OneMain (OMF)

We aren’t fans of OneMain. Its revenue growth has been weak and its profitability has caved, showing it’s struggling to adapt.― StockStory Analyst Team

1. News

2. Summary

Why We Think OneMain Will Underperform

Dating back to 1912 and formerly known as Springleaf, OneMain Holdings (NYSE:OMF) provides personal loans, auto financing, and credit cards to nonprime consumers who have limited access to traditional banking services.

- Earnings per share lagged its peers over the last five years as they only grew by 3.4% annually

- 4.3% annual revenue growth over the last five years was slower than its financials peers

OneMain’s quality is lacking. Better stocks can be found in the market.

Why There Are Better Opportunities Than OneMain

High Quality

Investable

Underperform

Why There Are Better Opportunities Than OneMain

OneMain is trading at $64.40 per share, or 8.6x forward P/E. This certainly seems like a cheap stock, but we think there are valid reasons why it trades this way.

Cheap stocks can look like great bargains at first glance, but you often get what you pay for. These mediocre businesses often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. OneMain (OMF) Research Report: Q3 CY2025 Update

Consumer finance company OneMain Holdings (NYSE:OMF) met Wall Street’s revenue expectations in Q3 CY2025, with sales up 7.1% year on year to $1.24 billion. Its non-GAAP profit of $1.90 per share was 18.5% above analysts’ consensus estimates.

OneMain (OMF) Q3 CY2025 Highlights:

- Net Interest Income: $1.07 billion vs analyst estimates of $1.04 billion (3.2% beat)

- Revenue: $1.24 billion vs analyst estimates of $1.23 billion (7.1% year-on-year growth, in line)

- Pre-tax Profit: $263 million (21.3% margin, 27.1% year-on-year growth)

- Adjusted EPS: $1.90 vs analyst estimates of $1.60 (18.5% beat)

- Market Capitalization: $6.63 billion

Company Overview

Dating back to 1912 and formerly known as Springleaf, OneMain Holdings (NYSE:OMF) provides personal loans, auto financing, and credit cards to nonprime consumers who have limited access to traditional banking services.

OneMain operates at the intersection of traditional branch-based lending and modern digital financial services. The company's core business revolves around installment loans with fixed rates and terms typically between three and six years. These loans may be secured by automobiles or other collateral, or they may be unsecured, depending on the customer's profile and needs.

The company serves a distinct market segment—consumers with credit profiles that often prevent them from accessing loans through traditional banks or credit card companies. For example, a customer might come to OneMain when they need to consolidate high-interest debt, cover unexpected medical expenses, or finance home improvements but have been turned down by mainstream lenders.

OneMain's underwriting process combines automated credit decisioning with personalized assessment of a customer's ability to repay, including income verification and monthly budget analysis. For secured loans, the company obtains security interests in titled property like vehicles, providing additional protection against default.

Beyond personal loans, OneMain has expanded into point-of-sale auto financing through dealership partnerships and offers two credit card products—BrightWay and BrightWay+. The company also generates revenue through optional products such as credit insurance, which can cover loan payments if a borrower experiences disability, death, or involuntary unemployment.

OneMain's business model balances the higher risk of its customer base with higher interest rates than prime lenders, while providing financial wellness tools through its Trim by OneMain platform to help customers improve their financial health.

4. Personal Loan

Personal loan providers offer unsecured credit for various consumer needs. The sector benefits from digital application processes, increasing consumer comfort with online financial services, and opportunities in underserved credit segments. Headwinds include credit risk management in unsecured lending, regulatory oversight of lending practices, and intense competition affecting margins from both traditional and fintech lenders.

OneMain Holdings competes with other nonprime consumer lenders such as Upstart (NASDAQ:UPST), LendingClub (NYSE:LC), and regional banks that offer personal loans. In the auto financing space, its competitors include Credit Acceptance Corporation (NASDAQ:CACC) and regional auto lenders focused on nonprime borrowers.

5. Revenue Growth

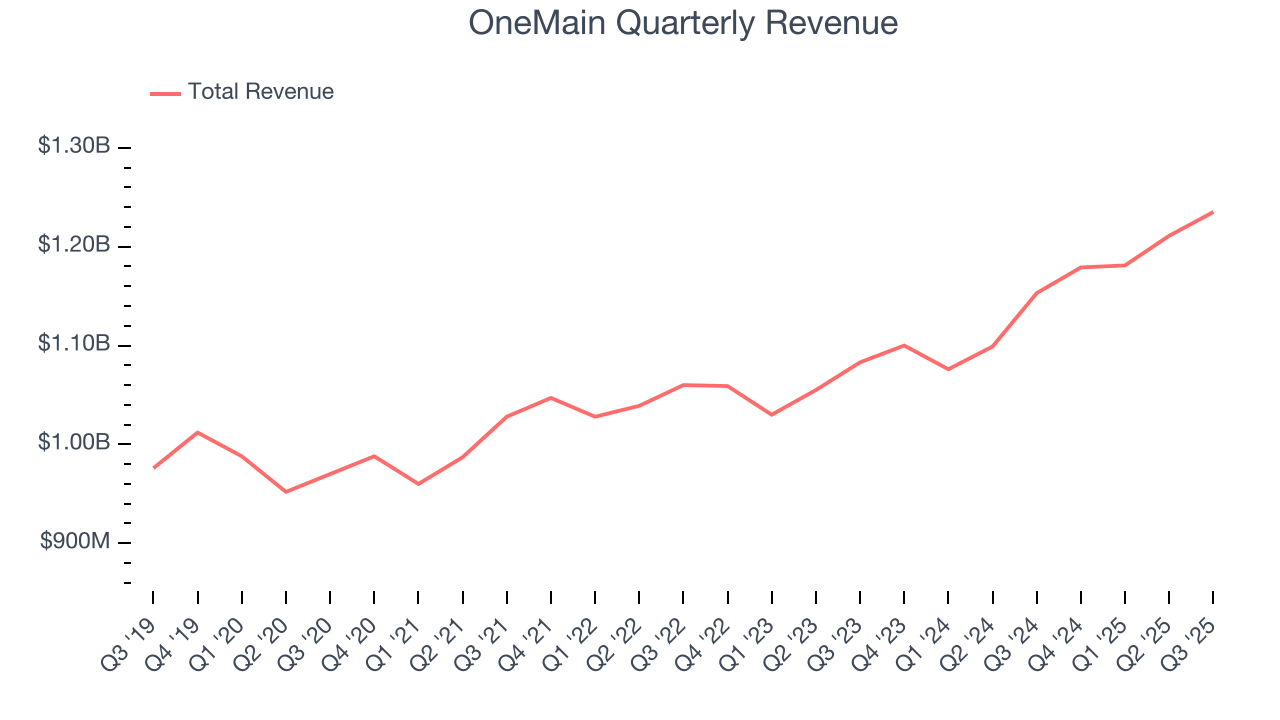

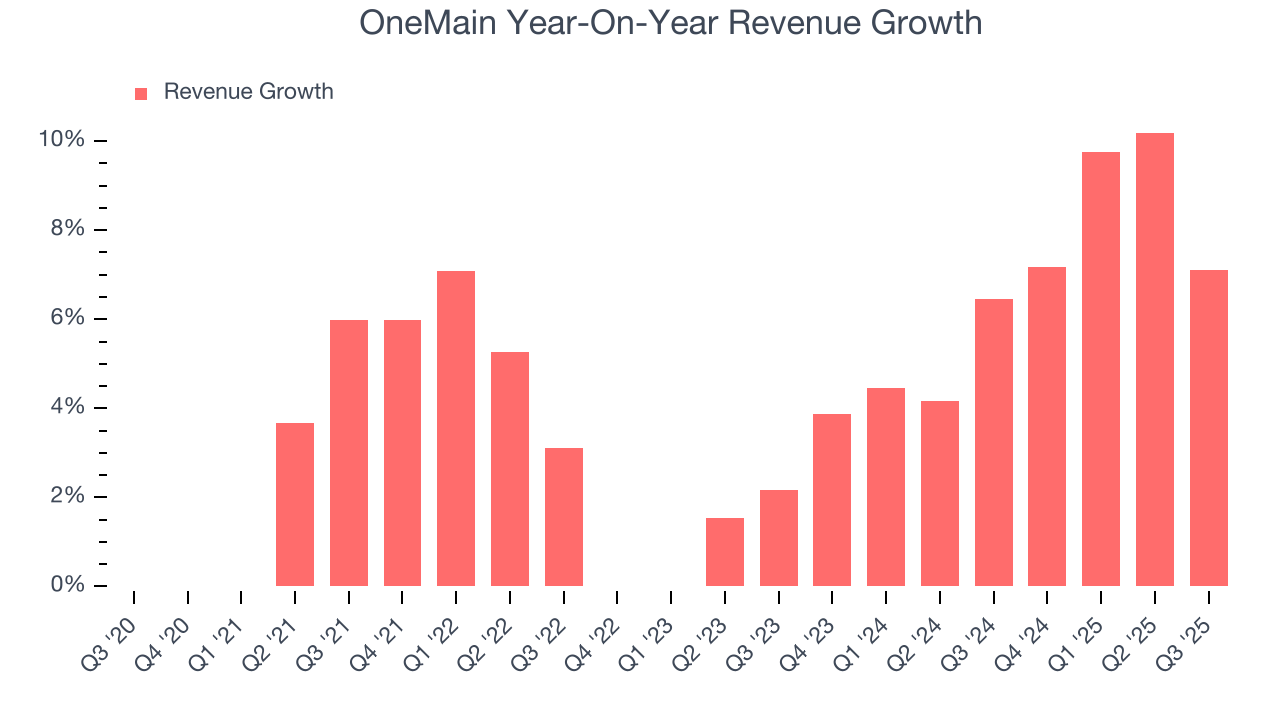

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, OneMain grew its revenue at a sluggish 4.1% compounded annual growth rate. This was below our standard for the financials sector and is a poor baseline for our analysis.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. OneMain’s annualized revenue growth of 6.6% over the last two years is above its five-year trend, but we were still disappointed by the results.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, OneMain grew its revenue by 7.1% year on year, and its $1.24 billion of revenue was in line with Wall Street’s estimates.

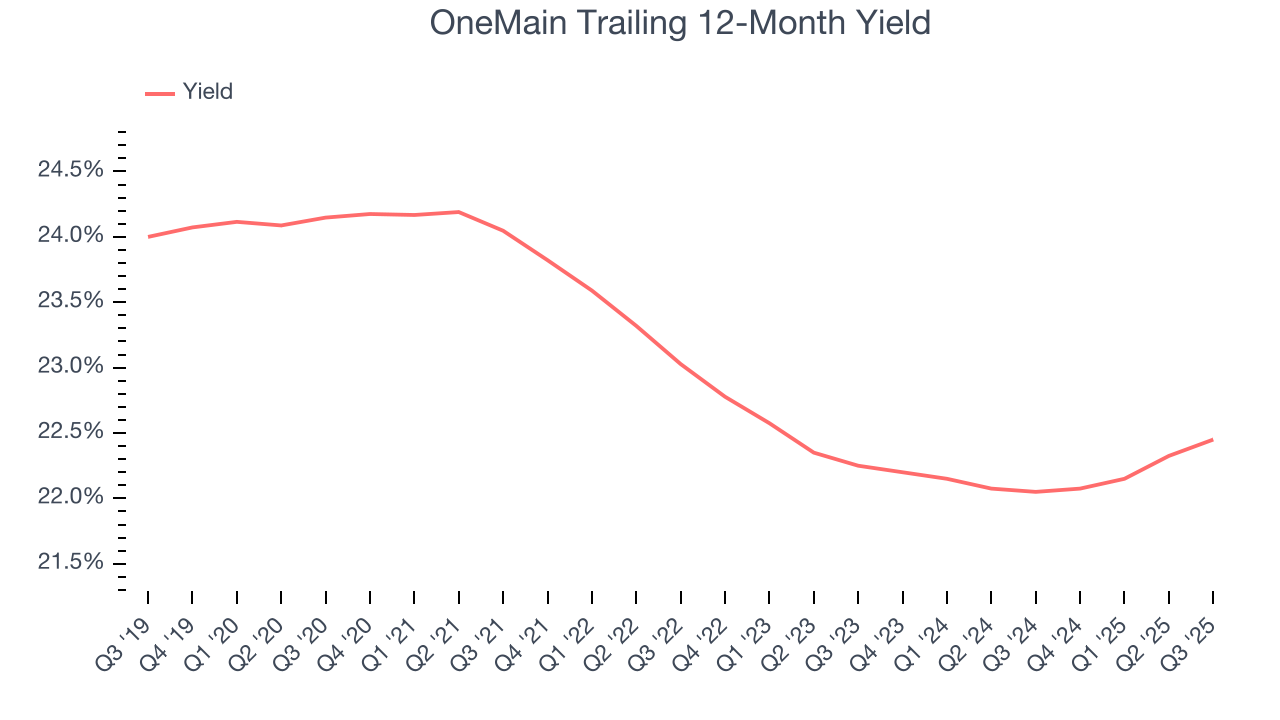

6. Yield

The yield on loans and financial instruments represents the interest income earned relative to the total amount of credit extended by financial institutions. This metric measures both revenue generation capacity and the risk profile of a firm's lending activities.

OneMain’s yield has decreased by 169.7 over the last five but increased by 20 basis points (100 basis points = 1 percentage point) on a two-year basis. Still, both rates of change were worse than the broader financials industry. The firm’s average yield in the most recent quarter was 22.6%.

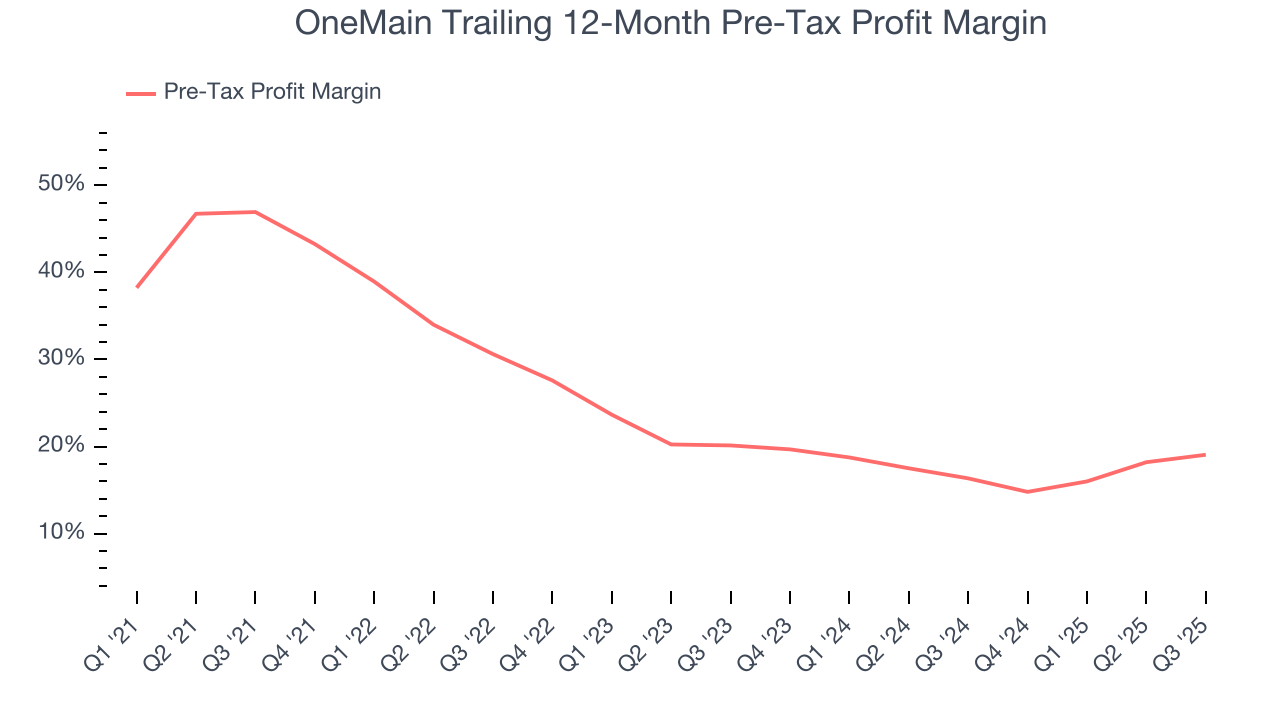

7. Pre-Tax Profit Margin

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For Personal Loan companies, we look at pre-tax profit rather than the operating margin that defines sectors such as consumer, tech, and industrials.

Interest income and expenses play a big role in financial institutions' profitability, so they should be factored into the definition of profit. Taxes, however, should not as they are largely out of a company's control. This is pre-tax profit by definition.

Over the last four years, OneMain’s pre-tax profit margin has risen by 27.9 percentage points, going from 46.9% to 19.1%. It has also declined by 1.1 percentage points on a two-year basis, showing its expenses have consistently increased at a faster rate than revenue. This usually raises questions unless the company is in high-growth mode and reinvesting its profits into attractive ventures.

OneMain’s pre-tax profit margin came in at 21.3% this quarter. This result was 3.3 percentage points better than the same quarter last year.

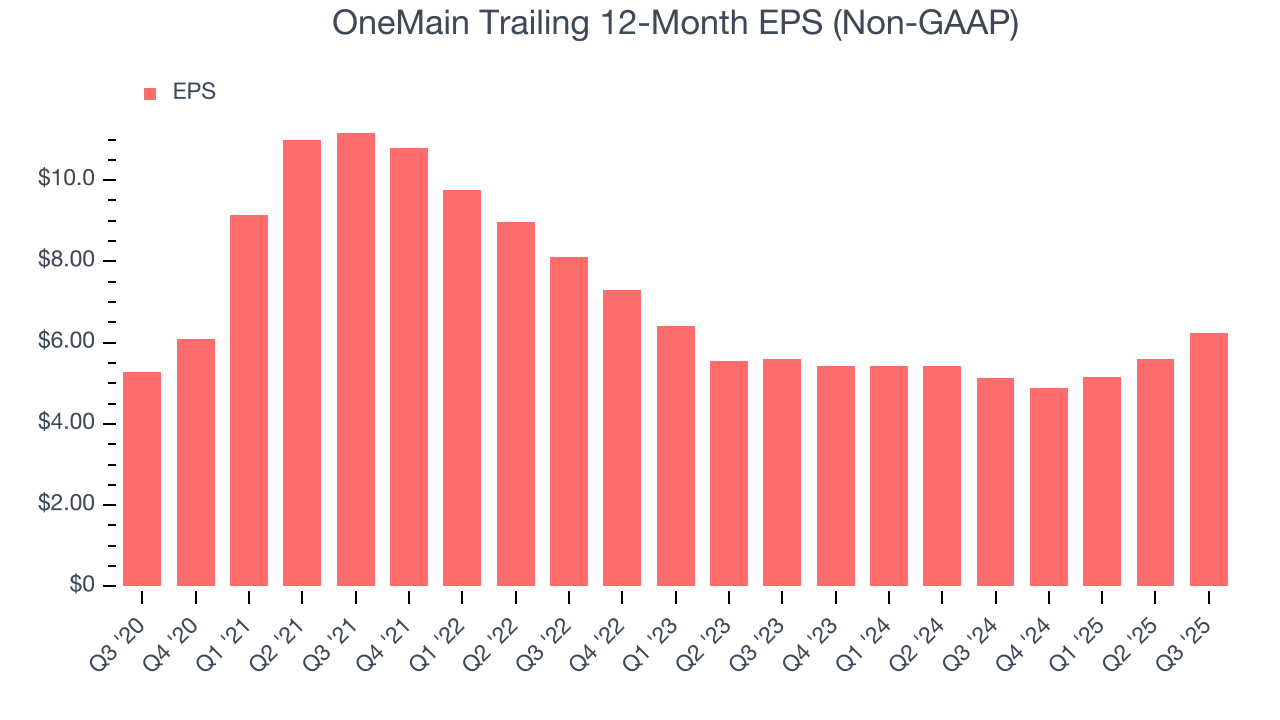

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

OneMain’s weak 3.4% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For OneMain, its two-year annual EPS growth of 5.5% was higher than its five-year trend. Accelerating earnings growth is almost always an encouraging data point.

In Q3, OneMain reported adjusted EPS of $1.90, up from $1.26 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects OneMain’s full-year EPS of $6.23 to grow 20.3%.

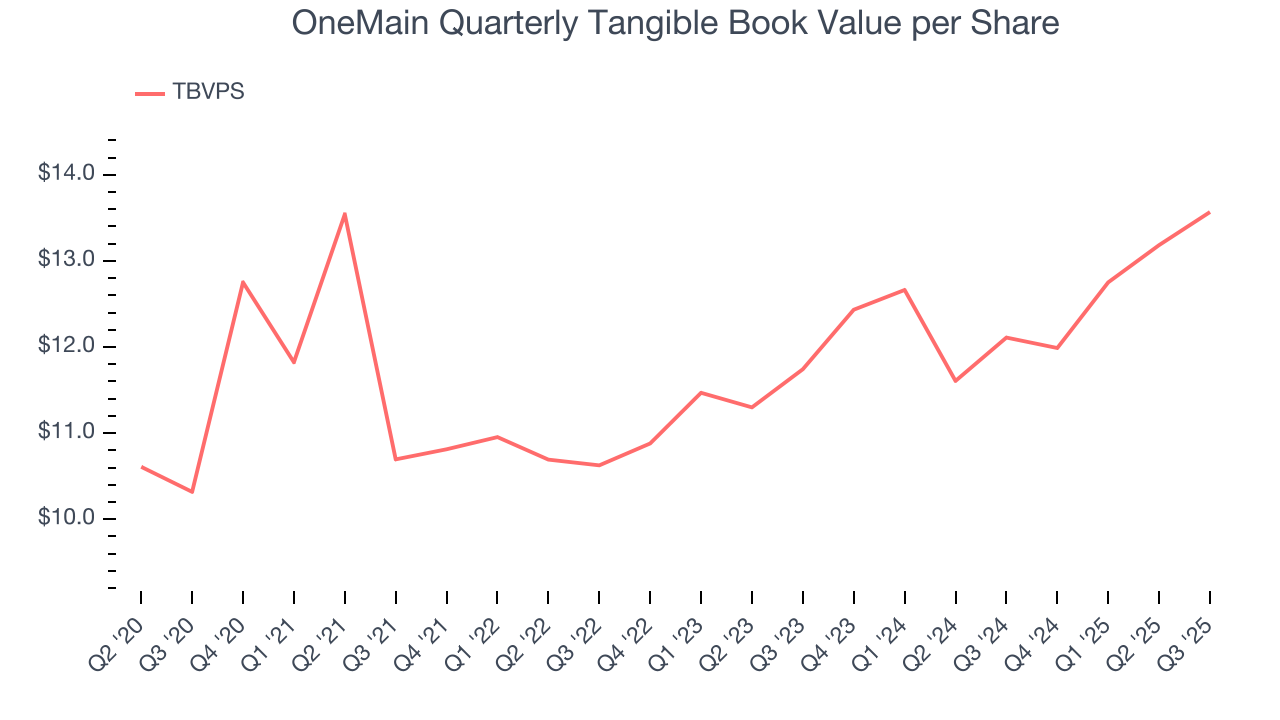

9. Tangible Book Value Per Share (TBVPS)

Financial firms profit by providing a wide range of services, making them fundamentally balance sheet-driven enterprises with multiple intermediation roles. Market participants emphasize balance sheet quality and sustained book value growth when evaluating these multifaceted institutions.

This is why we consider tangible book value per share (TBVPS) an important metric for the sector. TBVPS represents the real net worth per share across all business segments, providing a clear measure of shareholder equity regardless of the complexity of operations. Other (and more commonly known) per-share metrics like EPS can sometimes be murky due to the complexity of multiple business lines, M&A activity, or accounting rules that vary across different financial services segments.

OneMain’s TBVPS grew at a tepid 5.6% annual clip over the last five years. However, TBVPS growth has accelerated recently, growing by 7.5% annually over the last two years from $11.74 to $13.57 per share.

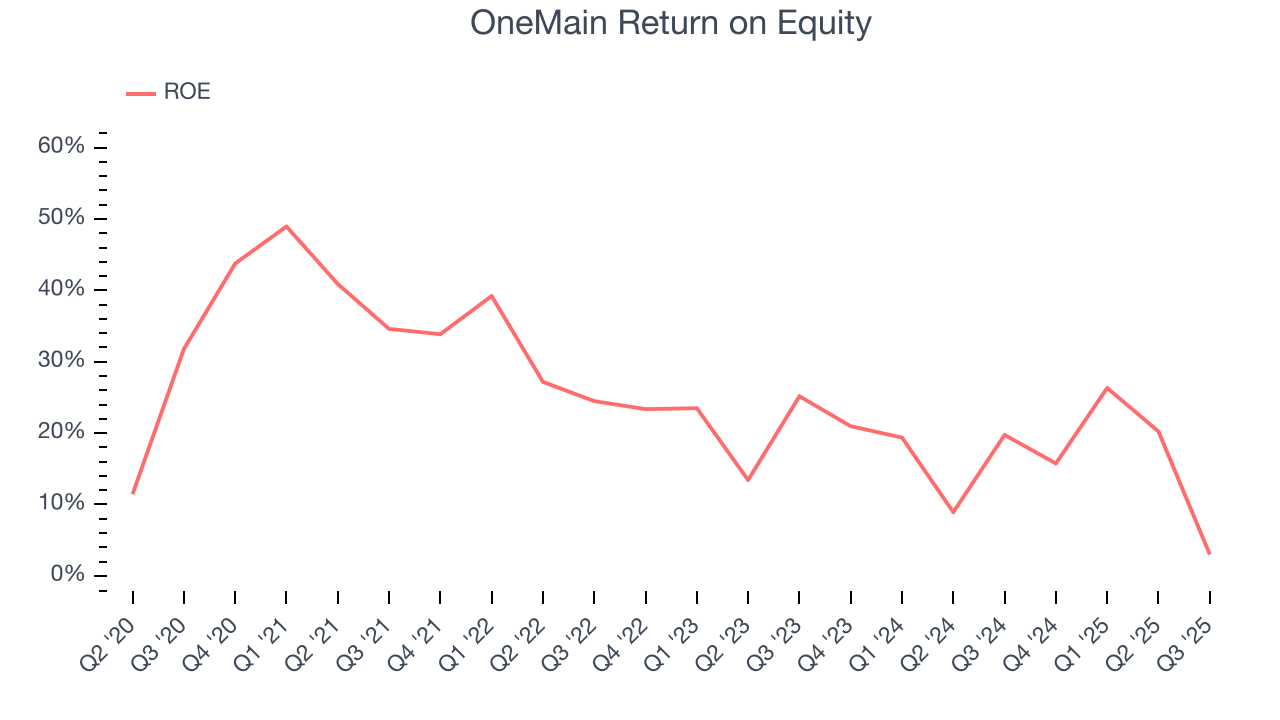

10. Return on Equity

Return on equity (ROE) reveals the profit generated per dollar of shareholder equity, which represents a key source of bank funding. Banks maintaining elevated ROE levels tend to accelerate wealth creation for shareholders via earnings retention, buybacks, and distributions.

Over the last five years, OneMain has averaged an ROE of 25.6%, exceptional for a company operating in a sector where the average shakes out around 10% and those putting up 25%+ are greatly admired. This is a bright spot for OneMain.

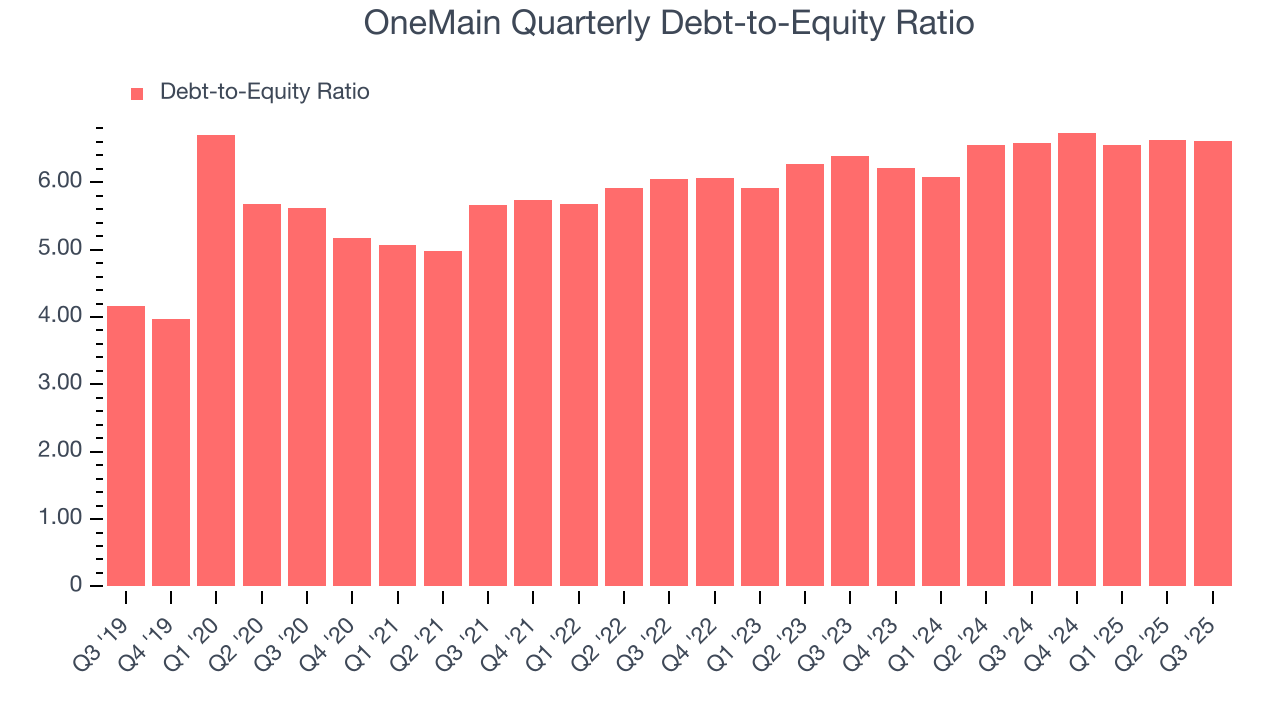

11. Balance Sheet Risk

The debt-to-equity ratio is a widely used measure to assess a company's balance sheet health. A higher ratio means that a business aggressively financed its growth with debt. This can result in higher earnings (if the borrowed funds are invested profitably) but also increases risk.

If debt levels are too high, there could be difficulties in meeting obligations, especially during economic downturns or periods of rising interest rates if the debt has variable-rate payments.

OneMain currently has $22.34 billion of debt and $3.38 billion of shareholder's equity on its balance sheet, and over the past four quarters, has averaged a debt-to-equity ratio of 6.6×. We think this is dangerous - for a financials business, anything above 3.5× raises red flags.

12. Key Takeaways from OneMain’s Q3 Results

It was good to see OneMain beat analysts’ EPS expectations this quarter. We were also glad its net interest income outperformed Wall Street’s estimates. Overall, we think this was a solid quarter with some key areas of upside. The stock traded up 3.5% to $57.66 immediately after reporting.

13. Is Now The Time To Buy OneMain?

Updated: January 22, 2026 at 11:32 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in OneMain.

OneMain’s business quality ultimately falls short of our standards. To begin with, its revenue growth was uninspiring over the last five years. And while its stellar ROE suggests it has been a well-run company historically, the downside is its declining pre-tax profit margin shows the business has become less efficient. On top of that, its falling yields show its credit portfolio is delivering lower returns than before.

OneMain’s P/E ratio based on the next 12 months is 8.6x. While this valuation is optically cheap, the potential downside is big given its shaky fundamentals. We're pretty confident there are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $73.87 on the company (compared to the current share price of $64.40).