OPENLANE (OPLN)

OPENLANE doesn’t excite us. Not only are its sales cratering but also its low returns on capital suggest it struggles to generate profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think OPENLANE Will Underperform

Facilitating the sale of approximately 1.3 million used vehicles in 2023, OPENLANE (NYSE:OPLN) operates digital marketplaces that connect sellers and buyers of used vehicles across North America and Europe, facilitating wholesale transactions.

- Products and services are facing significant end-market challenges during this cycle as sales have declined by 4% annually over the last five years

- Below-average returns on capital indicate management struggled to find compelling investment opportunities

- High net-debt-to-EBITDA ratio of 5× could force the company to raise capital at unfavorable terms if market conditions deteriorate

OPENLANE’s quality isn’t up to par. Our attention is focused on better businesses.

Why There Are Better Opportunities Than OPENLANE

High Quality

Investable

Underperform

Why There Are Better Opportunities Than OPENLANE

OPENLANE’s stock price of $29.01 implies a valuation ratio of 21.2x forward P/E. Not only does OPENLANE trade at a premium to companies in the business services space, but this multiple is also high for its top-line growth.

We prefer to invest in similarly-priced but higher-quality companies with superior earnings growth.

3. OPENLANE (OPLN) Research Report: Q4 CY2025 Update

Digital vehicle marketplace OPENLANE (NYSE:OPLN) reported Q4 CY2025 results topping the market’s revenue expectations, with sales up 8.6% year on year to $494.3 million. Its non-GAAP profit of $0.25 per share was 8.3% below analysts’ consensus estimates.

OPENLANE (OPLN) Q4 CY2025 Highlights:

- Revenue: $494.3 million vs analyst estimates of $473.4 million (8.6% year-on-year growth, 4.4% beat)

- Adjusted EPS: $0.25 vs analyst expectations of $0.27 (8.3% miss)

- Adjusted EBITDA: $76 million vs analyst estimates of $74.76 million (15.4% margin, 1.7% beat)

- Adjusted EPS guidance for the upcoming financial year 2026 is $1.31 at the midpoint, missing analyst estimates by 8%

- EBITDA guidance for the upcoming financial year 2026 is $360 million at the midpoint, above analyst estimates of $352.5 million

- Operating Margin: 8.6%, down from 17.4% in the same quarter last year

- Free Cash Flow Margin: 22.4%, up from 4% in the same quarter last year

- Market Capitalization: $3.08 billion

Company Overview

Facilitating the sale of approximately 1.3 million used vehicles in 2023, OPENLANE (NYSE:OPLN) operates digital marketplaces that connect sellers and buyers of used vehicles across North America and Europe, facilitating wholesale transactions.

OPENLANE's digital platforms primarily serve two distinct customer groups: commercial sellers (including vehicle manufacturers, financial institutions, fleet operators, and rental companies) and dealer customers (both franchised and independent used vehicle dealers). The company generates revenue through auction fees charged to both sellers and buyers, as well as through a suite of ancillary services.

These value-added services include transportation logistics, where OPENLANE arranges vehicle delivery using both its own fleet and third-party carriers. For example, a dealer in Chicago might purchase a vehicle from a rental car company in Dallas and use OPENLANE's logistics services to transport it to their lot. The company also offers vehicle inspection services, reconditioning, title processing, and administrative support.

An important component of OPENLANE's business model is its Finance segment, operated through its subsidiary AFC. This division provides floorplan financing—short-term loans secured by vehicle inventory—primarily to independent dealers. When a dealer purchases a vehicle through OPENLANE's marketplace, AFC might finance that purchase, collecting origination fees and interest until the loan is repaid, typically when the dealer sells the vehicle to a retail customer.

OPENLANE's technology platform supports more than 40 private-label digital remarketing sites for commercial customers and offers multiple sale formats for dealers. The company maintains vehicle logistics centers in Canada where physical vehicles can be inspected, while still being sold through digital channels using simulcast technology.

Unlike traditional physical auctions, OPENLANE generally doesn't take ownership of the vehicles sold through its marketplaces, instead facilitating direct transfers between sellers and buyers. This asset-light approach allows the company to operate efficiently across geographic boundaries, serving customers throughout North America and Europe.

4. Asset Management & Auction Services

Like in other industries, the shift to online platforms can lower transaction costs and improve liquidity for sellers. Increasing digitization, AI-driven pricing analytics, and automation in logistics can enhance efficiency for operators who invest in technology and software. On the other hand, challenges include potential regulatory scrutiny on auction transparency, data privacy concerns with AI-driven valuation models, and shifting environmental policies that could impact the resale market for internal combustion vehicles. Additionally, supply chain volatility in new car production may create unpredictable swings in used vehicle supply, impacting auction volumes.

OPENLANE's primary competitors in the North American wholesale used vehicle marketplace include Manheim (owned by Cox Automotive), Carvana's ADESA auction business, ACV Auctions (NASDAQ: ACVA), and America's Auto Auction. In the floorplan financing segment, AFC competes primarily with NextGear Capital, also owned by Cox Automotive.

5. Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $1.93 billion in revenue over the past 12 months, OPENLANE is a mid-sized business services company, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale.

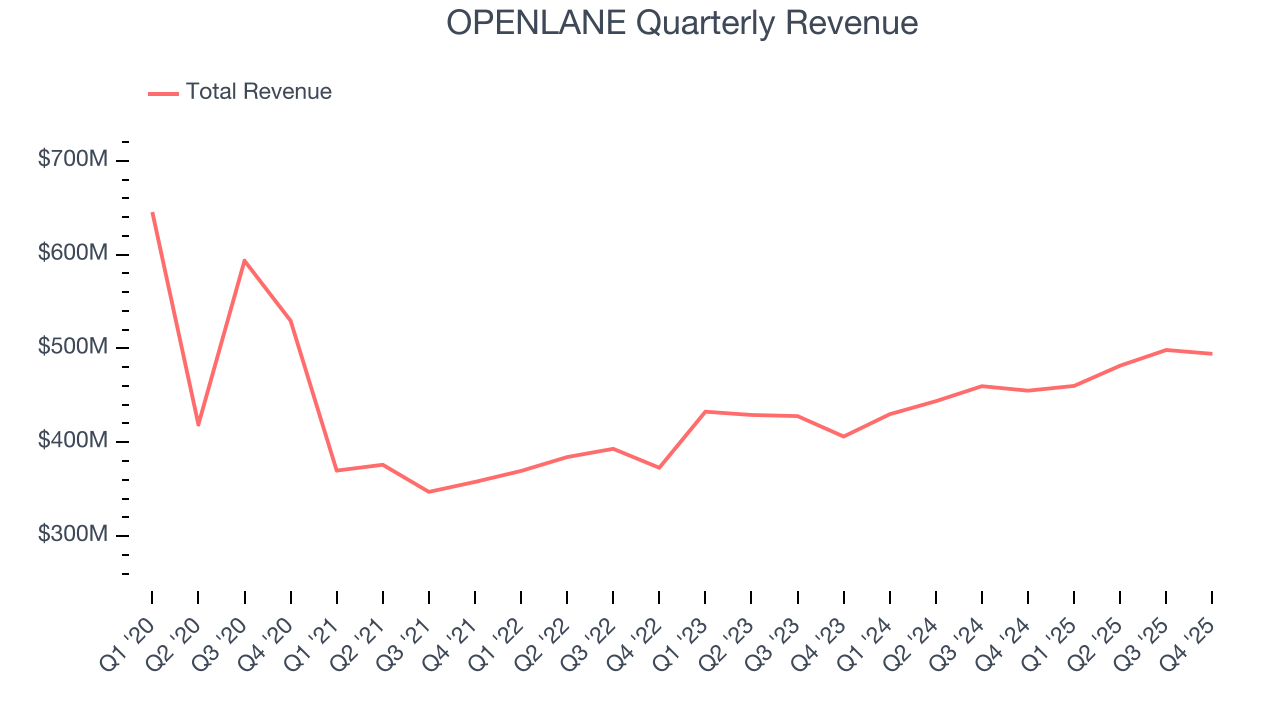

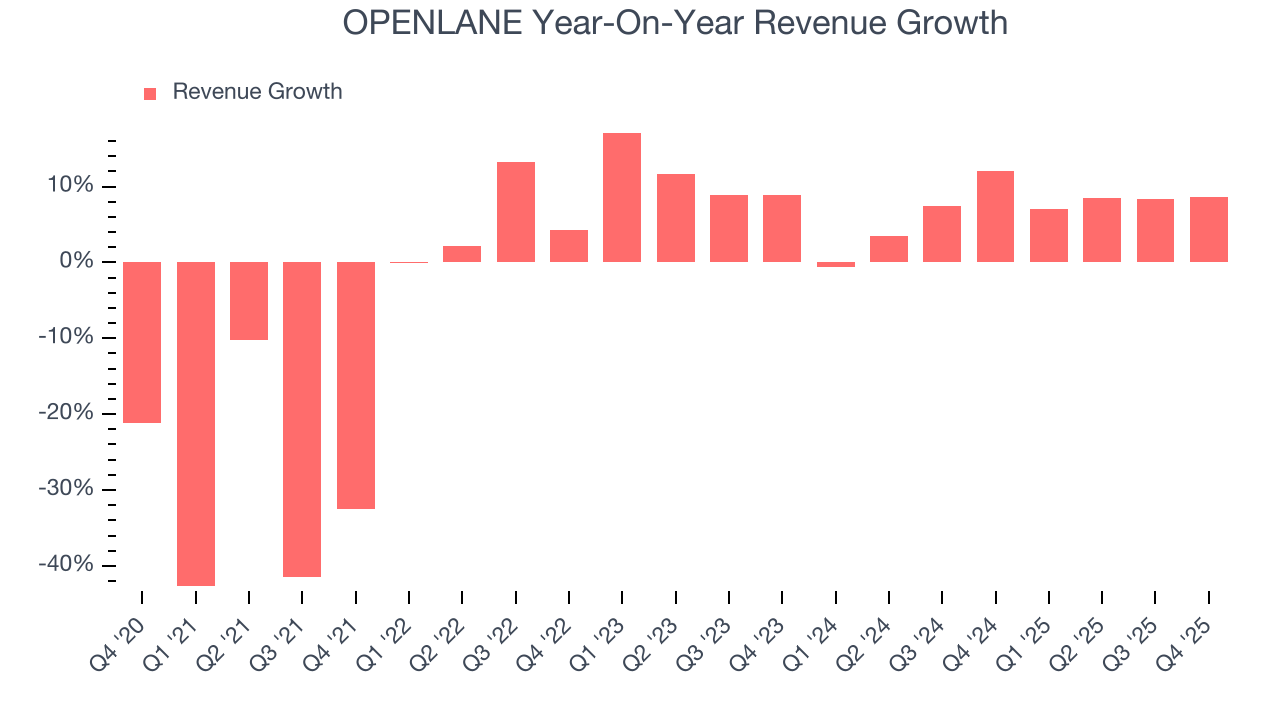

As you can see below, OPENLANE’s demand was weak over the last five years. Its sales fell by 2.4% annually, a rough starting point for our analysis.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. OPENLANE’s annualized revenue growth of 6.8% over the last two years is above its five-year trend, suggesting some bright spots.

This quarter, OPENLANE reported year-on-year revenue growth of 8.6%, and its $494.3 million of revenue exceeded Wall Street’s estimates by 4.4%.

Looking ahead, sell-side analysts expect revenue to grow 4.5% over the next 12 months, a slight deceleration versus the last two years. This projection is underwhelming and implies its products and services will see some demand headwinds.

6. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

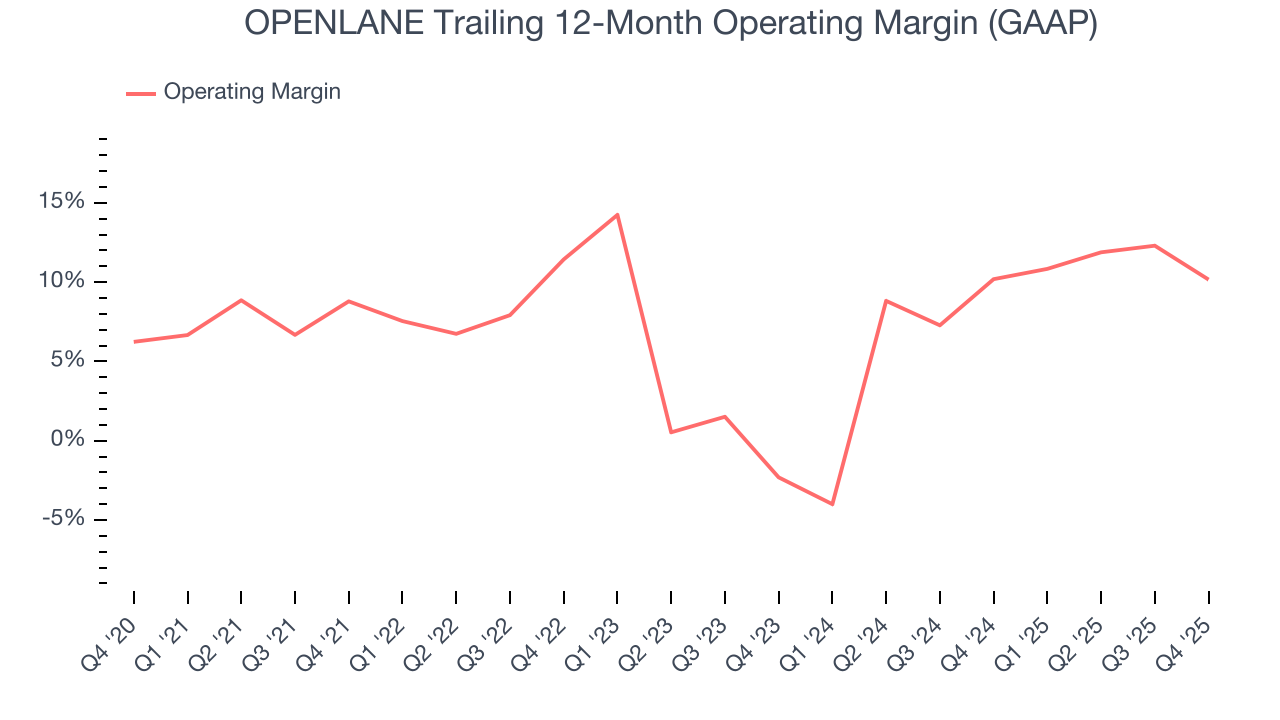

OPENLANE was profitable over the last five years but held back by its large cost base. Its average operating margin of 7.6% was weak for a business services business.

On the plus side, OPENLANE’s operating margin rose by 1.4 percentage points over the last five years.

This quarter, OPENLANE generated an operating margin profit margin of 8.6%, down 8.8 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

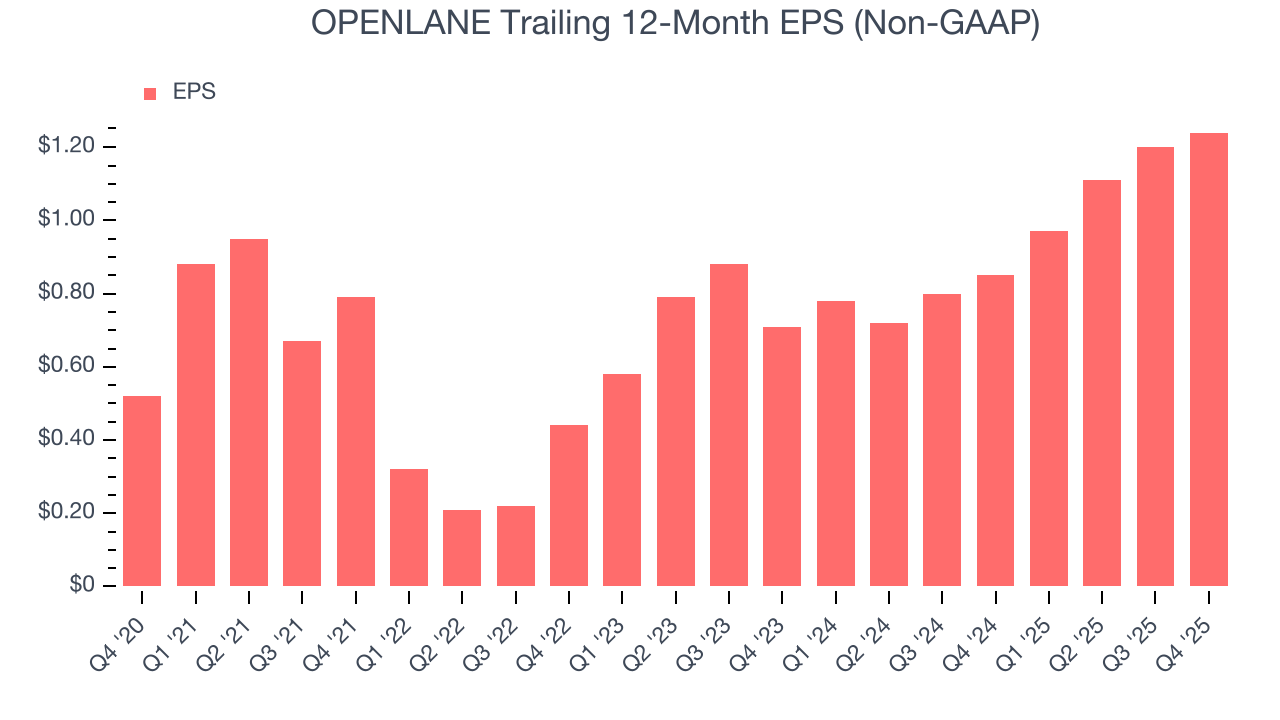

OPENLANE’s EPS grew at an astounding 19% compounded annual growth rate over the last five years, higher than its 2.4% annualized revenue declines. This tells us management adapted its cost structure in response to a challenging demand environment.

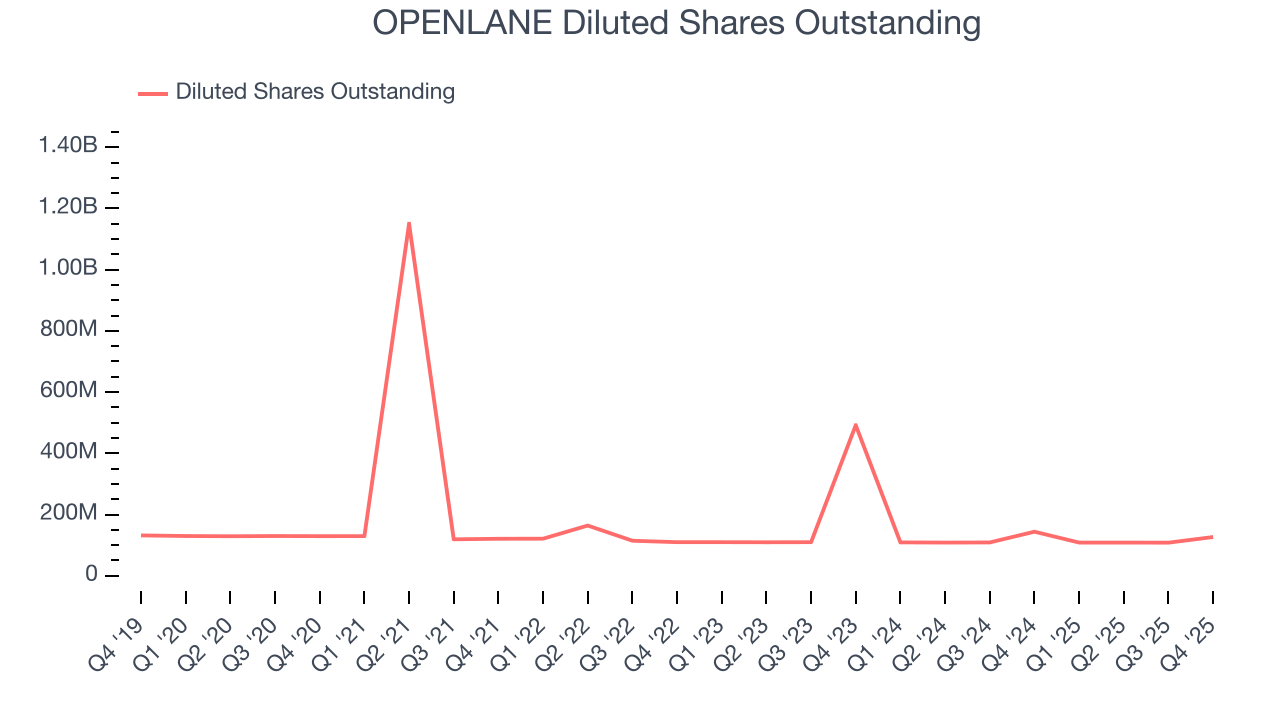

We can take a deeper look into OPENLANE’s earnings to better understand the drivers of its performance. As we mentioned earlier, OPENLANE’s operating margin declined this quarter but expanded by 1.4 percentage points over the last five years. Its share count also shrank by 2.2%, and these factors together are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For OPENLANE, its two-year annual EPS growth of 32.2% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q4, OPENLANE reported adjusted EPS of $0.25, up from $0.21 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates, but we care more about long-term adjusted EPS growth than short-term movements. Over the next 12 months, Wall Street expects OPENLANE’s full-year EPS of $1.24 to grow 11.7%.

8. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

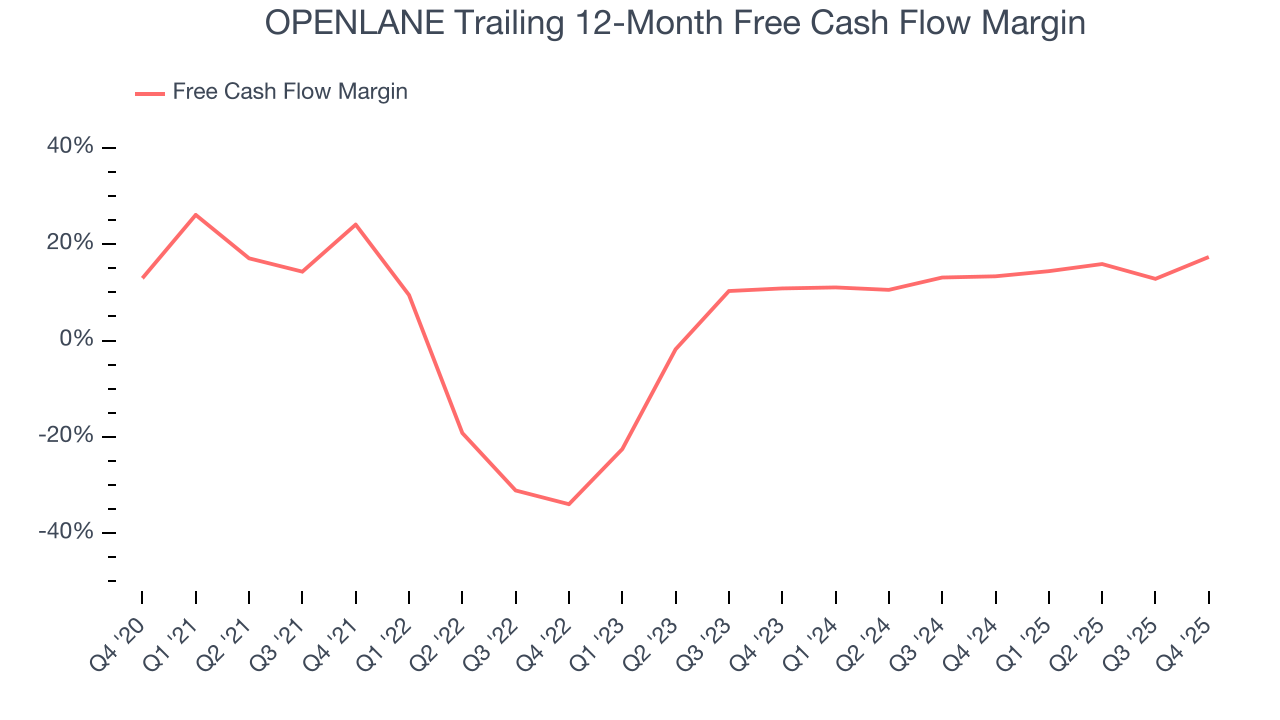

OPENLANE has shown impressive cash profitability, giving it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 7% over the last five years, better than the broader business services sector. The divergence from its underwhelming operating margin stems from the add-back of non-cash charges like depreciation and stock-based compensation. GAAP operating profit expenses these line items, but free cash flow does not.

Taking a step back, we can see that OPENLANE’s margin dropped by 6.7 percentage points during that time. It may have ticked higher more recently, but shareholders are likely hoping for its margin to at least revert to its historical level. If the longer-term trend returns, it could signal increasing investment needs and capital intensity.

OPENLANE’s free cash flow clocked in at $110.8 million in Q4, equivalent to a 22.4% margin. This result was good as its margin was 18.5 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, causing temporary swings. Long-term trends carry greater meaning.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

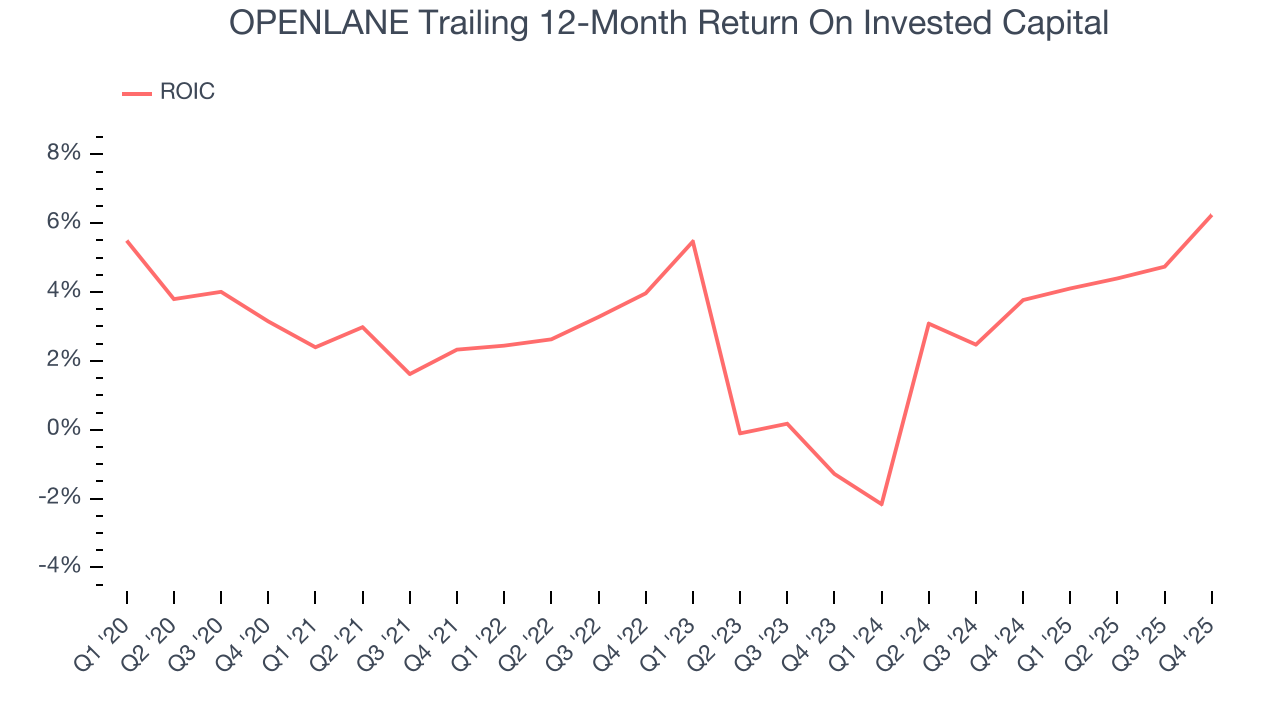

OPENLANE historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 3%, lower than the typical cost of capital (how much it costs to raise money) for business services companies.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Fortunately, OPENLANE’s ROIC averaged 1.9 percentage point increases each year over the last few years. This is a good sign, and we hope the company can continue improving.

10. Balance Sheet Assessment

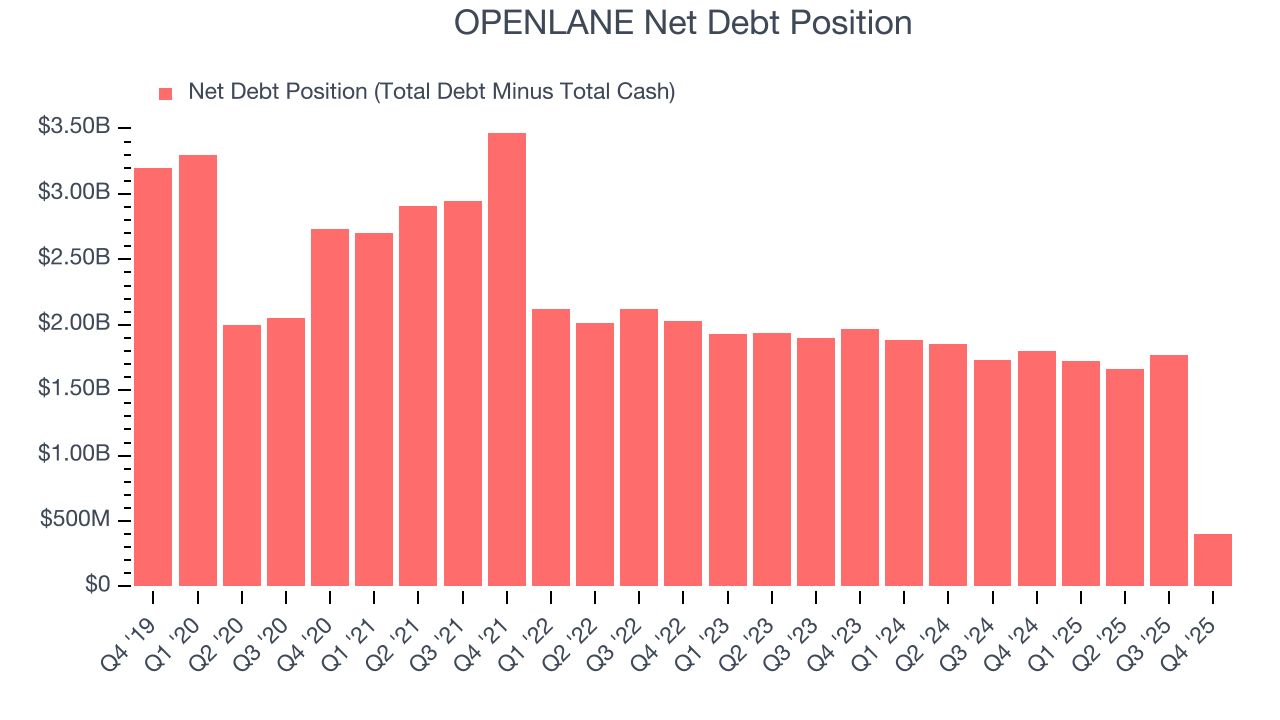

OPENLANE reported $185.4 million of cash and $588.6 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $332.6 million of EBITDA over the last 12 months, we view OPENLANE’s 1.2× net-debt-to-EBITDA ratio as safe. We also see its $80.9 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from OPENLANE’s Q4 Results

We enjoyed seeing OPENLANE beat analysts’ revenue expectations this quarter. On the other hand, its full-year EPS guidance missed and its EPS fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock remained flat at $29.02 immediately following the results.

12. Is Now The Time To Buy OPENLANE?

Updated: February 18, 2026 at 8:11 AM EST

When considering an investment in OPENLANE, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

OPENLANE’s business quality ultimately falls short of our standards. To kick things off, its revenue has declined over the last five years. While its astounding EPS growth over the last five years shows its profits are trickling down to shareholders, the downside is its cash profitability fell over the last five years. On top of that, its relatively low ROIC suggests management has struggled to find compelling investment opportunities.

OPENLANE’s P/E ratio based on the next 12 months is 21x. Investors with a higher risk tolerance might like the company, but we think the potential downside is too great. We're fairly confident there are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $32.19 on the company (compared to the current share price of $29.02).