Nubank (NU)

Nubank is an amazing business. Its revenue growth shows it’s winning market share, underscoring the popularity of its offerings.― StockStory Analyst Team

1. News

2. Summary

Why We Like Nubank

With nearly 94 million customers across Brazil, Mexico, and Colombia through its viral member-get-member referral program, Nubank (NYSE:NU) is a digital banking platform that offers financial services including spending, saving, investing, borrowing, and protection products to millions of customers across Latin America.

- Annual revenue growth of 83.4% over the last five years was superb and indicates its market share increased during this cycle

- Earnings per share have massively outperformed its peers over the last three years, increasing by 153% annually

- The stock is a timely buy because it’s trading at a reasonable price relative to its growth prospects

Nubank is a remarkable business. The price seems fair relative to its quality, and we think now is an opportune time to buy the stock.

Why Is Now The Time To Buy Nubank?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Nubank?

At $15.90 per share, Nubank trades at 18.8x forward P/E. Many financials names may carry a lower valuation multiple, but Nubank’s price is fair given its business quality.

Entry price certainly impacts returns, but over a long-term, multi-year period, business quality matters much more than where you buy a stock.

3. Nubank (NU) Research Report: Q3 CY2025 Update

Digital banking platform Nubank (NYSE:NU) reported revenue ahead of Wall Streets expectations in Q3 CY2025, with sales up 41.8% year on year to $4.17 billion. Its non-GAAP profit of $0.17 per share was in line with analysts’ consensus estimates.

Nubank (NU) Q3 CY2025 Highlights:

- Revenue: $4.17 billion vs analyst estimates of $4.04 billion (41.8% year-on-year growth, 3.4% beat)

- Pre-tax Profit: $1.12 billion (26.8% margin)

- Adjusted EPS: $0.17 vs analyst estimates of $0.17 (in line)

- Market Capitalization: $76.85 billion

Company Overview

With nearly 94 million customers across Brazil, Mexico, and Colombia through its viral member-get-member referral program, Nubank (NYSE:NU) is a digital banking platform that offers financial services including spending, saving, investing, borrowing, and protection products to millions of customers across Latin America.

Nu's business model centers on creating a digital alternative to the traditional banking experience, with a full suite of financial products accessible entirely through its mobile app. The company organizes its offerings into what it calls the "Five Financial Seasons": spending, saving, investing, borrowing, and protecting. Each category contains multiple product lines designed to meet different customer needs at various financial life stages.

Under its spending solutions, Nu offers credit and prepaid cards, including its premium Ultraviolet metal card for affluent users, plus mobile payment capabilities integrated with Brazil's instant payment system (Pix). Its saving solutions include personal and business accounts with interest-earning capabilities. Investing products range from "Money Boxes" (goal-based investment portfolios) to cryptocurrency trading and traditional investment accounts offering equities and fixed income.

Nu's borrowing solutions include personal unsecured loans, investment-backed loans, payroll-deductible loans, and various financing options. The company also offers insurance products covering life, mobile devices, auto, home, and financial protection through its brokerage services.

Nu's proprietary technology platform, NuCore, powers all of its operations, with capabilities including transaction processing, credit underwriting, fraud prevention, and regulatory reporting. The company employs a cloud-based architecture with over 500 microservices, allowing for rapid product development and scalability. Customer service is handled by specially trained "Xpeers" who aim to solve issues on first contact, supported by proprietary technology systems that help identify and address customer needs efficiently.

4. Personal Loan

Personal loan providers offer unsecured credit for various consumer needs. The sector benefits from digital application processes, increasing consumer comfort with online financial services, and opportunities in underserved credit segments. Headwinds include credit risk management in unsecured lending, regulatory oversight of lending practices, and intense competition affecting margins from both traditional and fintech lenders.

Nubank's competitors include traditional banking institutions across Latin America, as well as digital banking platforms like Banco Inter (BIDI11.SA), Ualá, and Brazil's largest banks: Itaú Unibanco (NYSE:ITUB), Banco Bradesco (NYSE:BBD), and Banco Santander Brasil (NYSE:BSBR). In fintech services, it also competes with PagSeguro (NYSE:PAGS) and StoneCo (NASDAQ:STNE).

5. Revenue Growth

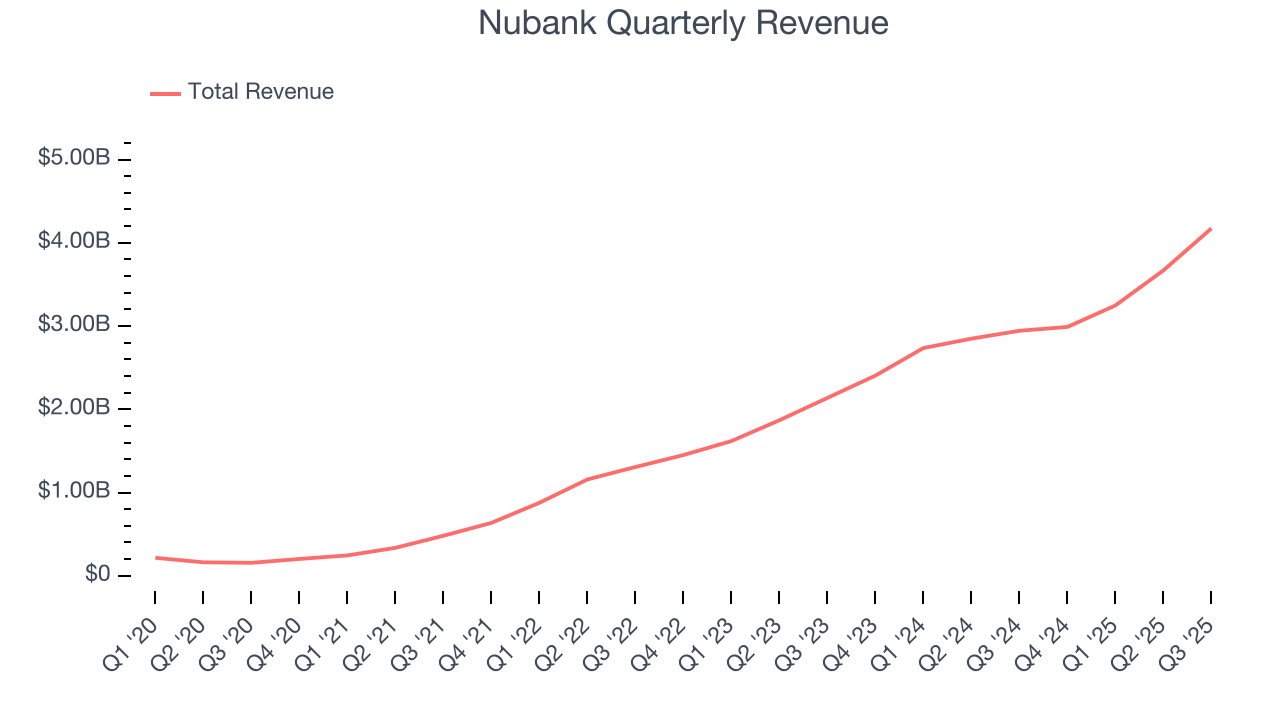

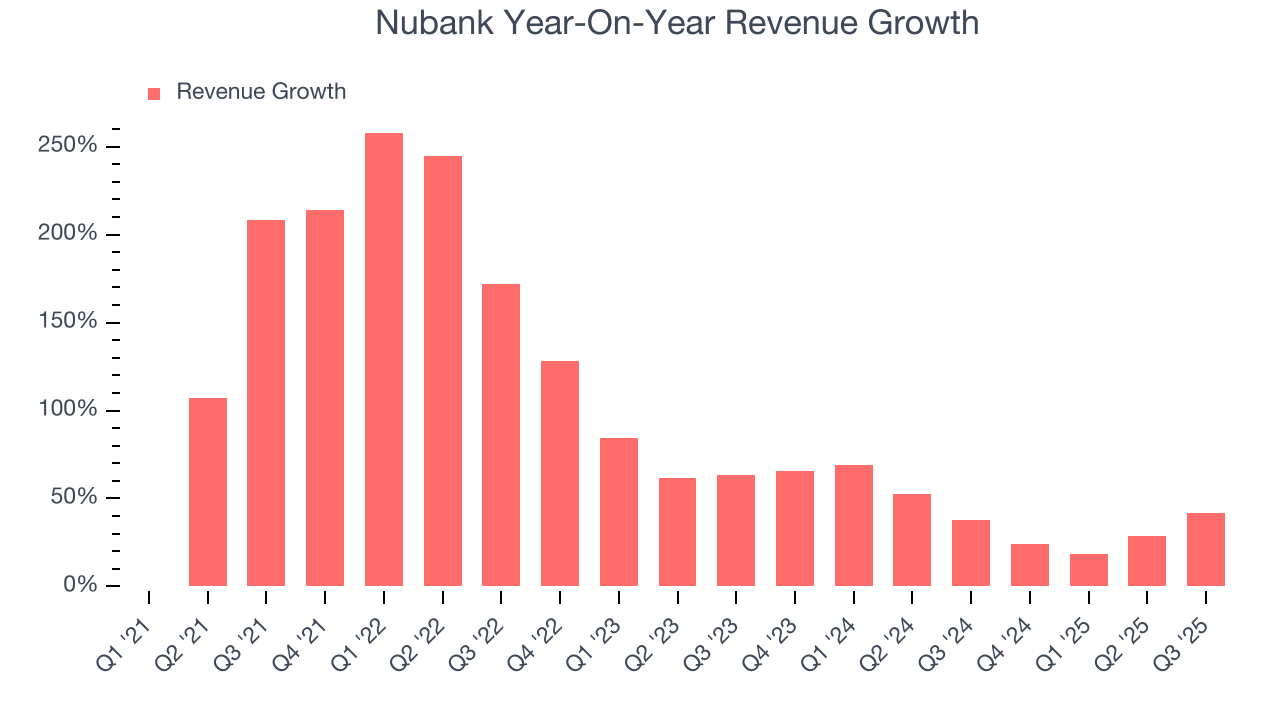

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, Nubank grew its revenue at an incredible 83.4% compounded annual growth rate. Its growth surpassed the average financials company and shows its offerings resonate with customers, a great starting point for our analysis.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. Nubank’s annualized revenue growth of 41.1% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Nubank reported magnificent year-on-year revenue growth of 41.8%, and its $4.17 billion of revenue beat Wall Street’s estimates by 3.4%.

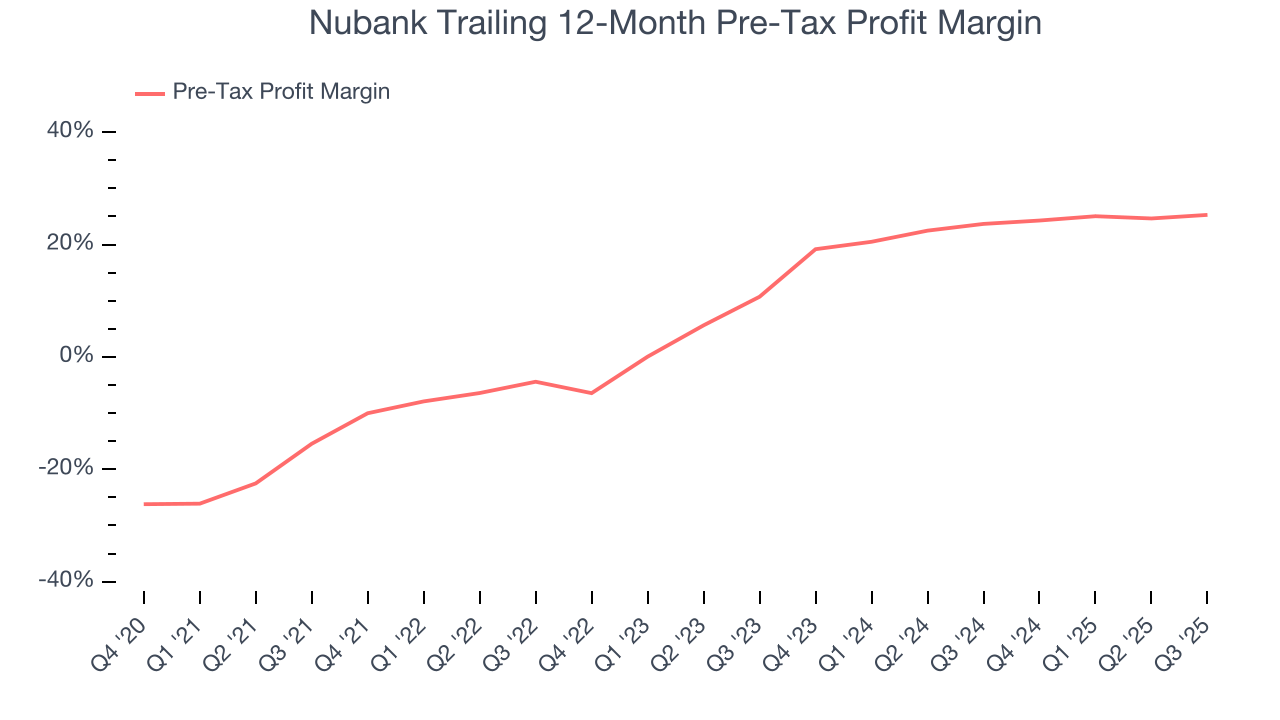

6. Pre-Tax Profit Margin

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For Personal Loan companies, we look at pre-tax profit rather than the operating margin that defines sectors such as consumer, tech, and industrials.

Interest income and expenses play a big role in financial institutions' profitability, so they should be factored into the definition of profit. Taxes, however, should not as they are largely out of a company's control. This is pre-tax profit by definition.

Over the last four years, Nubank’s pre-tax profit margin has fallen by 40.7 percentage points, going from negative 15.5% to 25.3%. It has also expanded by 14.6 percentage points on a two-year basis, showing its expenses have consistently grown at a slower rate than revenue. This typically signals prudent management.

Nubank’s pre-tax profit margin came in at 26.8% this quarter. This result was 2.2 percentage points better than the same quarter last year.

7. Earnings Per Share

We track the change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Nubank’s EPS grew at an astounding 72.8% compounded annual growth rate over the last two years, higher than its 41.1% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Diving into Nubank’s quality of earnings can give us a better understanding of its performance. Nubank’s pre-tax profit margin has expanded over the last two years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q3, Nubank reported adjusted EPS of $0.17, up from $0.12 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects Nubank’s full-year EPS of $0.57 to grow 52.3%.

8. Return on Equity

Return on equity, or ROE, tells us how much profit a company generates for each dollar of shareholder equity, a key funding source for banks. Over a long period, banks with high ROE tend to compound shareholder wealth faster through retained earnings, buybacks, and dividends.

Over the last five years, Nubank has averaged an ROE of 8.7%, uninspiring for a company operating in a sector where the average shakes out around 10%. We’re optimistic Nubank can turn the ship around given its success in other measures of financial health.

9. Balance Sheet Assessment

Leverage is core to a financial firm’s business model (loans funded by deposits). To ensure economic stability and avoid a repeat of the 2008 GFC, regulators require certain levels of capital and liquidity, focusing on the Tier 1 capital ratio.

Tier 1 capital is the highest-quality capital that a firm holds, consisting primarily of common stock and retained earnings, but also physical gold. It serves as the primary cushion against losses and is the first line of defense in times of financial distress.

This capital is divided by risk-weighted assets to derive the Tier 1 capital ratio. Risk-weighted means that cash and US treasury securities are assigned little risk while unsecured consumer loans and equity investments get much higher risk weights, for example.

New regulation after the 2008 financial crisis requires that all firms must maintain a Tier 1 capital ratio greater than 4.5%. On top of this, there are additional buffers based on scale, risk profile, and other regulatory classifications, so that at the end of the day, firms generally must maintain a 7-10% ratio at minimum.

Over the last two years, Nubank has averaged a Tier 1 capital ratio of 12.8%, which is considered safe and well capitalized in the event that macro or market conditions suddenly deteriorate.

10. Key Takeaways from Nubank’s Q3 Results

It was encouraging to see Nubank beat analysts’ revenue expectations this quarter. Overall, this print had some key positives. The stock remained flat at $15.92 immediately following the results.

11. Is Now The Time To Buy Nubank?

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own Nubank, you should also grasp the company’s longer-term business quality and valuation.

Nubank is one of the best financials companies out there. For starters, its revenue growth was exceptional over the last five years. On top of that, its astounding EPS growth over the last three years shows its profits are trickling down to shareholders, and its expanding pre-tax profit margin shows the business has become more efficient.

Nubank’s P/E ratio based on the next 12 months is 18.3x. Scanning the financials landscape today, Nubank’s fundamentals clearly illustrate that it’s an elite business, and we like it at this price.

Wall Street analysts have a consensus one-year price target of $19.21 on the company (compared to the current share price of $15.92), implying they see 20.7% upside in buying Nubank in the short term.