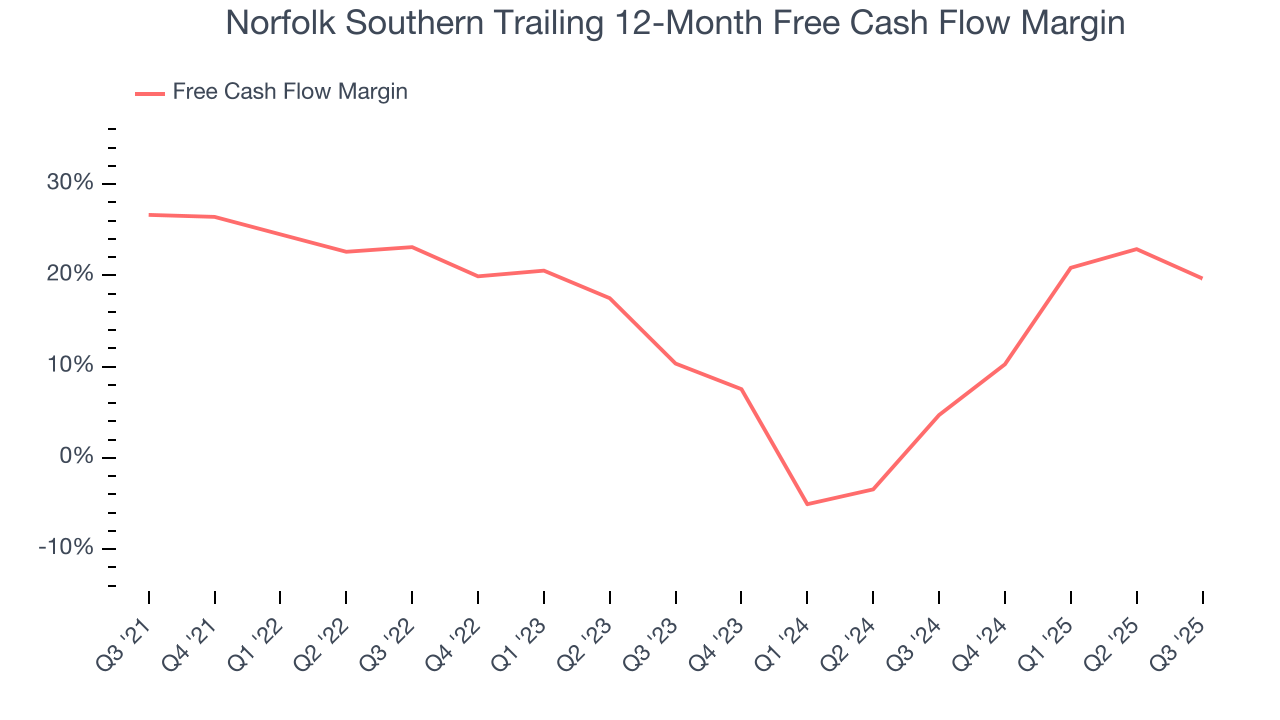

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Norfolk Southern has shown terrific cash profitability, putting it in an advantageous position to invest in new products, return capital to investors, and consolidate the market during industry downturns. The company’s free cash flow margin was among the best in the industrials sector, averaging 16.7% over the last five years.

Taking a step back, we can see that Norfolk Southern’s margin dropped by 7 percentage points during that time. It may have ticked higher more recently, but shareholders are likely hoping for its margin to at least revert to its historical level. If the longer-term trend returns, it could signal increasing investment needs and capital intensity.

Norfolk Southern’s free cash flow clocked in at $720 million in Q3, equivalent to a 23.2% margin. The company’s cash profitability regressed as it was 12.9 percentage points lower than in the same quarter last year, but it’s still above its five-year average. We wouldn’t read too much into this quarter’s decline because investment needs can be seasonal, causing short-term swings. Long-term trends trump temporary fluctuations.

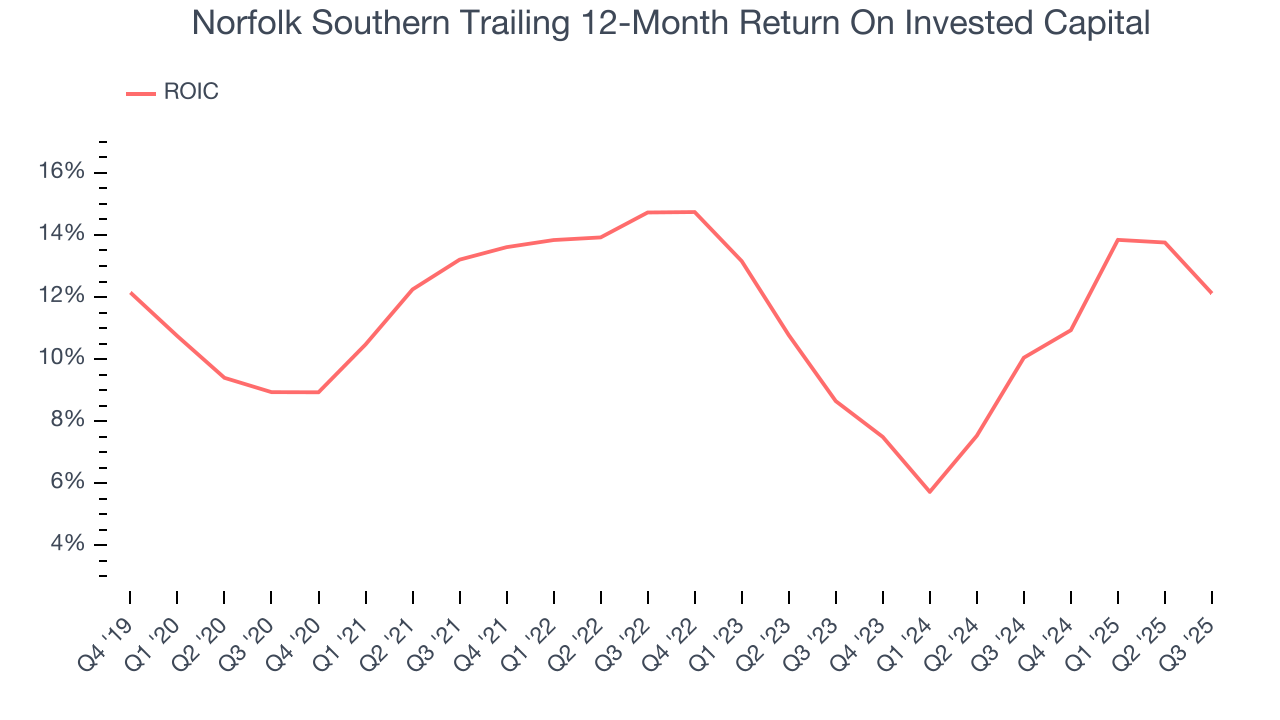

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Norfolk Southern’s management team makes decent investment decisions and generates value for shareholders. Its five-year average ROIC was 11.7%, slightly better than typical industrials business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Norfolk Southern’s ROIC averaged 2.9 percentage point decreases each year. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

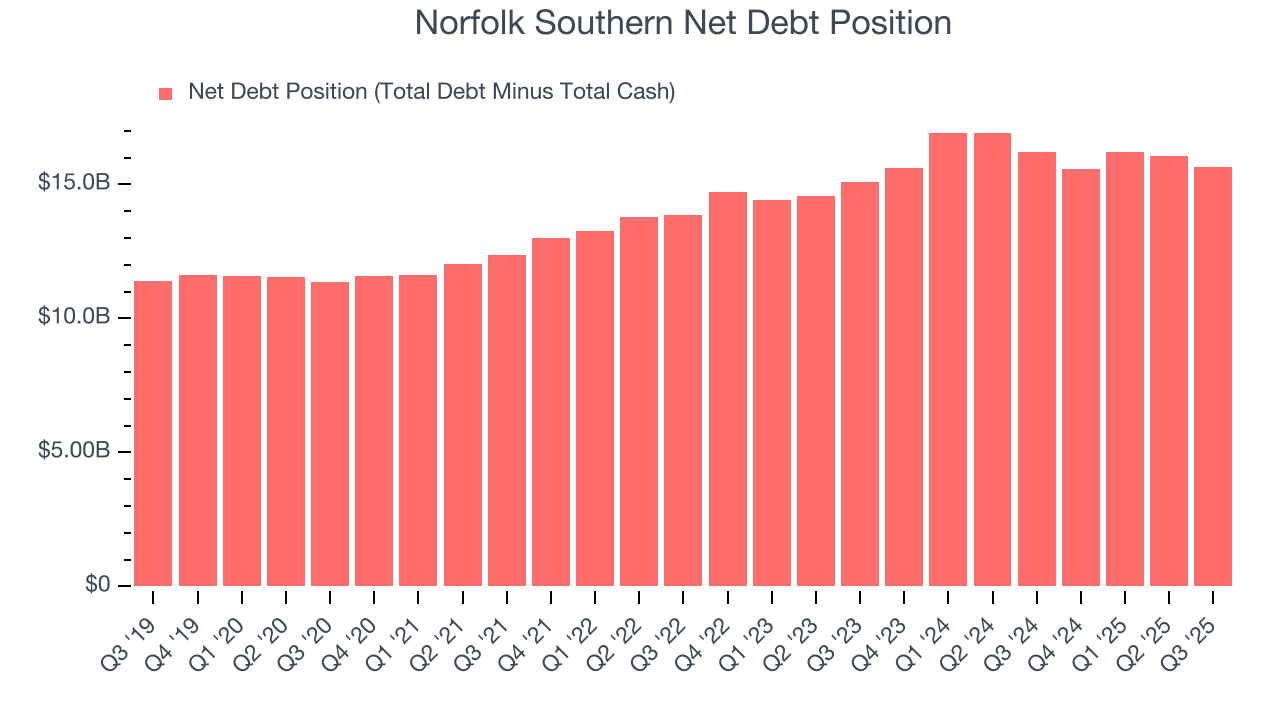

11. Balance Sheet Assessment

Norfolk Southern reported $1.42 billion of cash and $17.08 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $5.64 billion of EBITDA over the last 12 months, we view Norfolk Southern’s 2.8× net-debt-to-EBITDA ratio as safe. We also see its $402 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Norfolk Southern’s Q3 Results

We struggled to find many positives in these results. Its revenue was just in line and its EPS missed. The stock remained flat at $285.41 immediately following the results.

13. Is Now The Time To Buy Norfolk Southern?

Updated: January 24, 2026 at 10:31 PM EST

When considering an investment in Norfolk Southern, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

We see the value of companies helping their customers, but in the case of Norfolk Southern, we’re out. To kick things off, its revenue growth was uninspiring over the last five years, and analysts expect its demand to deteriorate over the next 12 months. And while its admirable gross margins indicate the mission-critical nature of its offerings, the downside is its projected EPS for the next year is lacking. On top of that, its cash profitability fell over the last five years.

Norfolk Southern’s P/E ratio based on the next 12 months is 23.6x. At this valuation, there’s a lot of good news priced in - we think other companies feature superior fundamentals at the moment.

Wall Street analysts have a consensus one-year price target of $310.63 on the company (compared to the current share price of $287.27).