Nextdoor (NXDR)

We’re skeptical of Nextdoor. Its poor revenue growth shows demand is soft and its cash burn makes us question its business model.― StockStory Analyst Team

1. News

2. Summary

Why We Think Nextdoor Will Underperform

Helping residents figure out what's happening on their block in real time, Nextdoor (NYSE:KIND) is a social network that connects neighbors with each other and with local businesses.

- Negative free cash flow raises questions about the return timeline for its investments

- Suboptimal cost structure is highlighted by its history of EBITDA margin losses

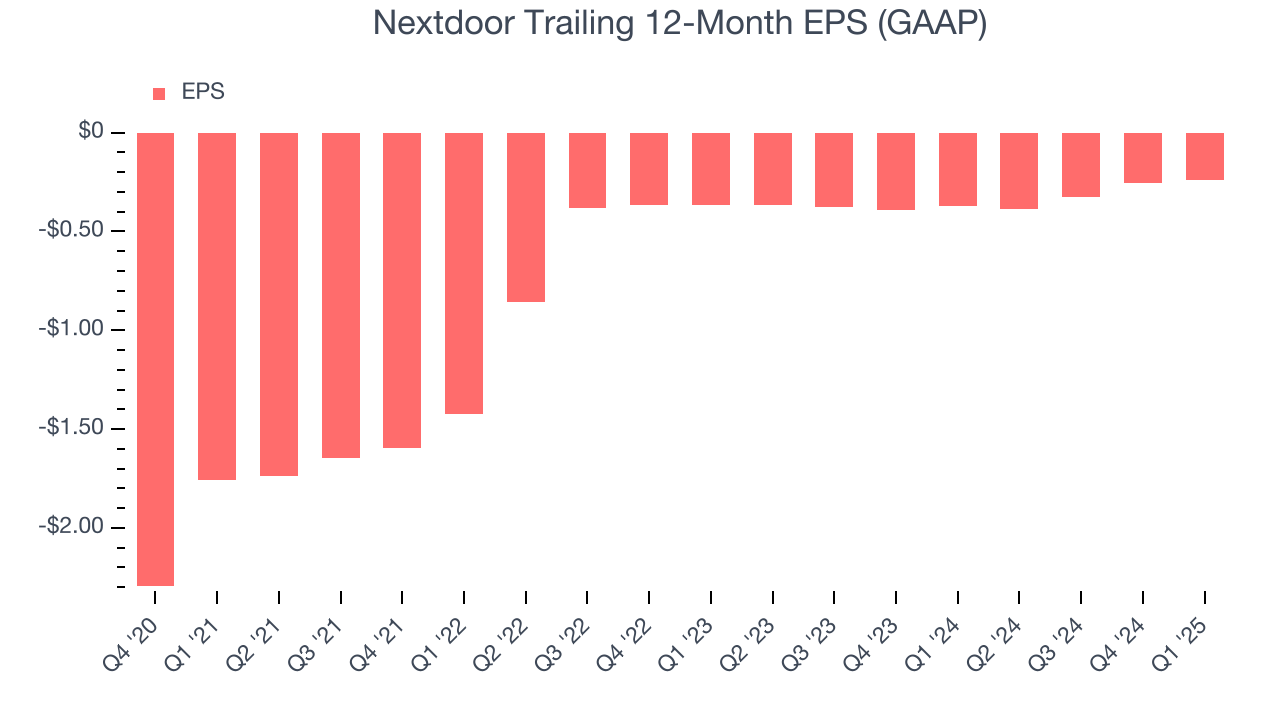

- A bright spot is that its additional sales over the last three years increased its profitability as the 24.3% annual growth in its earnings per share outpaced its revenue

Nextdoor’s quality is not up to our standards. There are better opportunities in the market.

Why There Are Better Opportunities Than Nextdoor

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Nextdoor

Nextdoor’s stock price of $2.14 implies a valuation ratio of 3.8x forward price-to-gross profit. This sure is a cheap multiple, but you get what you pay for.

Our advice is to pay up for elite businesses whose advantages are tailwinds to earnings growth. Don’t get sucked into lower-quality businesses just because they seem like bargains. These mediocre businesses often never achieve a higher multiple as hoped, a phenomenon known as a “value trap”.

3. Nextdoor (NXDR) Research Report: Q2 CY2025 Update

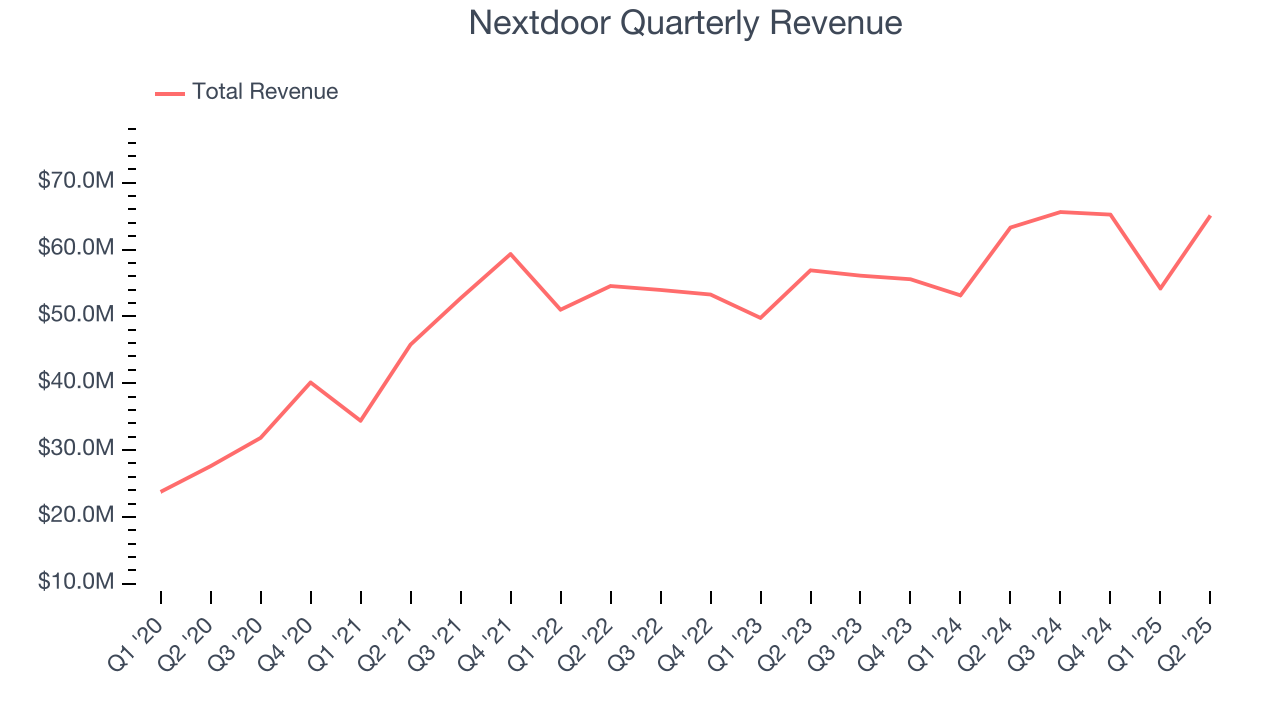

Neighborhood social network Nextdoor (NYSE:KIND) beat Wall Street’s revenue expectations in Q2 CY2025, with sales up 2.8% year on year to $65.09 million.

Nextdoor (KIND) Q2 CY2025 Highlights:

- Revenue: $65.09 million vs analyst estimates of $61.34 million (2.8% year-on-year growth, 6.1% beat)

- Adjusted EBITDA: -$2.25 million vs analyst estimates of -$9.81 million (-3.5% margin, 77.1% beat)

- Operating Margin: -31.1%, up from -77.4% in the same quarter last year

- Market Capitalization: $673.4 million

Company Overview

Helping residents figure out what's happening on their block in real time, Nextdoor (NYSE:KIND) is a social network that connects neighbors with each other and with local businesses.

Nextdoor Holdings was founded in 2008 in San Francisco and went public in 2021. The company aims to connect neighbors and local organizations (restaurants, local government entities) with each other so they can exchange information, goods, and services.

Nextdoor's primary product is a private social network for neighborhoods, and the company generates most of its revenue from advertising (as opposed to from users). The platform allows neighborhood residents to create private groups where they can post updates, events, and classifieds, and connect with neighbors. It also offers a directory of local businesses and services, allowing residents to find trusted recommendations from their neighbors. Additionally, Nextdoor has features such as crime and safety updates, lost and found pets, and emergency preparedness resources, which make it a valuable tool for residents to stay informed and connected with their community.

In the aftermath of natural disasters like hurricanes, wildfires, and earthquakes, for example, Nextdoor was used by residents to connect and support each other. During the COVID-19 pandemic, the platform has been used to organize food drives, mask donations, and other mutual aid efforts.

4. Social Networking

Businesses must meet their customers where they are, which over the past decade has come to mean on social networks. In 2020, users spent over 2.5 hours a day on social networks, a figure that has increased every year since measurement began. As a result, businesses continue to shift their advertising and marketing dollars online.

Competitors offering localized social networking include Meta (NASDAQ:META), Alphabet (NASDAQ:GOOGL) because of its Maps app, and Yelp (NYSE:YELP).

5. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Regrettably, Nextdoor’s sales grew at a sluggish 4.8% compounded annual growth rate over the last three years. This was below our standard for the consumer internet sector and is a poor baseline for our analysis.

This quarter, Nextdoor reported modest year-on-year revenue growth of 2.8% but beat Wall Street’s estimates by 6.1%.

Looking ahead, sell-side analysts expect revenue to grow 2.8% over the next 12 months, a slight deceleration versus the last three years. This projection is underwhelming and suggests its products and services will face some demand challenges.

6. Weekly Active Users

User Growth

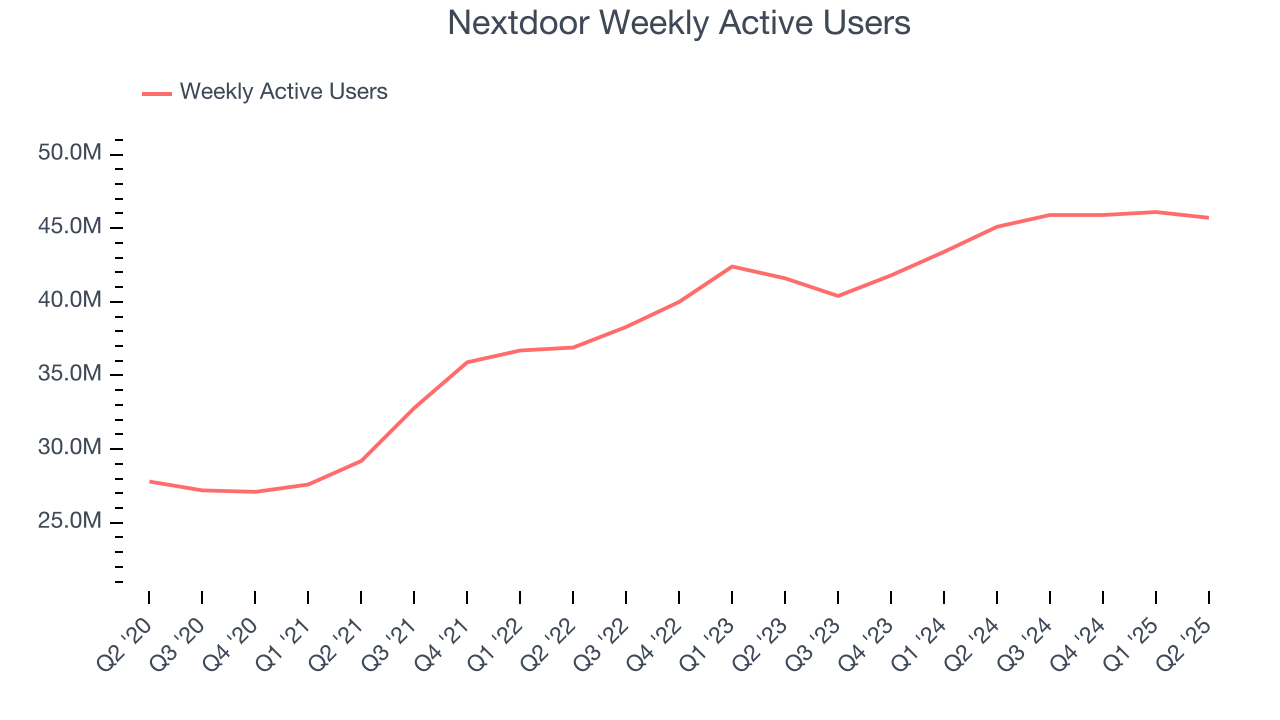

As a social network, Nextdoor generates revenue growth by increasing its user base and charging advertisers more for the ads each user is shown.

Over the last two years, Nextdoor’s weekly active users, a key performance metric for the company, increased by 6.5% annually to 45.71 million in the latest quarter. This growth rate is slightly below average for a consumer internet business. If Nextdoor wants to reach the next level, it likely needs to enhance the appeal of its current offerings or innovate with new products.

In Q2, Nextdoor added 609,069 weekly active users, leading to 1.4% year-on-year growth. The quarterly print was lower than its two-year result, suggesting its new initiatives aren’t accelerating user growth just yet.

Revenue Per User

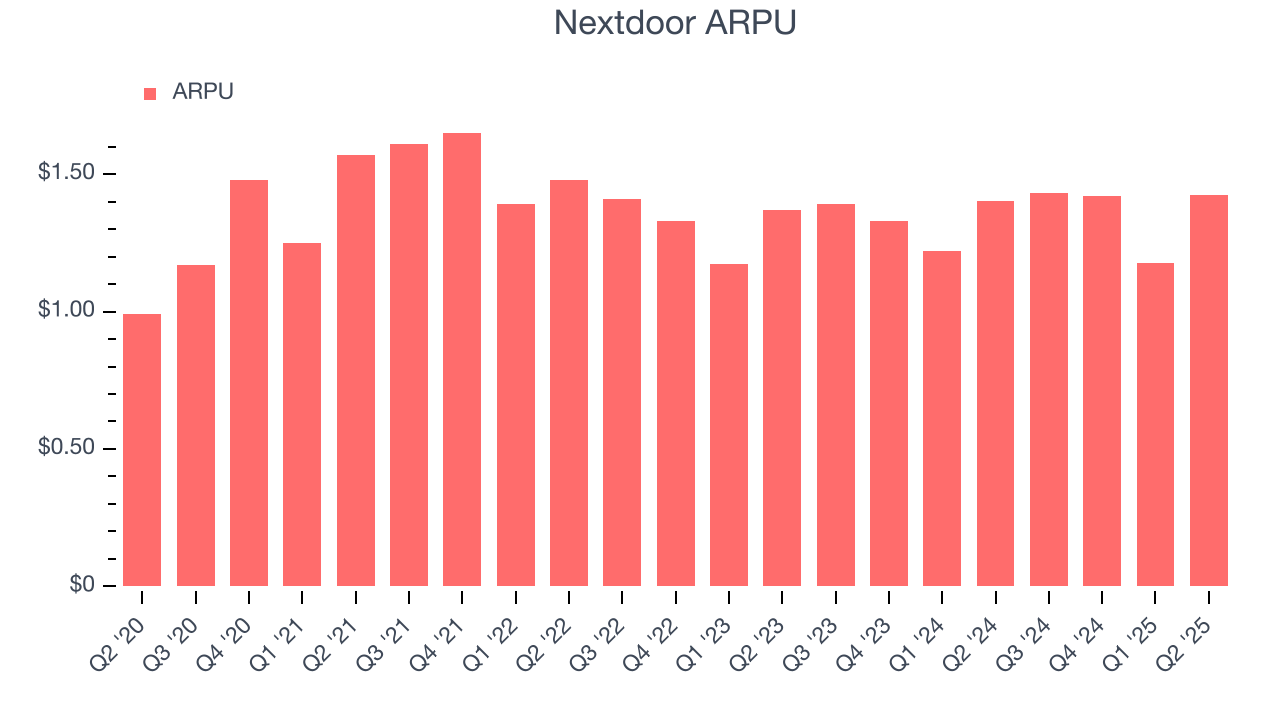

Average revenue per user (ARPU) is a critical metric to track because it measures how much the company earns from the ads shown to its users. ARPU can also be a proxy for how valuable advertisers find Nextdoor’s audience and its ad-targeting capabilities.

Nextdoor’s ARPU growth has been subpar over the last two years, averaging 1.6%. This isn’t great when combined with its weaker weekly active users performance. If Nextdoor tries boosting ARPU by taking a more aggressive approach to monetization, it’s unclear whether user growth would be sustainable.

This quarter, Nextdoor’s ARPU clocked in at $1.42. It grew by 1.6% year on year, mirroring the performance of its weekly active users.

7. Gross Margin & Pricing Power

For social network businesses like Nextdoor, gross profit tells us how much money the company gets to keep after covering the base cost of its products and services, which typically include customer service, data center, and other infrastructure expenses.

Nextdoor’s gross margin is one of the highest in the consumer internet sector, an output of its asset-lite business model and strong pricing power. It also enables the company to fund large investments in product and marketing during periods of rapid growth to achieve outsized profits at scale. As you can see below, it averaged an elite 82.4% gross margin over the last two years. Said differently, roughly $82.44 was left to spend on selling, marketing, and R&D for every $100 in revenue.

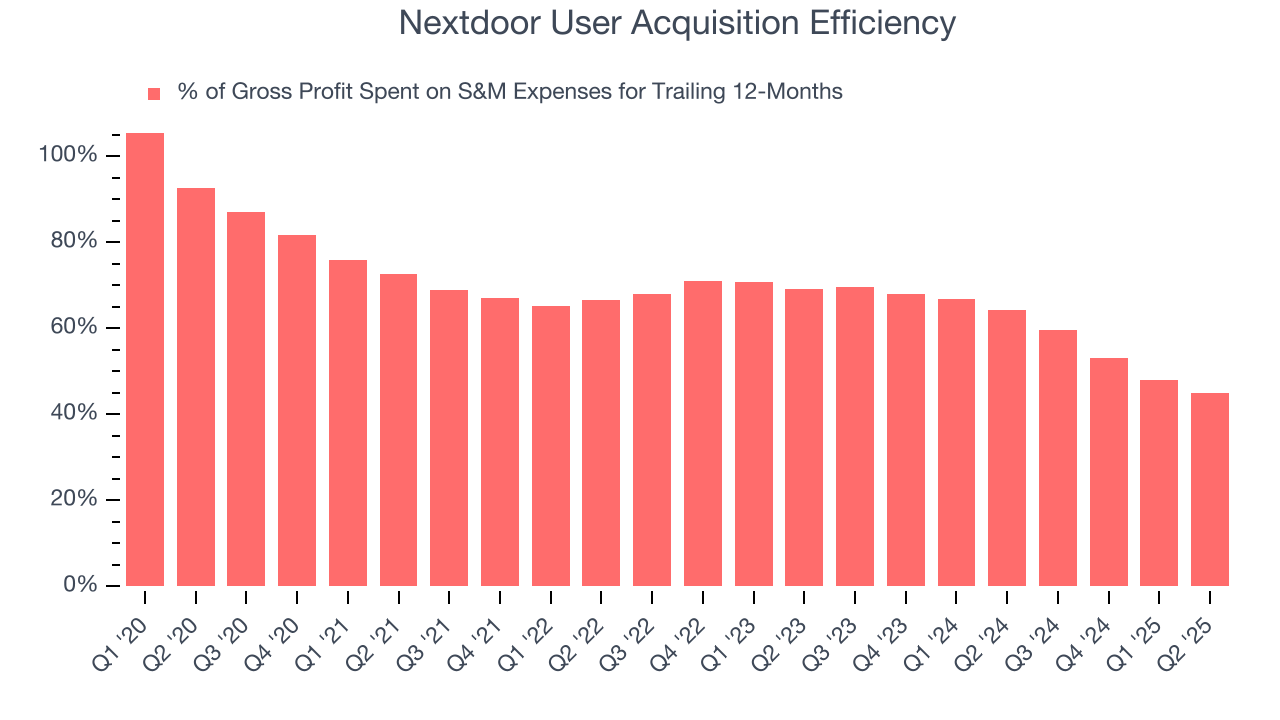

8. User Acquisition Efficiency

Consumer internet businesses like Nextdoor grow from a combination of product virality, paid advertisement, and incentives (unlike enterprise software products, which are often sold by dedicated sales teams).

Nextdoor does a decent job acquiring new users, spending 45% of its gross profit on sales and marketing expenses over the last year. This decent efficiency indicates relatively solid competitive positioning, giving Nextdoor the freedom to invest its resources into new growth initiatives.

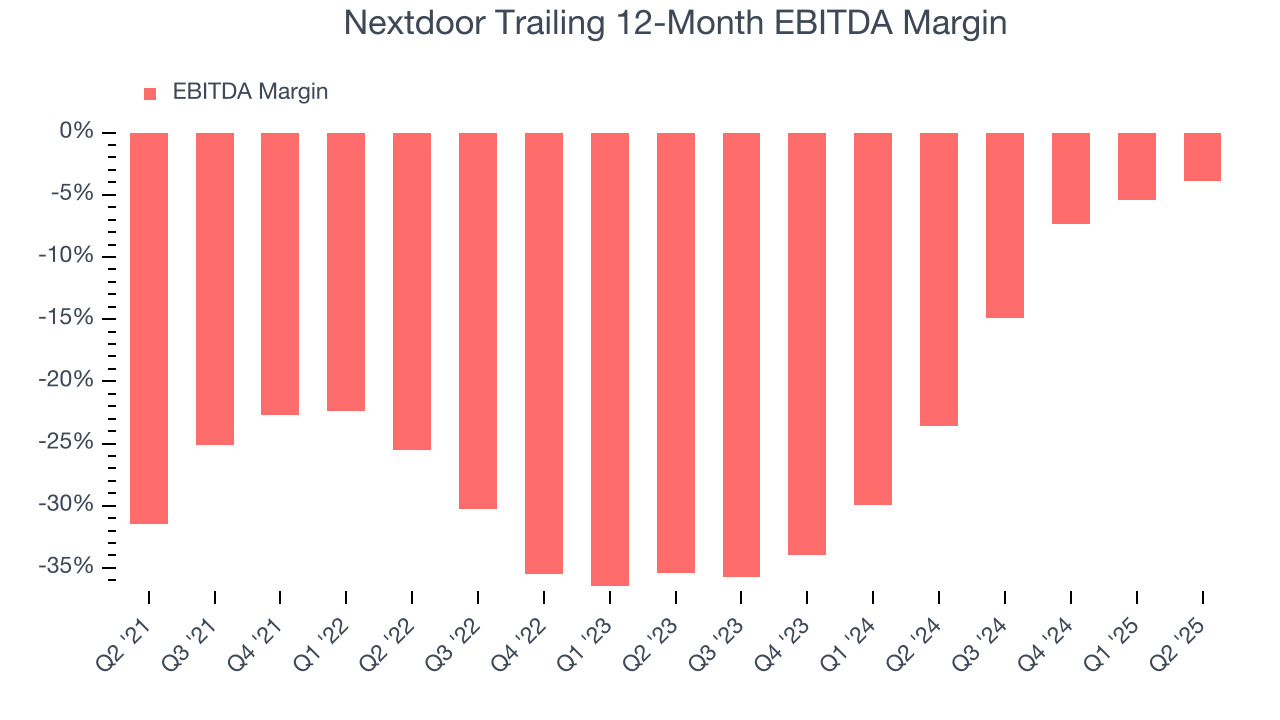

9. EBITDA

Operating income is often evaluated to assess a company’s underlying profitability. In a similar vein, EBITDA is used to analyze consumer internet companies because it excludes various one-time or non-cash expenses (depreciation), providing a clearer view of the business’s profit potential.

Nextdoor’s expensive cost structure has contributed to an average EBITDA margin of negative 13.3% over the last two years. Unprofitable consumer internet companies require extra attention because they spend heaps of money to capture market share. As seen in its historically underwhelming revenue performance, this strategy hasn’t worked so far, and it’s unclear what would happen if Nextdoor reeled back its investments. Wall Street seems to think it will face some obstacles, and we tend to agree.

On the plus side, Nextdoor’s EBITDA margin rose by 21.7 percentage points over the last few years, as its sales growth gave it operating leverage. Still, it will take much more for the company to reach long-term profitability.

In Q2, Nextdoor generated a negative 3.5% EBITDA margin. The company's consistent lack of profits raise a flag.

10. Earnings Per Share

Revenue trends explain a company’s historical growth, but the change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

11. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

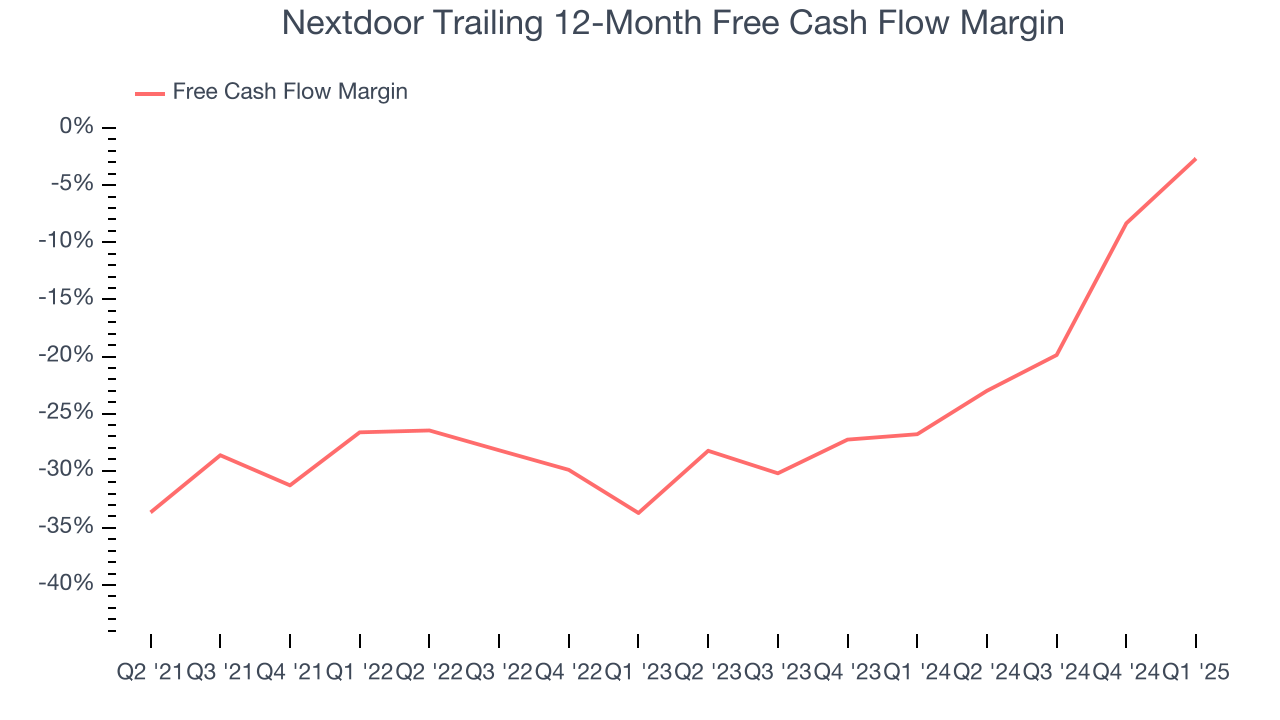

Nextdoor’s demanding reinvestments have drained its resources over the last two years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 13%, meaning it lit $12.98 of cash on fire for every $100 in revenue.

Taking a step back, an encouraging sign is that Nextdoor’s margin expanded by 20.4 percentage points over the last few years. In light of its glaring cash burn, however, this improvement is a bucket of hot water in a cold ocean.

12. Balance Sheet Assessment

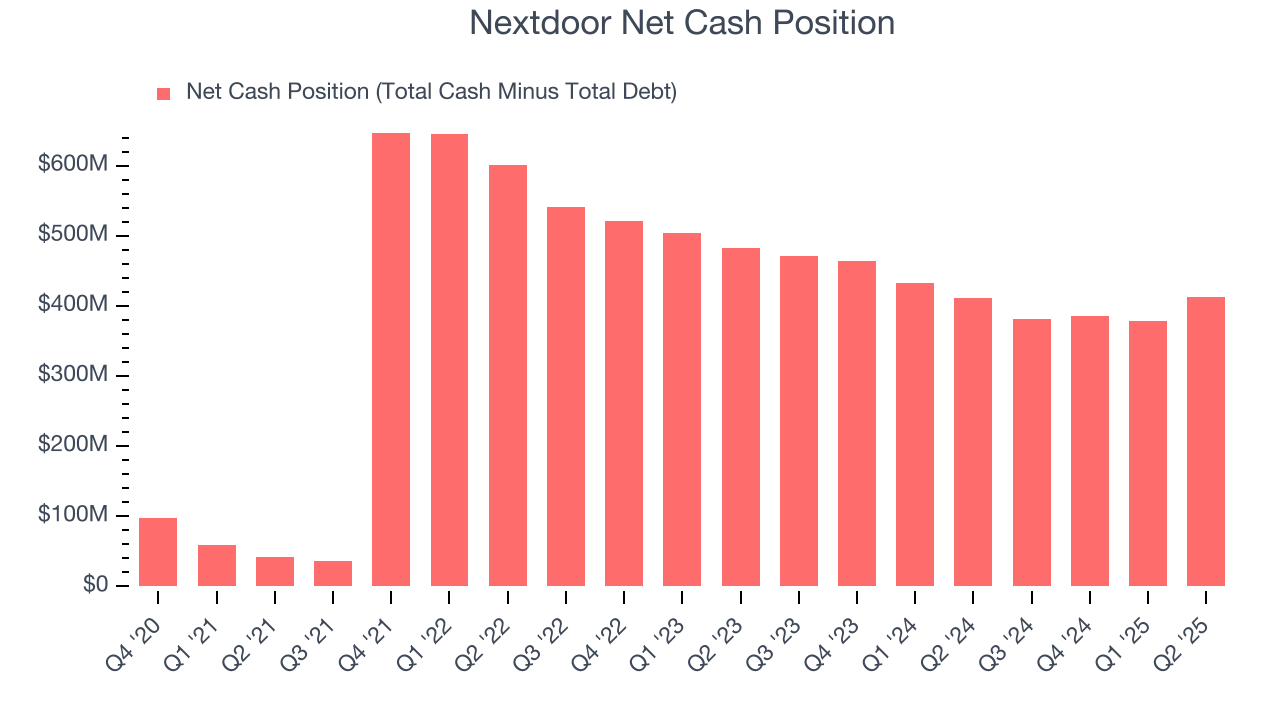

Companies with more cash than debt have lower bankruptcy risk.

Nextdoor is a well-capitalized company with $413 million of cash and no debt. This position is 61.3% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

13. Key Takeaways from Nextdoor’s Q2 Results

We were impressed by how significantly Nextdoor blew past analysts’ EBITDA expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. Zooming out, we think this was a good print with some key areas of upside. The stock remained flat at $1.89 immediately following the results.

14. Is Now The Time To Buy Nextdoor?

Updated: December 24, 2025 at 9:37 PM EST

Before investing in or passing on Nextdoor, we urge you to understand the company’s business quality (or lack thereof), valuation, and the latest quarterly results - in that order.

Nextdoor’s business quality ultimately falls short of our standards. To begin with, its revenue growth was weak over the last three years, and analysts don’t see anything changing over the next 12 months. And while its rising cash profitability gives it more optionality, the downside is its cash burn raises the question of whether it can sustainably maintain growth. On top of that, its EBITDA margins reveal poor profitability compared to other consumer internet companies.

Nextdoor’s price-to-gross profit ratio based on the next 12 months is 3.8x. Investors with a higher risk tolerance might like the company, but we think the potential downside is too great. We're pretty confident there are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $2.34 on the company (compared to the current share price of $2.17).