Omnicom Group (OMC)

We’re wary of Omnicom Group. Its weak sales growth and declining returns on capital show its demand and profits are shrinking.― StockStory Analyst Team

1. News

2. Summary

Why Omnicom Group Is Not Exciting

With a vast network of creative agencies that helped craft some of the most memorable ad campaigns in history, Omnicom Group (NYSE:OMC) is a strategic holding company that provides advertising, marketing, and communications services to many of the world's largest companies.

- Scale is a double-edged sword because it limits the company’s growth potential compared to its smaller competitors, as reflected in its below-average annual revenue increases of 3.5% for the last five years

- Organic sales performance over the past two years indicates the company may need to make strategic adjustments or rely on M&A to catalyze faster growth

- On the bright side, its massive revenue base of $16.07 billion makes it a well-known name that influences purchasing decisions

Omnicom Group is in the doghouse. We see more favorable opportunities in the market.

Why There Are Better Opportunities Than Omnicom Group

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Omnicom Group

Omnicom Group is trading at $68.00 per share, or 7.1x forward P/E. This certainly seems like a cheap stock, but we think there are valid reasons why it trades this way.

Cheap stocks can look like a great deal at first glance, but they can be value traps. They often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Omnicom Group (OMC) Research Report: Q4 CY2025 Update

Global advertising giant Omnicom Group (NYSE:OMC) announced better-than-expected revenue in Q4 CY2025, with sales up 27.9% year on year to $5.53 billion. Its non-GAAP profit of $2.59 per share was 11.8% below analysts’ consensus estimates.

Omnicom Group (OMC) Q4 CY2025 Highlights:

- Revenue: $5.53 billion vs analyst estimates of $4.50 billion (27.9% year-on-year growth, 22.8% beat)

- Adjusted EPS: $2.59 vs analyst expectations of $2.94 (11.8% miss)

- Adjusted EBITDA: $928.9 million vs analyst estimates of $1.27 billion (16.8% margin, 27.1% miss)

- Operating Margin: -17.7%, down from 15.9% in the same quarter last year

- Market Capitalization: $21.39 billion

Company Overview

With a vast network of creative agencies that helped craft some of the most memorable ad campaigns in history, Omnicom Group (NYSE:OMC) is a strategic holding company that provides advertising, marketing, and communications services to many of the world's largest companies.

Omnicom operates through several global networks including BBDO, DDB, and TBWA, along with specialized practice areas focused on healthcare, precision marketing, public relations, and commerce. These agencies collaborate through Omnicom's client-centric matrix structure, allowing them to deliver integrated marketing solutions across different disciplines and geographies.

The company's service portfolio spans traditional advertising, digital marketing, media planning and buying, data analytics, branding, experiential marketing, and public relations. For instance, a global consumer goods company might engage Omnicom to develop a comprehensive marketing campaign that includes television commercials created by BBDO, digital content managed by its precision marketing group, and media buying handled by Omnicom Media Group.

Omnicom generates revenue by charging clients fees for services and commissions on media placements. Its client base includes many Fortune 500 companies across virtually every sector of the global economy, with its top 100 clients accounting for more than half of its revenue. These clients typically work with multiple Omnicom agencies simultaneously, with the average top client being served by approximately 55 different Omnicom agencies.

The company has evolved its offerings to address changing market dynamics, including the shift toward digital platforms, data-driven marketing, and e-commerce. Omnicom's proprietary data and analytics platforms, Annalect and Omni, serve as strategic resources across its networks, enabling precision marketing at scale. The company has also expanded its capabilities through strategic acquisitions, such as its purchase of Flywheel Digital in 2024 to strengthen its digital commerce offerings.

4. Advertising & Marketing Services

The sector is on the precipice of both disruption and growth as AI, programmatic advertising, and data-driven marketing reshape how things are done. For example, the advent of the Internet broadly and programmatic advertising specifically means that brand building is not a relationship business anymore but instead one based on data and technology, which could hurt traditional ad agencies. On the other hand, the companies in the sector that beef up their tech chops by automating the buying of ad inventory or facilitating omnichannel marketing, for example, stand to benefit. With or without advances in digitization and AI, the sector is still highly levered to the macro, and economic uncertainty may lead to fluctuating ad spend, particularly in cyclical industries.

Omnicom's main competitors include other major advertising holding companies such as WPP (NYSE:WPP), Publicis Groupe (OTCMKTS:PUBGY), Interpublic Group (NYSE:IPG), and Dentsu Group (OTCMKTS:DNTUY). The company also increasingly competes with consulting firms like Accenture (NYSE:ACN) that have expanded into marketing services, as well as digital platforms that offer advertising solutions.

5. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $17.27 billion in revenue over the past 12 months, Omnicom Group is a behemoth in the business services sector and benefits from economies of scale, giving it an edge in distribution. This also enables it to gain more leverage on its fixed costs than smaller competitors and the flexibility to offer lower prices.

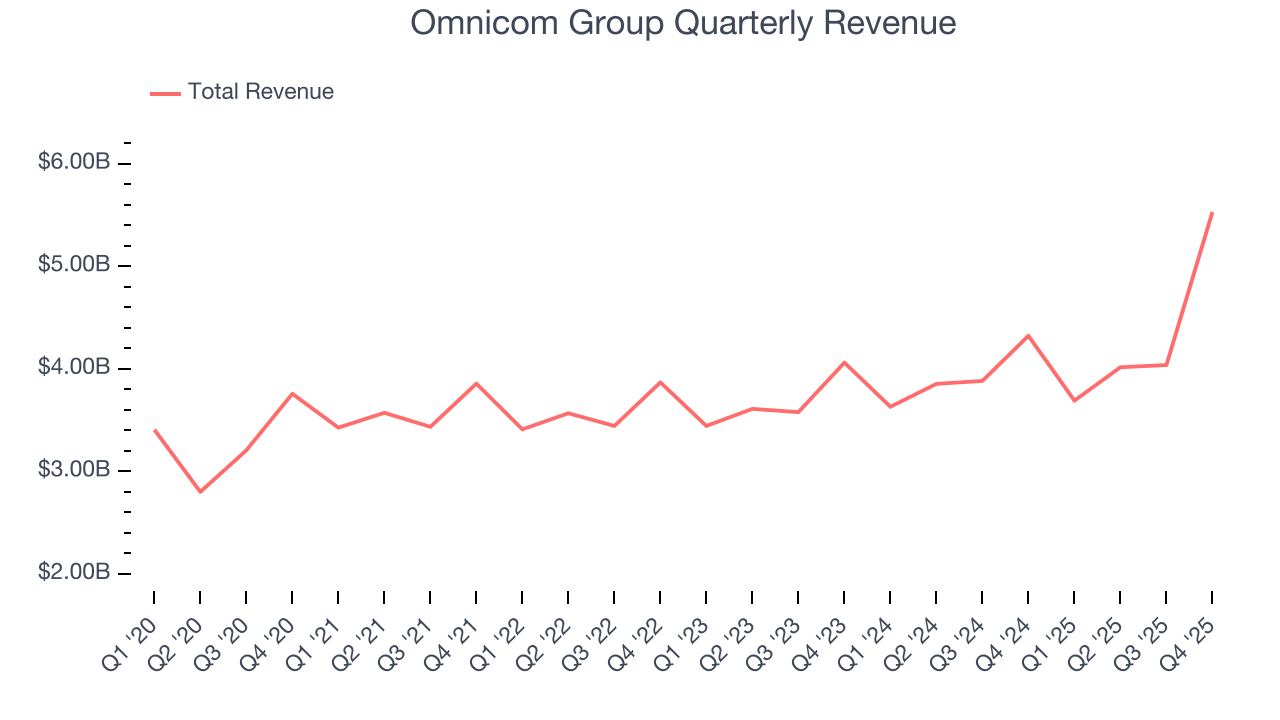

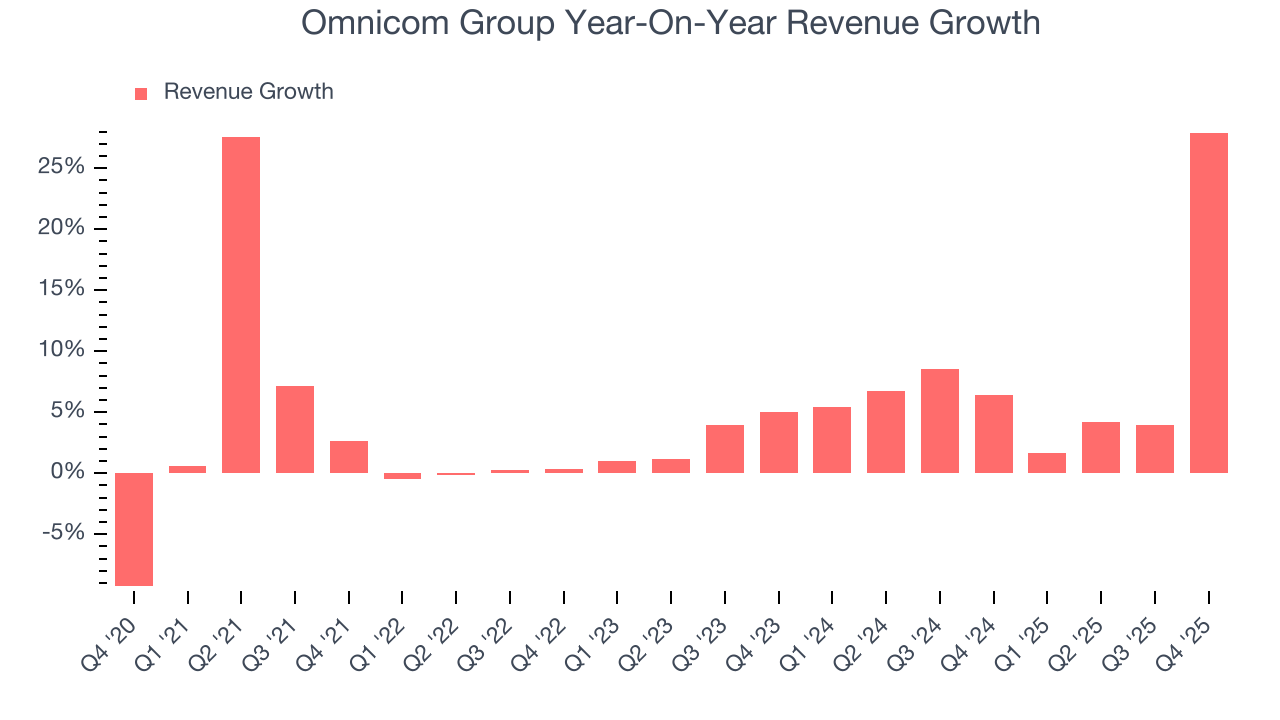

As you can see below, Omnicom Group’s 5.6% annualized revenue growth over the last five years was decent. This shows its offerings generated slightly more demand than the average business services company, a useful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. Omnicom Group’s annualized revenue growth of 8.4% over the last two years is above its five-year trend, suggesting its demand recently accelerated.

This quarter, Omnicom Group reported robust year-on-year revenue growth of 27.9%, and its $5.53 billion of revenue topped Wall Street estimates by 22.8%.

Looking ahead, sell-side analysts expect revenue to grow 55.4% over the next 12 months, an improvement versus the last two years. This projection is eye-popping for a company of its scale and indicates its newer products and services will spur better top-line performance.

6. Operating Margin

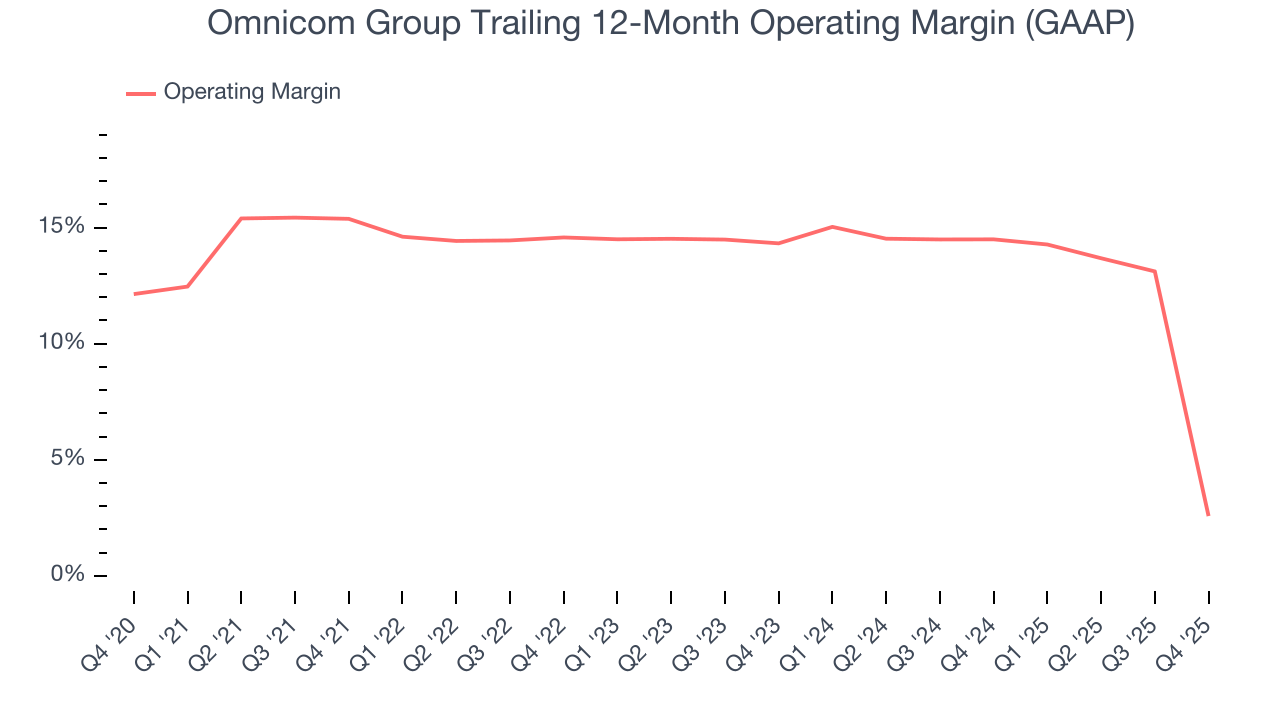

Omnicom Group has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 11.9%, higher than the broader business services sector.

Looking at the trend in its profitability, Omnicom Group’s operating margin decreased by 12.8 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q4, Omnicom Group generated an operating margin profit margin of negative 17.7%, down 33.5 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

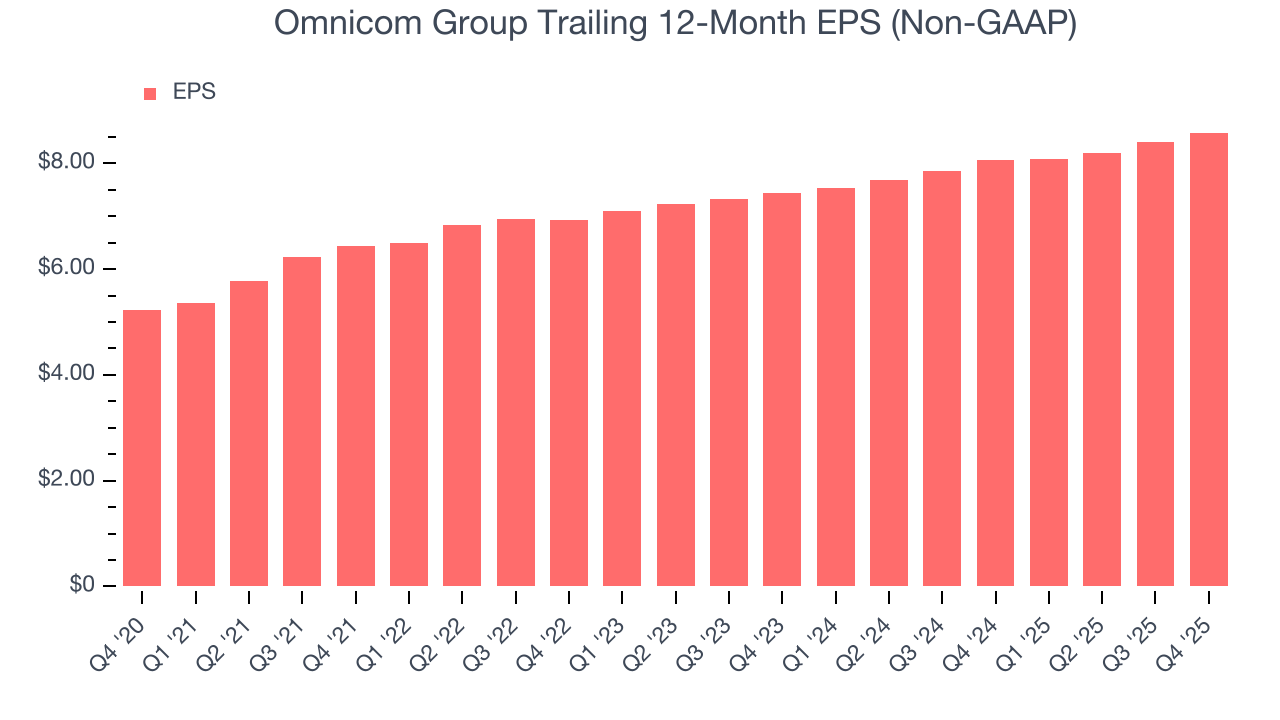

Omnicom Group’s EPS grew at a solid 10.4% compounded annual growth rate over the last five years, higher than its 5.6% annualized revenue growth. However, we take this with a grain of salt because its operating margin didn’t improve and it didn’t repurchase its shares, meaning the delta came from reduced interest expenses or taxes.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Omnicom Group, its two-year annual EPS growth of 7.5% was lower than its five-year trend. We hope its growth can accelerate in the future.

In Q4, Omnicom Group reported adjusted EPS of $2.59, up from $2.41 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates, but we care more about long-term adjusted EPS growth than short-term movements. Over the next 12 months, Wall Street expects Omnicom Group’s full-year EPS of $8.58 to grow 18.3%.

8. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

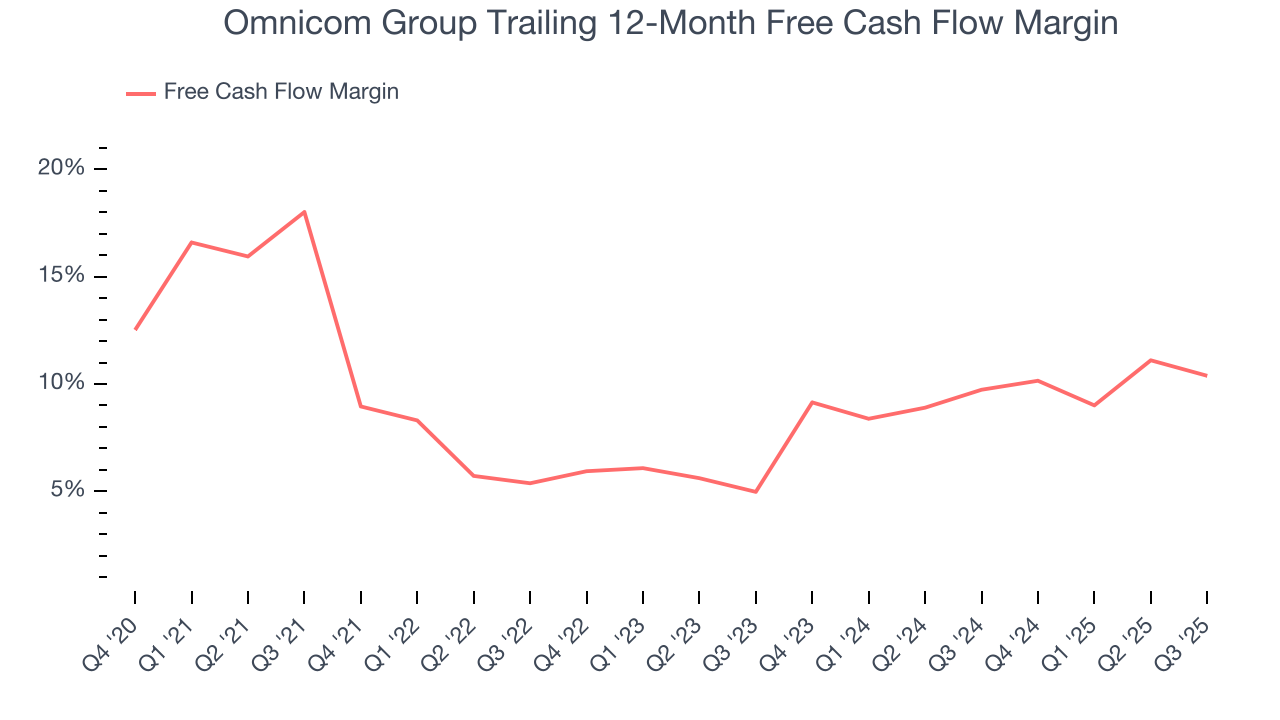

Omnicom Group has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 6.9% over the last five years, slightly better than the broader business services sector.

Taking a step back, we can see that Omnicom Group’s margin dropped by 3.7 percentage points during that time. Continued declines could signal it is in the middle of an investment cycle.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Although Omnicom Group hasn’t been the highest-quality company lately, it found a few growth initiatives in the past that worked out wonderfully. Its five-year average ROIC was 32.3%, splendid for a business services business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Omnicom Group’s ROIC has unfortunately decreased. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

10. Key Takeaways from Omnicom Group’s Q4 Results

We were impressed by how significantly Omnicom Group blew past analysts’ revenue expectations this quarter. On the other hand, its EPS missed. Overall, this was a softer quarter. The stock remained flat at $71.52 immediately following the results.

11. Is Now The Time To Buy Omnicom Group?

Updated: February 18, 2026 at 4:22 PM EST

Are you wondering whether to buy Omnicom Group or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

When it comes to Omnicom Group’s business quality, there are some positives, but it ultimately falls short. First off, its revenue growth was decent over the last five years and is expected to accelerate over the next 12 months. And while its diminishing returns show management's recent bets still have yet to bear fruit, its scale makes it a trusted partner with negotiating leverage. On top of that, its projected EPS for the next year implies the company’s fundamentals will improve.

Omnicom Group’s P/E ratio based on the next 12 months is 6.9x. This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're fairly confident there are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $99.60 on the company (compared to the current share price of $71.52).